|

|

市場調査レポート

商品コード

1117557

EV向け先進リチウム電池の世界市場:成長機会・将来の電池化学物質の採用Global Growth Opportunities for Advanced Lithium Batteries for EVs and the Adoption of Future Battery Chemistries |

||||||

| EV向け先進リチウム電池の世界市場:成長機会・将来の電池化学物質の採用 |

|

出版日: 2022年07月25日

発行: Frost & Sullivan

ページ情報: 英文 85 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

電気自動車 (EV) の普及に伴い、効率的な電池ソリューション、安全性の向上、長寿命化のニーズが高まっています。これまで、EVのパワートレインには主にリチウムイオン電池が使用されてきましたが、ニッケルコバルト酸化アルミニウム (NCA)、ニッケルマンガンコバルト酸化物 (NMC)、リン酸鉄リチウム (LFP) などのリチウムイオン電池化学物質の採用も活発化しています。

当レポートでは、世界のEV向け先進リチウム電池の市場を調査し、市場概要、技術ロードマップ、特許動向、現在の電池化学物質の採用動向と将来の電池化学物質の採用見通し、成長機会の分析などまとめています。

目次

戦略的必須要件

- 成長がますます困難になる理由

- Strategic Imperative 8 (TM)

- 上位3つの戦略的必須要件の市場への影響

- Growth Pipeline Engine (TM) を推進する成長機会

成長環境

- 成長環境

- 進化する電池化学物質の技術ロードマップ

- 技術準備レベル:電池化学物質別

- OEMによる採用:現在の化学物質 vs 将来の化学物質

- 主要なOEMによる全固体電池の採用

- 特許状況:将来の電池化学物質

- 主要OEMのギガファクトリーへの投資

成長機会の分析

- 調査範囲

- 本調査が答える主な質問

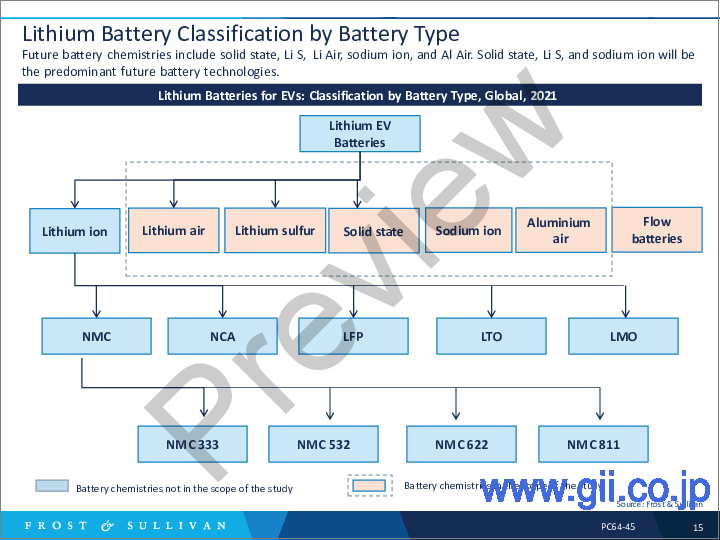

- リチウム電池の分類:電池タイプ別

- 成長指標

- EV電池市場の展望:電池容量別

- EV電池市場の展望:電池化学物質別

- EV電池セルサプライヤー上位10社

- EVメーカー上位10社

- EVの電池容量:平均航続距離

- 電池仕様ロードマップ:リチウムイオン

- 全固体電池とリチウムイオン電池

特許分析:現在と未来の化学

- NMC

- LFP

- 全固体電池

- ナトリウムイオン電池

- リチウム硫黄電池

主要市場動向:現在と将来の電池化学物質

- 電池技術の進化

- 電池タイプ別の性能比較

- 用途別の電池化学物質

- 電池センシング技術の今後の展開

- 電池技術の今後の展開

未来の電池化学物質:全固体電池へのパラダイムシフト

- 全固体電池の主な提供価値

- EV用全固体電池

- 固体電解質タイプ

- 全固体電池の商用化の障害

- 進化する全固体電池のエコシステム

将来の電池化学物質:リチウム硫黄

- リチウム硫黄電池の主な提供価値

- EV用リチウム硫黄電池

- リチウム硫黄電池の商用化の障害

- リチウム硫黄電池の進化するエコシステム

代替電池化学物質:ナトリウムイオン/リチウム空気/アルミニウム空気

- ナトリウムイオン電池の主な提供価値

- EV用ナトリウムイオン電池

- リチウム空気電池の主な提供価値

- EV用リチウム空気電池

- アルミニウム空気電池の主な提供価値

- EV用アルミ空気電池

- ナトリウムイオン/Li-Air/Al-Airの商品化の障害

- 進化するナトリウムイオン/Al-Air/Li-Air電池のエコシステム

- ロシア・ウクライナ戦争が電池化学物質に与えた影響

成長機会の領域

- 成長機会1:EV向けの将来の電池化学物質の採用

- 成長機会2:戦略的提携

- 成長機会3:熱管理

- 総論・将来の展望

次のステップ

Lithium-sulfur, sodium-ion, and solid-state batteries are likely to be adopted for EV applications between 2025 and 2030

The widespread adoption of electric vehicles (EVs) has increased the need for efficient battery solutions, augmented safety, and an extended life span. To date, lithium-ion (Li-ion) batteries have been predominantly used in electric powertrain; however, the adoption of Li-ion battery chemistries such as nickel cobalt aluminum oxide (NCA), nickel manganese cobalt oxide (NMC), and lithium iron phosphate (LFP) has also gained momentum. As demand rises, battery costs will reduce from more than $1,000/kWh in 2010 to $100-$110/kWh in 2022 (and reduce even further beyond this). Many research institutions, battery suppliers, and key OEMs are collaborating to develop future battery chemistries with effective material performance, reduced production costs, and enhanced safety. As future chemistries (solid state, sodium ion, lithium sulfur) evolve, they will offer improved safety, increased energy density, and fast-charging capabilities, thereby overcoming the challenges associated with traditional Li-ion batteries.

