|

|

市場調査レポート

商品コード

1791928

量子センサーの世界市場(2026年~2046年)The Global Quantum Sensors Market 2026-2046 |

||||||

|

|||||||

| 量子センサーの世界市場(2026年~2046年) |

|

出版日: 2025年08月18日

発行: Future Markets, Inc.

ページ情報: 英文 285 Pages, 89 Tables, 50 Figures

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の量子センサー市場は2025年に勢いを増しており、この技術が研究室での研究から商業的な現実へと移行していることを示す、記録的な投資の波に乗っています。2025年の第1四半期には、量子技術全体で12億5,000万米ドルを超える資金調達が行われました。これは前年の2倍以上であり、量子コンピューティング企業が量子関連の資金調達の70%超を獲得しています。量子コンピューティングが大きな話題となる一方で、量子センシングは2030年代半ばまでに数十億米ドル規模に成長する可能性があり、量子革命の重大な要素となっています。

この成長軌道は、重ね合わせやエンタングルメントといった量子力学的現象を活用することで、医療診断から地質調査まで幅広い用途において、古典的なセンサーの能力をはるかに超える測定精度を実現するという、この技術のユニークな価値提案を反映しています。近年の資金調達のハイライトは、量子センシング用途に対する投資家の信頼が持続していることを示しています。チップベースの量子センサーを開発するバーリ大学のスピンオフ企業であるQSENSATOは、2025年5月にLIFTTとQuantum Italiaからプレシード資金として50万ユーロを調達し、脳イメージングや地質調査などの用途に向けた小型蒸気セル技術の開発を進めています。の2024年~2025年のその他の注目すべき投資としては、Q-CTRLの5,900万米ドルのSeries B-2ラウンド、Aquark TechnologiesのNATO Innovation Fund主導による500万ユーロのシード資金調達、学術機関と業界参入企業とのさまざまなパートナーシップなどがあります。

政府の取り組みは、戦略的資金調達プログラムを通じて市場の拡大を推進し続けています。中国は量子技術を含む最先端分野に1兆元(1,380億1,000万米ドル)を投入する計画を発表し、米国エネルギー省は量子コンピューティングプロジェクトに6,500万米ドルを割り当てました。National Quantum Initiative Reauthorization Actは5年間で27億米ドルの連邦政府資金を承認するもので、量子技術の戦略的重要性を明示しています。

市場情勢を見ると、成熟度の異なる技術セグメントが存在することがわかります。原子時計はもっとも成熟した部門であり、通信やナビゲーションシステムへの応用が確立されています。磁気センサー、特にSQUIDとNVベースの磁力計は、医療用途と先進材料の特性評価により、市場の大部分を占めています。量子重力計やRFセンサーなどの新技術は、特殊な用途で人気を集めています。

主な市場の課題としては、小型化された物理パッケージの量産化、幅広い採用に向けたコスト削減、従来の代替技術を超える価値を明確に示す特定用途向けソリューションの開発などがあります。技術成熟度の向上、企業の信頼性、地政学的な緊急性の収束により、量子センサーは変曲点を迎えています。技術が概念実証から商業展開へと移行する中、量子エコシステムへの多額の投資により、量子センサーは2030年までにさまざまな産業にわたる変革的可能性を実現する好条件が整っています。

当レポートでは、世界の量子センサー市場について調査し、複数の産業における量子センサー技術の変革的可能性を検証し、今後20年間の詳細な市場予測、競合情勢の分析、戦略的提言を提供しています。

目次

第1章 エグゼクティブサマリー

- 第1と第2の量子革命

- 現在の量子技術市場情勢

- 投資情勢

- 世界各国の政府の取り組み

- 産業動向(2024年~2025年)

