|

|

市場調査レポート

商品コード

1629834

糖尿病向けデジタル治療の世界市場-2024~2031年Global Digital Therapeutics for Diabetes Market - 2024-2031 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 糖尿病向けデジタル治療の世界市場-2024~2031年 |

|

出版日: 2024年12月30日

発行: DataM Intelligence

ページ情報: 英文 179 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

糖尿病向けデジタル治療の世界市場は、2023年に16億米ドルに達し、2033年には53億米ドルに達すると予測され、予測期間2025年~2033年のCAGRは12.9%で成長する見込みです。

糖尿病向けデジタル治療は、デジタル技術、行動科学、個別化されたデータを活用し、糖尿病の予防、管理、治療のために設計された、エビデンスに基づくソフトウェア主導型ソリューションのカテゴリーを指します。これらのソリューションは、単独の治療法として、あるいは薬物療法やインスリン療法といった従来の治療法と併用して使用されることが意図されています。これらのソリューションは、リアルタイムのモニタリング、行動修正、患者教育を通じて、生活習慣、服薬遵守、グルコース調整といった糖尿病の根本原因に対処することで、患者の病状管理を支援することを目的としています。

糖尿病向けデジタル治療の需要は、糖尿病の有病率の増加と継続的な疾病管理の必要性により、著しい成長を遂げています。この成長は、主に糖尿病のような慢性疾患のための費用対効果が高く、スケーラブルで個別化された管理ソリューションを提供するスマートフォンやデジタルヘルス技術の採用が増加していることに後押しされています。例えば、ピーターソン医療技術研究所(PHTI)によると、デジタル糖尿病管理ソリューションの購入者に与える経済効果は、デジタルソリューションの価格と、それを利用する患者のヘルスケア利用パターンと支出にどのような影響を与えるかによって決まります。PHTIでは、対象となるユーザーにおける導入率を25%と想定しています。

市場力学:

促進要因と阻害要因

糖尿病有病率の上昇

糖尿病有病率の上昇が糖尿病向けデジタル治療市場の成長を大きく牽引しており、糖尿病と診断される患者数の増加により、拡張可能で効果的な新たな治療オプションが必要となるため、予測期間中も市場の牽引役となることが予想されます。デジタル治療は、糖尿病を管理する効率的な方法であると考えられており、特に遠隔治療、個別化された治療計画、リアルタイムのモニタリングに対する需要が高まっています。

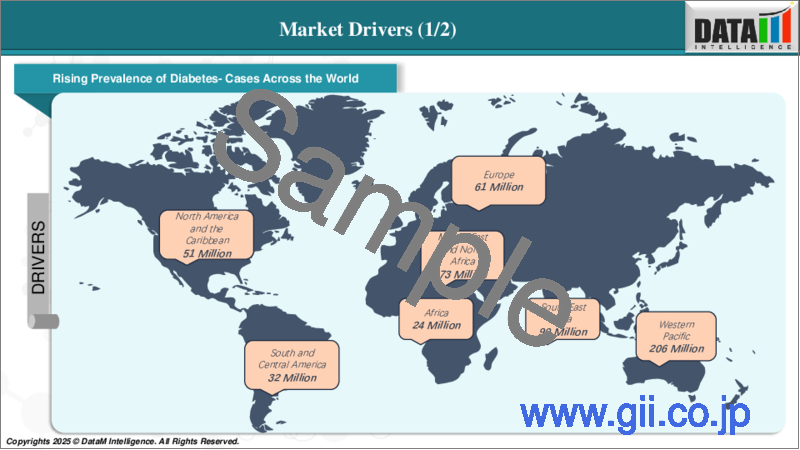

例えば、国際糖尿病連合によると、2021年には5億3,660万人の成人(20~79歳)が糖尿病を患っています。この数は2030年までに6億4,280万人、2045年までに7億8,370万人に増加すると予測されています。成人の糖尿病患者の4人に3人以上が低・中所得国に住んでいます。2021年の糖尿病による死亡者数は670万人で、これは5秒に1人の割合です。5億4,100万人の成人が耐糖能障害(IGT)で、2型糖尿病のリスクが高いです。このような有病率の増加は、アクセスしやすく費用対効果の高い糖尿病管理ソリューションの緊急の必要性を浮き彫りにしています。

