|

|

市場調査レポート

商品コード

1089626

慢性腎臓病の市場規模および動向レポート(疫学およびパイプライン分析、競合評価、アンメットニーズ、臨床試験戦略、予測を含む)、2021年~2031年Chronic Kidney Disease Market Size and Trend Report including Epidemiology and Pipeline Analysis, Competitor Assessment, Unmet Needs, Clinical Trial Strategies and Forecast, 2021-2031 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 慢性腎臓病の市場規模および動向レポート(疫学およびパイプライン分析、競合評価、アンメットニーズ、臨床試験戦略、予測を含む)、2021年~2031年 |

|

出版日: 2022年04月29日

発行: GlobalData

ページ情報: 英文 92 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

世界7ヶ国の慢性腎臓病の市場規模は、2021年に13億米ドルとなりました。同市場は、今後17.8%のCAGRで緩やかに成長し、2030年には45億米ドルに達すると予測されています。

当レポートでは、世界7ヶ国における慢性腎臓病市場について調査し、疾患の概要と疫学動向ともに、アンメットニーズ、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 慢性腎臓病:エグゼクティブサマリー

第2章 イントロダクション

第3章 疾患の概要

- 病因と病態生理学

- 分類または病期判定システム

第4章 疫学

- 病気の背景

- 危険因子と併存疾患

- 世界的および歴史的動向

- 7ヶ国市場の予測調査手法

- 慢性腎臓病の疫学的予測(2021年~2031年)

