|

|

市場調査レポート

商品コード

1501281

n-ヘプタンの世界市場 - 世界の業界分析、規模、シェア、成長、動向、予測(2031年)- 製品タイプ別、用途別、地域別n-Heptane Market - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast 2031 - By Product, Technology, Grade, Application, End-user, Region: (North America, Europe, Asia Pacific, Latin America and Middle East and Africa) |

||||||

|

|||||||

| n-ヘプタンの世界市場 - 世界の業界分析、規模、シェア、成長、動向、予測(2031年)- 製品タイプ別、用途別、地域別 |

|

出版日: 2024年06月19日

発行: Fairfield Market Research

ページ情報: 英文 160 Pages

納期: 2~5営業日

|

全表示

- 概要

- 目次

世界のn-ヘプタンの市場規模は、医薬品、塗料・コーティング剤、接着剤・シーリング剤など、いくつかの最終用途産業の拡大によって力強い成長を遂げています。n-ヘプタンは工業用洗浄から実験室での作業まで幅広い用途で使用されており、さまざまな分野で不可欠な溶剤になりつつあります。

n-ヘプタンは無極性で典型的な石油臭で知られ、多くの産業で広く利用されています。医薬品の製造プロセスや、希釈剤・洗浄剤としての塗料・コーティングへの応用は、n-ヘプタンの重要な役割を浮き彫りにしています。エレクトロニクス分野も、電子製品の消費量の増加と生活水準の向上に牽引され、市場需要に大きく貢献しています。

自動車業界と建築・建設業界は塗料・コーティング業界を強化し、n-ヘプタン市場の成長軌道を高めています。さらに、製薬業界の成長により高純度のn-ヘプタンが必要とされ、市場の拡大を下支えしています。

芳香族系溶剤の削減を強調する規制状況の変化により、n-ヘプタンは有利な選択肢として位置づけられ、需要をさらに押し上げています。生産能力の向上とプラントの効率化により、市場の成長は維持され、増大する需要に対応する安定供給が確保されます。

中国は引き続き世界のn-ヘプタン市場の最前線にあり、現地の産業活動が大幅な成長を牽引しています。日本と中国を除くアジア太平洋は、インドと韓国の経済発展に後押しされて急成長を遂げています。北米と欧州は安定した成長軌道を維持しているが、ラテンアメリカは都市化と建設活動の活発化によって重要な市場として浮上しています。

当レポートでは、世界のn-ヘプタン市場について調査し、市場の概要とともに、製品タイプ別、用途別、地域別動向、および市場に参入する企業の競合動向などを提供しています。

