|

|

市場調査レポート

商品コード

1173648

ワクチンの世界市場:業界分析(2019年~2021年)-成長動向と市場予測(2022年~2029年)Vaccines Market - Global Industry Analysis (2019 - 2022), Growth Trends, and Market Forecast (2023 - 2029) |

||||||

| ワクチンの世界市場:業界分析(2019年~2021年)-成長動向と市場予測(2022年~2029年) |

|

出版日: 2022年11月21日

発行: Fairfield Market Research

ページ情報: 英文 160 Pages

納期: 2~5営業日

|

- 全表示

- 概要

- 目次

世界のワクチンの市場規模は、2021年から2029年までの予測期間中のCAGRは11.2%(COVID-19ワクチンを含まない場合)、3.9%(COVID-19ワクチンを含む場合)になると予測されています。ワクチンメーカーや各国政府による投資の活発化は、市場の成長を促進しています。

当レポートでは、世界のワクチン市場について調査分析し、市場概要、市場の展望、競合情勢など、体系的な情報を提供しています。

目次

第1章 エグゼクティブサマリー

- 世界のワクチン市場の展望、金額(100万米ドル)および数量(投与数)(100万回)(2019年~2029年)

- 世界のワクチンの増加機会、金額(100万米ドル)および数量(100万回)(2019年~2029年)

- 重要ポイント

第2章 市場概要

- 市場のセグメンテーションと定義

- 市場力学

- 市場促進要因

- 市場抑制要因

- 市場機会

- COVID-19影響分析

第3章 ワクチン供給の力学

- ワクチン供給

第4章 ワクチンの価格分析

- ワクチン価格

- ワクチン価格の変更

第5章 世界のワクチン市場の展望(2019年~2029年):ワクチン別

- 主なハイライト

- 世界のワクチン市場の展望、金額(100万米ドル)および数量(100万回)(2019年~2029年):ワクチン別

- PCV

- D&T含有

- HPV

- 季節性インフルエンザ

- 帯状疱疹

- ロタウイルス

- 髄膜炎菌

- MCV

- 水痘

- COVID-19

- その他

- 世界のワクチン市場シェアとBPS(ベーシスポイント)分析(2023年および2029年):ワクチン別

- 世界のワクチン市場の魅力分析(2023年~2029年):ワクチン別

第6章 世界のワクチン市場の展望(2019年~2029年):国グループ別

- 主なハイライト

- 世界のワクチン市場の展望、金額(100万米ドル)および数量(100万回)(2019年~2029年):国グループ別

- PAHO RF(汎アメリカ保健機構)

- 自己調達HIC(高所得国)

- 自己調達MIC(中所得国)

- ユニセフ(GAVI-ワクチンと予防接種のための世界アライアンス)

- ユニセフ調達MIC(中所得国)

- 世界のワクチン市場シェアとBPS(ベーシスポイント)分析(2023年および2029年):国グループ別

- 世界のワクチン市場の魅力分析(2023年~2029年):国グループ別

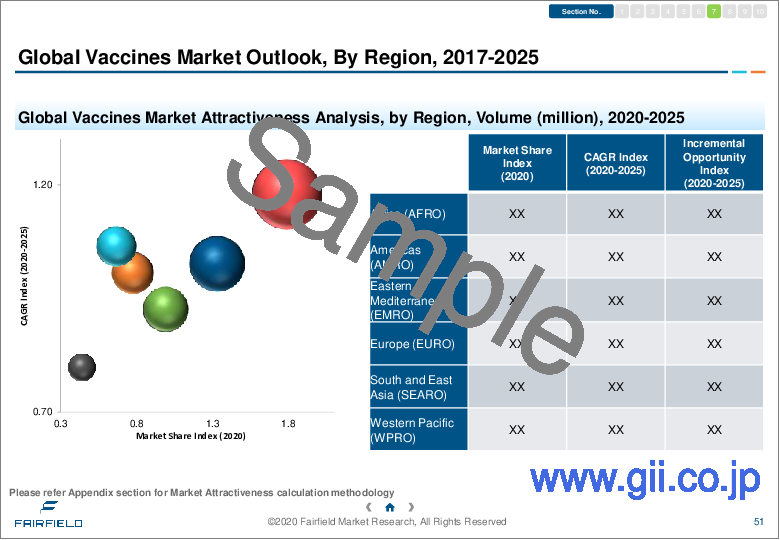

第7章 世界のワクチン市場の展望(2019年~2029年):地域別

- 主なハイライト

- 世界のワクチン市場の展望、金額(100万米ドル)および数量(100万回)(2019年~2029年):地域別

- アフリカ(アフロ)

