|

|

市場調査レポート

商品コード

1761115

医薬品受託製造の世界市場Pharmaceutical Contract Manufacturing |

||||||

適宜更新あり

|

|||||||

| 医薬品受託製造の世界市場 |

|

出版日: 2025年07月02日

発行: Market Glass, Inc. (Formerly Global Industry Analysts, Inc.)

ページ情報: 英文 528 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

医薬品受託製造の世界市場は2030年までに1,596億米ドルに到達

2024年に1,178億米ドルと推定される医薬品受託製造の世界市場は、2024年から2030年にかけてCAGR 5.2%で成長し、2030年には1,596億米ドルに達すると予測されます。本レポートで分析したセグメントの1つである医薬品は、CAGR 5.9%を記録し、分析期間終了時には938億米ドルに達すると予想されます。バイオ医薬品セグメントの成長率は、分析期間でCAGR 4.3%と推定されます。

米国市場は354億米ドルと推定、中国はCAGR6.3%で成長予測

米国の医薬品受託製造市場は2024年に354億米ドルと推定されます。世界第2位の経済大国である中国は、2030年までに269億米ドルの市場規模に達すると予測され、分析期間2024-2030年のCAGRは6.3%です。その他の注目すべき地域別市場としては、日本とカナダがあり、分析期間中のCAGRはそれぞれ4.1%と4.7%と予測されています。欧州では、ドイツがCAGR 4.7%で成長すると予測されています。

世界の医薬品受託製造市場- 主要動向と促進要因まとめ

医薬品受託製造とは何か、なぜ不可欠なのか?

医薬品受託製造とは、医薬品の製造を第三者機関に委託することです。このビジネスモデルにより、製薬会社は創薬、市場開拓、マーケティングなどのコアコンピタンスに集中することができ、一方、製造委託先(CMO)は厳しい規制基準への準拠を含む複雑な製造業務を処理することができます。このパートナーシップは、製造施設に投資するためのインフラや資本が不足している可能性のある中小規模のバイオテクノロジー企業にとって極めて重要です。さらに、大手製薬会社でさえ、柔軟性を高め、コストを管理し、新薬の市場投入までの時間を短縮するために、このモデルを活用しています。

世界規制は市場をどのように形成しているか?

FDA(米国食品医薬品局)、EMA(欧州医薬品庁)、その他の世界の規制機関が定める厳格なガイドラインにより、規制遵守は医薬品受託製造の極めて重要な側面となっています。これらの規制は、医薬品が一貫して製造され、品質基準に沿って管理されることを保証するものです。契約製造業者は、これらの進化する規制に適応しなければならず、コンプライアンスを確保するために技術やプロセスへの多額の投資を伴うことが多いです。規制の圧力が高まるにつれ、製薬会社は複雑な規制状況を乗り切ることのできるCMOへの依存度を高め、医薬品の安全性、有効性、品質を確保しています。

受託製造に影響を与える技術的進歩とは?

技術の進歩は、医薬品受託製造を大きく変化させています。生産を合理化し、効率を向上させる連続製造のような技術革新が普及しています。また、生産工程における精度を高め、人的ミスを減らすために、自動化やロボット工学も広く採用されています。さらに、製造工程全体の品質管理を確実にするために、高度な分析とリアルタイムの監視システムが導入されています。これらの技術は、製品の品質を向上させるだけでなく、無駄を省き、拡張性を高めることで、生産工程をより費用対効果の高い効率的なものにしています。

医薬品受託製造市場の成長の原動力は?

医薬品受託製造市場の成長は、ジェネリック医薬品に対する需要の高まり、医薬品製造の複雑化、生物製剤市場の拡大など、いくつかの要因によってもたらされます。特許の崖がジェネリック医薬品の競争激化につながる中、製薬企業は生産を迅速化し、市場機会を活用するために市場競争を重視しています。また、新世代の医薬品、特に生物製剤や個別化医薬品の製造は複雑であるため、専門的な能力が必要とされ、多くの製薬企業はアウトソーシングの方がより現実的であると考えています。さらに、個別化医療へのシフトにより、企業は柔軟でスケーラブルな生産プロセスへの適応を迫られており、受託製造業者はこれに対応できる能力を備えています。このような動向は、コスト効率と市場投入までの時間短縮を求める世界の動きと相まって、医薬品業界のサプライチェーンにおける重要な役割を浮き彫りにし、この分野の大幅な成長を牽引し続けています。

セグメント

製品タイプ(API/バルクドラッグ、先進ドラッグデリバリー製剤、パッケージング、完成用量製剤、その他製品タイプ);用途(医薬品、バイオ医薬品);最終用途(無菌、非無菌)

調査対象企業の例(注目の192社)

- AbbVie Inc.

