|

|

市場調査レポート

商品コード

1623584

ヘリウムの世界市場(2025年~2035年)The Global Helium Market 2025-2035 |

||||||

|

|||||||

| ヘリウムの世界市場(2025年~2035年) |

|

出版日: 2025年01月02日

発行: Future Markets, Inc.

ページ情報: 英文 100 Pages, 45 Tables, 6 Figures

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のヘリウム市場は、供給力学の変化と需要パターンの進化により、大きく変革しつつあります。現在の市場環境は、伝統的な用途と新用途との間の複雑な相互作用を反映しており、半導体産業が世界の需要の約24%を占める圧倒的な消費者として台頭してきています。この変化は、極低温用途、特に医用画像用途が消費の大半を占めていた過去のパターンからの顕著な変化です。米国、カタール、アルジェリアなどの主要生産地域がさまざまな課題に直面しており、供給の制約が引き続き市場力学を形成しています。米国Federal Helium Reserveの役割が衰えているため、より商業主導型の市場構造への移行が加速している一方、カタールのLNGプロジェクトによる拡大は、世界の供給パターンに大きな変化をもたらしています。ロシアのプロジェクト、特にアムールの施設は、世界供給への寄与に影響を与える開発課題に直面しています。

現在の世界の生産能力は年間約1億7,500万立方メートルで、需給はほぼ一致しています。この逼迫した市場バランスが価格上昇圧力を維持し、一部の地域では供給途絶時に大きな変動が発生しています。市場は、この重要なガスの世界の流通と貯蔵の課題を反映し、価格と供給力に地域差が生じています。将来を見据えて、需要は2035年にかけて年平均5~6%の割合で成長すると予測され、これは主に半導体製造、量子コンピューティング用途、新技術によるものです。特にアジアにおける半導体産業の拡大により、2030年までに世界の消費に占める割合が30%を超えると予測されています。この成長はサプライチェーンにさらなる圧力をもたらし、新たな生産源の必要性を強調します。

カナダ、タンザニア、南アフリカで開発中の新しいヘリウムプロジェクトは、潜在的な供給多様化の可能性を提供しますが、開発スケジュールはまだ長期化しています。これらのプロジェクトは通常、窒素を多く含むガス流中の高濃度ヘリウムを対象としており、従来の天然ガスベースの採掘に比べ、より経済的な生産をもたらす可能性があります。保存とリサイクルの技術はますます重要になってきており、主要ユーザーは95%を超える効率を達成する精巧な回収システムを導入しています。この動向は特に医用画像部門で顕著であり、新技術によって単位あたりのヘリウム消費が大幅に削減されています。

市場予測では、大規模な生産能力が新たに開発されない限り、2035年までに供給が抑制される可能性があります。2035年までに予測される2億200万立方メートルの需要には、生産技術と保存技術の両面で多額の投資が必要となります。価格に対する期待は引き続き強気で、上昇圧力が続くと予測されるため、保存技術や代替ソリューションへの投資がさらに促進されると見られます。

各国は、ヘリウムの安定供給がハイテク産業にとって極めて重要であると見なしており、戦略的な考慮が市場力学に影響を与えるようになっています。このため、資源開発と戦略的備蓄構想への政府の関与が強まっています。ヘリウム市場は、回収技術の向上、新用途、供給パターンの変化により、将来の発展を形成しながら進化を続けています。

当レポートでは、世界のヘリウム市場について詳細に分析し、2025年~2035年の主要動向、供給の課題、新用途などの情報を提供しています。また、生産、サプライチェーン力学、最終用途、保存とリサイクルの技術開発など、ヘリウム産業の重要な側面を取り上げています。

目次

第1章 エグゼクティブサマリー

- 主な市場動向

- ヘリウム消費

- 世界のヘリウム資源:地域別

- ヘリウム生産サプライチェーン

- 技術準備レベル

- ヘリウム要求の削減

- ヘリウムの市場需要の高まり

第2章 イントロダクション

- 概要

- 用途

第3章 ヘリウムの生産と供給

- 供給

- ヘリウム生産

- ヘリウム探査

- ヘリウム分離技術

- ヘリウム生産・供給産業

第4章 ヘリウムの市場

- 世界のヘリウムの総需要

- 生産能力

- 製造におけるヘリウム

- 半導体製造

- 光ファイバー

- リークテスト

- 磁気共鳴画像(MRI)

- 核磁気共鳴(NMR)分光法

- 量子コンピューティング

- 水素の液化

- 浮揚ガス

- ガスクロマトグラフィによる化学分析

- 航空宇宙

- 原子炉の冷却

第5章 ヘリウムの代替品と再生

- 概要

- ヘリウム資源の管理

- ヘリウム回収システム

- 企業

- ヘリウムの代替品と再生の予測

第6章 企業プロファイル(25社のプロファイル)

