|

|

市場調査レポート

商品コード

1770201

海底光ファイバーケーブルの世界市場Submarine Optical Fiber Cables |

||||||

適宜更新あり

|

|||||||

| 海底光ファイバーケーブルの世界市場 |

|

出版日: 2025年07月14日

発行: Market Glass, Inc. (Formerly Global Industry Analysts, Inc.)

ページ情報: 英文 360 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

海底光ファイバーケーブルの世界市場は2030年までに538億米ドルに達する見込み

2024年に260億米ドルと推定される海底光ファイバーケーブルの世界市場は、2030年には538億米ドルに達し、分析期間2024-2030年のCAGRは12.9%で成長すると予測されます。

米国市場は72億米ドル、中国はCAGR12.4%で成長すると予測

米国の海底光ファイバーケーブル市場は2024年に72億米ドルと推定されます。世界第2位の経済大国である中国は、2030年までに84億米ドルの市場規模に達すると予測され、分析期間2024-2030年のCAGRは12.4%です。その他の注目すべき地域別市場としては、日本とカナダがあり、分析期間中のCAGRはそれぞれ11.6%と10.8%と予測されています。欧州では、ドイツがCAGR約9.1%で成長すると予測されています。

世界の海底光ファイバーケーブル市場- 主要動向と促進要因まとめ

海底光ファイバーケーブルは世界通信のバックボーンであり、大陸や海底を横断する高速データ伝送を可能にしています。これらのケーブルは、過酷な水中環境に耐えるように設計された保護材料の層に包まれた光ファイバーで構成されています。各ケーブルには数十対のファイバーが含まれ、それぞれが毎秒テラビットのデータを伝送できます。海底ケーブルは国際的な接続に不可欠であり、インターネット・サービス、電話、データ交換を世界中で支えています。海底に張り巡らされた何千キロメートルもの海底ケーブルは、国や大陸をつなぎ、現代のデジタル経済にとって不可欠な存在となっています。これらのケーブルの敷設と保守には、信頼性と長寿命を確保するための特殊な船舶と技術が必要です。

技術の進歩は、海底光ファイバーケーブルの能力と配備を大幅に向上させました。高密度波長分割多重(DWDM)などの技術革新により、1本のファイバーで複数の信号を伝送できるようになり、ケーブルのデータ伝送容量が飛躍的に向上しました。ケーブルの設計や素材の進歩により、耐久性が向上し、深海の圧力や地質活動などの環境ストレスに対する耐性も向上しています。さらに、長距離にわたって信号を増幅する、より効率的な中継器の開発により、海底ケーブルの到達距離と性能が向上しました。リアルタイムの監視システムを統合することで、故障や破損の検出と迅速な対応が可能になり、ダウンタイムを最小限に抑え、継続的なサービスを確保することができます。

海底光ファイバーケーブル市場の成長は、高速インターネット需要の増加、クラウドサービスの拡大、世界のデータトラフィックの増加など、いくつかの要因によってもたらされます。インターネット対応機器の普及や、ビデオストリーミング、ソーシャルメディア、オンラインゲームなどのアプリケーションによるデータ消費の急増により、堅牢で大容量の国際接続に対するニーズが大幅に高まっています。クラウド・コンピューティングとデータセンターの拡大が、信頼性の高い高速データ伝送インフラに対する需要をさらに押し上げています。さらに、金融、ヘルスケア、教育など、さまざまな分野でデジタル変革が進行しているため、高度な海底ケーブルネットワークの展開が必要となっています。ブロードバンドアクセスや国際通信インフラを改善するための政府の取り組みや投資も市場の成長に貢献しており、海底光ファイバーケーブルが世界の接続に不可欠な存在であり続けることを保証しています。

セグメント

セグメント(海底光ファイバーケーブル)

調査対象企業の例

- ABB Ltd.

- Bharti Airtel Ltd.

- Corning, Inc.

- Ciena Corporation

- Amphenol Corporation

- Chunghwa Telecom Co., Ltd.

- Belden, Inc.

- China Unicom Global Limited

- AFL

- Antel

- Dialog Axiata PLC

- Bezeq International Ltd.

- BPP-Cables

- Broadband Infraco SOC Ltd.

- Cortland Co., Inc.

