|

|

市場調査レポート

商品コード

1552429

ネットワークインターフェースカードの世界市場 - 世界の業界分析、規模、シェア、成長、動向、予測(2031年)- タイプ別、用途別、エンドユーザー別、地域別Network Interface Card Market - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast 2031 - By Product, Technology, Grade, Application, End-user, Region: |

||||||

|

|||||||

| ネットワークインターフェースカードの世界市場 - 世界の業界分析、規模、シェア、成長、動向、予測(2031年)- タイプ別、用途別、エンドユーザー別、地域別 |

|

出版日: 2024年09月04日

発行: Fairfield Market Research

ページ情報: 英文 336 Pages

納期: 2~5営業日

|

全表示

- 概要

- 目次

世界のネットワークインターフェースカード(NIC)の市場規模は、2024年の54億米ドルから2031年には99億9,000万米ドルに拡大し、予測期間中のCAGRは9.20%と堅調に推移すると予測され、大幅な拡大が見込まれています。NICは、電子機器をネットワークやインターネットに接続するために不可欠なハードウェアであり、これまで以上に相互接続が進んだ世界ではますます重要性を増しています。スマートフォン、ノートパソコン、スマート・ホーム・アシスタントなど、スマート・デバイスの普及が加速するにつれ、堅牢で信頼性の高いネットワーク接続を提供するNICの重要性が顕著になっています。

NICは、ユーザーデバイスとデータネットワーク間の重要な仲介役として機能し、有線接続と無線接続の両方をサポートします。これらのカードは、ユーザーデバイスからのデータをネットワーク上でのトランスミッションに適したパケットに変換し、接続された他のデバイスによる正確なデータの受信と解釈を保証します。さまざまな分野でスマートテクノロジーへの依存が高まっていることから、NICの重要性が浮き彫りになり、現代の接続性の基本要素となっています。

いくつかの重要な要因がNIC市場の成長を促進しています。主な要因は、高性能なクラウドベースのソリューションに対するニーズの高まりです。クラウドコンピューティングは、企業のネットワーク管理方法を変革し、費用対効果に優れ、スケーラブルで効率的なネットワーク管理アプローチを提供しています。より多くの企業が業務をクラウドに移行するにつれて、高速で安全かつ信頼性の高い接続をサポートできる高度なNICに対する需要が急増しています。

当レポートでは、世界のネットワークインターフェースカード市場について調査し、市場の概要とともに、タイプ別、用途別、エンドユーザー別、地域別動向、および市場に参入する企業の競合動向などを提供しています。

目次

第1章 エグゼクティブサマリー

第2章 市場概要

- 市場の定義とセグメンテーション

- 市場力学

- バリューチェーン分析

- ポーターのファイブフォース分析

- COVID-19の影響分析

- ウクライナ・ロシア紛争の影響

- 経済概要

- PESTLE分析

第3章 世界のネットワークインターフェースカード(NIC)市場の見通し、2019年~2031年

- 世界のネットワークインターフェイスカード(NIC)市場の見通し、タイプ別、金額(10億米ドル)、2019年~2031年

- 世界のネットワークインターフェイスカード(NIC)市場の見通し、用途別、金額(10億米ドル)、2019年~2031年

- 世界のネットワークインターフェイスカード(NIC)市場の見通し、エンドユーザー別、金額(10億米ドル)、2019年~2031年

- 世界のネットワークインターフェイスカード(NIC)市場の見通し、地域別、金額(10億米ドル)、2019年~2031年

第4章 北米のネットワークインターフェースカード(NIC)市場の見通し、2019年~2031年

第5章 欧州のネットワークインターフェイスカード(NIC)市場の見通し、2019年~2031年

第6章 アジア太平洋のネットワークインターフェースカード(NIC)市場の見通し、2019年~2031年

第7章 ラテンアメリカのネットワークインターフェースカード(NIC)市場の見通し、2019年~2031年

第8章 中東・アフリカのネットワークインターフェースカード(NIC)市場の見通し、2019年~2031年

第9章 競合情勢

- エンドユーザー別vs用途別ヒートマップ

- 企業市場シェア分析、2024年

- 競争ダッシュボード

- 企業プロファイル

- NXP Semiconductors

- Qualcomm Technologies, Inc.