第7章 参考文献

List of Tables

- Table 1. Key Helium Market Trends

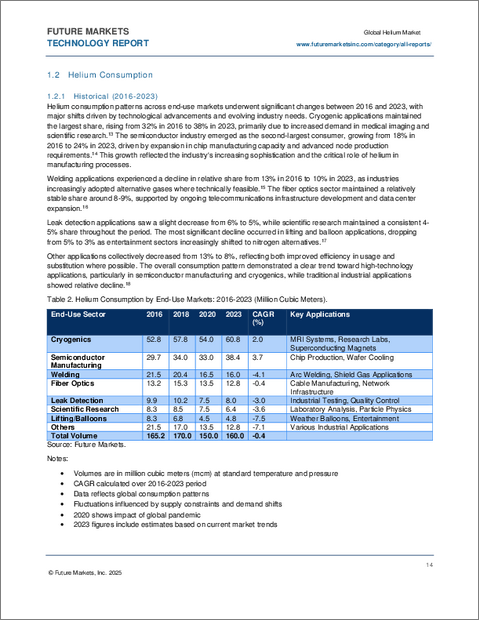

- Table 2. Helium Consumption by End-Use Markets: 2016-2023 (Million Cubic Meters)

- Table 3. Global Helium Resources by Region

- Table 4. Technology Readiness of Helium Reclamation in Key Markets

- Table 5. Adoption of Reclamation for Leak Testing and Cryogenic Applications (2024-2035)

- Table 6. Global Helium Demand Segmented by Application (2023-2035)

- Table 7. Helium Production Capacity and Demand Forecast (2024-2035)

- Table 8. Global Resources and Production

- Table 9. Major Global Helium Production Sites

- Table 10. Cryogenic Applications of Helium

- Table 11. Helium Supply Challenges

- Table 12. Helium Production and Separation Processes

- Table 13. Helium Supply Chain and Separation Processes

- Table 14. Global Helium Production Capacity (2005-2022)

- Table 15. Forecast for Yearly Global Helium Production Capacity (2020-2035)

- Table 16. Forecast for Share of Yearly Global Helium Production Capacity (2020-2035)

- Table 17. US Helium Production (2000-2023)

- Table 18. Main Active Helium Extraction and Processing Facilities in the US

- Table 19. Helium Exploration and Sourcing Projects

- Table 20. Helium Separation Technologies

- Table 21. Hollow Fiber Membrane Types for Helium Separation

- Table 22. Helium Separation Technologies Companies

- Table 23. Helium Production and Supply Company Landscape

- Table 24. Markets and applications for Helium

- Table 25. Total Global Helium Demand Segmented by Application (2023-2035)

- Table 26. Share of Total Yearly Helium Demand by Application (%)

- Table 27. Forecast for Helium Production Capacity (2020-2035)

- Table 28. Comparison of Helium Production Capacity and Demand Forecast (2024-2035)

- Table 29. Semiconductor Industry Helium Applications

- Table 30. Technology Readiness of Helium Reclamation

- Table 31. Rare Gas Reclamation Technologies

- Table 32. Helium Demand Forecast for Semiconductor and Fiber Optic Manufacturing (2023-2035)

- Table 33. Applications of Helium in Fiber Optic Manufacturing

- Table 34. Companies in helium leak testing

- Table 35. Helium Demand Forecast for Leak Testing in Manufacturing (2023-2035)

- Table 36. Companies in Magnetic Resonance Imaging Technologies

- Table 37. Helium Demand Forecast for MRI Applications (2023-2035)

- Table 38. Companies in NMR Spectroscopy Technologies

- Table 39. Helium (He-4) Demand Forecast for Quantum Computing (2024-2035)

- Table 40. Helium (He-3) Demand Forecast for Quantum Computing (2024-2035)

- Table 41. Types of Hydrogen Liquefaction Cycles & Refrigerants

- Table 42. Companies in Helium Lifting Gas Applications

- Table 43. Global Helium Demand Forecast for Lifting Gas (2023-2035)/

- Table 44. Helium Reclamation Systems for Cryogenic Applications

- Table 45. Helium Conservation and Reclamation Technologies by Company

List of Figures

- Figure 1. Helium Consumption by End-Use: 2016-2023 (Million Cubic Meters)

- Figure 2. Supply Chain for Helium Production

- Figure 3. Global Helium Demand Segmented by Application (2023-2035)

- Figure 4. Total Yearly Global Helium Demand Segmented by Application (2023-2035)

- Figure 5. Forecast for Helium Production Capacity (2020-2035)

- Figure 6. Helium Demand Forecast for Leak Testing in Manufacturing (2023-2035)

The global helium market is experiencing significant transformation driven by shifting supply dynamics and evolving demand patterns. Current market conditions reflect a complex interplay between traditional and emerging applications, with the semiconductor industry emerging as the dominant consumer, accounting for approximately 24% of global demand. This shift represents a notable change from historical patterns where cryogenic applications, particularly in medical imaging, dominated consumption. Supply constraints continue to shape market dynamics, with major producing regions including the United States, Qatar, and Algeria facing various challenges. The U.S. Federal Helium Reserve's diminishing role has accelerated the transition to a more commercially driven market structure, while Qatar's expansion through LNG projects represents a significant shift in global supply patterns. Russian projects, particularly the Amur facility, face ongoing development challenges that impact their contribution to global supply.