糖尿病は生涯にわたる管理が必要な慢性疾患であり、デジタル治療は治療計画を継続的にモニターし調整する手段を提供します。持続グルコースモニター(CGM)、モバイルアプリ、インスリン投与量トラッカーなどのデジタルプラットフォームや接続デバイスは、リアルタイムデータを提供し、より個別化されたケアを可能にします。これは、治療計画の遵守が重要な1型および2型糖尿病患者にとって特に有用です。

例えば、糖尿病管理のためのデジタル治療ソリューションであるBlueStar(powered by Welldoc)は、インスリン投与勧告や持続的グルコースモニタリングと統合して個別化されたガイダンスを提供し、日々の糖尿病管理におけるデジタル治療の重要性が高まっていることを示しています。

データプライバシーへの懸念

データプライバシーに関する懸念は、信頼性、採用率、規制遵守に直接影響するため、糖尿病向けデジタル治療市場の成長にとって大きな障壁となっています。デジタル治療には、グルコース値、インスリン投与量、生活習慣などの機密性の高い健康データの収集と処理が含まれるため、これらの情報のセキュリティ、保管、共有に関する懸念が生じています。

糖尿病管理のためのデジタルヘルスプラットフォームは、継続的グルコースモニター(CGM)やスマートインスリンペンのようなデバイスからのリアルタイムデータを含む、個人の健康情報の入力をユーザーに要求することが多いです。このようなデータは非常に機密性が高いため、個人の健康情報が漏洩するような侵害を避けるために、細心の注意を払って取り扱われなければなりません。

例えば、HIPAAジャーナルによると、2023年8月には2,300万件のヘルスケア記録の漏洩が発覚しています。過去12ヶ月間、毎月平均9,989,003件のヘルスケア記録が漏洩しています。2024年8月31日までの1年間で、500レコード以上のデータ漏洩が491件発生し、少なくとも58,668,002レコードが漏洩したことが判明しています。2024年の平均情報漏洩件数は119,487件、中央値は4,109件です。

目次

第1章 市場イントロダクションと範囲

- 報告書の目的

- 調査範囲と定義

- 調査範囲

第2章 エグゼクティブの洞察と重要なポイント

- 市場のハイライトと戦略的ポイント

- 主な動向と将来の予測

- 製品タイプ別のスニペット

- 用途別スニペット

- エンドユーザーによる抜粋

- 地域別スニペット

第3章 市場力学

- 影響要因

- 促進要因

- 糖尿病の罹患率の上昇

- 技術の進歩の高まり

- 抑制要因

- データプライバシーに関する懸念

- 機会

- 影響分析

- 促進要因

第4章 戦略的洞察と業界展望

- 市場のリーダーと先駆者

- 新たな先駆者と著名なプレーヤー

- 最大の売上を誇るブランドを確立したリーダー

- 確立された製品を持つ市場リーダー

- 新興スタートアップ企業と主要イノベーター

- CXOの視点

- 最新の開発とブレークスルー

- ケーススタディ/進行中の調査

- 規制と償還の情勢

- 北米

- 欧州

- アジア太平洋地域

- ラテンアメリカ

- 中東・アフリカ

- ポーターのファイブフォース分析

- サプライチェーン分析

- 特許分析

- SWOT分析

- アンメットニーズとギャップ

- 市場参入と拡大のための推奨戦略

- シナリオ分析ベストケース、ベースケース、ワーストケースの予測

- 価格分析と価格市場力学

第5章 糖尿病向けデジタル治療市場、製品タイプ別

- ソフトウェアソリューション

- モバイルアプリ

- Webベースソリューション

- ハードウェアソリューション

- ウェアラブル機器

- 持続血糖モニター

- その他

第6章 糖尿病向けデジタル治療市場、用途別

- 1型糖尿病

- 2型糖尿病

- 糖尿病前症

第7章 糖尿病向けデジタル治療市場、エンドユーザー別

- 病院

- 専門クリニック

- ホームケア設定

- その他

第8章 糖尿病向けデジタル治療市場、地域別市場分析と成長機会

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- その他欧州地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 中東・アフリカ

第9章 競合情勢と市場ポジショニング

- 競合状況の概要と主要な市場プレーヤー

- 市場シェア分析とポジショニングマトリックス

- 戦略的パートナーシップ、合併、買収

- 製品ポートフォリオとイノベーションにおける主な発展

- 企業ベンチマーク

第10章 企業プロファイル

- Welldoc, Inc.

