|

|

市場調査レポート

商品コード

1712472

PFAS・PFAS代替品・PFAS処理の世界市場(2025年~2035年)The Global Market for Per- and Polyfluoroalkyl Substances (PFAS), PFAS Alternatives and PFAS Treatment 2025-2035 |

||||||

|

|||||||

| PFAS・PFAS代替品・PFAS処理の世界市場(2025年~2035年) |

|

出版日: 2025年04月18日

発行: Future Markets, Inc.

ページ情報: 英文 352 Pages, 130 Tables, 17 Figures

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

現在、PFAS材料は半導体、テキスタイル、食品包装、電子、自動車部門を含むさまざまな産業において、撥水コーティングから重要技術向けの高性能材料に至るまでの用途があり、依然として重要です。市場力学は、特に厳しい規制によって従来のPFASからの移行が加速している欧州と北米を中心とした地域の規制枠組みに大きな影響を受けています。半導体産業は重要なユースケースの1つであり、そこではPFASが依然として先進の製造プロセスに不可欠ですが、代替品の開発に向けた活動が進められています。同様に、自動車部門と電子部門も、積極的に代替品を追求しながらも、特定の用途でPFASに依存し続けています。

PFAS代替品市場は急速な成長を示しており、複数の部門で革新的なソリューションが登場しています。これにはシリコン系材料、炭化水素技術、バイオベース代替品、新規のポリマーシステムなどが含まれます。テキスタイル産業と食品包装産業は、消費者の意識と規制要件に後押しされ、PFASフリーの代替品への移行を主導しています。しかし、多くの用途において、技術的な性能格差とコスト上の懸念が依然として大きな課題となっています。PFAS処理/修復技術は、環境汚染に対処する必要性によって成長している市場セグメントです。現在の技術には、先進の酸化プロセス、膜ろ過、吸着システム、新しい破壊技術などがあります。特に水処理部門では、PFAS除去技術に多額の投資が行われています。

2035年に向けて、市場は大きく変化すると予測されます。従来のPFASの使用は必須でない用途で大幅に減少すると予測される一方、代替品市場は力強く成長すると予測されます。半導体や医療機器のような重要な産業では、代替品がまだ実用可能でない特定のPFAS用途が維持される可能性がありますが、管理と封じ込め対策が強化されます。

処理技術市場は、環境規制の厳格化と修復要求の高まりにより、大幅な拡大が見込まれます。処理方法、特に破壊技術や生物にやさしいアプローチにおける技術革新が加速し、より費用対効果の高い効率的なソリューションがもたらされる可能性が高いです。産業にとっての主な課題は、重要な用途におけるPFASの性能に見合う代替品の開発、移行コストの管理、効果的な処理ソリューションの確保などです。市場の見通しは地域や用途によって大きく異なり、先進国市場が代替品への移行を主導する一方、新興国市場は特定の用途でPFASの使用を継続する可能性があります。この進化する市場での成功は、技術革新、規制遵守能力、性能要件と環境への配慮のバランスを取る能力にかかっています。持続可能なソリューションを開発しながら、こうした課題を効果的に乗り切ることができる企業は、代替品と処理技術の両方で大きな市場機会を獲得できる可能性が高いです。

産業の将来は、継続的な規制の進化、技術の進歩、持続可能なソリューションの重視によって形成され、2035年までにPFAS使用の減少、代替品の広範な採用、先進の処理能力を特徴とする市場情勢の変革につながるとみられます。

当レポートでは、世界のPFAS・PFAS代替品・PFAS処理市場について調査し、新しいPFAS代替品と処理技術の詳細な検討を含む、世界のPFAS部門の詳細な分析を提供しています。また、市場動向、規制の影響、技術開発に関する戦略的知見を提供しています。

目次

第1章 エグゼクティブサマリー

- PFASのイントロダクション

- PFASの定義と概要

- PFASのタイプ

- PFASの特性と用途

- 環境と健康への懸念

- PFAS代替品

- 分析技術

- 製造/取扱/輸入/輸出

- 保管/廃棄/処理/浄化

- 水質管理

- 代替技術とサプライチェーン

第2章 世界の規制情勢

- PFAS規制の拡大の影響

- 国際協定

- 欧州連合の規制

- 米国の規制

- アジアの規制

- 世界の規制動向と見通し

第3章 特定業界でのPFASの使用

- 半導体

- テキスタイル・衣料

- 食品包装

- 塗料・コーティング

- イオン交換膜

- エネルギー(燃料電池を除く)

- 5G向け低損失材料

- 化粧品

- 消火泡

- 自動車

- 電子

- 医療機器

- グリーン水素

第4章 PFAS代替品

- PFASフリー離型剤

- 非フッ素系界面活性剤、分散剤

- PFASフリー撥水/撥油材料

- フッ素フリー撥液表面

- PFASフリー無色透明ポリイミド

第5章 PFASの分解と除去

- 現在のPFASの分解と除去の方法

- 生物にやさしい方法

- 企業

第6章 PFAS処理

- イントロダクション

- PFASによる環境汚染の経路

- 規則

- PFAS水処理

- PFAS固体処理

- 企業

第7章 世界市場の分析と将来の見通し

- 現在の市場規模とセグメンテーション

- 市場力学に対する規制の影響

- 新たな動向と機会

- PFAS代替品に対する課題と障壁

- 将来の市場の予測

第8章 企業プロファイル(企業49社のプロファイル)

第9章 調査手法

第10章 参考文献

List of Tables

- Table 1. Established applications of PFAS

- Table 2. PFAS chemicals segmented by non-polymers vs polymers

- Table 3. Non-polymeric PFAS

- Table 4. Chemical structure and physiochemical properties of various perfluorinated surfactants

