|

|

市場調査レポート

商品コード

1249954

EVパワーエレクトロニクス用WBG半導体市場:戦略的分析、2030年までの予測Strategic Analysis of WBG Semiconductors in Power Electronics Applications for EVs, Forecast to 2030 |

||||||

| EVパワーエレクトロニクス用WBG半導体市場:戦略的分析、2030年までの予測 |

|

出版日: 2023年03月23日

発行: Frost & Sullivan

ページ情報: 英文 87 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

世界的に電気自動車(EV)の普及が進み、パワー半導体の需要が高まっています。政府の法律や補助金、OEMによるネットゼロエミッションへの取り組み、持続可能性の目標が、自動車産業におけるEVの普及を加速させています。

当レポートでは、北米の自動車OEMの需要に焦点を当て、EV向けWBG半導体デバイス市場の見通し、戦略的インペラティブ、成長の機会などを提供しています。

目次

戦略的インペラティブ

- 成長がますます困難になるのはなぜか

- 戦略的インペラティブ

- EV用WBG半導体業界に対する上位3つの戦略的インペラティブの影響

- 成長の機会が成長パイプラインエンジンを加速させる

成長機会分析

- 分析範囲

- EV市場セグメンテーション、地域別

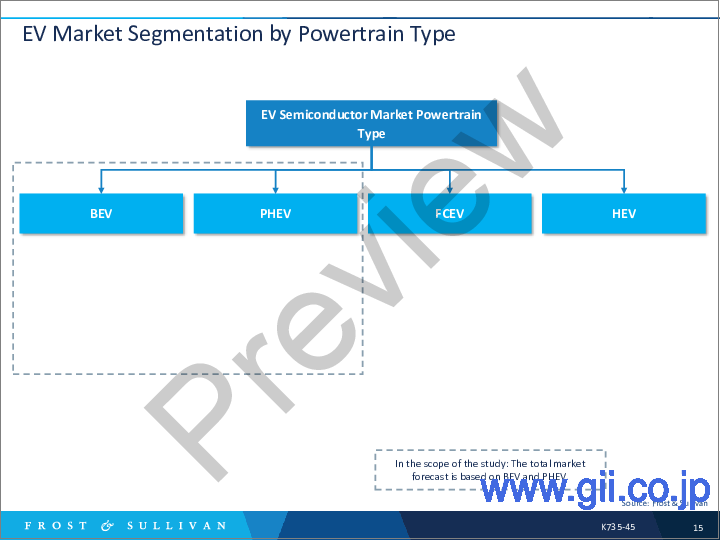

- EV市場セグメンテーション、パワートレインタイプ別

- EV市場セグメンテーション、材料タイプ別

- 半導体チップの地域別政策

- EV半導体バリューチェーン:プロセス

- EV半導体バリューチェーンの再編と再構築

- WBG半導体の分類

- EV WBG半導体材料:性能

- SiC半導体ウエハ開発のタイムライン

- WBG半導体の特許情勢

- 半導体エコシステムにおける合併と買収

- 主要参入企業:WBG半導体EV電力エコシステム

- OEM 800 V電化計画:技術動向

- コンポーネント別EV半導体用途

- 成長指標

- 促進要因

- 促進要因分析

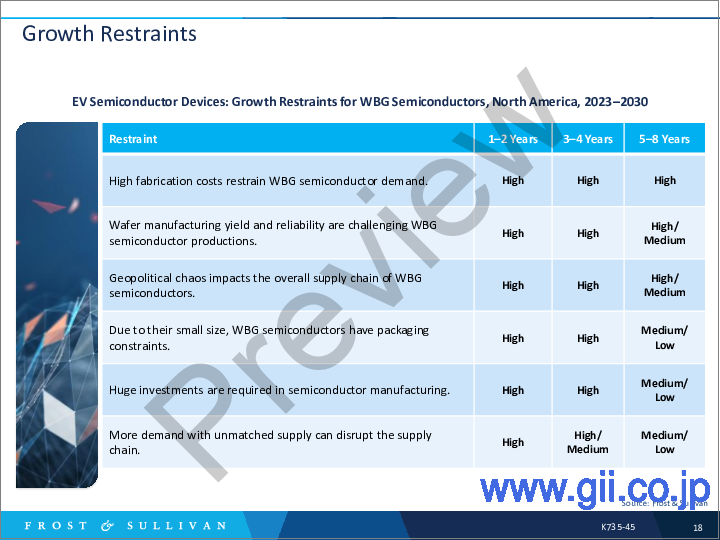

- 成長抑制

- 成長抑制分析

- 予測の前提条件

- シナリオ別収益見通し

- 収益予測分析

- 競合環境

成長機会分析:SiC半導体

- 成長指標

- シナリオ別収益見通し

成長機会分析:GaN半導体

- 成長指標

- シナリオ別収益見通し

OEMプロファイル

- Tesla

- GM

- Ford

- Lucid

- Rivian

サプライヤーのプロファイル

- Infineon

- onsemi

- Wolfspeed

- Navitas Semiconductor

- Qorvo

- Odyssey Semiconductor

成長の機会

- 成長の機会1:SiCおよびGaN WBG半導体の採用の増加

- 成長の機会2:SiCとGaNの半導体サプライヤー間の戦略的パートナーシップ

- 成長の機会3:WBGの半導体製造施設開発

次のステップ

Future Growth Potential of Semiconductor Industry With Growing Powertrain Electrification to Improve Power Density and Efficiency

The increasing use of electric vehicles (EVs) worldwide boosts power semiconductor demand. Government laws and subsidies, original equipment manufacturers' (OEMs') dedication to net zero emissions, and sustainability goals accelerate EV penetration in the vehicle industry. This study focuses on wide bandgap (WBG) semiconductors for the North American EV market. Silicon carbide (SiC) and gallium-nitride (GaN) are the 2 WBG technologies that overcome the limitations of silicon in EVs. The semiconductor content of an EV is 2 to 3 times higher than conventional ICE, and almost 75% of this comes from power semiconductors.

