|

|

市場調査レポート

商品コード

1347965

フェイシャルエステの世界市場-2023年~2030年Global Facial Aesthetics Market - 2023-2030 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| フェイシャルエステの世界市場-2023年~2030年 |

|

出版日: 2023年09月11日

発行: DataM Intelligence

ページ情報: 英文 186 Pages

納期: 約2営業日

|

- 全表示

- 概要

- 目次

概要

フェイシャルエステの世界市場は2022年に65億米ドルに達し、2023-2030年の予測期間中にCAGR 9.1%で成長し、2030年には193億米ドルに達すると予測されています。

フェイシャルエステは非外科的で低侵襲の施術であり、一時的にしわを目立たなくしたり、ボリュームを回復させたりすることができます。一般的な治療部位は、額、頬、唇などです。製品発売の増加と顔面手術の需要増加が市場の牽引要因となっています。

北米地域は市場シェアで大きな位置を占めると予想されます。施術数の増加と製品の発売が、この地域を支配的なシェアに保持しています。

フェイシャルエステ市場の調査分析では、量的および質的データを含む市場の詳細な展望を提供します。市場セグメンテーションに基づく世界市場の展望と予測を提供します。

ダイナミクス

製品発表数の増加が市場成長を牽引

製品上市数の増加が市場成長を牽引しています。例えば、2023年1月17日、AbbVie傘下のAllergan Aesthetics社は、待望のSkinMedica Even &Correct Collectionを発売しました。臨床的に証明され、的を絞った結果をもたらすように処方されたこれらの高度なブライトニング・トリートメント、ダークスポット・クリーム、ブライトニング・トリートメント・パッドは、別々に、または一緒に使用することで、肌のトーンを均一にし、顔の色素沈着やダークスポットを目立たなくします。

さらに、2023年1月10日、ムンバイを拠点とするENTOD Pharmaceuticals社は、目の快適性を改善し、目の美しさを高めることに焦点を当てた新しい眼科用美容製品シリーズを発売しました。製品はEyecirque、Lashfactor、Vasukiのブランドで発売されました。Eyecirqueシリーズは、世界初のナノテクノロジー・ベースのジェル状美容液、目の下用美白・アンチエイジング・タブレット、潤滑目薬、必須目のサプリメントで構成されています。このように、製品発売の増加は市場の成長を加速させると思われます。

フェイシャルエステ処置の需要増加と主要企業による戦略による市場成長の促進

フェイシャルエステに対する需要の増加は、製品発売を増加させ、市場成長を牽引しています。例えば、2023年1月9日、国際美容整形外科学会(ISAPS)は、美容/美容処置に関する年次世界調査の結果を発表し、2021年に形成外科医が実施する処置は全体で19.3%増加し、外科的処置は世界で1,280万件以上、非外科的処置は1,750万件以上実施されることを示しました。

提携やパートナーシップなど、各社が展開する戦略が市場開拓を促進するとみられます。例えば、2021年1月15日、医療エステティックの世界的リーダーであるMerz Aesthetics社と美容機器メーカーのCandela Corporation社は、世界中の消費者に幅広い医療エステティック・ポートフォリオを提供するための商業提携を開始しました。

さらに、2022年5月24日、完全に統合された世界の大手スキンケア企業であるクラウン・ラボラトリーズは、その世界のエステティックに特化した資産を買収しました。この買収により、クラウンのエステティック製品ポートフォリオは拡大し、科学に基づくエステティック・スキンケア・ソリューションの世界的リーダーとしてのクラウンの総合的な価値提案は強化されます。このように、上記の要因は市場の成長を促進すると予想されます。

製品・治療費の高騰が市場成長の妨げとなる見通し

これらのフェイシャルエステ施術は高額であり、その高コストが市場成長の障壁となります。例えば、米国形成外科学会(American Society of Plastic Surgeons)の最新の統計によると、フェイスリフトの平均費用は8,005ドルです。外科医が請求する料金は、治療費全体を決定する重要な要素の一つです。外科医の他に、麻酔医の料金も治療費に加算されます。手技の複雑さと要求に応じて、費用は増加します。そのため、市場成長の抑制要因となっています。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