- Aenova Holding GmbH

- Catalent Inc.

- Enteris BioPharma, Inc.

- Jubilant Pharma Ltd.

- Kemwell Biopharma Pvt. Ltd.

- Lifecore Biomedical

- Lonza Group Ltd.

- Thermo Fisher Scientific, Inc.

- WuXi AppTec Co., Ltd.

AI統合

Global Industry Analystsは、有効な専門家コンテンツとAIツールによって、市場情報と競合情報を変革しています。

Global Industry Analystsは、LLMや業界固有のSLMを照会する一般的な規範に従う代わりに、ビデオ記録、ブログ、検索エンジン調査、膨大な量の企業、製品/サービス、市場データなど、世界中の専門家から収集したコンテンツのリポジトリを構築しました。

関税影響係数

Global Industry Analystsは、本社の国、製造拠点、輸出入(完成品とOEM)に基づく企業の競争力の変化を予測しています。この複雑で多面的な市場力学は、売上原価(COGS)の増加、収益性の低下、サプライチェーンの再構築など、ミクロおよびマクロの市場力学の中でも特に競合他社に影響を与える見込みです。

目次

第1章 調査手法

第2章 エグゼクティブサマリー

- 市場概要

- 主要企業

- 市場動向と促進要因

- 世界市場の見通し

第3章 市場分析

- 米国

- カナダ

- 日本

- 中国

- 欧州

- フランス

- ドイツ

- イタリア

- 英国

- その他欧州

- アジア太平洋

- インド

- その他アジア太平洋地域

- その他の地域

第4章 競合

Global Pharmaceutical Contract Manufacturing Market to Reach US$159.6 Billion by 2030

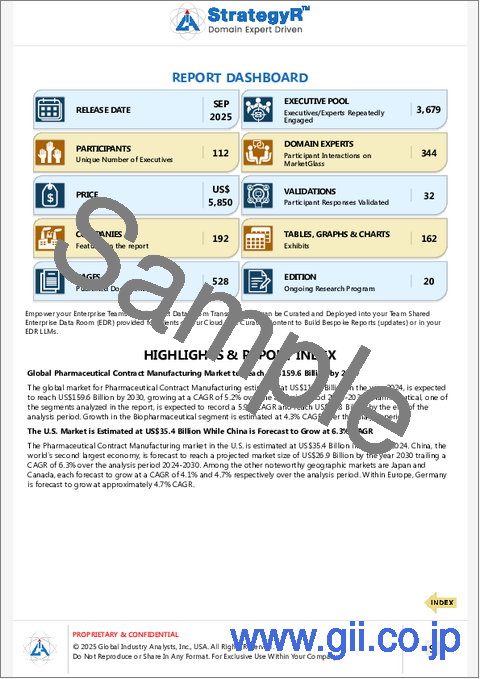

The global market for Pharmaceutical Contract Manufacturing estimated at US$117.8 Billion in the year 2024, is expected to reach US$159.6 Billion by 2030, growing at a CAGR of 5.2% over the analysis period 2024-2030. Pharmaceutical, one of the segments analyzed in the report, is expected to record a 5.9% CAGR and reach US$93.8 Billion by the end of the analysis period. Growth in the Biopharmaceutical segment is estimated at 4.3% CAGR over the analysis period.

The U.S. Market is Estimated at US$35.4 Billion While China is Forecast to Grow at 6.3% CAGR

The Pharmaceutical Contract Manufacturing market in the U.S. is estimated at US$35.4 Billion in the year 2024. China, the world's second largest economy, is forecast to reach a projected market size of US$26.9 Billion by the year 2030 trailing a CAGR of 6.3% over the analysis period 2024-2030. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at a CAGR of 4.1% and 4.7% respectively over the analysis period. Within Europe, Germany is forecast to grow at approximately 4.7% CAGR.

Global Pharmaceutical Contract Manufacturing Market - Key Trends & Drivers Summarized

What Is Pharmaceutical Contract Manufacturing, and Why Is It Essential?

Pharmaceutical contract manufacturing involves outsourcing the production of pharmaceutical products to third-party organizations. This business model allows pharmaceutical companies to focus on their core competencies such as drug discovery, development, and marketing, while contract manufacturers (CMOs) handle the complexities of production, including compliance with stringent regulatory standards. This partnership is crucial for small and mid-sized biotech firms that may lack the infrastructure or capital to invest in manufacturing facilities. Moreover, even large pharmaceutical companies leverage this model to enhance flexibility, manage costs, and reduce time to market for new medications.

How Are Global Regulations Shaping the Market?