- 市場促進要因

- 市場と技術の課題

- 技術の動向とイノベーション

- 市場予測と将来の見通し

- 新しい用途とユースケース

- 量子ナビゲーション

- 量子センサー技術のベンチマーク

- 潜在的な破壊的技術

- 市場マップ

- 量子センサーの世界市場

- 量子センサーのロードマップ

第2章 イントロダクション

- 量子センシングとは

- 量子センサーのタイプ

- 量子センシングの原理

- 量子現象

- 技術プラットフォーム

- 量子センシングの技術と用途

- 量子センサーに向けた価値提案

- SWOT分析

第3章 量子センシングコンポーネント

- 概要

- 特殊コンポーネント

- 蒸気セル

- VCSEL

- 量子センサー向け制御電子機器

- 統合光子と半導体技術

- 課題

- ロードマップ

第4章 原子時計

- 技術の概要

- 市場

- ロードマップ

- 高周波発振器

- 新しい原子時計技術

- 光原子時計

- 原子時計の小型化における課題

- 企業

- SWOT分析

- 市場予測

第5章 量子磁場センサー

- 技術の概要

- 市場機会

- 性能

- 超伝導量子干渉素子(Squid)

- 光ポンピング磁力計(OPM)

- トンネル磁気抵抗センサー(TMR)

- 窒素空孔中心(NV中心)

- 市場予測

第6章 量子重力計

- 技術の概要

- 動作原理

- 用途

- ロードマップ

- 企業

- 市場予測

- SWOT分析

第7章 量子ジャイロスコープ

- 技術の説明

- 用途

- ロードマップ

- 企業

- 市場予測

- SWOT分析

第8章 量子イメージセンサー

- 技術の概要

- 用途

- SWOT分析

- 市場予測

- 企業

第9章 量子レーダー

- 技術の概要

- 用途

第10章 量子化学センサー

- 技術の概要

- 商業活動

第11章 量子RFフィールドセンサー

- 概要

- 量子RFセンサーのタイプ

- リュードベリ原子ベースの電界センサーと無線受信機

- 窒素空孔中心ダイヤモンド電界センサーと無線受信機

- 市場と用途

- 市場予測

第12章 量子NEMS/MEMS

- 技術の概要

- タイプ

- 用途

- 課題

第13章 ケーススタディ

- 医療における量子センサー:早期疾患検出

- 軍事用途:強化ナビゲーションシステム

- 環境モニタリング

- 金融部門:高頻度取引

- 量子インターネット:安全な通信ネットワーク

第14章 最終用途産業

- 医療・ライフサイエンス

- 防衛・軍事

- 環境モニタリング

- 石油・ガス

- 輸送・自動車

- その他の産業

第15章 企業プロファイル(企業82社のプロファイル)

