|

市場調査レポート

商品コード

1667013

バリア材市場の機会、成長促進要因、産業動向分析、2025年~2034年の予測Barrier Material Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

カスタマイズ可能

|

|||||||

| バリア材市場の機会、成長促進要因、産業動向分析、2025年~2034年の予測 |

|

出版日: 2024年12月23日

発行: Global Market Insights Inc.

ページ情報: 英文 220 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

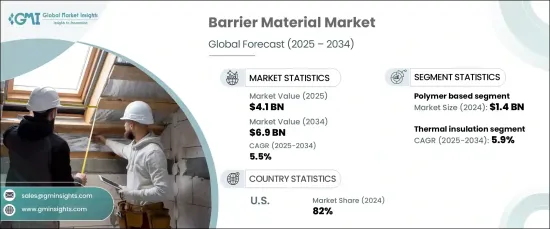

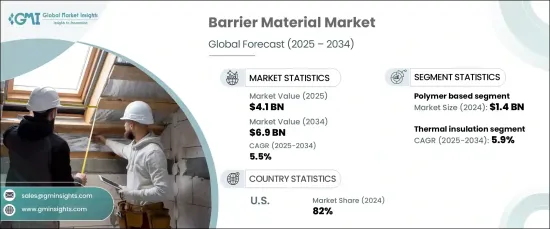

世界のバリア材市場は2024年に41億米ドルと評価され、2025年から2034年にかけてCAGR 5.5%で成長する見通しです。

この成長軌道は、建設、自動車、医薬品、食品パッケージングなど多様な業界において、安全性とセキュリティを強化する先進ソリューションへの需要が急増していることに後押しされています。これらの業界が製品や構造物を外部の脅威から守ることを優先する中、バリア材への信頼は高まり続けています。

水分の侵入、熱の変動、音の侵入を防ぐために不可欠なバリア材料は、さまざまな用途の耐久性と効率を向上させるために不可欠です。持続可能性に関する規制の監視が強化される中、企業は最新の業界基準を満たすため、環境に優しくリサイクル可能な高性能素材へと移行しつつあります。さらに、技術の進歩と研究開発努力は技術革新を促進し、特定の業界ニーズに合わせた最先端のソリューションを提供し、最終的に市場の可能性を拡大しています。

| 市場範囲 | |

|---|---|

| 開始年 | 2024 |

| 予測年 | 2025-2034 |

| 開始金額 | 41億米ドル |

| 予測金額 | 69億米ドル |

| CAGR | 5.5% |

材料タイプ別に見ると、市場は金属ベース、鉱物ベース、ポリマーベース、その他のカテゴリーに区分されます。ポリマーベースのセグメントは、2024年に14億米ドルと評価され、2035年までCAGR 5.6%で成長する見込みです。水の浸入を防ぐ優れた能力で知られるポリマー系材料は、屋根、地下室、基礎システムに最適な選択肢であり、水害に対する懸念の高まりに対応しています。これらの材料は、環境要因から確実に保護することができるため、新築プロジェクトでも改修プロジェクトでも欠かせないものとなっています。一方、金属系材料は、沿岸地域や高汚染を受けやすい工業地帯など、極端な気象条件にさらされる環境では不可欠であり、構造耐力上不可欠な要素となっています。

市場を機能別に分類すると、防湿、断熱、防音、防火、その他の分野があります。断熱材は2024年に41%の市場シェアを占め、予測期間中にCAGR 5.9%で成長すると予測されています。エネルギーコストの上昇と厳しいエネルギー効率規制が、高度な遮熱材への需要を高めています。これらの材料は、特に冷暖房システムにおいて、熱損失を減らしエネルギー消費を最適化するのに役立っており、持続可能性と費用対効果の高いエネルギー・ソリューションを重視する世界の動きに合致しています。

