|

|

市場調査レポート

商品コード

1747656

厚膜フォトレジストの世界市場Thick Layer Photoresists |

||||||

適宜更新あり

|

|||||||

| 厚膜フォトレジストの世界市場 |

|

出版日: 2025年06月13日

発行: Market Glass, Inc. (Formerly Global Industry Analysts, Inc.)

ページ情報: 英文 282 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

厚膜フォトレジストの世界市場は2030年までに1億3,400万米ドルに達する見込み

2024年に1億1,310万米ドルと推定される厚膜フォトレジストの世界市場は、分析期間2024-2030年にCAGR 2.9%で成長し、2030年には1億3,400万米ドルに達すると予測されます。本レポートで分析したセグメントの1つであるポジ型フォトレジストは、CAGR 3.4%を記録し、分析期間終了時には9,310万米ドルに達すると予測されています。ネガ型フォトレジスト分野の成長率は、分析期間でCAGR 1.6%と推定されます。

米国市場は3,080万米ドルと推定、中国はCAGR 5.6%で成長予測

米国の厚膜フォトレジスト市場は、2024年に3,080万米ドルと推定されます。世界第2位の経済大国である中国は、2030年までに2,630万米ドルの市場規模に達すると予測され、分析期間2024-2030年のCAGRは5.6%です。その他の注目すべき地域別市場としては、日本とカナダがあり、分析期間中のCAGRはそれぞれ1.1%と2.2%と予測されています。欧州では、ドイツがCAGR 1.6%で成長すると予測されています。

世界の「厚膜フォトレジスト」市場- 主要動向と促進要因のまとめ

微細加工における「厚膜フォトレジスト」復活の原動力は?

厚膜フォトレジスト(TLPR)は、MEMS、マイクロ流体、ウエハーレベルパッケージングで伝統的に使用されてきましたが、産業界がより複雑で高アスペクト比の微細構造への取り組みを推進するにつれて、需要が再燃しています。これらのフォトレジストは、ディープリソグラフィーを可能にする上で極めて重要な役割を担っており、かなりの深さにわたって機械的安定性とパターン忠実性の両方を提供します。エレクトロニクス産業がヘテロジニアス・インテグレーションや3D ICパッケージングへとシフトする中、TLPRは多層アーキテクチャの形成に不可欠なものとなっています。さらに、センサーやアクチュエーターが構造層や犠牲層に精密で厚いレジストパターンを必要とする微小電気機械システム(MEMS)産業からの需要も急増しています。高解像度の光学デバイスや高度なインターポーザーも、TLPRを使用することで、歪みを最小限に抑えて微細で高さのある特徴を作り出すことができます。特にエポキシ系レジストやドライフィルムレジストの配合化学の改良により、クラック、層間剥離、残留応力などの問題が減少しています。これらの進歩により、TLPRは電気メッキやエッチングなど、より熱的・化学的要求の高いプロセスで使用できるようになり、デバイスの小型化やシステム統合に新たな可能性をもたらしています。

厚膜フォトレジストはMEMSとウエハーレベルパッケージングの未来への秘薬となるか?

IoT、ウェアラブル技術、エッジデバイスの普及に伴い、MEMSと半導体パッケージングに対する小型化と集積化の要求はかつてないレベルに達しています。厚膜フォトレジストは、これらのシステムにおいて、金型としてだけでなく、保護や機能部品としても機能する構造体を作成する上で不可欠な材料として台頭してきました。ウエハーレベルパッケージング(WLP)において、TLPRは高度なチップ接続に不可欠な再配線層、バンプ、スルーシリコンビア(TSV)の形成を可能にします。ディープリアクティブイオンエッチング(DRIE)や電気メッキのような厳しい後処理工程でも完全性を維持できるため、従来の薄いレジストよりも優れています。センサーやアクチュエーターの複雑化に伴い、特に自動車やバイオメディカル用途では、精密な微細形状を維持しながら高い機械的・熱的ストレスに耐えるレジスト材料が必要とされています。ラボオンチップ・プラットフォームやバイオメディカル診断装置の動向も、マイクロチャネルやリザーバーを形成するための厚膜レジストに大きく依存しています。このようなアプリケーションの進化は、次世代の電子機器やマイクロ流体デバイスの製造においてTLPRが不可欠な役割を果たすことを裏付けています。

なぜメーカーは厚膜フォトレジストの先端配合に多額の投資をしているのか?

材料科学の革新により、接着性、アスペクト比、熱安定性に優れたレジストが登場し、市場は大きな変革期を迎えています。メーカーは、ネガトーン、エポキシベース、ハイブリッドポリマーシステムを含む次世代配合を開発し、フォトリソグラフィープラットフォームの特定のプロセスニーズに対応しています。主要企業は、シリコンからガラス、金属に至るまで、さまざまな基板への超均一な成膜のために、スピンコーティングに適した粘度の最適化を進めています。さらに、UVやX線に感応するフォトレジストは、超高解像度や100ミクロン以上の厚膜構造を必要とする用途向けに調整されています。これらの開発は、厚く安定した構造が不可欠なマイクロ流体デバイス、インクジェットプリントヘッド、光インターコネクトの製造に特に大きな影響を与えます。レジスト塗布・開発プロセスの自動化と標準化も、鋳造やファブでのスループットを向上させ、コストを削減し、中小メーカーのアクセスを拡大しています。厚膜ドライフィルムの使用は、溶剤の使用量と環境への影響を削減し、半導体および電子機器製造における広範な持続可能性目標に合致するため、より顕著になってきています。

厚膜フォトレジスト市場の成長はいくつかの要因に牽引されている...