- Table 5. Examples of long-chain PFAS-Applications, Regulatory Status and Environmental and Health Effects

- Table 6. Examples of short-chain PFAS

- Table 7. Other non-polymeric PFAS

- Table 8. Examples of fluoropolymers

- Table 9. Examples of side-chain fluorinated polymers

- Table 10. Applications of PFAs

- Table 11. PFAS surfactant properties

- Table 12. List of PFAS alternatives

- Table 13. Common PFAS and their regulation

- Table 14. International PFAS regulations

- Table 15. European Union Regulations

- Table 16. United States Regulations

- Table 17. PFAS Regulations in Asia-Pacific Countries

- Table 18. Identified uses of PFAS in semiconductors

- Table 19. Alternatives to PFAS in Semiconductors

- Table 20. Key properties of PFAS in water-repellent materials

- Table 21. Initiatives by outdoor clothing companies to phase out PFCs

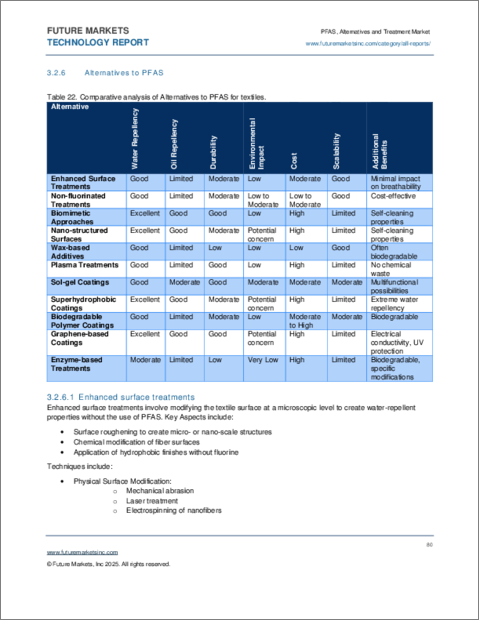

- Table 22. Comparative analysis of Alternatives to PFAS for textiles

- Table 23. Companies developing PFAS alternatives for textiles

- Table 24. Applications of PFAS in Food Packaging

- Table 25. Regulation related to PFAS in food contact materials

- Table 26. Applications of cellulose nanofibers (CNF)

- Table 27. Companies developing PFAS alternatives for food packaging

- Table 28. Applications and purpose of PFAS in paints and coatings

- Table 29. Companies developing PFAS alternatives for paints and coatings

- Table 30. Applications of Ion Exchange Membranes

- Table 31. Key aspects of PEMELs

- Table 32. Membrane Degradation Processes Overview

- Table 33. PFSA Membranes & Key Players

- Table 34. Competing Membrane Materials

- Table 35. Comparative analysis of membrane properties

- Table 36. Processes for manufacturing of perfluorosulfonic acid (PFSA) membranes

- Table 37. PFSA Resin Suppliers

- Table 38. CCM Production Technologies

- Table 39. Comparison of Coating Processes

- Table 40. Alternatives to PFAS in catalyst coated membranes

- Table 41. Key Properties and Considerations for RFB Membranes

- Table 42. PFSA Membrane Manufacturers for RFBs

- Table 43. Alternative Materials for RFB Membranes

- Table 44. Alternative Polymer Materials for Ion Exchange Membranes

- Table 45. Hydrocarbon Membranes for PEM Fuel Cells

- Table 46. Companies developing PFA alternatives for fuel cell membranes

- Table 47. Identified uses of PFASs in the energy sector

- Table 48. Alternatives to PFAS in Energy by Market (Excluding Fuel Cells)

- Table 49: Anti-icing and de-icing nanocoatings product and application developers

- Table 50. Companies developing alternatives to PFAS in energy (excluding fuel cells)

- Table 51. Commercial low-loss organic laminates-key properties at 10 GHz

- Table 52. Key Properties of PTFE to Consider for 5G Applications

- Table 53. Applications of PTFE in 5G in a table

- Table 54. Challenges in PTFE-based laminates in 5G

- Table 55. Key regulations affecting PFAS use in low-loss materials

- Table 56. Commercial low-loss materials suitable for 5G applications

- Table 57. Key low-loss materials suppliers

- Table 58. Alternatives to PFAS for low-loss applications in 5G

- Table 59. Benchmarking LTCC materials suitable for 5G applications

- Table 60. Benchmarking of various glass substrates suitable for 5G applications

- Table 61. Applications of PFAS in cosmetics

- Table 62. Alternatives to PFAS for various functions in cosmetics

- Table 63. Companies developing PFAS alternatives in cosmetics

- Table 64. Applications of PFAS in Automotive Industry

- Table 65. Application of PFAS in Electric Vehicles

- Table 66.Suppliers of PFAS-free Coolants and Refrigerants for EVs

- Table 67.Immersion Fluids for EVs

- Table 68. Immersion Cooling Fluids Requirements

- Table 69. Single-phase vs two-phase cooling

- Table 70. Companies producing Immersion Fluids for EVs

- Table 71. Alternatives to PFAS in the automotive sector

- Table 72. Use of PFAS in the electronics sector

- Table 73. Companies developing alternatives to PFAS in electronics & semiconductors

- Table 74. Applications of PFAS in Medical Devices

- Table 75. Alternatives to PFAS in medical devices

- Table 76. Readiness level of PFAS alternatives

- Table 77. Comparing PFAS-free alternatives to traditional PFAS-containing release agents

