|

|

市場調査レポート

商品コード

1368692

ポリクロロトリフルオロエチレン(PCTFE)市場- 用途別、最終用途別&予測、2023年~2032年Polychlorotrifluoroethylene Market - By Application (Films and Sheets, Cables & Wires, Coatings), By End-use (Chemical Processing, Oil and Gas, Pharmaceuticals, Electronics) & Forecast, 2023 - 2032 |

||||||

カスタマイズ可能

|

|||||||

| ポリクロロトリフルオロエチレン(PCTFE)市場- 用途別、最終用途別&予測、2023年~2032年 |

|

出版日: 2023年08月23日

発行: Global Market Insights Inc.

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 図表

- 目次

ポリクロロトリフルオロエチレン(PCTFE)の市場規模は、様々な産業用途における高性能材料の需要急増に起因して、2023年から2032年にかけて3%以上のCAGRを記録すると予測されています。

この材料の卓越した耐薬品性、熱安定性、低透過性の特性は、医薬品、電子機器、航空宇宙を含む複数の最終用途産業から注目を集めています。

さらに、持続可能で環境に優しい素材への注目の高まりが、市場の成長をさらに後押しすると予想されています。RoundUp Org社のデータによると、約55%の顧客が環境に優しい製品ブランドにより高い金額を支払うことを望んでおり、78%の消費者が持続可能性を重要だと感じています。業界全体の価値の約17%が持続可能です。

ポリクロロトリフルオロエチレン(PCTFE)市場全体は、用途、最終用途、地域によって区分されます。

ケーブル・電線分野は、この材料の顕著な絶縁特性と極端な温度に対する耐性により、2032年までに市場の需要を促進する見通しです。通信や送電分野で高品質なケーブルや電線の需要が高まる中、絶縁材料としてのPCTFEの使用が大幅に増加しています。過酷な環境条件に耐え、シグナルインテグリティを維持できることから、IT・通信やエネルギー産業におけるさまざまな重要用途に選ばれています。

石油・ガスの最終用途分野では、化学薬品、腐食、高圧に対する卓越した耐性が評価され、2032年まで大きな成長が続くと予測されています。これらの特徴により、PCTFEは探査、生産、輸送の各プロセスで使用されるバルブ、シール、ガスケットにおいて重要な部品となっています。世界のエネルギー需要の高まりが続く中、石油・ガス産業におけるPCTFEへの依存度はますます高まり、市場の成長をさらに後押しすると予測されています。

アジア太平洋地域のポリクロロトリフルオロエチレン市場は、2032年まで大幅に拡大すると予想されます。中国、インド、日本などの国々で急速な工業化とインフラ整備が進み、エレクトロニクス、自動車、化学処理などさまざまな用途でPCTFEに対する需要が大幅に増加しています。さらに、PCTFEは医療機器、薬剤包装、その他のヘルスケア用途で幅広く使用されているため、同地域のヘルスケアおよび製薬セクターへの投資が増加しており、業界に有利な成長機会が生まれています。

目次

第1章 調査手法と調査範囲

第2章 エグゼクティブサマリー

第3章 ポリクロロトリフルオロエチレン(PCTFE)産業洞察

- エコシステム分析

- 業界への影響要因

- 促進要因

- 業界の潜在的リスク&課題

- 潜在成長力分析

- COVID-19影響分析

- 規制状況

- 米国

- 欧州

- 価格分析、2022年

- 技術展望

- 今後の市場動向

- ポーター分析

- PESTEL分析

- ロシア・ウクライナ戦争の影響

第4章 競合情勢

- イントロダクション

- 企業マトリックス分析

- 世界企業シェア分析

- 競合のポジショニングマトリックス

- 戦略ダッシュボード

第5章 ポリクロロトリフルオロエチレン市場規模・予測:用途別、2018年~2032年

- フィルム・シート

- ケーブル・ワイヤー

- コーティング

- その他

第6章 ポリクロロトリフルオロエチレン市場規模・予測:最終用途別、2018年~2032年

- 化学処理

- 石油・ガス

- 医薬品

- エレクトロニクス

- その他

第7章 ポリクロロトリフルオロエチレン市場規模・予測:地域別、2018年~2032年

- 主要動向:地域別

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- アジア太平洋

- 日本

- 中国

- インド

- オーストラリア

- 韓国

- インドネシア

- マレーシア

- ラテンアメリカ

- ブラジル

- メキシコ

- アルゼンチン

- 中東・アフリカ

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

- エジプト

第8章 企業プロファイル

- Honeywell International Inc.

