|

|

市場調査レポート

商品コード

1441970

光学セラミックスの世界市場:材料、エンドユーザー、予測(2024~2032年)Optical Ceramics Market - Material (Sapphire, Aluminum Oxynitride, Spinel, Yttrium Aluminum Garnet), End User (Optics & Optoelectronics, Aerospace & Defense, Energy, Electrical & Electronics) & Forecast, 2024 - 2032 |

||||||

カスタマイズ可能

|

|||||||

| 光学セラミックスの世界市場:材料、エンドユーザー、予測(2024~2032年) |

|

出版日: 2024年01月17日

発行: Global Market Insights Inc.

ページ情報: 英文 180 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

世界の光学セラミックスの市場規模は、航空宇宙、防衛、ヘルスケア、通信を含む様々な産業における先端光学材料への需要の増加により、2024~2032年にかけて11.9%で拡大すると推定されています。

先端光学材料は、高い透明性、熱安定性、過酷な環境条件への耐性などの優れた特性を備えています。さらに、レーザー技術、フォトニクス、光センシング用途での製品採用が拡大していることも市場拡大に寄与しています。

2023年4月、オーストリアのセラミック3Dプリンティング会社Lithozと、ドイツを拠点とするガラスメーカーGlassomerは、高性能溶融シリカガラスであるLithaGlassと名付けられた新しい3Dプリンティング材料を発表しました。

メーカーは、光学純度の向上、欠陥の最小化、製造工程の最適化など、光学セラミックスの特性と性能を高めるための研究開発に投資しています。こうした努力の結果、光学的透明度、透過効率、耐久性が改善された製品が開発され、より高品質の光学部品に対するエンドユーザーの進化する要求に応えています。

光学セラミックス産業は、材料、エンドユーザー、地域によって区分されます。

スピネルセグメントは、そのユニークな特性の組み合わせにより、予測期間中に急拡大を示すと思われます。その高い熱伝導性と熱衝撃への耐性は、過酷な条件下での光学的透明性と性能の維持が重要な高出力レーザーシステムや光学コーティングでの使用に理想的です。さらに、スピネルの卓越した硬度と耐傷性は、航空宇宙用の窓や赤外線レンズなど、耐久性のある光学部品を必要とする用途に適しています。

エネルギー分野は、太陽光発電や風力発電などの再生可能エネルギーへの世界の注目の高まりに後押しされ、2024~2032年にかけて力強い成長が見込まれます。例えば太陽エネルギーでは、光学セラミックは太陽光発電所で太陽光を集光し、エネルギー効率と出力を高めるために不可欠です。さらに、リチウムイオン電池や燃料電池のようなエネルギー貯蔵装置では、光学セラミックは、エネルギー変換プロセスの精密な監視と制御を可能にすることで、性能と信頼性の向上に役立っています。

欧州の光学セラミック産業シェアは、厳しい環境規制と持続可能性への取り組みに起因して、2024~2032年の間にまともな成長を示す予定です。技術革新と研究開発への強い注力は、最先端用途への製品採用を促進します。産業プレーヤーと学術機関の戦略的コラボレーションは、この地域の技術進歩と高い競争力に貢献しています。