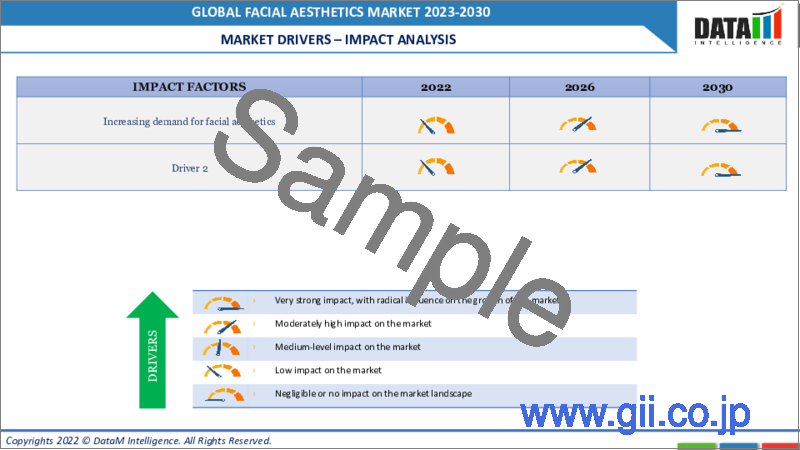

- 影響要因

- 促進要因

- 製品発売数の増加

- フェイシャルエステ処置の需要増加と主要企業による戦略

- 抑制要因

- 製品・治療費の高騰

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 製品別

- 皮膚フィラー

- ボツリヌス毒素

- ケミカルピーリング

- マイクロダーマブレーション

第8章 用途別

- フェイスライン矯正治療

- 傷跡治療

- 唇の治療

- ボリューム/ふくよかさの回復

- その他

第9章 エンドユーザー別

- 病院

- 専門クリニック

- 皮膚科クリニック

- その他

第10章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋

- 中東・アフリカ

第11章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第12章 企業プロファイル

- Galderma Holding SA

- 企業概要

- 製品ポートフォリオと概要

- 財務概要

- 主な動向

- Merz Pharmaceuticals, LLC

- Suneva Medical

- Dr. Korman Laboratories Ltd.

- Sinclair Pharma

- Teoxane

- Bloomage Biotech

- Johnson & Johnson MedTech

- Solta Medical

- Cynosure LLC

第13章 付録

Overview

Global Facial Aesthetics Market reached US$ 6.5 billion in 2022 and is expected to reach US$ 19.3 billion by 2030, growing with a CAGR of 9.1% during the forecast period 2023-2030.

Facial aesthetics are a non-surgical and minimally invasive procedure that can temporarily diminish wrinkles or restore volume. Common treatment areas include the forehead, cheeks, and lips. An increase in product launches and an increase in the demand for facial surgeries are driving factors for the market.

The North America region is expected to hold a significant position in the market share. The increase in the number of procedures and product launches is holding the region in the dominant share.

Facial Aesthetics Market study analysis offers an in-depth outlook on the market containing quantitative and qualitative data. It gives an outlook and forecast of the global market based on market segmentation.

Dynamics

Increase in the Number of Product Launches is Driving the Market Growth

The increase in the number of product launches is driving the market growth. For instance, on January 17, 2023, Allergan Aesthetics, an AbbVie company, launched the long-awaited SkinMedica Even & Correct Collection. Clinically proven and formulated to deliver targeted results, these advanced brightening treatments, dark spot creams, and brightening treatment pads work separately and together to even skin tone and reduce the appearance of hyperpigmentation and dark spots on the face.

Additionally, on January 10, 2023, Mumbai-based ENTOD Pharmaceuticals launched its new ocular aesthetic range focused on improving eye comfort and enhancing the aesthetics of the eyes. The products have been launched under the Eyecirque, Lashfactor, and Vasuki brands. The Eyecirque range comprises the world's first nanotechnology-based gel serum, under-eye skin brightening and anti-aging tablets, lubricating eye drops, and essential eye supplements. Thus, an increase in product launches will accelerate the market growth.