AIインテグレーション

私たちは、検証された専門家のコンテンツとAIツールにより、市場情報と競合情報を変革します。

Global Industry Analystsは、一般的なLLMや業界別SLMのクエリに従う代わりに、ビデオ記録、ブログ、検索エンジン調査、膨大な量の企業、製品/サービス、市場データなど、世界中の専門家から収集したコンテンツのリポジトリを構築しました。

関税影響係数

Global Industry Analystsは、本社の国、製造拠点、輸出入(完成品とOEM)に基づく企業の競争力の変化を予測しています。この複雑で多面的な市場力学は、売上原価(COGS)の増加、収益性の低下、サプライチェーンの再構築など、ミクロおよびマクロの市場力学の中でも特に競合他社に影響を与える見込みです。

目次

第1章 調査手法

第2章 エグゼクティブサマリー

- 市場概要

- 主要企業

- 市場動向と促進要因

- 世界市場の見通し

第3章 市場分析

- 南北アメリカ

- アジア内

- 大西洋横断

- 太平洋横断

- 欧州

- フランス

- ドイツ

- イタリア

- 英国

- その他欧州

- アジア太平洋

- その他の地域

第4章 競合

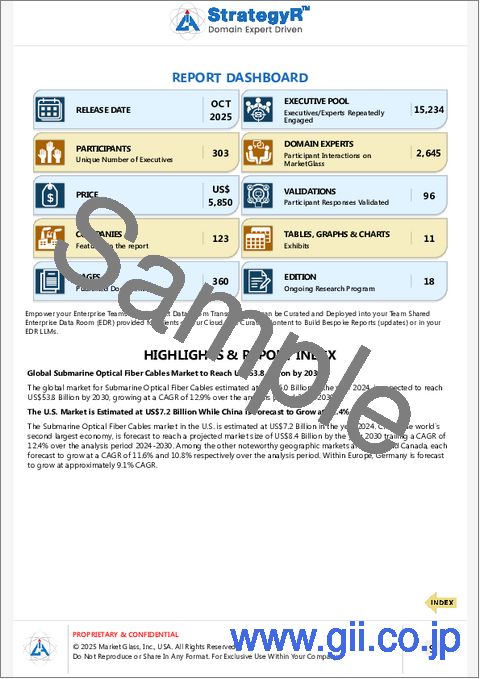

Global Submarine Optical Fiber Cables Market to Reach US$53.8 Billion by 2030

The global market for Submarine Optical Fiber Cables estimated at US$26.0 Billion in the year 2024, is expected to reach US$53.8 Billion by 2030, growing at a CAGR of 12.9% over the analysis period 2024-2030.

The U.S. Market is Estimated at US$7.2 Billion While China is Forecast to Grow at 12.4% CAGR

The Submarine Optical Fiber Cables market in the U.S. is estimated at US$7.2 Billion in the year 2024. China, the world's second largest economy, is forecast to reach a projected market size of US$8.4 Billion by the year 2030 trailing a CAGR of 12.4% over the analysis period 2024-2030. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at a CAGR of 11.6% and 10.8% respectively over the analysis period. Within Europe, Germany is forecast to grow at approximately 9.1% CAGR.

Global Submarine Optical Fiber Cables Market - Key Trends & Drivers Summarized

Submarine optical fiber cables are the backbone of global telecommunications, enabling the high-speed transmission of data across continents and under oceans. These cables consist of optical fibers encased in layers of protective materials designed to withstand the harsh underwater environment. Each cable can contain dozens of fiber pairs, each capable of carrying terabits of data per second. Submarine cables are critical for international connectivity, supporting internet services, phone calls, and data exchange across the globe. They span thousands of kilometers on the ocean floor, connecting countries and continents, and are essential for the modern digital economy. The installation and maintenance of these cables involve specialized ships and technology to ensure reliability and longevity.

Technological advancements have significantly enhanced the capabilities and deployment of submarine optical fiber cables. Innovations such as dense wavelength division multiplexing (DWDM) allow for the transmission of multiple signals over a single fiber, dramatically increasing the data-carrying capacity of these cables. Advances in cable design and materials have improved durability and resistance to environmental stresses, such as deep-sea pressure and geological activity. Additionally, the development of more efficient repeaters, which amplify signals over long distances, has extended the reach and performance of submarine cables. The integration of real-time monitoring systems enables the detection and rapid response to faults or breaks, minimizing downtime and ensuring continuous service.