- 南北アメリカ(AMRO)

- 東地中海(EMRO)

- 欧州(EURO)

- 南アジアおよび東アジア(SEARO)

- 西太平洋(WPRO)

- 世界のワクチン市場シェアとBPS(ベーシスポイント)分析(2023年および2029年):地域別

- 世界のワクチン市場の魅力分析(2023年~2029年):地域別

第8章 世界のワクチン市場の展望(2019年~2029年):企業別

- 主なハイライト

- 世界のワクチン市場の展望、金額(100万米ドル)および数量(100万回)(2019年~2029年):企業別

- AstraZeneca

- GlaxoSmithKline plc.

- Johnson & Johnson

- Merck & Co., Inc.

- Moderna, Inc.

- Novavax

- Pfizer Inc.

- Sanofi Pasteur

- その他

- 世界のワクチン市場シェアとBPS(ベーシスポイント)分析(2023年および2029年):企業別

第9章 競合情勢

- 企業の市場シェア分析

- 企業プロファイル

- CSL Limited (Seqirus)

- Emergent BioSolutions Inc.

- GlaxoSmithKline plc.

- Haffkine Bio-pharmaceutical Corporation Ltd.

- Merck & Co., Inc.

- Mitsubishi Tanabe Pharma Corporation

- Moderna

- Novavax

- Pfizer Inc.

- Sanofi Pasteur

- Serum Institute of India Pvt. Ltd.

- Sinopharm

第10章 付録

- 調査手法

- 頭字語と略語

Escalating investments by vaccine manufacturers, and governments from across the globe is predominantly driving the global vaccines market growth. This US$90 Bn market (2021) is projected to reach the valuation of US$82 Bn by the end of 2029. While vaccines market (excluding COVID-19 vaccine) is expected to demonstrate nearly 11.2% growth, the market (including COVID-19 vaccine) is likely to experience 3.9% growth through the end of forecast period. Epidemic, and pandemic situations like COVID-19 outbreak act as the key growth influencers for vaccines market, says a newly released market intelligence report of Fairfield Market Research.

Key Research Insights

- Combination vaccines remain a significant growth contributor to vaccines space

- Seasonal influenza vaccines slated for the fastest growth in demand by 2029 end

- Shingles vaccine category represents a highly lucrative segment projected for nearly 15.5% growth in demand toward 2029

- AMRO remains the top revenue contributor to vaccines market with nearly 50% share

- Vaccine manufacturers gained steadfast profits during the COVID-19 outbreak, causing a titanic spike in market revenue. Post-2021, vaccines market (including COVID-19 vaccine) will observe the anticipated decline as the pandemic situation has been subsiding

- A majority of market revenue remains concentrated within the top four - Pfizer, GSK, Sanofi, and Merck

- Seasonal Flu Vaccines Continue to Lead Global Vaccines Market, Shingles Vaccine and PCV in Demand

Pneumococcal diseases continue to be one of the mortality causes worldwide among both children, and adults. There has thus been an increasing consideration about including Pneumococcal Conjugate Vaccine (PCV) in regular immunization programs. This is likely to be a continuous booster to the PCV segment in vaccines market. The WHO suggests over 150 nations across the globe to have introduced PCV in their routine immunization programs. While this keeps PCV consumption afloat in the market, the projections also suggest more than 40 nations to be in a process of implementation of the same. This according to the report will act as a significant driving force for spike in demand for PCV in global vaccines market. Demand will prominently thrive across populous nations like India, Indonesia, and China. In addition, the Human Papilloma Virus (HPV) vaccine is also expected to witness a sharp increase in demand, says the report. On the other hand, demand for seasonal influenza vaccines is projected to remain buoyant and will see the fastest growth through 2029. Shingles vaccine demand is however poised for a solid double-digit growth during the period of forecast.

