|

|

市場調査レポート

商品コード

1133564

世界の医療食の成長機会Global Medical Food Growth Opportunities |

||||||

| 世界の医療食の成長機会 |

|

出版日: 2022年09月14日

発行: Frost & Sullivan

ページ情報: 英文 112 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

世界の医療食の市場では、医薬品メーカーと医療食メーカーの協働により成長機会が高まると考えられています。

成分別では、タンパク質成分の部門が、外傷や病気の回復に重要な役割を果たすことから、2021年に64.0%で大半のシェアを示しています。また、地域別では、医師の意識の高まりと患者による医療アドヒアランスの向上により、北米と欧州が2021年の食品成分および完成品の両方でシェアの大半を占めています。これらの地域の市場成長を支える要因は、老年人口の拡大、慢性疾患の蔓延、施政者による栄養失調管理の重視の高まりです。

当レポートでは、世界の医療食の市場を調査し、市場背景、市場への各種影響因子の分析、法規制・償還環境、成分・用途別の医療食の重要性、収益の推移・予測、各種区分・地域別の内訳、成長機会の分析などをまとめています。

目次

戦略的必須要件

- 成長がますます困難になる理由

- Strategic Imperative 8(TM)

- 上位3つの戦略的必須要件の産業への影響

- Growth Pipeline Engine(TM)を推進する成長機会

成長機会の分析

- 分析範囲

- 医療食の定義

- 栄養補助食品、医療食、医薬品の違い

- 分類

- 定義:成分別

- 定義:投与タイプ・モード別

- 定義:用途別

- 主要企業

- バリューチェーン

- 促進要因

- 成長抑制

- 予測の前提条件

- COVID-19:医療食市場に与える影響

- COVID-19:誘発調査

- COVID-19による市場動向

- 規制状況

- 規制状況:北米

- 規制状況: 欧州

- 規制状況:アジア太平洋

- 保険の適用範囲・償還シナリオ

成長機会の分析:医療食成分

- 成長指標

- 患者の回復における成分の役割:タンパク質成分

- 患者の回復における成分の役割:栄養脂質

- 患者の回復における成分の役割:プレバイオティクス

- 患者の回復における成分の役割:ビタミン・ミネラル

- 成分動向

- 収益予測

- 収益予測:成分別

- 収益予測分析:成分別

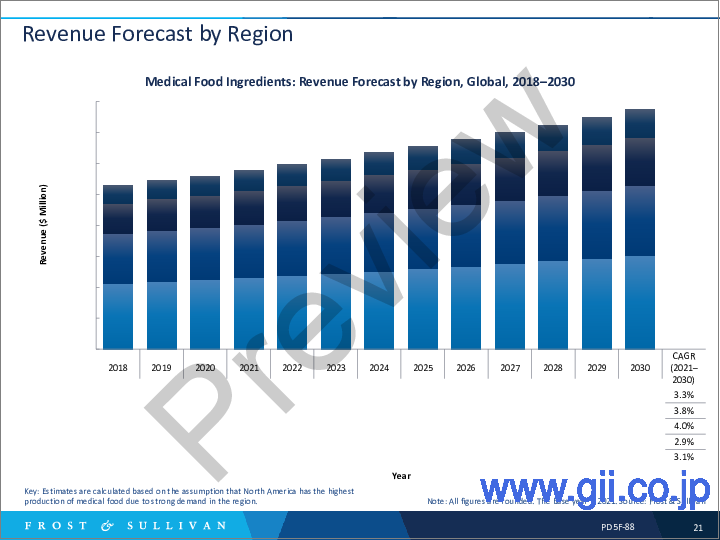

- 収益予測:地域別

- 収益予測分析:地域別

- 競合環境

- 競合製品マトリックス

- 製品の発売:医療食成分

成長機会の分析:完成医療食

- 成長指標

- 処方医療食の例

- 非処方医療食の例

- 医療食の役割:低栄養状態

- 医療食の役割:メタボリックヘルス

- 医療食の役割:消化器系の健康

- 医療食の役割:クリティカルケアと外傷

- 医療食の役割:筋骨格系の健康

- 医療食の役割:認知および中枢神経系の健康

- 医療食の役割:糖尿病の健康

- 医療食の役割:心臓血管の健康

- 収益予測

- 収益予測分析

- 収益予測:タイプ別

- 収益予測分析:タイプ別

- 収益予測:管理モード別

- 収益予測分析:管理モード別

- 収益予測:地域別

- 収益予測分析:地域別

- 収益率・市場普及率:用途別

- 競合環境

- 収益シェア

- 最近の買収

- 最近の製品発売

成長機会の領域

- 成長機会:医薬品メーカーと医療食メーカーの協業

- 成長機会:プロモーション活動と幅広い償還範囲

- 成長機会:医療食品用途向けの特定の成分の設計調査の焦点の増加

- 成長機会:機能性素材のイノベーション

次のステップ

Collaborative Efforts Between Drug Manufacturers and Medical Food Manufacturers to Boost Growth Opportunities for Medical Food

The US FDA defines medical food as "a food, which is formulated to be consumed or administered enterally under the supervision of a physician and which is intended for the specific dietary management of a disease or condition for which distinctive nutritional requirements, based on recognized scientific principles, are established by medical evaluation." Medical food is interpreted as 'food for special medical purposes (FSMPs)' in several countries, including Europe, India, China, and Australia and New Zealand. In Japan, medical food is interpreted as 'food for sick'. In Canada, medical food is governed by food for special dietary use (FSDU) and infant food regulations.