- 討論

第5章 疾病管理

- 診断と治療の概要

- 疾病管理に関するKOLの洞察

第6章 競争力評価

- 概要

第7章 アンメットニーズと機会の評価

- 概要

- 慢性腎臓病患者のための治療法の欠如

- 腎機能障害を患う患者のためのより効果的な治療法

- 慢性腎臓病を発症するリスクのある患者のための予防療法

- 慢性腎臓病治療の最適な管理

第8章 研究開発戦略

- 概要

- 臨床試験デザイン

第9章 パイプライン評価

- 概要

- 臨床開発における有望な薬剤

第10章 パイプライン評価分析

- 概要

- 競争力評価

第11章 現在および将来の参入企業析

- AstraZeneca

- Boehringer Ingelheim

- Mitsubishi Tanabe Pharma Corp

- Reata Pharma

- Novo Nordisk

- KBP Biosciences

- 取引動向

第12章 市場の見通し

- 世界市場

- 米国

- EU5ヶ国

- 日本

第13章 付録

List of Tables

List of Tables

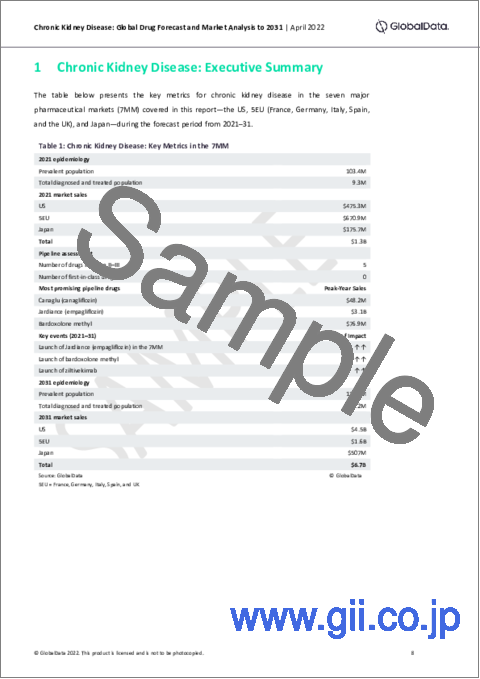

- Table 1: Chronic Kidney Disease: Key Metrics in the 7MM

- Table 2: Stages of CKD

- Table 3: KDIGO classification of CKD

- Table 4: Risk factors and comorbid conditions associated with CKD

- Table 5: Common Diagnostic Tests for CKD

- Table 6: Treatment Guidelines for CKD

- Table 7: AstraZeneca's CKD Portfolio Assessment, 2022

- Table 8: Boehringer Ingelheim's CKD Portfolio Assessment, 2022

- Table 9: Mitsubishi Tanabe's Portfolio Assessment, 2022

- Table 10: Reata's Portfolio Assessment, 2022

- Table 11: Novo Nordisk's Portfolio Assessment, 2022

- Table 12: KBP's CKD Portfolio Assessment, 2022

- Table 13: Chronic Kidney Disease Market - Global Drivers and Barriers, 2021-31

- Table 14: Key Events Impacting Sales for Chronic Kidney Disease in the US, 2021-31

- Table 15: Chronic Kidney Disease Market - Drivers and Barriers in the US, 2021-31

- Table 16: Key Events Impacting Sales for Chronic Kidney Disease in the 5EU, 2021-31

- Table 17: Chronic Kidney Disease Market - Drivers and Barriers in the 5EU, 2021-31

- Table 18: Key Events Impacting Sales for Chronic Kidney Disease in Japan, 2021-31

- Table 19: Chronic Kidney Disease Market - Drivers and Barriers in Japan, 2021-31

- Table 20: Key Launch dates for CKD

- Table 21: Key Patent Expiration Dates for CKD

- Table 22: High-Prescribing Physicians (non-KOLs) Surveyed, By Country

List of Figures

List of Figures

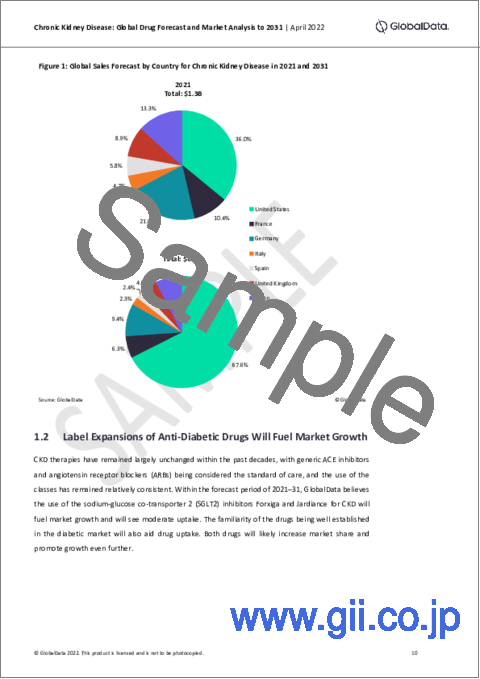

- Figure 1: Global Sales Forecast by Country for Chronic Kidney Disease in 2021 and 2031

- Figure 2: Analysis of the Company Portfolio Gap in Chronic Kidney Disease During the Forecast Period

- Figure 3: Competitive Assessment of the Late-Stage Pipeline Agents that GlobalData Expects to Be Licensed for the Treatment of Chronic Kidney Disease During the Forecast Period

- Figure 4: The Etiology of CKD

- Figure 5: The Pathophysiology of CKD

- Figure 6: 7MM, diagnosed prevalence of CKD (%), men, ages ≥18 years, 2021

- Figure 7: 7MM, sources used and not used to forecast the total and diagnosed prevalent cases of CKD

- Figure 8: 7MM, sources used to forecast the total prevalent cases of CKD by stage

- Figure 9: 7MM, sources used to forecast the diagnosed prevalent cases of CKD by stage

- Figure 10: 7MM, sources used to forecast the diagnosed prevalent cases of CKD by dialysis dependence

- Figure 11: 7MM, total prevalent cases of CKD, N, both sexes, ages ≥18 years, 2021

- Figure 12: 7MM, total prevalent cases of CKD by stage, N, both sexes, ages ≥18 years, 2021