目次

第1章 調査手法と調査範囲

第2章 エグゼクティブサマリー

第3章 光学セラミックスの産業洞察

- エコシステム分析

- 原材料サプライヤー

- メーカー

- 利益率分析

- 流通チャネル分析

- エンドユーザー

- ベンダーマトリックス

- 主要原材料サプライヤーリスト

- 主要メーカー/サプライヤーのリスト

- 主要/潜在顧客リスト

- 技術情勢

- 規制状況

- 産業への影響要因

- 促進要因

- 光学セラミックスは従来の材料と比較して独自の利点を提供

- 製造技術の向上

- 最終用途産業における需要の増加

- 産業の潜在的リスク・課題

- 高い初期コスト

- 促進要因

- 価格分析

- 地域別価格設定

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

- コスト構造分析

- 研究開発コスト

- 製造・設備コスト

- 原材料コスト

- 流通コスト

- 運用コスト

- その他費用

- イノベーションと持続可能性

- 特許分析

- 成長性分析

- ポーター分析

- PESTEL分析

第4章 競合情勢

- イントロダクション

- 企業市場シェア、2023年

- 企業市場シェア:地域別、2023年

- 市場企業の競合分析

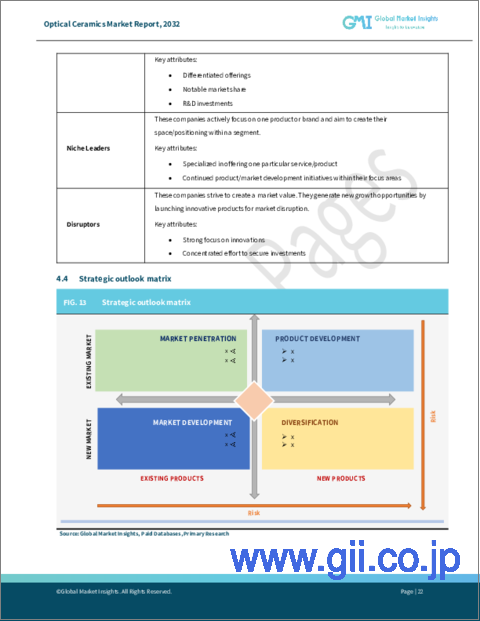

- 競合ポジショニングマトリックス

- 戦略展望マトリックス

第5章 光学セラミックスの市場規模・予測:材料別、2018~2032年

- 主要材料動向

- サファイア

- アルミニウム酸窒化物

- スピネル

- イットリウムアルミニウムガーネット(YAG)

第6章 光学セラミックスの市場規模・予測:エンドユーザー別、2018~2032年

- 主要エンドユーザー動向

- 光学・オプトエレクトロニクス

- 航空宇宙・防衛

- エネルギー

- 電気・電子

第7章 光学セラミックスの市場規模・予測:地域別、2018~2032年

- 主要動向:地域別

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- ロシア

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- インドネシア

- タイ

- ラテンアメリカ

- ブラジル

- メキシコ

- アルゼンチン

- 中東・アフリカ

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

第8章 企業プロファイル

- CeramTec GmbH

- CeraNova Corporation

- CoorsTek Corporation

- CoorsTek, Inc.

- Konoshima Chemical Co., Ltd.

- Kyocera Corporation

- Murata Manufacturing Co. Ltd.

- Ohara Corporation

- Schott AG

- Shenzhen Crystal Optoelectronics Technology Co. Ltd.

- Surmet Corporation

Data Tables

- TABLE 1. Market revenue, by material (2023)

- TABLE 2. Market revenue, by end user (2023)

- TABLE 3. Market revenue, by region (2023)

- TABLE 4. Global optical ceramics market size, 2018 - 2032, (USD Million)

- TABLE 5. Global optical ceramics market size, 2018 - 2032, (Cubic meters)

- TABLE 6. Global optical ceramics market size, by region, 2018 - 2032 (USD Million)

- TABLE 7. Global optical ceramics market size, by region, 2018 - 2032 (Cubic meters)

- TABLE 8. Global optical ceramics market size, by material, 2018 - 2032 (USD Million)

- TABLE 9. Global optical ceramics market size, by material, 2018 - 2032 (Cubic meters)

- TABLE 10. Global optical ceramics market size, by end user, 2018 - 2032 (USD Million)

- TABLE 11. Global optical ceramics market size, by end user, 2018 - 2032 (Cubic meters)

- TABLE 12. Industry impact forces

- TABLE 13. North America optical ceramics market size, by country, 2018 - 2032 (USD Million)

- TABLE 14. North America optical ceramics market size, by country, 2018 - 2032 (Cubic meters)