第16章 付録

第17章 参考文献

List of Tables

- Table 1. First and second quantum revolutions

- Table 2. Quantum Sensing Technologies and Applications

- Table 3. Quantum Technology investments 2012-2025 (millions USD), total

- Table 4. Major Quantum Technologies Investments 2024-2025

- Table 5. Global government initiatives in quantum technologies

- Table 6. Quantum Sensor industry developments 2024-2025

- Table 7. Market Drivers for Quantum Sensors

- Table 8. Market and technology challenges in quantum sensing

- Table 9. Technology Trends and Innovations in Quantum Sensors

- Table 10. Emerging Applications and Use Cases

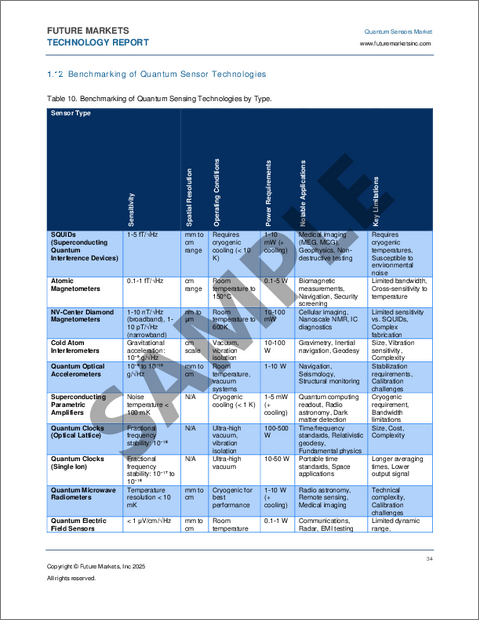

- Table 11. Benchmarking of Quantum Sensing Technologies by Type

- Table 12. Performance Metrics by Application Domain

- Table 13. Technology Readiness Levels (TRL) and Commercialization Status

- Table 14. Comparative Performance Metrics

- Table 15.Current Research and Development Focus Areas

- Table 16. Potential Disruptive Technologies

- Table 17. Global market for quantum sensors, by types, 2018-2046 (Millions USD)

- Table 18. Global market for quantum sensors, by volume (Units), 2018-2046

- Table 19. Global market for quantum sensors, by sensor price, 2025-2046 (Units)

- Table 20. Global market for quantum sensors, by end use industry, 2018-2046 (Millions USD)

- Table 21.Types of Quantum Sensors

- Table 22. Comparison between classical and quantum sensors

- Table 23. Applications in quantum sensors

- Table 24. Technology approaches for enabling quantum sensing

- Table 25. Key technology platforms for quantum sensing

- Table 26. Quantum sensing technologies and applications

- Table 27. Value proposition for quantum sensors

- Table 28. Components for quantum sensing

- Table 29. Specialized components for atomic and diamond-based quantum sensing

- Table 30. Companies in Chip-Scale Vapor Cell Development

- Table 31. Companies in VCSELs for Quantum Sensing

- Table 32. Challenges for Quantum Sensor Components

- Table 33. Key challenges and limitations of quartz crystal clocks vs. atomic clocks

- Table 34. Atomic clocks End users and addressable markets

- Table 35. Key Market Inflection Points and Technology Transitions

- Table 36. New modalities being researched to improve the fractional uncertainty of atomic clocks

- Table 37. Companies developing high-precision quantum time measurement

- Table 38. Key players in atomic clocks

- Table 39. Global market for atomic clocks 2025-2046 (Billions USD)

- Table 40. Global market for Bench/rack-scale atomic clocks, 2026-2046 (Millions USD)

- Table 41. Global market for Chip-scale atomic clocks, 2026-2046 (Millions USD)

- Table 42. Comparative analysis of key performance parameters and metrics of magnetic field sensors

- Table 43. Types of magnetic field sensors

- Table 44. Market opportunity for different types of quantum magnetic field sensors

- Table 45. Performance of magnetic field sensors

- Table 46. Applications of SQUIDs

- Table 47. Market opportunities for SQUIDs (Superconducting Quantum Interference Devices)

- Table 48. Key players in SQUIDs

- Table 49. Applications of optically pumped magnetometers (OPMs)

- Table 50. MEMS Manufacturing Techniques for Miniaturized OPMs

- Table 51. Key players in Optically Pumped Magnetometers (OPMs)

- Table 52. Applications for TMR (Tunneling Magnetoresistance) sensors

- Table 53. Market players in TMR (Tunneling Magnetoresistance) sensors

- Table 54. Applications of N-V center magnetic field centers

- Table 55. Quantum Grade Diamond

- Table 56. Synthetic Diamond Value Chain for Quantum Sensing

- Table 57. Key players in N-V center magnetic field sensors

- Table 58. Global market forecasts for quantum magnetic field sensors, by type, 2025-2046 (Millions USD)

- Table 59. Applications of quantum gravimeters

- Table 60. Comparative table between quantum gravity sensing and some other technologies commonly used for underground mapping

- Table 61. Key players in quantum gravimeters

- Table 62. Global market for Quantum gravimeters 2025-2046 (Millions USD)

- Table 63. Comparison of quantum gyroscopes with MEMs gyroscopes and optical gyroscopes

- Table 64. Comparison of Quantum Gyroscopes with MEMS Gyroscopes and Optical Gyroscopes

- Table 65. Key Players in Quantum Accelerometers

- Table 66. Markets and applications for quantum gyroscopes

- Table 67. Key players in quantum gyroscopes

- Table 68. Global market for for quantum gyroscopes and accelerometers 2026-2046 (millions USD)

