|

|

市場調査レポート

商品コード

1303511

商用ドローンの世界市場 (2023-2030年):産業分析・規模・シェア・成長率・動向・予測Commercial Drones Market - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast 2023-2030 |

||||||

|

|||||||

| 商用ドローンの世界市場 (2023-2030年):産業分析・規模・シェア・成長率・動向・予測 |

|

出版日: 2023年07月03日

発行: Fairfield Market Research

ページ情報: 英文 180 Pages

納期: 2~5営業日

|

- 全表示

- 概要

- 目次

無人航空機(UAV)としても知られる商用ドローンの世界市場は、さまざまな業界で急激な成長を遂げています。当初は軍事作戦で使用されていたこれらのドローンは現在、エンターテインメント、サプライチェーン、建設、セキュリティなどの分野で高い需要があります。商用ドローンは、救援任務や災害評価でその価値が証明されたため、eコマース用途としても政府の承認を受けました。これらの要因が市場を牽引しており、世界の商用ドローン産業は有望な成長を示すと予測されています。

当レポートでは、世界の商用ドローンの市場を調査し、市場概要、市場影響因子の分析、関連法規制、技術動向、需給動向、生産・貿易統計、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 エグゼクティブサマリー

- 世界の商用ドローン市場のスナップショット

- 主要市場動向

- 将来の予測

- アナリストによる提言

第2章 市場概要

- 市場の定義・分類

- 市場力学

- 促進要因

- 抑制要因

- 市場機会マトリックス

- バリューチェーン分析

- ポーターのファイブフォース分析

- COVID-19の影響分析

- 政府規制

- 技術情勢

- 世界のドローン市場- 概要

- 経済分析

- PESTLE

第3章 生産高統計

- 主なハイライト

- 北米

- 欧州

- アジア太平洋

- 中国

- その他の地域

第4章 価格動向の分析・将来のプロジェクト

- 主なハイライト

- 価格に影響を与える主な要因

- 製品別

- 地域別

第5章 世界の商用ドローン市場の展望

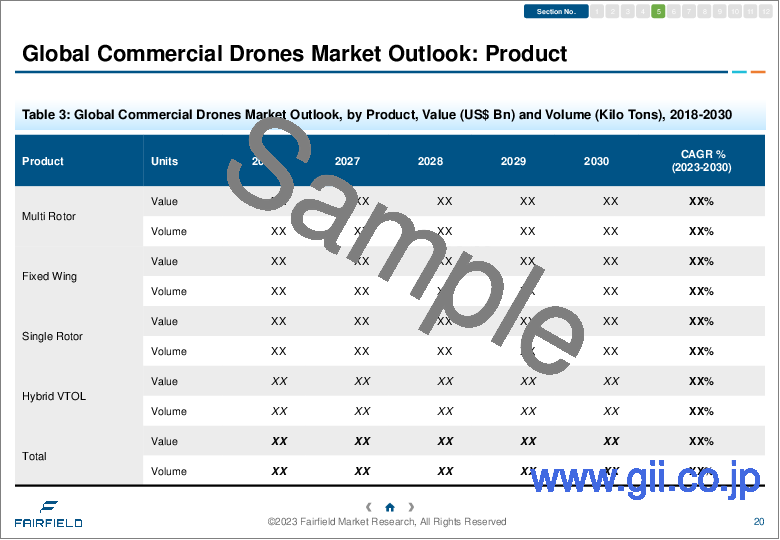

- 世界の商用ドローン市場の展望:製品別

- 主なハイライト

- 世界の商用ドローン市場の展望:用途別

- 主なハイライト

- 世界の商用ドローン市場の展望:地域別

- 主なハイライト

- BPS分析・市場魅力度分析

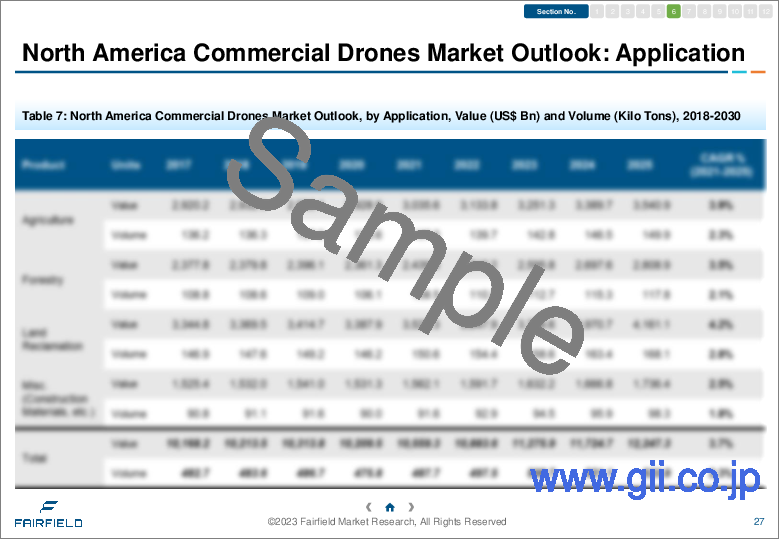

第6章 北米の商用ドローン市場の展望

第7章 欧州の商用ドローン市場の展望

第8章 アジア太平洋の商用ドローン市場の展望

第9章 ラテンアメリカの商用ドローン市場の展望

第10章 中東・アフリカの商用ドローン市場の展望

第11章 競合情勢

- 企業の市場シェア分析

- 競合ダッシュボード

- 企業プロファイル

- SZ DJI Technology Co., Ltd.

- Insitu Inc.

- Skydio Inc.

- Kespry

- Hoverfly Technologies, Inc.

- Ehang Inc.

- Yuneec International

- Parrot SA

- Delair

- AeroVironment, Inc.

- Autel Robotics

- SwellPro Technology LTD.

- Freefly Systems

- Xiaomi

- HighGreat

第12章 付録

The global market for commercial drones, also known as unmanned aerial vehicles (UAVs), is experiencing rapid growth across various industries. These drones, initially used in military operations, are now in high demand in sectors such as entertainment, supply chain, construction, and security. Commercial drones come in different types, including remote-operated, semi-autonomous, and fully