|

|

市場調査レポート

商品コード

1547180

ローラースクリューの市場 - 世界の業界分析、規模、シェア、成長、動向、予測(2031年)- タイプ別、用途別、地域別Roller Screw Market - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast 2031 |

||||||

|

|||||||

| ローラースクリューの市場 - 世界の業界分析、規模、シェア、成長、動向、予測(2031年)- タイプ別、用途別、地域別 |

|

出版日: 2024年08月27日

発行: Fairfield Market Research

ページ情報: 英文 164 Pages

納期: 2~5営業日

|

全表示

- 概要

- 目次

世界のローラースクリュー市場は、主要産業のさまざまな要因によって着実な成長を遂げています。ローラースクリューは、特に精密で堅牢なモーションコントロールシステムへの需要が高い航空宇宙・防衛分野で脚光を浴びています。世界のローラースクリュー市場は目覚ましい成長を遂げ、その市場規模は2024年に3億1,888万米ドルに達し、CAGR 6.80%の堅調な伸びによって2031年には5億430万米ドルに拡大すると予測されています。これらの部品は、航空機制御、衛星展開機構、防衛機器などの用途に不可欠です。ローラースクリューは、重要な用途に必要な性能と信頼性を提供するため、これらの要求の厳しい分野で好まれています。さらに、製造工程における持続可能性への意識の高まりに後押しされ、環境に優しいローラースクリューの材料や潤滑剤を使用する傾向が強まっています。

ローラースクリューの市場は、精密機械に対する需要の高まりと産業オートメーションの継続的な進歩により、過去数年間で大きな成長を遂げてきました。製造技術における革新も、製造、航空宇宙、自動車、ロボットなど、さまざまな産業分野でのローラースクリューの採用を促進する上で重要な役割を果たしています。この着実な上昇軌道は今後も続くと予想され、業界の専門家は継続的な市場拡大を予測しています。市場の見通しは依然として楽観的で、需要が持続し、メーカーや利害関係者にとって十分な機会があります。

ローラースクリューの需要は、いくつかの主要な促進要因によって支えられています。主な要因の1つは、さまざまな産業で精密かつ高負荷の用途に対するニーズが高まっていることです。ローラースクリューは、高効率や長寿命など、従来のスクリューシステムと比較して明確な利点を提供します。摺動体の代わりにローラーを組み込んだ革新的な設計により、滑らかで精密な直線運動が可能になり、正確な位置決めと卓越した耐荷重が保証されます。優れた性能、エネルギー効率の向上、耐久性の延長により、ローラースクリューは、要求の厳しい環境で信頼性の高い精密なモーションコントロールソリューションを求める産業にとって好ましい選択肢となっています。

しかし、ローラースクリュー市場に課題がないわけではありません。この分野で事業を展開するメーカーにとって、一貫した製品の品質と信頼性を維持することは非常に重要です。顧客の期待に応え、業界標準に準拠するために、メーカーは強固な品質管理プロセスを導入し、厳格な試験を実施しなければなりません。さらに、環境規制や持続可能性への関心の高まりは、ローラースクリューの製造工程や使用材料にも影響を及ぼしています。メーカーは、環境基準を遵守し、環境に優しい慣行に投資し、市場の新興国市場の需要に対応する持続可能なソリューションを開発する必要があります。

当レポートでは、世界のローラースクリュー市場について調査し、市場の概要とともに、タイプ別、用途別、地域別動向、および市場に参入する企業の競合動向などを提供しています。

