|

|

市場調査レポート

商品コード

1111926

ヘッドアップディスプレイ(HUD)システムの北米市場:成長機会North American Head-Up Display (HUD) System Growth Opportunities |

||||||

| ヘッドアップディスプレイ(HUD)システムの北米市場:成長機会 |

|

出版日: 2022年07月15日

発行: Frost & Sullivan

ページ情報: 英文 84 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

2021年の北米におけるヘッドアップディスプレイ(HUD)の普及率は、販売車両のわずか8.2%であると言われています。HUDは、2030年にはおよそ29.8%の車両に浸透し、17.3%のCAGRで拡大すると予測されています。

当レポートでは、北米のヘッドアップディスプレイ(HUD)システム市場について調査分析し、戦略的必須要件、成長環境、成長の促進要因、抑制要因、従来型HUD・AR-HUDの成長機会分析、HUD製品等に関する情報を提供しています。

目次

戦略的必須要件

- 成長がますます困難になっているのはなぜか?

- 戦略的必須要件 8(TM)

- 上位3つの戦略的必須要件がHUDに及ぼす影響

- 成長機会がGrowth Pipeline Engine (TM)を促進

成長環境

- 主な調査結果

- HUD普及率の合計

- HUD戦略:車両セグメント別

- HUD普及率スナップショット:OEMグループ別

- 車両セグメンテーション

成長機会分析:HUD

- 分析範囲

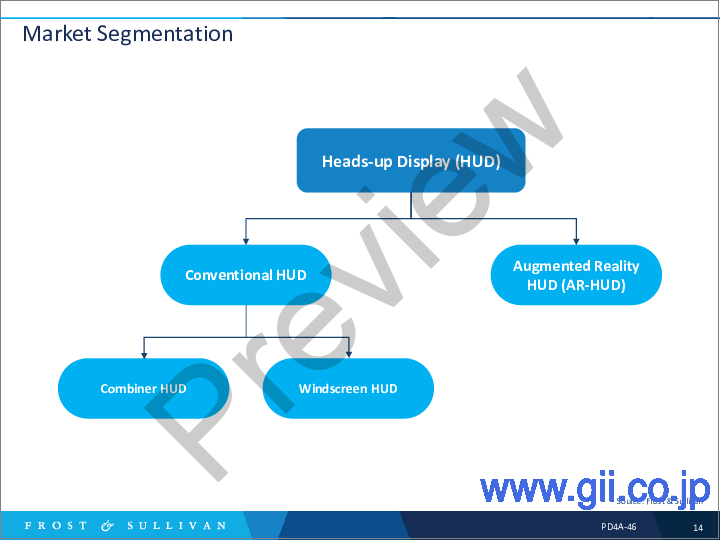

- 市場セグメンテーション

- 市場の定義

- 主な競合他社

- 主要な成長指標、HUD

- 成長の促進要因

- 成長の抑制要因

- 予測の前提条件

- 北米のHUD予測

- 出荷台数予測:技術別、HUD

- 出荷台数予測:車両セグメント別、HUD

- HUD戦略:車両セグメント別

- 北米のHUD収益予測

- 収益予測:技術別、HUD

- HUDの浸透率:技術別

- OEM展開戦略、HUD

- 競合環境

成長機会分析:従来型HUD

- 主な成長指標:従来型HUD

- 売上高と出荷台数の予測:従来型HUD

- 出荷台数予測:従来型HUD

- 売上高予測:従来型HUD

- 出荷台数予測:車両セグメント別、従来型HUD

- 予報分析:従来型HUD

成長機会分析:AR-HUD

- 主要な成長指標:AR-HUD

- 売上高と出荷台数の予測:AR-HUD

- 出荷台数予測:AR-HUD

- 売上高予測:AR-HUD

- 出荷台数予測:車両セグメント別、AR-HUD

- 予測分析:AR-HUD

HUDの提供製品:主要なOEMグループ

- HUDの提供製品-BMW Group

- HUDの提供製品-Ford Motor Company

- HUDの提供製品-Geely

- HUDの提供製品-General Motors Company

- HUDの提供製品-Honda Motor Company

- HUDの提供製品-Hyundai Motor Group

- HUDの提供製品-Mercedes-Benz Group

- HUDの提供製品-Renault Nissan Mitsubishi Alliance

- HUDの提供製品-Stellantis

- HUDの提供製品-Toyota Motor Corporation

- HUDの提供製品-Volkswagen Group

- HUD浸透率スナップショット:OEMグループ別

HUDの提供製品:主要なTier Iサプライヤー

- HUDの提供製品-Continental

- HUDの提供製品-Nippon Seiki

- HUDの提供製品-Denso

- HUDの提供製品-Panasonic

- HUDサプライヤーのポートフォリオスナップショット

成長機会ユニバース

- 成長機会1-製品の差別化

- 成長機会2-便利・安全機能

- 成長機会3-EVへのARとADの融合

次のステップ

- 次のステップ

- なぜFrost、なぜ今?

