|

|

市場調査レポート

商品コード

1629843

日本の液体クロマトグラフ質量分析市場(2024年~2031年)Japan Liquid Chromatography Mass Spectrometry Market - 2024-2031 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 日本の液体クロマトグラフ質量分析市場(2024年~2031年) |

|

出版日: 2024年12月30日

発行: DataM Intelligence

ページ情報: 英文 182 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

日本の液体クロマトグラフ質量分析の市場規模は、2023年に8億米ドルに達し、2031年には13億米ドルに達すると予測され、予測期間2024年~2031年のCAGRは6.26%で成長する見込みです。

液体クロマトグラフ質量分析(LC-MS)市場は、特にヘルスケアと医薬品を中心とした複数の分野における研究開発(R&D)支出の増加により、大幅な成長が予測されています。特に環境モニタリングや個別化医療における高度な分析手法に対する需要の高まりが、市場をさらに強化しています。分離能、感度、速度の向上など、LC-MS技術の開発が進むにつれ、これらのシステムの全体的な性能と能力が向上し、幅広い導入が促進されています。

高分解能質量分析計やハイブリッド質量分析計の登場を含む技術の進歩は、市場の成長にとって極めて重要です。これらの進歩は分析能力を高め、より迅速で正確な結果を促進します。さらに、自動化とデータ処理ソフトウェアのLC-MSシステムへの統合により、ワークフローの効率と分析スループットが著しく向上しています。

さらに、製薬業界やバイオテクノロジー業界における研究開発への投資の増加は、LC-MS業界にとって不可欠な触媒です。特にバイオ医薬品と個別化医療において、日本の研究開発費のかなりの割合を製薬事業が占めており、創薬、開発、臨床試験における質量分析ソリューションのニーズの増加が予想されます。

力学

医薬品とバイオテクノロジーの進歩

LC-MSシステムの開発は、さまざまな業界における新薬の創薬や開発手法に対する需要の高まりとともに不可欠なものとなっています。LC-MS技術は、複雑な生物学的マトリックス中の多様な物質の正確な同定と定量を容易にし、研究効率を著しく高め、革新的な創薬を促進します。LC-MS技術への依存の高まりは、医薬品開発の進歩を促進し、市場の成長を後押ししています。

製薬およびバイオテクノロジー業界における研究開発(R&D)支出の大幅な増加が、質量分析の需要を促進しています。製薬企業によるバイオ医薬品、個別化医療、その他の高度な治療領域への投資が、研究開発活動の顕著な増加をもたらしています。

食品と安全性に関する懸念の高まり

食品と安全性に関する懸念の高まりと厳しい世界的規制が、液体クロマトグラフィー質量分析(LC-MS)のような最新の分析手法の利用を後押ししています。この技術は、汚染物質や添加物の正確な検出と定量化を通じて、食品安全規制の遵守を保証するために不可欠です。LC-MSは、化学汚染物質の複雑な混合物を検出するのに非常に長けており、スクリーニング、確認、定量に比類のない感度と選択性を提供します。

食品の真正性、栄養評価、表示精度など、本質的な問題に取り組むこの技術の能力は、進歩する食品検査領域における基本的な要素として確立されています。食品の偽装表示、微生物汚染、食中毒の増加により、厳格な検査手順の必要性が高まっています。トリプル四重極(QqQ)や飛行時間型(TOF)技術などのタンデム質量分析の進歩は、LC-MSシステムの機能を向上させ、規制遵守と消費者の信頼に不可欠なものとなっています。

高コスト

液体クロマトグラフィー質量分析(LC-MS)システムのコストが高いことは、特に経済的な制約から高度な分析機器へのアクセスが制限される新興地域において、業界拡大の大きな障害となっています。装置の初期資本投資と、継続的なメンテナンスおよび運用コストは、小規模の研究所や研究機関がLC-MS技術を導入する意欲を失わせることが多いです。このため、これらの技術の採用率が制限され、市場全体の成長が妨げられます。

