|

|

市場調査レポート

商品コード

1634230

二相ステンレス鋼溶接パイプの世界市場-2024~2031年Global Duplex Stainless Steel Welded Pipe Market - 2024 - 2031 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 二相ステンレス鋼溶接パイプの世界市場-2024~2031年 |

|

出版日: 2025年01月13日

発行: DataM Intelligence

ページ情報: 英文 169 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

二相ステンレス鋼溶接パイプの世界市場は2023年に26億米ドルに達し、2031年には42億米ドルに達すると予測され、予測期間2024~2031年のCAGRは6.1%で成長する見込みです。

二相ステンレス鋼溶接パイプの世界市場は、その卓越した耐久性、高重量比、耐食性により急速に変貌しつつあります。この特性は、化学処理、海水淡水化、石油・ガス施設での使用が見込まれています。世界鉄鋼協会によると、世界のステンレス鋼生産量は年々増加しており、二相鋼が人気を集めています。

世界の水不足の深刻化が海水淡水化工場への投資に拍車をかけ、二相鋼溶接パイプの需要が急増しています。国際海水淡水化・再利用協会の報告によると、 2023年の世界の海水淡水化契約容量は、毎年6%増加し、1億940万立方メートル/日に達します。二相ステンレス鋼溶接パイプは、塩化物による応力腐食に耐性があり、塩分環境下での信頼性と寿命が保証されているため、この種の施設で頻繁に採用されています。

市場はアジア太平洋で急成長しています。アジア開発銀行(ADB)は、2030年までアジア全域のインフラに年間約1兆7,000億米ドルを投資しなければならないと予測しています。エネルギー、建設、石油化学などの産業において、中国、インド、日本などの国では現在、より多くの多機能DSS溶接パイプラインが採用されています。インド・ステンレス鋼開発協会の報告によると、インドのステンレス鋼生産は年平均16%で成長しており、二相鋼がその大部分を占めています。

ダイナミクス

多様な用途のための優れた特性

二相ステンレス鋼は、費用対効果、耐食性、高い機械的強度など、その特徴的な特性プロファイルに後押しされています。しかし、DSSは、オーステナイト系およびフェライト系ステンレス鋼とは異なり、オーステナイトとフェライトの比較的バランスの取れた微細構造を持っており、これによりピッティングやクレバス腐食への耐性が強化され、耐久性が向上します。調査によると、DSSはオーステナイト系ステンレス鋼よりもCO2や塩化物に対する耐性が高いです。

化学工場では、硫酸などの腐食性流体を輸送する大小のパイプラインの建設にDSSが採用され、プロセスの安全性と信頼性を確保しています。米国エネルギー省は、2023年の再生可能エネルギープロジェクト数の大幅な増加を確認しており、太陽熱および地熱施設のかなりの部分をDSS溶接パイプが占めています。さらに、このパイプは高圧と高温の条件に耐えることができるため、耐用年数の長さと加工の有効性が保証されます。その結果、これらの用途には有力な選択肢となります。

海洋石油・ガス探査の成長

海洋石油・ガス探査の拡大は、DSS溶接パイプ市場の主要な成長促進要因です。米国エネルギー情報局(EIA)によると、2022年の世界の原油生産量に占める海洋石油生産量の割合は30%近くに達し、陸上埋蔵量の減少により増加傾向が見込まれています。DSS溶接パイプは、高圧と腐食性海水にさらされる海底パイプライン、ライザー、フローラインで重要な役割を果たし、堅牢な材料が求められます。

国際エネルギー機関(IEA)は、2023年に世界の上流石油・ガスへの投資額が約11%増の5,280億米ドルに達すると予測しており、長期的な信頼性を確保するためにDSSパイプの使用が重視されています。同様に、北海では、ライフサイクルコストを最適化し、操業の安全性を確保するために、二相鋼の採用が増えています。DSSは熱膨張が小さく強度が高いため、深海や石油・ガス探査、温度・圧力の変動が多い用途に最適です。

高い初期コストと製造の複雑さ

二相ステンレス鋼溶接パイプの高い初期コストと加工上の課題は、大きな制約となります。二相ステンレス鋼パイプは、クロム、モリブデン、窒素を含む合金組成のため、標準的なステンレス鋼の代替品よりも一般的に20~30%高価になります。また、溶接工程では、二相構造を維持するために特殊な技術が必要となり、製造の複雑さとコストが増加します。