- Chemours Company

- 3M Company

- Daikin Industries Ltd.

- Asahi Glass Co., Ltd.

- Solvay S.A.

- Arkema Group

- Shanghai 3F New Materials Co., Ltd.

- Kureha Corporation

- Halopolymer OJSC

- Qingdao Hongfengxin International Trade Co., Ltd.

- Ganapathy Industries

- Jiangxi Aidmer Seal and Packing Co., Ltd.

- DuPont(prior to separation of Chemours)

- Hubei Everflon Polymer Co

Data Tables

- TABLE 1 Market revenue, by product type (2022)

- TABLE 2 Market revenue, by end-use (2022)

- TABLE 3 Market revenue, by application (2022)

- TABLE 4 Market revenue, by region (2022)

- TABLE 5 Global polychlorotrifluoroethylene market size, 2018 - 2032, (USD Million)

- TABLE 6 Global polychlorotrifluoroethylene market size, 2018 - 2032, (Kilo Tons)

- TABLE 7 Global polychlorotrifluoroethylene market size, by region, 2018 - 2032 (USD Million)

- TABLE 8 Global polychlorotrifluoroethylene market size, by region, 2018 - 2032 (Kilo Tons)

- TABLE 9 Global polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (USD Million)

- TABLE 10 Global polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (Kilo Tons)

- TABLE 11 Global polychlorotrifluoroethylene market size, by application, 2018 - 2032 (USD Million)

- TABLE 12 Global polychlorotrifluoroethylene market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 13 Industry impact forces

- TABLE 14 North America polychlorotrifluoroethylene market size, by country, 2018 - 2032 (USD Million)

- TABLE 15 North America polychlorotrifluoroethylene market size, by country, 2018 - 2032 (Kilo Tons)

- TABLE 16 North America polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (USD Million)

- TABLE 17 North America polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (Kilo Tons)

- TABLE 18 North America polychlorotrifluoroethylene market size, by application, 2018 - 2032 (USD Million)

- TABLE 19 North America polychlorotrifluoroethylene market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 20 U.S. polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (USD Million)

- TABLE 21 U.S. polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (Kilo Tons)

- TABLE 22 U.S. polychlorotrifluoroethylene market size, by application, 2018 - 2032 (USD Million)

- TABLE 23 U.S. polychlorotrifluoroethylene market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 24 Canada polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (USD Million)

- TABLE 25 Canada polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (Kilo Tons)

- TABLE 26 Canada polychlorotrifluoroethylene market size, by application, 2018 - 2032 (USD Million)

- TABLE 27 Canada polychlorotrifluoroethylene market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 28 Europe polychlorotrifluoroethylene market size, by country, 2018 - 2032 (USD Million)

- TABLE 29 Europe polychlorotrifluoroethylene market size, by country, 2018 - 2032 (Kilo Tons)

- TABLE 30 Europe polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (USD Million)

- TABLE 31 Europe polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (Kilo Tons)

- TABLE 32 Europe polychlorotrifluoroethylene market size, by application, 2018 - 2032 (USD Million)

- TABLE 33 Europe polychlorotrifluoroethylene market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 34 Germany polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (USD Million)

- TABLE 35 Germany polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (Kilo Tons)

- TABLE 36 Germany polychlorotrifluoroethylene market size, by application, 2018 - 2032 (USD Million)

- TABLE 37 Germany polychlorotrifluoroethylene market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 38 UK polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (USD Million)

- TABLE 39 UK polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (Kilo Tons)

- TABLE 40 UK polychlorotrifluoroethylene market size, by application, 2018 - 2032 (USD Million)

- TABLE 41 UK polychlorotrifluoroethylene market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 42 France polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (USD Million)

- TABLE 43 France polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (Kilo Tons)

- TABLE 44 France polychlorotrifluoroethylene market size, by application, 2018 - 2032 (USD Million)

- TABLE 45 France polychlorotrifluoroethylene market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 46 Spain polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (USD Million)