- Table 69. Types of quantum image sensors and their key features

- Table 70. Applications of quantum image sensors

- Table 71. SPAD Bioimaging Applications

- Table 72. Global market for quantum image sensors 2025-2046 (Millions USD)

- Table 73. Key players in quantum image sensors

- Table 74. Comparison of quantum radar versus conventional radar and lidar technologies

- Table 75. Applications of quantum radar

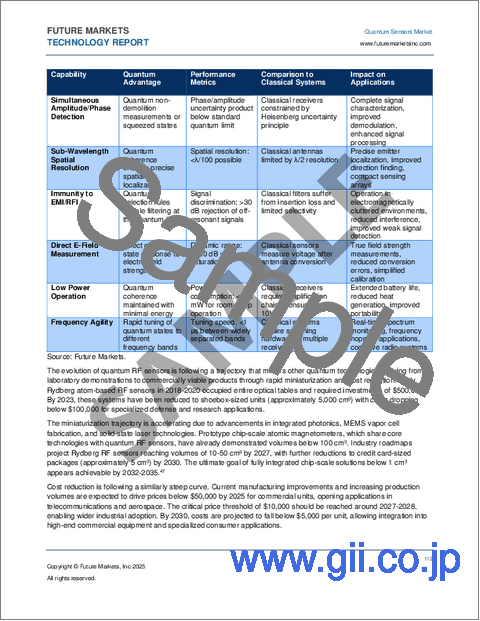

- Table 76. Value Proposition of Quantum RF Sensors

- Table 77. Types of Quantum RF Sensors

- Table 78. Markets for Quantum RF Sensors

- Table 79. Technology Transition Milestones

- Table 80. Application-Specific Adoption Timeline

- Table 81. Global market for quantum RF sensors 2026-2046 (Millions USD)

- Table 82.Types of Quantum NEMS and MEMS

- Table 83. Quantum Sensors in Healthcare and Life Sciences

- Table 84. Quantum Sensors in Defence and Military

- Table 85. Quantum Sensors in Environmental Monitoring

- Table 86. Quantum Sensors in Oil and Gas

- Table 87. Quantum Sensors in Transportation

- Table 88.Glossary of terms

- Table 89. List of Abbreviations

List of Figures

- Figure 1. Quantum computing development timeline

- Figure 2. Quantum Technology investments 2012-2025 (millions USD), total

- Figure 3. National quantum initiatives and funding

- Figure 4. Quantum Sensors: Market and Technology Roadmap to 2040

- Figure 5. Quantum sensor industry market map

- Figure 6. Global market for quantum sensors, by types, 2018-2046 (Millions USD)

- Figure 7. Global market for quantum sensors, by volume, 2018-2046

- Figure 8. Global market for quantum sensors, by sensor price, 2025-2046 (Units)

- Figure 9. Global market for quantum sensors, by end use industry, 2018-2046 (Millions USD)

- Figure 10. Atomic clocks roadmap

- Figure 11. Quantum magnetometers roadmap

- Figure 12. Quantum gravimeters roadmap

- Figure 13. Inertial quantum sensors roadmap

- Figure 14. Quantum RF sensors roadmap

- Figure 15. Single photon detectors roadmap

- Figure 16. Q.ANT quantum particle sensor

- Figure 17. SWOT analysis for quantum sensors market

- Figure 18. Roadmap for quantum sensing components and their applications

- Figure 19. Atomic clocks market roadmap

- Figure 20. Strontium lattice optical clock

- Figure 21. NIST's compact optical clock

- Figure 22. SWOT analysis for atomic clocks

- Figure 23. Global market for atomic clocks 2025-2046 (Billions USD)

- Figure 24. Global market for Bench/rack-scale atomic clocks, 2026-2046 (Millions USD)

- Figure 25. Global market for Chip-scale atomic clocks, 2026-2046 (Millions USD)