- 図表一覧

- 免責事項

Future Growth Potential of North American HUD Hinges on the Gamification of the Passenger Cabin

The study provides forecasts for the heads-up display (HUD) market in North America from 2021 to 2030. The first-ever HUD in a motor vehicle was a monochrome HUD integrated by General Motors in 1988 as a technological improvement over the head-down display (HDD) interface, which is commonly used in the automobile industry. Over the years, HUDs have been integrated into different types of vehicles in North America. Currently, the two most common types of HUDs in the market are combiner HUDs and windscreen HUDs. As of 2021, combiner HUDs are almost redundant in the North American market, with the newer generation of windscreen HUDs being able to pack a larger field of view (FoV) along with more volume in a compact size. The augmented-reality HUDS (AR-HUDs), which are the next-generation HUDs, have already hit the market in some premium vehicle models, such as the Mercedes Benz S-Class and EQS.

This study aims to research, analyze, forecast, and provide an overview of the HUD trends in North America. It discusses the impact of these trends on the growth and deployment strategies of different OEMs and suppliers in the market and analyzes various aspects of the market, including types of HUD systems and industry growth opportunities.

Our research indicates that HUD penetration in North America as of 2021 stood at a meager 8.2% of the vehicles sold. HUDs are expected to penetrate roughly 29.8% of the vehicles by 2030, with the market for it expanding at a CAGR of 17.3%.

The growth of the HUD market can be attributed to four main reasons:

- 1) OEMs bundling HUDs with sought-after packages

- 2) Proliferation of advanced driver assistance systems (ADAS) forcing OEMs to offer a solution that reduces driver distraction

- 3) OEMs' need to differentiate their product from the competition

- 4) Increase in adoption of electric vehicles (EV) driving OEMs to offer added features in order to distinguish their product from traditional ICE vehicles

Key Issues Addressed:

- What is HUD? What are the factors driving the introduction of HUDs?

- What are the key drivers and restraints for the HUD market?

- How is the HUD market expected to grow? Which are the key OEMs responding to the HUD trend?

- What strategies are OEMs adopting for HUD deployment in North America?

- What are the avenues of growth for the HUD market in North America until 2030?

Table of Contents

Strategic Imperatives

- Why Is It Increasingly Difficult to Grow?

- The Strategic Imperative 8™

- The Impact of the Top 3 Strategic Imperatives on HUDs

- Growth Opportunities Fuel the Growth Pipeline Engine™

Growth Environment

- Key Findings

- Total HUD Penetration

- HUD Strategies by Vehicle Segment

- HUD Penetration Snapshot by OEM Group

- Vehicle Segmentation

Growth Opportunity Analysis: HUD

- Scope of Analysis

- Market Segmentation

- Market Definitions

- Key Competitors

- Key Growth Metrics, HUD

- Growth Drivers

- Growth Restraints

- Forecast Assumptions

- North American HUD Forecast

- Unit Shipment Forecast by Technology, HUD

- Unit Shipment Forecast by Vehicle Segment, HUD

- HUD Strategies by Vehicle Segment

- North American HUD Revenue Forecast

- Revenue Forecast by Technology, HUD

- HUD Penetration by Technology

- OEM Deployment Strategy, HUD

- Competitive Environment

Growth Opportunity Analysis: Conventional HUD

- Key Growth Metrics, Conventional HUD

- Revenue and Unit Shipment Forecast, Conventional HUD

- Unit Shipment Forecast, Conventional HUD

- Revenue Forecast, Conventional HUD

- Unit Shipment Forecast by Vehicle Segment, Conventional HUD

- Forecast Analysis, Conventional HUD

Growth Opportunity Analysis: AR-HUD

- Key Growth Metrics, AR-HUD

- Revenue and Unit Shipment Forecast, AR-HUD

- Unit Shipment Forecast, AR-HUD

- Revenue Forecast, AR-HUD

- Unit Shipment Forecast by Vehicle Segment, AR-HUD

- Forecast Analysis, AR-HUD

HUD Offerings: Key OEM Groups

- HUD Offering-BMW Group

- HUD Offering-Ford Motor Company

- HUD Offering-Geely

- HUD Offering-General Motors Company

- HUD Offering-Honda Motor Company

- HUD Offering-Hyundai Motor Group

- HUD Offering-Mercedes-Benz Group

- HUD Offering-Renault Nissan Mitsubishi Alliance

- HUD Offering-Stellantis

- HUD Offering-Toyota Motor Corporation

- HUD Offering-Volkswagen Group

- HUD Penetration Snapshot by OEM Group

- HUD Penetration Snapshot by OEM Group (continued)

HUD Offerings: Key Tier I Suppliers

- HUD Offering-Continental

- HUD Offering-Nippon Seiki

- HUD Offering-Denso

- HUD Offering-Panasonic

- HUD Supplier Portfolio Snapshot

Growth Opportunity Universe

- Growth Opportunity 1-Product Differentiation

- Growth Opportunity 1-Product Differentiation (continued)

- Growth Opportunity 2-Convenience and Safety Features

- Growth Opportunity 2-Convenience and Safety Features (continued)

- Growth Opportunity 3-Integration of AR and AD in EVs

- Growth Opportunity 3-Integration of AR and AD in EVs (continued)

Next Steps

- Your Next Steps

- Why Frost, Why Now?

- List of Exhibits

- List of Exhibits (continued)

- List of Exhibits (continued)

- List of Exhibits (continued)

- Legal Disclaimer