|

|

市場調査レポート

商品コード

1326728

耐久撥水(DWR)コーティングの世界市場(2024年~2034年)The Global Market for Durable Water Repellent (DWR) Coatings 2024-2034 |

||||||

|

|||||||

| 耐久撥水(DWR)コーティングの世界市場(2024年~2034年) |

|

出版日: 2023年08月10日

発行: Future Markets, Inc.

ページ情報: 英文 197 Pages, 27 Tables, 17 Figures

納期: 即納可能

|

- 全表示

- 概要

- 目次

耐久撥水(DWR)コーティングは、水をはじくが水蒸気は通す疎水性の表面を作ります。PTFEのようなフッ素樹脂は、反応性がなく撥水性に優れているため、DWRコーティングに使用される化学のもっとも一般的なタイプですが、環境への配慮から、炭化水素、シリコン、ナノコーティング、バイオベースの代替品、スマートコーティングに注目が集まっています。テキスタイルは最大の用途セグメントです。主な成長促進要因は、耐水性ファブリックに対する需要や、水害やカビの繁殖を防ぐことで建物の寿命を延ばす必要性です。

当レポートでは、世界の耐久撥水(DWR)コーティング市場について調査分析し、市場の促進要因と課題、市場規模の予測、企業プロファイルなどを提供しています。

目次

第1章 イントロダクション

- 技術の概要

- PFC

- PFCフリー

- 特性とパフォーマンスメトリクス

- アウトドア衣料品企業によるPFCの段階的廃止の取り組み

- 主な化学のタイプ

- フッ素ポリマー

- 炭化水素

- シリコン、シラン、シロキサン

- ナノコーティング

- ハイブリッドコーティング

- バイオベース

- スマートDWRコーティング

- 現在のDWR化学の限界

- 耐久性と撥水性能の向上

第2章 耐久撥水(DWR)コーティングの世界市場

- 市場促進要因

- 市場課題

- DWRコーティング市場

- アウトドアアパレル

- ファッションアパレル

- パフォーマンスフットウェア

- 作業服

- メディカルウェア

- ミリタリーアパレル

- 室内装飾品

- 日よけ、テント、バッグ

- 輸送

- 建築、建設

- 電子

- 工業用コーティング

- 主要企業

- DWRコーティングの世界市場

- 化学別

- 最終用途市場別

- 地域別

第3章 企業プロファイル(172社のプロファイル)

第4章 調査手法

第5章 参考材料

Durable Water Repellent (DWR) Coatings create hydrophobic surfaces that repel water but allow water vapor to pass through. Fluoropolymers like PTFE are the most common type of chemistry used for DWR coatings due to their non-reactivity and excellent water repellency, but environmental concerns are shifting focus to hydrocarbons, silicones, nanocoatings, bio-based alternatives and smart coatings. Textiles are the largest application segment. Major factors driving growth are demand for water-resistant fabrics and the need to extend building lifespans by preventing water damage and mould growth.

Report contents include:

- Coatings analysis including chemistry, properties, application process and environmental issues. DWR coatings types covered include:

- Fluoropolymers.

- PTFE (polytetrafluoroethylene).

- Fluorinated acrylates/methacrylates.

- Shorter-chain fluorotelomer-based polymers.

- Branched fluoropolymers.

- Plasma-induced grafting.

- Hydrocarbons.

- Paraffins.

- Polyurethanes

- Silicones, Silanes, & Siloxanes.

- Polydimethylsiloxane (PDMS).

- Modified silicones.

- Block copolymers.

- Nanocoatings.

- Hybrid coatings.

- Bio-based

- Wax emulsions.

- Aliphatic polyesters.

- Chitosan.

- Protein-based.

- Plant-derived C6, C8, and C10 chemistry platforms.

- Lignin-derived polymers.

- Nanoscale citrus-derived.

- Smart DWR coatings

- Temperature-responsive DWR coatings.

- pH-responsive DWR coatings.

- Light-responsive DWR coatings.

- Self-healing DWR coatings.

