|

|

市場調査レポート

商品コード

1303476

大型トラック市場 - 世界の業界分析、規模、シェア、成長、動向、予測(2023年~2030年)- クラス別、燃料タイプ別、エンドユーザー別、地域別(北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ)Heavy Trucks Market - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast 2023-2030 - By Product, Technology, Grade, Application, End-user, Region: (North America, Europe, Asia Pacific, Latin America and Middle East and Africa) |

||||||

| 大型トラック市場 - 世界の業界分析、規模、シェア、成長、動向、予測(2023年~2030年)- クラス別、燃料タイプ別、エンドユーザー別、地域別(北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ) |

|

出版日: 2023年07月03日

発行: Fairfield Market Research

ページ情報: 英文 220 Pages

納期: 2~5営業日

|

- 全表示

- 概要

- 目次

大規模な物資輸送と流通のための大型トラックの需要は、特に急速な工業化が進む発展途上国において、世界的に著しい伸びを示しています。建築・建設、輸送・物流、鉱業・インフラ、eコマースなどの産業はかつてない成長を遂げており、貨物積載能力の高い大型車両への依存度を高めています。

当レポートでは、世界の大型トラック市場について調査し、市場の概要とともに、クラス別、燃料タイプ別、エンドユーザー別、地域別動向、および市場に参入する企業の競合動向などを提供しています。

目次

第1章 エグゼクティブサマリー

第2章 市場概要

- 市場の定義とセグメンテーション

- 市場力学

- バリューチェーン分析

- ポーターのファイブフォース分析

- COVID-19の影響分析

- 政府の規制

- 技術情勢

- 経済分析

- PESTLE

第3章 生産高と貿易統計、2018年~2021年

第4章 価格動向分析と将来のプロジェクト、2018年~2029年

第5章 世界の大型トラック市場の見通し、2018年~2029年

- 世界の大型トラック市場の見通し、クラス別、2018年~2029年

- 世界の大型トラック市場の見通し、燃料タイプ別、2018年~2029年

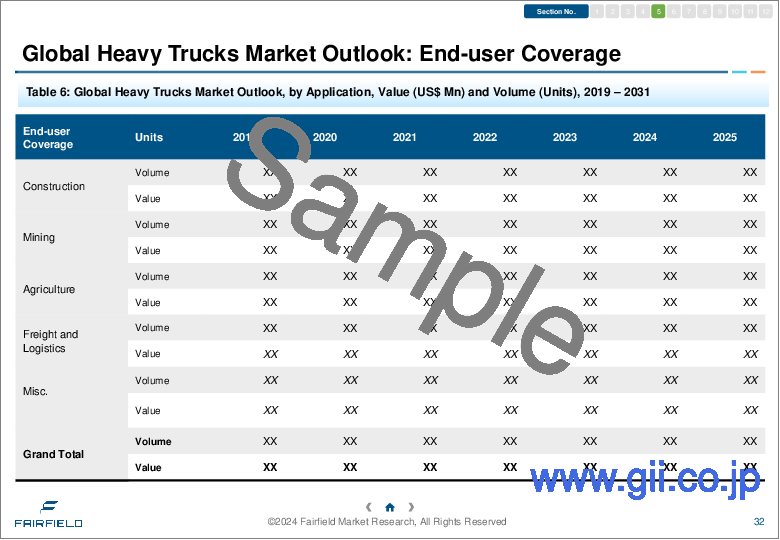

- 世界の大型トラック市場の見通し、エンドユーザー別、2018年~2029年

- 世界の大型トラック市場の見通し、地域別、2018年~2029年

第6章 北米の大型トラック市場の見通し、2018年~2029年

第7章 欧州の大型トラック市場の見通し、2018年~2029年

第8章 アジア太平洋の大型トラック市場の見通し、2018年~2029年

第9章 ラテンアメリカの大型トラック市場の見通し、2018年~2029年

第10章 中東・アフリカの大型トラック市場の見通し、2018年~2029年

第11章 競合情勢

- 企業の市場シェア分析、2021年

- 競争力ダッシュボード

- 企業プロファイル

- Daimler Trucks

- Volvo Global Trucks

- Paccar

- Dongfeng

- FAW Group

- Scania AB

- Beijing Automotive Group Co. Ltd. (BAIC)

- MAN SE

- Hino Motors

- Iveco

- Navistar

- Shaanxi Automobile Holding Group

- KAMAZ

- Sinotruk Group (CNHTC)

- TATA Motors

第12章 付録

The demand for heavy trucks for large-scale material transportation and distribution is witnessing significant growth worldwide, particularly in developing nations undergoing rapid industrialization. Industries such as building and construction, transportation and logistics, mining and infrastructure, and e-commerce are experiencing unprecedented growth, leading to an increased reliance on heavy-duty vehicles with high cargo-carrying capacities. A forthcoming study by Fairfield Market Research highlights the crucial role of supply chain and logistics developments in driving the growth of the global heavy trucks market.

