|

市場調査レポート

商品コード

1928953

トリクロロシラン市場の機会、成長要因、業界動向分析、および2026年から2035年までの予測Trichlorosilane Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

カスタマイズ可能

|

|||||||

| トリクロロシラン市場の機会、成長要因、業界動向分析、および2026年から2035年までの予測 |

|

出版日: 2026年01月13日

発行: Global Market Insights Inc.

ページ情報: 英文 190 Pages

納期: 2~3営業日

|

概要

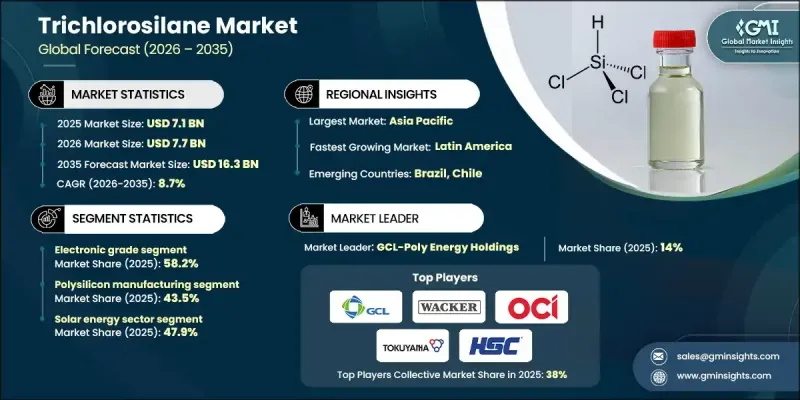

世界のトリクロロシラン市場は、2025年に71億米ドルと評価され、2035年までにCAGR8.7%で成長し、163億米ドルに達すると予測されています。

市場拡大の背景には、電子機器、太陽光発電、グリーン水素技術における高純度シリコンへの依存度の高まりが挙げられます。カーボンニュートラルとクリーンエネルギーへの世界の取り組みが太陽光発電の導入を加速させており、特にアジア太平洋地域では主要経済圏の政府支援政策が現地の太陽光製造を促進しています。半導体分野も需要に大きく貢献しており、人工知能、電気自動車、5G、IoTデバイスなどの新興技術には、トリクロロシラン由来の超高純度ポリシリコンが不可欠です。企業は需要増に対応するため、高度な精製プロセスへの投資と生産能力の拡大を進めています。さらに、環境規制や生産コスト削減の必要性から、流動層反応器(FBR)技術などのエネルギー効率の高いプロセスへの移行が進んでいます。この技術は従来法と比較して最大80%のエネルギー消費削減を実現します。

| 市場範囲 | |

|---|---|

| 開始年 | 2025年 |

| 予測年度 | 2026-2035 |

| 開始時価値 | 71億米ドル |

| 予測金額 | 163億米ドル |

| CAGR | 8.7% |

電子グレードのTCSセグメントは、2025年に58.2%のシェアを占め、2035年までCAGR8.9%で成長すると予想されています。このセグメントの主導的な地位は、半導体、太陽光発電セル、光ファイバー向けの超高純度ポリシリコンの製造において重要な役割を担っていることに起因しています。高度な電子機器における欠陥のないウエハーおよびチップ生産の必要性から、純度99.9999%以上のTCSに対する需要が高まっています。低グレードの代替品では、高性能半導体アプリケーションに必要な厳しい純度要件を満たすことができません。

太陽光エネルギー分野は2025年に47.9%のシェアを占め、2035年までCAGR8.6%で成長すると予測されています。トリクロロシランは結晶シリコン太陽電池に不可欠な太陽電池グレードポリシリコンの主要原料です。特に太陽光発電容量拡大を目指す国々における脱炭素化とクリーンエネルギー導入に向けた世界の取り組みが、市場成長を継続的に牽引しています。

北米トリクロロシラン市場は2025年に25.9%のシェアを占めました。同地域の成長は、国内の半導体・太陽電池製造エコシステムの再構築を目的とした政府施策によって支えられており、これによりトリクロロシランの生産量と消費量の増加が促進されています。

よくあるご質問

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 業界考察

- エコシステム分析

- サプライヤーの情勢

- 利益率

- 各段階における付加価値

- バリューチェーンに影響を与える要因

- ディスラプション

- 業界への影響要因

- 促進要因

- 業界の潜在的リスク&課題

- 市場機会

- 成長可能性分析

- 規制情勢

- 北米

- 欧州

- アジア太平洋地域

- ラテンアメリカ

- 中東・アフリカ

- ポーターの分析

- PESTEL分析

- 価格動向

- 地域別

- グレード別

- 今後の市場動向

- 技術とイノベーションの動向

- 現在の技術動向

- 新興技術

- 特許状況

- 貿易統計(HSコード)

(注:貿易統計は主要国のみ提供されます)

- 主要輸入国

- 主要な輸出国

- 持続可能性と環境面

- 持続可能な取り組み

- 廃棄物削減戦略

- 生産におけるエネルギー効率

- 環境に配慮した取り組み

- カーボンフットプリントへの配慮

第4章 競合情勢

- イントロダクション

- 企業の市場シェア分析

- 地域別

- 北米

- 欧州

- アジア太平洋地域

- ラテンアメリカ

- 中東・アフリカ地域

- 地域別

- 企業マトリクス分析

- 主要市場企業の競合分析

- 競合ポジショニングマトリックス

- 主な発展

- 合併・買収

- 提携・協業

- 新製品の発売

- 事業拡大計画

第5章 市場推計・予測:グレード別、2022-2035

- 電子グレード

- 工業用グレード

第6章 市場推計・予測:用途別、2022-2035

- ポリシリコン製造

- シランガス生産

- シリコーン中間体

- 太陽電池

- 光ファイバー

- コーティングおよび接着剤

- 実験室用試薬

- 半導体部品

第7章 市場推計・予測:最終用途別、2022-2035

- 太陽光エネルギー分野

- 太陽光発電セルの製造

- 太陽光パネル製造

- 半導体・エレクトロニクス

- IC製造

- ウエハーおよびチップ製造

- MEMSセンサー

- LEDおよび光検出器の製造

- 化学処理

- シランおよびシリコーンの製造

- 特殊化学中間体

- 電気通信

- 光ファイバーケーブルおよび部品

- ガラスプリフォーム製造

- 自動車・モビリティ

- ADASおよびEV向けシリコンチップ

- シリコン技術を用いたコーティングとセンサー

- 航空宇宙・防衛

- 耐熱性シリコーン部品

- 電子シールド部品

- 建設・インフラ

- 耐候性シーラント

- コーティング・接着剤

- ヘルスケア・医療機器

- 医療用シリコーン及びインプラント

- 診断用センサー部品

第8章 市場推計・予測:地域別、2022-2035

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- その他アジア太平洋地域

- ラテンアメリカ

- ブラジル

- メキシコ

- アルゼンチン

- その他ラテンアメリカ地域

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- アラブ首長国連邦

- その他中東・アフリカ地域

第9章 企業プロファイル

- American Elements

- Evonik Industries

- GCL-Poly Energy Holdings

- Gelest

- Haihang Group

- Hemlock Semiconductor Operations

- Hubei Jianghan New Materials

- Iota Corporation

- Linde

- OCI Company Ltd.

- REC Silicon

- Shin-Etsu Chemical

- Siad

- Tokuyama Corporation

- Wacker Chemie

- Others