- Figure 26. Quantum Magnetometers Market Roadmap

- Figure 27.Principle of SQUID magnetometer

- Figure 28. SWOT analysis for SQUIDS

- Figure 29. SWOT analysis for OPMs

- Figure 30. Tunneling magnetoresistance mechanism and TMR ratio formats

- Figure 31. SWOT analysis for TMR (Tunneling Magnetoresistance) sensors

- Figure 32. SWOT analysis for N-V Center Magnetic Field Sensors

- Figure 33. Global market forecasts for quantum magnetic field sensors, by type, 2025-2046 (Millions USD)

- Figure 34. Quantum Gravimeter

- Figure 35. Quantum gravimeters Market roadmap

- Figure 36. Global market for Quantum gravimeters 2025-2046 (Millions USD)

- Figure 37. SWOT analysis for Quantum Gravimeters

- Figure 38. Inertial Quantum Sensors Market roadmap

- Figure 39. Global market for quantum gyroscopes and accelerometers 2026-2046 (millions USD)

- Figure 40. SWOT analysis for Quantum Gyroscopes

- Figure 41. SWOT analysis for Quantum image sensing

- Figure 42. Global market for quantum image sensors 2025-2046 (Millions USD)

- Figure 43. Principle of quantum radar

- Figure 44. Illustration of a quantum radar prototype

- Figure 45. Quantum RF Sensors Market Roadmap (2023-2046)

- Figure 46. Global market for quantum RF sensors 2026-2046 (Millions USD)

- Figure 47. ColdQuanta Quantum Core (left), Physics Station (middle) and the atoms control chip (right)

- Figure 48. PsiQuantum's modularized quantum computing system networks

- Figure 49. Quantum Brilliance device

- Figure 50. SpinMagIC quantum sensor

The global quantum sensors market is experiencing increased momentum in 2025, riding a wave of record-breaking investment that signals the technology's transition from laboratory research to commercial reality. The first quarter of 2025 witnessed over $1.25 billion raised across quantum technologies-more than double the previous year-with quantum computing companies receiving more than 70% of all quantum-related funding. While quantum computing dominates headlines, quantum sensing could be worth multiple billions by the mid 2030s, establishing it as a critical component of the broader quantum revolution.

This growth trajectory reflects the technology's unique value proposition: leveraging quantum mechanical phenomena such as superposition and entanglement to achieve measurement precision far beyond classical sensor capabilities across applications ranging from medical diagnostics to geological exploration. Recent funding highlights demonstrate sustained investor confidence in quantum sensing applications. QSENSATO, a University of Bari spin-off developing chip-based quantum sensors, raised Euro-500,000 in pre-seed funding from LIFTT and Quantum Italia in May 2025 to advance miniaturized vapor cell technology for applications including brain imaging and geological surveys. Other notable 2024-2025 investments include Q-CTRL's $59 million Series B-2 round, Aquark Technologies' Euro-5 million seed funding led by the NATO Innovation Fund, and various partnerships between academic institutions and industry players.

Government initiatives continue driving market expansion through strategic funding programs. China announced plans to mobilize 1 trillion yuan ($138.01 billion) into cutting-edge fields including quantum technology, while the U.S. Department of Energy allocated $65 million specifically for quantum computing projects. The National Quantum Initiative Reauthorization Act would authorize $2.7 billion in federal funding over five years, underscoring quantum technologies' strategic importance.

The market landscape reveals distinct technology segments with varying maturity levels. Atomic clocks represent the most mature sector, with established applications in telecommunications and navigation systems. Magnetic sensors, particularly SQUIDs and NV-based magnetometers, comprise a significant percentage of the market, driven by healthcare applications and advanced materials characterization. Emerging technologies including quantum gravimeters and RF sensors are gaining traction in specialized applications.

