|

|

市場調査レポート

商品コード

1479980

世界の製薬業界の展望、2024年Global Pharmaceutical Industry Outlook, 2024 |

||||||

|

|||||||

| 世界の製薬業界の展望、2024年 |

|

出版日: 2024年04月22日

発行: Frost & Sullivan

ページ情報: 英文 86 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

競争の激化が製薬のデジタル化を促進し、独自の成長機会を構築

Frost & Sullivanは、世界の製薬業界を形成する主要な動向を特定し、定義しています。調査期間は2021~2028年で、2023年を基準年、2024~2028年を予測期間としています。地理的範囲は5地域で、北米、ラテンアメリカ・カリブ海地域、アジア太平洋地域、欧州、中東・アフリカです。

景気後退と継続するインフレは、2024年も製薬業界にとって差し迫った課題であり、投資収益率に影響を及ぼすと思われます。製薬企業は、地理的な近接性と、よりスムーズで信頼性の高いサプライチェーンを確保するため、グローバルなサプライヤーよりもローカルなサプライヤーにシフトし続けると思われます。

目次

アナリストのハイライト

- ハイライト

- 2024年の主要予測

世界の製薬業界における変革

- なぜ成長が難しくなっているのか?

- The Strategic Imperative 8(TM)

- 世界の製薬業界に対する主要な戦略的インペラティブの影響

エコシステム

- セグメンテーションと範囲

- 業界の主要テーマ

業界動向

- 動向1:バイオ製薬業界におけるM&Aの増加

- 動向2:精密医療への注目の高まり

- 動向3:医薬品研究開発におけるRWE統合の進展

- 世界の製薬業界 - 研究開発費の見通し

- 世界の医薬品開発パイプライン、開発段階別

- 主要治療領域の展望

マクロ経済要因

成長要因

- 世界の製薬業界 - 過去の売上高と予測

- セグメントの業績 - 過去の売上高と予測

- 収益予測、地域別

- 収益予測分析、地域別

- 地域の規制動向 - 北米

- 地域の規制動向 - 欧州

- 地域の規制動向 - アジア太平洋地域

- 地域の規制動向 - アジア太平洋地域、ラテンアメリカ・カリブ海地域、中東・アフリカ

予測、2024年

- 予測1

- 予測2

- 予測3

- 予測4

- 予測5

成長ジェネレーター:低分子

- スナップショット - 2024年

- 注目すべき企業

成長ジェネレーター:生物製剤

- スナップショット - 2024年

- 注目すべき企業

成長機会ユニバース

- 成長機会1:官民連携モデルによるアジア太平洋地域での精密オンコロジーの拡大

- 成長機会2:新興バイオテクノロジープラットフォームによる未治療タンパク質の標的化

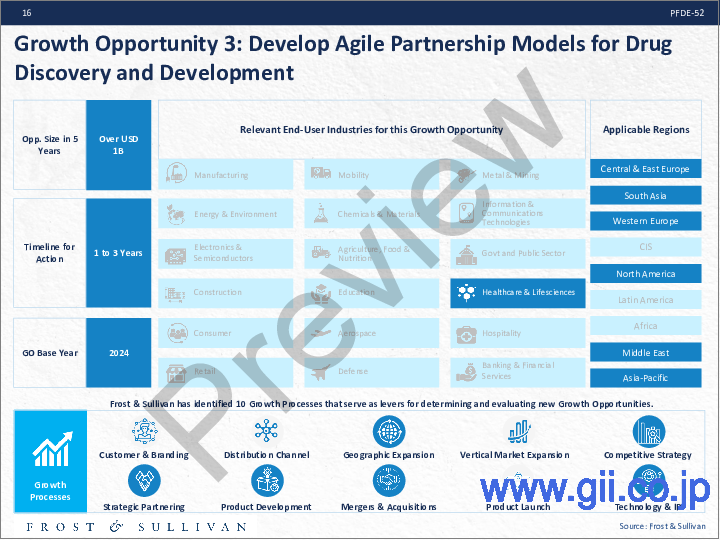

- 成長機会3:創薬開発のアジャイルパートナーシップモデルの開発

ベストプラクティスの認識

Frost Radar

次のステップ

Growing Competitive Intensity is Driving Pharma Digitization, Building Unique Growth Opportunities

Frost & Sullivan identifies and defines the leading trends shaping the global pharmaceutical landscape in this analysis. The study period is 2021-2028, with 2023 as the base year and 2024-2028 as the forecast period. The geographic scope includes 5 regions: North America, Latin America (LATAM) and the Caribbean, Asia-Pacific (APAC), Europe, and the Middle East and Africa. Chemicals/Small molecules and biologics are the 2 segments covered.

