|

|

市場調査レポート

商品コード

1654721

クラウドERPの日本市場:2025年~2032年Japan Cloud ERP Market - 2025-2032 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| クラウドERPの日本市場:2025年~2032年 |

|

出版日: 2025年02月13日

発行: DataM Intelligence

ページ情報: 英文 193 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

日本のクラウドERP市場は、世界のクラウドERP市場の約3分の1を占め、予測期間中の2025年から2032年にかけてCAGR20.1%で成長すると予測されています。

クラウドERPシステムには、従来のオンプレミス型と比較してコスト面で大きなメリットがあります。クラウドERPシステムには、従来のオンプレミス型ERPシステムよりも低いインフラ費用、少ないメンテナンス費用、適応可能な拡張性などがあります。日本の企業は、多額の初期資本コストをかけずに業務を最適化するために、こうした利点を取り入れています。クラウドERPと人工知能(AI)、モノのインターネット(IoT)、ビッグデータ、機械学習などのテクノロジーの統合は、日本の企業が急速に変化する市場で競争力を維持し、機敏に行動するのに役立ちます。

日本政府は、デジタルインフラ開発とビジネスプロセスの革新を促進するイニシアチブを通じて、クラウドコンピューティングの導入を奨励しています。データセキュリティとプライバシーに対する規制上の支援も、クラウドシステムに対する信頼を高め、ERPの採用を加速させています。2024年、日本政府は経済安全保障促進法に基づき、クラウドプログラムを特定重要製品に指定し、クラウドプログラムの安定供給を確保することを決定したほか、特にジェネレーティブAI向けに、さまざまな開発者が利用できるように日本国内の計算リソースをアップグレードするために企業が申請した計画を承認・支援することを決定しました。

市場力学

セキュリティとコンプライアンスの強化に注力

日本には厳格なデータ保護規則があるため、クラウドERPプロバイダーは、個人情報保護法(APPI)のような現地の法律へのコンプライアンスを確保するための強力なセキュリティ対策を提供しています。データセキュリティとコンプライアンスの強化は、業務と消費者データの保護を目指す企業にとって重要な推進力です。クラウドベースのERPソリューションは、中小企業にリーズナブルなコストでエンタープライズレベルの機能へのアクセスを提供し、この分野での導入拡大を後押ししています。

日本は2021年9月にデジタル庁を設立し、政府クラウドを立ち上げたことで、大きな一歩を踏み出しました。デジタル技術を通じて利便性、健康、幸福を向上させ、誰一人取り残されることのない社会を実現することを目的としています。2024年6月、国内最大のAWS学習イベント「アマゾンウェブサービス(AWS)サミットジャパン」で、デジタル庁のクラウドエンジニアである武田一真氏と西畑真一氏の2人が、その取り組みと学びを明らかにしました。

高い初期費用とデータプライバシー

企業はクラウドERPソリューションの導入をためらっています。なぜなら、クラウドERPソリューションには重要な企業データの保存が必要であり、データ漏洩やローカルルールへの準拠に対する懸念があるからです。日本にはデータプライバシー法、特に個人情報の保護に関する法律(APPI)があり、データの収集、保存、使用について厳格な基準が定められています。これは、特に機密性の高い消費者データや企業データを扱う企業において、クラウドベースのERPソリューションの採用を妨げています。

クラウドERPソリューションは一般的に、長期的にはオンプレミス・ソリューションよりも費用対効果が高いと考えられているが、(カスタマイズ、統合、トレーニングのための)初期支出は大きくなる可能性があります。これは、特に日本の中小企業にとっては大きなハードルです。日本経済のかなりの割合を占める中小企業は、初期費用が高いと認識されているため、クラウドERPソリューションの導入に踏み切れない可能性があります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- セキュリティとコンプライアンスの強化に注力