目次

第1章 エグゼクティブサマリー

第2章 市場概要

- 市場の定義とセグメンテーション

- 市場力学

- バリューチェーン分析

- ポーターのファイブフォース分析

- COVID-19の影響分析

- ウクライナ・ロシア紛争の影響

- 経済概要

- PESTLE分析

第3章 生産高と貿易統計、2019年~2023年

第4章 価格分析、2019年~2023年

第5章 世界のローラースクリュー市場の見通し、2019年~2031年

- 世界のローラースクリュー市場の見通し、タイプ別、金額(100万米ドル)、数量(トン)、2019年~2031年

- 世界のローラースクリュー市場の見通し、用途別、金額(100万米ドル)、数量(トン)、2019年~2031年

- 世界のローラースクリュー市場の見通し、地域別、価値(100万米ドル)、数量(トン)、2019年~2031年

第6章 北米のローラースクリュー市場の見通し、2019年~2031年

第7章 欧州のローラースクリュー市場の見通し、2019年~2031年

第8章 アジア太平洋のローラースクリュー市場の見通し、2019年~2031年

第9章 ラテンアメリカのローラースクリュー市場の見通し、2019年~2031年

第10章 中東・アフリカのローラースクリュー市場の見通し、2019年~2031年

第11章 競合情勢

- 製品と適応のヒートマップ

- 企業市場シェア分析、2024年

- 競合ダッシュボード

- 企業プロファイル

- AB SKF

- Creative Motion Control Corporation

- Rollvis SA

- Kugel Motion Limited

- Nook Industries, Inc.

- Moog, Inc.

- Schaeffer AG

- Bosch Rexroth Group

- THK Co., Ltd.

- Ewellix

- U-Screws

- HIWIN Corporation

- Fastener World Inc.

- Power Jacks Limited

第12章 付録

The global roller screw market is experiencing steady growth, driven by various factors across key industries. Roller screws are gaining prominence, particularly in the aerospace and defense sectors, where there is a high demand for precise and robust motion control systems.The global roller screw market is poised for remarkable growth, with its market size expected to reach $318.88 million in 2024 and projected to expand to $504.3 million by 2031, driven by a robust CAGR of 6.80%. These components are essential for applications such as aircraft control, satellite deployment mechanisms, and defense equipment. Roller screws provide the necessary performance and reliability required for critical applications, making them a preferred choice in these demanding fields. Additionally, there is a growing trend toward the use of environment-friendly roller screw materials and lubricants, fueled by increasing awareness of sustainability in manufacturing processes.

The market for roller screws has witnessed significant growth over the past few years, thanks to the rising demand for precision machinery and the continued advancement of industrial automation. Innovations in manufacturing technologies have also played a crucial role in driving the adoption of roller screws across various industry verticals, including manufacturing, aerospace, automotive, and robotics. This steady upward trajectory is expected to continue, with industry experts forecasting ongoing market expansion. The market outlook remains optimistic, with sustained demand and ample opportunities for manufacturers and stakeholders.

The demand for roller screws is being propelled by several key drivers. One of the primary factors is the increasing need for precision and high-load applications across various industries. Roller screws offer distinct advantages over traditional screw systems, including higher efficiency and longer service life. Their innovative design, which incorporates rollers instead of sliding elements, enables smooth and precise linear motion, ensuring accurate positioning and exceptional load-carrying capacity. With superior performance, improved energy efficiency, and extended durability, roller screws have become the preferred choice for industries seeking reliable and precise motion control solutions in demanding environments.

However, the roller screw market is not without its challenges. Maintaining consistent product quality and reliability is critical for manufacturers operating in this space. To meet customer expectations and comply with industry standards, manufacturers must implement robust quality control processes and conduct rigorous testing. Furthermore, increasing environmental regulations and sustainability concerns are impacting the manufacturing process and materials used in roller screws. Manufacturers need to comply with environmental standards, invest in eco-friendly practices, and develop sustainable solutions to meet the evolving demands of the market.

Despite these challenges, the roller screw industry presents numerous opportunities for growth. Advances in material science have the potential to lead to the development of new materials with enhanced properties, such as increased strength, reduced weight, and improved resistance to wear and corrosion. These advancements can pave the way for more efficient and durable roller screw designs, expanding their applications across various industries. As more industries adopt automation to improve efficiency and productivity, the demand for precise and reliable linear motion control systems, such as roller screws, is expected to rise.

Emerging sectors such as electric vehicles, renewable energy, and advanced robotics offer promising opportunities for market expansion. As these industries continue to grow and develop, the need for high-performance linear motion solutions will increase, and roller screws are well-positioned to meet these demands. Roller screws are known for their higher mechanical efficiency compared to other linear motion technologies, which contributes to energy savings and a reduced environmental impact. The demand for sustainable solutions in industries such as renewable energy, green manufacturing, and transportation is likely to drive the adoption of roller screws.

