|

|

市場調査レポート

商品コード

1920587

直接リチウム抽出(DLE)の世界市場(2026年~2036年)The Global Direct Lithium Extraction Market 2026-2036 |

||||||

|

|||||||

| 直接リチウム抽出(DLE)の世界市場(2026年~2036年) |

|

出版日: 2026年01月26日

発行: Future Markets, Inc.

ページ情報: 英文 245 Pages, 110 Tables, 20 Figures

納期: 即納可能

|

概要

直接リチウム抽出(DLE)市場は、電気自動車やエネルギー貯蔵用途におけるリチウム需要の急増により、重要鉱物産業においてもっとも急速に成長しているセグメントの1つです。DLE技術は従来のリチウム抽出法に対する大きな優位性をもたらします。従来の蒸発池プロセスでは12~24ヶ月を要し、リチウム回収率はわずか40~60%に留まります。一方、DLEシステムでは数時間から数日で抽出を完了でき、回収率は90%を超えます。この効率性の向上に加え、大幅な水消費の削減と物理的フットプリントの縮小が相まって、環境規制の強化やリチウム産出地域における水資源の争奪激化が進む中、DLEは特に魅力的な選択肢となっています。

技術情勢には複数の異なるアプローチが存在し、それぞれが異なる塩水の化学組成や運用要件に適しています。イオン交換技術は定評のある拡張性と性能により、現在商業導入の主流を占めています。吸着ベースのシステムは効率向上と運用コスト削減により、新規プロジェクトで市場シェアを拡大中です。膜技術、電気化学的抽出、溶媒抽出の手法は主に開発段階にありますが、特に困難な塩水環境などの特定の用途において有望視されています。

市場には多額の投資が集まっており、2020年以降、世界的にDLEプロジェクトに30億米ドル超が投じられています。主要な鉱業企業、自動車メーカー、電池メーカーは、提携、買収、直接的なプロジェクト開発を通じて戦略的なポジションを取っています。業界が直面する主な課題には、技術のパイロット段階から商業運転への拡大、ソリューションの多様な塩水化学組成への適応、プロジェクト開発の資本集約的な性質の管理が含まれます。吸着剤の耐久性、膜のファウリング、プロセス最適化に関する技術的障壁は、引き続きイノベーションを必要としています。

市場の成長軌道は、重要鉱物生産におけるサプライチェーンの安全性と持続可能性を求める広範な動向を反映しています。北米や欧州における国内リチウム生産を支援する政府政策と、従来の採掘方法に対する環境監視の強化が組み合わさり、DLE技術の採用を加速させています。技術の成熟と標準化の進行に伴い、プロジェクト開発コストと工期は減少が見込まれ、2020年代末までに市場の拡大がさらに加速する可能性があります。

直接リチウム抽出技術は、従来の塩水蒸発法や硬岩採掘法に革新をもたらしています。処理時間の大幅な短縮、90%を超える高い回収率、環境負荷の低減を実現し、地熱塩水、油田生産水、低濃度大陸塩水など、従来は採算が取れなかったリチウム資源の開発を可能にします。

当レポートでは、世界の直接リチウム抽出(DLE)市場について調査し、DLE技術、市場力学、競合情勢、2036年までの成長予測に関する詳細な分析を提供しています。

目次

第1章 エグゼクティブサマリー

- 市場の概要

- リチウムの生産高と需要

- 従来の抽出方法の問題点

- DLE手法

- 技術の利点、欠点、コスト

- 直接リチウム抽出市場

- 直接リチウム抽出市場の成長軌道

- 市場予測(~2036年)

- DLE生産高の予測:国別

- DLEの市場規模:技術タイプ別(2024年~2036年)

- 主な市場セグメント

- 短期の見通し(2024年~2026年)

- 中期予測(2026年~2030年)

- 長期予測(2030年~2035年)