Increasing Demands for Facial Aesthetic Procedures and Strategies by the Key Players will Drive Market Growth

The increase in the demand for facial aesthetic procedures increases the product launches, which are driving the market growth. For instance, on January 9, 2023, the International Society of Aesthetic Plastic Surgery (ISAPS) released the results of its annual global survey on Aesthetic/Cosmetic Procedures, showing a 19.3% overall increase in procedures performed by plastic surgeons in 2021, with more than 12.8 million surgical, and 17.5 million non-surgical, procedures performed worldwide.

The strategies developed by the companies, such as collaborations, partnerships, and others, are expected to drive market growth. For instance, on January 15, 2021, Merz Aesthetics, the world leader in medical aesthetics, and Candela Corporation, an aesthetic device company, launched a commercial collaboration to provide a broad medical aesthetics portfolio to consumers across the globe.

Additionally, May 24, 2022, Crown Laboratories, a leading, fully integrated global skincare company, has acquired its global aesthetics-focused assets. The acquisition expands Crown's aesthetics product portfolio and enhances Crown's overall value proposition as a global leader in science-based aesthetic skincare solutions. Thus, the above factors are expected to drive the market growth.

High Cost of the Products and Treatments are Expected to Hamper the Market Growth

These facial aesthetic procedures are expensive, and the high cost becomes a barrier to market growth. For instance, according to the American Society of Plastic Surgeons, The average cost of a facelift is $8,005, according to the most recent statistics from the American Society of Plastic Surgeons. The fee charged by the surgeon is one of the key factors determining the overall treatment cost. Besides the surgeon, the anesthetist's fee also adds to the treatment cost. Depending on the complexity and requirements of the procedure, the cost increases. Thus, it acts as a restraining factor for the market growth.

Segment Analysis

The global facial aesthetics market is segmented based on product, application, end-user, and region.

Derma Fillers Segment is Expected to Hold the Largest Market Share in the Global Facial Aesthetics Market

The derma fillers segment holds a significant share in the global facial aesthetics market. The increase in the number of FDA approvals of the products drives the segment growth. For instance, on May 19, 2023, Sculptra Aesthetic, the first poly-L-lactic acid (PLLA) Derma filler used to restore natural-looking facial volume, was recently granted FDA approval to treat fine lines and wrinkles throughout the cheek area.

Additionally, on May 15, 2023, Allergan Aesthetics, an AbbVie company, announced the U.S. FDA approval of SKINVIVE by JUVEDERM to improve skin smoothness of the cheeks in adults over the age of 21. SKINVIVE by JUVEDERM is the first and only hyaluronic acid (HA) intraDerma microdroplet injection for skin smoothness available in the U.S., with results lasting through six months with optimal treatment. Thus, the increased product approvals are holding the segment in the dominant position in the market share.

Geographical Penetration

North America is Expected to Hold a Significant Position in the Global Facial Aesthetics Market Share

North America is a dominant force in the global facial aesthetics market share. With the increase in the demand for facial surgeries, there is an increase in the number of launches of treatment procedures. For instance, according to ClevelandClinic Organization it is estimated that every year, providers perform more than 15 million cosmetic surgery procedures in the United States. More than 13 million of those are minimally invasive procedures.

Additionally increase in the demand for surgeries increases the launch of the products. For instance, on August 18, 2023, Movel Medical Aesthetics, a state-of-the-art and unique mobile Med Spa for facial aesthetics introduced the revolutionary Fotona 4D, Eyelase, and LipLase procedures to its service offering for patients. Thus, the above factors are holding the region in the dominant position of the market share.

COVID-19 Impact Analysis

COVID-19 has impacted the growth of the facial aesthetics market. There are a number of individuals who frequently approach clinics and facial aesthetics centers for surgeries. Due to the pandemic, the clinics were shut down. Having most facial aesthetics surgery cases as elective operations, plastic and aesthetic surgery became one of the branches most affected by the pandemic process.

A drastic decline was experienced in the number of plastic surgeries. The stringent rules and regulations have impacted the market growth. The implementation of lockdown has restricted people from visiting the clinics and continuing the treatment process. The restrictions helped in preventing the spread of the virus. However, there was an increase in demand that occurred in the period after the restrictions.

