|

|

市場調査レポート

商品コード

1716476

透析市場の機会、成長促進要因、産業動向分析、2025年~2034年の予測Dialysis Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

カスタマイズ可能

|

|||||||

| 透析市場の機会、成長促進要因、産業動向分析、2025年~2034年の予測 |

|

出版日: 2025年03月05日

発行: Global Market Insights Inc.

ページ情報: 英文 140 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

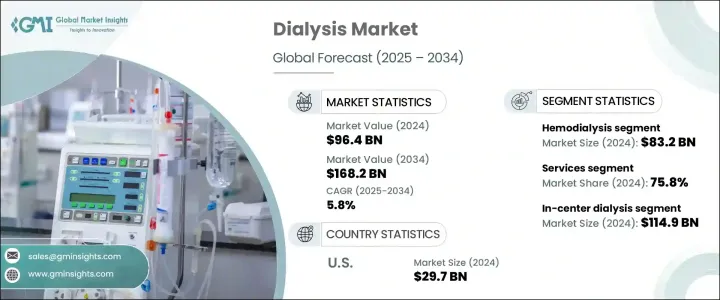

世界の透析市場は2024年に964億米ドルに達し、2025年から2034年にかけてCAGR 5.8%で安定した成長が見込まれています。

この成長の主な要因は、慢性腎臓病(CKD)、末期腎不全(ESRD)の罹患率の上昇と、世界の急速な高齢化です。腎不全の2大原因である糖尿病と高血圧の負担増が、透析治療の需要をさらに押し上げています。ヘルスケアシステムが効果的な腎臓ケアを提供する必要に迫られているため、世界の透析市場は大幅に拡大する見通しです。さらに、透析技術の進歩、ヘルスケア支出の増加、官民によるヘルスケア枠組みの改善が、この市場の成長に寄与しています。

また、腎疾患に対する意識の高まりや、革新的な透析療法への患者アクセスの向上により、在宅透析や施設内透析の需要も急増しています。さらに、遠隔医療、遠隔患者モニタリング、使いやすく生体適合性が向上した次世代透析装置の統合により、治療環境が変化し、患者はより安全で効率的な透析を受けられるようになっています。個別化医療へのシフトと在宅透析導入の動向は、今後10年間の市場拡大をさらに加速させると予想されます。

| 市場規模 | |

|---|---|

| 開始年 | 2024 |

| 予測年 | 2025-2034 |

| 開始金額 | 964億米ドル |

| 予測金額 | 1,682億米ドル |

| CAGR | 5.8% |

透析市場は、血液透析と腹膜透析に大別されます。2024年には血液透析が圧倒的なシェアを占め、832億米ドルの売上を計上しました。CKDおよびESRD患者が世界的に増加し続ける中、血液透析サービスの需要増に対応するためのヘルスケアシステムへの圧力は強まっています。血液透析は、主に進行した腎不全の管理に高い効果を発揮することから、依然として最も広く用いられている治療法です。ダイアライザーHDF、生体適合ダイアライザー、遠隔監視システム、人間工学に基づいた機器の改良などの血液透析機器の技術革新が進み、治療成績と患者の快適性が向上しています。特に、信頼性が高く効率的な長期治療の選択肢を求める患者が増加しているため、これらの進歩により、世界中で血液透析の導入が促進されると期待されています。

透析市場はさらにサービス、消耗品、機器に分類され、サービスは2024年に758億米ドルを生み出し、市場を独占しています。2034年までCAGR 5.7%で成長すると予測されるサービス分野には、慢性透析と急性透析の両方が含まれるが、慢性透析のシェアが大半を占める。CKD患者は通常、週3~4回の血液透析や毎日の腹膜透析など、継続的な透析治療を必要とします。このような透析サービスへの持続的なニーズは、安定した収益源を確保し、この分野の長期的な成長を促進します。

米国の透析市場だけでも、2024年の市場規模は297億米ドルで、2025年から2034年までのCAGR成長率は6%と予想されています。最も先進的なヘルスケア市場の1つである米国は、最先端の透析技術と在宅透析ソリューションの導入で最先端を走っています。専門的な透析センターと強固なインフラが確立されている米国では、患者の遠隔モニタリングと在宅治療へのシフトが進んでいます。フレゼニウス・メディカル・ケア(Fresenius Medical Care)やダビタ・インク(DaVita Inc.)などの主要市場企業は、需要の増加に対応するため、サービスネットワークを拡大し、高度な透析機器を導入しています。革新的で患者に優しいソリューションの推進により、米国は引き続き市場成長を促進し、世界の透析市場の主要な貢献国として位置づけられています。