Regulatory compliance is a pivotal aspect of pharmaceutical contract manufacturing, with stringent guidelines set by authorities like the FDA (U.S. Food and Drug Administration), EMA (European Medicines Agency), and other global regulatory bodies. These regulations ensure that pharmaceutical products are consistently produced and controlled to quality standards. Contract manufacturers must adapt to these evolving regulations, which often involve substantial investments in technology and processes to ensure compliance. As regulatory pressures increase, pharmaceutical companies are increasingly relying on CMOs that can navigate complex regulatory landscapes, thus ensuring the safety, efficacy, and quality of pharmaceutical products.

What Technological Advances Are Impacting Contract Manufacturing?

Technological advancements are profoundly transforming pharmaceutical contract manufacturing. Innovations such as continuous manufacturing, which streamlines production and improves efficiency, are becoming more prevalent. Automation and robotics have also been widely adopted to enhance precision and reduce human error in production processes. Additionally, advanced analytics and real-time monitoring systems are being implemented to ensure quality control throughout the manufacturing process. These technologies not only improve product quality but also reduce waste and enhance scalability, making the production process more cost-effective and efficient.

What Drives the Growth in the Pharmaceutical Contract Manufacturing Market?

The growth in the pharmaceutical contract manufacturing market is driven by several factors, including the rising demand for generic medicines, the increasing complexity of drug production, and the expansion of the biologics market. As patent cliffs lead to increased generic competition, pharmaceutical companies are turning to CMOs to expedite production and capitalize on market opportunities. The complexity of producing new generations of drugs, especially biologics and personalized medicines, also necessitates specialized capabilities that many pharmaceutical firms find more feasible to outsource. Additionally, the shift towards personalized medicine is pushing companies to adapt to flexible and scalable production processes, which contract manufacturers are equipped to handle. These trends, combined with the global push for cost efficiency and faster time-to-market, continue to drive significant growth in this sector, highlighting its critical role in the pharmaceutical industry’s supply chain.

SCOPE OF STUDY:

The report analyzes the Pharmaceutical Contract Manufacturing market in terms of units by the following Segments, and Geographic Regions/Countries:

Segments:

Product Type (API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations, Other Product Types); Application (Pharmaceutical, Biopharmaceutical); End-Use (Sterile, Non-Sterile)

Geographic Regions/Countries:

World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Rest of Europe; Asia-Pacific; India; Rest of Asia-Pacific; Rest of World.

Select Competitors (Total 192 Featured) -

- AbbVie Inc.

- Aenova Holding GmbH

- Catalent Inc.

- Enteris BioPharma, Inc.

- Jubilant Pharma Ltd.

- Kemwell Biopharma Pvt. Ltd.

- Lifecore Biomedical

- Lonza Group Ltd.

- Thermo Fisher Scientific, Inc.

- WuXi AppTec Co., Ltd.

AI INTEGRATIONS

We're transforming market and competitive intelligence with validated expert content and AI tools.

Instead of following the general norm of querying LLMs and Industry-specific SLMs, we built repositories of content curated from domain experts worldwide including video transcripts, blogs, search engines research, and massive amounts of enterprise, product/service, and market data.

TARIFF IMPACT FACTOR

Our new release incorporates impact of tariffs on geographical markets as we predict a shift in competitiveness of companies based on HQ country, manufacturing base, exports and imports (finished goods and OEM). This intricate and multifaceted market reality will impact competitors by increasing the Cost of Goods Sold (COGS), reducing profitability, reconfiguring supply chains, amongst other micro and macro market dynamics.

TABLE OF CONTENTS

I. METHODOLOGY

II. EXECUTIVE SUMMARY

- 1. MARKET OVERVIEW

- Influencer Market Insights

- Tariff Impact on Global Supply Chain Patterns

- Pharmaceutical Contract Manufacturing - Global Key Competitors Percentage Market Share in 2025 (E)

- Competitive Market Presence - Strong/Active/Niche/Trivial for Players Worldwide in 2025 (E)

- Recent Market Activity

- 2. FOCUS ON SELECT PLAYERS

- 3. MARKET TRENDS & DRIVERS

- Strong Rise in Pharmaceutical Sales to Drive Demand for Pharmaceutical Contract Manufacturing

- Global Prescription Drug Sales (In US$ Billion) for the Years 2017, 2019, 2021, 2023 & 2025

- Emergence of Outsourcing Trend Bodes Well for CDMOs

- Pharmaceutical Contract Manufacturers Adopt Advanced Manufacturing Technologies

- Embracing Emerging Technologies

- Exploring & Exploiting New Technologies for Rich Dividends

- Rapid Growth of Generic Drugs Drives Demand for Pharma Contract Manufacturing

- Global Generic Drugs Market Size (in $ Billion) for the Years 2016, 2019, 2020 & 2025