Key market challenges include scaling miniaturized physics packages for mass production, reducing costs for broader adoption, and developing application-specific solutions that clearly demonstrate value over classical alternatives. The convergence of improved technology maturity, enterprise confidence, and geopolitical urgency positions quantum sensors at an inflection point. As the technology transitions from proof-of-concept to commercial deployment, the substantial investment flowing into the broader quantum ecosystem creates favourable conditions for quantum sensors to realize their transformative potential across multiple industries by 2030.

"The Global Quantum Sensors Market 2026-2046" report provides an exhaustive analysis of the rapidly evolving quantum sensing industry, delivering critical insights for stakeholders, investors, and technology developers. This comprehensive market intelligence report examines the transformative potential of quantum sensor technologies across multiple industry verticals, offering detailed market forecasts, competitive landscape analysis, and strategic recommendations for the next two decades.

Quantum sensors represent a paradigm shift in measurement technology, leveraging quantum mechanical principles to achieve unprecedented precision and sensitivity. This report analyzes market dynamics, technological innovations, and commercial opportunities across all major quantum sensor categories, providing stakeholders with essential intelligence for strategic decision-making in this high-growth market segment.

Report contents include:

- Market Size & Growth Projections: Detailed revenue forecasts and volume analysis from 2026-2046 across all quantum sensor categories

- Technology Roadmaps: Comprehensive development timelines for atomic clocks, magnetometers, gravimeters, gyroscopes, and emerging sensor types

- Competitive Intelligence: In-depth profiles of 85+ leading companies and emerging players in the quantum sensing ecosystem

- Application Analysis: Market opportunities across healthcare, defense, automotive, environmental monitoring, and industrial sectors

- Investment Landscape: Analysis of funding trends, government initiatives, and private sector investments driving market growth

- Market Analysis

- Global market size and growth projections through 2036

- Investment landscape and funding trends analysis

- Market segmentation by technology type and end-use industry

- Government initiatives and policy impact assessment

- Technology readiness levels across quantum sensor categories

- Technology Segments

- Atomic clocks market analysis and commercialization status

- Magnetic sensors (SQUIDs, OPMs, TMRs, NV-centers) competitive landscape

- Quantum gravimeters development roadmap and applications

- Emerging technologies: RF sensors, quantum radar, image sensors

- Component ecosystem analysis: vapor cells, VCSELs, integrated photonics

- Industry Applications

- Defense and military applications and market opportunities

- Healthcare and life sciences adoption drivers and barriers

- Transportation and automotive integration challenges

- Environmental monitoring use cases and market potential

- Oil & gas exploration applications and growth drivers

- Competitive Intelligence

- Company profiles covering startups to established players

- Technology differentiation strategies and market positioning

- Partnership dynamics and supply chain relationships

- Geographic market distribution and regional advantages

- M&A activity and consolidation trends

- Strategic Analysis

- Market entry strategies and timing recommendations

- Technology platform selection criteria

- Regulatory environment and compliance requirements

- Supply chain risk factors and mitigation strategies

- Business model evolution and pricing trends

This report features comprehensive profiles of 82 leading companies and emerging players across the quantum sensing value chain, providing detailed analysis of their technology platforms, market positioning, strategic partnerships, and commercial activities. Companies profiled include established quantum technology leaders, innovative startups, research institutions, and traditional sensor manufacturers expanding into quantum technologies.

Featured Companies include:

|

|

and more....

TABLE OF CONTENTS

1. EXECUTIVE SUMMARY

- 1.1. First and second quantum revolutions

- 1.2. Current quantum technology market landscape

- 1.2.1. Key developments

- 1.3. Investment landscape

- 1.4. Global government initiatives

- 1.5. Industry developments 2024-2025

- 1.6. Market Drivers

- 1.7. Market and technology challenges

- 1.8. Technology trends and innovations

- 1.9. Market forecast and future outlook

- 1.9.1. Short-term Outlook (2025-2027)

- 1.9.2. Medium-term Outlook (2028-2031)

- 1.9.3. Long-term Outlook (2032-2046)