目次

第1章 調査手法と調査範囲

第2章 エグゼクティブサマリー

第3章 業界洞察

- エコシステム分析

- 業界への影響要因

- 促進要因

- 末期腎疾患(ESRD)患者の増加

- 糖尿病の増加

- ドナー腎臓の不足

- 透析治療に対する有利な償還シナリオ

- 先進国および新興諸国における研究開発投資の増加

- 業界の潜在的リスク&課題

- 製品リコール

- 透析治療に伴う合併症

- 促進要因

- 成長可能性分析

- 規制状況

- 米国

- 欧州

- 技術展望

- 償還シナリオ

- ポーター分析

- PESTEL分析

- ギャップ分析

- バリューチェーン分析

第4章 競合情勢

- イントロダクション

- 企業マトリックス分析

- 企業シェア分析

- 主要市場プレーヤーの競合分析

- 競合のポジショニング・マトリックス

- 戦略ダッシュボード

第5章 市場推計・予測:タイプ別、2021年~2034年

- 主要動向

- 血液透析

- 腹膜透析

第6章 市場推計・予測:製品・サービス別、2021年~2034年

- 主要動向

- サービス

- 慢性透析

- 急性透析

- 消耗品

- ダイアライザー

- カテーテル

- アクセス製品

- 濃縮液

- その他消耗品

- 装置

- 透析装置

- 水処理システム

- その他機器

第7章 市場推計・予測:最終用途別、2021年~2034年

- 主要動向

- 施設内透析

- 在宅透析

第8章 市場推計・予測:地域別、2021年~2034年

- 主要動向

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- オランダ

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- ラテンアメリカ

- ブラジル

- メキシコ

- アルゼンチン

- 中東・アフリカ

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

第9章 企業プロファイル

- angiodynamics

- Asahi KASEI

- B. Braun

- Baxter

- Becton, Dickinson and Company

- DaVita

- Dialife

- Fresenius

- JMS

- Medtronic

- NIKKISO

- NIPRO

- Rogosin Institute

- SATELLITE HEALTHCARE

- SB-KAWASUMI

- Teleflex

- TORAY

- U.S. RENAL CARE

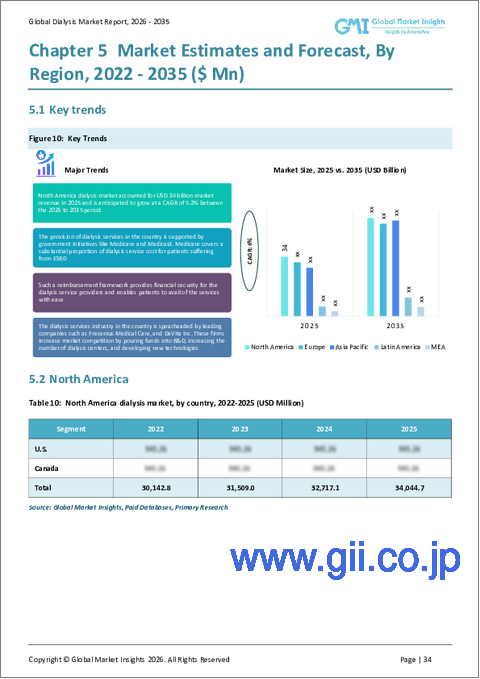

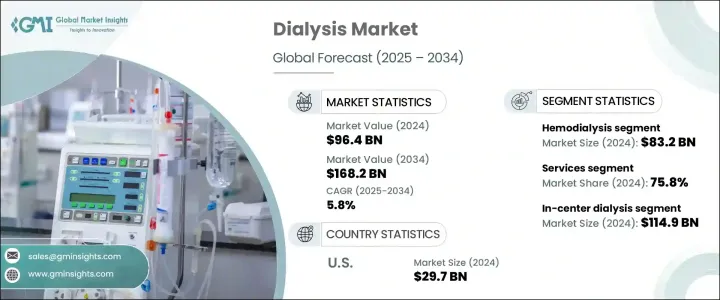

The Global Dialysis Market reached USD 96.4 billion in 2024 and is expected to witness a steady growth trajectory at a CAGR of 5.8% between 2025 and 2034. This growth is primarily driven by the rising incidence of chronic kidney disease (CKD), end-stage renal disease (ESRD), and a rapidly aging population worldwide. The increasing burden of diabetes and hypertension, the two major causes of kidney failure, is further propelling the demand for dialysis treatments. With healthcare systems under mounting pressure to provide effective renal care, the global dialysis market is poised to expand significantly. Additionally, advancements in dialysis technology, growing healthcare expenditures, and improved healthcare frameworks driven by public and private sectors are contributing to this market's growth.