- Increasing Significance of Biologic Drugs Fuels Innovations Supports Demand for Pharmaceutical Contract Manufacturing Market

- Global Biologic Drugs Market Size (in US$ Billion) for the Years 2019, 2022 & 2025

- Aging Population & Increasing Burden of Chronic Diseases Spurs Pharma Product Sales, Driving Market Growth

- Global Aging Population Statistics for the 65+ Age Group in Million by Geographic Region for the Years 2019, 2025, 2035 and 2050

- Global Cancer Incidence: Number of New Cancer Cases in Million for the Years 2018, 2020, 2025, 2030, 2035 and 2040

- World Diabetes and Population Statistics (2019, 2030 & 2045)

- Persistent Increase in Pharmaceutical R&D Bodes Well for PCM

- Pharmaceutical R&D Spending Worldwide (USD Billion): 2015-2025

- Increasing Sales of OTC Drugs Presents an Opportunity for Pharma Contract Manufacturing Market

- Increasing Outsourcing of Clinical Trials to Emerging Markets

- New Technology Promises to Improve Sterile Manufacturing Process

- Serialization Drives New Design Developments in Pharma Sector

- 4. GLOBAL MARKET PERSPECTIVE

- TABLE 1: World Recent Past, Current & Future Analysis for API/Bulk Drugs by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 2: World Historic Review for API/Bulk Drugs by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 3: World 16-Year Perspective for API/Bulk Drugs by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2014, 2025 & 2030

- TABLE 4: World Recent Past, Current & Future Analysis for Advanced Drug Delivery Formulations by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 5: World Historic Review for Advanced Drug Delivery Formulations by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 6: World 16-Year Perspective for Advanced Drug Delivery Formulations by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2014, 2025 & 2030

- TABLE 7: World Recent Past, Current & Future Analysis for Packaging by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 8: World Historic Review for Packaging by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 9: World 16-Year Perspective for Packaging by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2014, 2025 & 2030

- TABLE 10: World Recent Past, Current & Future Analysis for Finished Dose Formulations by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 11: World Historic Review for Finished Dose Formulations by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 12: World 16-Year Perspective for Finished Dose Formulations by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2014, 2025 & 2030

- TABLE 13: World Recent Past, Current & Future Analysis for Other Product Types by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 14: World Historic Review for Other Product Types by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 15: World 16-Year Perspective for Other Product Types by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2014, 2025 & 2030

- TABLE 16: World Recent Past, Current & Future Analysis for Pharmaceutical by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 17: World Historic Review for Pharmaceutical by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 18: World 16-Year Perspective for Pharmaceutical by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2014, 2025 & 2030

- TABLE 19: World Recent Past, Current & Future Analysis for Biopharmaceutical by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 20: World Historic Review for Biopharmaceutical by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 21: World 16-Year Perspective for Biopharmaceutical by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2014, 2025 & 2030

- TABLE 22: World Recent Past, Current & Future Analysis for Sterile by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 23: World Historic Review for Sterile by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 24: World 16-Year Perspective for Sterile by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2014, 2025 & 2030

- TABLE 25: World Recent Past, Current & Future Analysis for Non-Sterile by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 26: World Historic Review for Non-Sterile by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 27: World 16-Year Perspective for Non-Sterile by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2014, 2025 & 2030

- TABLE 28: World Pharmaceutical Contract Manufacturing Market Analysis of Annual Sales in US$ Million for Years 2014 through 2030

- TABLE 29: World Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 30: World Historic Review for Pharmaceutical Contract Manufacturing by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 31: World 16-Year Perspective for Pharmaceutical Contract Manufacturing by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets for Years 2014, 2025 & 2030

III. MARKET ANALYSIS

- UNITED STATES

- Pharmaceutical Contract Manufacturing Market Presence - Strong/Active/Niche/Trivial - Key Competitors in the United States for 2025 (E)

- TABLE 32: USA Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by Product Type - API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 33: USA Historic Review for Pharmaceutical Contract Manufacturing by Product Type - API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 34: USA 16-Year Perspective for Pharmaceutical Contract Manufacturing by Product Type - Percentage Breakdown of Value Sales for API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types for the Years 2014, 2025 & 2030

- TABLE 35: USA Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by Application - Pharmaceutical and Biopharmaceutical - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 36: USA Historic Review for Pharmaceutical Contract Manufacturing by Application - Pharmaceutical and Biopharmaceutical Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 37: USA 16-Year Perspective for Pharmaceutical Contract Manufacturing by Application - Percentage Breakdown of Value Sales for Pharmaceutical and Biopharmaceutical for the Years 2014, 2025 & 2030