- MACOM

- BONN Elektronik GmbH

- OPHIR RF

- Infineon Technologies AG

- CML Microsystems PLC

- Broadcom

- Analog Devices

- ETL Systems Ltd

- Analogic Corporation

- ETS-Lindgren

- Murata Manufacturing Co., Ltd

第10章 付録

The global network interface card (NIC) market is poised for significant expansion, with its value projected to rise from $5.40 billion in 2024 to $9.99 billion by 2031, registering a robust CAGR of 9.20% over the forecast period. NICs, essential hardware that enables electronic devices to connect to networks or the internet, are becoming increasingly crucial in a world that is more interconnected than ever. As the proliferation of smart devices-such as smartphones, laptops, and smart home assistants-continues to accelerate, the importance of NICs in providing robust and reliable network connectivity is becoming more pronounced.

NICs act as vital intermediaries between user devices and data networks, supporting both wired and wireless connections. These cards convert data from the user's device into packets suitable for transmission over networks, ensuring accurate data reception and interpretation by other connected devices. The growing dependence on smart technologies across various sectors highlights the significance of NICs, making them a fundamental element of modern connectivity.

Market Growth Drivers

Several key factors are driving the growth of the NIC market. A major contributor is the increasing need for high-performance, cloud-based solutions. Cloud computing has transformed the way organizations manage their networks, offering a cost-effective, scalable, and efficient approach to network management. As more businesses transition their operations to the cloud, the demand for advanced NICs that can support high-speed, secure, and reliable connections has surged.

Beyond cloud computing, there is an intensified focus on network security, which is further amplifying the demand for NICs. As cyber threats evolve in sophistication, organizations are seeking enhanced security features to safeguard their networks. NICs play a critical role in ensuring the security of data transmission, positioning them as key components in the battle against cyber threats.

The rise of software-defined networking (SDN) is another significant trend shaping the NIC market. SDN offers a flexible and automated approach to network management, enabling organizations to quickly respond to changing network requirements. This has led to a growing demand for NICs that can support SDN environments, further propelling market growth.

Moreover, the escalating demand for high-bandwidth solutions is driven by the continuous surge in data consumption. Organizations are increasingly seeking ways to reduce costs without compromising performance, leading to a heightened demand for low-cost, high-performance NICs. This trend is particularly prevalent in industries that rely heavily on data-intensive operations, such as data centers and cloud service providers.

Regional Perspectives

The NIC market is experiencing robust growth across various regions, with North America emerging as a leading force. The region's advanced technological infrastructure, combined with a large and sophisticated customer base, has positioned it at the forefront of the global NIC market. North America is home to numerous leading NIC manufacturers and data centers, further strengthening its market leadership.

Conversely, emerging markets such as India are witnessing rapid adoption of advanced network technologies. The growing penetration of smartphones and the increasing popularity of online gaming in these regions are driving the demand for NICs. Additionally, the rise of cloud computing and the expanding adoption of IoT devices in India are contributing to the significant growth of the NIC market in this region.

The increasing need for faster and more reliable network connections within the enterprise segment is also a major factor driving NIC demand in India. As businesses upgrade their networks to support higher speeds and enhanced performance, the demand for advanced NICs is expected to rise. This trend is further bolstered by the growing adoption of fixed broadband devices and the expansion of internet infrastructure in rural and remote areas.

Wireless Network Interface Cards: A Key Growth Area

Wireless network interface cards are gaining substantial momentum, driven by the widespread adoption of IoT and 5G technologies. The proliferation of connected devices, including smartphones, tablets, and wearables, is fueling the demand for wireless NICs. These cards enable devices to connect to networks without the limitations of physical cables, making them essential in today's mobile-centric environment.

The rollout of 5G technology is particularly significant, as it promises faster data transmission, higher bandwidth, and improved connection quality. These advancements are expected to accelerate the growth of the wireless NIC market, as more devices and applications require high-speed, reliable network connections to function effectively. The increasing prevalence of smart homes and connected vehicles further underscores the importance of wireless NICs in enabling seamless connectivity across a wide range of devices.

Data Centers Driving Demand

Data centers represent a pivotal segment propelling the growth of the NIC market. As the need for high-speed and reliable networking solutions in data centers continues to expand, so does the demand for advanced NICs. Data centers, which are essential for large-scale data processing and storage operations, require high-performance NICs to operate efficiently.

The growing adoption of cloud computing and virtualization technologies in data centers is further enhancing the demand for NICs. These technologies require high-speed networking solutions to manage the vast volumes of data generated and processed in data centers. The increasing reliance on cloud services and the global expansion of data center operations are expected to significantly drive growth in the NIC market.