- TABLE 15. North America optical ceramics market size, by material, 2018 - 2032 (USD Million)

- TABLE 16. North America optical ceramics market size, by material, 2018 - 2032 (Cubic meters)

- TABLE 17. North America optical ceramics market size, by end user, 2018 - 2032 (USD Million)

- TABLE 18. North America optical ceramics market size, by end user, 2018 - 2032 (Cubic meters)

- TABLE 19. U.S. optical ceramics market size, by material, 2018 - 2032 (USD Million)

- TABLE 20. U.S. optical ceramics market size, by material, 2018 - 2032 (Cubic meters)

- TABLE 21. U.S. optical ceramics market size, by end user, 2018 - 2032 (USD Million)

- TABLE 22. U.S. optical ceramics market size, by end user, 2018 - 2032 (Cubic meters)

- TABLE 23. Canada optical ceramics market size, by material, 2018 - 2032 (USD Million)

- TABLE 24. Canada optical ceramics market size, by material, 2018 - 2032 (Cubic meters)

- TABLE 25. Canada optical ceramics market size, by end user, 2018 - 2032 (USD Million)

- TABLE 26. Canada optical ceramics market size, by end user, 2018 - 2032 (Cubic meters)

- TABLE 27. Europe optical ceramics market size, by country, 2018 - 2032 (USD Million)

- TABLE 28. Europe optical ceramics market size, by country, 2018 - 2032 (Cubic meters)

- TABLE 29. Europe optical ceramics market size, by material, 2018 - 2032 (USD Million)

- TABLE 30. Europe optical ceramics market size, by material, 2018 - 2032 (Cubic meters)

- TABLE 31. Europe optical ceramics market size, by end user, 2018 - 2032 (USD Million)

- TABLE 32. Europe optical ceramics market size, by end user, 2018 - 2032 (Cubic meters)

- TABLE 33. Germany optical ceramics market size, by material, 2018 - 2032 (USD Million)

- TABLE 34. Germany optical ceramics market size, by material, 2018 - 2032 (Cubic meters)

- TABLE 35. Germany optical ceramics market size, by end user, 2018 - 2032 (USD Million)

- TABLE 36. Germany optical ceramics market size, by end user, 2018 - 2032 (Cubic meters)

- TABLE 37. UK optical ceramics market size, by material, 2018 - 2032 (USD Million)

- TABLE 38. UK optical ceramics market size, by material, 2018 - 2032 (Cubic meters)

- TABLE 39. UK optical ceramics market size, by end user, 2018 - 2032 (USD Million)

- TABLE 40. UK optical ceramics market size, by end user, 2018 - 2032 (Cubic meters)

- TABLE 41. France optical ceramics market size, by material, 2018 - 2032 (USD Million)

- TABLE 42. France optical ceramics market size, by material, 2018 - 2032 (Cubic meters)

- TABLE 43. France optical ceramics market size, by end user, 2018 - 2032 (USD Million)

- TABLE 44. France optical ceramics market size, by end user, 2018 - 2032 (Cubic meters)

- TABLE 45. Spain optical ceramics market size, by material, 2018 - 2032 (USD Million)

- TABLE 46. Spain optical ceramics market size, by material, 2018 - 2032 (Cubic meters)

- TABLE 47. Spain optical ceramics market size, by end user, 2018 - 2032 (USD Million)

- TABLE 48. Spain optical ceramics market size, by end user, 2018 - 2032 (Cubic meters)

- TABLE 49. Italy optical ceramics market size, by material, 2018 - 2032 (USD Million)

- TABLE 50. Italy optical ceramics market size, by material, 2018 - 2032 (Cubic meters)

- TABLE 51. Italy optical ceramics market size, by end user, 2018 - 2032 (USD Million)

- TABLE 52. Italy optical ceramics market size, by end user, 2018 - 2032 (Cubic meters)