- TABLE 38: USA Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by End-Use - Sterile and Non-Sterile - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 39: USA Historic Review for Pharmaceutical Contract Manufacturing by End-Use - Sterile and Non-Sterile Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 40: USA 16-Year Perspective for Pharmaceutical Contract Manufacturing by End-Use - Percentage Breakdown of Value Sales for Sterile and Non-Sterile for the Years 2014, 2025 & 2030

- CANADA

- TABLE 41: Canada Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by Product Type - API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 42: Canada Historic Review for Pharmaceutical Contract Manufacturing by Product Type - API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 43: Canada 16-Year Perspective for Pharmaceutical Contract Manufacturing by Product Type - Percentage Breakdown of Value Sales for API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types for the Years 2014, 2025 & 2030

- TABLE 44: Canada Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by Application - Pharmaceutical and Biopharmaceutical - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 45: Canada Historic Review for Pharmaceutical Contract Manufacturing by Application - Pharmaceutical and Biopharmaceutical Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 46: Canada 16-Year Perspective for Pharmaceutical Contract Manufacturing by Application - Percentage Breakdown of Value Sales for Pharmaceutical and Biopharmaceutical for the Years 2014, 2025 & 2030

- TABLE 47: Canada Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by End-Use - Sterile and Non-Sterile - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 48: Canada Historic Review for Pharmaceutical Contract Manufacturing by End-Use - Sterile and Non-Sterile Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 49: Canada 16-Year Perspective for Pharmaceutical Contract Manufacturing by End-Use - Percentage Breakdown of Value Sales for Sterile and Non-Sterile for the Years 2014, 2025 & 2030

- JAPAN

- Pharmaceutical Contract Manufacturing Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Japan for 2025 (E)

- TABLE 50: Japan Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by Product Type - API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 51: Japan Historic Review for Pharmaceutical Contract Manufacturing by Product Type - API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 52: Japan 16-Year Perspective for Pharmaceutical Contract Manufacturing by Product Type - Percentage Breakdown of Value Sales for API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types for the Years 2014, 2025 & 2030

- TABLE 53: Japan Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by Application - Pharmaceutical and Biopharmaceutical - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 54: Japan Historic Review for Pharmaceutical Contract Manufacturing by Application - Pharmaceutical and Biopharmaceutical Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 55: Japan 16-Year Perspective for Pharmaceutical Contract Manufacturing by Application - Percentage Breakdown of Value Sales for Pharmaceutical and Biopharmaceutical for the Years 2014, 2025 & 2030

- TABLE 56: Japan Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by End-Use - Sterile and Non-Sterile - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 57: Japan Historic Review for Pharmaceutical Contract Manufacturing by End-Use - Sterile and Non-Sterile Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 58: Japan 16-Year Perspective for Pharmaceutical Contract Manufacturing by End-Use - Percentage Breakdown of Value Sales for Sterile and Non-Sterile for the Years 2014, 2025 & 2030

- CHINA

- Pharmaceutical Contract Manufacturing Market Presence - Strong/Active/Niche/Trivial - Key Competitors in China for 2025 (E)

- TABLE 59: China Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by Product Type - API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 60: China Historic Review for Pharmaceutical Contract Manufacturing by Product Type - API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 61: China 16-Year Perspective for Pharmaceutical Contract Manufacturing by Product Type - Percentage Breakdown of Value Sales for API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types for the Years 2014, 2025 & 2030

- TABLE 62: China Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by Application - Pharmaceutical and Biopharmaceutical - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 63: China Historic Review for Pharmaceutical Contract Manufacturing by Application - Pharmaceutical and Biopharmaceutical Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 64: China 16-Year Perspective for Pharmaceutical Contract Manufacturing by Application - Percentage Breakdown of Value Sales for Pharmaceutical and Biopharmaceutical for the Years 2014, 2025 & 2030

- TABLE 65: China Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by End-Use - Sterile and Non-Sterile - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 66: China Historic Review for Pharmaceutical Contract Manufacturing by End-Use - Sterile and Non-Sterile Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 67: China 16-Year Perspective for Pharmaceutical Contract Manufacturing by End-Use - Percentage Breakdown of Value Sales for Sterile and Non-Sterile for the Years 2014, 2025 & 2030

- EUROPE

- Pharmaceutical Contract Manufacturing Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Europe for 2025 (E)

- TABLE 68: Europe Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by Product Type - API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 69: Europe Historic Review for Pharmaceutical Contract Manufacturing by Product Type - API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 70: Europe 16-Year Perspective for Pharmaceutical Contract Manufacturing by Product Type - Percentage Breakdown of Value Sales for API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types for the Years 2014, 2025 & 2030