TLPR市場の拡大は、基本的に特定の技術および最終用途の進歩と結びついています。自動車(LiDARセンサー、圧力センサーなど)、バイオメディカル(マイクロ流体診断チップなど)、産業オートメーション分野での複雑なMEMSデバイスに対する継続的な需要は、主要な促進要因の1つです。これらのアプリケーションでは、高アスペクト比で機械的に堅牢なパターンが要求されるが、これはTLPRによってのみ実現可能です。半導体パッケージングでは、ファンアウト・ウエハーレベル・パッケージングと2.5D/3D統合の台頭が、スルーモールド・ビアと再配線層加工における厚膜フォトレジストへの持続的な需要を生み出しています。さらに、特にスマートフォンやAR/VRデバイスにおけるマイクロオプティクスと高度なカメラモジュールの成長は、レンズモールドの作成と導波路の構造化のための厚膜レジスト材料に依存しています。ファブリケーションハウスや鋳造も、厚膜レジスト用に最適化された高スループットのスピンコーティングシステムや露光ツールに投資しており、製造能力と採用率を高めています。ハイブリッドボンディング、先端インターポーザ、データセンターとAIプロセッサにおけるTSVアーキテクチャの重要性が高まっていることも、市場牽引に貢献しています。これらの促進要因はそれぞれ、特定の技術的および消費者行動の変化を反映しており、進化する微細加工エコシステムにおけるTLPRの重要性が浮き彫りになっています。

セグメント

タイプ(ポジ型フォトレジスト、ネガ型フォトレジスト);アプリケーション(ウエハーレベルパッケージング、フリップチップ、その他のアプリケーション)

調査対象企業の例(注目の48社)

- Allresist GmbH

- Asahi Kasei Corporation

- DJ Microlaminates, Inc.

- DuPont de Nemours, Inc.

- Everlight Chemical Industrial Corp.

- Fujifilm Holdings Corporation

- Futurrex, Inc.

- JSR Corporation

- Kayaku Advanced Materials, Inc.

- KemLab, Inc.

- Kempur Microelectronics Inc.

- Kolon Industries, Inc.

- Merck KGaA(AZ Electronic Materials)

- Microchemicals GmbH

- Shin-Etsu Chemical Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- TOKYO OHKA KOGYO CO., LTD.(TOK)

- Veeco Instruments Inc.

- Xuzhou B & C Chemical Co., Ltd.

- Youngchang Chemical Co., Ltd.

関税影響係数

Global Industry Analystsは、本社の国、製造拠点、輸出入(完成品とOEM)に基づく企業の競争力の変化を予測しています。この複雑で多面的な市場力学は、人為的な売上原価の増加、収益性の低下、サプライチェーンの再構築など、ミクロおよびマクロの市場力学の中でも特に競合他社に影響を与える見込みです。

Global Industry Analystsは、世界の主要なチーフ・エコノミスト(1万4,949人)、シンクタンク(62団体)、貿易・産業団体(171団体)の専門家の意見に熱心に従いながら、エコシステムへの影響を評価し、新たな市場の現実に対処しています。あらゆる主要国の専門家やエコノミストが、関税とそれが自国に与える影響についての意見を追跡調査しています。

Global Industry Analystsは、この混乱が今後2-3ヶ月で収束し、新しい世界秩序がより明確に確立されると予想しています。Global Industry Analystsは、これらの開発をリアルタイムで追跡しています。

2025年4月:交渉フェーズ

4月のリリースでは、世界市場全体に対する関税の影響を取り上げ、地域別の市場調整について紹介します。当社の予測は、過去のデータと進化する市場影響要因に基づいています。

2025年7月:最終関税リセット

お客様には、各国間で最終リセットが発表された後、7月に無料アップデート版をお届けします。最終アップデート版には、明確に定義された関税影響分析が組み込まれています。

相互および二国間貿易と関税の影響分析:

アメリカ <>中国<>メキシコ <>カナダ <>EU <>日本<>インド <>その他176カ国

業界をリードするエコノミスト:Global Industry Analystsの知識ベースは、国家、シンクタンク、貿易・業界団体、大企業、そして世界の計量経済状況におけるこの前例のないパラダイムシフトの影響を共有する領域の専門家など、最も影響力のあるチーフエコノミストを含む1万4,949人のエコノミストを追跡しています。当社の16,491を超えるレポートのほとんどは、マイルストーンに基づくこの2段階のリリーススケジュールを取り入れています。

目次

第1章 調査手法

第2章 エグゼクティブサマリー

- 市場概要

- 主要企業

- 市場動向と促進要因

- 世界市場の見通し

第3章 市場分析

- 米国

- カナダ

- 日本

- 中国

- 欧州

- フランス

- ドイツ

- イタリア

- 英国

- スペイン

- ロシア

- その他欧州

- アジア太平洋

- オーストラリア

- インド

- 韓国

- その他アジア太平洋地域

- ラテンアメリカ

- アルゼンチン

- ブラジル

- メキシコ

- その他ラテンアメリカ

- 中東

- イラン

- イスラエル

- サウジアラビア

- アラブ首長国連邦

- その他中東

- アフリカ

第4章 競合

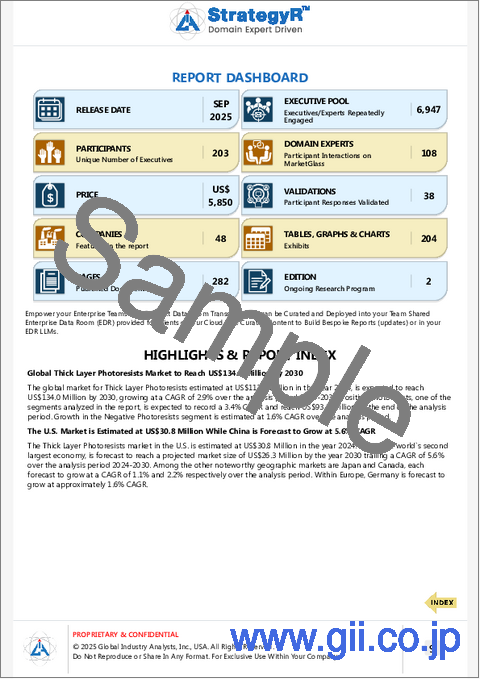

Global Thick Layer Photoresists Market to Reach US$134.0 Million by 2030

The global market for Thick Layer Photoresists estimated at US$113.1 Million in the year 2024, is expected to reach US$134.0 Million by 2030, growing at a CAGR of 2.9% over the analysis period 2024-2030. Positive Photoresists, one of the segments analyzed in the report, is expected to record a 3.4% CAGR and reach US$93.1 Million by the end of the analysis period. Growth in the Negative Photoresists segment is estimated at 1.6% CAGR over the analysis period.