- Table 78. Novel PFAS-free CTPI structures

- Table 79. Applications of PFAS-free CTPIs in flexible electronics

- Table 80. Current methods for PFAS elimination

- Table 81. Companies developing processes for PFA degradation and elimination

- Table 82. Total PFAS Treatment Market Forecast by Segment (2025-2035)

- Table 83. PFAS Treatment Market Share Evolution

- Table 84. Pathways for PFAS environmental contamination

- Table 85. Global PFAS Drinking Water Limits

- Table 86. USA PFAS Regulations

- Table 87. EU PFAS Regulations

- Table 88. Global PFAS Regulations

- Table 89. PFAS drinking water treatment market forecast 2025-2035

- Table 90. Applications requiring PFAS water treatment

- Table 91. Point-of-Use (POU) and Point-of-Entry (POE) Systems

- Table 92. PFAS treatment approaches

- Table 93. Typical Flow Rates for Different Facilities

- Table 94. In-Situ vs Ex-Situ Treatment Comparison

- Table 95. Technology Readiness Level (TRL) for PFAS Removal

- Table 96. Removal technologies for PFAS in water

- Table 97. Suppliers of GAC media for PFAS removal applications

- Table 98. Commercially Available PFAS-Selective Resins

- Table 99. Estimated Treatment Costs by Method

- Table 100. Comparison of technologies for PFAS removal

- Table 101. Emerging removal technologies for PFAS in water

- Table 102. Companies in emerging PFAS removal technologies

- Table 103. PFAS Destruction Technologies

- Table 104. Technology Readiness Level (TRL) for PFAS Destruction Technologies

- Table 105. Thermal Treatment Types

- Table 106. Liquid-Phase Technology Segmentation

- Table 107. PFAS Destruction Technologies Challenges

- Table 108. Companies developing PFAS Destruction Technologies

- Table 109. PFAS Solids Treatment Market Forecast 2025-2035

- Table 110. Treatment Methods for PFAS-Contaminated Solids

- Table 111. Companies developing processes for PFAS water and solid treatment

- Table 112. Global PFAS Market Projection (2023-2035), Billions USD

- Table 113. Regional PFAS Market Projection (2023-2035), Billions USD

- Table 114. PFAS Market Segmentation by Industry (2023-2035), Billions USD

- Table 115. PFAS treatment market by region, North America

- Table 116. PFAS treatment market by region, Europe

- Table 117. PFAS treatment market by region, Asia-Pacific

- Table 118. PFAS treatment market by region, Latin America

- Table 119. PFAS treatment market by region Middle East and Africa

- Table 120. Long-Chain PFAS andShort-Chain PFAS Market Share

- Table 121.PFAS-Free Alternatives Market Size from 2020 to 2035, (Billions USD)

- Table 122. Regional Market Data (2023) for PFAS and trends

- Table 123. Market Opportunities for PFAS alternatives

- Table 124. Circular Economy Initiatives and Potential Impact

- Table 125. Digital Technology Applications and Market Potential

- Table 126. Performance Comparison Table

- Table 127. Cost Comparison Table-PFAS and PFAS alternatives

- Table 128. Global market Size 2023-2026 (USD Billions)

- Table 129. Market size 2026-2030 (USD Billions)

- Table 130. Long-Term Market Projections (2035)

List of Figures

- Figure 1. Types of PFAS

- Figure 2. Structure of PFAS-based polymer finishes

- Figure 3. Water and Oil Repellent Textile Coating

- Figure 4. Main PFAS exposure route

- Figure 5. Main sources of perfluorinated compounds (PFC) and general pathways that these compounds may take toward human exposure

- Figure 6. Photolithography process in semiconductor manufacturing

- Figure 7. PFAS containing Chemicals by Technology Node

- Figure 8. The photoresist application process in photolithography

- Figure 9: Contact angle on superhydrophobic coated surface

- Figure 10. PEMFC Working Principle

- Figure 11. Schematic representation of a Membrane Electrode Assembly (MEA)

- Figure 12. Slippery Liquid-Infused Porous Surfaces (SLIPS)

- Figure 13. Aclarity's Octa system

- Figure 14. Process for treatment of PFAS in water

- Figure 15. Octa(TM) system

- Figure 16. Gradiant Forever Gone

- Figure 17. PFAS Annihilator-R unit

Currently, PFAS materials remain crucial in various industries including semiconductors, textiles, food packaging, electronics, and automotive sectors, with applications ranging from water-repellent coatings to high-performance materials for critical technologies. Market dynamics are heavily influenced by regional regulatory frameworks, particularly in Europe and North America, where stringent regulations are accelerating the transition away from traditional PFAS. The semiconductor industry represents a critical use case, where PFAS remains essential for advanced manufacturing processes, though efforts are underway to develop alternatives. Similarly, the automotive and electronics sectors continue to rely on PFAS for specific applications while actively pursuing substitutes.

The PFAS alternatives market is experiencing rapid growth, with innovative solutions emerging across multiple sectors. These include silicon-based materials, hydrocarbon technologies, bio-based alternatives, and novel polymer systems. The textiles and food packaging industries are leading the transition to PFAS-free alternatives, driven by consumer awareness and regulatory requirements. However, technical performance gaps and cost considerations remain significant challenges in many applications. PFAS treatment and remediation technologies represent a growing market segment, driven by the need to address environmental contamination. Current technologies include advanced oxidation processes, membrane filtration, adsorption systems, and emerging destruction technologies. The water treatment sector, in particular, is seeing significant investment in PFAS removal technologies.

