|

|

市場調査レポート

商品コード

1683333

サイバーセキュリティにおけるAIの世界市場:2025年~2032年Global AI in Cybersecurity Market - 2025-2032 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| サイバーセキュリティにおけるAIの世界市場:2025年~2032年 |

|

出版日: 2025年03月20日

発行: DataM Intelligence

ページ情報: 英文 180 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

世界のサイバーセキュリティにおけるAI市場規模は、2024年に262億9,000万米ドルに達しました。同市場は、2032年には1,093億3,000万米ドルに達すると予測され、予測期間の2025年~2032年のCAGRは19.50%となる見込みです。

世界のサイバーセキュリティにおける人工知能(AI)市場は、サイバー脅威の高度化とAI主導型セキュリティソリューションの採用増加に後押しされ、力強い成長を遂げています。組織は、脅威の検出と対応能力を強化するために、サイバーセキュリティのフレームワークにAIを組み込むケースが増えています。AI主導のシステムは、膨大な量のデータをリアルタイムで分析し、従来の方法よりも効率的に異常や潜在的な脅威を特定することができます。このプロアクティブなアプローチにより、サイバーインシデントへの迅速な対応が可能になり、潜在的な損害や業務の混乱を最小限に抑えることができます。サイバーセキュリティ戦略の中核技術としてAIが重視されていることは、大手企業の間でも明らかであり、高度なサイバー攻撃からの防御におけるAIの重要性の高まりを反映しています。

サイバー脅威の高度化は、サイバーセキュリティにおけるAI導入の主要な促進要因です。サイバー敵対者は、より効果的で回避的な攻撃を実行するために、AIを搭載したツールを含む高度な技術を採用しています。

このようなエスカレートにより、これらの複雑な脅威を効果的に検知し、対抗するために、サイバーセキュリティ対策にAIを統合する必要が生じています。AIが防御側と攻撃側の両方に利用されることによってもたらされる二重の課題は、AIを活用した高度なセキュリティソリューションの重要な必要性を浮き彫りにしています。

当レポートでは、世界のサイバーセキュリティにおけるAI市場について調査し、市場の概要とともに、セキュリティタイプ別、コンポーネント別、展開タイプ別、技術別、用途別、最終用途産業別、地域別動向、競合情勢、および市場に参入する企業のプロファイルなどを提供しています。

目次

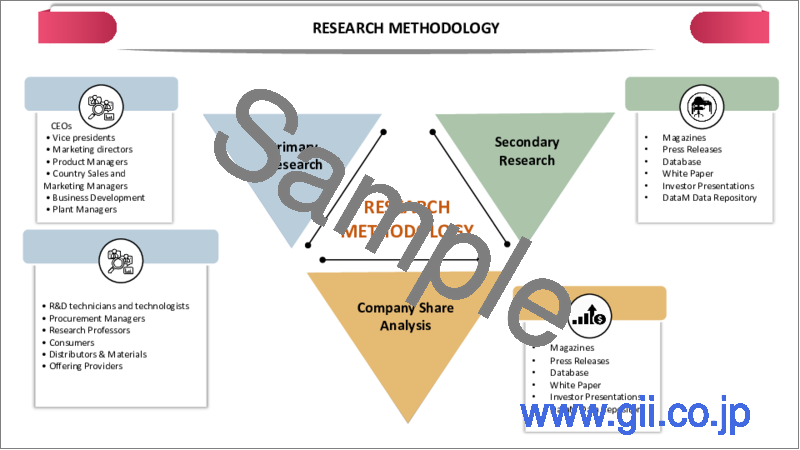

第1章 調査手法と範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 抑制要因

- 機会

- 影響分析

第5章 業界分析

第6章 セキュリティタイプ別

- ネットワークセキュリティ

- エンドポイントセキュリティ

- アプリケーションセキュリティ

- ハードウェアセキュリティ

- その他

第7章 コンポーネント別

- ハードウェア

- ソリューション

- サービス

第8章 展開タイプ別

- オンプレミス

- クラウドベース

第9章 技術別

- 機械学習

- 自然言語処理(NLP)