新興国の中小企業は、資金的な制約に直面していることが多く、DSS溶接パイプの採用を制限しています。国際金融公社(IFC)は、DSSのような先端材料への投資を検討している中小企業にとって、手頃な資金調達へのアクセスが依然として重要な障壁となっていると指摘しています。さらに、新興国ではDSS製造に熟練した労働力が不足していることも課題を悪化させ、市場開拓を遅らせています。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 優れた特性と多様な用途

- 海上石油・ガス探査の成長

- 抑制要因

- 初期コストが高く、製造が複雑

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- 持続可能な分析

- DMIの見解

第6章 製品タイプ別

- ハイパーデュプレックス

- スタンダードデュプレックス

- スーパーデュプレックス

- その他

第7章 材質グレード別

- 304

- 316

- 304L

- 316L

- その他

第8章 表面処理別

- 無塗装

- 亜鉛メッキ

- 銅メッキ

- 塗装済み

第9章 厚さ別

- 5.0~10ミリ

- 2.5~5.0ミリ

- 0.3~2.5ミリ

第10章 外径別

- 10~16インチ

- 3~10インチ

- 1.5~3インチ

第11章 用途別

- 海上石油・ガス

- 化学プロセス産業

- ケミカルタンカー/造船

- 海水淡水化/水処理

- その他

第12章 サスティナビリティ分析

- 環境分析

- 経済分析

- ガバナンス分析

第13章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第14章 競合情勢

- 競合シナリオ

- 市況・シェア分析

- M&A分析

第15章 企業プロファイル

- NIPPON STEEL CORPORATION

- 会社概要

- 製品ポートフォリオと概要

- 財務概要

- 主な発展

- Zhengzhou City Huitong Pipe Fittings Co., Ltd.

- Oshwin Overseas

- Special Piping Materials

- AMETEK Inc.

- Savoy Piping Inc.

- Tubacex Group

- Aesteiron Steels LLP

- MTSCO

- Metline Industries

第16章 付録

Global Duplex Stainless Steel Welded Pipe Market reached US$ 2.6 billion in 2023 and is expected to reach US$ 4.2 billion by 2031, growing with a CAGR of 6.1% during the forecast period 2024-2031.

The global market for duplex stainless steel welded pipe is being rapidly transformed as a result of its exceptional durability, high-weight ratio and corrosion resistance. The properties are anticipated to be used in chemical processing, desalination and oil and gas facilities. According to the World Steel Association, the production of global stainless steel is increasing annually and duplex grades are gaining traction.

The growing water scarcity worldwide has spurred investments in desalination plants, creating a surge in demand for duplex stainless steel welded pipes. Global desalination contracted capacity, as reported by the International Desalination & Reuse Association, increased by 6% annually in 2023 to 109.4 million cubic meters per day. The duplex stainless steel welded pipes are frequently employed in these types of facilities due to their ability to resist chloride-induced stress corrosion, which guarantees their dependability and longevity in salt environments.

The market is experiencing rapid growth in Asia-Pacific. The Asian Development Bank (ADB) estimates that approximately US$ 1.7 trillion will have to be invested annually in infrastructure across Asia through 2030. In industries such as energy, construction and petrochemicals, countries such as China, India and Japan are now employing a greater number of multifunctional DSS welded pipelines. The Indian Stainless Steel Development Association reports that the Indian stainless steel production has grown at an average of 16% per annum, with duplex grades accounting for a significant portion of this growth.

Dynamics

Superior Properties for Diverse Applications

Duplex stainless steel is fueled by its distinctive property profile, which includes cost-effectiveness, corrosion resistance and high mechanical strength. However, DSS is distinguished from both an austenitic and ferritic stainless steel by its comparatively balanced microstructure of austenite and ferrite, which enhances its resistance to pitting and crevice corrosion and enhances its endurance. DSS are better resistant to CO2 and chlorides than the austenitic stainless steels, as per the research.