autonomous variants. While remote-operated drones are most common, there is a significant focus on testing and developing autonomous models. Commercial drones have proven their value in relief missions and disaster assessment, leading to government approvals for e-commerce applications. With these factors driving the market, the global commercial drones industry is poised for promising growth.

Expanding Application Pool Drives Market Growth:

As drone technology advances, industries are eager to leverage its capabilities. Commercial drones find applications in aerial photography, filmmaking, surveillance, mapping, precision agriculture, and more. The logistics and supply chain sector is investing in drone technology to enhance delivery systems. Governments are using drones for wildlife monitoring and anti-poaching efforts. These diverse applications are projected to positively impact the global commercial drones market.

Increased Demand for Fully Autonomous Drones:

The market is witnessing a growing interest in fully autonomous commercial drones. Stakeholders are recognizing the potential of this technology, integrating advanced artificial intelligence and IoT capabilities. Fully autonomous drones can operate beyond visual line of sight (BVLOS) areas and are suitable for inspecting railroads, bridges, power plants, and other infrastructure. With the expanding application pool, more industries are expected to adopt fully autonomous drones, presenting lucrative opportunities in the market.

Supportive Government Norms and Technological Innovations Sustain North America's Market Leadership:

North America leads the commercial drones market, benefiting from favorable government initiatives, a robust tech industry, and reliable infrastructure. The region has been at the forefront of approving commercial UAVs for various applications and is home to several industry leaders. The supportive legal framework further solidifies North America's position as the leading regional market. In Asia Pacific, positive developments in drone technology and legal frameworks are promoting market growth.