The growth in the submarine optical fiber cables market is driven by several factors, including the increasing demand for high-speed internet, the expansion of cloud services, and the rise in global data traffic. The proliferation of internet-enabled devices and the surge in data consumption for applications like video streaming, social media, and online gaming have significantly boosted the need for robust and high-capacity international connectivity. The expansion of cloud computing and data centers has further driven demand for reliable, high-speed data transmission infrastructure. Additionally, the ongoing digital transformation across various sectors, including finance, healthcare, and education, necessitates the deployment of advanced submarine cable networks. Government initiatives and investments in improving broadband access and international communication infrastructure also contribute to the market's growth, ensuring that submarine optical fiber cables remain vital for global connectivity.

SCOPE OF STUDY:

The report analyzes the Submarine Optical Fiber Cables market in terms of units by the following Segments, and Geographic Regions/Countries:

Segments:

Segment (Submarine Optical Fiber Cables)

Geographic Regions/Countries:

World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Rest of Europe; Asia-Pacific; Rest of World.

Select Competitors (Total 123 Featured) -

- ABB Ltd.

- Bharti Airtel Ltd.

- Corning, Inc.

- Ciena Corporation

- Amphenol Corporation

- Chunghwa Telecom Co., Ltd.

- Belden, Inc.

- China Unicom Global Limited

- AFL

- Antel

- Dialog Axiata PLC

- Bezeq International Ltd.

- BPP-Cables

- Broadband Infraco SOC Ltd.

- Cortland Co., Inc.

AI INTEGRATIONS

We're transforming market and competitive intelligence with validated expert content and AI tools.

Instead of following the general norm of querying LLMs and Industry-specific SLMs, we built repositories of content curated from domain experts worldwide including video transcripts, blogs, search engines research, and massive amounts of enterprise, product/service, and market data.

TARIFF IMPACT FACTOR

Our new release incorporates impact of tariffs on geographical markets as we predict a shift in competitiveness of companies based on HQ country, manufacturing base, exports and imports (finished goods and OEM). This intricate and multifaceted market reality will impact competitors by increasing the Cost of Goods Sold (COGS), reducing profitability, reconfiguring supply chains, amongst other micro and macro market dynamics.

TABLE OF CONTENTS

I. METHODOLOGY

II. EXECUTIVE SUMMARY

- 1. MARKET OVERVIEW

- Tariff Impact on Global Supply Chain Patterns

- Global Economic Update

- Submarine Optical Fiber Cables - Global Key Competitors Percentage Market Share in 2025 (E)

- An Introduction to Submarine Optical Fiber Cables

- Historical Evolution of Submarine Communication Cables

- Basic Structure of Submarine Communication Cable

- Ownership Structure in Submarine Cable Industry

- Submarine Cable Networks: The Lifeline of Global Communications

- Global Market Prospects & Outlook

- Global Submarine Telecom Cable System Capacity: An Overview

- Global Addition of Planned Submarine Optic Fiber Cable System by Region (in %) for the Period 2021-2026

- Multiple Ownership of Submarine Telecom Cable Systems on the Rise

- A Glance at Recent Submarine Telecom Cable Systems

- Submarine Fiber Optic Cable Between Australia and Antarctica to Offer Reliable Communication Service

- Enhancements to MAREA Creates Record Capacity and Data Rates

- Competitive Landscape

- Competitive Market Presence - Strong/Active/Niche/Trivial for Players Worldwide in 2025 (E)

- Recent Market Activity

- 2. FOCUS ON SELECT PLAYERS

- 3. MARKET TRENDS & DRIVERS

- Fiber Optics: The Preferred Transmission Mode in Undersea Applications

- Submarine Cabling Emerges to Address Data Transmission Needs

- Rise in Digital Services Usage Necessitates Maintenance of Subsea Optical Fiber Cables

- Global Digital Data Created (In Zettabytes) for the Years 2015, 2020, 2025, and 2030

- Internet's Rising Contribution to Economy Fuels Need for Submarine Communication Cable Systems

- Growing Demand for High Bandwidth Applications Bodes Well for the Market

- Submarine Cable Systems to Benefit from the Rise in Internet-enabled Devices Resultant Need for Bandwidth Capacity Expansion

- Global Mobile Data Traffic (Million Terabytes/Month) for the Period 2020-2027

- Breakdown of Network Latency (in Milliseconds) by Network Type

- Rising Penetration of Smartphones Drives Growth of Mobile Network Traffic

- Global Mobile Data Traffic Per Smartphone (in GB per Month) by Region/Country for 2019 and 2025