Competitive Analysis

- NXP Semiconductors

- Qualcomm Technologies, Inc.

- MACOM

- BONN Elektronik GmbH

- OPHIR RF

- Infineon Technologies AG

- CML Microsystems PLC

- Broadcom

- Analog Devices

- ETL Systems Ltd

- Analogic Corporation

- ETS-Lindgren

- Murata Manufacturing Co., Ltd

Key Segments of Network Interface Card Industry Research

By Type:

- Ethernet NICs

- 5-Base T

- 10-Base T

- 100-Base T

- Gigabit Ethernet

- Wireless NICs

By Application:

- Wireless Communication Devices

- Firewall

- Bridges

- Repeaters

- Wired Communication Devices

- Hubs

- Switches

- Routers

- Telephones

By End User:

- Data Centers

- Networking Service Providers

- Telecom Operators

- Enterprises/Corporates

- Others

By Region:

- North America

- Latin America

- East Asia

- South Asia & Pacific

- Western Europe

- Eastern Europe

- Central Asia

- Russia & Belarus

- Balkan & Baltic Countries

- Middle East and Africa

Table of Contents

1. Executive Summary

- 1.1. Global Network Interface Card (NIC) Market Snapshot

- 1.2. Future Projections

- 1.3. Key Market Trends

- 1.4. Regional Snapshot, by Value, 2024

- 1.5. Analyst Recommendations

2. Market Overview

- 2.1. Market Definitions and Segmentations

- 2.2. Market Dynamics

- 2.2.1. Drivers

- 2.2.2. Restraints

- 2.2.3. Market Opportunities

- 2.3. Value Chain Analysis

- 2.4. Porter's Five Forces Analysis

- 2.5. COVID-19 Impact Analysis

- 2.5.1. Supply

- 2.5.2. Demand

- 2.6. Impact of Ukraine-Russia Conflict

- 2.7. Economic Overview

- 2.7.1. World Economic Projections

- 2.8. PESTLE Analysis

3. Global Network Interface Card (NIC) Market Outlook, 2019 - 2031

- 3.1. Global Network Interface Card (NIC) Market Outlook, by Type, Value (US$ Bn), 2019 - 2031

- 3.1.1. Key Highlights

- 3.1.1.1. Ethernet NICs

- 3.1.1.1.1. 5-Base T

- 3.1.1.1.2. 10-Base T

- 3.1.1.1.3. 100-Base T

- 3.1.1.1.4. Gigabit Ethernet

- 3.1.1.2. Wireless NICs

- 3.1.1.1. Ethernet NICs

- 3.1.1. Key Highlights

- 3.2. Global Network Interface Card (NIC) Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

- 3.2.1. Key Highlights

- 3.2.1.1. Wireless Communication Devices

- 3.2.1.1.1. Firewall

- 3.2.1.1.2. Bridges

- 3.2.1.1.3. Repeaters

- 3.2.1.2. Wired Communication Devices

- 3.2.1.2.1. Hubs

- 3.2.1.2.2. Switches

- 3.2.1.2.3. Routers

- 3.2.1.2.4. Telephones

- 3.2.1.1. Wireless Communication Devices

- 3.2.1. Key Highlights

- 3.3. Global Network Interface Card (NIC) Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

- 3.3.1. Key Highlights

- 3.3.1.1. Data Centers

- 3.3.1.2. Networking Service Providers

- 3.3.1.3. Telecom Operators

- 3.3.1.4. Enterprises/Corporates

- 3.3.1.5. Others

- 3.3.1. Key Highlights

- 3.4. Global Network Interface Card (NIC) Market Outlook, by Region, Value (US$ Bn), 2019 - 2031