- Conductive DWR coatings.

- Fluoropolymers.

- Limitations of current DWR chemistries.

- Market drivers and challenges.

- Analysis of markets for DWR coatings including:

- Outdoor apparel

- Fashion apparel

- Performance footwear

- Workwear

- Medical wear

- Military apparel

- Upholstery

- Awnings, tents, and bags

- Transportation

- Building & Construction

- Electronics

- Industrial coatings.

- Analysis of key market players, textile mills and fabric finishers providing durable water repellent (DWR) treatments.

- Global market revenues for DWR Coatings, by chemistry, end-use market and regions, historical and forecast to 2034.

- Profiles of 172 chemical manufacturers, product developers, coating producers and start-ups. Companies profiled include 3M, Actnano, Amphico, BASF, Chemours, Dimpora, Dow, Earthodic, Elkem, Green Theme Technologies, Inc., Hitachi Chemical, Kukdo Chemical Co., Ltd., Lamoral Coatings, NICCA Chemical, P2i, and Toray.

TABLE OF CONTENTS

1. INTRODUCTION

- 1.1. Technology overview

- 1.1.1. PFCs

- 1.1.2. PFC-Free

- 1.2. Properties and performance metrics

- 1.3. Initiatives by outdoor clothing companies to phase out PFCs

- 1.4. Key chemistry types

- 1.4.1. Fluoropolymers

- 1.4.1.1. PTFE (polytetrafluoroethylene)

- 1.4.1.1.1. Chemical Structure

- 1.4.1.1.2. Properties

- 1.4.1.1.3. Application Process

- 1.4.1.1.4. Environmental Concerns

- 1.4.1.2. Fluorinated acrylates/methacrylates

- 1.4.1.2.1. Chemical Structure

- 1.4.1.2.2. Properties

- 1.4.1.2.3. Application Process

- 1.4.1.2.4. Environmental Considerations

- 1.4.1.3. Shorter-chain fluorotelomer-based polymers

- 1.4.1.3.1. Chemistry

- 1.4.1.3.2. Properties

- 1.4.1.3.3. Environmental Considerations

- 1.4.1.4. Branched fluoropolymers

- 1.4.1.4.1. Chemical Structure

- 1.4.1.4.2. Properties

- 1.4.1.4.3. Environmental Considerations

- 1.4.1.5. Plasma-induced grafting

- 1.4.1.5.1. Application process

- 1.4.1.5.2. Environmental Considerations

- 1.4.1.1. PTFE (polytetrafluoroethylene)

- 1.4.2. Hydrocarbons

- 1.4.2.1. Paraffins

- 1.4.2.1.1. Properties

- 1.4.2.1.2. Application Process

- 1.4.2.1.3. Environmental Considerations

- 1.4.2.2. Polyurethanes

- 1.4.2.2.1. Chemistry

- 1.4.2.2.2. Properties

- 1.4.2.2.3. Application Process

- 1.4.2.2.4. Environmental Considerations

- 1.4.2.1. Paraffins

- 1.4.3. Silicones, Silanes, & Siloxanes

- 1.4.3.1. Polydimethylsiloxane (PDMS)

- 1.4.3.1.1. Chemistry

- 1.4.3.1.2. Properties

- 1.4.3.1.3. Application Process

- 1.4.3.1.4. Environmental Considerations

- 1.4.3.2. Modified silicones

- 1.4.3.2.1. Chemistry

- 1.4.3.2.2. Properties

- 1.4.3.2.3. Types of Modifications

- 1.4.3.2.4. Application Techniques

- 1.4.3.2.5. Environmental Considerations

- 1.4.3.3. Block copolymers

- 1.4.3.3.1. Chemistry

- 1.4.3.3.2. Properties

- 1.4.3.3.3. Environmental Considerations

- 1.4.3.1. Polydimethylsiloxane (PDMS)