- TABLE 53. Netherlands optical ceramics market size, by material, 2018 - 2032 (USD Million)

- TABLE 54. Netherlands optical ceramics market size, by material, 2018 - 2032 (Cubic meters)

- TABLE 55. Netherlands optical ceramics market size, by end user, 2018 - 2032 (USD Million)

- TABLE 56. Netherlands optical ceramics market size, by end user, 2018 - 2032 (Cubic meters)

- TABLE 57. Poland optical ceramics market size, by material, 2018 - 2032 (USD Million)

- TABLE 58. Poland optical ceramics market size, by material, 2018 - 2032 (Cubic meters)

- TABLE 59. Poland optical ceramics market size, by end user, 2018 - 2032 (USD Million)

- TABLE 60. Poland optical ceramics market size, by end user, 2018 - 2032 (Cubic meters)

- TABLE 61. Russia optical ceramics market size, by material, 2018 - 2032 (USD Million)

- TABLE 62. Russia optical ceramics market size, by material, 2018 - 2032 (Cubic meters)

- TABLE 63. Russia optical ceramics market size, by end user, 2018 - 2032 (USD Million)

- TABLE 64. Russia optical ceramics market size, by end user, 2018 - 2032 (Cubic meters)

- TABLE 65. Asia Pacific optical ceramics market size, by country, 2018 - 2032 (USD Million)

- TABLE 66. Asia Pacific optical ceramics market size, by country, 2018 - 2032 (Cubic meters)

- TABLE 67. Asia Pacific optical ceramics market size, by material, 2018 - 2032 (USD Million)

- TABLE 68. Asia Pacific optical ceramics market size, by material, 2018 - 2032 (Cubic meters)

- TABLE 69. Asia Pacific optical ceramics market size, by end user, 2018 - 2032 (USD Million)

- TABLE 70. Asia Pacific optical ceramics market size, by end user, 2018 - 2032 (Cubic meters)

- TABLE 71. China optical ceramics market size, by material, 2018 - 2032 (USD Million)

- TABLE 72. China optical ceramics market size, by material, 2018 - 2032 (Cubic meters)

- TABLE 73. China optical ceramics market size, by end user, 2018 - 2032 (USD Million)

- TABLE 74. China optical ceramics market size, by end user, 2018 - 2032 (Cubic meters)

- TABLE 75. Japan optical ceramics market size, by material, 2018 - 2032 (USD Million)

- TABLE 76. Japan optical ceramics market size, by material, 2018 - 2032 (Cubic meters)

- TABLE 77. Japan optical ceramics market size, by end user, 2018 - 2032 (USD Million)

- TABLE 78. Japan optical ceramics market size, by end user, 2018 - 2032 (Cubic meters)

- TABLE 79. India optical ceramics market size, by material, 2018 - 2032 (USD Million)

- TABLE 80. India optical ceramics market size, by material, 2018 - 2032 (Cubic meters)

- TABLE 81. India optical ceramics market size, by end user, 2018 - 2032 (USD Million)

- TABLE 82. India optical ceramics market size, by end user, 2018 - 2032 (Cubic meters)

- TABLE 83. Australia optical ceramics market size, by material, 2018 - 2032 (USD Million)

- TABLE 84. Australia optical ceramics market size, by material, 2018 - 2032 (Cubic meters)

- TABLE 85. Australia optical ceramics market size, by end user, 2018 - 2032 (USD Million)

- TABLE 86. Australia optical ceramics market size, by end user, 2018 - 2032 (Cubic meters)

- TABLE 87. South Korea optical ceramics market size, by material, 2018 - 2032 (USD Million)

- TABLE 88. South Korea optical ceramics market size, by material, 2018 - 2032 (Cubic meters)

- TABLE 89. South Korea optical ceramics market size, by end user, 2018 - 2032 (USD Million)

- TABLE 90. South Korea optical ceramics market size, by end user, 2018 - 2032 (Cubic meters)