- 3.4.1. Key Highlights

- 3.4.1.1. North America

- 3.4.1.2. Europe

- 3.4.1.3. Asia Pacific

- 3.4.1.4. Latin America

- 3.4.1.5. Middle East & Africa

- 3.4.1. Key Highlights

4. North America Network Interface Card (NIC) Market Outlook, 2019 - 2031

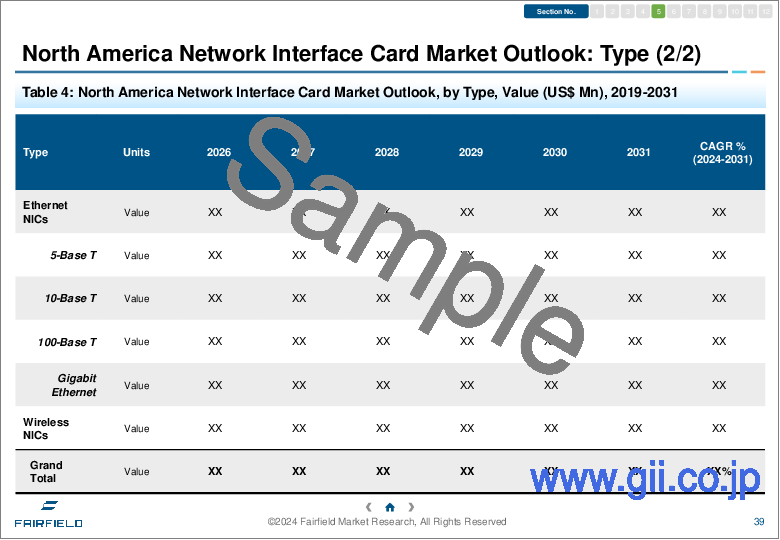

- 4.1. North America Network Interface Card (NIC) Market Outlook, by Type, Value (US$ Bn), 2019 - 2031

- 4.1.1. Key Highlights

- 4.1.1.1. Ethernet NICs

- 4.1.1.1.1. 5-Base T

- 4.1.1.1.2. 10-Base T

- 4.1.1.1.3. 100-Base T

- 4.1.1.1.4. Gigabit Ethernet

- 4.1.1.2. Wireless NICs

- 4.1.1.1. Ethernet NICs

- 4.1.1. Key Highlights

- 4.2. North America Network Interface Card (NIC) Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

- 4.2.1. Key Highlights

- 4.2.1.1. Wireless Communication Devices

- 4.2.1.1.1. Firewall

- 4.2.1.1.2. Bridges

- 4.2.1.1.3. Repeaters

- 4.2.1.2. Wired Communication Devices

- 4.2.1.2.1. Hubs

- 4.2.1.2.2. Switches

- 4.2.1.2.3. Routers

- 4.2.1.2.4. Telephones

- 4.2.1.1. Wireless Communication Devices

- 4.2.1. Key Highlights

- 4.3. North America Network Interface Card (NIC) Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

- 4.3.1. Key Highlights

- 4.3.1.1. Data Centers

- 4.3.1.2. Networking Service Providers

- 4.3.1.3. Telecom Operators

- 4.3.1.4. Enterprises/Corporates

- 4.3.1.5. Others

- 4.3.1. Key Highlights

- 4.4. North America Network Interface Card (NIC) Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

- 4.4.1. Key Highlights

- 4.4.1.1. U.S. Network Interface Card (NIC) Market by Type, Value (US$ Bn), 2019 - 2031

- 4.4.1.2. U.S. Network Interface Card (NIC) Market by Application, Value (US$ Bn), 2019 - 2031

- 4.4.1.3. U.S. Network Interface Card (NIC) Market by End User, Value (US$ Bn), 2019 - 2031

- 4.4.1.4. Canada Network Interface Card (NIC) Market by Type, Value (US$ Bn), 2019 - 2031

- 4.4.1.5. Canada Network Interface Card (NIC) Market by Application, Value (US$ Bn), 2019 - 2031

- 4.4.1.6. Canada Network Interface Card (NIC) Market by End User, Value (US$ Bn), 2019 - 2031

- 4.4.1. Key Highlights

5. Europe Network Interface Card (NIC) Market Outlook, 2019 - 2031

- 5.1. Europe Network Interface Card (NIC) Market Outlook, by Type, Value (US$ Bn), 2019 - 2031

- 5.1.1. Key Highlights

- 5.1.1.1. Ethernet NICs

- 5.1.1.1.1. 5-Base T

- 5.1.1.1.2. 10-Base T

- 5.1.1.1.3. 100-Base T

- 5.1.1.1.4. Gigabit Ethernet

- 5.1.1.2. Wireless NICs

- 5.1.1.1. Ethernet NICs

- 5.1.1. Key Highlights

- 5.2. Europe Network Interface Card (NIC) Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

- 5.2.1. Key Highlights

- 5.2.1.1. Wireless Communication Devices

- 5.2.1.1.1. Firewall

- 5.2.1.1.2. Bridges

- 5.2.1.1.3. Repeaters

- 5.2.1.2. Wired Communication Devices

- 5.2.1.2.1. Hubs

- 5.2.1.2.2. Switches

- 5.2.1.2.3. Routers

- 5.2.1.2.4. Telephones

- 5.2.1.1. Wireless Communication Devices

- 5.2.1. Key Highlights

- 5.3. Europe Network Interface Card (NIC) Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