Leading Market Participants:

Key players actively involved in the global commercial drones market include: Intel Corporation, Autel Robotics, 3D Robotics Inc., Aeronavics Ltd., Teal Drones, Skydio Inc., Holy Stone, FLIR Systems, Parrot Group, and Ehang Holdings Limited. These companies are making substantial investments in advancing fully autonomous drone technologies.

Table of Contents

1. Executive Summary

- 1.1. Global Commercial Drones Market Snapshot

- 1.2. Key Market Trends

- 1.3. Future Projections

- 1.4. Analyst Recommendations

2. Market Overview

- 2.1. Market Definitions and Segmentations

- 2.2. Market Dynamics

- 2.2.1. Drivers

- 2.2.1.1. Driver A

- 2.2.1.2. Driver B

- 2.2.1.3. Driver C

- 2.2.2. Restraints

- 2.2.2.1. Restraint 1

- 2.2.2.2. Restraint 2

- 2.2.3. Market Opportunities Matrix

- 2.2.1. Drivers

- 2.3. Value Chain Analysis

- 2.4. Porter's Five Forces Analysis

- 2.5. Covid-19 Impact Analysis

- 2.5.1. Pre-covid and Post-covid Scenario

- 2.5.2. Supply Impact

- 2.5.3. Demand Impact

- 2.6. Government Regulations

- 2.7. Technology Landscape

- 2.8. Global Drones Market - Overview

- 2.9. Economic Analysis

- 2.10. PESTLE

3. Production Output Statistics, 2019 - 2023

- 3.1. Key Highlights

- 3.2. North America

- 3.3. Europe

- 3.4. Asia Pacific

- 3.4.1. China

- 3.5. Rest of the World

4. Price Trends Analysis and Future Projects, 2019 - 2030

- 4.1. Key Highlights

- 4.2. Prominent Factors Affecting Prices

- 4.3. By Product

- 4.4. By Region

5. Global Commercial Drones Market Outlook, 2019 - 2030

- 5.1. Global Commercial Drones Market Outlook, by Product, Value (US$ Mn) and Volume (Units), 2019 - 2030

- 5.1.1. Key Highlights

- 5.1.1.1. Multi Rotor

- 5.1.1.2. Fixed Wing

- 5.1.1.3. Single Rotor

- 5.1.1.4. Hybrid VTOL

- 5.1.1. Key Highlights

- 5.2. Global Commercial Drones Market Outlook, by Application, Value (US$ Mn) and Volume (Units), 2019 - 2030

- 5.2.1. Key Highlights

- 5.2.1.1. Surveillance and Monitoring

- 5.2.1.2. Mapping & Surveying

- 5.2.1.3. Inspection & Maintenance

- 5.2.1.4. Precision Agriculture

- 5.2.1.5. Delivery & Logistics

- 5.2.1.6. Filming & Photography

- 5.2.1.7. Misc.

- 5.2.1. Key Highlights

- 5.3. Global Commercial Drones Market Outlook, by Region, Value (US$ Mn) and Volume (Units), 2019 - 2030

- 5.3.1. Key Highlights

- 5.3.1.1. North America

- 5.3.1.2. Europe

- 5.3.1.3. Asia Pacific

- 5.3.1.4. Latin America

- 5.3.1.5. Middle East & Africa

- 5.3.2. BPS Analysis/Market Attractiveness Analysis

- 5.3.1. Key Highlights

6. North America Commercial Drones Market Outlook, 2019 - 2030

- 6.1. North America Commercial Drones Market Outlook, by Product, Value (US$ Mn) and Volume (Units), 2019 - 2030

- 6.1.1. Key Highlights

- 6.1.1.1. Multi Rotor

- 6.1.1.2. Fixed Wing

- 6.1.1.3. Single Rotor

- 6.1.1.4. Hybrid VTOL

- 6.1.1. Key Highlights

- 6.2. North America Commercial Drones Market Outlook, by Application, Value (US$ Mn) and Volume (Units), 2019 - 2030

- 6.2.1. Key Highlights

- 6.2.1.1. Surveillance and Monitoring

- 6.2.1.2. Mapping & Surveying

- 6.2.1.3. Inspection & Maintenance

- 6.2.1.4. Precision Agriculture

- 6.2.1.5. Delivery & Logistics

- 6.2.1.6. Filming & Photography

- 6.2.1.7. Misc.