米国では、バリア材市場が2024年の地域別シェアの82%を占めています。この優位性は、プラスチック廃棄物の削減と持続可能な慣行の奨励を目的とした強固な規制枠組みによってもたらされています。企業は環境意識の高い消費者に対応するため、リサイクル可能な多層フィルム、バイオポリマーをベースとしたプラスチック、堆肥化可能なパッケージングなど、生分解性で低カーボンフットプリントの素材を採用する傾向を強めています。このシフトは、環境スチュワードシップへのコミットメントを反映したものであり、持続可能性の目標に沿った業界の継続的な成長を可能にするものです。

目次

第1章 調査手法と調査範囲

- 市場範囲と定義

- 基本推定と計算

- 予測計算

- データソース

- 1次データ

- 2次データ

- 有料情報源

- 公的情報源

第2章 エグゼクティブサマリー

第3章 業界洞察

- エコシステム分析

- バリューチェーンに影響を与える要因

- 利益率分析

- 破壊

- 将来の展望

- メーカー

- 流通業者

- サプライヤーの状況

- 利益率分析

- 主要ニュースと取り組み

- 規制状況

- 影響要因

- 促進要因

- 建設活動の増加

- 製品革新の進展

- 業界の潜在的リスク&課題

- 市場の飽和と激しい競合

- 持続可能性への懸念

- 促進要因

- 成長可能性分析

- ポーターの分析

- PESTEL分析

第4章 競合情勢

- イントロダクション

- 企業シェア分析

- 競合のポジショニング・マトリックス

- 戦略展望マトリックス

第5章 市場推計・予測:素材別、2021年~2035年

- 主要動向

- ポリマーベース

- ポリ塩化ビニリデン(PVDC)

- エチレンビニルアルコール(EVOH)

- ポリエチレンナフタレート(PEN)

- その他

- 金属ベース

- 鉱物ベース

- ジオシンセティック・クレイライナー(GCL)

- 石膏

- その他(ミネラルウッドなど)

- その他(繊維素材ベースなど)

第6章 市場推計・予測:機能別、2021年~2035年

- 主要動向

- 防湿

- 断熱

- 防音

- 防火

- その他(放射線バリア、シーリング材など)

第7章 市場推計・予測:バリアタイプ別、2021年~2035年

- 主要動向

- 一時的バリア

- 恒久バリア

第8章 市場推計・予測:建設タイプ別、2021年~2035年

- 主要動向

- 新築

- レトロフィット

第9章 市場推計・予測:最終用途別、2021年~2035年

- 主要動向

- 住宅

- 商業

- 産業・倉庫

- インフラ施設

第10章 市場推計・予測:流通チャネル別、2021年~2035年

- 主要動向

- 直接

- 間接流通

第11章 市場推計・予測:地域別、2021年~2035年

- 主要動向

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- ロシア

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- オーストラリア

- ラテンアメリカ

- ブラジル

- メキシコ

- 中東・アフリカ

- UAE

- サウジアラビア

- 南アフリカ

第12章 企業プロファイル

- 3M

- BASF

- Dow

- Geosynthetics

- Gundle/SLT Environmental

- H.B. Fuller

- Honeywell International

- Owosso

- Pall Corporation

- Renolit

- Saint-Gobain

- Sika

- Solvay

- TenCate Geosynthetics

- Trelleborg

The Global Barrier Material Market was valued at USD 4.1 billion in 2024 and is poised to grow at a CAGR of 5.5% between 2025 and 2034. This upward trajectory is fueled by surging demand for advanced solutions that enhance safety and security across diverse industries such as construction, automotive, pharmaceuticals, and food packaging. As these sectors prioritize protecting their products and structures from external threats, the reliance on barrier materials continues to rise.