- TABLE 47 Spain polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (Kilo Tons)

- TABLE 48 Spain polychlorotrifluoroethylene market size, by application, 2018 - 2032 (USD Million)

- TABLE 49 Spain polychlorotrifluoroethylene market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 50 Italy polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (USD Million)

- TABLE 51 Italy polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (Kilo Tons)

- TABLE 52 Italy polychlorotrifluoroethylene market size, by application, 2018 - 2032 (USD Million)

- TABLE 53 Italy polychlorotrifluoroethylene market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 54 Asia Pacific polychlorotrifluoroethylene market size, by country, 2018 - 2032 (USD Million)

- TABLE 55 Asia Pacific polychlorotrifluoroethylene market size, by country, 2018 - 2032 (Kilo Tons)

- TABLE 56 Asia Pacific polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (USD Million)

- TABLE 57 Asia Pacific polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (Kilo Tons)

- TABLE 58 Asia Pacific polychlorotrifluoroethylene market size, by application, 2018 - 2032 (USD Million)

- TABLE 59 Asia Pacific polychlorotrifluoroethylene market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 60 China polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (USD Million)

- TABLE 61 China polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (Kilo Tons)

- TABLE 62 China polychlorotrifluoroethylene market size, by application, 2018 - 2032 (USD Million)

- TABLE 63 China polychlorotrifluoroethylene market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 64 Japan polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (USD Million)

- TABLE 65 Japan polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (Kilo Tons)

- TABLE 66 Japan polychlorotrifluoroethylene market size, by application, 2018 - 2032 (USD Million)

- TABLE 67 Japan polychlorotrifluoroethylene market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 68 India polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (USD Million)

- TABLE 69 India polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (Kilo Tons)

- TABLE 70 India polychlorotrifluoroethylene market size, by application, 2018 - 2032 (USD Million)

- TABLE 71 India polychlorotrifluoroethylene market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 72 Australia polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (USD Million)

- TABLE 73 Australia polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (Kilo Tons)

- TABLE 74 Australia polychlorotrifluoroethylene market size, by application, 2018 - 2032 (USD Million)

- TABLE 75 Australia polychlorotrifluoroethylene market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 76 South Korea polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (USD Million)

- TABLE 77 South Korea polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (Kilo Tons)

- TABLE 78 South Korea polychlorotrifluoroethylene market size, by application, 2018 - 2032 (USD Million)

- TABLE 79 South Korea polychlorotrifluoroethylene market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 80 Indonesia polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (USD Million)

- TABLE 81 Indonesia polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (Kilo Tons)

- TABLE 82 Indonesia polychlorotrifluoroethylene market size, by application, 2018 - 2032 (USD Million)

- TABLE 83 Indonesia polychlorotrifluoroethylene market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 84 Malaysia polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (USD Million)

- TABLE 85 Malaysia polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (Kilo Tons)

- TABLE 86 Malaysia polychlorotrifluoroethylene market size, by application, 2018 - 2032 (USD Million)

- TABLE 87 Malaysia polychlorotrifluoroethylene market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 88 Latin America polychlorotrifluoroethylene market size, by country, 2018 - 2032 (USD Million)

- TABLE 89 Latin America polychlorotrifluoroethylene market size, by country, 2018 - 2032 (Kilo Tons)

- TABLE 90 Latin America polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (USD Million)

- TABLE 91 Latin America polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (Kilo Tons)

- TABLE 92 Latin America polychlorotrifluoroethylene market size, by application, 2018 - 2032 (USD Million)

- TABLE 93 Latin America polychlorotrifluoroethylene market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 94 Brazil polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (USD Million)

- TABLE 95 Brazil polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (Kilo Tons)

- TABLE 96 Brazil polychlorotrifluoroethylene market size, by application, 2018 - 2032 (USD Million)

- TABLE 97 Brazil polychlorotrifluoroethylene market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 98 Mexico polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (USD Million)

- TABLE 99 Mexico polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (Kilo Tons)

- TABLE 100 Mexico polychlorotrifluoroethylene market size, by application, 2018 - 2032 (USD Million)

- TABLE 101 Mexico polychlorotrifluoroethylene market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 102 Argentina polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (USD Million)