- 5G to Further Enhance Mobile Internet Traffic

- Global Smartphone Subscription Breakdown by Technology for 2019 and 2025

- Surge in Internet Video Consumption to Trigger Deployment of Undersea Optical Fiber Cable Systems

- Rising Popularity of OTT Services Bodes Well for Market Prospects: Global Number of OTT Video Users (In Million) for the Years 2019, 2021, 2023 & 2025

- Content Providers Emerge as Major Drivers of Growth in Submarine Cable System Development

- Content Providers-driven Submarine Telecom Cable Systems as % of Total Cable Systems for 2016, 2018, 2020, and 2021-2023

- Data Center Providers Fuel Need for Submarine Telecom Cable Systems

- Demand for Data Centers Surge as Remote Working Becomes the New Normal

- Subsea Cable Systems Become Attractive for Hyperscalers and Telecom Operators

- Hyperscalers Make Increased Investments into Submarine Cables

- Shift towards Cloud-based Services and Applications Enhance Bandwidth & Capacity, Necessitating Undersea Cable Systems

- Key Benefits Driving Adoption of Cloud Services of Large, Medium and Small Businesses

- Rising Deployment of Submarine Optic Fiber Cables in the Oil & Gas Industry

- Infrastructure Revamp Propels Demand for Submarine Communications Cable System

- Unconventional Applications Provide Growth Opportunities

- Creating Mesh Networks for Greater Reliability and Faster Connectivity

- Service Providers Focus on Improving Flexibility of Submarine Cable Networks

- Sustainable Submarine Cable Networks Gain Importance

- Technology Advancements Promise Faster Undersea Transmissions

- SDM: A High Potential Technology for Augmenting Cable Capacity

- Caltech Researchers Study Submarine Cables to Sense Oceanic Earthquakes

- Role of AI in Submarine Telecom Cable Systems

- Infinera and Seaborn Networks Introduce Novel Submarine Network Services

- Satellite Communications Present Challenges to Submarine Cable Fiber Optic Systems

- Lack of New Submarine Cable System Installations: Repairs & Upgrades to Provide Growth Opportunities

- Submarine Cables At Risk from Snooping and Natural Disasters

- Measures to Safeguard Submarine Fiber Optic Cables

- Undersea Cables Face Risk from Spy Submarines

- Natural Disasters Present Threat to Undersea Cable Systems

- Congestion, Political Feuds Push Subsea Cable Companies to Seek Alternate Routes

- 4. GLOBAL MARKET PERSPECTIVE

- TABLE 1: World Recent Past, Current & Future Analysis for Submarine Optical Fiber Cables by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Spending in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 2: World 6-Year Perspective for Submarine Optical Fiber Cables by Geographic Region - Percentage Breakdown of Value Spending for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets for Years 2025 & 2030

- World 15-Year Perspective for Submarine Optical Fiber Cables by Geographic Region - Percentage Breakdown of Spending for Americas, Intra-Asia, Transatlantic and Transpacific Markets for Years 2015, 2021 & 2027

- TABLE 3: World Submarine Optical Fiber Cables Market Analysis of Annual Sales in US$ Million for Years 2015 through 2030

III. MARKET ANALYSIS

- AMERICAS

- Submarine Optical Fiber Cables Market Presence - Strong/Active/Niche/Trivial - Key Competitors in the United States for 2025 (E)

- United States

- Need for Faster Internet Connectivity and Expanding Fiber Optic Networks Fuel Market Growth

- US Government Tightens Control on Undersea Cable Services and Systems

- Latin America

- TABLE 4: USA Recent Past, Current & Future Analysis for Submarine Optical Fiber Cables by Segment - Submarine Optical Fiber Cables - Independent Analysis of Annual Spending in US$ Million for the Years 2024 through 2030 and % CAGR

- Americas Historic Review for Submarine Optical Fiber Cables - Analysis of Annual Spending in US$ Million for Years 2015 through 2019 and % CAGR

- INTRA-ASIA

- Asia-Pacific: Internet-based Services Spur Investments in Submarine Communication Systems

- Australia

- High Cost of Internet Data Transmission over Submarine Cables

- Creating Mesh Networks for Greater Reliability and Faster Connectivity

- India

- Market Overview

- Submarine Cables Market on Expansion Mode

- New Submarine Optical Fiber System to Provide High-Speed Broadband to Lakshadweep