- 市場の促進要因

- 電気自動車の成長

- エネルギー貯蔵需要

- 政府の政策

- 技術の進歩

- 持続可能性目標

- 供給の安全性

- 市場の課題

- 技術的障壁

- 経済的実現可能性

- スケールアップの問題

- 資源の可用性

- 規制上のハードル

- 競合

- サプライチェーンと地政学上のリスク

- 商業活動

- 市場マップ

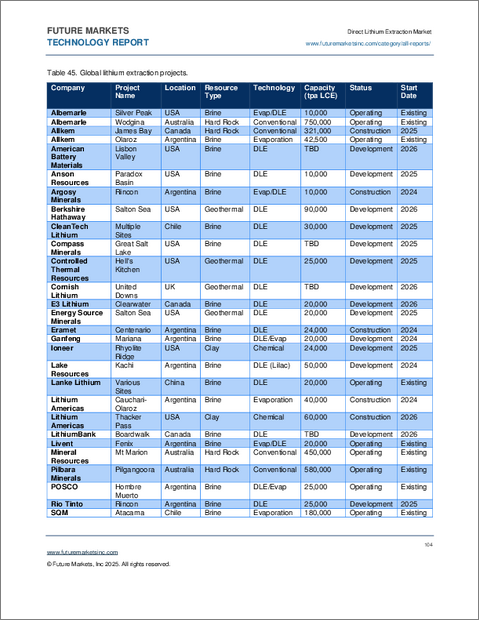

- 世界のリチウム抽出プロジェクト

- DLEプロジェクト

- ビジネスモデル

- 投資

第2章 イントロダクション

- リチウムの用途

- リチウム塩水堆積物

- 定義と動作原理

- 基本的な概念とメカニズム

- プロセス化学

- DLEの歴史と発展

- DLE技術のタイプ

- 塩水資源

- 硬岩資源

- 堆積物に包有された鉱床

- イオン交換

- 吸着

- 膜分離

- 溶媒抽出

- 電気化学的抽出

- 化学沈殿

- 新しいハイブリッドアプローチ

- 従来の抽出法に対する優位性

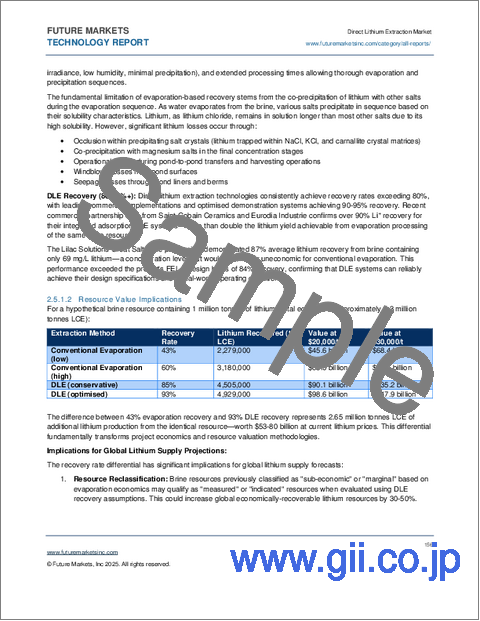

- 回収率

- 環境への影響

- 処理時間

- 製品の純度

- DLE技術の比較

- 価格

- 環境への影響と持続可能性

- エネルギー要件

- 水使用

- 回収率

- 技術タイプ別

- 資源タイプ別

- 最適化の可能性

- スケーラビリティ

- 資源の分析

- 塩水資源

- 粘土鉱床

- 地熱水

- 資源品質評価

- 抽出可能性

第3章 世界市場の分析

- 市場規模と成長

- 地域の市場シェア

- 北米

- 南米

- アジア太平洋

- 欧州

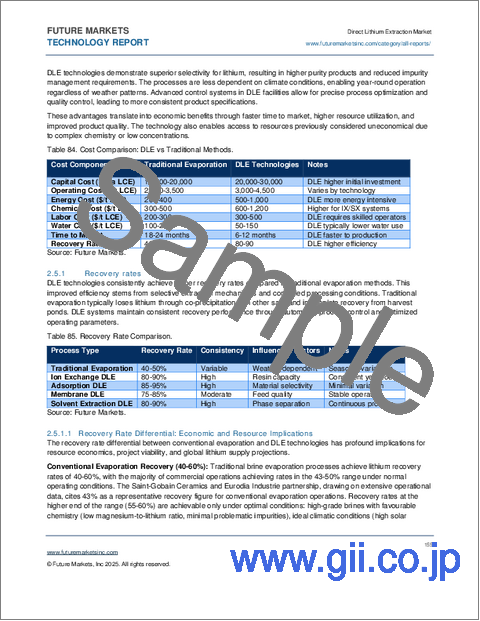

- コスト分析

- CAPEXの比較

- OPEXの内訳

- トン当たりコストの分析

- 需給力学

- 現在の供給

- 需要予測

- 規制

- 競合情勢