Rise in Demand for Electric and Hybrid Electric Heavy Trucks:

The global shift towards e-mobility has been influencing both passenger and commercial vehicles. Original Equipment Manufacturers (OEMs) are focusing on hybrid commercial vehicles to reduce emissions and combat air pollution. Multiple brands have introduced electric and hybrid electric heavy trucks to the market, which are gaining traction. The growing adoption of fully electric and hybrid electric heavy trucks and other commercial vehicles for various daily operations holds promising prospects for the heavy trucks market in the future.

Impact of Auto Industry Mega Trends on Heavy Truck Fleets:

Technological advancements are disrupting industries worldwide, including the automotive heavy-duty vehicles sector. The Logistics, Electrification, Autonomous, and Digitalization (LEAD) trend has been revolutionary in the automotive industry and is set to bring radical developments, particularly in the heavy trucks segment. The rapid progress of the logistics industry is expected to significantly influence the growth of heavy truck fleets. The next anticipated innovation in the realm of automation and digitalization is driverless heavy trucks. These and other industry trend waves are likely to provide a strong impetus to the global heavy trucks market in the future.

Asia Pacific as the Epicenter of Opportunities in the Heavy Trucks Market:

The Asian subcontinent, characterized by robust auto manufacturing and registration rates, will continue to represent the most lucrative market for heavy truck manufacturers and other heavy commercial vehicles. The region benefits from a favorable business environment, including cheaper labor availability and abundant raw materials, which further strengthens the key end-use industries such as building and construction, logistics, and transportation. This contributes to the growth of the heavy trucks market, with significant opportunities arising in Asia's heavy-duty operations segment. Industrialization and infrastructure developments in key countries of the Asia Pacific have been instrumental in driving the growth of the heavy trucks market.

Key Competitors in the Heavy Trucks Market:

Major players such as Daimler AG, Tata Motors, Volvo Trucks, Isuzu Motors Ltd., Eicher Motors Limited, and Ashok Leyland will undergo detailed financial and strategic profiling in the forthcoming heavy trucks market report.

Table of Contents

1. Executive Summary

- 1.1. Global Heavy Trucks Market Snapshot

- 1.2. Key Market Trends

- 1.3. Future Projections

- 1.4. Analyst Recommendations

2. Market Overview

- 2.1. Market Definitions and Segmentations

- 2.2. Market Dynamics

- 2.2.1. Drivers

- 2.2.1.1. Driver A

- 2.2.1.2. Driver B

- 2.2.1.3. Driver C

- 2.2.2. Restraints

- 2.2.2.1. Restraint 1

- 2.2.2.2. Restraint 2

- 2.2.3. Market Opportunities Matrix

- 2.2.1. Drivers

- 2.3. Value Chain Analysis

- 2.4. Porter's Five Forces Analysis

- 2.5. Covid-19 Impact Analysis

- 2.5.1. Pre-covid and Post-covid Scenario

- 2.5.2. Supply Impact

- 2.5.3. Demand Impact

- 2.6. Government Regulations

- 2.7. Technology Landscape

- 2.8. Economic Analysis

- 2.9. PESTLE

3. Production Output and Trade Statistics, 2018 - 2021

- 3.1. Regional Production Statistics

- 3.1.1. North America

- 3.1.2. Europe

- 3.1.3. Asia Pacific

- 3.1.4. Latin America

- 3.1.5. Middle East & Africa

- 3.2. Trade Statistics

4. Price Trends Analysis and Future Projects, 2018 - 2029

- 4.1. Key Highlights

- 4.2. Prominent Factors Affecting Prices

- 4.3. By Class

- 4.4. By Region

5. Global Heavy Trucks Market Outlook, 2018 - 2029

- 5.1. Global Heavy Trucks Market Outlook, by Class, Volume ('000 Units) and Value (US$ Mn), 2018 - 2029