- 5.3.1. Key Highlights

- 5.3.1.1. Data Centers

- 5.3.1.2. Networking Service Providers

- 5.3.1.3. Telecom Operators

- 5.3.1.4. Enterprises/Corporates

- 5.3.1.5. Others

- 5.3.1. Key Highlights

- 5.4. Europe Network Interface Card (NIC) Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

- 5.4.1. Key Highlights

- 5.4.1.1. Germany Network Interface Card (NIC) Market by Type, Value (US$ Bn), 2019 - 2031

- 5.4.1.2. Germany Network Interface Card (NIC) Market by Application, Value (US$ Bn), 2019 - 2031

- 5.4.1.3. Germany Network Interface Card (NIC) Market by End User, Value (US$ Bn), 2019 - 2031

- 5.4.1.4. U.K. Network Interface Card (NIC) Market by Type, Value (US$ Bn), 2019 - 2031

- 5.4.1.5. U.K. Network Interface Card (NIC) Market by Application, Value (US$ Bn), 2019 - 2031

- 5.4.1.6. U.K. Network Interface Card (NIC) Market by End User, Value (US$ Bn), 2019 - 2031

- 5.4.1.7. France Network Interface Card (NIC) Market by Type, Value (US$ Bn), 2019 - 2031

- 5.4.1.8. France Network Interface Card (NIC) Market by Application, Value (US$ Bn), 2019 - 2031

- 5.4.1.9. France Network Interface Card (NIC) Market by End User, Value (US$ Bn), 2019 - 2031

- 5.4.1.10. Italy Network Interface Card (NIC) Market by Type, Value (US$ Bn), 2019 - 2031

- 5.4.1.11. Italy Network Interface Card (NIC) Market by Application, Value (US$ Bn), 2019 - 2031

- 5.4.1.12. Italy Network Interface Card (NIC) Market by End User, Value (US$ Bn), 2019 - 2031

- 5.4.1.13. Turkey Network Interface Card (NIC) Market by Type, Value (US$ Bn), 2019 - 2031

- 5.4.1.14. Turkey Network Interface Card (NIC) Market by Application, Value (US$ Bn), 2019 - 2031

- 5.4.1.15. Turkey Network Interface Card (NIC) Market by End User, Value (US$ Bn), 2019 - 2031

- 5.4.1.16. Russia Network Interface Card (NIC) Market by Type, Value (US$ Bn), 2019 - 2031

- 5.4.1.17. Russia Network Interface Card (NIC) Market by Application, Value (US$ Bn), 2019 - 2031

- 5.4.1.18. Russia Network Interface Card (NIC) Market by End User, Value (US$ Bn), 2019 - 2031

- 5.4.1.19. Rest of Europe Network Interface Card (NIC) Market by Type, Value (US$ Bn), 2019 - 2031

- 5.4.1.20. Rest of Europe Network Interface Card (NIC) Market by Application, Value (US$ Bn), 2019 - 2031

- 5.4.1.21. Rest of Europe Network Interface Card (NIC) Market by End User, Value (US$ Bn), 2019 - 2031

- 5.4.1. Key Highlights

6. Asia Pacific Network Interface Card (NIC) Market Outlook, 2019 - 2031

- 6.1. Asia Pacific Network Interface Card (NIC) Market Outlook, by Type, Value (US$ Bn), 2019 - 2031

- 6.1.1. Key Highlights

- 6.1.1.1. Ethernet NICs

- 6.1.1.1.1. 5-Base T

- 6.1.1.1.2. 10-Base T

- 6.1.1.1.3. 100-Base T

- 6.1.1.1.4. Gigabit Ethernet

- 6.1.1.2. Wireless NICs

- 6.1.1.1. Ethernet NICs

- 6.1.1. Key Highlights

- 6.2. Asia Pacific Network Interface Card (NIC) Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

- 6.2.1. Key Highlights

- 6.2.1.1. Wireless Communication Devices

- 6.2.1.1.1. Firewall

- 6.2.1.1.2. Bridges

- 6.2.1.1.3. Repeaters

- 6.2.1.2. Wired Communication Devices

- 6.2.1.2.1. Hubs

- 6.2.1.2.2. Switches

- 6.2.1.2.3. Routers

- 6.2.1.2.4. Telephones

- 6.2.1.1. Wireless Communication Devices

- 6.2.1. Key Highlights

- 6.3. Asia Pacific Network Interface Card (NIC) Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