Globally, the regulatory landscape for medical food is not clearly defined, even in developed economies. As medical food is not intended to prevent or treat diseases, it is not subject to the same regulatory requirements as pharmaceutical drugs.

This Frost & Sullivan study aims to understand the role of medical food in patients' recovery. It provides qualitative and quantitative analyses of medical food ingredients and finished product medical food.

By ingredient, the medical food market is divided into vitamins and minerals; protein ingredients (animal and plant); nutritional lipids; prebiotics; and others (amino acids and probiotics). Of these, protein ingredients held the majority share of 64.0% (2021) in the total medical food ingredients market due to the important role they play in trauma and illness recovery.

Geographically, the study covers North America, Europe, Asia-Pacitfic, and Latin America and the Middle East and Africa (LAMEA). North America and Europe accounted for most of the market share for both medical food ingredients and finished product medical food in 2021 due to the rising physician awareness and the increasing medical adherence by patients. Factors supporting market growth in these regions are the expanding geriatric population, the prevalence of chronic diseases, and policymakers' growing emphasis on malnutrition management.

The impact of the COVID-19 pandemic is taken into account in the analysis. The pandemic induced both positive and negative changes in the medical food market. Supply chain disruptions due to the shutting down of processing facilities and other lockdown measures affected the sale of ingredients and finished medical food. However, the negaitve effects were reduced to some extent due to the growing consumer awareness and research highlighting the benefits of medical food in patients' recovery.

Key Features:

- By finished product, the medical food market is segmented by type, mode of administration, and application.

- By type, the medical food market is fragmented into prescription and nonprescription food. Prescription medical food dominated the medical food market with a 60.0% share in 2021 due to strong demand from developed economies for use in fatal health conditions such as oncology health, critical care and trauma, cardiovascular health, diabetes health, and cognitive health. Key market participants, such as Abbott, Nestle Health Science, and Nutricia, offer vast product portfolios of prescription medical food to meet the growing demand.

- By mode of administration, the medical food market is categorized into oral (food or supplement format) and enteral tube feeding. The oral mode accounted for the larger market share of 75.0% in 2021. Preference for orally administered products, ease of availability without prescriptions, and supportive initiatives are key factors driving demand for orally administered medical food.

- By application, the medical food market is segmented into malnutrition (including oncology health, immune health, and general malnutrition); metabolic health; digestive health; critical care and trauma; diabetes health; cardiovascular health; musculoskeletal health; and cognitive and central nervous system (CNS) health. Malnutrition, metabolic disorders, digestive disorders, and critical care and trauma are the top target diseases for medical food. Brain and cognitive health remains a small segment; nevertheless, it is one of the fastest-growing application areas for medical food.

Table of Contents

Strategic Imperatives

- Why is it Increasingly Difficult To Grow?

- The Strategic Imperative 8™

- The Impact of the Top 3 Strategic Imperatives on the Medical Food Industry

- Growth Opportunities Fuel The Growth Pipeline Engine™

Growth Opportunity Analysis

- Scope of Analysis

- Medical Food-Definition

- Differences between Dietary Supplements, Medical Food, and Pharmaceutical Drugs

- Segmentation

- Segmentation (continued)

- Definition by Ingredient Type

- Definition by Type and Mode of Administration

- Definition by Application

- Key Competitors

- Value Chain

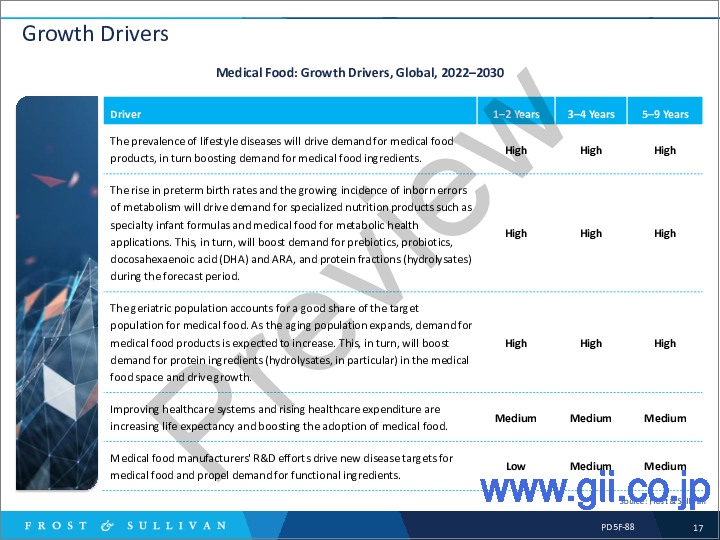

- Growth Drivers

- Growth Restraints

- Forecast Assumptions

- Forecast Assumptions (continued)