The U.S. Market is Estimated at US$30.8 Million While China is Forecast to Grow at 5.6% CAGR

The Thick Layer Photoresists market in the U.S. is estimated at US$30.8 Million in the year 2024. China, the world's second largest economy, is forecast to reach a projected market size of US$26.3 Million by the year 2030 trailing a CAGR of 5.6% over the analysis period 2024-2030. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at a CAGR of 1.1% and 2.2% respectively over the analysis period. Within Europe, Germany is forecast to grow at approximately 1.6% CAGR.

Global "Thick Layer Photoresists" Market - Key Trends & Drivers Summarized

What’s Fueling the Resurgence of Thick Layer Photoresists in Microfabrication?

Thick layer photoresists (TLPRs), traditionally used in MEMS, microfluidics, and wafer-level packaging, are witnessing renewed demand as industries push toward more complex and high-aspect-ratio microstructures. These photoresists play a pivotal role in enabling deep lithography, offering both mechanical stability and pattern fidelity over considerable depths. As the electronics industry shifts toward heterogeneous integration and 3D IC packaging, TLPRs are becoming critical in forming multilayer architectures. Additionally, demand is surging from the microelectromechanical systems (MEMS) industry, where sensors and actuators require precise, thick resist patterns for structural and sacrificial layers. High-resolution optical devices and advanced interposers also benefit from the use of TLPRs in creating fine, tall features with minimal distortion. Improvements in the formulation chemistry-especially in epoxy-based and dry film resists-have reduced issues such as cracking, delamination, and residual stress. These advancements are allowing TLPRs to be used in more thermally and chemically demanding processes, such as electroplating and etching, opening new possibilities in device miniaturization and system integration.

Could Thick Photoresists Be the Secret Ingredient to the Future of MEMS and Wafer-Level Packaging?

With the proliferation of IoT, wearable technology, and edge devices, the miniaturization and integration demands on MEMS and semiconductor packaging are reaching unprecedented levels. Thick photoresists have emerged as essential materials in creating structures that serve not only as molds but also as protective and functional components in these systems. In wafer-level packaging (WLP), TLPRs enable the formation of redistribution layers, bumps, and through-silicon vias (TSVs), essential for advanced chip connectivity. Their ability to maintain integrity during aggressive post-processing steps such as deep reactive ion etching (DRIE) and electroplating makes them superior to traditional thin resists. The increasing complexity of sensors and actuators, especially in automotive and biomedical applications, necessitates resist materials that can withstand high mechanical and thermal stress while preserving precise microfeatures. The trend toward lab-on-chip platforms and biomedical diagnostic devices also relies heavily on thick resists for creating microchannels and reservoirs. These evolving applications underscore the indispensable role of TLPRs in next-generation electronic and microfluidic device manufacturing.

Why Are Manufacturers Investing Heavily in Advanced Formulations of Thick Layer Photoresists?

The market is undergoing a significant transformation driven by innovations in material science, enabling resists with superior adhesion, aspect ratio capability, and thermal stability. Manufacturers are developing next-gen formulations that include negative-tone, epoxy-based, and hybrid polymeric systems to cater to specific process needs across photolithography platforms. Key companies are optimizing viscosities to suit spin-coating for ultra-uniform deposition on various substrates, from silicon to glass and metal. Additionally, UV- and X-ray-sensitive photoresists are being tailored for applications that require ultra-high resolution or thick structuring beyond 100 microns. These developments are particularly impactful in the production of microfluidic devices, inkjet printheads, and optical interconnects, where thick, stable structures are essential. Automation and standardization of resist application and development processes are also improving throughput in foundries and fabs, reducing costs and expanding access for small- and medium-sized manufacturers. The use of thick dry films is becoming more prominent as they reduce solvent usage and environmental impact, aligning with broader sustainability goals in semiconductor and electronics production.

The Growth in the Thick Layer Photoresists Market Is Driven by Several Factors…

The expansion of the TLPR market is fundamentally tied to specific technological and end-use advancements. The ongoing demand for complex MEMS devices in automotive (e.g., LiDAR sensors, pressure sensors), biomedical (e.g., microfluidic diagnostic chips), and industrial automation sectors is one of the leading drivers. These applications require high-aspect-ratio, mechanically robust patterns, which are achievable only through TLPRs. In semiconductor packaging, the rise of fan-out wafer-level packaging and 2.5D/3D integration is creating sustained demand for thick photoresists in through-mold via and redistribution layer processing. Additionally, the growth of micro-optics and advanced camera modules-particularly in smartphones and AR/VR devices-relies on thick resist materials for lens mold creation and waveguide structuring. Fabrication houses and foundries are also investing in high-throughput spin-coating systems and exposure tools optimized for thick resists, which is enhancing manufacturing capabilities and adoption rates. The increasing relevance of hybrid bonding, advanced interposers, and TSV architectures in data centers and AI processors further contributes to market traction. Each of these drivers reflects specific technical and consumer behavior shifts, underscoring the critical importance of TLPRs in the evolving microfabrication ecosystem.

SCOPE OF STUDY:

The report analyzes the Thick Layer Photoresists market in terms of units by the following Segments, and Geographic Regions/Countries:

Segments:

Type (Positive Photoresists, Negative Photoresists); Application (Wafer-Level Packaging, Flip Chip, Other Applications)

Geographic Regions/Countries:

World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Select Competitors (Total 48 Featured) -

- Allresist GmbH

- Asahi Kasei Corporation

- DJ Microlaminates, Inc.

- DuPont de Nemours, Inc.

- Everlight Chemical Industrial Corp.

- Fujifilm Holdings Corporation

- Futurrex, Inc.