- Figure 13: 7MM, diagnosed prevalent cases of CKD, N, both sexes, ages ≥18 years, 2021

- Figure 14: 7MM, diagnosed prevalent cases of CKD by age group, N, both sexes, 2021

- Figure 15: 7MM, diagnosed prevalent cases of CKD by sex, N, ages ≥18 years, 2021

- Figure 16: 7MM, diagnosed prevalent cases of CKD by stage, N, both sexes, ages ≥18 years, 2021

- Figure 17: 7MM, diagnosed prevalent cases of CKD by dialysis dependence, N, both sexes, ages ≥18 years, 2021

- Figure 18: 7MM, diagnosed prevalent cases of CKD based on dialysis-dependent subtype, N, both sexes, ages ≥18 years, 2021

- Figure 19: Unmet Needs and Opportunities in CKD

- Figure 20: Overview of the Development Pipeline in CKD

- Figure 21: Key Late-Stage Trials for the Promising Pipeline Agents that GlobalData Expects to Be Licensed for Chronic Kidney Disease in the 7MM During the Forecast Period

- Figure 22: Competitive Assessment of the Late-Stage Pipeline Agents that GlobalData Expects to Be Licensed for the Treatment of Chronic Kidney Disease During the Forecast Period

- Figure 23: Competitive Assessment of the Marketed and Pipeline Drugs Benchmarked Against the Standard of Care

- Figure 24: Competitive Assessment of the Marketed and Pipeline Drugs Benchmarked Against the Standard of Care, SGLT2 inhibitors

- Figure 25: Analysis of the Company Portfolio Gap in Chronic Kidney Disease During the Forecast Period

- Figure 26: Global (7MM) Sales Forecast by Country for Chronic Kidney Disease in 2021 and 2031

- Figure 27: Sales Forecast by Class for Chronic Kidney Disease in the US in 2021 and 2031

- Figure 28: Sales Forecast by Class for Chronic Kidney Disease in the 5EU in 2021 and 2031

- Figure 29: Sales Forecast by Class for Chronic Kidney Disease in Japan in 2021 and 2031

Chronic Kidney Disease (CKD) is a chronic condition in which patients suffer from an irreversible and progressive loss in renal function over many months or years, ultimately resulting in end-stage renal disease and the requirement for renal replacement therapy. CKD manifests when both kidneys are damaged sufficiently to hinder the removal of metabolic products from the body and the ability to provide mineral balance. The Centers for Disease Control and Prevention states that approximately 96% of people with kidney damage or mild to moderate reduced kidney function are oblivious to having CKD.

The global CKD market 2021 sales is estimated at approximately $1.3 billion across the 7MM, encompassing the US, the five major European countries (5EU: France, Germany, Italy, Spain, and UK), and Japan. By 2031, GlobalData expects the overall market to grow at a moderate compound annual growth rate (CAGR) of 17.8% to reach sales of $4.5 billion over the 10-year period. Sales figures were forecast for both branded and generic drugs, from 2021 base year to 2031. The total market size for the 7MM (the "global market") in 2021 was $1.3 billion. GlobalData expects that the total CKD drug market will grow at a Compound Annual Growth Rate (CAGR) of 17.8% over the 10-year forecast period, resulting in a market value of $4.5 billion by 2030.

Over the 10-year forecast period, the CKD market is expected to grow at a compound annual growth rate (CAGR) of 17.8%, reaching around $4.5 billion in 2030. The major driver for this growth will be the increased use of drugs from different classes in combination with each other, which will lead to increased treatment costs. According to KOLs, combination therapy will become a mainstay in CKD treatment during the forecast period. This, in turn, will be the major driver of the market, despite the patent expirations of most currently marketed drugs and generic erosion.

Overall, the greatest unmet need in the CKD space is for novel drugs with curative or disease-stabilizing properties. The currently available drugs work in delaying disease progression. However, there is no marketed drug that addresses the underlying disease mechanism.