- コンテキスト認識コンピューティング

- その他

第10章 用途別

- アイデンティティとアクセス管理

- 自然言語処理(NLP)

- データ損失防止

- 統合脅威管理

- 不正行為の検出/不正行為防止

- 脅威インテリジェンス

- その他

第11章 最終用途産業別

- 銀行、金融サービス、保険

- 小売

- 政府・防衛

- 製造業

- 企業

- ヘルスケア

- 自動車・輸送

- その他

第12章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他

- 中東・アフリカ

第13章 競合情勢

第14章 企業プロファイル

- NVIDIA

- Amazon Web Services, Inc.

- Cylance Inc.(BlackBerry)

- Darktrace

- Microsoft Corporation

- Fortinet, Inc.

- IBM Corporation

- Intel Corporation

- LexisNexis

- Micron Technology, Inc..

第15章 付録

Global AI in Cybersecurity Market reached US$ 26.29 billion in 2024 and is expected to reach US$ 109.33 billion by 2032, growing with a CAGR of 19.50% during the forecast period 2025-2032.

The global Artificial Intelligence (AI) in cybersecurity market is witnessing robust growth, propelled by the escalating sophistication of cyber threats and the increasing adoption of AI-driven security solutions. Organizations are increasingly integrating AI into their cybersecurity frameworks to bolster threat detection and response capabilities. AI-driven systems can analyze vast amounts of data in real-time, identifying anomalies and potential threats more efficiently than traditional methods. This proactive approach enables quicker responses to cyber incidents, minimizing potential damages and operational disruptions. The emphasis on AI as a core technology in cybersecurity strategies is evident among leading firms, reflecting its growing importance in defending against sophisticated cyber-attacks.

Market Dynamics

Driver - Escalating Sophistication of Cyber Threats

The increasing sophistication of cyber threats is a primary driver for the adoption of AI in cybersecurity. Cyber adversaries are employing advanced techniques, including AI-powered tools, to execute more effective and evasive attacks.

This escalation necessitates the integration of AI in cybersecurity measures to detect and counteract these complex threats effectively. The dual challenge posed by AI being utilized by both defenders and attackers underscores the critical need for advanced AI-driven security solutions.

Restraint - High Implementation Costs and Skill Gaps

Despite its benefits, the implementation of AI in cybersecurity faces challenges such as high initial costs and a shortage of skilled professionals. Deploying AI-driven security systems requires substantial investment in technology and infrastructure, which can be a barrier for small and medium-sized enterprises.

Additionally, there is a notable gap in expertise, as managing and maintaining AI-based security solutions necessitates specialized skills. Balancing security needs with usability remains a challenge, highlighting the need for comprehensive strategies to address these issues.

Segment Analysis

The global AI in cybersecurity market is segmented based on security type, component, deployment type, technology, application, end-use industry, and region.

Network Security represent the largest application segment in the global market.

Network security stands as the largest segment within the AI in cybersecurity market, driven by the critical need to protect organizational networks from increasingly sophisticated cyber threats. The integration of AI into network security enhances the ability to detect and respond to threats in real-time. AI algorithms analyze network traffic patterns, identify anomalies, and predict potential security breaches before they occur. This proactive approach is essential in mitigating risks associated with advanced persistent threats and zero-day vulnerabilities. The demand for AI-driven network security solutions is further propelled by the increasing adoption of cloud services, the proliferation of Internet of Things (IoT) devices, and the shift towards remote work environments. These trends have expanded the attack surface, making robust network security measures more critical than ever.

Geographical Penetration

North America leads the AI in cybersecurity market, attributed to stringent data protection regulations, high adoption rates of AI technologies, and substantial investments in cybersecurity infrastructure.