By Product

- Derma Fillers

- Botulinum Toxin

- Chemical Peel

- Microdermabrasion

By Application

- Facial Line Correction Treatment

- Scar Treatment

- Lip Treatments

- Restoration of Volume/ Fullness

- Others

By End-User

- Hospitals

- Specialty Clinics

- Dermatology Clinics

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Competitive Landscape

The global facial aesthetics market is fragmented, with the presence of many local and international players. Galderma Holding SA, Merz Pharmaceuticals, LLC, Suneva Medical, Dr. Korman Laboratories Ltd., Sinclair Pharma, Teoxane, Bloomage Biotech, Johnson & Johnson MedTech, Solta Medical, and Cynosure LLC are the leading companies with a significant market share.

Why Purchase the Report?

- To visualize the global facial aesthetics market segmentation based on product, application, end-user, and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of facial aesthetics market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global facial aesthetics market report would provide approximately 61 tables, 58 figures, and 186 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Product

- 3.2. Snippet by Application

- 3.3. Snippet by End-User

- 3.4. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Increase in the number of product launches

- 4.1.1.2. Increasing demands for facial aesthetic procedures and strategies by the key players

- 4.1.2. Restraints

- 4.1.2.1. High cost of the products and treatments

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Product

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 7.1.2. Market Attractiveness Index, By Product

- 7.2. Derma Fillers *

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Botulinum Toxin

- 7.4. Chemical Peel

- 7.5. Microdermabrasion

8. By Application

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 8.1.2. Market Attractiveness Index, By Application

- 8.2. Facial Line Correction Treatment *

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Scar Treatment

- 8.4. Lip Treatments

- 8.5. Restoration of Volume/ Fullness

- 8.6. Others

9. By End-User

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 9.1.2. Market Attractiveness Index, By End-User

- 9.2. Hospitals

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Specialty Clinics

- 9.4. Dermatology Clinics

- 9.5. Others

10. By Region

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 10.1.2. Market Attractiveness Index, By Region

- 10.2. North America

- 10.2.1. Introduction

- 10.2.2. Key Region-Specific Dynamics

- 10.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.2.6.1. U.S.

- 10.2.6.2. Canada

- 10.2.6.3. Mexico

- 10.3. Europe

- 10.3.1. Introduction

- 10.3.2. Key Region-Specific Dynamics

- 10.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.3.6.1. Germany

- 10.3.6.2. UK

- 10.3.6.3. France

- 10.3.6.4. Italy

- 10.3.6.5. Spain

- 10.3.6.6. Rest of Europe

- 10.4. South America

- 10.4.1. Introduction

- 10.4.2. Key Region-Specific Dynamics

- 10.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.4.6.1. Brazil

- 10.4.6.2. Argentina

- 10.4.6.3. Rest of South America

- 10.5. Asia-Pacific

- 10.5.1. Introduction

- 10.5.2. Key Region-Specific Dynamics

- 10.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.5.6.1. China

- 10.5.6.2. India

- 10.5.6.3. Japan

- 10.5.6.4. Australia

- 10.5.6.5. Rest of Asia-Pacific

- 10.6. Middle East and Africa

- 10.6.1. Introduction

- 10.6.2. Key Region-Specific Dynamics

- 10.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

11. Competitive Landscape

- 11.1. Competitive Scenario

- 11.2. Market Positioning/Share Analysis

- 11.3. Mergers and Acquisitions Analysis

12. Company Profiles

13. Galderma Holding SA *

- 13.1.1. Company Overview

- 13.1.2. Product Portfolio and Description

- 13.1.3. Financial Overview

- 13.1.4. Key Developments

- 13.2. Merz Pharmaceuticals, LLC

- 13.3. Suneva Medical

- 13.4. Dr. Korman Laboratories Ltd.

- 13.5. Sinclair Pharma

- 13.6. Teoxane

- 13.7. Bloomage Biotech

- 13.8. Johnson & Johnson MedTech

- 13.9. Solta Medical

- 13.10. Cynosure LLC

LIST NOT EXHAUSTIVE

14. Appendix

- 14.1. About Us and Services

- 14.2. Contact Us