- 会社概要

- 製品ポートフォリオと概要

- 財務概要

- 主な発展

- SWOT分析

- Omada Health Inc.

- Glooko, Inc.

- Azumio Inc.

- Abbott Laboratories

- mySugr GmbH

- Dexcom, Inc.

- Health2Sync

- iHealth Labs Inc.

- Medtronic plc

第11章 仮定と調査手法

- データ収集方法

- データの三角測量

- 予測技術

- データの検証と検証

第12章 付録

The global digital therapeutics for diabetes market reached US$ 1.6 billion in 2023 and is expected to reach US$ 5.3 billion by 2033, growing at a CAGR of 12.9% during the forecast period 2025-2033.

Digital therapeutics for diabetes refers to a category of evidence-based, software-driven solutions designed to prevent, manage or treat diabetes, leveraging digital technology, behavioral science and personalized data. These solutions are intended to be used either as stand-alone therapies or in conjunction with traditional treatments such as medications and insulin. They aim to help patients manage their condition by addressing the root causes of diabetes, such as lifestyle factors, medication adherence and glucose regulation, through real-time monitoring, behavior modification and patient education.

The demand for digital therapeutics for diabetes is experiencing significant growth, driven by the increasing prevalence of diabetes and the need for continuous disease management. This growth is primarily fueled by the rising adoption of smartphones and digital health technologies, which provide cost-effective, scalable and personalized management solutions for chronic diseases like diabetes. For instance, according to the Peterson Health Technology Institute (PHTI), the economic impact on purchasers of digital diabetes management solutions depends on the price of the digital solution and how it affects patterns of healthcare utilization and spending for patients who use them. It assumes a 25% adoption rate among eligible users.

Market Dynamics: Drivers & Restraints

Rising prevalence of diabetes

The rising prevalence of diabetes is significantly driving the growth of the digital therapeutics for diabetes market and is expected to drive the market over the forecast period, as the increasing number of people diagnosed with diabetes necessitates new, scalable and effective treatment options. Digital therapeutics are seen as an efficient way to manage diabetes, especially with the growing demand for remote care, personalized treatment plans and real-time monitoring.

For instance, according to the International Diabetes Federation, in 2021, 536.6 million adults (20-79 years) are living with diabetes i.e., 1 in 10 people. This number is predicted to rise to 642.8 million by 2030 and 783.7 million by 2045. Over 3 in 4 adults with diabetes live in low- and middle-income countries. Diabetes is responsible for 6.7 million deaths in 2021 - 1 every 5 seconds. 541 million adults have Impaired Glucose Tolerance (IGT), which places them at high risk of type 2 diabetes. This escalating prevalence highlights the urgent need for accessible and cost-effective diabetes management solutions.

Diabetes is a chronic condition requiring lifelong management and digital therapeutics provide a means to continuously monitor and adjust treatment plans. Digital platforms and connected devices, like continuous glucose monitors (CGMs), mobile apps, and insulin dose trackers, offer real-time data, allowing for more personalized care. This is particularly useful for the Type 1 and Type 2 diabetes populations, where adherence to treatment plans is crucial.

For instance, BlueStar (powered by Welldoc), a digital therapeutic solution for diabetes management, integrates with insulin dosing recommendations and continuous glucose monitoring to provide personalized guidance, demonstrating the growing importance of digital therapeutics in day-to-day diabetes management.

Data privacy concerns

Data privacy concerns are a significant barrier to the growth of digital therapeutics for the diabetes market, as they directly impact trust, adoption rates and regulatory compliance. Digital therapeutics involve the collection and processing of sensitive health data, such as glucose levels, insulin doses and lifestyle habits, which raises concerns regarding the security, storage and sharing of this information.