さらに、消耗品、試薬、専門家養成を含むLC-MSに関連する多額の運営費は、企業の財政負担を悪化させます。

その結果、多くの見込み顧客は、従来のクロマトグラフィー法や質量分析システムのような、より経済的な選択肢を選ぶ可能性があります。これらは初期費用は抑えられますが、LC-MSに比べて精度や感度が劣る可能性があります。価格に対する敏感さは、特に学術機関や小規模企業のような予算重視の分野では、LC-MS産業の成長可能性を制約します。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 医薬品とバイオテクノロジーの進歩

- 食品と安全に関する懸念の高まり

- 抑制要因

- 高コスト

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- DMIの見解

第6章 技術別

- 飛行時間型

- 四重極 - 飛行時間型

- ハイブリッドLC-MS

- イオントラップLC-MS

- その他

第7章 用途別

- 医薬品の創薬と開発

- 臨床診断

- 環境試験

- 法医学検査

- 製薬およびバイオテクノロジー

- その他

第8章 エンドユーザー別

- 学術研究機関

- 契約研究機関

- バイオ医薬品企業

- 病院および診断センター

- 病理学研究所

- 法医学研究所

- その他

第9章 競合情勢

- 競合シナリオ

- 市況・シェア分析

- M&A分析

第10章 企業プロファイル

- Shimadzu Corporation

- 会社概要

- 製品ポートフォリオと概要

- 財務概要

- 主な発展

- JEOL Ltd.

- Hitachi High-Tech Corporation

- PerkinElmer Japan Co., Ltd.

- Agilent Technologies Japan, Ltd.

- Thermo Fisher Scientific Japan

- Bruker Japan K.K.

- Waters Corporation Japan

- SCIEX Japan

- Kyoto Electronics Manufacturing Co., Ltd.(KEM)

第11章 付録

Japan Liquid Chromatography Mass Spectrometry Market reached US$ 0.8 billion in 2023 and is expected to reach US$ 1.3 billion by 2031, growing with a CAGR of 6.26% during the forecast period 2024-2031.

The Liquid Chromatography Mass Spectrometry (LC-MS) market is projected to undergo substantial growth due to heightened spending in research and development (R&D) across multiple sectors, especially in healthcare and pharmaceuticals. The increasing demand for sophisticated analytical methods, especially in environmental monitoring and personalized medicine, further strengthens the market. The ongoing developments in LC-MS technology, including enhanced resolution, sensitivity and speed, are augmenting the overall performance and capabilities of these systems, facilitating their broad implementation.

Technological advancements, including the emergence of high-resolution and hybrid mass spectrometers, are crucial to the market's growth. These advances enhance analytical capabilities and facilitate swifter and more precise outcomes. Furthermore, the integration of automation and data processing software with LC-MS systems has markedly enhanced workflow efficiency and analytical throughput.

Moreover, the increasing investments in research and development within the pharmaceutical and biotechnology industries are essential catalysts for the LC-MS industry. Pharmaceutical businesses represent a substantial share of Japan R&D spending, especially in biopharmaceuticals and personalized medicine, leading to an anticipated rise in the need for mass spectrometry solutions in drug discovery, development and clinical trials.

Dynamics

Advancements in Pharmaceutical and Biotechnology

The deployment of LC-MS systems is becoming essential, with the increasing demand for new drug discovery and development methods in various industries. LC-MS technology facilitates the accurate identification and quantification of diverse substances in intricate biological matrices, markedly enhancing research efficiency and fostering innovative discoveries. The increased dependence on LC-MS technologies is facilitating advancements in medication development, hence aiding market growth.

The significant rise in research and development (R&D) spending in the pharmaceutical and biotechnology industries is driving the demand for mass spectrometry. Investments by pharmaceutical corporations in biopharmaceuticals, personalized medicine and other advanced therapeutic domains have resulted in a notable increase in research and development activity.

Rising Food and Safety Concerns

The increasing awareness of food safety and stringent global regulations are propelling the utilization of modern analytical methods like Liquid Chromatography-Mass Spectrometry (LC-MS). This technology is essential for guaranteeing adherence to food safety regulations through accurate detection and quantification of pollutants and additives. LC-MS is exceptionally proficient at detecting intricate mixtures of chemical pollutants, providing unmatched sensitivity and selectivity for screening, confirmation and quantification.