目次

第1章 エグゼクティブサマリー

第2章 市場概要

- 市場の定義とセグメンテーション

- 市場力学

- バリューチェーン分析

- ポーターのファイブフォース分析

- COVID-19の影響分析

- ウクライナ・ロシア紛争の影響

- 経済概要

- PESTLE分析

第3章 生産高と貿易統計、2018年~2024年

第4章 世界のn-ヘプタン市場の見通し、2018年~2031年

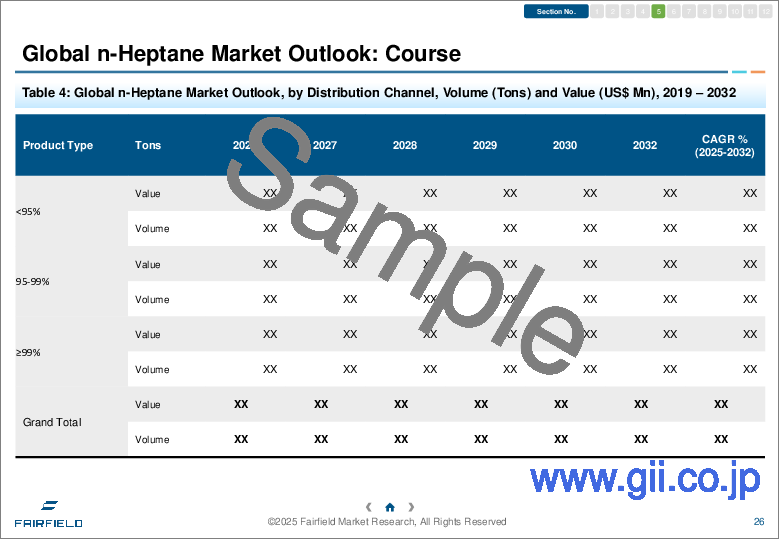

- 世界のn-ヘプタン市場の見通し、製品タイプ別、数量(トン)、金額(10億ドル)、2018年~2031年

- 世界のn-ヘプタン市場の見通し、用途別、数量(トン)、金額(10億米ドル)、2018年~2031年

- 世界のn-ヘプタン市場の見通し、地域別、数量(トン)、金額(10億米ドル)、2018年~2031年

第5章 北米のn-ヘプタン市場の見通し、2018年~2031年

第6章 欧州のn-ヘプタン市場の見通し、2018年~2031年

第7章 アジア太平洋のn-ヘプタン市場の見通し、2018年~2031年

第8章 ラテンアメリカのn-ヘプタン市場の見通し、2018年~2031年

第9章 中東・アフリカのn-ヘプタン市場の見通し、2018年~2031年

第10章 競合情勢

- 純度と用途のヒートマップ

- メーカーと用途のヒートマップ

- 企業市場シェア分析、2024年

- 競合ダッシュボード

- 企業プロファイル

- Exxon Mobil Corporation

第11章 付録

The global n-Heptane market is experiencing robust growth, catalyzed by the expansion of several end-use industries such as pharmaceuticals, paints & coatings, and adhesives & sealants. With its extensive use in a range of applications from industrial cleaning to laboratory operations, n-Heptane is becoming an indispensable solvent in various sectors.

Market Dynamics: A Surge in Demand from Key Industries

n-Heptane, known for its non-polar characteristics and typical petroleum odor, is widely utilized across numerous industries. Its application in pharmaceuticals for manufacturing processes and in paints & coatings as a diluent and cleaner highlights its integral role. The electronics sector also significantly contributes to the market demand, driven by the rising consumption of electronic goods and the increasing standards of living.

The automotive and building & construction sectors are bolstering the paints & coatings industry, subsequently enhancing the growth trajectory of the n-Heptane market. Additionally, the growth of the pharmaceutical industry necessitates high-purity n-Heptane, underpinning the market's expansion.

Regulatory Impact and Market Trends

The shift in regulatory landscapes, emphasizing the reduction of aromatic solvents, has positioned n-Heptane as a favorable choice, further propelling its demand. Advances in production capacities and enhancements in plant efficiencies are set to sustain market growth, ensuring a steady supply to meet the escalating demand.

Geographical Outlook: China Leads, APEJ&C and Latin America Show Promising Growth

China remains at the forefront of the global n-Heptane market, with substantial growth driven by local industrial activities. The Asia Pacific Excluding Japan & China region is witnessing rapid growth, fueled by the economic developments in India and South Korea. While North America and Europe maintain a steady growth trajectory, Latin America is emerging as a significant market, spurred by urbanization and increased construction activities.

Competitive Analysis

The competitive arena of the n-Heptane market is fairly consolidated with major players dominating the scene. Companies like Exxon Mobil Corporation have expanded their production capacities, enhancing their market foothold and ensuring they can meet the global demand. Strategic initiatives such as acquisitions, joint ventures, and collaborations are prevalent among key players aiming to fortify their market presence and expand their customer base.

Market Segmentation

By Product Type

- <95%

- 95-99%

- >=99%

By Application

- Pharmaceuticals

- Paints & Coatings

- Electronics

- Adhesives & Sealants

- Plastic & Polymers

- Others

By Region

- North America

- Latin America

- Europe

- APEJ&C

- China

- Japan

- Middle East & Africa

Table of Contents

1. Executive Summary

- 1.1. Global n-Heptane Market Snapshot

- 1.2. Future Projections

- 1.3. Key Market Trends

- 1.4. Regional Snapshot, by Value, 2024

- 1.5. Analyst Recommendations

2. Market Overview

- 2.1. Market Definitions and Segmentations

- 2.2. Market Dynamics

- 2.2.1. Drivers

- 2.2.2. Restraints

- 2.2.3. Market Opportunities

- 2.3. Value Chain Analysis

- 2.4. Porter's Five Forces Analysis

- 2.5. COVID-19 Impact Analysis

- 2.5.1. Supply

- 2.5.2. Demand

- 2.6. Impact of Ukraine-Russia Conflict

- 2.7. Economic Overview

- 2.7.1. World Economic Projections

- 2.8. PESTLE Analysis

3. Production Output and Trade Statistics, 2018-2024

- 3.1. Global n-Heptane, Production Output, by Region, 2018 - 2024

- 3.1.1. North America

- 3.1.2. Europe

- 3.1.3. Asia Pacific

- 3.1.4. Latin America

- 3.1.5. Middle East & Africa

4. Global n-Heptane Market Outlook, 2018 - 2031

- 4.1. Global n-Heptane Market Outlook, by Product Type, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 4.1.1. Key Highlights