- 5.1.1. Key Highlights

- 5.1.1.1. Class 7

- 5.1.1.2. Class 8

- 5.1.1.3. Class 9

- 5.1.1. Key Highlights

- 5.2. Global Heavy Trucks Market Outlook, by Fuel Type, Volume ('000 Units) and Value (US$ Mn), 2018 - 2029

- 5.2.1. Key Highlights

- 5.2.1.1. Diesel

- 5.2.1.2. Petrol

- 5.2.1.3. Alternate Fuels

- 5.2.1.4. Hybrid Electric

- 5.2.1.5. Electrically Chargeable

- 5.2.1. Key Highlights

- 5.3. Global Heavy Trucks Market Outlook, by End-user, Volume ('000 Units) and Value (US$ Mn), 2018 - 2029

- 5.3.1. Key Highlights

- 5.3.1.1. Construction

- 5.3.1.2. Mining

- 5.3.1.3. Agriculture

- 5.3.1.4. Freight and Logistics

- 5.3.1.5. Misc.

- 5.3.1. Key Highlights

- 5.4. Global Heavy Trucks Market Outlook, by Region, Volume ('000 Units) and Value (US$ Mn), 2018 - 2029

- 5.4.1. Key Highlights

- 5.4.1.1. North America

- 5.4.1.2. Europe

- 5.4.1.3. Asia Pacific

- 5.4.1.4. Latin America

- 5.4.1.5. Middle East & Africa

- 5.4.2. BPS Analysis/Market Attractiveness Analysis

- 5.4.1. Key Highlights

6. North America Heavy Trucks Market Outlook, 2018 - 2029

- 6.1. North America Heavy Trucks Market Outlook, by Class, Volume ('000 Units) and Value (US$ Mn), 2018 - 2029

- 6.1.1. Key Highlights

- 6.1.1.1. Class 7

- 6.1.1.2. Class 8

- 6.1.1.3. Class 9

- 6.1.1. Key Highlights

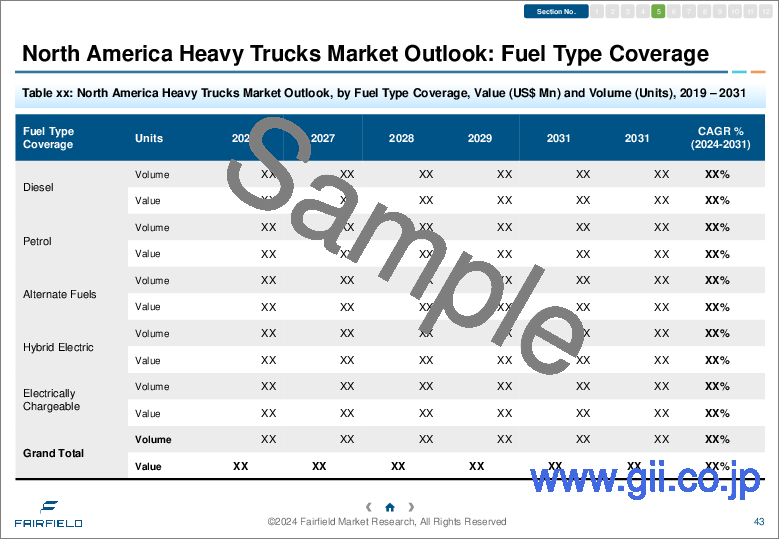

- 6.2. North America Heavy Trucks Market Outlook, by Fuel Type, Volume ('000 Units) and Value (US$ Mn), 2018 - 2029

- 6.2.1. Key Highlights

- 6.2.1.1. Diesel

- 6.2.1.2. Petrol

- 6.2.1.3. Alternate Fuels

- 6.2.1.4. Hybrid Electric

- 6.2.1.5. Electrically Chargeable

- 6.2.1. Key Highlights

- 6.3. North America Heavy Trucks Market Outlook, by End-user, Volume ('000 Units) and Value (US$ Mn), 2018 - 2029

- 6.3.1. Key Highlights

- 6.3.1.1. Construction

- 6.3.1.2. Mining

- 6.3.1.3. Agriculture

- 6.3.1.4. Freight and Logistics

- 6.3.1.5. Misc.