- TABLE 103 Argentina polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (Kilo Tons)

- TABLE 104 Argentina polychlorotrifluoroethylene market size, by application, 2018 - 2032 (USD Million)

- TABLE 105 Argentina polychlorotrifluoroethylene market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 106 MEA polychlorotrifluoroethylene market size, by country, 2018 - 2032 (USD Million)

- TABLE 107 MEA polychlorotrifluoroethylene market size, by country, 2018 - 2032 (Kilo Tons)

- TABLE 108 MEA polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (USD Million)

- TABLE 109 MEA polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (Kilo Tons)

- TABLE 110 MEA polychlorotrifluoroethylene market size, by application, 2018 - 2032 (USD Million)

- TABLE 111 MEA polychlorotrifluoroethylene market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 112 South Africa polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (USD Million)

- TABLE 113 South Africa polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (Kilo Tons)

- TABLE 114 South Africa polychlorotrifluoroethylene market size, by application, 2018 - 2032 (USD Million)

- TABLE 115 South Africa polychlorotrifluoroethylene market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 116 Saudi Arabia polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (USD Million)

- TABLE 117 Saudi Arabia polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (Kilo Tons)

- TABLE 118 Saudi Arabia polychlorotrifluoroethylene market size, by application, 2018 - 2032 (USD Million)

- TABLE 119 Saudi Arabia polychlorotrifluoroethylene market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 120 UAE polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (USD Million)

- TABLE 121 UAE polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (Kilo Tons)

- TABLE 122 UAE polychlorotrifluoroethylene market size, by application, 2018 - 2032 (USD Million)

- TABLE 123 UAE polychlorotrifluoroethylene market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 124 Egypt polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (USD Million)

- TABLE 125 Egypt polychlorotrifluoroethylene market size, by end-use, 2018 - 2032 (Kilo Tons)

- TABLE 126 Egypt polychlorotrifluoroethylene market size, by application, 2018 - 2032 (USD Million)

- TABLE 127 Egypt polychlorotrifluoroethylene market size, by application, 2018 - 2032 (Kilo Tons)

Charts & Figures

- FIG. 1 Industry segmentation

- FIG. 2 Market estimation and forecast methodology

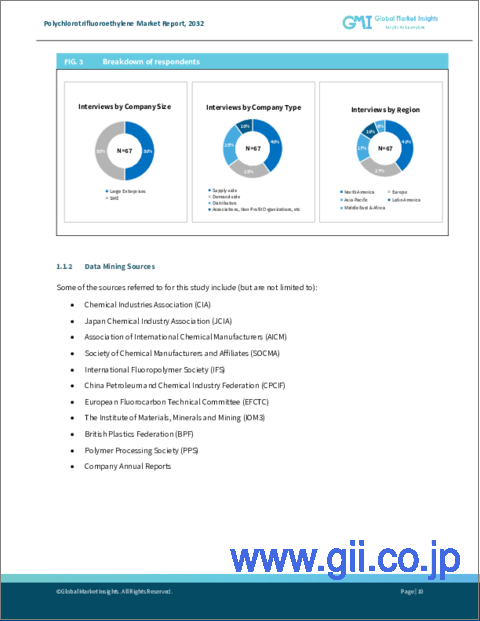

- FIG. 3 Breakdown of primary participants

- FIG. 4 Polychlorotrifluoroethylene industry, 360 degree synopsis, 2018 - 2032

- FIG. 5 Industry landscape, 2018-2032 (USD Million)

- FIG. 6 Growth potential analysis

- FIG. 7 Porter's analysis

- FIG. 8 PESTEL analysis

- FIG. 9 Company matrix analysis, 2022

- FIG. 10 Strategy dashboard, 2022

Polychlorotrifluoroethylene market size is anticipated to record more than 3% CAGR from 2023 to 2032 attributed to the surging demand for high-performance materials in various industrial applications. The material's exceptional chemical resistance, thermal stability, and low permeability characteristics have garnered attention from multiple end-use industries, including pharmaceuticals, electronics, and aerospace.

Furthermore, the increasing focus on sustainable and eco-friendly materials is expected to bolster the market growth further. According to the data by RoundUp Org, nearly 55% customers are willing to pay more for eco-friendly product brands and 78% consumers feel sustainability is important. Around 17% of the overall industry value is sustainable.