Frost & Sullivan estimates the EV market will continue double-digit growth until the decade's end. The WBG semiconductor market is sizable, expanding, and highly fragmented, providing a significant opportunity for new competitors. High-voltage, high-performance power semiconductors will continue to be vital for EVs and a growing part of the semiconductor segment in the forecast period.

The study aims to understand the impact of new regional policies, Chips Act 2022, highlights drivers and restraints, performance differences of WBG semiconductor materials, patent landscape, and key vendors in the ecosystem. The automotive EV components covered are main inverters, onboard chargers, and DC-DC converters. Based on the analysis, WBG semiconductor content will rise 2 times in EVs, from 2026 to 2027, due to OEM adoption of 800 V electrical architecture.

This report provides an outlook on the WBG semiconductor device market for EVs, focusing on North American automotive OEM demand. The key North American OEMs identified are Tesla, GM, Ford, Lucid, and Rivian, adopting WBG or compound semiconductor technology. The report forecasts the demand for WBG based on upcoming EVs till 2030. In addition, a few North American supplier profiles discussed are Wolfspeed, onsemi, Odyssey Semiconductor, Qorvo, Navitas Semiconductor, and GaN Systems.

KEY ISSUES ADDRESSED

- What are the market dynamics that drive WBG semiconductor demand in North America?

- What are the different WBG semiconductor technologies available in North America?

- What is the North American market potential (revenue) of WBG semiconductors in EVs?

- What are the preferences of North American OEMs and suppliers in adopting these WBG semiconductor technologies, and what is their outlook for the future?

- How will technologies evolve during the next decade with different automotive OEMs?

- Who are the key market players of WBG semiconductors for EVs?