The demand for home-based and in-center dialysis services is also surging, supported by rising awareness of renal diseases and enhanced patient access to innovative dialysis therapies. Furthermore, the integration of telemedicine, remote patient monitoring, and next-generation dialysis machines with user-friendly designs and improved biocompatibility are transforming the treatment landscape, allowing patients to undergo safer and more efficient dialysis sessions. The shift toward personalized care and the growing trend of home dialysis adoption are expected to further accelerate market expansion over the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $96.4 Billion |

| Forecast Value | $168.2 Billion |

| CAGR | 5.8% |

The dialysis market is broadly segmented into two main types-hemodialysis and peritoneal dialysis. Hemodialysis accounted for a dominant share in 2024, generating USD 83.2 billion in revenue. As CKD and ESRD cases continue to climb globally, the pressure on healthcare systems to meet the growing demand for hemodialysis services is intensifying. Hemodialysis remains the most widely used treatment method, primarily because of its high efficacy in managing advanced kidney failure. The ongoing innovations in hemodialysis machines, including the development of Dialyzer HDF, biocompatible dialyzers, telemonitoring systems, and improved ergonomic equipment, are enhancing treatment outcomes and patient comfort. These advancements are expected to boost the adoption of hemodialysis worldwide, especially as more patients seek reliable and efficient long-term treatment options.

The dialysis market is further categorized into services, consumables, and equipment, with services dominating the landscape by generating USD 75.8 billion in 2024. Expected to grow at a 5.7% CAGR through 2034, the services segment includes both chronic and acute dialysis services, though chronic dialysis accounts for the majority share. Patients with CKD typically require ongoing dialysis treatments, such as three to four hemodialysis sessions weekly or daily peritoneal dialysis. This sustained need for dialysis services ensures a consistent revenue stream, driving long-term growth in this segment.

U.S. Dialysis Market alone was valued at USD 29.7 billion in 2024, with an anticipated growth rate of 6% CAGR from 2025 to 2034. As one of the most advanced healthcare markets, the U.S. is at the forefront of adopting cutting-edge dialysis technologies and home dialysis solutions. With well-established specialized dialysis centers and robust infrastructure, the country is witnessing an increasing shift toward remote patient monitoring and home-based treatments. Key market players such as Fresenius Medical Care and DaVita Inc. are expanding their service networks and integrating advanced dialysis equipment to meet rising demand. The push for innovative, patient-friendly solutions continues to enhance market growth across the U.S., positioning it as a leading contributor to the global dialysis market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising number of end-stage renal diseases (ESRD) patients

- 3.2.1.2 Increasing incidence of diabetes

- 3.2.1.3 Shortage of donor kidneys

- 3.2.1.4 Favorable reimbursement scenario for dialysis treatment

- 3.2.1.5 Growing research and development investments in developed and developing countries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Product recalls

- 3.2.2.2 Complications associated with dialysis treatment

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technology landscape

- 3.6 Reimbursement scenario

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Gap analysis

- 3.10 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Hemodialysis

- 5.3 Peritoneal dialysis

Chapter 6 Market Estimates and Forecast, By Product and Services, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Services

- 6.2.1 Chronic dialysis

- 6.2.2 Acute dialysis

- 6.3 Consumables

- 6.3.1 Dialyzers

- 6.3.2 Catheters

- 6.3.3 Access products

- 6.3.4 Concentrates

- 6.3.5 Other consumables

- 6.4 Equipment

- 6.4.1 Dialysis machines

- 6.4.2 Water treatment systems

- 6.4.3 Other equipment

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 In-center dialysis

- 7.3 Home dialysis

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 angiodynamics

- 9.2 Asahi KASEI

- 9.3 B. Braun

- 9.4 Baxter

- 9.5 Becton, Dickinson and Company

- 9.6 DaVita

- 9.7 Dialife

- 9.8 Fresenius

- 9.9 JMS

- 9.10 Medtronic

- 9.11 NIKKISO

- 9.12 NIPRO

- 9.13 Rogosin Institute

- 9.14 SATELLITE HEALTHCARE

- 9.15 SB-KAWASUMI

- 9.16 Teleflex

- 9.17 TORAY

- 9.18 U.S. RENAL CARE