Other information covered include:

- Pharmaceutical industry overview

- Revenue forecasts by segment

- The top 5 predictions for 2024 and beyond

- Macro and micro trends driving the industry's future

- R&D expenditure and leading therapeutic areas

- Growth opportunities

After a plateaued growth in 2023 due to the biologics segment slowdown and a decrease in the uptake of COVID-19 vaccines and therapeutics, the industry will likely realign its growth to record a 5.9% CAGR between 2023 and 2028. Year-on-year (YoY) growth will remain low in developed economies, including the United States and Europe. In contrast, emerging economies in APAC, LATAM, and the rest of the world will register comparatively stronger single-digit YoY growth.

The recession and ongoing inflation will remain pressing challenges for the pharmaceutical industry in 2024, affecting returns on investment. Pharmaceutical companies will continue to shift toward regional rather than global suppliers to ensure geographic proximity and a smoother, more reliable supply chain.

There continues to be a strong focus on environmental, social, and governance commitments and supply-chain digitalization through lighthouse manufacturing techniques, decentralized clinical trial approaches, and the application of artificial intelligence. The industry is also witnessing a healthy mergers and acquisitions landscape, with several successful transactions recently. In addition, Frost & Sullivan expects a rebound in initial public offerings (IPOs), with 5 IPOs completed by February 2024.

Table of Contents

Analyst Highlights

- Highlights

- Top Predictions for 2024

Transformation in the Global Pharmaceutical Industry

- Why is it Increasingly Difficult to Grow?

- The Strategic Imperative 8™

- The Impact of the Top 3 Strategic Imperatives on the Global Pharmaceutical Industry

Ecosystem

- Segmentation and Scope

- Key Industry Themes

Industry Trends

- Trend 1: Increasing M&As in Biopharma

- Trend 2: Higher Focus on Precision Medicine

- Trend 3: More RWE Integration in Drug R&D

- Global Pharmaceutical Industry-R&D Expenditure Outlook

- Global Drug Development Pipeline by Development Phase

- Key Therapeutic Area Outlook

Macroeconomic Factors

- Top 10 Trends for 2024

- Top 10 Growth Opportunities

- Global GDP Growth-Global Growth will See a Mild Slowdown from 3% in 2023 to 2.6% in 2024 as Major Economies Lose Momentum

- Inflation and Interest Rates-Headline Inflation will Continue to Decline. H2 2024 will Shift Toward Rate Cuts for Advanced Economies

- Currency Trajectory-The Dollar will Remain Strong in H1 2024. Emerging Market Currencies will Receive a Boost From Q3 2024

- Oil Markets-OPEC+ will Cut Oil Production in Q1. Non-OPEC Production will Increase

- Labor Market-Unemployment will See a Moderate Uptick. Positive Expectations Over Market Sentiment will Support Labor Hoarding

- Critical Mineral Supplies-The Need for Economic Resiliency will Bolster Cross-border and Cross-industry Partnerships

- North America-The Region will See an Economic Slowdown Amidst a Discretionary Spending Pullback and Elevated Interest Rates

- Western Europe-The Region will See a Moderate Growth Pick-up as Inflation Headwinds Ease. Rebuilding Fiscal Buffers will Take Precedence

- The Middle East-Economic Diversification will Drive Non-oil Growth to Limit the Pullback From a Slowdown in Global oil Markets

- Asia-Emerging Economies will Drive Growth Momentum. Fiscal Measures will Support CHINESE Economic Recovery

- High Inflation and Global Recession

- Intensification of Supply Chain Resilience Strategies

- Sustainability Across the Pharma Value Chain

Growth Generator

- Global Pharmaceutical Industry-Historic Sales and Forecast

- Segment Performance-Historic Sales and Forecast

- Revenue Forecast by Region

- Revenue Forecast Analysis by Region

- Regional Regulatory Trends-North America

- Regional Regulatory Trends-Europe

- Regional Regulatory Trends-APAC

- Regional Regulatory Trends-APAC, LATAM, the Caribbean, the Middle East, and Africa

Predictions for 2024

- Prediction 1

- Prediction 2

- Prediction 3

- Prediction 4

- Prediction 5

Growth Generator: Small Molecules

- Small Molecules Snapshot-2024

- Small-molecule Companies to Watch

Growth Generator: Biologics

- Biologics Snapshot-2024

- Biologics Companies to Watch

Growth Opportunity Universe

- Growth Opportunity 1: Scale Precision Oncology in Asia-Pacific Through Public-private Partnership Models

- Growth Opportunity 2: Target Undruggable Proteins with Emerging Biotech Platforms

- Growth Opportunity 3: Develop Agile Partnership Models for Drug Discovery and Development

Best Practices Recognition

- Best Practices Recognition

Frost Radar

- Frost Radar

Next Steps

- Benefits and Impacts of Growth Opportunities

- Next Steps

- Take the Next Step

- List of Exhibits

- Legal Disclaimer