- 6.3.1. Key Highlights

- 6.3.1.1. Data Centers

- 6.3.1.2. Networking Service Providers

- 6.3.1.3. Telecom Operators

- 6.3.1.4. Enterprises/Corporates

- 6.3.1.5. Others

- 6.3.1. Key Highlights

- 6.4. Asia Pacific Network Interface Card (NIC) Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

- 6.4.1. Key Highlights

- 6.4.1.1. China Network Interface Card (NIC) Market by Type, Value (US$ Bn), 2019 - 2031

- 6.4.1.2. China Network Interface Card (NIC) Market by Application, Value (US$ Bn), 2019 - 2031

- 6.4.1.3. China Network Interface Card (NIC) Market by End User, Value (US$ Bn), 2019 - 2031

- 6.4.1.4. Japan Network Interface Card (NIC) Market by Type, Value (US$ Bn), 2019 - 2031

- 6.4.1.5. Japan Network Interface Card (NIC) Market by Application, Value (US$ Bn), 2019 - 2031

- 6.4.1.6. Japan Network Interface Card (NIC) Market by End User, Value (US$ Bn), 2019 - 2031

- 6.4.1.7. South Korea Network Interface Card (NIC) Market by Type, Value (US$ Bn), 2019 - 2031

- 6.4.1.8. South Korea Network Interface Card (NIC) Market by Application, Value (US$ Bn), 2019 - 2031

- 6.4.1.9. South Korea Network Interface Card (NIC) Market by End User, Value (US$ Bn), 2019 - 2031

- 6.4.1.10. India Network Interface Card (NIC) Market by Type, Value (US$ Bn), 2019 - 2031

- 6.4.1.11. India Network Interface Card (NIC) Market by Application, Value (US$ Bn), 2019 - 2031

- 6.4.1.12. India Network Interface Card (NIC) Market by End User, Value (US$ Bn), 2019 - 2031

- 6.4.1.13. Southeast Asia Network Interface Card (NIC) Market by Type, Value (US$ Bn), 2019 - 2031

- 6.4.1.14. Southeast Asia Network Interface Card (NIC) Market by Application, Value (US$ Bn), 2019 - 2031

- 6.4.1.15. Southeast Asia Network Interface Card (NIC) Market by End User, Value (US$ Bn), 2019 - 2031

- 6.4.1.16. Rest of Asia Pacific Network Interface Card (NIC) Market by Type, Value (US$ Bn), 2019 - 2031

- 6.4.1.17. Rest of Asia Pacific Network Interface Card (NIC) Market by Application, Value (US$ Bn), 2019 - 2031

- 6.4.1.18. Rest of Asia Pacific Network Interface Card (NIC) Market by End User, Value (US$ Bn), 2019 - 2031

- 6.4.1. Key Highlights

7. Latin America Network Interface Card (NIC) Market Outlook, 2019 - 2031

- 7.1. Latin America Network Interface Card (NIC) Market Outlook, by Type, Value (US$ Bn), 2019 - 2031

- 7.1.1. Key Highlights

- 7.1.1.1. Ethernet NICs

- 7.1.1.1.1. 5-Base T

- 7.1.1.1.2. 10-Base T

- 7.1.1.1.3. 100-Base T

- 7.1.1.1.4. Gigabit Ethernet

- 7.1.1.2. Wireless NICs

- 7.1.1.1. Ethernet NICs

- 7.1.1. Key Highlights

- 7.2. Latin America Network Interface Card (NIC) Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

- 7.2.1. Key Highlights

- 7.2.1.1. Wireless Communication Devices

- 7.2.1.1.1. Firewall

- 7.2.1.1.2. Bridges

- 7.2.1.1.3. Repeaters

- 7.2.1.2. Wired Communication Devices

- 7.2.1.2.1. Hubs

- 7.2.1.2.2. Switches

- 7.2.1.2.3. Routers

- 7.2.1.2.4. Telephones

- 7.2.1.1. Wireless Communication Devices

- 7.2.1. Key Highlights

- 7.3. Latin America Network Interface Card (NIC) Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

- 7.3.1. Key Highlights

- 7.3.1.1. Data Centers

- 7.3.1.2. Networking Service Providers

- 7.3.1.3. Telecom Operators

- 7.3.1.4. Enterprises/Corporates

- 7.3.1.5. Others

- 7.3.1. Key Highlights

- 7.4. Latin America Network Interface Card (NIC) Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