- JSR Corporation

- Kayaku Advanced Materials, Inc.

- KemLab, Inc.

- Kempur Microelectronics Inc.

- Kolon Industries, Inc.

- Merck KGaA (AZ Electronic Materials)

- Microchemicals GmbH

- Shin-Etsu Chemical Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- TOKYO OHKA KOGYO CO., LTD. (TOK)

- Veeco Instruments Inc.

- Xuzhou B & C Chemical Co., Ltd.

- Youngchang Chemical Co., Ltd.

TARIFF IMPACT FACTOR

Our new release incorporates impact of tariffs on geographical markets as we predict a shift in competitiveness of companies based on HQ country, manufacturing base, exports and imports (finished goods and OEM). This intricate and multifaceted market reality will impact competitors by artificially increasing the COGS, reducing profitability, reconfiguring supply chains, amongst other micro and macro market dynamics.

We are diligently following expert opinions of leading Chief Economists (14,949), Think Tanks (62), Trade & Industry bodies (171) worldwide, as they assess impact and address new market realities for their ecosystems. Experts and economists from every major country are tracked for their opinions on tariffs and how they will impact their countries.

We expect this chaos to play out over the next 2-3 months and a new world order is established with more clarity. We are tracking these developments on a real time basis.

As we release this report, U.S. Trade Representatives are pushing their counterparts in 183 countries for an early closure to bilateral tariff negotiations. Most of the major trading partners also have initiated trade agreements with other key trading nations, outside of those in the works with the United States. We are tracking such secondary fallouts as supply chains shift.

To our valued clients, we say, we have your back. We will present a simplified market reassessment by incorporating these changes!

APRIL 2025: NEGOTIATION PHASE

Our April release addresses the impact of tariffs on the overall global market and presents market adjustments by geography. Our trajectories are based on historic data and evolving market impacting factors.

JULY 2025 FINAL TARIFF RESET

Complimentary Update: Our clients will also receive a complimentary update in July after a final reset is announced between nations. The final updated version incorporates clearly defined Tariff Impact Analyses.

Reciprocal and Bilateral Trade & Tariff Impact Analyses:

USA <> CHINA <> MEXICO <> CANADA <> EU <> JAPAN <> INDIA <> 176 OTHER COUNTRIES.

Leading Economists - Our knowledge base tracks 14,949 economists including a select group of most influential Chief Economists of nations, think tanks, trade and industry bodies, big enterprises, and domain experts who are sharing views on the fallout of this unprecedented paradigm shift in the global econometric landscape. Most of our 16,491+ reports have incorporated this two-stage release schedule based on milestones.

COMPLIMENTARY PREVIEW

Contact your sales agent to request an online 300+ page complimentary preview of this research project. Our preview will present full stack sources, and validated domain expert data transcripts. Deep dive into our interactive data-driven online platform.

TABLE OF CONTENTS

I. METHODOLOGY

II. EXECUTIVE SUMMARY

- 1. MARKET OVERVIEW

- Influencer Market Insights

- World Market Trajectories

- Tariff Impact on Global Supply Chain Patterns

- Thick Layer Photoresists - Global Key Competitors Percentage Market Share in 2025 (E)

- Competitive Market Presence - Strong/Active/Niche/Trivial for Players Worldwide in 2025 (E)

- 2. FOCUS ON SELECT PLAYERS

- 3. MARKET TRENDS & DRIVERS

- Semiconductor Packaging Innovations Propel Growth in Thick Photoresist Usage

- Increase in MEMS and CMOS Devices Expands Market Application Base

- Rising Demand for Wafer-Level Packaging Drives Adoption of High-Aspect Ratio Photoresists

- Growth of the Automotive and Industrial Sensor Market Strengthens Business Case

- Advanced Lithography Requirements Spur Technological Advancements in Photoresist Materials

- Shift Toward 3D Integration in Semiconductors Throws Spotlight on Thick Layer Materials

- Proliferation of IoT Devices Drives Demand for Reliable Microfabrication Techniques

- Rise in Consumer Electronics Manufacturing Accelerates Use of Thick Film Processes

- Demand for High Durability and Chemical Resistance Expands Product Adoption

- Integration with Advanced Display Technologies Creates New Growth Avenues

- Sustainability in Semiconductor Manufacturing Raises Questions on Waste Management

- 4. GLOBAL MARKET PERSPECTIVE

- TABLE 1: World Thick Layer Photoresists Market Analysis of Annual Sales in US$ for Years 2015 through 2030

- TABLE 2: World Recent Past, Current & Future Analysis for Thick Layer Photoresists by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ for Years 2024 through 2030 and % CAGR

- TABLE 3: World Historic Review for Thick Layer Photoresists by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 4: World 15-Year Perspective for Thick Layer Photoresists by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets for Years 2015, 2025 & 2030

- TABLE 5: World Recent Past, Current & Future Analysis for Positive Photoresists by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ for Years 2024 through 2030 and % CAGR

- TABLE 6: World Historic Review for Positive Photoresists by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 7: World 15-Year Perspective for Positive Photoresists by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2015, 2025 & 2030

- TABLE 8: World Recent Past, Current & Future Analysis for Negative Photoresists by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ for Years 2024 through 2030 and % CAGR

- TABLE 9: World Historic Review for Negative Photoresists by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 10: World 15-Year Perspective for Negative Photoresists by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2015, 2025 & 2030

- TABLE 11: World Recent Past, Current & Future Analysis for Wafer-Level Packaging by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ for Years 2024 through 2030 and % CAGR

- TABLE 12: World Historic Review for Wafer-Level Packaging by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 13: World 15-Year Perspective for Wafer-Level Packaging by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2015, 2025 & 2030

- TABLE 14: World Recent Past, Current & Future Analysis for Flip Chip by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ for Years 2024 through 2030 and % CAGR

- TABLE 15: World Historic Review for Flip Chip by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 16: World 15-Year Perspective for Flip Chip by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2015, 2025 & 2030