- 抑制要因

- 高額な初期コストとデータのプライバシー

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 コンポーネント別

- ソリューション

- サービス

第7章 業務機能別

- 財務・会計

- 注文・調達

- セールス・マーケティング

- オペレーション

- 人事

- 企業業績

- その他

第8章 組織規模別

- 大企業

- 中小企業

第9章 展開モード別

- パブリッククラウド

- プライベートクラウド

- ハイブリッドクラウド

第10章 エンドユーザー別

- BFSI

- IT・通信

- 政府・防衛

- 小売り

- 製造業

- 教育

- ヘルスケア・ライフサイエンス

- その他

第11章 競合情勢

- 競合シナリオ

- 市況・シェア分析

- M&A分析

第12章 企業プロファイル

- Oracle

- 会社概要

- 製品ポートフォリオと概要

- 財務概要

- 主な発展

- SAP

- Microsoft

- Infor

- Workday

- Zoho

- Freee

- SmartHR

- PCA

- Rootstock Software

第13章 付録

Japan Cloud ERP Market is expected to hold about one third of the global cloud ERP market, growing with a CAGR of 20.1% during the forecast period 2025-2032.

Cloud ERP systems have substantial cost advantages over traditional on-premises alternatives. These include lower infrastructure expenditures, fewer maintenance charges and adaptable scalability. Businesses in Japan are embracing these advantages in order to optimize their operations without incurring significant upfront capital costs. The integration of cloud ERP with technologies like Artificial Intelligence (AI), Internet of Things (IoT), Big Data and Machine Learning helps Japanese organizations to stay competitive and nimble in a rapidly changing market.

The Japanese government has encouraged cloud computing adoption through initiatives that promote digital infrastructure development and business process innovation. Regulatory support for data security and privacy has also increased confidence in cloud systems, accelerating ERP adoption. In 2024, under the Economic Security Promotion Act, the Government of Japan decided to designate cloud programs to be specified critical products and ensure the stable supply of cloud programs, as well as approve and support plans filed by companies to upgrade computational resources in Japan for use by a wide variety of developers, particularly for generative AI.

Dynamics

Focus on Enhanced Security and Compliance

As Japan has stringent data protection rules, cloud ERP providers provide strong security measures to ensure compliance with local laws like the Act on the Protection of Personal Information (APPI). Enhanced data security and compliance are critical drivers for businesses looking to protect their operations and consumer data. Cloud-based ERP solutions provide SMEs with access to enterprise-level features at a reasonable cost, encouraging growing adoption in this sector.

Japan made a significant step forward in September 2021 when it established the Digital Agency and launched the government cloud. The Digital Agency of Japan reflects the country's ambitious commitment to digital innovation throughout government and society, with the objective of creating a society in which no one is left behind by increasing convenience, health and happiness through digital technology. In June 2024, two cloud engineers from the Digital Agency, Kazuma Takeda and Shinichi Nishihata, revealed their approach and learnings at the Amazon Web Services (AWS) Summit Japan, the country's largest AWS learning event.

High Initial Costs and Data Privacy

Companies are hesitant to adopt cloud ERP solutions because they require the storage of vital corporate data, raising concerns about data breaches and compliance with local rules. Japan has data privacy laws, particularly the Act on the privacy of Personal Information (APPI), which establishes strict criteria for data collection, storage and usage. It hinders the adoption of cloud-based ERP solutions, especially in companies that handle sensitive consumer and corporate data.

Although cloud ERP solutions are typically thought to be more cost-effective than on-premise solutions in the long run, the initial expenditure (for customisation, integration and training) can be significant. This is a substantial hurdle, particularly for small and medium-sized businesses (SMEs) in Japan. SMEs, who account for a sizable share of Japan's economy, may be prevented from implementing cloud ERP solutions due to the perceived high initial cost.