In chemical plants, DSS is employed to construct both small and large pipelines that transport corrosive fluids, such as sulfuric acid, to ensure the safety and reliability of processes. The U.S. Department of Energy observed a substantial increase in the number of renewable energy projects in 2023, with DSS welded pipes comprising a substantial portion of solar thermal and geothermal facilities. In addition, the pipes are capable of withstanding high-pressure and temperature conditions, which guarantees the longevity of their service life and the efficacy of processing. Consequently, they are a viable alternative for these applications.

Growth in Offshore Oil & Gas Exploration

The expansion of offshore oil & gas exploration is a major growth driver for the DSS welded pipe market. According to the U.S. Energy Information Administration (EIA), offshore oil production accounted for nearly 30% of global crude oil output in 2022, with an upward trend expected due to declining onshore reserves. DSS welded pipes are critical in subsea pipelines, risers and flowlines, where exposure to high pressures and corrosive seawater demands robust materials.

The International Energy Agency predicts that the global upstream oil and gas investments increase by about 11 percent to $528bn in 2023, emphasizing the use of DSS pipes for long-term reliability. Similarly, in the North Sea, operators have increasingly adopted duplex grades to optimize lifecycle costs and ensure operational safety. DSS's low thermal expansion and high strength make it ideal for deepwater and oil & gas exploration and applications, where temperature and pressure fluctuations are common.

High Initial Cost and Fabrication Complexity

The high initial cost and fabrication challenges of Duplex Stainless Steel welded pipes act as significant restraints. Duplex stainless steel pipes are 20-30 typically more expensive than standard stainless steel alternatives due to their alloy composition, including chromium, molybdenum and nitrogen. Additionally, the welding process requires specialized techniques to maintain the duplex structure, which increases manufacturing complexity and costs.

Small and medium-sized enterprises (SMEs) in emerging economies often face financial constraints, limiting the adoption of DSS welded pipes. The International Finance Corporation (IFC) notes that access to affordable financing remains a critical barrier for SMEs looking to invest in advanced materials like DSS. Furthermore, the lack of skilled labor for DSS fabrication in developing regions exacerbates the challenge, slowing market penetration.

Segment Analysis

The global duplex stainless steel welded pipe market is segmented based on product type, material grade, surface treatment, thickness, outer diameter, application and region.

Rising Oil Exploration and Production Infrastructure

The oil & gas industry represents the largest demand segment for Duplex Stainless Steel welded pipes. The EIA projects that global oil demand will increase by 1.2 million barrels per day (bpd) to reach 104.3 million barrels per day by 2025, driving investments in exploration and production infrastructure. DSS welded pipes are integral to upstream, midstream and downstream operations, providing unmatched durability and corrosion resistance. In upstream applications, DSS pipes are used in drilling and production systems where exposure to sour gas and high-pressure environments necessitates robust materials.

Midstream operations, including pipeline transport, also rely on DSS pipes for their ability to handle corrosive substances like crude oil and natural gas. Downstream facilities, such as refineries, use DSS pipes in distillation units and heat exchangers, ensuring process efficiency and safety. The U.S. Energy Information Administration (EIA) highlights a 7% annual increase in offshore drilling projects, where DSS pipes are indispensable. Furthermore, Middle Eastern countries like Saudi Arabia and the UAE are investing heavily in refinery expansions, further bolstering demand for DSS welded pipes.

Geographical Penetration

Asia-Pacific's Robust Industrial Base Demands High Durable Pipes

Asia-Pacific holds the largest market share in the Duplex Stainless Steel Welded Pipe market, driven by robust infrastructure development and industrial growth. According to the World Steel Association, the region accounted for over 96.4 mt of crude steel production in 2023, with duplex grades witnessing the highest growth rate. China's National Development and Reform Commission (NDRC) also highlighted significant investments in chemical and petrochemical industries, further driving the demand for DSS welded pipes.

Furthermore, the International Trade Administration reported that, in 2023, Japan exported 32.1 million metric tons of steel, a 1.4% increase from 31.7 million metric tons in 2022. Japan Stainless Steel Association and AICHI Steel Corporation are coming together and making more composite for stainless steel for other applications, such as; reinforced concrete construction for which they provide chromium stainless steel welded pipe for concrete reinforcement.