Several trends are currently shaping the roller screw market. The influence of smart technology and Industry 4.0 concepts is becoming increasingly evident. Roller screws equipped with sensors, connectivity features, and predictive maintenance capabilities enable real-time monitoring, data analysis, and remote control. This trend enhances operational efficiency, reduces downtime, and enables proactive maintenance in applications utilizing roller screw systems. Additionally, there is a growing emphasis on energy efficiency and sustainability, with manufacturers investing heavily in research and development to meet these demands.

Regionally, different markets are exhibiting varying growth trajectories. In the United States, the market is expected to show substantial growth, driven by the increasing demand for precision machinery, advancements in industrial automation, and a continuous push for technological innovations. This growth presents significant opportunities for manufacturers and suppliers to capitalize on the rising demand for roller screws and cater to the evolving needs of various sectors, including manufacturing, aerospace, automotive, and robotics.

In the United Kingdom, the market is also expected to expand, with rising demand for roller screws in commercial and industrial sectors. The country's conducive environment for roller screw manufacturers provides ample opportunities to meet the evolving needs of industries such as manufacturing, aerospace, automotive, and robotics. The projected growth of the market in the United Kingdom underscores its significance as a key player in driving industry expansion and highlights its potential as a lucrative market for roller screw applications.

In China, the market is projected to experience a high growth trajectory, driven by increasing investments in automation and robotics and a strong emphasis on technological innovation. As China continues to establish itself as a manufacturing powerhouse, the demand for precision machinery and automation solutions is expected to soar. Manufacturers are well-positioned to capitalize on this trend, catering to the needs of various sectors, including manufacturing, automotive, aerospace, and robotics.

Among the different types of roller screws, the standard roller screw segment is expected to maintain its dominance and exhibit significant growth in the coming years. The popularity of standard roller screws can be attributed to their widespread applications across various industries and their cost-effectiveness compared to other specialized variants. These screws find extensive usage in industrial automation, manufacturing machinery, robotics, and other sectors that require reliable linear motion solutions. The steady growth of this segment highlights the reliability, versatility, and continued demand for standard roller screws from a diverse range of industries, solidifying its position as a key driver of the roller screw industry's expansion.

The industrial machinery sector is playing a crucial role in driving the growth of the global roller screw market. The utilization of roller screws in this sector is expected to continue rising, driven by their precise and reliable linear motion capabilities. Roller screws are essential components in a wide range of machinery, including manufacturing equipment, packaging machines, and metalworking machinery. The sector's strong presence and focus on continuous innovation contribute significantly to the overall expansion and development of the market.

Key players in the roller screw market are adopting several strategies to strengthen their market position. Product innovation remains a top priority, with companies investing heavily in research and development to introduce new products that offer enhanced efficiency, reliability, and cost-effectiveness. Strategic partnerships and collaborations are also common, allowing companies to leverage their strengths, expand their market reach, and gain access to new technologies. The expansion into emerging markets, such as those in Asia, is another strategy employed by key players, as they establish local manufacturing facilities and strengthen their distribution networks. Mergers and acquisitions are also prevalent in the industry, as companies seek to consolidate their market position and expand their product portfolios.

Key Companies Profiled

- AB SKF

- Creative Motion Control Corporation

- Rollvis SA

- Kugel Motion Limited

- Nook Industries, Inc.

- Moog, Inc.

- Schaeffer AG

- Bosch Rexroth Group

- THK Co., Ltd.

- Ewellix

- U-Screws

- HIWIN Corporation

- Fastener World Inc.