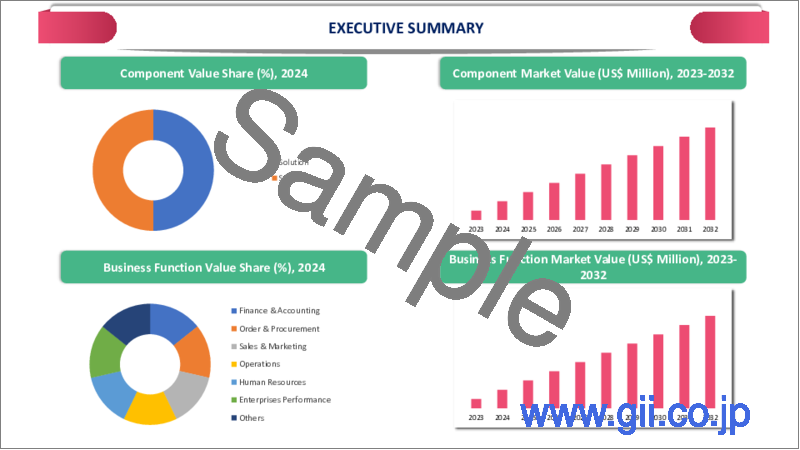

Segment Analysis

Japan cloud ERP market is segmented based on component, business function, organization size, deployment mode and end-user.

Rising Trend of Cloud Solutions in Japan

Solutions in component segment is expected to hold a significant share in the cloud ERP market. It is predicted that AI-enhanced collaboration solutions improve internal communication, teamwork and decision-making across departments, fostering a more agile and responsive business environment. As Japanese firms pursue digital transformation, cloud ERP solutions are increasingly being used to increase operational efficiency, data accessibility and decision-making. The increasing trend of cloud usage among small, medium and big organizations is a primary driver of the industry.

In 2024 oracle Japan announced to invest more than US$ 8 billion over the next ten years to improve its cloud computing and AI infrastructure, with the goal of meeting rising regional demand and regulatory requirements. The business will increase its Oracle Cloud Infrastructure (OCI) operations along with engineering teams in Japan, easing the transition of mission-critical workloads to Oracle Cloud. Oracle is cooperating with Reka, an AI research company, to enhance GenAI models that support various languages and different inputs, leveraging OCI's capabilities to promote innovation in AI applications for global organizations.

Competitive Landscape

The major players in Japan for the cloud ERP market include Oracle, SAP, Microsoft, Infor, Workday, Zoho, Freee, SmartHR, PCA and Rootstock Software.

Sustainability Analysis

Cloud-based ERP systems enable businesses to reduce the environmental impact of their IT infrastructure. By using shared data centers and adopting energy-efficient technologies, cloud solutions help companies lower their carbon footprint. Japan's emphasis on energy efficiency and reduced greenhouse gas emissions is driving cloud service providers to adopt greener technologies.

Major cloud ERP vendors operating in Japan, like Oracle, SAP, and Microsoft, are investing in state-of-the-art, energy-efficient data centers. These data centers often leverage renewable energy sources, reducing the environmental impact compared to traditional on-premise systems that require energy-intensive servers. Collaboration with external partners allows ERP vendors to align their offerings with Japan's national sustainability goals, such as the Green Growth Strategy and the Sustainable Development Goals (SDGs).

AI Impact Analysis

AI is important to achieving Industry 4.0 in Japan, which entails the integration of smart factories, linked devices and data-driven industrial processes. Cloud ERP systems that incorporate AI technology enable manufacturers to exploit real-time data, automate manufacturing lines and increase operational efficiency. This change contributes to Japan's desire for innovation in the manufacturing sector.

In 2024, Microsoft stated that it will invest US$ 2.9 billion over the following two years to expand its hyperscale cloud computing and AI infrastructure in Japan. It will also extend its digital skilling initiatives, with the objective of imparting AI skills to more than 3 million individuals over the next three years, open its first Microsoft Research Asia facility in Japan and enhance its cybersecurity engagement with the Japanese government.

As AI improves automation, decision-making, data analytics and customer experiences, Japanese businesses may increase productivity and reduce costs while adjusting fast to changing market dynamics. AI breakthroughs are expected to propel Japan's cloud ERP market to new heights, providing businesses with a strategic advantage in a highly competitive global context.