Looking toward 2035, the market is expected to undergo substantial changes. Traditional PFAS usage is projected to decline significantly in non-essential applications, while the alternatives market is forecast to experience robust growth. Critical industries like semiconductors and medical devices may retain specific PFAS applications where alternatives are not yet viable, but with enhanced controls and containment measures.

The treatment technologies market is expected to expand considerably, driven by stricter environmental regulations and growing remediation requirements. Innovation in treatment methods, particularly in destruction technologies and bio-friendly approaches, is likely to accelerate, leading to more cost-effective and efficient solutions. Key challenges for the industry include developing alternatives that match PFAS performance in critical applications, managing transition costs, and ensuring effective treatment solutions. The market outlook varies significantly by region and application, with developed markets leading the transition to alternatives while emerging markets may continue PFAS use in certain applications. Success in this evolving market will depend on technological innovation, regulatory compliance capabilities, and the ability to balance performance requirements with environmental considerations. Companies that can effectively navigate these challenges while developing sustainable solutions are likely to capture significant market opportunities in both alternatives and treatment technologies.

The industry's future will be shaped by continued regulatory evolution, technological advancement, and growing emphasis on sustainable solutions, leading to a transformed market landscape by 2035 characterized by reduced PFAS usage, widespread adoption of alternatives, and advanced treatment capabilities.

"The Global Market for Per- and Polyfluoroalkyl Substances (PFAS), PFAS Alternatives and PFAS Treatment 2025-2035" provides an in-depth analysis of the global PFAS sector, including detailed examination of emerging PFAS alternatives and treatment technologies. The study offers strategic insights into market trends, regulatory impacts, and technological developments shaping the industry through 2035.

Report contents include:

- Comprehensive overview of PFAS chemical structures, properties, and historical development

- Detailed classification of PFAS types, including long-chain, short-chain, polymeric and non-polymeric variants

- Analysis of unique PFAS properties driving industrial applications

- Examination of environmental persistence, bioaccumulation, and health concerns

- Global Regulatory Landscape

- Current and emerging regulations across major markets including the US, EU, and Asia

- Impact assessment of regulatory changes on market dynamics

- State-level regulatory developments in the United States

- International agreements and collaborative frameworks

- Industry-Specific PFAS Usage and Alternatives

- Detailed analysis of PFAS applications and alternative solutions across 13 critical sectors:

- Semiconductors and electronics

- Textiles and clothing

- Food packaging

- Paints and coatings

- Ion exchange membranes

- Energy (excluding fuel cells)

- Low-loss materials for 5G

- Cosmetics

- Firefighting foam

- Automotive (including electric vehicles)

- Medical devices

- Green hydrogen

- Electronics

- Detailed analysis of PFAS applications and alternative solutions across 13 critical sectors:

- PFAS Alternatives Market

- Technical assessment of non-fluorinated alternatives:

- PFAS-free release agents

- Non-fluorinated surfactants and dispersants

- Water and oil-repellent materials

- Fluorine-free liquid-repellent surfaces

- PFAS-free colorless transparent polyimide

- Technical assessment of non-fluorinated alternatives:

- PFAS Degradation and Elimination

- Current methodologies for PFAS degradation

- Bio-friendly remediation approaches:

- Phytoremediation and microbial degradation

- Enzyme-based solutions

- Mycoremediation

- Green oxidation methods

- PFAS Treatment Market

- Detailed market forecasts for PFAS treatment (2025-2035)

- Analysis of contamination pathways and global regulatory standards

- Comprehensive review of water treatment technologies:

- Traditional removal technologies (GAC, ion exchange, membrane filtration)

- Emerging removal technologies

- Destruction technologies (electrochemical oxidation, SCWO, plasma treatment)

- Solid treatment technologies and market projections

- Market Analysis and Future Outlook

- Current market size and segmentation across regions and industries

- Impact of regulations on market dynamics

- Emerging trends and opportunities in green chemistry and circular economy

- Challenge assessment for PFAS substitution

- Short-term (1-3 years), medium-term (3-5 years), and long-term (5-10 years) market projections

- Company Profiles. Details of over 500 companies involved in the PFAS, PFAS Alternatives and PFAS Treatment supply chain plus in-depth profiles of 49 companies including 374Water, Aclarity, AquaBlok, Aquagga, Aqua Metrology Systems (AMS), AECOM, Aether Biomachines, Allonia, BioLargo, Cabot Corporation, Calgon Carbon, Claros Technologies, CoreWater Technologies, Cornelsen Umwelttechnologie GmbH, Cyclopure, Desotec, Dmax Plasma, DuPont, ECT2 (Montrose Environmental Group), Element Six, EPOC Enviro, Evoqua Water Technologies, Framergy, General Atomics, Gradiant, Greenlab, Haycarb, InEnTec, Inhance Technologies, Jacobi Group, Kuraray, Lanxess AG, Memsys Water Technologies GmbH, Myconaut, Onvector, OXbyEL Technologies, Ovivo, Oxyle AG and more...