- TABLE 17: World Recent Past, Current & Future Analysis for Other Applications by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ for Years 2024 through 2030 and % CAGR

- TABLE 18: World Historic Review for Other Applications by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 19: World 15-Year Perspective for Other Applications by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2015, 2025 & 2030

III. MARKET ANALYSIS

- UNITED STATES

- Thick Layer Photoresists Market Presence - Strong/Active/Niche/Trivial - Key Competitors in the United States for 2025 (E)

- TABLE 20: USA Recent Past, Current & Future Analysis for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 21: USA Historic Review for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 22: USA 15-Year Perspective for Thick Layer Photoresists by Type - Percentage Breakdown of Value Sales for Positive Photoresists and Negative Photoresists for the Years 2015, 2025 & 2030

- TABLE 23: USA Recent Past, Current & Future Analysis for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 24: USA Historic Review for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 25: USA 15-Year Perspective for Thick Layer Photoresists by Application - Percentage Breakdown of Value Sales for Wafer-Level Packaging, Flip Chip and Other Applications for the Years 2015, 2025 & 2030

- CANADA

- TABLE 26: Canada Recent Past, Current & Future Analysis for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 27: Canada Historic Review for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 28: Canada 15-Year Perspective for Thick Layer Photoresists by Type - Percentage Breakdown of Value Sales for Positive Photoresists and Negative Photoresists for the Years 2015, 2025 & 2030

- TABLE 29: Canada Recent Past, Current & Future Analysis for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 30: Canada Historic Review for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 31: Canada 15-Year Perspective for Thick Layer Photoresists by Application - Percentage Breakdown of Value Sales for Wafer-Level Packaging, Flip Chip and Other Applications for the Years 2015, 2025 & 2030

- JAPAN

- Thick Layer Photoresists Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Japan for 2025 (E)

- TABLE 32: Japan Recent Past, Current & Future Analysis for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 33: Japan Historic Review for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 34: Japan 15-Year Perspective for Thick Layer Photoresists by Type - Percentage Breakdown of Value Sales for Positive Photoresists and Negative Photoresists for the Years 2015, 2025 & 2030

- TABLE 35: Japan Recent Past, Current & Future Analysis for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 36: Japan Historic Review for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 37: Japan 15-Year Perspective for Thick Layer Photoresists by Application - Percentage Breakdown of Value Sales for Wafer-Level Packaging, Flip Chip and Other Applications for the Years 2015, 2025 & 2030

- CHINA

- Thick Layer Photoresists Market Presence - Strong/Active/Niche/Trivial - Key Competitors in China for 2025 (E)

- TABLE 38: China Recent Past, Current & Future Analysis for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 39: China Historic Review for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 40: China 15-Year Perspective for Thick Layer Photoresists by Type - Percentage Breakdown of Value Sales for Positive Photoresists and Negative Photoresists for the Years 2015, 2025 & 2030

- TABLE 41: China Recent Past, Current & Future Analysis for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 42: China Historic Review for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 43: China 15-Year Perspective for Thick Layer Photoresists by Application - Percentage Breakdown of Value Sales for Wafer-Level Packaging, Flip Chip and Other Applications for the Years 2015, 2025 & 2030

- EUROPE

- Thick Layer Photoresists Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Europe for 2025 (E)

- TABLE 44: Europe Recent Past, Current & Future Analysis for Thick Layer Photoresists by Geographic Region - France, Germany, Italy, UK, Spain, Russia and Rest of Europe Markets - Independent Analysis of Annual Sales in US$ for Years 2024 through 2030 and % CAGR

- TABLE 45: Europe Historic Review for Thick Layer Photoresists by Geographic Region - France, Germany, Italy, UK, Spain, Russia and Rest of Europe Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 46: Europe 15-Year Perspective for Thick Layer Photoresists by Geographic Region - Percentage Breakdown of Value Sales for France, Germany, Italy, UK, Spain, Russia and Rest of Europe Markets for Years 2015, 2025 & 2030

- TABLE 47: Europe Recent Past, Current & Future Analysis for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 48: Europe Historic Review for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 49: Europe 15-Year Perspective for Thick Layer Photoresists by Type - Percentage Breakdown of Value Sales for Positive Photoresists and Negative Photoresists for the Years 2015, 2025 & 2030

- TABLE 50: Europe Recent Past, Current & Future Analysis for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 51: Europe Historic Review for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 52: Europe 15-Year Perspective for Thick Layer Photoresists by Application - Percentage Breakdown of Value Sales for Wafer-Level Packaging, Flip Chip and Other Applications for the Years 2015, 2025 & 2030

- FRANCE

- Thick Layer Photoresists Market Presence - Strong/Active/Niche/Trivial - Key Competitors in France for 2025 (E)

- TABLE 53: France Recent Past, Current & Future Analysis for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 54: France Historic Review for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 55: France 15-Year Perspective for Thick Layer Photoresists by Type - Percentage Breakdown of Value Sales for Positive Photoresists and Negative Photoresists for the Years 2015, 2025 & 2030

- TABLE 56: France Recent Past, Current & Future Analysis for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 57: France Historic Review for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 58: France 15-Year Perspective for Thick Layer Photoresists by Application - Percentage Breakdown of Value Sales for Wafer-Level Packaging, Flip Chip and Other Applications for the Years 2015, 2025 & 2030

- GERMANY

- Thick Layer Photoresists Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Germany for 2025 (E)

- TABLE 59: Germany Recent Past, Current & Future Analysis for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 60: Germany Historic Review for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 61: Germany 15-Year Perspective for Thick Layer Photoresists by Type - Percentage Breakdown of Value Sales for Positive Photoresists and Negative Photoresists for the Years 2015, 2025 & 2030

- TABLE 62: Germany Recent Past, Current & Future Analysis for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 63: Germany Historic Review for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 64: Germany 15-Year Perspective for Thick Layer Photoresists by Application - Percentage Breakdown of Value Sales for Wafer-Level Packaging, Flip Chip and Other Applications for the Years 2015, 2025 & 2030