By Component

- Solutions

- Services

By Business Function

- Finance & Accounting

- Order & Procurement

- Sales & Marketing

- Operations

- Human Resources

- Enterprises Performance

- Others

By Organization Size

- Large Enterprises

- SMEs

By Deployment Mode

- Public Cloud

- Private Cloud

- Hybrid Cloud

By End-User

- BFSI

- IT & Telecom

- Government & Defense

- Retail

- Manufacturing

- Education

- Healthcare & Life Sciences

- Other

Key Developments

- In 2024, Sazae has taken a further step forward by becoming an official partner of Odoo, a well-known Enterprise Resource Planning (ERP) system utilized by organizations around the world. We are forming a partnership in Japan, Australia and Taiwan. This agreement allows Sazae to provide comprehensive solutions that promote business process efficiency, digital transformation (DX) and sustainable growth for enterprises in Japan and Asia-Pacific.

- In 2023, Boomi(TM), the intelligent connection and automation pioneer, has announced a new relationship with Works Applications Systems, Co., Ltd. ("WAPS"), which provides system development, support and SI services. WAPS is a group company of Works Applications Co., Ltd., a prominent developer of ERP software solutions for financial and supply chain management.

Why Purchase the Report?

- To visualize Japan cloud ERP market segmentation based on component, business function, organization size, deployment mode and end-user, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel spreadsheet containing a comprehensive dataset of the cloud ERP market, covering all levels of segmentation.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

Japan cloud ERP market report would provide approximately 45 tables, 46 figures and 193 pages

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Component

- 3.2. Snippet by Business Function

- 3.3. Snippet by Organization Size

- 3.4. Snippet by Deployment Mode

- 3.5. Snippet by End-User

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Focus on Enhanced Security and Compliance

- 4.1.2. Restraints

- 4.1.2.1. High Initial Costs and Data Privacy

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. By Component

- 6.1. Introduction

- 6.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Component

- 6.1.2. Market Attractiveness Index, By Component

- 6.2. Solutions*

- 6.2.1. Introduction

- 6.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 6.3. Services

7. By Business Function

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Business Function

- 7.1.2. Market Attractiveness Index, By Business Function

- 7.2. Finance & Accounting*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Order & Procurement

- 7.4. Sales & Marketing

- 7.5. Operations

- 7.6. Human Resources

- 7.7. Enterprises Performance

- 7.8. Others

8. By Organization Size

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Organization Size

- 8.1.2. Market Attractiveness Index, By Organization Size

- 8.2. Large Enterprises*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. SMEs

9. By Deployment Mode

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment Mode

- 9.1.2. Market Attractiveness Index, By Deployment Mode

- 9.2. Public Cloud*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Private Cloud

- 9.4. Hybrid Cloud

10. By End-User

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.1.2. Market Attractiveness Index, By End-User

- 10.2. BFSI*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. IT & Telecom

- 10.4. Government & Defense

- 10.5. Retail

- 10.6. Manufacturing

- 10.7. Education

- 10.8. Healthcare & Life Sciences

- 10.9. Other

11. Competitive Landscape

- 11.1. Competitive Scenario

- 11.2. Market Positioning/Share Analysis

- 11.3. Mergers and Acquisitions Analysis

12. Company Profiles

- 12.1. Oracle*

- 12.1.1. Company Overview

- 12.1.2. Product Portfolio and Description

- 12.1.3. Financial Overview

- 12.1.4. Key Developments

- 12.2. SAP

- 12.3. Microsoft

- 12.4. Infor

- 12.5. Workday

- 12.6. Zoho

- 12.7. Freee

- 12.8. SmartHR

- 12.9. PCA

- 12.10. Rootstock Software

LIST NOT EXHAUSTIVE

13. Appendix

- 13.1. About Us and Services

- 13.2. Contact Us