- 7.4.1. Key Highlights

- 7.4.1.1. Brazil Network Interface Card (NIC) Market by Type, Value (US$ Bn), 2019 - 2031

- 7.4.1.2. Brazil Network Interface Card (NIC) Market by Application, Value (US$ Bn), 2019 - 2031

- 7.4.1.3. Brazil Network Interface Card (NIC) Market by End User, Value (US$ Bn), 2019 - 2031

- 7.4.1.4. Mexico Network Interface Card (NIC) Market by Type, Value (US$ Bn), 2019 - 2031

- 7.4.1.5. Mexico Network Interface Card (NIC) Market by Application, Value (US$ Bn), 2019 - 2031

- 7.4.1.6. Mexico Network Interface Card (NIC) Market by End User, Value (US$ Bn), 2019 - 2031

- 7.4.1.7. Argentina Network Interface Card (NIC) Market by Type, Value (US$ Bn), 2019 - 2031

- 7.4.1.8. Argentina Network Interface Card (NIC) Market by Application, Value (US$ Bn), 2019 - 2031

- 7.4.1.9. Argentina Network Interface Card (NIC) Market by End User, Value (US$ Bn), 2019 - 2031

- 7.4.1.10. Rest of Latin America Network Interface Card (NIC) Market by Type, Value (US$ Bn), 2019 - 2031

- 7.4.1.11. Rest of Latin America Network Interface Card (NIC) Market by Application, Value (US$ Bn), 2019 - 2031

- 7.4.1.12. Rest of Latin America Network Interface Card (NIC) Market by End User, Value (US$ Bn), 2019 - 2031

- 7.4.1. Key Highlights

8. Middle East & Africa Network Interface Card (NIC) Market Outlook, 2019 - 2031

- 8.1. Middle East & Africa Network Interface Card (NIC) Market Outlook, by Type, Value (US$ Bn), 2019 - 2031

- 8.1.1. Key Highlights

- 8.1.1.1. Ethernet NICs

- 8.1.1.1.1. 5-Base T

- 8.1.1.1.2. 10-Base T

- 8.1.1.1.3. 100-Base T

- 8.1.1.1.4. Gigabit Ethernet

- 8.1.1.2. Wireless NICs

- 8.1.1.1. Ethernet NICs

- 8.1.1. Key Highlights

- 8.2. Middle East & Africa Network Interface Card (NIC) Market Outlook, by Application, Value (US$ Bn), 2019 - 2031

- 8.2.1. Key Highlights

- 8.2.1.1. Wireless Communication Devices

- 8.2.1.1.1. Firewall

- 8.2.1.1.2. Bridges

- 8.2.1.1.3. Repeaters

- 8.2.1.2. Wired Communication Devices

- 8.2.1.2.1. Hubs

- 8.2.1.2.2. Switches

- 8.2.1.2.3. Routers

- 8.2.1.2.4. Telephones

- 8.2.1.1. Wireless Communication Devices

- 8.2.1. Key Highlights

- 8.3. Middle East & Africa Network Interface Card (NIC) Market Outlook, by End User, Value (US$ Bn), 2019 - 2031

- 8.3.1. Key Highlights

- 8.3.1.1. Data Centers

- 8.3.1.2. Networking Service Providers

- 8.3.1.3. Telecom Operators

- 8.3.1.4. Enterprises/Corporates

- 8.3.1.5. Others

- 8.3.1. Key Highlights

- 8.4. Middle East & Africa Network Interface Card (NIC) Market Outlook, by Country, Value (US$ Bn), 2019 - 2031

- 8.4.1. Key Highlights

- 8.4.1.1. GCC Network Interface Card (NIC) Market by Type, Value (US$ Bn), 2019 - 2031

- 8.4.1.2. GCC Network Interface Card (NIC) Market by Application, Value (US$ Bn), 2019 - 2031

- 8.4.1.3. GCC Network Interface Card (NIC) Market by End User, Value (US$ Bn), 2019 - 2031

- 8.4.1.4. South Africa Network Interface Card (NIC) Market by Type, Value (US$ Bn), 2019 - 2031

- 8.4.1.5. South Africa Network Interface Card (NIC) Market by Application, Value (US$ Bn), 2019 - 2031

- 8.4.1.6. South Africa Network Interface Card (NIC) Market by End User, Value (US$ Bn), 2019 - 2031

- 8.4.1.7. Egypt Network Interface Card (NIC) Market by Type, Value (US$ Bn), 2019 - 2031