- 4.1.1.1.1. <95%

- 4.1.1.1.2. 95-99%

- 4.1.1.1.3. >=99%

- 4.1.1. Key Highlights

- 4.2. Global n-Heptane Market Outlook, by Application, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 4.2.1. Key Highlights

- 4.2.1.1. Pharmaceuticals

- 4.2.1.2. Paints & Coatings

- 4.2.1.3. Electronics

- 4.2.1.4. Adhesives & Sealants

- 4.2.1.5. Plastic & Polymers

- 4.2.1.6. Others

- 4.2.1. Key Highlights

- 4.3. Global n-Heptane Market Outlook, by Region, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 4.3.1. Key Highlights

- 4.3.1.1. North America

- 4.3.1.2. Europe

- 4.3.1.3. Asia Pacific

- 4.3.1.4. Latin America

- 4.3.1.5. Middle East & Africa

- 4.3.1. Key Highlights

5. North America n-Heptane Market Outlook, 2018 - 2031

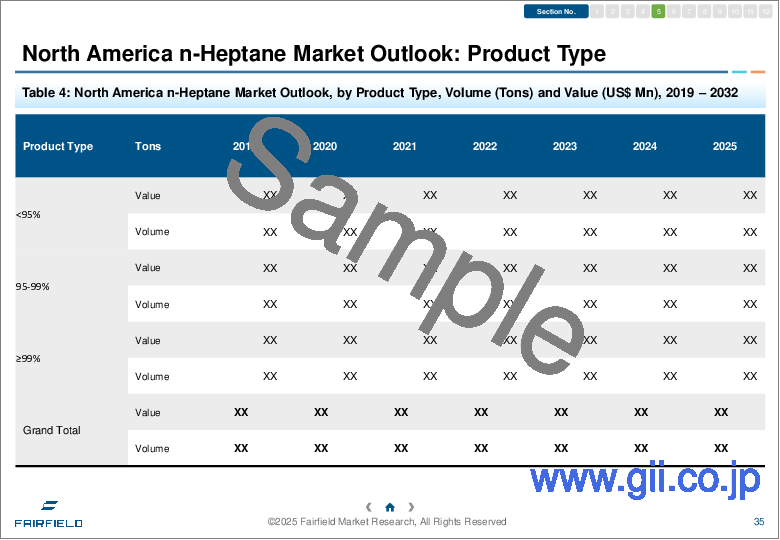

- 5.1. North America n-Heptane Market Outlook, by Product Type, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 5.1.1. Key Highlights

- 5.1.1.1.1. <95%

- 5.1.1.1.2. 95-99%

- 5.1.1.1.3. >=99%

- 5.1.1. Key Highlights

- 5.2. North America n-Heptane Market Outlook, by Application, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 5.2.1. Key Highlights

- 5.2.1.1. Pharmaceuticals

- 5.2.1.2. Paints & Coatings

- 5.2.1.3. Electronics

- 5.2.1.4. Adhesives & Sealants

- 5.2.1.5. Plastic & Polymers

- 5.2.1.6. Others

- 5.2.2. BPS Analysis/Market Attractiveness Analysis

- 5.2.1. Key Highlights

- 5.3. North America n-Heptane Market Outlook, by Country, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 5.3.1. Key Highlights

- 5.3.1.1. U.S. n-Heptane Market by Product Type, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 5.3.1.2. U.S. n-Heptane Market Application, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 5.3.1.3. Canada n-Heptane Market by Product Type, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 5.3.1.4. Canada n-Heptane Market Application, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 5.3.2. BPS Analysis/Market Attractiveness Analysis

- 5.3.1. Key Highlights

6. Europe n-Heptane Market Outlook, 2018 - 2031

- 6.1. Europe n-Heptane Market Outlook, by Product Type, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 6.1.1. Key Highlights