- Power Jacks Limited

- Others

Segmentation Roller Screw Industry Research

By Type:

- Standard Roller Screws

- Recirculating Roller Screws

- Inverted Roller Screws

- Bearing Ring Roller Screws

By Application:

- Industrial Machinery

- Robotics

- Heavy Machinery

- Medical Equipment

- Material Handling Equipment

- Automotive & Aviation Components

- Others

By Region:

- North America

- Latin America

- Europe

- East Asia

- South Asia and Pacific

- Middle East and Africa

Table of Contents

1. Executive Summary

- 1.1. Global Roller Screw Market Snapshot

- 1.2. Future Projections

- 1.3. Key Market Trends

- 1.4. Regional Snapshot, by Value and Volume, 2023

- 1.5. Analyst Recommendations

2. Market Overview

- 2.1. Market Definitions and Segmentations

- 2.2. Market Dynamics

- 2.2.1. Drivers

- 2.2.2. Restraints

- 2.2.3. Market Opportunities

- 2.3. Value Chain Analysis

- 2.4. Porter's Five Forces Analysis

- 2.5. COVID-19 Impact Analysis

- 2.5.1. Supply

- 2.5.2. Demand

- 2.6. Impact of Ukraine-Russia Conflict

- 2.7. Economic Overview

- 2.7.1. World Economic Projections

- 2.8. PESTLE Analysis

3. Production Output and Trade Statistics, 2019 - 2023

- 3.1. Global Roller Screw Market Production Output, by Region, Value (US$ Mn) and Volume (Tons), 2019 - 2023

- 3.1.1. North America

- 3.1.2. Europe

- 3.1.3. Asia Pacific

- 3.1.4. Latin America

- 3.1.5. Middle East and Africa

4. Price Analysis, 2019 - 2023

- 4.1. Global Average Price Analysis, by Type, US$ Per Tons, 2019 - 2023

- 4.2. Prominent Factor Affecting Roller Screw Prices

- 4.3. Global Average Price Analysis, by Region, US$ Per Ton

5. Global Roller Screw Market Outlook, 2019 - 2031

- 5.1. Global Roller Screw Market Outlook, by Type, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 5.1.1. Key Highlights

- 5.1.1.1. Standard Roller Screws

- 5.1.1.2. Recirculating Roller Screws

- 5.1.1.3. Inverted Roller Screws

- 5.1.1.4. Bearing Ring Roller Screws

- 5.1.1. Key Highlights

- 5.2. Global Roller Screw Market Outlook, by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 5.2.1. Key Highlights

- 5.2.1.1. Industrial Machinery

- 5.2.1.2. Robotics

- 5.2.1.3. Heavy Machinery

- 5.2.1.4. Medical Equipment

- 5.2.1.5. Material Handling Equipment

- 5.2.1.6. Automotive & Aviation Components

- 5.2.1.7. Others

- 5.2.1. Key Highlights

- 5.3. Global Roller Screw Market Outlook, by Region, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 5.3.1. Key Highlights

- 5.3.1.1. North America

- 5.3.1.2. Europe

- 5.3.1.3. Asia Pacific

- 5.3.1.4. Latin America

- 5.3.1.5. Middle East & Africa

- 5.3.1. Key Highlights

6. North America Roller Screw Market Outlook, 2019 - 2031

- 6.1. North America Roller Screw Market Outlook, by Type, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 6.1.1. Key Highlights