- TABLE 71: Europe Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by Application - Pharmaceutical and Biopharmaceutical - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 72: Europe Historic Review for Pharmaceutical Contract Manufacturing by Application - Pharmaceutical and Biopharmaceutical Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 73: Europe 16-Year Perspective for Pharmaceutical Contract Manufacturing by Application - Percentage Breakdown of Value Sales for Pharmaceutical and Biopharmaceutical for the Years 2014, 2025 & 2030

- TABLE 74: Europe Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by End-Use - Sterile and Non-Sterile - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 75: Europe Historic Review for Pharmaceutical Contract Manufacturing by End-Use - Sterile and Non-Sterile Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 76: Europe 16-Year Perspective for Pharmaceutical Contract Manufacturing by End-Use - Percentage Breakdown of Value Sales for Sterile and Non-Sterile for the Years 2014, 2025 & 2030

- TABLE 77: Europe Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by Geographic Region - France, Germany, Italy, UK and Rest of Europe Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 78: Europe Historic Review for Pharmaceutical Contract Manufacturing by Geographic Region - France, Germany, Italy, UK and Rest of Europe Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 79: Europe 16-Year Perspective for Pharmaceutical Contract Manufacturing by Geographic Region - Percentage Breakdown of Value Sales for France, Germany, Italy, UK and Rest of Europe Markets for Years 2014, 2025 & 2030

- FRANCE

- Pharmaceutical Contract Manufacturing Market Presence - Strong/Active/Niche/Trivial - Key Competitors in France for 2025 (E)

- TABLE 80: France Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by Product Type - API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 81: France Historic Review for Pharmaceutical Contract Manufacturing by Product Type - API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 82: France 16-Year Perspective for Pharmaceutical Contract Manufacturing by Product Type - Percentage Breakdown of Value Sales for API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types for the Years 2014, 2025 & 2030

- TABLE 83: France Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by Application - Pharmaceutical and Biopharmaceutical - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 84: France Historic Review for Pharmaceutical Contract Manufacturing by Application - Pharmaceutical and Biopharmaceutical Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 85: France 16-Year Perspective for Pharmaceutical Contract Manufacturing by Application - Percentage Breakdown of Value Sales for Pharmaceutical and Biopharmaceutical for the Years 2014, 2025 & 2030

- TABLE 86: France Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by End-Use - Sterile and Non-Sterile - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 87: France Historic Review for Pharmaceutical Contract Manufacturing by End-Use - Sterile and Non-Sterile Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 88: France 16-Year Perspective for Pharmaceutical Contract Manufacturing by End-Use - Percentage Breakdown of Value Sales for Sterile and Non-Sterile for the Years 2014, 2025 & 2030

- GERMANY

- Pharmaceutical Contract Manufacturing Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Germany for 2025 (E)

- TABLE 89: Germany Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by Product Type - API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 90: Germany Historic Review for Pharmaceutical Contract Manufacturing by Product Type - API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 91: Germany 16-Year Perspective for Pharmaceutical Contract Manufacturing by Product Type - Percentage Breakdown of Value Sales for API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types for the Years 2014, 2025 & 2030

- TABLE 92: Germany Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by Application - Pharmaceutical and Biopharmaceutical - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 93: Germany Historic Review for Pharmaceutical Contract Manufacturing by Application - Pharmaceutical and Biopharmaceutical Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 94: Germany 16-Year Perspective for Pharmaceutical Contract Manufacturing by Application - Percentage Breakdown of Value Sales for Pharmaceutical and Biopharmaceutical for the Years 2014, 2025 & 2030

- TABLE 95: Germany Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by End-Use - Sterile and Non-Sterile - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 96: Germany Historic Review for Pharmaceutical Contract Manufacturing by End-Use - Sterile and Non-Sterile Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 97: Germany 16-Year Perspective for Pharmaceutical Contract Manufacturing by End-Use - Percentage Breakdown of Value Sales for Sterile and Non-Sterile for the Years 2014, 2025 & 2030

- ITALY

- TABLE 98: Italy Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by Product Type - API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 99: Italy Historic Review for Pharmaceutical Contract Manufacturing by Product Type - API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 100: Italy 16-Year Perspective for Pharmaceutical Contract Manufacturing by Product Type - Percentage Breakdown of Value Sales for API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types for the Years 2014, 2025 & 2030

- TABLE 101: Italy Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by Application - Pharmaceutical and Biopharmaceutical - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 102: Italy Historic Review for Pharmaceutical Contract Manufacturing by Application - Pharmaceutical and Biopharmaceutical Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 103: Italy 16-Year Perspective for Pharmaceutical Contract Manufacturing by Application - Percentage Breakdown of Value Sales for Pharmaceutical and Biopharmaceutical for the Years 2014, 2025 & 2030