- 1.4.4. Nanocoatings

- 1.4.4.1. Chemistry

- 1.4.4.2. Properties

- 1.4.4.2.1. Superhydrophobicity

- 1.4.4.3. Application process

- 1.4.5. Hybrid coatings

- 1.4.5.1. Types

- 1.4.6. Bio-based

- 1.4.6.1. Wax emulsions

- 1.4.6.1.1. Chemistry

- 1.4.6.1.2. Properties

- 1.4.6.1.3. Application Process

- 1.4.6.1.4. Environmental Considerations

- 1.4.6.2. Aliphatic polyesters

- 1.4.6.3. Chitosan

- 1.4.6.4. Protein-based

- 1.4.6.5. Plant-derived C6, C8, and C10 chemistry platforms

- 1.4.6.6. Lignin-derived polymers

- 1.4.6.7. Nanoscale citrus-derived

- 1.4.6.1. Wax emulsions

- 1.4.7. Smart DWR coatings

- 1.4.7.1. Temperature-responsive DWR coatings

- 1.4.7.2. pH-responsive DWR coatings

- 1.4.7.3. Light-responsive DWR coatings

- 1.4.7.4. Self-healing DWR coatings

- 1.4.7.5. Conductive DWR coatings

- 1.4.1. Fluoropolymers

- 1.5. Limitations of current DWR chemistries

- 1.6. Improving durability and repellency performance

2. THE GLOBAL MARKET FOR DURABLE WATER REPELLENT (DWR) COATINGS

- 2.1. Market drivers

- 2.2. Market challenges

- 2.3. Markets for DWR coatings

- 2.3.1. Outdoor apparel

- 2.3.1.1. Market overview

- 2.3.1.2. Applications

- 2.3.2. Fashion apparel

- 2.3.2.1. Market overview

- 2.3.2.2. Applications

- 2.3.3. Performance footwear

- 2.3.3.1. Market overview

- 2.3.3.2. Applications

- 2.3.4. Workwear

- 2.3.4.1. Market overview

- 2.3.4.2. Applications

- 2.3.5. Medical wear

- 2.3.5.1. Market overview

- 2.3.5.2. Applications

- 2.3.6. Military apparel

- 2.3.6.1. Market overview

- 2.3.6.2. Applications

- 2.3.7. Upholstery

- 2.3.7.1. Market overview

- 2.3.7.2. Applications

- 2.3.8. Awnings, tents, and bags

- 2.3.8.1. Market overview

- 2.3.8.2. Applications

- 2.3.9. Transportation

- 2.3.9.1. Market overview

- 2.3.9.2. Applications

- 2.3.10. Building & Construction

- 2.3.10.1. Market overview

- 2.3.10.2. Applications

- 2.3.11. Electronics

- 2.3.11.1. Market overview

- 2.3.11.2. Applications

- 2.3.12. Industrial coatings

- 2.3.12.1. Market overview

- 2.3.12.2. Applications

- 2.3.1. Outdoor apparel

- 2.4. Key players

- 2.5. Global market for DWR Coatings

- 2.5.1. By chemistries

- 2.5.2. By end-use market

- 2.5.3. By region

- 2.5.3.1. Asia-Pacific

- 2.5.3.2. Europe

- 2.5.3.3. North America

- 2.5.3.4. South America

3. COMPANY PROFILES (172 company profiles)

4. RESEARCH METHODOLOGY

- 4.1. Aims and objectives of the study

5. REFERENCES

List of tables

- Table 1. Key properties and performance metrics of durable water repellent (DWR) coatings

- Table 2. Initiatives by outdoor clothing companies to phase out PFCs

- Table 3. Market overview for hydrophobic nanocoatings

- Table 4. Contact angles of hydrophilic, super hydrophilic, hydrophobic and superhydrophobic surfaces

- Table 5. Disadvantages of commonly utilized superhydrophobic coating methods

- Table 6. Limitations of current DWR chemistries

- Table 7. Market drivers for durable water repellent (DWR) coatings

- Table 8. Market challenges for durable water repellent (DWR) coatings

- Table 9. Markets for durable water repellent (DWR) coatings

- Table 10. Applications of durable water repellent (DWR) coatings in outdoor apparel