- ITALY

- TABLE 65: Italy Recent Past, Current & Future Analysis for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 66: Italy Historic Review for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 67: Italy 15-Year Perspective for Thick Layer Photoresists by Type - Percentage Breakdown of Value Sales for Positive Photoresists and Negative Photoresists for the Years 2015, 2025 & 2030

- TABLE 68: Italy Recent Past, Current & Future Analysis for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 69: Italy Historic Review for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 70: Italy 15-Year Perspective for Thick Layer Photoresists by Application - Percentage Breakdown of Value Sales for Wafer-Level Packaging, Flip Chip and Other Applications for the Years 2015, 2025 & 2030

- UNITED KINGDOM

- Thick Layer Photoresists Market Presence - Strong/Active/Niche/Trivial - Key Competitors in the United Kingdom for 2025 (E)

- TABLE 71: UK Recent Past, Current & Future Analysis for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 72: UK Historic Review for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 73: UK 15-Year Perspective for Thick Layer Photoresists by Type - Percentage Breakdown of Value Sales for Positive Photoresists and Negative Photoresists for the Years 2015, 2025 & 2030

- TABLE 74: UK Recent Past, Current & Future Analysis for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 75: UK Historic Review for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 76: UK 15-Year Perspective for Thick Layer Photoresists by Application - Percentage Breakdown of Value Sales for Wafer-Level Packaging, Flip Chip and Other Applications for the Years 2015, 2025 & 2030

- SPAIN

- TABLE 77: Spain Recent Past, Current & Future Analysis for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 78: Spain Historic Review for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 79: Spain 15-Year Perspective for Thick Layer Photoresists by Type - Percentage Breakdown of Value Sales for Positive Photoresists and Negative Photoresists for the Years 2015, 2025 & 2030

- TABLE 80: Spain Recent Past, Current & Future Analysis for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 81: Spain Historic Review for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 82: Spain 15-Year Perspective for Thick Layer Photoresists by Application - Percentage Breakdown of Value Sales for Wafer-Level Packaging, Flip Chip and Other Applications for the Years 2015, 2025 & 2030

- RUSSIA

- TABLE 83: Russia Recent Past, Current & Future Analysis for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 84: Russia Historic Review for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 85: Russia 15-Year Perspective for Thick Layer Photoresists by Type - Percentage Breakdown of Value Sales for Positive Photoresists and Negative Photoresists for the Years 2015, 2025 & 2030

- TABLE 86: Russia Recent Past, Current & Future Analysis for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 87: Russia Historic Review for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 88: Russia 15-Year Perspective for Thick Layer Photoresists by Application - Percentage Breakdown of Value Sales for Wafer-Level Packaging, Flip Chip and Other Applications for the Years 2015, 2025 & 2030

- REST OF EUROPE

- TABLE 89: Rest of Europe Recent Past, Current & Future Analysis for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 90: Rest of Europe Historic Review for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 91: Rest of Europe 15-Year Perspective for Thick Layer Photoresists by Type - Percentage Breakdown of Value Sales for Positive Photoresists and Negative Photoresists for the Years 2015, 2025 & 2030

- TABLE 92: Rest of Europe Recent Past, Current & Future Analysis for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 93: Rest of Europe Historic Review for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 94: Rest of Europe 15-Year Perspective for Thick Layer Photoresists by Application - Percentage Breakdown of Value Sales for Wafer-Level Packaging, Flip Chip and Other Applications for the Years 2015, 2025 & 2030

- ASIA-PACIFIC

- Thick Layer Photoresists Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Asia-Pacific for 2025 (E)

- TABLE 95: Asia-Pacific Recent Past, Current & Future Analysis for Thick Layer Photoresists by Geographic Region - Australia, India, South Korea and Rest of Asia-Pacific Markets - Independent Analysis of Annual Sales in US$ for Years 2024 through 2030 and % CAGR

- TABLE 96: Asia-Pacific Historic Review for Thick Layer Photoresists by Geographic Region - Australia, India, South Korea and Rest of Asia-Pacific Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 97: Asia-Pacific 15-Year Perspective for Thick Layer Photoresists by Geographic Region - Percentage Breakdown of Value Sales for Australia, India, South Korea and Rest of Asia-Pacific Markets for Years 2015, 2025 & 2030

- TABLE 98: Asia-Pacific Recent Past, Current & Future Analysis for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 99: Asia-Pacific Historic Review for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 100: Asia-Pacific 15-Year Perspective for Thick Layer Photoresists by Type - Percentage Breakdown of Value Sales for Positive Photoresists and Negative Photoresists for the Years 2015, 2025 & 2030

- TABLE 101: Asia-Pacific Recent Past, Current & Future Analysis for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 102: Asia-Pacific Historic Review for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 103: Asia-Pacific 15-Year Perspective for Thick Layer Photoresists by Application - Percentage Breakdown of Value Sales for Wafer-Level Packaging, Flip Chip and Other Applications for the Years 2015, 2025 & 2030

- AUSTRALIA

- Thick Layer Photoresists Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Australia for 2025 (E)

- TABLE 104: Australia Recent Past, Current & Future Analysis for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 105: Australia Historic Review for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 106: Australia 15-Year Perspective for Thick Layer Photoresists by Type - Percentage Breakdown of Value Sales for Positive Photoresists and Negative Photoresists for the Years 2015, 2025 & 2030

- TABLE 107: Australia Recent Past, Current & Future Analysis for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 108: Australia Historic Review for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 109: Australia 15-Year Perspective for Thick Layer Photoresists by Application - Percentage Breakdown of Value Sales for Wafer-Level Packaging, Flip Chip and Other Applications for the Years 2015, 2025 & 2030

- INDIA

- Thick Layer Photoresists Market Presence - Strong/Active/Niche/Trivial - Key Competitors in India for 2025 (E)

- TABLE 110: India Recent Past, Current & Future Analysis for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 111: India Historic Review for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 112: India 15-Year Perspective for Thick Layer Photoresists by Type - Percentage Breakdown of Value Sales for Positive Photoresists and Negative Photoresists for the Years 2015, 2025 & 2030