- 6.3.1. Key Highlights

- 6.4. North America Heavy Trucks Market Outlook, by Country, Volume ('000 Units) and Value (US$ Mn), 2018 - 2029

- 6.4.1. Key Highlights

- 6.4.1.1. U.S.

- 6.4.1.2. Canada

- 6.4.2. BPS Analysis/Market Attractiveness Analysis

- 6.4.1. Key Highlights

7. Europe Heavy Trucks Market Outlook, 2018 - 2029

- 7.1. Europe Heavy Trucks Market Outlook, by Class, Volume ('000 Units) and Value (US$ Mn), 2018 - 2029

- 7.1.1. Key Highlights

- 7.1.1.1. Class 7

- 7.1.1.2. Class 8

- 7.1.1.3. Class 9

- 7.1.1. Key Highlights

- 7.2. Europe Heavy Trucks Market Outlook, by Fuel Type, Volume ('000 Units) and Value (US$ Mn), 2018 - 2029

- 7.2.1. Key Highlights

- 7.2.1.1. Diesel

- 7.2.1.2. Petrol

- 7.2.1.3. Alternate Fuels

- 7.2.1.4. Hybrid Electric

- 7.2.1.5. Electrically Chargeable

- 7.2.1. Key Highlights

- 7.3. Europe Heavy Trucks Market Outlook, by End-user, Volume ('000 Units) and Value (US$ Mn), 2018 - 2029

- 7.3.1. Key Highlights

- 7.3.1.1. Construction

- 7.3.1.2. Mining

- 7.3.1.3. Agriculture

- 7.3.1.4. Freight and Logistics

- 7.3.1.5. Misc.

- 7.3.1. Key Highlights

- 7.4. Europe Heavy Trucks Market Outlook, by Country, Volume ('000 Units) and Value (US$ Mn), 2018 - 2029

- 7.4.1. Key Highlights

- 7.4.1.1. Germany

- 7.4.1.2. France

- 7.4.1.3. U.K.

- 7.4.1.4. Italy

- 7.4.1.5. Spain

- 7.4.1.6. Russia

- 7.4.1.7. Rest of Europe

- 7.4.2. BPS Analysis/Market Attractiveness Analysis

- 7.4.1. Key Highlights

8. Asia Pacific Heavy Trucks Market Outlook, 2018 - 2029

- 8.1. Asia Pacific Heavy Trucks Market Outlook, by Class, Volume ('000 Units) and Value (US$ Mn), 2018 - 2029

- 8.1.1. Key Highlights

- 8.1.1.1. Class 7

- 8.1.1.2. Class 8

- 8.1.1.3. Class 9

- 8.1.1. Key Highlights

- 8.2. Asia Pacific Heavy Trucks Market Outlook, by Fuel Type, Volume ('000 Units) and Value (US$ Mn), 2018 - 2029

- 8.2.1. Key Highlights

- 8.2.1.1. Diesel

- 8.2.1.2. Petrol

- 8.2.1.3. Alternate Fuels

- 8.2.1.4. Hybrid Electric

- 8.2.1.5. Electrically Chargeable

- 8.2.1. Key Highlights

- 8.3. Asia Pacific Heavy Trucks Market Outlook, by End-user, Volume ('000 Units) and Value (US$ Mn), 2018 - 2029

- 8.3.1. Key Highlights

- 8.3.1.1. Construction

- 8.3.1.2. Mining

- 8.3.1.3. Agriculture

- 8.3.1.4. Freight and Logistics

- 8.3.1.5. Misc.

- 8.3.1. Key Highlights

- 8.4. Asia Pacific Heavy Trucks Market Outlook, by Country, Volume ('000 Units) and Value (US$ Mn), 2018 - 2029

- 8.4.1. Key Highlights

- 8.4.1.1. China

- 8.4.1.2. Japan

- 8.4.1.3. South Korea

- 8.4.1.4. India

- 8.4.1.5. Southeast Asia

- 8.4.1.6. Rest of Asia Pacific

- 8.4.2. BPS Analysis/Market Attractiveness Analysis

- 8.4.1. Key Highlights

9. Latin America Heavy Trucks Market Outlook, 2018 - 2029

- 9.1. Latin America Heavy Trucks Market Outlook, by Class, Volume ('000 Units) and Value (US$ Mn), 2018 - 2029