- 6.2.1. Key Highlights

- 6.3. North America Commercial Drones Market Outlook, by Country, Value (US$ Mn) and Volume (Units), 2019 - 2030

- 6.3.1. Key Highlights

- 6.3.1.1. U.S.

- 6.3.1.2. Canada

- 6.3.2. BPS Analysis/Market Attractiveness Analysis

- 6.3.1. Key Highlights

7. Europe Commercial Drones Market Outlook, 2019 - 2030

- 7.1. Europe Commercial Drones Market Outlook, by Product, Value (US$ Mn) and Volume (Units), 2019 - 2030

- 7.1.1. Key Highlights

- 7.1.1.1. Multi Rotor

- 7.1.1.2. Fixed Wing

- 7.1.1.3. Single Rotor

- 7.1.1.4. Hybrid VTOL

- 7.1.1. Key Highlights

- 7.2. Europe Commercial Drones Market Outlook, by Application, Value (US$ Mn) and Volume (Units), 2019 - 2030

- 7.2.1. Key Highlights

- 7.2.1.1. Surveillance and Monitoring

- 7.2.1.2. Mapping & Surveying

- 7.2.1.3. Inspection & Maintenance

- 7.2.1.4. Precision Agriculture

- 7.2.1.5. Delivery & Logistics

- 7.2.1.6. Filming & Photography

- 7.2.1.7. Misc.

- 7.2.1. Key Highlights

- 7.3. Europe Commercial Drones Market Outlook, by Country, Value (US$ Mn) and Volume (Units), 2019 - 2030

- 7.3.1. Key Highlights

- 7.3.1.1. Germany

- 7.3.1.2. France

- 7.3.1.3. U.K.

- 7.3.1.4. Italy

- 7.3.1.5. Spain

- 7.3.1.6. Russia

- 7.3.1.7. Rest of Europe

- 7.3.2. BPS Analysis/Market Attractiveness Analysis

- 7.3.1. Key Highlights

8. Asia Pacific Commercial Drones Market Outlook, 2019 - 2030

- 8.1. Asia Pacific Commercial Drones Market Outlook, by Product, Value (US$ Mn) and Volume (Units), 2019 - 2030

- 8.1.1. Key Highlights

- 8.1.1.1. Multi Rotor

- 8.1.1.2. Fixed Wing

- 8.1.1.3. Single Rotor

- 8.1.1.4. Hybrid VTOL

- 8.1.1. Key Highlights

- 8.2. Asia Pacific Commercial Drones Market Outlook, by Application, Value (US$ Mn) and Volume (Units), 2019 - 2030

- 8.2.1. Key Highlights

- 8.2.1.1. Surveillance and Monitoring

- 8.2.1.2. Mapping & Surveying

- 8.2.1.3. Inspection & Maintenance

- 8.2.1.4. Precision Agriculture

- 8.2.1.5. Delivery & Logistics

- 8.2.1.6. Filming & Photography

- 8.2.1.7. Misc.

- 8.2.1. Key Highlights

- 8.3. Asia Pacific Commercial Drones Market Outlook, by Country, Value (US$ Mn) and Volume (Units), 2019 - 2030

- 8.3.1. Key Highlights

- 8.3.1.1. China

- 8.3.1.2. Japan

- 8.3.1.3. South Korea

- 8.3.1.4. India

- 8.3.1.5. Southeast Asia

- 8.3.1.6. Rest of Asia Pacific

- 8.3.2. BPS Analysis/Market Attractiveness Analysis

- 8.3.1. Key Highlights

9. Latin America Commercial Drones Market Outlook, 2019 - 2030

- 9.1. Latin America Commercial Drones Market Outlook, by Product, Value (US$ Mn) and Volume (Units), 2019 - 2030