- TABLE 113: India Recent Past, Current & Future Analysis for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 114: India Historic Review for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 115: India 15-Year Perspective for Thick Layer Photoresists by Application - Percentage Breakdown of Value Sales for Wafer-Level Packaging, Flip Chip and Other Applications for the Years 2015, 2025 & 2030

- SOUTH KOREA

- TABLE 116: South Korea Recent Past, Current & Future Analysis for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 117: South Korea Historic Review for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 118: South Korea 15-Year Perspective for Thick Layer Photoresists by Type - Percentage Breakdown of Value Sales for Positive Photoresists and Negative Photoresists for the Years 2015, 2025 & 2030

- TABLE 119: South Korea Recent Past, Current & Future Analysis for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 120: South Korea Historic Review for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 121: South Korea 15-Year Perspective for Thick Layer Photoresists by Application - Percentage Breakdown of Value Sales for Wafer-Level Packaging, Flip Chip and Other Applications for the Years 2015, 2025 & 2030

- REST OF ASIA-PACIFIC

- TABLE 122: Rest of Asia-Pacific Recent Past, Current & Future Analysis for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 123: Rest of Asia-Pacific Historic Review for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 124: Rest of Asia-Pacific 15-Year Perspective for Thick Layer Photoresists by Type - Percentage Breakdown of Value Sales for Positive Photoresists and Negative Photoresists for the Years 2015, 2025 & 2030

- TABLE 125: Rest of Asia-Pacific Recent Past, Current & Future Analysis for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 126: Rest of Asia-Pacific Historic Review for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 127: Rest of Asia-Pacific 15-Year Perspective for Thick Layer Photoresists by Application - Percentage Breakdown of Value Sales for Wafer-Level Packaging, Flip Chip and Other Applications for the Years 2015, 2025 & 2030

- LATIN AMERICA

- Thick Layer Photoresists Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Latin America for 2025 (E)

- TABLE 128: Latin America Recent Past, Current & Future Analysis for Thick Layer Photoresists by Geographic Region - Argentina, Brazil, Mexico and Rest of Latin America Markets - Independent Analysis of Annual Sales in US$ for Years 2024 through 2030 and % CAGR

- TABLE 129: Latin America Historic Review for Thick Layer Photoresists by Geographic Region - Argentina, Brazil, Mexico and Rest of Latin America Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 130: Latin America 15-Year Perspective for Thick Layer Photoresists by Geographic Region - Percentage Breakdown of Value Sales for Argentina, Brazil, Mexico and Rest of Latin America Markets for Years 2015, 2025 & 2030

- TABLE 131: Latin America Recent Past, Current & Future Analysis for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 132: Latin America Historic Review for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 133: Latin America 15-Year Perspective for Thick Layer Photoresists by Type - Percentage Breakdown of Value Sales for Positive Photoresists and Negative Photoresists for the Years 2015, 2025 & 2030

- TABLE 134: Latin America Recent Past, Current & Future Analysis for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 135: Latin America Historic Review for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 136: Latin America 15-Year Perspective for Thick Layer Photoresists by Application - Percentage Breakdown of Value Sales for Wafer-Level Packaging, Flip Chip and Other Applications for the Years 2015, 2025 & 2030

- ARGENTINA

- TABLE 137: Argentina Recent Past, Current & Future Analysis for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 138: Argentina Historic Review for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 139: Argentina 15-Year Perspective for Thick Layer Photoresists by Type - Percentage Breakdown of Value Sales for Positive Photoresists and Negative Photoresists for the Years 2015, 2025 & 2030

- TABLE 140: Argentina Recent Past, Current & Future Analysis for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 141: Argentina Historic Review for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 142: Argentina 15-Year Perspective for Thick Layer Photoresists by Application - Percentage Breakdown of Value Sales for Wafer-Level Packaging, Flip Chip and Other Applications for the Years 2015, 2025 & 2030

- BRAZIL

- TABLE 143: Brazil Recent Past, Current & Future Analysis for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 144: Brazil Historic Review for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 145: Brazil 15-Year Perspective for Thick Layer Photoresists by Type - Percentage Breakdown of Value Sales for Positive Photoresists and Negative Photoresists for the Years 2015, 2025 & 2030

- TABLE 146: Brazil Recent Past, Current & Future Analysis for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 147: Brazil Historic Review for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 148: Brazil 15-Year Perspective for Thick Layer Photoresists by Application - Percentage Breakdown of Value Sales for Wafer-Level Packaging, Flip Chip and Other Applications for the Years 2015, 2025 & 2030

- MEXICO

- TABLE 149: Mexico Recent Past, Current & Future Analysis for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 150: Mexico Historic Review for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 151: Mexico 15-Year Perspective for Thick Layer Photoresists by Type - Percentage Breakdown of Value Sales for Positive Photoresists and Negative Photoresists for the Years 2015, 2025 & 2030

- TABLE 152: Mexico Recent Past, Current & Future Analysis for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 153: Mexico Historic Review for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 154: Mexico 15-Year Perspective for Thick Layer Photoresists by Application - Percentage Breakdown of Value Sales for Wafer-Level Packaging, Flip Chip and Other Applications for the Years 2015, 2025 & 2030

- REST OF LATIN AMERICA

- TABLE 155: Rest of Latin America Recent Past, Current & Future Analysis for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 156: Rest of Latin America Historic Review for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 157: Rest of Latin America 15-Year Perspective for Thick Layer Photoresists by Type - Percentage Breakdown of Value Sales for Positive Photoresists and Negative Photoresists for the Years 2015, 2025 & 2030

- TABLE 158: Rest of Latin America Recent Past, Current & Future Analysis for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 159: Rest of Latin America Historic Review for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 160: Rest of Latin America 15-Year Perspective for Thick Layer Photoresists by Application - Percentage Breakdown of Value Sales for Wafer-Level Packaging, Flip Chip and Other Applications for the Years 2015, 2025 & 2030