The entire polychlorotrifluoroethylene (PCTFE) market is divided on the basis of application, end-use, and region.

The cables & wires segment is poised to fuel the market demand by 2032, owing to the material's remarkable insulation properties and resistance to extreme temperatures. With the escalating demand for high-quality cables and wires in the telecommunications and power transmission sectors, the use of PCTFE as an insulating material is witnessign a significant upsurge. Its ability to withstand harsh environmental conditions and maintain signal integrity positions it as a preferred choice for various critical applications in the telecommunications and energy industries.

The oil & gas end-use segment is predicted to observe significant growth through 2032 attributed to the product's exceptional resistance to chemicals, corrosion, and high pressures. These features have made PCTFE a crucial component in valves, seals, and gaskets used in the exploration, production, and transportation processes. As the global energy demand continues to rise, the oil & gas industry's reliance on PCTFE is projected to escalate, further boosting the growth of the market.

Asia Pacific polychlorotrifluoroethylene market is expected to expand significantly through 2032. With rapid industrialization and infrastructural developments in countries such as China, India, and Japan, the demand for PCTFE in various applications, including electronics, automotive, and chemical processing, is witnessing a substantial upsurge. Furthermore, the increasing investments in the region's healthcare and pharmaceutical sectors are creating lucrative growth opportunities for the industry, as PCTFE finds extensive usage in medical equipment, drug packaging, and other healthcare applications.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Industry coverage

- 1.2 Market scope & definition

- 1.3 Base estimates & calculations

- 1.3.1 Data collection

- 1.4 Forecast parameters

- 1.5 COVID-19 impact analysis at global level

- 1.6 Data validation

- 1.7 Data Sources

- 1.7.1 Primary

- 1.7.2 Secondary

- 1.7.2.1 Paid sources

- 1.7.2.2 Unpaid sources

Chapter 2 Executive Summary

- 2.1 Polychlorotrifluoroethylene industry 360 degree synopsis, 2018 - 2032

- 2.2 Business trends

- 2.3 Application trends

- 2.4 Enduse trends

- 2.5 Regional trends

Chapter 3 Polychlorotrifluoroethylene Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.3 Growth potential analysis

- 3.3.1 By application

- 3.3.2 By end-use

- 3.4 COVID- 19 impact analysis

- 3.5 Regulatory landscape

- 3.5.1 U.S.

- 3.5.2 Europe

- 3.6 Pricing analysis, 2022

- 3.7 Technology landscape

- 3.7.1 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Impact of Russia Ukraine war

Chapter 4 Competitive Landscape, 2022

- 4.1 Introduction

- 4.2 Company matrix analysis, 2022

- 4.3 Global company market share analysis, 2022

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Polychlorotrifluoroethylene Market Size and Forecast, By Application 2018 - 2032

- 5.1 Films and Sheets

- 5.2 Cables & Wires

- 5.3 Coatings

- 5.4 Others

Chapter 6 Polychlorotrifluoroethylene Market Size and Forecast, By End-use 2018 - 2032

- 6.1 Chemical Processing

- 6.2 Oil and Gas

- 6.3 Pharmaceuticals

- 6.4 Electronics

- 6.5 Others

Chapter 7 Polychlorotrifluoroethylene Market Size and Forecast, By Region 2018 - 2032

- 7.1 Key trends, by region

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 Japan

- 7.4.2 China

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Indonesia

- 7.4.7 Malaysia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

- 7.6.4 Egypt

Chapter 8 Company Profiles

- 8.1 Honeywell International Inc.

- 8.2 Chemours Company

- 8.3 3M Company

- 8.4 Daikin Industries Ltd.

- 8.5 Asahi Glass Co., Ltd.

- 8.6 Solvay S.A.

- 8.7 Arkema Group

- 8.8 Shanghai 3F New Materials Co., Ltd.

- 8.9 Kureha Corporation

- 8.10 Halopolymer OJSC

- 8.11 Qingdao Hongfengxin International Trade Co., Ltd.

- 8.12 Ganapathy Industries

- 8.13 Jiangxi Aidmer Seal and Packing Co., Ltd.

- 8.14 DuPont (prior to separation of Chemours)

- 8.15 Hubei Everflon Polymer Co