Barrier materials, essential for preventing moisture intrusion, thermal fluctuations, and sound penetration, are critical to improving the durability and efficiency of various applications. With increasing regulatory scrutiny on sustainability, businesses are transitioning toward eco-friendly, recyclable, and high-performance materials to meet modern industry standards. Moreover, technological advancements and R&D efforts are driving innovation, offering cutting-edge solutions tailored to meet specific industry needs, ultimately expanding the market's potential.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.1 Billion |

| Forecast Value | $6.9 Billion |

| CAGR | 5.5% |

By material type, the market is segmented into metal-based, mineral-based, polymer-based, and other categories. The polymer-based segment, valued at USD 1.4 billion in 2024, is expected to grow at a CAGR of 5.6% through 2035. Renowned for their superior ability to prevent water infiltration, polymer-based materials are the go-to choice for roofing, basement, and foundation systems, addressing the growing concerns about water damage. These materials have become indispensable for both new construction and renovation projects, offering reliable protection against environmental factors. Meanwhile, metal-based materials are vital in environments exposed to extreme weather conditions, such as coastal regions or industrial zones prone to high pollution, making them an essential component for structural resilience.

When categorized by function, the market includes moisture prevention, thermal insulation, soundproofing, fire protection, and other segments. Thermal insulation commanded a significant 41% market share in 2024 and is projected to grow at a 5.9% CAGR during the forecast period. Rising energy costs and stringent energy efficiency regulations have heightened the demand for advanced thermal barriers. These materials are instrumental in reducing heat loss and optimizing energy consumption, particularly in heating and cooling systems, aligning with the global focus on sustainability and cost-effective energy solutions.

In the United States, the barrier material market accounted for 82% of the regional share in 2024. This dominance is driven by robust regulatory frameworks aimed at reducing plastic waste and encouraging sustainable practices. Businesses are increasingly adopting biodegradable, low-carbon-footprint materials, including recyclable multi-layer films, biopolymer-based plastics, and compostable packaging, to cater to eco-conscious consumers. This shift reflects a commitment to environmental stewardship and positions the industry for continued growth in alignment with sustainability goals.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2035

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing construction activities

- 3.6.1.2 Growing product innovation

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Market saturation and intense competition

- 3.6.2.2 Sustainability concerns

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material, 2021-2035 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Polymer based

- 5.2.1 Polyvinylidene chloride (PVDC)

- 5.2.2 Ethylene vinyl alcohol (EVOH)

- 5.2.3 Polyethylene naphthalate (PEN)

- 5.3 Others

- 5.4 Metal based

- 5.5 Mineral based

- 5.5.1 Geosynthetic clay liners (GCLs)

- 5.5.2 Gypsum

- 5.6 Others (mineral wood, etc.)

- 5.7 Others (fibrous material based, etc.)

Chapter 6 Market Estimates & Forecast, By Function, 2021-2035 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Moisture prevention

- 6.3 Thermal insulation

- 6.4 Sound proofing

- 6.5 Fire protection

- 6.6 Others (radiation barrier, sealant, etc.)

Chapter 7 Market Estimates & Forecast, By Type of Barrier, 2021-2035 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Temporary barriers

- 7.3 Permanent barriers

Chapter 8 Market Estimates & Forecast, By Type of Construction, 2021-2035 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 New construction

- 8.3 Retrofit

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2035 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 Residential

- 9.3 Commercial

- 9.4 Industrial and warehousing

- 9.5 Infrastructure facility

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2035 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 Direct

- 10.3 Indirect

Chapter 11 Market Estimates & Forecast, By Region, 2021-2035 (USD Million) (Kilo Tons)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 3M

- 12.2 BASF

- 12.3 Dow

- 12.4 Geosynthetics

- 12.5 Gundle/SLT Environmental

- 12.6 H.B. Fuller

- 12.7 Honeywell International

- 12.8 Owosso

- 12.9 Pall Corporation

- 12.10 Renolit

- 12.11 Saint-Gobain

- 12.12 Sika

- 12.13 Solvay

- 12.14 TenCate Geosynthetics

- 12.15 Trelleborg