Who Should Read This Report:

- Chemical manufacturers and suppliers

- Environmental engineering firms

- Water and waste treatment companies

- Regulatory compliance professionals

- Sustainability executives

- Product development specialists

- Research and academic institutions

- Environmental consultants

- Investment and financial analysts

- Industry associations and NGOs

TABLE OF CONTENTS

1. EXECUTIVE SUMMARY

- 1.1. Introduction to PFAS

- 1.2. Definition and Overview of PFAS

- 1.2.1. Chemical Structure and Properties

- 1.2.2. Historical Development and Use

- 1.3. Types of PFAS

- 1.3.1. Non-polymeric PFAS

- 1.3.1.1. Long-Chain PFAS

- 1.3.1.2. Short-Chain PFAS

- 1.3.1.3. Other non-polymeric PFAS

- 1.3.2. Polymeric PFAS

- 1.3.2.1. Fluoropolymers (FPs)

- 1.3.2.2. Side-chain fluorinated polymers:

- 1.3.2.3. Perfluoropolyethers

- 1.3.1. Non-polymeric PFAS

- 1.4. Properties and Applications of PFAS

- 1.4.1. Water and Oil Repellency

- 1.4.2. Thermal and Chemical Stability

- 1.4.3. Surfactant Properties

- 1.4.4. Low Friction

- 1.4.5. Electrical Insulation

- 1.4.6. Film-Forming Abilities

- 1.4.7. Atmospheric Stability

- 1.5. Environmental and Health Concerns

- 1.5.1. Persistence in the Environment

- 1.5.2. Bioaccumulation

- 1.5.3. Toxicity and Health Effects

- 1.5.4. Environmental Contamination

- 1.6. PFAS Alternatives

- 1.7. Analytical techniques

- 1.8. Manufacturing/handling/import/export

- 1.9. Storage/disposal/treatment/purification

- 1.10. Water quality management

- 1.11. Alternative technologies and supply chains

2. GLOBAL REGULATORY LANDSCAPE

- 2.1. Impact of growing PFAS regulation

- 2.2. International Agreements

- 2.3. European Union Regulations

- 2.4. United States Regulations

- 2.4.1. Federal regulations

- 2.4.2. State-Level Regulations

- 2.5. Asian Regulations

- 2.5.1. Japan

- 2.5.1.1. Chemical Substances Control Law (CSCL)

- 2.5.1.2. Water Quality Standards

- 2.5.2. China

- 2.5.2.1. List of New Contaminants Under Priority Control

- 2.5.2.2. Catalog of Toxic Chemicals Under Severe Restrictions

- 2.5.2.3. New Pollutants Control Action Plan

- 2.5.3. Taiwan

- 2.5.3.1. Toxic and Chemical Substances of Concern Act

- 2.5.4. Australia and New Zealand

- 2.5.5. Canada

- 2.5.6. South Korea

- 2.5.1. Japan

- 2.6. Global Regulatory Trends and Outlook

3. INDUSTRY-SPECIFIC PFAS USAGE

- 3.1. Semiconductors

- 3.1.1. Importance of PFAS

- 3.1.2. Front-end processes

- 3.1.2.1. Lithography

- 3.1.2.2. Wet etching solutions

- 3.1.2.3. Chiller coolants for dry etchers

- 3.1.2.4. Piping and valves

- 3.1.3. Back-end processes

- 3.1.3.1. Interconnects and Packaging Materials

- 3.1.3.2. Molding materials

- 3.1.3.3. Die attach materials

- 3.1.3.4. Interlayer film for package substrates

- 3.1.3.5. Thermal management

- 3.1.4. Product life cycle and impact of PFAS

- 3.1.4.1. Manufacturing Stage (Raw Materials)

- 3.1.4.2. Usage Stage (Semiconductor Factory)

- 3.1.4.3. Disposal Stage

- 3.1.5. Environmental and Human Health Impacts

- 3.1.6. Regulatory Trends Related to Semiconductors

- 3.1.7. Exemptions

- 3.1.8. Future Regulatory Trends

- 3.1.9. Alternatives to PFAS

- 3.1.9.1. Alkyl Polyglucoside and Polyoxyethylene Surfactants

- 3.1.9.2. Non-PFAS Etching Solutions

- 3.1.9.3. PTFE-Free Sliding Materials

- 3.1.9.4. Metal oxide-based materials

- 3.1.9.5. Fluoropolymer Alternatives

- 3.1.9.6. Silicone-based Materials

- 3.1.9.7. Hydrocarbon-based Surfactants

- 3.1.9.8. Carbon Nanotubes and Graphene

- 3.1.9.9. Engineered Polymers

- 3.1.9.10. Supercritical CO2 Technology

- 3.1.9.11. Plasma Technologies

- 3.1.9.12. Sol-Gel Materials

- 3.1.9.13. Biodegradable Polymers

- 3.2. Textiles and Clothing

- 3.2.1. Overview

- 3.2.2. PFAS in Water-Repellent Materials

- 3.2.3. Stain-Resistant Treatments

- 3.2.4. Regulatory Impact on Water-Repellent Clothing

- 3.2.5. Industry Initiatives and Commitments

- 3.2.6. Alternatives to PFAS

- 3.2.6.1. Enhanced surface treatments

- 3.2.6.2. Non-fluorinated treatments

- 3.2.6.3. Biomimetic approaches

- 3.2.6.4. Nano-structured surfaces

- 3.2.6.5. Wax-based additives

- 3.2.6.6. Plasma treatments

- 3.2.6.7. Sol-gel coatings

- 3.2.6.8. Superhydrophobic coatings

- 3.2.6.9. Biodegradable Polymer Coatings

- 3.2.6.10. Graphene-based Coatings

- 3.2.6.11. Enzyme-based Treatments

- 3.2.6.12. Companies

- 3.3. Food Packaging

- 3.3.1. Sustainable packaging

- 3.3.1.1. PFAS in Grease-Resistant Packaging

- 3.3.1.2. Other applications

- 3.3.1.3. Regulatory Trends in Food Contact Materials

- 3.3.2. Alternatives to PFAS

- 3.3.2.1. Biobased materials

- 3.3.2.1.1. Polylactic Acid (PLA)