- 9.1.1. Key Highlights

- 9.1.1.1. Multi Rotor

- 9.1.1.2. Fixed Wing

- 9.1.1.3. Single Rotor

- 9.1.1.4. Hybrid VTOL

- 9.1.1. Key Highlights

- 9.2. Latin America Commercial Drones Market Outlook, by Application, Value (US$ Mn) and Volume (Units), 2019 - 2030

- 9.2.1. Key Highlights

- 9.2.1.1. Surveillance and Monitoring

- 9.2.1.2. Mapping & Surveying

- 9.2.1.3. Inspection & Maintenance

- 9.2.1.4. Precision Agriculture

- 9.2.1.5. Delivery & Logistics

- 9.2.1.6. Filming & Photography

- 9.2.1.7. Misc.

- 9.2.1. Key Highlights

- 9.3. Latin America Commercial Drones Market Outlook, by Country, Value (US$ Mn) and Volume (Units), 2019 - 2030

- 9.3.1. Key Highlights

- 9.3.1.1. Brazil

- 9.3.1.2. Mexico

- 9.3.1.3. Rest of Latin America

- 9.3.2. BPS Analysis/Market Attractiveness Analysis

- 9.3.1. Key Highlights

10. Middle East & Africa Commercial Drones Market Outlook, 2019 - 2030

- 10.1. Middle East & Africa Commercial Drones Market Outlook, by Product, Value (US$ Mn) and Volume (Units), 2019 - 2030

- 10.1.1. Key Highlights

- 10.1.1.1. Multi Rotor

- 10.1.1.2. Fixed Wing

- 10.1.1.3. Single Rotor

- 10.1.1.4. Hybrid VTOL

- 10.1.1. Key Highlights

- 10.2. Middle East & Africa Commercial Drones Market Outlook, by Application, Value (US$ Mn) and Volume (Units), 2019 - 2030

- 10.2.1. Key Highlights

- 10.2.1.1. Surveillance and Monitoring

- 10.2.1.2. Mapping & Surveying

- 10.2.1.3. Inspection & Maintenance

- 10.2.1.4. Precision Agriculture

- 10.2.1.5. Delivery & Logistics

- 10.2.1.6. Filming & Photography

- 10.2.1.7. Misc.

- 10.2.1. Key Highlights

- 10.3. Middle East & Africa Commercial Drones Market Outlook, by Country, Value (US$ Mn) and Volume (Units), 2019 - 2030

- 10.3.1. Key Highlights

- 10.3.1.1. GCC

- 10.3.1.2. South Africa

- 10.3.1.3. Rest of Middle East & Africa

- 10.3.2. BPS Analysis/Market Attractiveness Analysis

- 10.3.1. Key Highlights

11. Competitive Landscape

- 11.1. Company Market Share Analysis, 2022

- 11.2. Competitive Dashboard

- 11.3. Company Profiles

- 11.3.1. SZ DJI Technology Co., Ltd.

- 11.3.1.1. Company Overview

- 11.3.1.2. Product Portfolio

- 11.3.1.3. Financial Overview

- 11.3.1.4. Business Strategies and Development

- 11.3.2. Insitu Inc.

- 11.3.3. Skydio Inc.

- 11.3.4. Kespry

- 11.3.5. Hoverfly Technologies, Inc.

- 11.3.6. Ehang Inc.

- 11.3.7. Yuneec International

- 11.3.8. Parrot SA

- 11.3.9. Delair

- 11.3.10. AeroVironment, Inc.

- 11.3.11. Autel Robotics

- 11.3.12. SwellPro Technology LTD.

- 11.3.13. Freefly Systems

- 11.3.14. Xiaomi

- 11.3.15. HighGreat

- 11.3.1. SZ DJI Technology Co., Ltd.

12. Appendix

- 12.1. Research Methodology

- 12.2. Report Assumptions

- 12.3. Acronyms and Abbreviations