In 2023, North America dominated the global AI in cybersecurity market, reflecting the region's commitment to enhancing its cybersecurity posture. The United States, in particular, has implemented robust regulatory frameworks to safeguard data and critical infrastructure. Agencies have requested $1.9 billion for research and development investment in AI for fiscal year 2024, underscoring the government's dedication to advancing AI applications in cybersecurity.

The private sector in North America is also proactive in adopting AI-driven cybersecurity solutions. Companies are leveraging AI to enhance threat detection, automate responses, and predict potential security incidents. This proactive approach is crucial in defending against increasingly sophisticated cyber threats.

Technology Roadmap

The global AI in cybersecurity market is expected to evolve significantly over the coming years, driven by advancements in network infrastructure, the expansion of IoT, and the increasing adoption of artificial intelligence (AI) at the edge. Government initiatives, regulatory frameworks, and private sector investments are set to accelerate AI adoption in cybersecurity across multiple industries.

Competitive Landscape

The major Global players in the market include NVIDIA, Amazon Web Services, Inc., Cylance Inc. (BlackBerry), Darktrace, Microsoft Corporation, Fortinet, Inc., IBM Corporation, Intel Corporation, LexisNexis, and Micron Technology, Inc.

Why Choose DataM?

- Data-Driven Insights: Dive into detailed analyses with granular insights such as pricing, market shares and value chain evaluations, enriched by interviews with industry leaders and disruptors.

- Post-Purchase Support and Expert Analyst Consultations: As a valued client, gain direct access to our expert analysts for personalized advice and strategic guidance, tailored to your specific needs and challenges.

- White Papers and Case Studies: Benefit quarterly from our in-depth studies related to your purchased titles, tailored to refine your operational and marketing strategies for maximum impact.

- Annual Updates on Purchased Reports: As an existing customer, enjoy the privilege of annual updates to your reports, ensuring you stay abreast of the latest market insights and technological advancements. Terms and conditions apply.

- Specialized Focus on Emerging Markets: DataM differentiates itself by delivering in-depth, specialized insights specifically for emerging markets, rather than offering generalized geographic overviews. This approach equips our clients with a nuanced understanding and actionable intelligence that are essential for navigating and succeeding in high-growth regions.

- Value of DataM Reports: Our reports offer specialized insights tailored to the latest trends and specific business inquiries. This personalized approach provides a deeper, strategic perspective, ensuring you receive the precise information necessary to make informed decisions. These insights complement and go beyond what is typically available in generic databases.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Security Type

- 3.2. Snippet by Component

- 3.3. Snippet by Deployment Type

- 3.4. Snippet by Technology

- 3.5. Snippet by Application

- 3.6. Snippet by End-Use Industry

- 3.7. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Escalating Sophistication of Cyber Threats

- 4.1.2. Restraints

- 4.1.2.1. High Implementation Costs and Skill Gaps

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Value Chain Analysis

- 5.4. Pricing Analysis

- 5.5. Regulatory and Compliance Analysis

- 5.6. AI & Automation Impact Analysis

- 5.7. R&D and Innovation Analysis

- 5.8. Sustainability & Green Technology Analysis

- 5.9. Cybersecurity Analysis

- 5.10. Next Generation Technology Analysis

- 5.11. Technology Roadmap

- 5.12. DMI Opinion

6. By Security Type

- 6.1. Introduction

- 6.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Security Type

- 6.1.2. Market Attractiveness Index, By Security Type

- 6.2. Network Security*

- 6.2.1. Introduction

- 6.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 6.3. Endpoint Security

- 6.4. Application Security

- 6.5. Hardware Security

- 6.6. Others

7. By Component

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Component

- 7.1.2. Market Attractiveness Index, By Component

- 7.2. Hardware*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.2.3. Accelerators

- 7.2.4. Processors

- 7.2.5. Storage

- 7.2.6. Others

- 7.3. Solutions

- 7.3.1. Software

- 7.3.2. Platforms

- 7.4. Services

- 7.4.1. Professional Services

- 7.4.2. Managed Services

8. By Deployment Type

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment Type

- 8.1.2. Market Attractiveness Index, By Deployment Type

- 8.2. On-premises*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Cloud-based