SEARO, and WPRO All Set for Phenomenal Growth in Global Vaccines Market

Asia Pacific remains a significant market, led by the fast-developing nations like China, and India. While these nations have been the largest vaccine producers and the trend will prevail throughout the period of projection. The report identifies a continuous demand surge across the South and East Asia (SEARO), as well as the Western Pacific (WPRO) region. On the flipside, the report also states that the conventional high-value markets such as the US, and Canada in addition to the Americas (AMRO) are likely to be the top revenue contributors to global vaccines market. These markets are expected to capture around 50% of the overall vaccines market valuation over the next few years. The report marks AMRO as the most prominent vaccines market as the region is characterized by the relatively high value for Influenza (adult), Varicella, meningococcal vaccines, and HPV.

Global Vaccines Market - Key Competitors

Pfizer, GSK, Sanofi, and Merck represent the world leaders in vaccines space and collectively hold command over more than 90% of the overall manufacturing. The report also highlights 60% volume share of Sanofi, GSK, Bharat Biotech International Limited, Serum Institute of India, and Haffkine in worldwide vaccines production. Some of the prominent players that have been covered for detailed competitive profiling and strategic analysis, include Mitsubishi Tanabe Pharma Corporation, CSL Limited (Seqirus), Moderna, Emergent BioSolutions Inc., Novavax, and Sinopharm.

Table of Contents

1. Executive Summary

- 1.1. Global Vaccines Market Outlook, Value (US$ Million) and Volume (Number of Doses) (Million), 2019 - 2029

- 1.2. Global Vaccines Incremental Opportunity, Value (US$ Million) and Volume (Million), 2019 - 2029

- 1.3. Key Takeaways

2. Market Overview

- 2.1. Market Segmentations and Definitions

- 2.2. Market Dynamics

- 2.2.1. Market Drivers

- 2.2.2. Market Restraints

- 2.2.3. Market Opportunities

- 2.3. COVID-19 Impact Analysis

3. Vaccines Supply Dynamics

- 3.1. Vaccines Supply

4. Vaccines Pricing Analysis

- 4.1. Vaccine Prices

- 4.2. Vaccine Price Changes

5. Global Vaccines Market Outlook, By Vaccine, 2019-2029

- 5.1. Key Highlights

- 5.2. Global Vaccines Market Outlook, by Vaccine, Value (US$ Million) and Volume (Million), 2019 - 2029

- 5.2.1. PCV

- 5.2.2. D&T-containing

- 5.2.3. HPV

- 5.2.4. Seasonal Influenza

- 5.2.5. Shingles

- 5.2.6. Rotavirus

- 5.2.7. Meningococcal

- 5.2.8. MCVs

- 5.2.9. Varicella

- 5.2.10. COVID-19

- 5.2.11. Others

- 5.3. Global Vaccines Market Share and BPS (Basis Points) Analysis, by Vaccine, 2023 and 2029

- 5.4. Global Vaccines Market Attractiveness Analysis, by Vaccine, 2023-2029

6. Global Vaccines Market Outlook, By Country Group , 2019-2029

- 6.1. Key Highlights

- 6.2. Global Vaccines Market Outlook, by Country Group, Value (US$ Million) and Volume (Million), 2019 - 2029

- 6.2.1. PAHO RF (Pan American Health Organization)

- 6.2.2. Self-procuring HICs (High Income Countries)

- 6.2.3. Self-procuring MICs (Middle Income Countries)

- 6.2.4. UNICEF (GAVI - Global Alliance for Vaccines and Immunizations)

- 6.2.5. UNICEF-procuring MICs (Middle Income Countries)

- 6.3. Global Vaccines Market Share and BPS (Basis Points) Analysis, by Country Group, 2023 and 2029

- 6.4. Global Vaccines Market Attractiveness Analysis, by Country Group, 2023-2029

7. Global Vaccines Market Outlook, By Region, 2019-2029

- 7.1. Key Highlights

- 7.2. Global Vaccines Market Outlook, by Region, Value (US$ Million) and Volume (million), 2019 - 2029

- 7.2.1. Africa (AFRO)

- 7.2.1.1. Market Share Analysis, By Vaccine, Value (US$ Million)

- 7.2.1.2. Market Share Analysis, By Dosage, value (US$ Million)

- 7.2.1.3. Market Share Analysis, By Procurement Method, Value (US$ Million)

- 7.2.1.4. Vaccines Supply and Pricing Analysis

- 7.2.1.5. List of Manufacturers in the Region, By Vaccine

- 7.2.2. Americas (AMRO)