Current global production capacity stands at approximately 175 million cubic meters annually, with demand closely matching supply. This tight market balance has maintained upward pressure on prices, with some regions experiencing significant volatility during supply disruptions. The market has shown increasing regional variation in pricing and availability, reflecting the challenges in global distribution and storage of this critical gas. Looking toward the future, demand is projected to grow at a compound annual rate of 5-6% through 2035, driven primarily by semiconductor manufacturing, quantum computing applications, and emerging technologies. The semiconductor industry's expansion, particularly in Asia, is expected to increase its share of global consumption to over 30% by 2030. This growth creates additional pressure on supply chains and emphasizes the need for new production sources.

New helium projects under development in Canada, Tanzania, and South Africa offer potential supply diversification, though development timelines remain extended. These projects typically target higher helium concentrations in nitrogen-rich gas streams, potentially offering more economical production compared to traditional natural gas-based extraction. Conservation and recycling technologies are becoming increasingly critical, with major users implementing sophisticated recovery systems achieving efficiency rates exceeding 95%. This trend is particularly evident in the medical imaging sector, where new technologies have significantly reduced helium consumption per unit.

Market forecasts indicate potential supply constraints by 2035 unless significant new production capacity is developed. The projected demand of 202 million cubic meters by 2035 will require substantial investment in both production and conservation technologies. Price expectations remain bullish, with continued upward pressure likely to drive further investment in conservation technologies and alternative solutions where feasible.

Strategic considerations are increasingly influencing market dynamics, with countries viewing helium supply security as crucial for high-technology industries. This has prompted increased government involvement in resource development and strategic stockpiling initiatives. The market continues to evolve with improved recovery technologies, emerging applications, and shifting supply patterns shaping its future development.

"The Global Helium Market 2025-2035" provides an in-depth analysis of the global helium market, examining key trends, supply challenges, and emerging applications from 2025 to 2035. The report addresses critical aspects of the helium industry, including production, supply chain dynamics, end-user applications, and technological developments in conservation and recycling.

Report contents include:

- Key Growth Drivers and Trends

- Supply and Production Analysis

- Market Segmentation and Applications

- Technological Developments

- Conservation and Recycling

- Alternative Technologies

- Supply Chain Analysis

- Extraction and separation technologies

- Transportation and storage requirements

- Distribution networks

- Supply security considerations

- Market Challenges and Opportunities

- Growth Opportunities

- New production regions

- Technology development

- Conservation systems

- Alternative applications

- Regional Analysis

- Market Forecasts and Projections

- Production capacity projections

- Demand growth by application

- Regional market development

- Price trend analysis

- Competitive Landscape

- Major industrial gas companies

- Specialized helium producers

- Technology providers. Companies profiled include Air Liquide, Air Products, Blue Star Helium, BlueFors, Bruker, Cincinnati Test Systems, Desert Mountain Energy Corp., Evonik Industries AG, First Helium, Generon, Helium One Global Ltd., HeLIX Exploration PLC, Hybrid Air Vehicles, IACX Energy, iSpace Inc., Linde, Mendel Helium, Mosman Oil & Gas, New Era Helium, North American Helium, Pulsar Helium and more. Plus lists of helium-based suppliers in Cryogenics, Semiconductor and fiber optic manufacturing processes, Leak Detection and Testing, Lifting Applications, Imaging, Helium separation technologies, Magnetic Resonance Imaging (MRI), and Nuclear Magnetic Resonance (NMR) Spectroscopy.