Competitive Landscape

The major global players in the market include NIPPON STEEL CORPORATION, Zhengzhou City Huitong Pipe Fittings Co., Ltd., Oshwin Overseas, Special Piping Materials, AMETEK Inc., Savoy Piping Inc., Tubacex Group, Aesteiron Steels LLP, MTSCO and Metline Industries.

Sustainability Analysis

The Duplex Stainless Steel Welded Pipe market is aligning with global sustainability goals by promoting resource efficiency and reducing carbon footprints. The World Steel Association emphasizes that duplex grades reduce material usage due to their high strength, contributing to lower emissions during production and transportation.

Moreover, DSS's long service life and recyclability make it an eco-friendly choice for industries. Companies are increasingly adopting green manufacturing practices, such as using renewable energy sources and minimizing waste. These initiatives & Factors align with global efforts to create sustainable and resilient industrial ecosystems.

Technological Advancement

Digital transformation is revolutionizing the Duplex Stainless Steel Welded Pipe market by enhancing manufacturing efficiency and quality. The adoption of Industry 4.0 technologies, such as IoT and AI, enables real-time monitoring of production processes, ensuring optimal resource utilization. According to the Office of Scientific and Technical Information, smart manufacturing solutions have improved operational efficiency in the steel industry.

Additionally, digital twin technology is gaining traction, allowing manufacturers to simulate and optimize pipe performance under various conditions. For instance, predictive maintenance systems reduce downtime and operational costs by identifying potential failures in advance. These advancements not only enhance competitiveness but also ensure compliance with stringent quality standards, driving the market forward.

Why Purchase the Report?

- To visualize the global duplex stainless steel welded pipe market segmentation based on product type, material grade, surface treatment, thickness, outer diameter, application and region.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points at the duplex stainless steel welded pipe market level for all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global duplex stainless steel welded pipe market report would provide approximately 86 tables, 84 figures and 219 pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

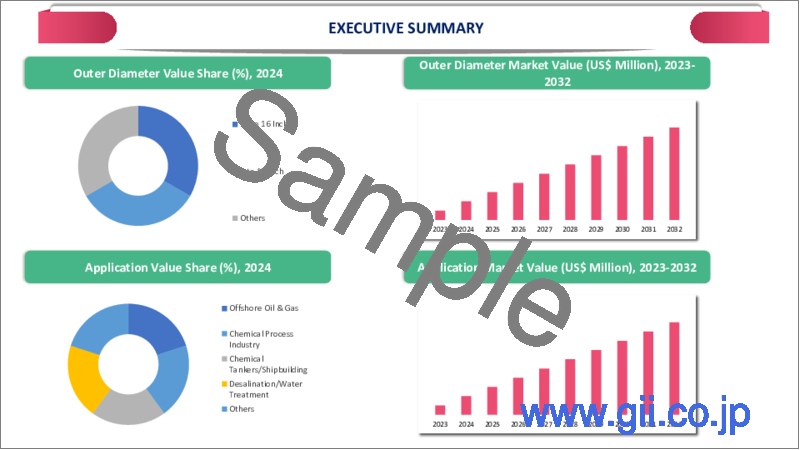

3. Executive Summary

- 3.1. Snippet by Product Type

- 3.2. Snippet by Material Grade

- 3.3. Snippet by Surface Treatment

- 3.4. Snippet by Thickness

- 3.5. Snippet by Outer Diameter

- 3.6. Snippet by Application

- 3.7. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Superior Properties and Diverse Applications

- 4.1.1.2. Growth in Offshore Oil & Gas Exploration

- 4.1.2. Restraints

- 4.1.2.1. High Initial Cost and Fabrication Complexity

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Sustainable Analysis

- 5.6. DMI Opinion

6. By Product Type

- 6.1. Introduction

- 6.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 6.1.2. Market Attractiveness Index, By Product Type