The technology's capacity to tackle essential issues including food authenticity, nutritional evaluation and labeling precision has established it as a fundamental element in the advancing food testing domain. The increasing occurrences of food mislabeling, microbial contamination and foodborne illnesses have heightened the necessity for rigorous testing procedures. Advancements in tandem mass spectrometry, such as triple quadrupole (QqQ) and time-of-flight (TOF) technologies, have improved the functionality of LC-MS systems, rendering them essential for regulatory adherence and consumer confidence.

High Cost

The high cost of liquid chromatography mass spectrometry (LC-MS) systems is a considerable obstacle to industry expansion, especially in emerging regions where financial limitations restrict access to sophisticated analytical instruments. The initial capital investment for the equipment, together with the continuous maintenance and operational costs, frequently dissuades smaller laboratories and research organizations from implementing LC-MS technology. This limits the adoption rate of these technologies, obstructing total market growth.

Moreover, the substantial operating expenses linked to LC-MS, encompassing consumables, reagents and specialist personnel training, exacerbate the financial strain on companies.

Consequently, numerous prospective customers may choose more economical options, such as conventional chromatographic methods or mass spectrometric systems, which present reduced initial costs but may be deficient in precision and sensitivity compared to LC-MS. The price sensitivity constrains the growth potential of the LC-MS industry, particularly in budget-conscious sectors such as academics and small-scale companies.

Segment Analysis

The Japan liquid chromatography mass spectrometry market is segmented based on technology, application, end-user and region.

Revolutionizing Drug Development with LC-MS

LC-MS is essential for assessing medicines throughout different phases of the drug development lifecycle. From the preliminary phases of drug development, where it facilitates the separation and characterisation of prospective drug candidates from synthetic or natural substances, to sophisticated metabolism investigations (both in vitro and in vivo), LC-MS guarantees precise and dependable analytical outcomes.

Furthermore, LC-MS is crucial for detecting contaminants and degradation products, so guaranteeing the safety and efficacy of pharmaceutical formulations. Its capacity to identify and measure intricate molecular structures with exceptional sensitivity and specificity renders it an essential instrument for pharmaceutical research. The strong applicability of LC-MS systems in drug discovery and development enhances their demand, establishing them as essential tools in the pharmaceutical sector.

Competitive Landscape

The major Japan players in the market include Shimadzu Corporation, JEOL Ltd., Hitachi High-Tech Corporation, PerkinElmer Japan Co., Ltd., Agilent Technologies Japan, Ltd., Thermo Fisher Scientific Japan, Bruker Japan K.K., Waters Corporation Japan, SCIEX Japan and Kyoto Electronics Manufacturing Co., Ltd. (KEM).

Sustainability Analysis

The LC-MS (Liquid Chromatography-Mass Spectrometry) market is progressively conforming to the tenets of green chemistry, emphasizing the reduction of environmental effect while improving laboratory efficiency. Green chemistry promotes the utilization of eco-friendly reaction medium, the reduction of hazardous chemical waste and the optimization of laboratory procedures to decrease energy usage. Liquid chromatography, a prevalent analytical technique in pharmaceuticals, biotechnology and environmental monitoring, has considerable opportunities for the incorporation of sustainable practices.

The implementation of environmentally friendly technologies is essential for promoting sustainability in the LC-MS sector. Contemporary chromatography apparatus has improved in energy efficiency and the adoption of methods like solvent recycling and waste reutilization further promotes sustainability. Furthermore, the utilization of supercritical CO2 and alternative green solvents offers a promising strategy for minimizing the environmental impact of the approach.

Technological Advancement

The LC-MS market is experiencing substantial technological developments, propelled by innovations in low-flow LC-MS applications and the integration of cutting-edge technology. The shift of nano-, capillary- and micro-flow LC-MS from research and development laboratories to widespread industrial use has transformed analytical processes, especially in proteomics and drug discovery.

Innovations such as ion mobility spectrometry (IMS) augment molecular characterisation by providing an extra dimension of separation, hence enhancing specificity and analytical peak capacity for intricate materials. These developments, along with efforts to enhance time-of-flight detection, are establishing new benchmarks for precision and resolution in biomolecular analysis.