- 1.10. Emerging applications and use cases

- 1.11. Quantum Navigation

- 1.12. Benchmarking of Quantum Sensor Technologies

- 1.13. Potential Disruptive Technologies

- 1.14. Market Map

- 1.15. Global market for quantum sensors

- 1.15.1. By sensor type

- 1.15.2. By volume

- 1.15.3. By sensor price

- 1.15.4. By end use industry

- 1.16. Quantum Sensors Roadmapping

- 1.16.1. Atomic clocks

- 1.16.2. Quantum magnetometers

- 1.16.3. Quantum gravimeters

- 1.16.4. Inertial quantum sensors

- 1.16.5. Quantum RF sensors

- 1.16.6. Single photon detectors

2. INTRODUCTION

- 2.1. What is quantum sensing?

- 2.2. Types of quantum sensors

- 2.2.1. Comparison between classical and quantum sensors

- 2.3. Quantum Sensing Principles

- 2.4. Quantum Phenomena

- 2.5. Technology Platforms

- 2.6. Quantum Sensing Technologies and Applications

- 2.7. Value proposition for quantum sensors

- 2.8. SWOT Analysis

3. QUANTUM SENSING COMPONENTS

- 3.1. Overview

- 3.2. Specialized components

- 3.3. Vapor cells

- 3.3.1. Overview

- 3.3.2. Manufacturing

- 3.3.3. Alkali azides

- 3.3.4. Companies

- 3.4. VCSELs

- 3.4.1. Overview

- 3.4.2. Quantum sensor miniaturization

- 3.4.3. Companies

- 3.5. Control electronics for quantum sensors

- 3.6. Integrated photonic and semiconductor technologies

- 3.7. Challenges

- 3.8. Roadmap

4. ATOMIC CLOCKS

- 4.1. Technology Overview

- 4.1.1. Hyperfine energy levels

- 4.1.2. Self-calibration

- 4.2. Markets

- 4.3. Roadmap

- 4.4. High frequency oscillators

- 4.4.1. Emerging oscillators

- 4.5. New atomic clock technologies

- 4.6. Optical atomic clocks

- 4.6.1. Chip-scale optical clocks

- 4.6.2. Rack-sized atomic clocks

- 4.7. Challenge in atomic clock miniaturization

- 4.8. Companies

- 4.9. SWOT analysis

- 4.10. Market forecasts

- 4.10.1. Total market

- 4.10.2. Bench/rack-scale atomic clocks

- 4.10.3. Chip-scale atomic clocks

5. QUANTUM MAGNETIC FIELD SENSORS

- 5.1. Technology overview

- 5.1.1. Measuring magnetic fields

- 5.1.2. Sensitivity

- 5.1.3. Motivation for use

- 5.2. Market opportunity

- 5.3. Performance

- 5.4. Superconducting Quantum Interference Devices (Squids)

- 5.4.1. Introduction

- 5.4.2. Operating principle

- 5.4.3. Applications

- 5.4.4. Companies

- 5.4.5. SWOT analysis

- 5.5. Optically Pumped Magnetometers (OPMs)

- 5.5.1. Introduction

- 5.5.2. Operating principle

- 5.5.3. Applications

- 5.5.3.1. Miniaturization

- 5.5.3.2. Navigation

- 5.5.4. MEMS manufacturing

- 5.5.5. Companies

- 5.5.6. SWOT analysis

- 5.6. Tunneling Magneto Resistance Sensors (TMRs)

- 5.6.1. Introduction

- 5.6.2. Operating principle

- 5.6.3. Applications

- 5.6.4. Companies

- 5.6.5. SWOT analysis

- 5.7. Nitrogen Vacancy Centers (N-V Centers)

- 5.7.1. Introduction

- 5.7.2. Operating principle

- 5.7.3. Applications

- 5.7.4. Synthetic diamonds

- 5.7.5. Companies

- 5.7.6. SWOT analysis

- 5.8. Market forecasts

6. QUANTUM GRAVIMETERS

- 6.1. Technology overview

- 6.2. Operating principle

- 6.3. Applications

- 6.3.1. Commercial deployment

- 6.3.2. Comparison with other technologies

- 6.4. Roadmap

- 6.5. Companies

- 6.6. Market forecasts

- 6.7. SWOT analysis

7. QUANTUM GYROSCOPES

- 7.1. Technology description

- 7.1.1. Inertial Measurement Units (IMUs)