- TABLE 91. Indonesia optical ceramics market size, by material, 2018 - 2032 (USD Million)

- TABLE 92. Indonesia optical ceramics market size, by material, 2018 - 2032 (Cubic meters)

- TABLE 93. Indonesia optical ceramics market size, by end user, 2018 - 2032 (USD Million)

- TABLE 94. Indonesia optical ceramics market size, by end user, 2018 - 2032 (Cubic meters)

- TABLE 95. Thailand optical ceramics market size, by material, 2018 - 2032 (USD Million)

- TABLE 96. Thailand optical ceramics market size, by material, 2018 - 2032 (Cubic meters)

- TABLE 97. Thailand optical ceramics market size, by end user, 2018 - 2032 (USD Million)

- TABLE 98. Thailand optical ceramics market size, by end user, 2018 - 2032 (Cubic meters)

- TABLE 99. Latin America optical ceramics market size, by country, 2018 - 2032 (USD Million)

- TABLE 100. Latin America optical ceramics market size, by country, 2018 - 2032 (Cubic meters)

- TABLE 101. Latin America optical ceramics market size, by material, 2018 - 2032 (USD Million)

- TABLE 102. Latin America optical ceramics market size, by material, 2018 - 2032 (Cubic meters)

- TABLE 103. Latin America optical ceramics market size, by end user, 2018 - 2032 (USD Million)

- TABLE 104. Latin America optical ceramics market size, by end user, 2018 - 2032 (Cubic meters)

- TABLE 105. Brazil optical ceramics market size, by material, 2018 - 2032 (USD Million)

- TABLE 106. Brazil optical ceramics market size, by material, 2018 - 2032 (Cubic meters)

- TABLE 107. Brazil optical ceramics market size, by end user, 2018 - 2032 (USD Million)

- TABLE 108. Brazil optical ceramics market size, by end user, 2018 - 2032 (Cubic meters)

- TABLE 109. Mexico optical ceramics market size, by material, 2018 - 2032 (USD Million)

- TABLE 110. Mexico optical ceramics market size, by material, 2018 - 2032 (Cubic meters)

- TABLE 111. Mexico optical ceramics market size, by end user, 2018 - 2032 (USD Million)

- TABLE 112. Mexico optical ceramics market size, by end user, 2018 - 2032 (Cubic meters)

- TABLE 113. Argentina optical ceramics market size, by material, 2018 - 2032 (USD Million)

- TABLE 114. Argentina optical ceramics market size, by material, 2018 - 2032 (Cubic meters)

- TABLE 115. Argentina optical ceramics market size, by end user, 2018 - 2032 (USD Million)

- TABLE 116. Argentina optical ceramics market size, by end user, 2018 - 2032 (Cubic meters)

- TABLE 117. MEA optical ceramics market size, by country, 2018 - 2032 (USD Million)

- TABLE 118. MEA optical ceramics market size, by country, 2018 - 2032 (Cubic meters)

- TABLE 119. MEA optical ceramics market size, by material, 2018 - 2032 (USD Million)

- TABLE 120. MEA optical ceramics market size, by material, 2018 - 2032 (Cubic meters)

- TABLE 121. MEA optical ceramics market size, by end user, 2018 - 2032 (USD Million)

- TABLE 122. MEA optical ceramics market size, by end user, 2018 - 2032 (Cubic meters)

- TABLE 123. South Africa optical ceramics market size, by material, 2018 - 2032 (USD Million)

- TABLE 124. South Africa optical ceramics market size, by material, 2018 - 2032 (Cubic meters)

- TABLE 125. South Africa optical ceramics market size, by end user, 2018 - 2032 (USD Million)

- TABLE 126. South Africa optical ceramics market size, by end user, 2018 - 2032 (Cubic meters)

- TABLE 127. Saudi Arabia optical ceramics market size, by material, 2018 - 2032 (USD Million)