- 6.1.1.1.1. <95%

- 6.1.1.1.2. 95-99%

- 6.1.1.1.3. >=99%

- 6.1.1. Key Highlights

- 6.2. Europe n-Heptane Market Outlook, by Application, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 6.2.1. Key Highlights

- 6.2.1.1. Pharmaceuticals

- 6.2.1.2. Paints & Coatings

- 6.2.1.3. Electronics

- 6.2.1.4. Adhesives & Sealants

- 6.2.1.5. Plastic & Polymers

- 6.2.1.6. Others

- 6.2.2. BPS Analysis/Market Attractiveness Analysis

- 6.2.1. Key Highlights

- 6.3. Europe n-Heptane Market Outlook, by Country, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 6.3.1. Key Highlights

- 6.3.1.1. Germany n-Heptane Market by Product Type, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 6.3.1.2. Germany n-Heptane Market Application, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 6.3.1.3. U.K. n-Heptane Market by Product Type, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 6.3.1.4. U.K. n-Heptane Market Application, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 6.3.1.5. France n-Heptane Market by Product Type, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 6.3.1.6. France n-Heptane Market Application, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 6.3.1.7. Italy n-Heptane Market by Product Type, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 6.3.1.8. Italy n-Heptane Market Application, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 6.3.1.9. Turkey n-Heptane Market by Product Type, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 6.3.1.10. Turkey n-Heptane Market Application, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 6.3.1.11. Russia n-Heptane Market by Product Type, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 6.3.1.12. Russia n-Heptane Market Application, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 6.3.1.13. Rest of Europe n-Heptane Market by Product Type, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 6.3.1.14. Rest of Europe n-Heptane Market Application, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 6.3.2. BPS Analysis/Market Attractiveness Analysis

- 6.3.1. Key Highlights

7. Asia Pacific n-Heptane Market Outlook, 2018 - 2031

- 7.1. Asia Pacific n-Heptane Market Outlook, by Product Type, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 7.1.1. Key Highlights

- 7.1.1.1.1. <95%

- 7.1.1.1.2. 95-99%

- 7.1.1.1.3. >=99%

- 7.1.1. Key Highlights

- 7.2. Asia Pacific n-Heptane Market Outlook, by Application, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 7.2.1. Key Highlights

- 7.2.1.1. Pharmaceuticals

- 7.2.1.2. Paints & Coatings

- 7.2.1.3. Electronics

- 7.2.1.4. Adhesives & Sealants

- 7.2.1.5. Plastic & Polymers

- 7.2.1.6. Others

- 7.2.2. BPS Analysis/Market Attractiveness Analysis

- 7.2.1. Key Highlights

- 7.3. Asia Pacific n-Heptane Market Outlook, by Country, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 7.3.1. Key Highlights

- 7.3.1.1. China n-Heptane Market by Product Type, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 7.3.1.2. China n-Heptane Market Application, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 7.3.1.3. China n-Heptane Market Purity, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 7.3.1.4. Japan n-Heptane Market by Product Type, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 7.3.1.5. Japan n-Heptane Market Application, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 7.3.1.6. South Korea n-Heptane Market by Product Type, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 7.3.1.7. South Korea n-Heptane Market Application, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 7.3.1.8. India n-Heptane Market by Product Type, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 7.3.1.9. India n-Heptane Market Application, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 7.3.1.10. Southeast Asia n-Heptane Market by Product Type, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 7.3.1.11. Southeast Asia n-Heptane Market Application, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 7.3.1.12. Rest of Asia Pacific n-Heptane Market by Product Type, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 7.3.1.13. Rest of Asia Pacific n-Heptane Market Application, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 7.3.2. BPS Analysis/Market Attractiveness Analysis

- 7.3.1. Key Highlights

8. Latin America n-Heptane Market Outlook, 2018 - 2031

- 8.1. Latin America n-Heptane Market Outlook, by Product Type, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 8.1.1. Key Highlights

- 8.1.1.1.1. <95%

- 8.1.1.1.2. 95-99%

- 8.1.1.1.3. >=99%

- 8.1.1. Key Highlights

- 8.2. Latin America n-Heptane Market Outlook, by Application, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 8.2.1.1. Pharmaceuticals

