|

|

市場調査レポート

商品コード

1221151

医薬品連続生産の世界市場:成長の機会Global Pharmaceutical Continuous Manufacturing Market, Growth Opportunities |

||||||

| 医薬品連続生産の世界市場:成長の機会 |

|

出版日: 2023年02月03日

発行: Frost & Sullivan

ページ情報: 英文 90 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

連続生産は製薬会社の化学および製造プロセスの大幅なスピードアップを支援し、特に重要な救命薬品において、全体の製造スケジュールを短縮することができます。製薬業界では、毒性のある試薬を含む可能性のあるバッチプロセスや、電気化学反応や光化学反応を含むスケールアップ反応など、制限のあるプロセスにこの技術を適用してきました。プロセス分析技術(PAT)やデジタルツインなどの技術を導入してリアルタイムでの意思決定を改善することで、バッチやCMなどの製造工程をより適切に管理することが可能になります。

当レポートでは、世界の医薬品連続生産市場について調査し、市場の概要とともに、戦略的インペラティブ、成長の機会などを提供しています。

目次

戦略的インペラティブ

- 成長がますます困難になるのはなぜか

- 戦略的インペラティブ

- 医薬品連続生産業界に対する上位3つの戦略的インペラティブの影響

- 成長の機会が成長パイプラインエンジンを加速させる

成長の機会分析

- 分析範囲

- セグメンテーション

- 市場動向分析

- バッチ製造とCM(連続生産)

- CM導入のメリット

- ベンダーエコシステム

- 促進要因

- 成長抑制

CM市場シナリオ

- CM-採用タイムライン(FDA)

- CM成長の現在の市場シナリオ

- CM-技術概要

投資動向 - パートナーシップと拡大

- 投資動向 - パートナーシップと拡大

- 施設の拡張/取得

- パートナーシップ/コラボレーション

成長の機会分析-世界の医薬品CM市場

- 成長指標

- 予測の前提条件

- 世界の医薬品市場

- 収益予測

- 収益予測分析

- 地域の視点

成長の機会分析- 社内vs外部委託

成長の機会分析 - 低分子対高分子

成長の機会分析- 原薬と医薬品

成長の機会分析- 競合の評価

競合企業プロファイル-CMサービスを提供するCDMO

- Cambrex Corporation-概要

- SK Biotek-概要

- Corden Pharma-概要

- Patheon(Thermo Fisher Scientific)- 概要

- Wuxi Biologics-概要

- Fujifilm Diosynth Biotechnologies-概要

CM機器メーカー

- CM機器メーカー

成長の機会

- 成長の機会1-APACにおけるCMの機能拡張

- 成長の機会2-生産性向上のためのプロセス自動化への注力

- 成長の機会3-遺伝子治療のための-ウイルスベクターCM

次のステップ

Regulatory Acceptance Propelling Continuous Manufacturing Investments through Partnerships and In-house Expansions

Continuous manufacturing (CM) is a method for manufacturing end-to-end pharmaceutical products on a single, uninterrupted production line. While batch manufacturing requires transporting, testing, and refeeding materials from one process to the next, continuous processes execute all testing, feeding, and processing inline at a single manufacturing site. The global pharma industry is slowly shifting its focus from primary care to specialty medicine and rare diseases. To modify research and development (R&D) models to address and adapt to challenges associated with rare, ultra-rare, and specialty diseases, the strategy is changing from being present in a few large segments to many small segments and exploring new disease areas with high unmet needs.

CM helps pharma companies significantly speed up the chemistry and manufacturing processes, which can cut down on the overall manufacturing timelines, especially in critical life-saving drugs. To date, the US Food and Drug Administration (FDA) has approved the manufacture of over 7 drugs using continuous processes, which started off from only one product less than 4 years ago. In 2020 alone, the FDA approved 4 new drugs to be manufactured using CM. Alongside the FDA, health authorities in Canada, Europe, Australia, Japan, Switzerland, and New Zealand have approved CM application for the production of solid oral dosage forms, indicating the growing acceptance of the technology worldwide.

With such nascent technology, the pharma industry has been applying the technique for processes that are off limits for batch processes, which might include toxic reagents, and for scale-up reactions that include electrochemical or photochemical reactions. Implementing technologies, such as process analytical technology (PAT) and digital twins, for improved real-time decision making will allow for the better control of manufacturing processes, including batch and CM.

Considering the large-scale benefits of flexibility and timeline management and a quantifiable reduction in the cost of manufacturing through automated processes and better resource management, CM is expected to witness large-scale adoption in the form of integrated processes. Furthermore, the ecosystem is currently focused on pharma companies that take the majority share, in terms of setting up facilities. Contract development and manufacturing organizations (CDMOs), however, are slowly expanding their facilities by collaborating with CM platform vendors, with system integrators and automation experts providing additional support in the optimization manufacturing value chain. In the coming years, as the regulatory and operational benefits become more realized, CDMOs and pharma companies will likely continue enhancing and building their CM capabilities and expertise to remain competitive.

Table of Contents

Strategic Imperatives

- Why is it Increasingly Difficult to Grow?