- TABLE 128. Saudi Arabia optical ceramics market size, by material, 2018 - 2032 (Cubic meters)

- TABLE 129. Saudi Arabia optical ceramics market size, by end user, 2018 - 2032 (USD Million)

- TABLE 130. Saudi Arabia optical ceramics market size, by end user, 2018 - 2032 (Cubic meters)

- TABLE 131. UAE optical ceramics market size, by material, 2018 - 2032 (USD Million)

- TABLE 132. UAE optical ceramics market size, by material, 2018 - 2032 (Cubic meters)

- TABLE 133. UAE optical ceramics market size, by end user, 2018 - 2032 (USD Million)

- TABLE 134. UAE optical ceramics market size, by end user, 2018 - 2032 (Cubic meters

Charts & Figures

- FIG. 1 Industry segmentation

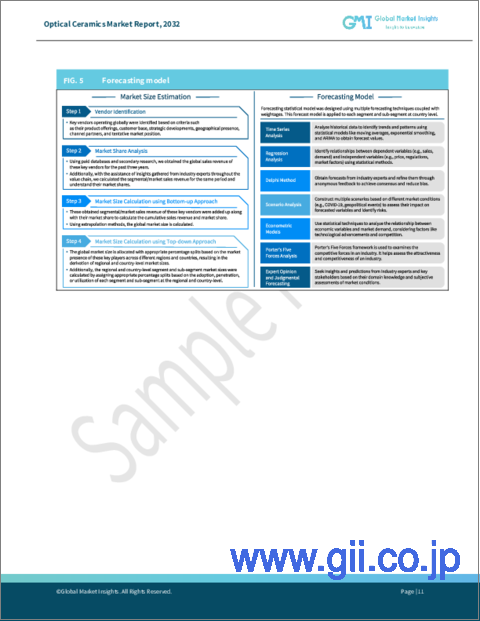

- FIG. 2 Market estimation and forecast methodology

- FIG. 3 Breakdown of primary participants

- FIG. 4 Optical ceramics industry, 360 degree synopsis, 2018 - 2032

- FIG. 5 Industry landscape, 2018-2032 (USD Million)

- FIG. 6 Growth potential analysis

- FIG. 7 Porter's analysis

- FIG. 8 PESTEL analysis

- FIG. 9 Company matrix analysis, 2023

- FIG. 10 Strategy dashboard, 2023

Optical Ceramics Market is estimated to expand at 11.9% from 2024 to 2032, owing to the increasing demand for advanced optical materials in various industries, including aerospace, defense, healthcare, and telecommunications. They offer superior properties such as high transparency, thermal stability, and resistance to harsh environmental conditions. Additionally, the growing product adoption in laser technology, photonics, and optical sensing applications further contributes to market expansion.

In April 2023, Austrian ceramic 3D printing company Lithoz and Germany-based glass manufacturer Glassomer introduced a new 3D printing material named LithaGlass, which is a high-performance fused silica glass.

Manufacturers are investing in R&D to enhance the properties and performance of optical ceramics, such as improving optical purity, minimizing defects, and optimizing manufacturing processes. These efforts result in the development of the product with improved optical clarity, transmission efficiency, and durability, meeting the evolving demands of end-users for higher-quality optical components.

Optical ceramics industry is segmented based on material, end-user, and region.

Spinel segment will witness rapid expansion in the forecast period, owing to its unique combination of properties. Its high thermal conductivity and resistance to thermal shock make it ideal for use in high-power laser systems and optical coatings, where maintaining optical clarity and performance under extreme conditions is important. Additionally, spinel's exceptional hardness and scratch resistance make it suitable for applications requiring durable optical components, such as aerospace windows and infrared lenses.