- 7.2.2.1. Market Share Analysis, By Value (US$ Million)

- 7.2.2.2. Market Share Analysis, By Dosage (US$ Million)

- 7.2.2.3. Market Share Analysis, By Procurement Method (US$ Million)

- 7.2.2.4. Vaccines Supply and Pricing Analysis

- 7.2.2.5. List of Manufacturers in the Region, By Vaccine

- 7.2.3. Eastern Mediterranean (EMRO)

- 7.2.3.1. Market Share Analysis, By Value (US$ Million)

- 7.2.3.2. Market Share Analysis, By Dosage (US$ Million)

- 7.2.3.3. Market Share Analysis, By Procurement Method (US$ Million)

- 7.2.3.4. Vaccines Supply and Pricing Analysis

- 7.2.3.5. List of Manufacturers in the Region, By Vaccine

- 7.2.4. Europe (EURO)

- 7.2.4.1. Market Share Analysis, By Value (US$ Million)

- 7.2.4.2. Market Share Analysis, By Dosage (US$ Million)

- 7.2.4.3. Market Share Analysis, By Procurement Method (US$ Million)

- 7.2.4.4. Vaccines Supply and Pricing Analysis

- 7.2.4.5. List of Manufacturers in the Region, By Vaccine

- 7.2.5. South and East Asia (SEARO)

- 7.2.5.1. Market Share Analysis, By Value (US$ Million)

- 7.2.5.2. Market Share Analysis, By Dosage (US$ Million)

- 7.2.5.3. Market Share Analysis, By Procurement Method (US$ Million)

- 7.2.5.4. Vaccines Supply and Pricing Analysis

- 7.2.5.5. List of Manufacturers in the Region, By Vaccine

- 7.2.6. Western Pacific (WPRO)

- 7.2.6.1. Market Share Analysis, By Value (US$ Million)

- 7.2.6.2. Market Share Analysis, By Dosage (US$ Million)

- 7.2.6.3. Market Share Analysis, By Procurement Method (US$ Million)

- 7.2.6.4. Vaccines Supply and Pricing Analysis

- 7.2.6.5. List of Manufacturers in the Region, By Vaccine

- 7.2.1. Africa (AFRO)

- 7.3. Global Vaccines Market Share and BPS (Basis Points) Analysis, by Region, 2023 and 2029

- 7.4. Global Vaccines Market Attractiveness Analysis, by Region, 2023-2029

8. Global Vaccines Market Outlook, By Company, 2019-2029

- 8.1. Key Highlights

- 8.2. Global Vaccines Market Outlook, by Company, Value (US$ Million), 2019 - 2029

- 8.2.1. AstraZeneca

- 8.2.2. GlaxoSmithKline plc.

- 8.2.3. Johnson & Johnson

- 8.2.4. Merck & Co., Inc.

- 8.2.5. Moderna, Inc.

- 8.2.6. Novavax

- 8.2.7. Pfizer Inc.

- 8.2.8. Sanofi Pasteur

- 8.2.9. Others

- 8.2. Global Vaccines Market Share and BPS (Basis Points) Analysis, by Company, 2023 and 2029

9. Competitive Landscape

- 9.1. Company Market Share Analysis

- 9.2. Company Profiles

- 9.2.1. CSL Limited (Seqirus)

- 9.2.1.1. Company overview

- 9.2.1.2. Financial performance

- 9.2.1.3. Product Portfolio

- 9.2.1.4. Research and Development

- 9.2.1.5. Recent Developments

- 9.2.2. Emergent BioSolutions Inc.

- 9.2.3. GlaxoSmithKline plc.

- 9.2.4. Haffkine Bio-pharmaceutical Corporation Ltd.

- 9.2.5. Merck & Co., Inc.

- 9.2.6. Mitsubishi Tanabe Pharma Corporation

- 9.2.7. Moderna

- 9.2.8. Novavax

- 9.2.9. Pfizer Inc.

- 9.2.10. Sanofi Pasteur

- 9.2.11. Serum Institute of India Pvt. Ltd.

- 9.2.12. Sinopharm

- 9.2.1. CSL Limited (Seqirus)

10. Appendix

- 10.1. Research Methodology

- 10.2. Acronyms and Abbreviations