- 3.3.2.1.2. Polyhydroxyalkanoates (PHAs)

- 3.3.2.1.3. Cellulose-based materials

- 3.3.2.1.3.1. Nano-fibrillated cellulose (NFC)

- 3.3.2.1.3.2. Bacterial Nanocellulose (BNC)

- 3.3.2.1.4. Silicon-based Alternatives

- 3.3.2.1.5. Natural Waxes and Resins

- 3.3.2.1.6. Engineered Paper and Board

- 3.3.2.1.7. Nanocomposites

- 3.3.2.1.8. Plasma Treatments

- 3.3.2.1.9. Biodegradable Polymer Blends

- 3.3.2.1.10. Chemically Modified Natural Polymers

- 3.3.2.1.11. Molded Fiber

- 3.3.2.2. PFAS-free coatings for food packaging

- 3.3.2.2.1. Silicone-based Coatings:

- 3.3.2.2.2. Bio-based Barrier Coatings

- 3.3.2.2.3. Nanocellulose Coatings

- 3.3.2.2.4. Superhydrophobic and Omniphobic Coatings

- 3.3.2.2.5. Clay-based Nanocomposite Coatings

- 3.3.2.2.6. Coated Papers

- 3.3.2.3. Companies

- 3.3.2.1. Biobased materials

- 3.3.1. Sustainable packaging

- 3.4. Paints and Coatings

- 3.4.1. Overview

- 3.4.2. Applications

- 3.4.3. Alternatives to PFAS

- 3.4.3.1. Silicon-Based Alternatives:

- 3.4.3.2. Hydrocarbon-Based Alternatives:

- 3.4.3.3. Nanomaterials

- 3.4.3.4. Plasma-Based Surface Treatments

- 3.4.3.5. Inorganic Alternatives

- 3.4.3.6. Bio-based Polymers:

- 3.4.3.7. Dendritic Polymers

- 3.4.3.8. Zwitterionic Polymers

- 3.4.3.9. Graphene-based Coatings

- 3.4.3.10. Hybrid Organic-Inorganic Coatings

- 3.4.3.11. Companies

- 3.5. Ion Exchange membranes

- 3.5.1. Overview

- 3.5.1.1. PFAS in Ion Exchange Membranes

- 3.5.2. Proton Exchange Membranes

- 3.5.2.1. Overview

- 3.5.2.2. Proton Exchange Membrane Electrolyzers (PEMELs)

- 3.5.2.3. Membrane Degradation

- 3.5.2.4. Nafion

- 3.5.2.5. Membrane electrode assembly (MEA)

- 3.5.3. Manufacturing PFSA Membranes

- 3.5.4. Enhancing PFSA Membranes

- 3.5.5. Commercial PFSA membranes

- 3.5.6. Catalyst Coated Membranes

- 3.5.6.1. Alternatives to PFAS

- 3.5.7. Membranes in Redox Flow Batteries

- 3.5.7.1. Alternative Materials for RFB Membranes

- 3.5.8. Alternatives to PFAS

- 3.5.8.1. Alternative Polymer Materials

- 3.5.8.2. Anion Exchange Membrane Technology (AEM) fuel cells

- 3.5.8.3. Nanocellulose

- 3.5.8.4. Boron-containing membranes

- 3.5.8.5. Hydrocarbon-based membranes

- 3.5.8.6. Metal-Organic Frameworks (MOFs)

- 3.5.8.6.1. MOF Composite Membranes

- 3.5.8.7. Graphene

- 3.5.8.8. Companies

- 3.5.1. Overview

- 3.6. Energy (excluding fuel cells)

- 3.6.1. Overview

- 3.6.2. Solar Panels

- 3.6.3. Wind Turbines

- 3.6.3.1. Blade Coatings

- 3.6.3.2. Lubricants and Greases

- 3.6.3.3. Electrical and Electronic Components

- 3.6.3.4. Seals and Gaskets

- 3.6.4. Lithium-Ion Batteries

- 3.6.4.1. Electrode Binders

- 3.6.4.2. Electrolyte Additives

- 3.6.4.3. Separator Coatings

- 3.6.4.4. Current Collector Coatings

- 3.6.4.5. Gaskets and Seals

- 3.6.4.6. Fluorinated Solvents in Electrode Manufacturing

- 3.6.4.7. Surface Treatments

- 3.6.5. Alternatives to PFAS

- 3.6.5.1. Solar

- 3.6.5.1.1. Ethylene Vinyl Acetate (EVA) Encapsulants

- 3.6.5.1.2. Polyolefin Encapsulants

- 3.6.5.1.3. Glass-Glass Module Design

- 3.6.5.1.4. Bio-based Backsheets

- 3.6.5.2. Wind Turbines

- 3.6.5.2.1. Silicone-Based Coatings

- 3.6.5.2.2. Nanocoatings

- 3.6.5.2.3. Thermal De-icing Systems

- 3.6.5.2.4. Polyurethane-Based Coatings

- 3.6.5.3. Lithium-Ion Batteries

- 3.6.5.3.1. Water-Soluble Binders

- 3.6.5.3.2. Polyacrylic Acid (PAA) Based Binders

- 3.6.5.3.3. Alginate-Based Binders

- 3.6.5.3.4. Ionic Liquid Electrolytes

- 3.6.5.4. Companies

- 3.6.5.1. Solar

- 3.7. Low-loss materials for 5G

- 3.7.1. Overview

- 3.7.1.1. Organic PCB materials for 5G

- 3.7.2. PTFE in 5G

- 3.7.2.1. Properties

- 3.7.2.2. PTFE-Based Laminates

- 3.7.2.3. Regulations

- 3.7.2.4. Commercial low-loss

- 3.7.3. Alternatives to PFAS

- 3.7.3.1. Liquid crystal polymers (LCP)