Key Highlights

- The proportion of people at risk of developing CKD is expected to increase over the 10-year forecast period due to the growing disease prevalence.

- The potential launch of 5 late-stage pipeline agents will increase the number of patients who can be offered pharmacological treatment options. In addition, novel drugs in late-stage development are expected to have a high annual cost of therapy (ACOT), a factor that will contribute to notable profitability.

- Despite multiple therapies currently available to CKD patients, there is still a high level of unmet need within the treatment space. The most recognizable is the need for novel therapies targeting new mechanisms and improving access to novel therapies.

KEY QUESTIONS ANSWERED

Despite the existence of numerous well-established treatment options in the CKD space, a few-yet significant-unmet needs remain.

Which unmet needs are the most pressing in the 7MM?

Where should pharmaceutical companies focus drug development efforts in order to become a significant player in the space?

The CKD market hasn't seen many novel drug launches, though, clinical development activity has picked up.

What are the most promising late-stage candidates and how much they expected to generate over the forecast period?

What do KOLs say about their clinical and commercial positioning?

Although there is currently no cure for CKD small companies are developing drugs to target new pathways .

Which have been historically the companies leading the way?

What new companies are emerging in the space?

Scope

- Overview of Chronic Kidney Disease- including epidemiology, disease etiology and management.

- Topline CKD drugs market revenue, annual cost of therapy, and anticipated sales for major late-stage pipeline drugs.

- Key topics covered include assessment of current and pipeline therapies, unmet needs, current and future players and market outlook for the US, 5U and Japan over the 10-year forecast period.

- Pipeline analysis: Emerging novel trends under development, and detailed analysis of late-stage pipeline drugs.

- Analysis of the current and future market competition in the global CKD therapeutics market. Insightful review of the key industry drivers, restraints and challenges.

Reasons to Buy

The report will enable you to -

- Develop and design your in-licensing and out-licensing strategies, using a detailed overview of current pipeline products and technologies to identify companies with the most robust pipelines.

- Develop business strategies by understanding the trends shaping and driving the global CKD therapeutics market.

- Drive revenues by understanding the key trends, innovative products and technologies, market segments, and companies likely to impact the global CKD market in the future.

- Formulate effective sales and marketing strategies by understanding the competitive landscape and by analyzing the performance of various competitors.

- Identify emerging players with potentially strong product portfolios and create effective counter-strategies to gain a competitive advantage.

- Track drug sales in the global CKD therapeutics market from 2021-2031.

- Organize your sales and marketing efforts by identifying the market categories and segments that present maximum opportunities for consolidations, investments and strategic partnerships.

Table of Contents

Table of Contents

- 1 Chronic Kidney Disease: Executive Summary

- 1.1 The CKD Market Will Exhibit Moderate Growth Between 2021 and 2031

- 1.2 Label Expansions of Anti-Diabetic Drugs Will Fuel Market Growth

- 1.3 Unmet Needs Remain in the CKD Market Despite the Availability of Well-Established Therapies

- 1.4 SGLT2 Inhibitors Will Likely Dominate Branded CKD Market

- 1.5 What Do Physicians Think?

- 2 Introduction

- 2.1 Catalyst

- 2.2 Related Reports

- 3 Disease Overview

- 3.1 Etiology and Pathophysiology

- 3.1.1 Etiology

- 3.1.2 Pathophysiology

- 3.2 Classification or Staging Systems

- 4 Epidemiology

- 4.1 Disease Background

- 4.2 Risk Factors and Comorbidities

- 4.3 Global and Historical Trends

- 4.4 7MM Forecast Methodology

- 4.4.1 Sources

- 4.4.2 Forecast Assumptions and Methods

- 4.4.3 Total Prevalent Cases of CKD

- 4.4.4 Total Prevalent Cases of CKD by Stage

- 4.4.5 Diagnosed Prevalent Cases of CKD

- 4.4.6 Diagnosed Prevalent Cases of CKD by Stage

- 4.4.7 Diagnosed Prevalent Cases of CKD Based on Dialysis Dependence

- 4.5 Epidemiological Forecast for CKD (2021-31)