- The Strategic Imperative 8™

- The Impact of the Top 3 Strategic Imperatives on the Pharmaceutical Continuous Manufacturing (CM) Industry

- Growth Opportunities Fuel the Growth Pipeline Engine™

Growth Opportunity Analysis

- Scope of Analysis

- Segmentation

- Market Trend Analysis

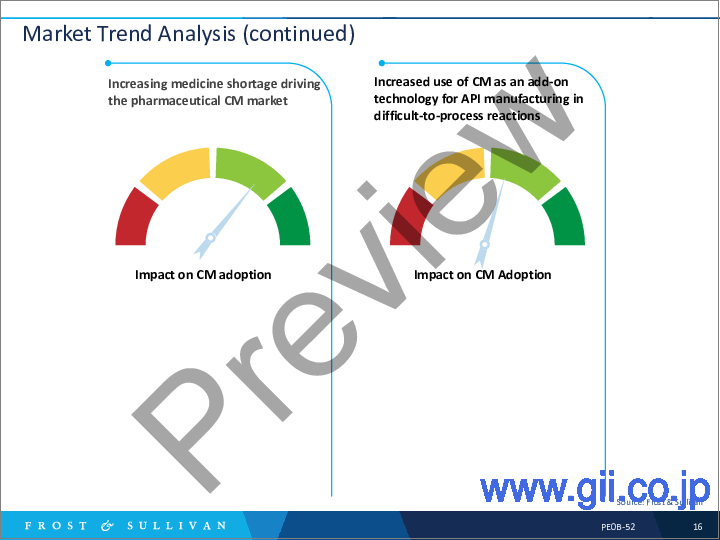

- Market Trend Analysis (continued)

- Batch Manufacturing versus CM

- Batch Manufacturing versus CM (continued)

- Benefits of Adopting CM

- Vendor Ecosystem

- Growth Drivers

- Growth Restraints

CM Market Scenario

- CM-Adoption Timeline (FDA)

- CM-Adoption Timeline (FDA) (continued)

- Current Market Scenario of CM Growth

- CM-Technology Overview

Investment Trends-Partnerships and Expansions

- Investment Trends-Partnerships and Expansions

- Facility Expansions/Acquisitions

- Facility Expansions/Acquisitions (continued)

- Facility Expansions/Acquisitions (continued)

- Facility Expansions/Acquisitions (continued)

- Partnerships/Collaborations

- Partnerships/Collaborations (continued)

- Partnerships/Collaborations (continued)

- Partnerships/Collaborations (continued)

Growth Opportunity Analysis-Global Pharmaceutical CM Market

- Growth Metrics

- Forecast Assumptions

- Forecast Assumptions (continued)

- Global Pharmaceutical Market

- Revenue Forecast

- Revenue Forecast Analysis

- Revenue Forecast Analysis (continued)

- Regional Perspective

Growth Opportunity Analysis-In-house versus Outsourced

- Revenue Forecast-In-house versus Outsourced

- Percent Revenue Forecast-In-house versus Outsourced

- Revenue Forecast Analysis-In-house versus Outsourced

- Revenue Forecast Analysis-In-house versus Outsourced (continued)

Growth Opportunity Analysis-Small Molecules versus Large Molecules

- Revenue Forecast-Small Molecules versus Large Molecules

- Percent Revenue Forecast-Small Molecules versus Large Molecules

- Revenue Forecast Analysis-Small Molecules versus Large Molecules

Growth Opportunity Analysis-Drug Substance versus Drug Product

- Revenue Forecast-DS versus DP (Large Molecules)

- Revenue Forecast-API versus FDF (Small Molecules)

- Revenue Forecast Analysis by Segments

Growth Opportunity Analysis-Competitor Assessment

- Competitive Environment

- Key Competitors by Region-End Users

Competitor Profiles-CDMOs Providing CM Services

- Cambrex Corporation-Overview

- Cambrex Corporation-Overview (continued)

- SK Biotek-Overview

- SK Biotek-Overview (continued)

- Corden Pharma-Overview

- Corden Pharma-Overview (continued)

- Patheon (Thermo Fisher Scientific)-Overview

- Patheon (Thermo Fisher Scientific)-Overview (continued)

- Wuxi Biologics-Overview

- Wuxi Biologics-Overview (continued)

- Fujifilm Diosynth Biotechnologies-Overview

- Fujifilm Diosynth Biotechnologies-Overview (continued)

CM-Equipment Manufacturers

- CM-Equipment Manufacturers

- CM-Equipment Manufacturers (continued)

Growth Opportunity Universe

- Growth Opportunity 1-Capability Expansion for CM in APAC

- Growth Opportunity 1-Capability Expansion for CM in APAC (continued)

- Growth Opportunity 2-Focus on Process Automation for Enhanced Productivity

- Growth Opportunity 2-Focus on Process Automation for Enhanced Productivity (continued)

- Growth Opportunity 3-Viral Vector CM for Gene Therapy

- Growth Opportunity 3-Viral Vector CM for Gene Therapy (continued)

Next Steps

- Your Next Steps

- Why Frost, Why Now?

- List of Exhibits

- Legal Disclaimer