- 6.1.1.1. Standard Roller Screws

- 6.1.1.2. Recirculating Roller Screws

- 6.1.1.3. Inverted Roller Screws

- 6.1.1.4. Bearing Ring Roller Screws

- 6.1.1. Key Highlights

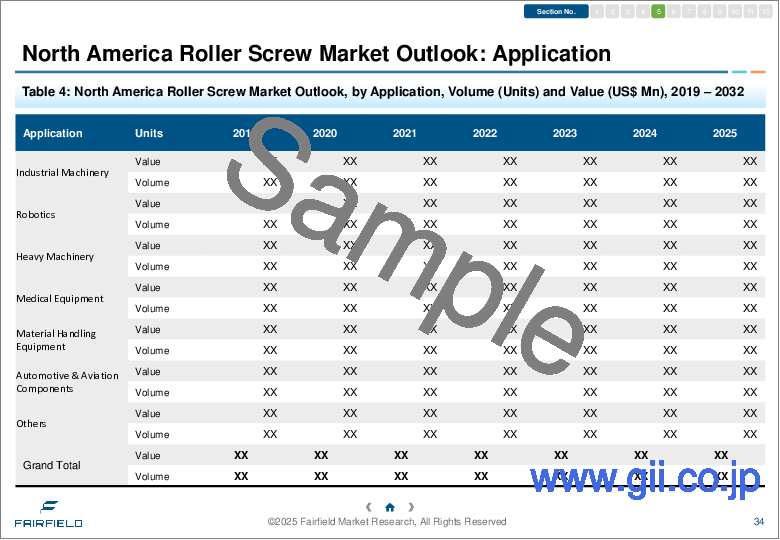

- 6.2. North America Roller Screw Market Outlook, by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 6.2.1. Key Highlights

- 6.2.1.1. Industrial Machinery

- 6.2.1.2. Robotics

- 6.2.1.3. Heavy Machinery

- 6.2.1.4. Medical Equipment

- 6.2.1.5. Material Handling Equipment

- 6.2.1.6. Automotive & Aviation Components

- 6.2.1.7. Others

- 6.2.1. Key Highlights

- 6.3. North America Roller Screw Market Outlook, by Country, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 6.3.1. Key Highlights

- 6.3.1.1. U.S. Roller Screw Market by Type, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 6.3.1.2. U.S. Roller Screw Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 6.3.1.3. Canada Roller Screw Market by Type, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 6.3.1.4. Canada Roller Screw Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 6.3.2. BPS Analysis/Market Attractiveness Analysis

- 6.3.1. Key Highlights

7. Europe Roller Screw Market Outlook, 2019 - 2031

- 7.1. Europe Roller Screw Market Outlook, by Type, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 7.1.1. Key Highlights

- 7.1.1.1. Standard Roller Screws

- 7.1.1.2. Recirculating Roller Screws

- 7.1.1.3. Inverted Roller Screws

- 7.1.1.4. Bearing Ring Roller Screws

- 7.1.1. Key Highlights

- 7.2. Europe Roller Screw Market Outlook, by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 7.2.1. Key Highlights

- 7.2.1.1. Industrial Machinery

- 7.2.1.2. Robotics

- 7.2.1.3. Heavy Machinery

- 7.2.1.4. Medical Equipment

- 7.2.1.5. Material Handling Equipment

- 7.2.1.6. Automotive & Aviation Components

- 7.2.1.7. Others

- 7.2.1. Key Highlights

- 7.3. Europe Roller Screw Market Outlook, by Country, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 7.3.1. Key Highlights

- 7.3.1.1. Germany Roller Screw Market by Type, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 7.3.1.2. Germany Roller Screw Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 7.3.1.3. U.K. Roller Screw Market by Type, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 7.3.1.4. U.K. Roller Screw Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 7.3.1.5. France Roller Screw Market by Type, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 7.3.1.6. France Roller Screw Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 7.3.1.7. Italy Roller Screw Market by Type, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 7.3.1.8. Italy Roller Screw Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 7.3.1.9. Turkey Roller Screw Market by Type, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 7.3.1.10. Turkey Roller Screw Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 7.3.1.11. Russia Roller Screw Market by Type, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 7.3.1.12. Russia Roller Screw Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 7.3.1.13. Rest of Europe Roller Screw Market by Type, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 7.3.1.14. Rest of Europe Roller Screw Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 7.3.2. BPS Analysis/Market Attractiveness Analysis

- 7.3.1. Key Highlights

8. Asia Pacific Roller Screw Market Outlook, 2019 - 2031

- 8.1. Asia Pacific Roller Screw Market Outlook, by Type, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 8.1.1. Key Highlights

- 8.1.1.1. Standard Roller Screws

- 8.1.1.2. Recirculating Roller Screws

- 8.1.1.3. Inverted Roller Screws

- 8.1.1.4. Bearing Ring Roller Screws

- 8.1.1. Key Highlights

- 8.2. Asia Pacific Roller Screw Market Outlook, by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 8.2.1. Key Highlights