- MIDDLE EAST

- Thick Layer Photoresists Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Middle East for 2025 (E)

- TABLE 161: Middle East Recent Past, Current & Future Analysis for Thick Layer Photoresists by Geographic Region - Iran, Israel, Saudi Arabia, UAE and Rest of Middle East Markets - Independent Analysis of Annual Sales in US$ for Years 2024 through 2030 and % CAGR

- TABLE 162: Middle East Historic Review for Thick Layer Photoresists by Geographic Region - Iran, Israel, Saudi Arabia, UAE and Rest of Middle East Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 163: Middle East 15-Year Perspective for Thick Layer Photoresists by Geographic Region - Percentage Breakdown of Value Sales for Iran, Israel, Saudi Arabia, UAE and Rest of Middle East Markets for Years 2015, 2025 & 2030

- TABLE 164: Middle East Recent Past, Current & Future Analysis for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 165: Middle East Historic Review for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 166: Middle East 15-Year Perspective for Thick Layer Photoresists by Type - Percentage Breakdown of Value Sales for Positive Photoresists and Negative Photoresists for the Years 2015, 2025 & 2030

- TABLE 167: Middle East Recent Past, Current & Future Analysis for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 168: Middle East Historic Review for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 169: Middle East 15-Year Perspective for Thick Layer Photoresists by Application - Percentage Breakdown of Value Sales for Wafer-Level Packaging, Flip Chip and Other Applications for the Years 2015, 2025 & 2030

- IRAN

- TABLE 170: Iran Recent Past, Current & Future Analysis for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 171: Iran Historic Review for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 172: Iran 15-Year Perspective for Thick Layer Photoresists by Type - Percentage Breakdown of Value Sales for Positive Photoresists and Negative Photoresists for the Years 2015, 2025 & 2030

- TABLE 173: Iran Recent Past, Current & Future Analysis for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 174: Iran Historic Review for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 175: Iran 15-Year Perspective for Thick Layer Photoresists by Application - Percentage Breakdown of Value Sales for Wafer-Level Packaging, Flip Chip and Other Applications for the Years 2015, 2025 & 2030

- ISRAEL

- TABLE 176: Israel Recent Past, Current & Future Analysis for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 177: Israel Historic Review for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 178: Israel 15-Year Perspective for Thick Layer Photoresists by Type - Percentage Breakdown of Value Sales for Positive Photoresists and Negative Photoresists for the Years 2015, 2025 & 2030

- TABLE 179: Israel Recent Past, Current & Future Analysis for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 180: Israel Historic Review for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 181: Israel 15-Year Perspective for Thick Layer Photoresists by Application - Percentage Breakdown of Value Sales for Wafer-Level Packaging, Flip Chip and Other Applications for the Years 2015, 2025 & 2030

- SAUDI ARABIA

- TABLE 182: Saudi Arabia Recent Past, Current & Future Analysis for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 183: Saudi Arabia Historic Review for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 184: Saudi Arabia 15-Year Perspective for Thick Layer Photoresists by Type - Percentage Breakdown of Value Sales for Positive Photoresists and Negative Photoresists for the Years 2015, 2025 & 2030

- TABLE 185: Saudi Arabia Recent Past, Current & Future Analysis for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 186: Saudi Arabia Historic Review for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 187: Saudi Arabia 15-Year Perspective for Thick Layer Photoresists by Application - Percentage Breakdown of Value Sales for Wafer-Level Packaging, Flip Chip and Other Applications for the Years 2015, 2025 & 2030

- UNITED ARAB EMIRATES

- TABLE 188: UAE Recent Past, Current & Future Analysis for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 189: UAE Historic Review for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 190: UAE 15-Year Perspective for Thick Layer Photoresists by Type - Percentage Breakdown of Value Sales for Positive Photoresists and Negative Photoresists for the Years 2015, 2025 & 2030

- TABLE 191: UAE Recent Past, Current & Future Analysis for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 192: UAE Historic Review for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 193: UAE 15-Year Perspective for Thick Layer Photoresists by Application - Percentage Breakdown of Value Sales for Wafer-Level Packaging, Flip Chip and Other Applications for the Years 2015, 2025 & 2030

- REST OF MIDDLE EAST

- TABLE 194: Rest of Middle East Recent Past, Current & Future Analysis for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 195: Rest of Middle East Historic Review for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 196: Rest of Middle East 15-Year Perspective for Thick Layer Photoresists by Type - Percentage Breakdown of Value Sales for Positive Photoresists and Negative Photoresists for the Years 2015, 2025 & 2030

- TABLE 197: Rest of Middle East Recent Past, Current & Future Analysis for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 198: Rest of Middle East Historic Review for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 199: Rest of Middle East 15-Year Perspective for Thick Layer Photoresists by Application - Percentage Breakdown of Value Sales for Wafer-Level Packaging, Flip Chip and Other Applications for the Years 2015, 2025 & 2030

- AFRICA

- Thick Layer Photoresists Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Africa for 2025 (E)

- TABLE 200: Africa Recent Past, Current & Future Analysis for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 201: Africa Historic Review for Thick Layer Photoresists by Type - Positive Photoresists and Negative Photoresists Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 202: Africa 15-Year Perspective for Thick Layer Photoresists by Type - Percentage Breakdown of Value Sales for Positive Photoresists and Negative Photoresists for the Years 2015, 2025 & 2030

- TABLE 203: Africa Recent Past, Current & Future Analysis for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications - Independent Analysis of Annual Sales in US$ for the Years 2024 through 2030 and % CAGR

- TABLE 204: Africa Historic Review for Thick Layer Photoresists by Application - Wafer-Level Packaging, Flip Chip and Other Applications Markets - Independent Analysis of Annual Sales in US$ for Years 2015 through 2023 and % CAGR

- TABLE 205: Africa 15-Year Perspective for Thick Layer Photoresists by Application - Percentage Breakdown of Value Sales for Wafer-Level Packaging, Flip Chip and Other Applications for the Years 2015, 2025 & 2030