- 3.7.3.2. Poly(p-phenylene ether) (PPE)

- 3.7.3.3. Poly(p-phenylene oxide) (PPO)

- 3.7.3.4. Hydrocarbon-based laminates

- 3.7.3.5. Low Temperature Co-fired Ceramics (LTCC)

- 3.7.3.6. Glass Substrates

- 3.7.1. Overview

- 3.8. Cosmetics

- 3.8.1. Overview

- 3.8.2. Use in cosmetics

- 3.8.3. Alternatives to PFAS

- 3.8.3.1. Silicone-based Polymers

- 3.8.3.2. Plant-based Waxes and Oils

- 3.8.3.3. Naturally Derived Polymers

- 3.8.3.4. Silica-based Materials

- 3.8.3.5. Companies Developing PFAS Alternatives in Cosmetics

- 3.9. Firefighting Foam

- 3.9.1. Overview

- 3.9.2. Aqueous Film-Forming Foam (AFFF)

- 3.9.3. Environmental Contamination from AFFF Use

- 3.9.4. Regulatory Pressures and Phase-Out Initiatives

- 3.9.5. Alternatives to PFAS

- 3.9.5.1. Fluorine-Free Foams (F3)

- 3.9.5.2. Siloxane-Based Foams

- 3.9.5.3. Protein-Based Foams

- 3.9.5.4. Synthetic Detergent Foams (Syndet)

- 3.9.5.5. Compressed Air Foam Systems (CAFS)

- 3.10. Automotive

- 3.10.1. Overview

- 3.10.2. PFAS in Lubricants and Hydraulic Fluids

- 3.10.3. Use in Fuel Systems and Engine Components

- 3.10.4. Electric Vehicle

- 3.10.4.1. PFAS in Electric Vehicles

- 3.10.4.2. High-Voltage Cables

- 3.10.4.3. Refrigerants

- 3.10.4.3.1. Coolant Fluids in EVs

- 3.10.4.3.2. Refrigerants for EVs

- 3.10.4.3.3. Regulations

- 3.10.4.3.4. PFAS-free Refrigerants

- 3.10.4.4. Immersion Cooling for Li-ion Batteries

- 3.10.4.4.1. Overview

- 3.10.4.4.2. Single-phase Cooling

- 3.10.4.4.3. Two-phase Cooling

- 3.10.4.4.4. Companies

- 3.10.4.4.5. PFAS-based Coolants in Immersion Cooling for EVs

- 3.10.5. Alternatives to PFAS

- 3.10.5.1. Lubricants and Greases

- 3.10.5.2. Fuel System Components

- 3.10.5.3. Surface Treatments and Coatings

- 3.10.5.4. Gaskets and Seals

- 3.10.5.5. Hydraulic Fluids

- 3.10.5.6. Electrical and Electronic Components

- 3.10.5.7. Paint and Coatings

- 3.10.5.8. Windshield and Glass Treatments

- 3.11. Electronics

- 3.11.1. Overview

- 3.11.2. PFAS in Printed Circuit Boards

- 3.11.3. Cable and Wire Insulation

- 3.11.4. Regulatory Challenges for Electronics Manufacturers

- 3.11.5. Alternatives to PFAS

- 3.11.5.1. Wires and Cables

- 3.11.5.2. Coating

- 3.11.5.3. Electronic Components

- 3.11.5.4. Sealing and Lubricants

- 3.11.5.5. Cleaning

- 3.11.5.6. Companies

- 3.12. Medical Devices

- 3.12.1. Overview

- 3.12.2. PFAS in Implantable Devices

- 3.12.3. Diagnostic Equipment Applications

- 3.12.4. Balancing Safety and Performance in Regulations

- 3.12.5. Alternatives to PFAS

- 3.13. Green hydrogen

- 3.13.1. Electrolyzers

- 3.13.2. Alternatives to PFAS

- 3.13.3. Economic implications

4. PFAS ALTERNATIVES

- 4.1. PFAS-Free Release Agents

- 4.1.1. Silicone-Based Alternatives

- 4.1.2. Hydrocarbon-Based Solutions

- 4.1.3. Performance Comparisons

- 4.2. Non-Fluorinated Surfactants and Dispersants

- 4.2.1. Bio-Based Surfactants

- 4.2.2. Silicon-Based Surfactants

- 4.2.3. Hydrocarbon-Based Surfactants

- 4.3. PFAS-Free Water and Oil-Repellent Materials

- 4.3.1. Dendrimers and Hyperbranched Polymers

- 4.3.2. PFA-Free Durable Water Repellent (DWR) Coatings

- 4.3.3. Silicone-Based Repellents

- 4.3.4. Nano-Structured Surfaces

- 4.4. Fluorine-Free Liquid-Repellent Surfaces

- 4.4.1. Superhydrophobic Coatings

- 4.4.2. Omniphobic Surfaces

- 4.4.3. Slippery Liquid-Infused Porous Surfaces (SLIPS)