By Technology

- Time of Flight

- Quadrupole - Time of Flight

- Hybrid LC-MS

- Ion Trap LC-MS

- Others

By Application

- Drug Discovery and Development

- Clinical Diagnostics

- Environmental Testing

- Forensic Testing

- Pharmaceutical and Biotechnology

- Others

By End-User

- Academic Research Institutions

- Contract Research Organizations

- Biopharmaceutical Companies

- Hospitals and Diagnostic Centers

- Pathology Laboratories

- Forensic Laboratories

- Others

Why Purchase the Report?

- To visualize the Japan liquid chromatography mass spectrometry market segmentation based on technology, application, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of the liquid chromatography mass spectrometry market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

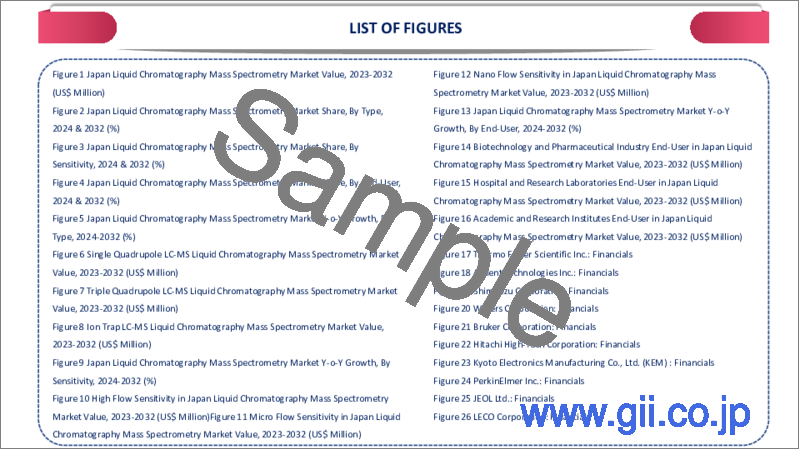

The Japan liquid chromatography mass spectrometry market report would provide approximately 39 tables, 35 figures and 182 pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Technology

- 3.2. Snippet by Application

- 3.3. Snippet by End-User

- 3.4. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Advancements in Pharmaceutical and Biotechnology

- 4.1.1.2. Rising Food and Safety Concerns

- 4.1.2. Restraints

- 4.1.2.1. High Cost

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. DMI Opinion

6. By Technology

- 6.1. Introduction

- 6.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 6.1.2. Market Attractiveness Index, By Technology

- 6.2. Time of Flight*

- 6.2.1. Introduction

- 6.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 6.3. Quadrupole - Time of Flight

- 6.4. Hybrid LC-MS

- 6.5. Ion Trap LC-MS

- 6.6. Others

7. By Application

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 7.1.2. Market Attractiveness Index, By Application

- 7.2. Drug Discovery and Development*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Clinical Diagnostics

- 7.4. Environmental Testing

- 7.5. Forensic Testing

- 7.6. Pharmaceutical and Biotechnology

- 7.7. Others

8. By End-User

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 8.1.2. Market Attractiveness Index, By End-User

- 8.2. Academic Research Institutions*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Contract Research Organizations

- 8.4. Biopharmaceutical Companies

- 8.5. Hospitals and Diagnostic Centers

- 8.6. Pathology Laboratories

- 8.7. Forensic Laboratories

- 8.8. Others

9. Competitive Landscape

- 9.1. Competitive Scenario

- 9.2. Market Positioning/Share Analysis

- 9.3. Mergers and Acquisitions Analysis

10. Company Profiles

- 10.1. Shimadzu Corporation*

- 10.1.1. Company Overview

- 10.1.2. Product Portfolio and Description

- 10.1.3. Financial Overview

- 10.1.4. Key Developments

- 10.2. JEOL Ltd.

- 10.3. Hitachi High-Tech Corporation

- 10.4. PerkinElmer Japan Co., Ltd.

- 10.5. Agilent Technologies Japan, Ltd.

- 10.6. Thermo Fisher Scientific Japan

- 10.7. Bruker Japan K.K.

- 10.8. Waters Corporation Japan

- 10.9. SCIEX Japan

- 10.10. Kyoto Electronics Manufacturing Co., Ltd. (KEM)

LIST NOT EXHAUSTIVE

11. Appendix

- 11.1. About Us and Services

- 11.2. Contact Us