- 4.5.1 Total Prevalent Cases of CKD

- 4.5.2 Total Prevalent Cases of CKD by Stage

- 4.5.3 Diagnosed Prevalent Cases of CKD

- 4.5.4 Age-Specific Diagnosed Prevalent Cases of CKD

- 4.5.5 Sex-Specific Diagnosed Prevalent Cases of CKD

- 4.5.6 Diagnosed Prevalent Cases of CKD by Stage

- 4.5.7 Diagnosed Prevalent Cases of CKD by Dialysis Dependence

- 4.6 Discussion

- 4.6.1 Epidemiological Forecast Insight

- 4.6.2 COVID-19 Impact

- 4.6.3 Limitations of the Analysis

- 4.6.4 Strengths of the Analysis

- 5 Disease Management

- 5.1 Diagnosis and Treatment Overview

- 5.2 KOL Insights on Disease Management

- 6 Competitive Assessment

- 6.1 Overview

- 7 Unmet Needs and Opportunity Assessment

- 7.1 Overview

- 7.2 Lack of Therapies for CKD Patients

- 7.3 More Effective Therapies for Patients with Renal Impairment

- 7.4 Preventative Therapies for Patients at Risk of Developing CKD

- 7.5 Optimal Management of CKD Treatments

- 8 R&D Strategies

- 8.1 Overview

- 8.1.1 Optimizing Treatment Safety and Compliance in Both the Pre-dialysis and Dialysis Setting

- 8.2 Clinical Trials Design

- 9 Pipeline Assessment

- 9.1 Overview

- 9.2 Promising Drugs in Clinical Development

- 10 Pipeline Valuation Analysis

- 10.1 Overview

- 10.2 Competitive Assessment

- 11 Current and Future Players

- 11.1 Overview

- 11.2 AstraZeneca

- 11.3 Boehringer Ingelheim

- 11.4 Mitsubishi Tanabe Pharma Corp

- 11.5 Reata Pharma

- 11.6 Novo Nordisk

- 11.7 KBP Biosciences

- 11.8 Deal-Making Trends

- 12 Market Outlook

- 12.1 Global Markets

- 12.1.1 Forecast

- 12.1.2 Drivers and Barriers - Global Issues

- 12.2 US

- 12.2.1 Forecast

- 12.2.2 Key Events

- 12.2.3 Drivers and Barriers

- 12.3 5EU

- 12.3.1 Forecast

- 12.3.2 Key Events

- 12.3.3 Drivers and Barriers

- 12.4 Japan

- 12.4.1 Forecast

- 12.4.2 Key Events

- 12.4.3 Drivers and Barriers

13 Appendix

- 13.1 Bibliography

- 13.2 Abbreviations

- 13.3 Methodology

- 13.3.1 Forecasting Methodology

- 13.3.2 Diagnosed Patients

- 13.3.3 Percent Drug-Treated Patients

- 13.3.4 Drugs Included in Each Therapeutic Class

- 13.3.5 Launch and Patent Expiry Dates

- 13.3.6 General Pricing Assumptions

- 13.3.7 Individual Drug Assumptions

- 13.3.8 Generic Erosion

- 13.3.9 Pricing of Pipeline Agents

- 13.4 Primary Research - KOLs Interviewed for This Report

- 13.4.1 KOLs

- 13.5 Primary Research - Prescriber Survey

- 13.6 About the Authors

- 13.6.1 Analyst

- 13.6.2 Therapy Area Director

- 13.6.3 Epidemiologist

- 13.6.4 Managing Epidemiologists/Reviewers

- 13.6.5 Vice President of Disease Analysis and Intelligence

- 13.6.6 Global Head and EVP of Healthcare Operations and Strategy

- Contact Us