- Table 11. Applications of durable water repellent (DWR) coatings in fashion apparel

- Table 12. Applications of durable water repellent (DWR) coatings in performance footwear

- Table 13. Applications of durable water repellent (DWR) coatings in workwear

- Table 14. Applications of durable water repellent (DWR) coatings in medical wear

- Table 15. Applications of durable water repellent (DWR) coatings military apparel

- Table 16. Applications of durable water repellent (DWR) coatings in the upholstery sector

- Table 17. Applications of durable water repellent (DWR) coatings in awnings, tents, and bags

- Table 18. Applications of durable water repellent (DWR) coatings in the automotive sector

- Table 19. Applications of durable water repellent (DWR) coatings in building and construction

- Table 20. Applications of durable water repellent (DWR) coatings in electronics

- Table 21. Applications of durable water repellent (DWR) coatings in industrial coatings

- Table 22. Key players in DWR coatings

- Table 23. Textile mills and fabric finishers providing durable water repellent (DWR) treatments

- Table 24. Global revenues for DWR coatings, by chemistry types, 2018-2034 (billions USD)

- Table 25. Global revenues for DWR coatings, by end-use markets, 2018-2034 (billions USD)

- Table 26. Global revenues for DWR coatings, by region, 2018-2034 (billions USD)

- Table 27. Granbio Nanocellulose Processes

List of figures

- Figure 1. Contact angle of a water drop on a hydrophilic, a hydrophobic, and superhydrophobic surface

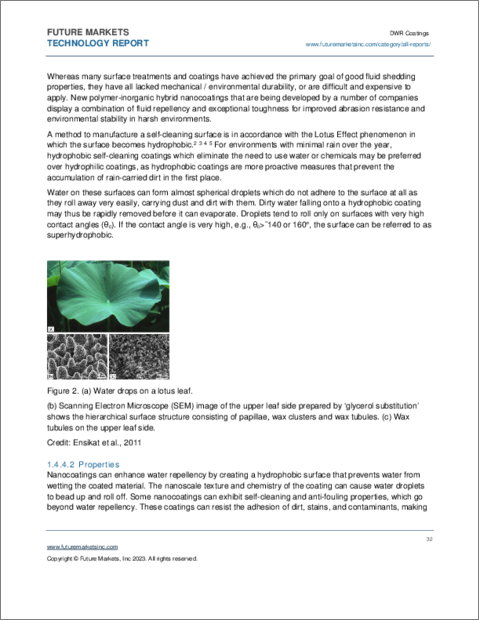

- Figure 2. (a) Water drops on a lotus leaf

- Figure 3. A schematic of (a) water droplet on normal hydrophobic surface with contact angle greater than 90° and (b) water droplet on a superhydrophobic surface with a contact angle > 150°

- Figure 4. Contact angle on superhydrophobic coated surface

- Figure 5. Global revenues for DWR coatings, 2018-2034 (billions USD)

- Figure 6. Global revenues for DWR coatings, by chemistry types, 2018-2034 (billions USD)

- Figure 7. Global revenues for DWR coatings, by end-use markets, 2018-2034 (billions USD)

- Figure 8. Global revenues for DWR coatings, by region, 2018-2034 (billions USD)

- Figure 9. Global revenues for DWR coatings, in Asia-Pacific, 2018-2034 (billions USD)

- Figure 10. Global revenues for DWR coatings, in Europe, 2018-2034 (billions USD)

- Figure 11. Global revenues for DWR coatings, in North America, 2018-2034 (billions USD)

- Figure 12. Global revenues for DWR coatings, in South America, 2018-2034 (billions USD)

- Figure 13. Lab tests on DSP coatings

- Figure 14. Self-cleaning nanocoating applied to face masks

- Figure 15. NanoSeptic surfaces

- Figure 16. NascNanoTechnology personnel shown applying MEDICOAT to airport luggage carts

- Figure 17. AquaStop™ paper