- 8.2.1.1. Industrial Machinery

- 8.2.1.2. Robotics

- 8.2.1.3. Heavy Machinery

- 8.2.1.4. Medical Equipment

- 8.2.1.5. Material Handling Equipment

- 8.2.1.6. Automotive & Aviation Components

- 8.2.1.7. Others

- 8.2.1. Key Highlights

- 8.3. Asia Pacific Roller Screw Market Outlook, by Country, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 8.3.1. Key Highlights

- 8.3.1.1. China Roller Screw Market by Type, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 8.3.1.2. China Roller Screw Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 8.3.1.3. Japan Roller Screw Market by Type, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 8.3.1.4. Japan Roller Screw Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 8.3.1.5. South Korea Roller Screw Market by Type, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 8.3.1.6. South Korea Roller Screw Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 8.3.1.7. India Roller Screw Market by Type, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 8.3.1.8. India Roller Screw Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 8.3.1.9. Southeast Asia Roller Screw Market by Type, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 8.3.1.10. Southeast Asia Roller Screw Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 8.3.1.11. Rest of Asia Pacific Roller Screw Market by Type, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 8.3.1.12. Rest of Asia Pacific Roller Screw Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 8.3.2. BPS Analysis/Market Attractiveness Analysis

- 8.3.1. Key Highlights

9. Latin America Roller Screw Market Outlook, 2019 - 2031

- 9.1. Latin America Roller Screw Market Outlook, by Type, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 9.1.1. Key Highlights

- 9.1.1.1. Standard Roller Screws

- 9.1.1.2. Recirculating Roller Screws

- 9.1.1.3. Inverted Roller Screws

- 9.1.1.4. Bearing Ring Roller Screws

- 9.1.1. Key Highlights

- 9.2. Latin America Roller Screw Market Outlook, by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 9.2.1. Key Highlights

- 9.2.1.1. Industrial Machinery

- 9.2.1.2. Robotics

- 9.2.1.3. Heavy Machinery

- 9.2.1.4. Medical Equipment

- 9.2.1.5. Material Handling Equipment

- 9.2.1.6. Automotive & Aviation Components

- 9.2.1.7. Others

- 9.2.1. Key Highlights

- 9.3. Latin America Roller Screw Market Outlook, by Country, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 9.3.1. Key Highlights

- 9.3.1.1. Brazil Roller Screw Market by Type, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 9.3.1.2. Brazil Roller Screw Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 9.3.1.3. Mexico Roller Screw Market by Type, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 9.3.1.4. Mexico Roller Screw Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 9.3.1.5. Argentina Roller Screw Market by Type, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 9.3.1.6. Argentina Roller Screw Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 9.3.1.7. Rest of Latin America Roller Screw Market by Type, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 9.3.1.8. Rest of Latin America Roller Screw Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 9.3.2. BPS Analysis/Market Attractiveness Analysis

- 9.3.1. Key Highlights

10. Middle East & Africa Roller Screw Market Outlook, 2019 - 2031

- 10.1. Middle East & Africa Roller Screw Market Outlook, by Type, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 10.1.1. Key Highlights

- 10.1.1.1. Standard Roller Screws

- 10.1.1.2. Recirculating Roller Screws

- 10.1.1.3. Inverted Roller Screws

- 10.1.1.4. Bearing Ring Roller Screws

- 10.1.1. Key Highlights

- 10.2. Middle East & Africa Roller Screw Market Outlook, by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 10.2.1. Key Highlights

- 10.2.1.1. Industrial Machinery

- 10.2.1.2. Robotics

- 10.2.1.3. Heavy Machinery

- 10.2.1.4. Medical Equipment

- 10.2.1.5. Material Handling Equipment

- 10.2.1.6. Automotive & Aviation Components

- 10.2.1.7. Others

- 10.2.1. Key Highlights

- 10.3. Middle East & Africa Roller Screw Market Outlook, by Country, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 10.3.1. Key Highlights