9. By Technology

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 9.1.2. Market Attractiveness Index, By Technology

- 9.2. Machine Learning*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Natural Language Processing (NLP)

- 9.4. Context-aware computing

- 9.5. Others

10. By Application

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.1.2. Market Attractiveness Index, By Application

- 10.2. Identity and Access Management*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Natural Language Processing (NLP)

- 10.4. Data Loss Prevention

- 10.5. Unified Threat Management

- 10.6. Fraud Detection/Anti-Fraud

- 10.7. Threat Intelligence

- 10.8. Others

11. By End-Use Industry

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-Use Industry

- 11.1.2. Market Attractiveness Index, By End-Use Industry

- 11.2. Banking, Financial Services and Insurance*

- 11.2.1. Introduction

- 11.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 11.3. Retail

- 11.4. Government & Defense

- 11.5. Manufacturing

- 11.6. Enterprise

- 11.7. Healthcare

- 11.8. Automotive & Transportation

- 11.9. Others

12. By Region

- 12.1. Introduction

- 12.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 12.1.2. Market Attractiveness Index, By Region

- 12.2. North America

- 12.2.1. Introduction

- 12.2.2. Key Region-Specific Dynamics

- 12.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Security Type

- 12.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Component

- 12.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment Type

- 12.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 12.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.2.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-Use Industry

- 12.2.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.2.9.1. US

- 12.2.9.2. Canada

- 12.2.9.3. Mexico

- 12.3. Europe

- 12.3.1. Introduction

- 12.3.2. Key Region-Specific Dynamics

- 12.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Security Type

- 12.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Component

- 12.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment Type

- 12.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 12.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.3.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-Use Industry

- 12.3.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.3.9.1. Germany

- 12.3.9.2. UK

- 12.3.9.3. France

- 12.3.9.4. Italy

- 12.3.9.5. Spain

- 12.3.9.6. Rest of Europe

- 12.4. South America

- 12.4.1. Introduction

- 12.4.2. Key Region-Specific Dynamics

- 12.4.3. Key Region-Specific Dynamics

- 12.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Security Type

- 12.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Component

- 12.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment Type

- 12.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 12.4.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.4.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-Use Industry

- 12.4.10. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.4.10.1. Brazil

- 12.4.10.2. Argentina

- 12.4.10.3. Rest of South America

- 12.5. Asia-Pacific

- 12.5.1. Introduction

- 12.5.2. Key Region-Specific Dynamics

- 12.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Security Type

- 12.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Component

- 12.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment Type

- 12.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 12.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.5.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-Use Industry

- 12.5.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.5.9.1. China

- 12.5.9.2. India

- 12.5.9.3. Japan

- 12.5.9.4. Australia

- 12.5.9.5. Rest of Asia-Pacific

- 12.6. Middle East and Africa

- 12.6.1. Introduction

- 12.6.2. Key Region-Specific Dynamics

- 12.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Security Type

- 12.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Component

- 12.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment Type

- 12.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 12.6.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.6.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-Use Industry

13. Competitive Landscape

- 13.1. Competitive Scenario

- 13.2. Market Positioning/Share Analysis

- 13.3. Mergers and Acquisitions Analysis

14. Company Profiles

- 14.1. NVIDIA*

- 14.1.1. Company Overview

- 14.1.2. Product Portfolio and Description

- 14.1.3. Financial Overview

- 14.1.4. Key Developments

- 14.2. Amazon Web Services, Inc.

- 14.3. Cylance Inc. (BlackBerry)

- 14.4. Darktrace

- 14.5. Microsoft Corporation

- 14.6. Fortinet, Inc.

- 14.7. IBM Corporation

- 14.8. Intel Corporation

- 14.9. LexisNexis

- 14.10. Micron Technology, Inc..

LIST NOT EXHAUSTIVE

15. Appendix

- 15.1. About Us and Services

- 15.2. Contact Us