- 4.5. PFAS-Free Colorless Transparent Polyimide

- 4.5.1. Novel Polymer Structures

- 4.5.2. Applications in Flexible Electronics

5. PFAS DEGRADATION AND ELIMINATION

- 5.1. Current methods for PFAS degradation and elimination

- 5.2. Bio-friendly methods

- 5.2.1. Phytoremediation

- 5.2.2. Microbial Degradation

- 5.2.3. Enzyme-Based Degradation

- 5.2.4. Mycoremediation

- 5.2.5. Biochar Adsorption

- 5.2.6. Green Oxidation Methods

- 5.2.7. Bio-based Adsorbents

- 5.2.8. Algae-Based Systems

- 5.3. Companies

6. PFAS TREATMENT

- 6.1. Introduction

- 6.2. Pathways for PFAS environmental contamination

- 6.3. Regulations

- 6.3.1. USA

- 6.3.2. EU

- 6.3.3. Rest of the World

- 6.4. PFAS water treatment

- 6.4.1. Introduction

- 6.4.2. Market Forecast 2025-2035

- 6.4.3. Applications

- 6.4.3.1. Drinking water

- 6.4.3.2. Aqueous film forming foam (AFFF)

- 6.4.3.3. Landfill leachate

- 6.4.3.4. Municipal wastewater treatment

- 6.4.3.5. Industrial process and wastewater

- 6.4.3.6. Sites with heavy PFAS contamination

- 6.4.3.7. Point-of-use (POU) and point-of-entry (POE) filters and systems

- 6.4.4. PFAS treatment approaches

- 6.4.5. Traditional removal technologies

- 6.4.5.1. Adsorption: granular activated carbon (GAC)

- 6.4.5.1.1. Sources

- 6.4.5.1.2. Short-chain PFAS compounds

- 6.4.5.1.3. Reactivation

- 6.4.5.1.4. PAC systems

- 6.4.5.2. Adsorption: ion exchange resins (IER)

- 6.4.5.2.1. Pre-treatment

- 6.4.5.2.2. Resins

- 6.4.5.3. Membrane filtration-reverse osmosis and nanofiltration

- 6.4.5.1. Adsorption: granular activated carbon (GAC)

- 6.4.6. Emerging removal technologies

- 6.4.6.1. Foam fractionation and ozofractionation

- 6.4.6.1.1. Polymeric sorbents

- 6.4.6.1.2. Mineral-based sorbents

- 6.4.6.1.3. Flocculation/coagulation

- 6.4.6.1.4. Electrostatic coagulation/concentration

- 6.4.6.2. Companies

- 6.4.6.1. Foam fractionation and ozofractionation

- 6.4.7. Destruction technologies

- 6.4.7.1. PFAS waste management

- 6.4.7.2. Landfilling of PFAS-containing waste

- 6.4.7.3. Thermal treatment

- 6.4.7.4. Liquid-phase PFAS destruction

- 6.4.7.5. Electrochemical oxidation

- 6.4.7.6. Supercritical water oxidation (SCWO)

- 6.4.7.7. Hydrothermal alkaline treatment (HALT)

- 6.4.7.8. Plasma treatment

- 6.4.7.9. Photocatalysis

- 6.4.7.10. Sonochemical oxidation

- 6.4.7.11. Challenges

- 6.4.7.12. Companies

- 6.5. PFAS Solids Treatment

- 6.5.1. Market Forecast 2025-2035

- 6.5.2. PFAS migration

- 6.5.3. Soil washing (or soil scrubbing)

- 6.5.4. Soil flushing

- 6.5.5. Thermal desorption

- 6.5.6. Phytoremediation

- 6.5.7. In-situ immobilization

- 6.5.8. Pyrolysis and gasification

- 6.5.9. Plasma

- 6.5.10. Supercritical water oxidation (SCWO)

- 6.6. Companies

7. GLOBAL MARKET ANALYSIS AND FUTURE OUTLOOK

- 7.1. Current Market Size and Segmentation

- 7.1.1. Global PFAS Market Overview

- 7.1.2. Regional Market Analysis

- 7.1.2.1. North America

- 7.1.2.2. Europe

- 7.1.2.3. Asia-Pacific

- 7.1.2.4. Latin America

- 7.1.2.5. Middle East and Africa

- 7.1.3. Market Segmentation by Industry

- 7.1.3.1. Textiles and Apparel

- 7.1.3.2. Food Packaging

- 7.1.3.3. Firefighting Foams

- 7.1.3.4. Electronics & semiconductors

- 7.1.3.5. Automotive

- 7.1.3.6. Aerospace

- 7.1.3.7. Construction

- 7.1.3.8. Others

- 7.1.4. Global PFAS Treatment Market Overview

- 7.1.4.1. Regional PFAS Treatment Market Analysis

- 7.1.4.1.1. North America

- 7.1.4.1.2. Europe

- 7.1.4.1.3. Asia-Pacific

- 7.1.4.1.4. Latin America

- 7.1.4.1.5. Middle East and Africa

- 7.1.4.1. Regional PFAS Treatment Market Analysis

- 7.2. Impact of Regulations on Market Dynamics

- 7.2.1. Shift from Long-Chain to Short-Chain PFAS

- 7.2.2. Growth in PFAS-Free Alternatives Market

- 7.2.3. Regional Market Shifts Due to Regulatory Differences

- 7.3. Emerging Trends and Opportunities

- 7.3.1. Green Chemistry Innovations

- 7.3.2. Circular Economy Approaches

- 7.3.3. Digital Technologies for PFAS Management

- 7.4. Challenges and Barriers to PFAS Substitution

- 7.4.1. Technical Performance Gaps

- 7.4.2. Cost Considerations

- 7.4.3. Regulatory Uncertainty

- 7.5. Future Market Projections

- 7.5.1. Short-Term Outlook (1-3 Years)

- 7.5.2. Medium-Term Projections (3-5 Years)

- 7.5.3. Long-Term Scenarios (5-10 Years)