- Technology Assessment

- Separation methods

- Conservation systems

- Alternative technologies

- Future developments

- Regulatory Environment

- Investment Analysis

This comprehensive report provides essential insights for companies operating in or considering entry into the helium market. It combines detailed market analysis with practical implementation guidance, supporting strategic decision-making through 2035. The report's extensive coverage makes it an invaluable resource for:

- Industry executives

- Market strategists

- Technology developers

- Investment analysts

- Policy makers

TABLE OF CONTENTS

1. EXECUTIVE SUMMARY

- 1.1. Key Market Trends

- 1.2. Helium Consumption

- 1.2.1. Historical (2016-2023)

- 1.3. Global Helium Resources, by Region

- 1.4. Helium Production Supply Chain

- 1.4.1. Supply Challenges

- 1.4.2. Manufacturing dependence on reliable helium

- 1.4.3. Semiconductor industry's reliance on helium

- 1.4.4. Separation technologies

- 1.5. Technology Readiness Level

- 1.6. Reducing Helium Requirements

- 1.6.1. MRI Systems

- 1.6.2. Superconductor technology

- 1.6.3. Recapture and Recycling Systems

- 1.7. Growing market demand for Helium

2. INTRODUCTION

- 2.1. Overview

- 2.1.1. Helium Characteristics

- 2.1.2. Global Resources and Production

- 2.1.3. Major Global Helium Production Sites

- 2.2. Applications

- 2.2.1. Semiconductors

- 2.2.2. Cryogenics

- 2.2.3. Aerospace

- 2.2.4. Semiconductor and fiber optic manufacturing processes

- 2.2.5. Welding

- 2.2.6. Deep-Sea Diving

- 2.2.7. Leak Detection and Testing

- 2.2.8. Lifting Applications

- 2.2.9. Critical Raw Materials

3. HELIUM PRODUCTION AND SUPPLY

- 3.1. Supply

- 3.2. Helium production

- 3.2.1. Natural formation of helium

- 3.2.2. Helium-3

- 3.2.3. Impact of facility downtime

- 3.2.4. Global Helium Production Capacity

- 3.2.4.1 Historical

- 3.2.4.2 Forecast

- 3.2.5. US Helium Production

- 3.2.6. Emerging Helium Production Regions

- 3.3. Helium exploration

- 3.3.1. Commercial exploration examples

- 3.4. Helium separation technologies

- 3.4.1. Main technologies

- 3.4.2. Hollow fiber membranes

- 3.4.3. Commercial examples

- 3.4.4. Companies

- 3.5. Helium production and supply industry

4. MARKETS FOR HELIUM

- 4.1. Total Global Helium Demand

- 4.2. Production capacity

- 4.3. Helium in manufacturing

- 4.4. Semiconductor manufacturing

- 4.4.1. Overview

- 4.4.2. Properties

- 4.4.3. Reclamation

- 4.4.4. Helium Demand Forecast

- 4.5. Fiber Optics

- 4.5.1. Overview

- 4.5.2. Conservation and reclamation technology

- 4.6. Leak Testing

- 4.6.1. Overview

- 4.6.2. Trace gas leak testing

- 4.6.3. Sniffer and accumulation testing methods

- 4.6.4. Helium recycling systems

- 4.6.5. Commercial examples

- 4.6.6. Leak testing in Automotive manufacturing processes and components

- 4.6.7. HVAC systems

- 4.6.8. Thermal management systems

- 4.6.9. Companies

- 4.6.10 Helium Demand Forecast

- 4.7. Magnetic Resonance Imaging (MRI)

- 4.7.1. Overview

- 4.7.2. Reduced helium dependence

- 4.7.2.1. Low Temperature Superconducting (LTS) MRI systems

- 4.7.2.2. MRI magnets

- 4.7.2.3. Helium-Free Low-field MRI systems

- 4.7.2.4. MgB2 and High-Temperature Superconductors

- 4.7.2.5. Metamaterials

- 4.7.3. Companies

- 4.7.4. Helium Demand Forecast

- 4.8. Nuclear Magnetic Resonance (NMR) Spectroscopy

- 4.8.1. Overview

- 4.8.2. Recapture and Recycling

- 4.8.3. High-Temperature Superconductor (HTS) magnet technology

- 4.8.4. Reduced helium dependence

- 4.8.5. Commercial examples

- 4.8.6. Companies

- 4.9. Quantum Computing

- 4.9.1. Overview

- 4.9.2. He-3 and He-4 in Milli-Kelvin Cooling

- 4.9.3. Helium Demand Forecast

- 4.10. Liquefying Hydrogen

- 4.10.1. Overview

- 4.11. Lifting Gas

- 4.11.1. Overview

- 4.11.2. Companies

- 4.11.3. Helium Demand Forecast

- 4.12. Chemical Analysis using Gas Chromatography

- 4.12.1. Overview

- 4.13. Aerospace

- 4.13.1. Overview

- 4.14. Nuclear reactor cooling

- 4.14.1. Overview

5. HELIUM SUBSTITUTES AND RECLAMATION

- 5.1. Overview

- 5.2. Management of helium resources

- 5.3. Helium reclamation systems

- 5.3.1. Helium reclamation systems for cryogenic applications

- 5.4. Companies

- 5.5. Forecast for Helium Substitutes and Reclamation