- 7.1.1.1. Atomic quantum gyroscopes

- 7.1.1.2. Quantum accelerometers

- 7.1.1.2.1. Operating Principles

- 7.1.1.2.2. Grating magneto-optical traps (MOTs)

- 7.1.1.2.3. Applications

- 7.1.1.2.4. Companies

- 7.1.1. Inertial Measurement Units (IMUs)

- 7.2. Applications

- 7.3. Roadmap

- 7.4. Companies

- 7.5. Market forecasts

- 7.6. SWOT analysis

8. QUANTUM IMAGE SENSORS

- 8.1. Technology overview

- 8.1.1. Single photon detectors

- 8.1.2. Semiconductor single photon detectors

- 8.1.3. Superconducting single photon detectors

- 8.2. Applications

- 8.2.1. Single Photon Avalanche Diodes with Time-Correlated Single Photon Counting (TCSPC

- 8.2.2. Bioimaging

- 8.3. SWOT analysis

- 8.4. Market forecast

- 8.5. Companies

9. QUANTUM RADAR

- 9.1. Technology overview

- 9.1.1. Quantum entanglement

- 9.1.2. Ghost imaging

- 9.1.3. Quantum holography

- 9.2. Applications

- 9.2.1. Cancer detection

- 9.2.2. Glucose Monitoring

10. QUANTUM CHEMICAL SENSORS

- 10.1. Technology overview

- 10.2. Commercial activities

11. QUANTUM RADIO FREQUENCY (RF) FIELD SENSORS

- 11.1. Overview

- 11.2. Types of Quantum RF Sensors

- 11.3. Rydberg Atom Based Electric Field Sensors and Radio Receivers

- 11.3.1. Principles

- 11.3.2. Commercialization

- 11.4. Nitrogen-Vacancy Centre Diamond Electric Field Sensors and Radio Receivers

- 11.4.1. Principles

- 11.4.2. Applications

- 11.5. Market and applications

- 11.6. Market forecast

12. QUANTUM NEMS AND MEMS

- 12.1. Technology overview

- 12.2. Types

- 12.3. Applications

- 12.4. Challenges

13. CASE STUDIES

- 13.1. Quantum Sensors in Healthcare: Early Disease Detection

- 13.2. Military Applications: Enhanced Navigation Systems

- 13.3. Environmental Monitoring

- 13.4. Financial Sector: High-Frequency Trading

- 13.5. Quantum Internet: Secure Communication Networks

14. END-USE INDUSTRIES

- 14.1. Healthcare and Life Sciences

- 14.1.1. Medical Imaging

- 14.1.2. Drug Discovery

- 14.1.3. Biosensing

- 14.2. Defence and Military

- 14.2.1. Navigation Systems

- 14.2.2. Underwater Detection

- 14.2.3. Communication Systems

- 14.3. Environmental Monitoring

- 14.3.1. Climate Change Research

- 14.3.2. Geological Surveys

- 14.3.3. Natural Disaster Prediction

- 14.3.4. Other Applications

- 14.4. Oil and Gas

- 14.4.1. Exploration and Surveying

- 14.4.2. Pipeline Monitoring

- 14.4.3. Other Applications

- 14.5. Transportation and Automotive

- 14.5.1. Autonomous Vehicles

- 14.5.2. Aerospace Navigation

- 14.5.3. Other Applications

- 14.6. Other Industries

- 14.6.1. Finance and Banking

- 14.6.2. Agriculture

- 14.6.3. Construction

- 14.6.4. Mining

15. COMPANY PROFILES (82 company profiles)

16. APPENDICES

- 16.1. Research Methodology

- 16.2. Glossary of Terms

- 16.3. List of Abbreviations