- TABLE 104: Italy Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by End-Use - Sterile and Non-Sterile - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 105: Italy Historic Review for Pharmaceutical Contract Manufacturing by End-Use - Sterile and Non-Sterile Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 106: Italy 16-Year Perspective for Pharmaceutical Contract Manufacturing by End-Use - Percentage Breakdown of Value Sales for Sterile and Non-Sterile for the Years 2014, 2025 & 2030

- UNITED KINGDOM

- Pharmaceutical Contract Manufacturing Market Presence - Strong/Active/Niche/Trivial - Key Competitors in the United Kingdom for 2025 (E)

- TABLE 107: UK Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by Product Type - API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 108: UK Historic Review for Pharmaceutical Contract Manufacturing by Product Type - API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 109: UK 16-Year Perspective for Pharmaceutical Contract Manufacturing by Product Type - Percentage Breakdown of Value Sales for API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types for the Years 2014, 2025 & 2030

- TABLE 110: UK Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by Application - Pharmaceutical and Biopharmaceutical - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 111: UK Historic Review for Pharmaceutical Contract Manufacturing by Application - Pharmaceutical and Biopharmaceutical Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 112: UK 16-Year Perspective for Pharmaceutical Contract Manufacturing by Application - Percentage Breakdown of Value Sales for Pharmaceutical and Biopharmaceutical for the Years 2014, 2025 & 2030

- TABLE 113: UK Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by End-Use - Sterile and Non-Sterile - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 114: UK Historic Review for Pharmaceutical Contract Manufacturing by End-Use - Sterile and Non-Sterile Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 115: UK 16-Year Perspective for Pharmaceutical Contract Manufacturing by End-Use - Percentage Breakdown of Value Sales for Sterile and Non-Sterile for the Years 2014, 2025 & 2030

- REST OF EUROPE

- TABLE 116: Rest of Europe Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by Product Type - API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 117: Rest of Europe Historic Review for Pharmaceutical Contract Manufacturing by Product Type - API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 118: Rest of Europe 16-Year Perspective for Pharmaceutical Contract Manufacturing by Product Type - Percentage Breakdown of Value Sales for API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types for the Years 2014, 2025 & 2030

- TABLE 119: Rest of Europe Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by Application - Pharmaceutical and Biopharmaceutical - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 120: Rest of Europe Historic Review for Pharmaceutical Contract Manufacturing by Application - Pharmaceutical and Biopharmaceutical Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 121: Rest of Europe 16-Year Perspective for Pharmaceutical Contract Manufacturing by Application - Percentage Breakdown of Value Sales for Pharmaceutical and Biopharmaceutical for the Years 2014, 2025 & 2030

- TABLE 122: Rest of Europe Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by End-Use - Sterile and Non-Sterile - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 123: Rest of Europe Historic Review for Pharmaceutical Contract Manufacturing by End-Use - Sterile and Non-Sterile Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 124: Rest of Europe 16-Year Perspective for Pharmaceutical Contract Manufacturing by End-Use - Percentage Breakdown of Value Sales for Sterile and Non-Sterile for the Years 2014, 2025 & 2030

- ASIA-PACIFIC

- Pharmaceutical Contract Manufacturing Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Asia-Pacific for 2025 (E)

- TABLE 125: Asia-Pacific Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by Product Type - API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 126: Asia-Pacific Historic Review for Pharmaceutical Contract Manufacturing by Product Type - API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 127: Asia-Pacific 16-Year Perspective for Pharmaceutical Contract Manufacturing by Product Type - Percentage Breakdown of Value Sales for API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types for the Years 2014, 2025 & 2030

- TABLE 128: Asia-Pacific Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by Application - Pharmaceutical and Biopharmaceutical - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 129: Asia-Pacific Historic Review for Pharmaceutical Contract Manufacturing by Application - Pharmaceutical and Biopharmaceutical Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 130: Asia-Pacific 16-Year Perspective for Pharmaceutical Contract Manufacturing by Application - Percentage Breakdown of Value Sales for Pharmaceutical and Biopharmaceutical for the Years 2014, 2025 & 2030

- TABLE 131: Asia-Pacific Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by End-Use - Sterile and Non-Sterile - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 132: Asia-Pacific Historic Review for Pharmaceutical Contract Manufacturing by End-Use - Sterile and Non-Sterile Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 133: Asia-Pacific 16-Year Perspective for Pharmaceutical Contract Manufacturing by End-Use - Percentage Breakdown of Value Sales for Sterile and Non-Sterile for the Years 2014, 2025 & 2030