Table of Contents

Strategic Imperatives

- Why Is It Increasingly Difficult to Grow?

- The Strategic Imperative 8™

- The Impact of the Top 3 Strategic Imperatives on Wide Bandgap EV Semiconductor Industry

- Growth Opportunities Fuel the Growth Pipeline Engine™

Growth Opportunity Analysis

- Scope of Analysis

- EV Market Segmentation by Region

- EV Market Segmentation by Powertrain Type

- EV Market Segmentation by Material Type

- Regional Policies of Semiconductor Chips

- EV Semiconductor Value Chain: Process

- EV Semiconductor Value Chain: Reshuffled and Rebuilding

- WBG Semiconductor Classifications

- EV WBG Semiconductor Materials: Performance

- EV WBG Semiconductor Materials: Performance (continued)

- EV WBG Semiconductor Materials: Performance (continued)

- SiC Semiconductor Wafer Development Timeline

- WBG Semiconductor Patent Landscape

- Merger and Acquisition in Semiconductor Ecosystem

- Key Players: WBG Semiconductor EV Power Ecosystem

- Key Players: WBG Semiconductor EV Power Ecosystem (continued)

- OEM 800 V Electrification Plan: Technology Trends

- OEM 800 V Electrification Plan: Technology Trends (continued)

- EV Semiconductor Applications by Components

- EV Semiconductor Applications by Components (continued)

- EV Semiconductor Applications by Components (continued)

- Growth Metrics

- Growth Drivers

- Growth Drivers Analysis

- Growth Restraints

- Growth Restraints Analysis

- Forecast Assumptions

- Revenue Forecast by Scenario

- Revenue Forecast by Segment: Optimistic Scenario

- Revenue Forecast by Segment: F&S Scenario

- Revenue Forecast by Segment, Conservative Scenario

- Revenue Forecast by EV Components: Optimistic Scenario

- Revenue Forecast by EV Components: F&S Scenario

- Revenue Forecast by EV Components: Conservative Scenario

- Revenue Forecast Analysis

- Competitive Environment

Growth Opportunity Analysis: SiC Semiconductor

- Growth Metrics

- Revenue Forecast by Scenario

- Revenue Forecast by EV Components: Optimistic Scenario

- Revenue Forecast by EV Components: F&S Scenario

- Revenue Forecast by EV Components: Conservative Scenario

Growth Opportunity Analysis: GaN Semiconductor

- Growth Metrics

- Revenue Forecast by Scenario

- Revenue Forecast by EV Components: Optimistic Scenario

- Revenue Forecast by EV Components: F&S Scenario

- Revenue Forecast by EV Components: Conservative Scenario

OEM Profiles

- Tesla: WBG Adoption

- GM: WBG Adoption

- Ford: WBG Adoption

- Lucid: WBG Adoption

- Rivian: WBG Adoption

Supplier Profiles

- Infineon: WBG Adoption

- onsemi: WBG Adoption

- Wolfspeed: WBG Adoption

- Navitas Semiconductor: WBG Adoption

- Qorvo: WBG Adoption

- Odyssey Semiconductor: WBG Adoption

Growth Opportunity Universe

- Growth Opportunity 1: Increasing SiC and GaN WBG Semiconductor Adoption

- Growth Opportunity 1: Increasing SiC and GaN WBG Semiconductor Adoption (continued)

- Growth Opportunity 2: Strategic Partnerships Between SiC and GaN Semiconductor Suppliers

- Growth Opportunity 2: Strategic Partnerships Between SiC and GaN Semiconductor Suppliers (continued)

- Growth Opportunity 3: WBG Semiconductor Manufacturing Facility Development

- Growth Opportunity 3: WBG Semiconductor Manufacturing Facility Development (continued)

Next Steps

- Your Next Steps

- Why Frost, Why Now?

- List of Exhibits

- List of Exhibits (continued)

- List of Exhibits (continued)

- Legal Disclaimer