- 8.2.1.2. Paints & Coatings

- 8.2.1.3. Electronics

- 8.2.1.4. Adhesives & Sealants

- 8.2.1.5. Plastic & Polymers

- 8.2.1.6. Others

- 8.2.2. BPS Analysis/Market Attractiveness Analysis

- 8.3. Latin America n-Heptane Market Outlook, by Country, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 8.3.1. Key Highlights

- 8.3.1.1. Brazil n-Heptane Market by Product Type, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 8.3.1.2. Brazil n-Heptane Market Application, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 8.3.1.3. Mexico n-Heptane Market by Product Type, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 8.3.1.4. Mexico n-Heptane Market Application, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 8.3.1.5. Argentina n-Heptane Market by Product Type, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 8.3.1.6. Argentina n-Heptane Market Application, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 8.3.1.7. Rest of Latin America n-Heptane Market by Product Type, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 8.3.1.8. Rest of Latin America n-Heptane Market Application, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 8.3.2. BPS Analysis/Market Attractiveness Analysis

- 8.3.1. Key Highlights

9. Middle East & Africa n-Heptane Market Outlook, 2018 - 2031

- 9.1. Middle East & Africa n-Heptane Market Outlook, by Product Type, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 9.1.1. Key Highlights

- 9.1.1.1.1. <95%

- 9.1.1.1.2. 95-99%

- 9.1.1.1.3. >=99%

- 9.1.1. Key Highlights

- 9.2. Middle East & Africa n-Heptane Market Outlook, by Application, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 9.2.1. Key Highlights

- 9.2.1.1. Pharmaceuticals

- 9.2.1.2. Paints & Coatings

- 9.2.1.3. Electronics

- 9.2.1.4. Adhesives & Sealants

- 9.2.1.5. Plastic & Polymers

- 9.2.1.6. Others

- 9.2.2. BPS Analysis/Market Attractiveness Analysis

- 9.2.1. Key Highlights

- 9.3. Middle East & Africa n-Heptane Market Outlook, by Country, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 9.3.1. Key Highlights

- 9.3.1.1. GCC n-Heptane Market by Product Type, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 9.3.1.2. GCC n-Heptane Market Application, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 9.3.1.3. South Africa n-Heptane Market by Product Type, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 9.3.1.4. South Africa n-Heptane Market Application, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 9.3.1.5. Egypt n-Heptane Market by Product Type, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 9.3.1.6. Egypt n-Heptane Market Application, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 9.3.1.7. Nigeria n-Heptane Market by Product Type, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 9.3.1.8. Nigeria n-Heptane Market Application, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 9.3.1.9. Rest of Middle East & Africa n-Heptane Market by Product Type, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 9.3.1.10. Rest of Middle East & Africa n-Heptane Market Application, Volume (Tons) and Value (US$ Bn), 2018 - 2031

- 9.3.2. BPS Analysis/Market Attractiveness Analysis

- 9.3.1. Key Highlights

10. Competitive Landscape

- 10.1. Purity vs Application Heatmap

- 10.2. Manufacturer vs Application Heatmap

- 10.3. Company Market Share Analysis, 2024

- 10.4. Competitive Dashboard

- 10.5. Company Profiles

- 10.5.1. Exxon Mobil Corporation

- 10.5.1.1. Company Overview

- 10.5.1.2. Product Portfolio

- 10.5.1.3. Financial Overview

- 10.5.1.4. Business Strategies and Development

- 10.5.1.5. Royal Dutch Shell plc.

- 10.5.1.6. SK Global Chemical Co., Ltd.

- 10.5.1.7. Haltermann Carless Deutschland GmbH

- 10.5.1.8. Chevron Phillips Chemical Company

- 10.5.1.9. Sankyo Chemical Co. Ltd.

- 10.5.1.10. Hanwha Total Petrochemical Company Limited

- 10.5.1.11. DHC Solvent Chemie GmbH

- 10.5.1.12. Mehta Petro-Refineries Limited

- 10.5.1.13. Merck Millipore Limited

- 10.5.1.14. Gadiv Petrochemical Industries Ltd.

- 10.5.1.15. Chuzhou Runda Solvents Co.

- 10.5.1. Exxon Mobil Corporation

11. Appendix

- 11.1. Research Methodology

- 11.2. Report Assumptions

- 11.3. Acronyms and Abbreviations