Energy segment is projected to witness a strong growth during 2024 and 2032, favored by the increasing global focus on renewable energy sources, such as solar and wind power. In solar energy, for instance, optical ceramics are essential for concentrating sunlight in solar power plants, enhancing energy efficiency and output. Moreover, in energy storage technologies like lithium-ion batteries and fuel cells, optical ceramics help in improving performance and reliability by enabling precise monitoring and control of energy conversion processes.

Europe optical ceramic industry share is slated to witness decent growth during 2024-2032, attributed to stringent environmental regulations and sustainability initiatives. The strong focus on innovation and R&D fosters the product adoption for cutting-edge applications. Strategic collaborations between industry players and academic institutions contribute to technological advancements and high competitiveness in the region.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & workings

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Data mining source

- 1.4.2.1 Paid source

- 1.4.2.2 Public source

Chapter 2 Executive Summary

- 2.1 Optical ceramics industry 360 degree synopsis, 2018 - 2032

- 2.2 Business trends

- 2.3 Material trends

- 2.4 End user trends

- 2.5 Regional trends

Chapter 3 Optical Ceramics Industry Insights

- 3.1.1 Industry ecosystem analysis

- 3.1.2 Raw material suppliers

- 3.1.3 Manufacturers

- 3.1.4 Profit margin analysis

- 3.1.5 Distribution channel analysis

- 3.1.6 End-users

- 3.1.7 Vendor matrix

- 3.1.7.1 List of key raw material suppliers

- 3.1.7.2 List of key manufacturers/suppliers

- 3.1.8 Lits of key/potential customers

- 3.1.9 Technology landscape

- 3.1.10 Regulatory landscape

- 3.1.10.1 North America

- 3.1.10.2 Europe

- 3.1.10.3 Asia Pacific

- 3.1.10.4 Latin America

- 3.1.10.5 Middle East & Africa

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Optical ceramics offer unique advantages over traditional materials

- 3.2.1.2 Improvements in manufacturing techniques

- 3.2.1.3 Increasing demand across end use industries

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial cost

- 3.2.1 Growth drivers

- 3.3 Pricing analysis

- 3.3.1 Regional pricing

- 3.3.2 North America

- 3.3.3 Europe

- 3.3.4 Asia Pacific

- 3.3.5 Latin America

- 3.3.6 Middle East & Africa

- 3.4 Cost structure analysis

- 3.4.1 R&D cost

- 3.4.2 Manufacturing & equipment cost

- 3.4.3 Raw material cost

- 3.4.4 Distribution cost

- 3.4.5 Operating cost

- 3.4.6 Miscellaneous cost

- 3.5 Innovation & sustainability

- 3.5.1 Patent analysis

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share, 2023

- 4.2.1 Company market share, by region, 2023

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 Company market share, by region, 2023

- 4.3 Competitive analysis of market player

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

Chapter 5 Optical Ceramics Market Size and Forecast, By Material 2018 - 2032

- 5.1 Key material trends

- 5.2 Sapphire

- 5.3 Aluminum oxynitride

- 5.4 Spinel

- 5.5 Yttrium aluminum garnet (YAG)

Chapter 6 Optical Ceramics Market Size and Forecast, By End User2018 - 2032

- 6.1 Key end user trend

- 6.2 Optics & optoelectronics

- 6.3 Aerospace & defense

- 6.4 Energy

- 6.5 Electrical & electronics

Chapter 7 Optical Ceramics Market Size and Forecast, By Region 2018 - 2032

- 7.1 Key trends, by region

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Indonesia

- 7.4.7 Thailand

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 CeramTec GmbH

- 8.2 CeraNova Corporation

- 8.3 CoorsTek Corporation

- 8.4 CoorsTek, Inc.

- 8.5 Konoshima Chemical Co., Ltd.

- 8.6 Kyocera Corporation

- 8.7 Murata Manufacturing Co. Ltd.

- 8.8 Ohara Corporation

- 8.9 Schott AG

- 8.10 Shenzhen Crystal Optoelectronics Technology Co. Ltd.

- 8.11 Surmet Corporation