- 10.3.1.1. GCC Roller Screw Market by Type, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 10.3.1.2. GCC Roller Screw Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 10.3.1.3. South Africa Roller Screw Market by Type, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 10.3.1.4. South Africa Roller Screw Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 10.3.1.5. Egypt Roller Screw Market by Type, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 10.3.1.6. Egypt Roller Screw Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 10.3.1.7. Nigeria Roller Screw Market by Type, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 10.3.1.8. Nigeria Roller Screw Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 10.3.1.9. Rest of Middle East & Africa Roller Screw Market by Type, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 10.3.1.10. Rest of Middle East & Africa Roller Screw Market by Application, Value (US$ Mn) and Volume (Tons), 2019 - 2031

- 10.3.2. BPS Analysis/Market Attractiveness Analysis

- 10.3.1. Key Highlights

11. Competitive Landscape

- 11.1. Product vs Indication Heatmap

- 11.2. Company Market Share Analysis, 2024

- 11.3. Competitive Dashboard

- 11.4. Company Profiles

- 11.4.1. AB SKF

- 11.4.1.1. Company Overview

- 11.4.1.2. Product Portfolio

- 11.4.1.3. Financial Overview

- 11.4.1.4. Business Strategies and Development

- 11.4.2. Creative Motion Control Corporation

- 11.4.2.1. Company Overview

- 11.4.2.2. Product Portfolio

- 11.4.2.3. Financial Overview

- 11.4.2.4. Business Strategies and Development

- 11.4.3. Rollvis SA

- 11.4.3.1. Company Overview

- 11.4.3.2. Product Portfolio

- 11.4.3.3. Financial Overview

- 11.4.3.4. Business Strategies and Development

- 11.4.4. Kugel Motion Limited

- 11.4.4.1. Company Overview

- 11.4.4.2. Product Portfolio

- 11.4.4.3. Financial Overview

- 11.4.4.4. Business Strategies and Development

- 11.4.5. Nook Industries, Inc.

- 11.4.5.1. Company Overview

- 11.4.5.2. Product Portfolio

- 11.4.5.3. Financial Overview

- 11.4.5.4. Business Strategies and Development

- 11.4.6. Moog, Inc.

- 11.4.6.1. Company Overview

- 11.4.6.2. Product Portfolio

- 11.4.6.3. Financial Overview

- 11.4.6.4. Business Strategies and Development

- 11.4.7. Schaeffer AG

- 11.4.7.1. Company Overview

- 11.4.7.2. Product Portfolio

- 11.4.7.3. Financial Overview

- 11.4.7.4. Business Strategies and Development

- 11.4.8. Bosch Rexroth Group

- 11.4.8.1. Company Overview

- 11.4.8.2. Product Portfolio

- 11.4.8.3. Financial Overview

- 11.4.8.4. Business Strategies and Development

- 11.4.9. THK Co., Ltd.

- 11.4.9.1. Company Overview

- 11.4.9.2. Product Portfolio

- 11.4.9.3. Financial Overview

- 11.4.9.4. Business Strategies and Development

- 11.4.10. Ewellix

- 11.4.10.1. Company Overview

- 11.4.10.2. Product Portfolio

- 11.4.10.3. Financial Overview

- 11.4.10.4. Business Strategies and Development

- 11.4.11. U-Screws

- 11.4.11.1. Company Overview

- 11.4.11.2. Product Portfolio

- 11.4.11.3. Financial Overview

- 11.4.11.4. Business Strategies and Development

- 11.4.12. HIWIN Corporation

- 11.4.12.1. Company Overview

- 11.4.12.2. Product Portfolio

- 11.4.12.3. Financial Overview

- 11.4.12.4. Business Strategies and Development

- 11.4.13. Fastener World Inc.

- 11.4.13.1. Company Overview

- 11.4.13.2. Product Portfolio

- 11.4.13.3. Financial Overview

- 11.4.13.4. Business Strategies and Development

- 11.4.14. Power Jacks Limited

- 11.4.14.1. Company Overview

- 11.4.14.2. Product Portfolio

- 11.4.14.3. Financial Overview

- 11.4.14.4. Business Strategies and Development

- 11.4.1. AB SKF

12. Appendix

- 12.1. Research Methodology

- 12.2. Report Assumptions

- 12.3. Acronyms and Abbreviations