Almost all the major suppliers, including CATL, LG Chem, and Panasonic, have ramped-up production capacities. The EV battery market has grown from 4,892 MWH in 2013 to 296,657 MWH in 2021 at a CAGR of 55.7%. These companies think that future battery chemistries will be a game-changing technology for EVs. Several suppliers and OEMs have signed contracts with research institutions to develop and expand future battery chemistry technologies.

This Frost & Sullivan study discusses global growth opportunities for advanced lithium batteries for EVs and the adoption of future battery chemistries; some of the topics covered are disruptive technologies impacting the market; the technology readiness level of future batteries; key automakers' investments in gigafactories; a performance comparison of existing battery chemistries and future chemistries; OEM preferences in terms of adopting solid-state battery technologies; and challenges and roadblocks to commercialization. The research service also analyzes the patent landscape for future chemistries such as solid-state, sodium-ion, lithium-sulfur, and lithium-air batteries.

Table of Contents

Strategic Imperatives

- Why Is It Increasingly Difficult to Grow?

- The Strategic Imperative 8™

- The Impact of the Top 3 Strategic Imperatives on Advanced Lithium Batteries for EVs

- Growth Opportunities Fuel the Growth Pipeline Engine™

Growth Environment

- Growth Environment

- Growth Environment (continued)

- Growth Environment (continued)

- Technology Roadmap for Evolving Battery Chemistries

- Technology Readiness Level by Battery Chemistry

- OEM Adoption of Current versus Future Chemistries

- Key OEMs' Adoption of Solid-state Batteries

- Patent Landscape-Future Battery Chemistries

- Key OEMs' Investments in Gigafactories

Growth Opportunity Analysis

- Scope of Analysis

- Key Questions This Study Will Answer

- Lithium Battery Classification by Battery Type

- Growth Metrics

- EV Battery Market Outlook by Battery Capacity

- EV Battery Market Outlook by Battery Chemistry

- Top 10 EV Battery Cell Suppliers

- Top 10 EV Manufacturers

- Battery Capacity-Average Range of EVs

- Battery Specification Roadmap-Lithium Ion

- Solid-state Batteries versus Lithium-ion Batteries

Patent Analysis-Current versus Future Chemistries

- Patent Overview-NMC

- Top Forward Citations

- Patent Overview-LFP

- Top Forward Citations

- Patent Overview-Solid-state Batteries

- Top Forward Citations

- Patent Overview-Sodium-ion Batteries

- Top Forward Citations

- Patent Overview-Lithium-sulfur Batteries

- Top Forward Citations

Key Market Trends-Current versus Future Battery Chemistries

- Evolution of Battery Technologies

- Performance Comparison by Different Battery Types

- Battery Chemistry by Application

- Future Developments in Battery Sensing Technology

- Future Developments in Battery Technology

Future Battery Chemistries-Paradigm Shift to Solid-state Batteries

- Key Value Proposition of Solid-state Batteries

- Solid-state Batteries for EVs

- Types of Solid-state Electrolytes

- Roadblocks for Solid-state Battery Commercialization

- Evolving Ecosystem of Solid-state Batteries

Future Battery Chemistries-Lithium Sulfur

- Key Value Proposition of Lithium-sulfur Batteries

- Lithium-sulfur Batteries for EVs

- Roadblocks for Lithium-sulfur Battery Commercialization

- Evolving Ecosystem of Lithium-sulfur Batteries

Alternative Battery Chemistries-Sodium Ion/Lithium Air/Aluminum Air

- Key Value Proposition of Sodium-ion Batteries

- Sodium-ion Batteries for EVs

- Key Value Proposition of Lithium-air Batteries

- Lithium-air Batteries for EVs

- Key Value Proposition of Aluminum-air Batteries

- Aluminum-air Batteries for EVs

- Roadblocks for Sodium-ion/Li-Air/Al-Air Commercialization

- Evolving Ecosystem of Sodium-ion/Al-Air/Li-Air Batteries

- Impact of the Russo-Ukrainian War on Battery Chemistries

Growth Opportunity Universe

- Growth Opportunity 1-Adoption of Future Battery Chemistries for EVs

- Growth Opportunity 1-Adoption of Future Battery Chemistries for EVs (continued)

- Growth Opportunity 2-Strategic Partnerships

- Growth Opportunity 2-Strategic Partnerships (continued)

- Growth Opportunity 3-Thermal Management

- Growth Opportunity 3-Thermal Management (continued)

- Key Conclusions and Future Outlook

Next Steps

- Your Next Steps

- Why Frost, Why Now?

- List of Exhibits

- List of Exhibits (continued)

- Legal Disclaimer