- 6.2. Hyper Duplex*

- 6.2.1. Introduction

- 6.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 6.3. Standard Duplex

- 6.4. Super Duplex

- 6.5. Others

7. By Material Grade

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material Grade

- 7.1.2. Market Attractiveness Index, By Material Grade

- 7.2. 304*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. 316

- 7.4. 304L

- 7.5. 316L

- 7.6. Others

8. By Surface Treatment

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Surface Treatment

- 8.1.2. Market Attractiveness Index, By Surface Treatment

- 8.2. Bare*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Galvanized

- 8.4. Copper Plated

- 8.5. Painted

9. By Thickness

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material Grade

- 9.1.2. Market Attractiveness Index, By Material Grade

- 9.2. 5.0-10 Mm*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. 2.5-5.0 Mm

- 9.4. 0.3-2.5 Mm

10. By Outer Diameter

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material Grade

- 10.1.2. Market Attractiveness Index, By Material Grade

- 10.2. 10 to 16 Inch*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. 3 to 10 Inch

- 10.4. 1.5 to 3 Inch

11. By Application

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.1.2. Market Attractiveness Index, By Application

- 11.2. Offshore Oil & Gas*

- 11.2.1. Introduction

- 11.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 11.3. Chemical Process Industry

- 11.4. Chemical Tankers/Shipbuilding

- 11.5. Desalination/Water Treatment

- 11.6. Others

12. Sustainability Analysis

- 12.1. Environmental Analysis

- 12.2. Economic Analysis

- 12.3. Governance Analysis

13. By Region

- 13.1. Introduction

- 13.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 13.1.2. Market Attractiveness Index, By Region

- 13.2. North America

- 13.2.1. Introduction

- 13.2.2. Key Region-Specific Dynamics

- 13.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 13.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material Grade

- 13.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Surface Treatment

- 13.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Thickness

- 13.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Outer Diameter

- 13.2.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 13.2.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 13.2.9.1. US

- 13.2.9.2. Canada

- 13.2.9.3. Mexico

- 13.3. Europe

- 13.3.1. Introduction

- 13.3.2. Key Region-Specific Dynamics

- 13.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 13.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material Grade

- 13.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Surface Treatment

- 13.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Thickness

- 13.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Outer Diameter

- 13.3.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 13.3.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 13.3.9.1. Germany

- 13.3.9.2. UK

- 13.3.9.3. France

- 13.3.9.4. Italy

- 13.3.9.5. Spain

- 13.3.9.6. Rest of Europe

- 13.4. South America

- 13.4.1. Introduction

- 13.4.2. Key Region-Specific Dynamics

- 13.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 13.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material Grade

- 13.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Surface Treatment

- 13.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Thickness

- 13.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Outer Diameter

- 13.4.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 13.4.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 13.4.9.1. Brazil

- 13.4.9.2. Argentina

- 13.4.9.3. Rest of South America

- 13.5. Asia-Pacific

- 13.5.1. Introduction

- 13.5.2. Key Region-Specific Dynamics

- 13.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 13.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material Grade

- 13.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Surface Treatment

- 13.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Thickness

- 13.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Outer Diameter

- 13.5.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 13.5.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 13.5.9.1. China

- 13.5.9.2. India

- 13.5.9.3. Japan

- 13.5.9.4. Australia

- 13.5.9.5. Rest of Asia-Pacific

- 13.6. Middle East and Africa

- 13.6.1. Introduction

- 13.6.2. Key Region-Specific Dynamics

- 13.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 13.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material Grade

- 13.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Surface Treatment

- 13.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Thickness

- 13.6.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Outer Diameter

- 13.6.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

14. Competitive Landscape

- 14.1. Competitive Scenario

- 14.2. Market Positioning/Share Analysis

- 14.3. Mergers and Acquisitions Analysis

15. Company Profiles

- 15.1. NIPPON STEEL CORPORATION*

- 15.1.1. Company Overview

- 15.1.2. Product Portfolio and Description

- 15.1.3. Financial Overview

- 15.1.4. Key Developments

- 15.2. Zhengzhou City Huitong Pipe Fittings Co., Ltd.

- 15.3. Oshwin Overseas

- 15.4. Special Piping Materials

- 15.5. AMETEK Inc.

- 15.6. Savoy Piping Inc.

- 15.7. Tubacex Group

- 15.8. Aesteiron Steels LLP

- 15.9. MTSCO

- 15.10. Metline Industries

LIST NOT EXHAUSTIVE

16. Appendix

- 16.1. About Us and Services

- 16.2. Contact Us