- Reliance Jio Announces Largest Submarine Cable Project

- TABLE 5: Canada Recent Past, Current & Future Analysis for Submarine Optical Fiber Cables by Segment - Submarine Optical Fiber Cables - Independent Analysis of Annual Spending in US$ Million for the Years 2024 through 2030 and % CAGR

- Intra-Asia Historic Review for Submarine Optical Fiber Cables - Analysis of Annual Spending in US$ Million for Years 2015 through 2019 and % CAGR

- TRANSATLANTIC

- Submarine Optical Fiber Cables Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Japan for 2025 (E)

- TABLE 6: Japan Recent Past, Current & Future Analysis for Submarine Optical Fiber Cables by Segment - Submarine Optical Fiber Cables - Independent Analysis of Annual Spending in US$ Million for the Years 2024 through 2030 and % CAGR

- Transatlantic Historic Review for Submarine Optical Fiber Cables - Analysis of Annual Spending in US$ Million for Years 2015 through 2019 and % CAGR

- TRANSPACIFIC

- Submarine Optical Fiber Cables Market Presence - Strong/Active/Niche/Trivial - Key Competitors in China for 2025 (E)

- TABLE 7: China Recent Past, Current & Future Analysis for Submarine Optical Fiber Cables by Segment - Submarine Optical Fiber Cables - Independent Analysis of Annual Spending in US$ Million for the Years 2024 through 2030 and % CAGR

- Transpacific Historic Review for Submarine Optical Fiber Cables - Analysis of Annual Spending in US$ Million for Years 2015 through 2019 and % CAGR

- EUROPE

- Submarine Optical Fiber Cables Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Europe for 2025 (E)

- TABLE 8: Europe Recent Past, Current & Future Analysis for Submarine Optical Fiber Cables by Geographic Region - France, Germany, Italy, UK and Rest of Europe Markets - Independent Analysis of Annual Spending in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 9: Europe 6-Year Perspective for Submarine Optical Fiber Cables by Geographic Region - Percentage Breakdown of Value Spending for France, Germany, Italy, UK and Rest of Europe Markets for Years 2025 & 2030

- FRANCE

- Submarine Optical Fiber Cables Market Presence - Strong/Active/Niche/Trivial - Key Competitors in France for 2025 (E)

- TABLE 10: France Recent Past, Current & Future Analysis for Submarine Optical Fiber Cables by Segment - Submarine Optical Fiber Cables - Independent Analysis of Annual Spending in US$ Million for the Years 2024 through 2030 and % CAGR

- GERMANY

- Submarine Optical Fiber Cables Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Germany for 2025 (E)

- TABLE 11: Germany Recent Past, Current & Future Analysis for Submarine Optical Fiber Cables by Segment - Submarine Optical Fiber Cables - Independent Analysis of Annual Spending in US$ Million for the Years 2024 through 2030 and % CAGR

- ITALY

- TABLE 12: Italy Recent Past, Current & Future Analysis for Submarine Optical Fiber Cables by Segment - Submarine Optical Fiber Cables - Independent Analysis of Annual Spending in US$ Million for the Years 2024 through 2030 and % CAGR

- UNITED KINGDOM

- Submarine Optical Fiber Cables Market Presence - Strong/Active/Niche/Trivial - Key Competitors in the United Kingdom for 2025 (E)

- TABLE 13: UK Recent Past, Current & Future Analysis for Submarine Optical Fiber Cables by Segment - Submarine Optical Fiber Cables - Independent Analysis of Annual Spending in US$ Million for the Years 2024 through 2030 and % CAGR

- REST OF EUROPE

- TABLE 14: Rest of Europe Recent Past, Current & Future Analysis for Submarine Optical Fiber Cables by Segment - Submarine Optical Fiber Cables - Independent Analysis of Annual Spending in US$ Million for the Years 2024 through 2030 and % CAGR

- ASIA-PACIFIC

- Submarine Optical Fiber Cables Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Asia-Pacific for 2025 (E)

- TABLE 15: Asia-Pacific Recent Past, Current & Future Analysis for Submarine Optical Fiber Cables by Segment - Submarine Optical Fiber Cables - Independent Analysis of Annual Spending in US$ Million for the Years 2024 through 2030 and % CAGR

- REST OF WORLD

- TABLE 16: Rest of World Recent Past, Current & Future Analysis for Submarine Optical Fiber Cables by Segment - Submarine Optical Fiber Cables - Independent Analysis of Annual Spending in US$ Million for the Years 2024 through 2030 and % CAGR