- Impact of the COVID-19 Pandemic on the Medical Food Market

- COVID-19-Induced Research

- COVID-19-Induced Market Trends

- Regulatory Landscape

- Regulatory Landscape-North America

- Regulatory Landscape-Europe

- Regulatory Landscape-Asia-Pacific

- Regulatory Landscape-Asia-Pacific (continued)

- Insurance Coverage and Reimbursement Scenario

- Insurance Coverage and Reimbursement Scenario (continued)

Growth Opportunity Analysis-Medical Food Ingredients

- Growth Metrics

- Role of Ingredients in Patient Recovery-Protein Ingredients

- Role of Ingredients in Patient Recovery-Nutritional Lipids

- Role of Ingredients in Patient Recovery-Nutritional Lipids (continued)

- Role of Ingredients in Patient Recovery-Prebiotics

- Role of Ingredients in Patient Recovery-Vitamins and Minerals

- Role of Ingredients in Patient Recovery-Vitamins and Minerals (continued)

- Role of Ingredients in Patient Recovery-Vitamins and Minerals (continued)

- Ingredient Trends

- Ingredient Trends (continued)

- Ingredient Trends (continued)

- Revenue Forecast

- Revenue Forecast by Ingredient

- Revenue Forecast Analysis by Ingredients

- Revenue Forecast Analysis by Ingredients (continued)

- Revenue Forecast Analysis by Ingredients (continued)

- Revenue Forecast by Region

- Revenue Forecast Analysis by Region

- Revenue Forecast Analysis by Region (continued)

- Competitive Environment

- Competitive Product Matrix

- Product Launches-Medical Food Ingredients: 2021 and 2022

- Product Launches-Medical Food Ingredients: 2021

- Product Launches-Medical Food Ingredients: 2020 and 2022

- Product Launches-Medical Food Ingredients: 2019 and 2020

Growth Opportunity Analysis-Finished Product Medical Food

- Growth Metrics

- Prescription Medical Food-Examples

- Nonprescription Medical Food-Examples

- Role of Medical Food in Malnutrition Condition

- Role of Medical Food in Malnutrition Condition (continued)

- Role of Medical Food in Malnutrition Condition (continued)

- Role of Medical Food in Metabolic Health

- Role of Medical Food in Metabolic Health (continued)

- Role of Medical Food in Digestive Health

- Role of Medical Food in Critical Care and Trauma

- Role of Medical Food in Musculoskeletal Health

- Role of Medical Food in Cognitive and CNS Health

- Role of Medical Food in Diabetes Health

- Role of Medical Food in Cardiovascular Health

- Revenue Forecast

- Revenue Forecast Analysis

- Revenue Forecast Analysis (continued)

- Revenue Forecast by Type

- Revenue Forecast Analysis by Type

- Revenue Forecast by Mode of Administration

- Revenue Forecast Analysis by Mode of Administration

- Revenue Forecast Analysis by Mode of Administration (continued)

- Revenue Forecast by Region

- Revenue Forecast Analysis by Region

- Revenue Forecast Analysis by Region (continued)

- Revenue Forecast Analysis by Region (continued)

- Revenue Forecast Analysis by Region (continued)

- Revenue Forecast Analysis by Region (continued)

- Percent Revenue by Application and Market Penetration

- Competitive Environment

- Revenue Share

- Recent Acquisitions-2019-2022

- Recent Product Launches-2019, 2020, and 2021

Growth Opportunity Universe

- Growth Opportunity 1: Collaborative Efforts between Drug Manufacturers and Medical Food Manufacturers

- Growth Opportunity 1: Collaborative Efforts between Drug Manufacturers and Medical Food Manufacturers (continued)

- Growth Opportunity 2: Promotional Activities and Wide Reimbursement Coverage

- Growth Opportunity 2: Promotional Activities and Wide Reimbursement Coverage (continued)

- Growth Opportunity 3: Increased Research Focus on Designing Specific Ingredients for Medical Food Applications

- Growth Opportunity 3: Increased Research Focus on Designing Specific Ingredients for Medical Food Applications (continued)

- Growth Opportunity 4: Innovation in Functional Ingredients

- Growth Opportunity 4: Innovation in Functional Ingredients (continued)

Next Steps

- Your Next Steps

- Why Frost, Why Now?

- List of Exhibits

- List of Exhibits (continued)

- Legal Disclaimer