- 8.4.1.8. Egypt Network Interface Card (NIC) Market by Application, Value (US$ Bn), 2019 - 2031

- 8.4.1.9. Egypt Network Interface Card (NIC) Market by End User, Value (US$ Bn), 2019 - 2031

- 8.4.1.10. Nigeria Network Interface Card (NIC) Market by Type, Value (US$ Bn), 2019 - 2031

- 8.4.1.11. Nigeria Network Interface Card (NIC) Market by Application, Value (US$ Bn), 2019 - 2031

- 8.4.1.12. Nigeria Network Interface Card (NIC) Market by End User, Value (US$ Bn), 2019 - 2031

- 8.4.1.13. Rest of Middle East & Africa Network Interface Card (NIC) Market by Type, Value (US$ Bn), 2019 - 2031

- 8.4.1.14. Rest of Middle East & Africa Network Interface Card (NIC) Market by Application, Value (US$ Bn), 2019 - 2031

- 8.4.1.15. Rest of Middle East & Africa Network Interface Card (NIC) Market by End User, Value (US$ Bn), 2019 - 2031

- 8.4.1. Key Highlights

9. Competitive Landscape

- 9.1. By End User vs By Application Heat map

- 9.2. Company Market Share Analysis, 2024

- 9.3. Competitive Dashboard

- 9.4. Company Profiles

- 9.4.1. NXP Semiconductors

- 9.4.1.1. Company Overview

- 9.4.1.2. Product Portfolio

- 9.4.1.3. Financial Overview

- 9.4.1.4. Business Strategies and Development

- 9.4.2. Qualcomm Technologies, Inc.

- 9.4.2.1. Company Overview

- 9.4.2.2. Product Portfolio

- 9.4.2.3. Financial Overview

- 9.4.2.4. Business Strategies and Development

- 9.4.3. MACOM

- 9.4.3.1. Company Overview

- 9.4.3.2. Product Portfolio

- 9.4.3.3. Financial Overview

- 9.4.3.4. Business Strategies and Development

- 9.4.4. BONN Elektronik GmbH

- 9.4.4.1. Company Overview

- 9.4.4.2. Product Portfolio

- 9.4.4.3. Financial Overview

- 9.4.4.4. Business Strategies and Development

- 9.4.5. OPHIR RF

- 9.4.5.1. Company Overview

- 9.4.5.2. Product Portfolio

- 9.4.5.3. Financial Overview

- 9.4.5.4. Business Strategies and Development

- 9.4.6. Infineon Technologies AG

- 9.4.6.1. Company Overview

- 9.4.6.2. Product Portfolio

- 9.4.6.3. Financial Overview

- 9.4.6.4. Business Strategies and Development

- 9.4.7. CML Microsystems PLC

- 9.4.7.1. Company Overview

- 9.4.7.2. Product Portfolio

- 9.4.7.3. Financial Overview

- 9.4.7.4. Business Strategies and Development

- 9.4.8. Broadcom

- 9.4.8.1. Company Overview

- 9.4.8.2. Product Portfolio

- 9.4.8.3. Financial Overview

- 9.4.8.4. Business Strategies and Development

- 9.4.9. Analog Devices

- 9.4.9.1. Company Overview

- 9.4.9.2. Product Portfolio

- 9.4.9.3. Financial Overview

- 9.4.9.4. Business Strategies and Development

- 9.4.10. ETL Systems Ltd

- 9.4.10.1. Company Overview

- 9.4.10.2. Product Portfolio

- 9.4.10.3. Financial Overview

- 9.4.10.4. Business Strategies and Development

- 9.4.11. Analogic Corporation

- 9.4.11.1. Company Overview

- 9.4.11.2. Product Portfolio

- 9.4.11.3. Financial Overview

- 9.4.11.4. Business Strategies and Development

- 9.4.12. ETS-Lindgren

- 9.4.12.1. Company Overview

- 9.4.12.2. Product Portfolio

- 9.4.12.3. Financial Overview

- 9.4.12.4. Business Strategies and Development

- 9.4.13. Murata Manufacturing Co., Ltd

- 9.4.13.1. Company Overview

- 9.4.13.2. Product Portfolio

- 9.4.13.3. Financial Overview

- 9.4.13.4. Business Strategies and Development

- 9.4.1. NXP Semiconductors

10. Appendix

- 10.1. Research Methodology

- 10.2. Report Assumptions

- 10.3. Acronyms and Abbreviations