- 9.1.1. Key Highlights

- 9.1.1.1. Class 7

- 9.1.1.2. Class 8

- 9.1.1.3. Class 9

- 9.1.1. Key Highlights

- 9.2. Latin America Heavy Trucks Market Outlook, by Fuel Type, Volume ('000 Units) and Value (US$ Mn), 2018 - 2029

- 9.2.1. Key Highlights

- 9.2.1.1. Diesel

- 9.2.1.2. Petrol

- 9.2.1.3. Alternate Fuels

- 9.2.1.4. Hybrid Electric

- 9.2.1.5. Electrically Chargeable

- 9.2.1. Key Highlights

- 9.3. Latin America Heavy Trucks Market Outlook, by End-user, Volume ('000 Units) and Value (US$ Mn), 2018 - 2029

- 9.3.1. Key Highlights

- 9.3.1.1. Construction

- 9.3.1.2. Mining

- 9.3.1.3. Agriculture

- 9.3.1.4. Freight and Logistics

- 9.3.1.5. Misc.

- 9.3.1. Key Highlights

- 9.4. Latin America Heavy Trucks Market Outlook, by Country, Volume ('000 Units) and Value (US$ Mn), 2018 - 2029

- 9.4.1. Key Highlights

- 9.4.1.1. Brazil

- 9.4.1.2. Mexico

- 9.4.1.3. Rest of Latin America

- 9.4.2. BPS Analysis/Market Attractiveness Analysis

- 9.4.1. Key Highlights

10. Middle East & Africa Heavy Trucks Market Outlook, 2018 - 2029

- 10.1. Middle East & Africa Heavy Trucks Market Outlook, by Class, Volume ('000 Units) and Value (US$ Mn), 2018 - 2029

- 10.1.1. Key Highlights

- 10.1.1.1. Class 7

- 10.1.1.2. Class 8

- 10.1.1.3. Class 9

- 10.1.1. Key Highlights

- 10.2. Middle East & Africa Heavy Trucks Market Outlook, by Fuel Type, Volume ('000 Units) and Value (US$ Mn), 2018 - 2029

- 10.2.1. Key Highlights

- 10.2.1.1. Diesel

- 10.2.1.2. Petrol

- 10.2.1.3. Alternate Fuels

- 10.2.1.4. Hybrid Electric

- 10.2.1.5. Electrically Chargeable

- 10.2.1. Key Highlights

- 10.3. Middle East & Africa Heavy Trucks Market Outlook, by End-user, Volume ('000 Units) and Value (US$ Mn), 2018 - 2029

- 10.3.1. Key Highlights

- 10.3.1.1. Construction

- 10.3.1.2. Mining

- 10.3.1.3. Agriculture

- 10.3.1.4. Freight and Logistics

- 10.3.1.5. Misc.

- 10.3.1. Key Highlights

- 10.4. Middle East & Africa Heavy Trucks Market Outlook, by Country, Volume ('000 Units) and Value (US$ Mn), 2018 - 2029

- 10.4.1. Key Highlights

- 10.4.1.1. GCC

- 10.4.1.2. South Africa

- 10.4.1.3. Rest of Middle East & Africa

- 10.4.2. BPS Analysis/Market Attractiveness Analysis

- 10.4.1. Key Highlights

11. Competitive Landscape

- 11.1. Company Market Share Analysis, 2021

- 11.2. Competitive Dashboard

- 11.3. Company Profiles

- 11.3.1. Daimler Trucks

- 11.3.1.1. Company Overview

- 11.3.1.2. Product Portfolio

- 11.3.1.3. Financial Overview

- 11.3.1.4. Business Strategies and Development

- 11.3.2. Volvo Global Trucks

- 11.3.3. Paccar

- 11.3.4. Dongfeng

- 11.3.5. FAW Group

- 11.3.6. Scania AB

- 11.3.7. Beijing Automotive Group Co. Ltd. (BAIC)

- 11.3.8. MAN SE

- 11.3.9. Hino Motors

- 11.3.10. Iveco

- 11.3.11. Navistar

- 11.3.12. Shaanxi Automobile Holding Group

- 11.3.13. KAMAZ

- 11.3.14. Sinotruk Group (CNHTC)

- 11.3.15. TATA Motors

- 11.3.1. Daimler Trucks

12. Appendix

- 12.1. Research Methodology

- 12.2. Report Assumptions

- 12.3. Acronyms and Abbreviations