- TABLE 134: Asia-Pacific Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by Geographic Region - India and Rest of Asia-Pacific Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 135: Asia-Pacific Historic Review for Pharmaceutical Contract Manufacturing by Geographic Region - India and Rest of Asia-Pacific Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 136: Asia-Pacific 16-Year Perspective for Pharmaceutical Contract Manufacturing by Geographic Region - Percentage Breakdown of Value Sales for India and Rest of Asia-Pacific Markets for Years 2014, 2025 & 2030

- INDIA

- Pharmaceutical Contract Manufacturing Market Presence - Strong/Active/Niche/Trivial - Key Competitors in India for 2025 (E)

- TABLE 137: India Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by Product Type - API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 138: India Historic Review for Pharmaceutical Contract Manufacturing by Product Type - API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 139: India 16-Year Perspective for Pharmaceutical Contract Manufacturing by Product Type - Percentage Breakdown of Value Sales for API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types for the Years 2014, 2025 & 2030

- TABLE 140: India Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by Application - Pharmaceutical and Biopharmaceutical - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 141: India Historic Review for Pharmaceutical Contract Manufacturing by Application - Pharmaceutical and Biopharmaceutical Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 142: India 16-Year Perspective for Pharmaceutical Contract Manufacturing by Application - Percentage Breakdown of Value Sales for Pharmaceutical and Biopharmaceutical for the Years 2014, 2025 & 2030

- TABLE 143: India Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by End-Use - Sterile and Non-Sterile - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 144: India Historic Review for Pharmaceutical Contract Manufacturing by End-Use - Sterile and Non-Sterile Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 145: India 16-Year Perspective for Pharmaceutical Contract Manufacturing by End-Use - Percentage Breakdown of Value Sales for Sterile and Non-Sterile for the Years 2014, 2025 & 2030

- REST OF ASIA-PACIFIC

- TABLE 146: Rest of Asia-Pacific Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by Product Type - API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 147: Rest of Asia-Pacific Historic Review for Pharmaceutical Contract Manufacturing by Product Type - API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 148: Rest of Asia-Pacific 16-Year Perspective for Pharmaceutical Contract Manufacturing by Product Type - Percentage Breakdown of Value Sales for API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types for the Years 2014, 2025 & 2030

- TABLE 149: Rest of Asia-Pacific Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by Application - Pharmaceutical and Biopharmaceutical - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 150: Rest of Asia-Pacific Historic Review for Pharmaceutical Contract Manufacturing by Application - Pharmaceutical and Biopharmaceutical Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 151: Rest of Asia-Pacific 16-Year Perspective for Pharmaceutical Contract Manufacturing by Application - Percentage Breakdown of Value Sales for Pharmaceutical and Biopharmaceutical for the Years 2014, 2025 & 2030

- TABLE 152: Rest of Asia-Pacific Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by End-Use - Sterile and Non-Sterile - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 153: Rest of Asia-Pacific Historic Review for Pharmaceutical Contract Manufacturing by End-Use - Sterile and Non-Sterile Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 154: Rest of Asia-Pacific 16-Year Perspective for Pharmaceutical Contract Manufacturing by End-Use - Percentage Breakdown of Value Sales for Sterile and Non-Sterile for the Years 2014, 2025 & 2030

- REST OF WORLD

- TABLE 155: Rest of World Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by Product Type - API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 156: Rest of World Historic Review for Pharmaceutical Contract Manufacturing by Product Type - API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 157: Rest of World 16-Year Perspective for Pharmaceutical Contract Manufacturing by Product Type - Percentage Breakdown of Value Sales for API/Bulk Drugs, Advanced Drug Delivery Formulations, Packaging, Finished Dose Formulations and Other Product Types for the Years 2014, 2025 & 2030

- TABLE 158: Rest of World Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by Application - Pharmaceutical and Biopharmaceutical - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 159: Rest of World Historic Review for Pharmaceutical Contract Manufacturing by Application - Pharmaceutical and Biopharmaceutical Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 160: Rest of World 16-Year Perspective for Pharmaceutical Contract Manufacturing by Application - Percentage Breakdown of Value Sales for Pharmaceutical and Biopharmaceutical for the Years 2014, 2025 & 2030

- TABLE 161: Rest of World Recent Past, Current & Future Analysis for Pharmaceutical Contract Manufacturing by End-Use - Sterile and Non-Sterile - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 162: Rest of World Historic Review for Pharmaceutical Contract Manufacturing by End-Use - Sterile and Non-Sterile Markets - Independent Analysis of Annual Sales in US$ Million for Years 2014 through 2023 and % CAGR

- TABLE 163: Rest of World 16-Year Perspective for Pharmaceutical Contract Manufacturing by End-Use - Percentage Breakdown of Value Sales for Sterile and Non-Sterile for the Years 2014, 2025 & 2030