Digital health platforms for diabetes management often require users to input personal health information, including real-time data from devices like continuous glucose monitors (CGMs) or smart insulin pens. This data, being highly sensitive, must be handled with the utmost care to avoid breaches that could expose personal health information.

For instance, according to the HIPAA Journal, in August 2023, 23 million breached healthcare records are noticed. Over the past 12 months, an average of 9,989,003 healthcare records were breached each month. In the year to August 31, 2024, there have been 491 data breaches of 500 or more records, and at least 58,668,002 records are known to have been breached. The average breach size in 2024 is currently 119,487 records and the median breach size is 4,109 records.

Segment Analysis

The global digital therapeutics for diabetes market is segmented based on product type, application, end-user and region.

Product Type:

The software solutions segment is expected to dominate the digital therapeutics for diabetes market share

The software solutions segment is expected to dominate the global digital therapeutics for diabetes market. Software-based solutions such as mobile apps and digital platforms allow patients to track glucose levels, insulin use, diet and physical activity, providing personalized feedback and treatment recommendations. For instance, in November 2024, PureHealth revealed a huge surge in users of Pura, the group's AI-enabled app. With over 140,000 downloads to date, Pura aims to improve quality of life and lifespans by providing individuals with personalized data, empowering them to improve their health through user-friendly tools and tailored insights.

Mobile and web-based applications are easy to use and accessible for a wide range of patients, including those in rural or underserved areas. The growing smartphone penetration is a key factor in this segment's dominance. For instance, in November 2023, Abbott launched its digital health tool, FreeStyle LibreLink app in India. The mobile app allows people who use the FreeStyle Libre system to measure their glucose readings on their mobile phones without pricking. The mobile app is compatible with iPhone and Android smartphones.

The integration of digital therapeutics software with wearable devices like continuous glucose monitors and smart insulin pens allows for seamless, continuous monitoring of diabetes. These integrations are essential for patients with Type 1 and Type 2 diabetes, who need real-time adjustments to their insulin and lifestyle. As mentioned above, Abbott's Freestyle Libre, connects with mobile apps to provide real-time glucose tracking, demonstrating the growing adoption of software solutions in diabetes management.

Geographical Analysis

North America is expected to hold a significant position in the digital therapeutics for diabetes market share

North America is expected to hold the largest market share in the global digital therapeutics for diabetes market. North America, particularly the United States, has a high diabetes prevalence, which fuels the demand for digital therapeutics solutions. For instance, according to the Centers for Disease Control and Prevention (CDC), In 2021, 29.7 million people of all ages or 8.9% of the U.S. population had been diagnosed with diabetes and the number is expected to rise as the population ages. This includes 304,000 with type 1 diabetes. 3.6 million adults aged 20 years or older or 12.3% of all U.S. adults with diagnosed diabetes and started using insulin within a year of their diagnosis.

The United States has one of the highest rates of smartphone and internet penetration globally, making it an ideal market for the adoption of digital health solutions like mobile apps and wearable devices. This technological infrastructure is pivotal for the adoption of digital therapeutics platforms that require constant connectivity for real-time data sharing and analysis. For instance, new National Telecommunications and Information Administration (NTIA) data showed 13 million more internet users in the U.S. in 2023 than in 2021.

Digital health solutions like Welldoc's BlueStar and Omada Health's digital platform for diabetes management have gained significant traction in the U.S., further solidifying North America's leadership in the space.

Asia-Pacific is growing at the fastest pace in the digital therapeutics for diabetes market

The Asia-Pacific region is experiencing the fastest growth in the digital therapeutics for diabetes market. There is a strong push towards digital health and telemedicine in countries like India, China and Australia, where smartphone penetration is rapidly increasing.

For instance, India had over 700 million active internet users aged 2 years and above as of December 2022, according to Nielsen's India Internet Report 2023. Of these, rural India accounted for 425 million users, which was almost 44% higher than the number of active internet users in urban areas, with 295 million users, providing a strong foundation for the growth of mobile-based digital therapeutics platforms.

Several APAC countries have launched initiatives to support digital health technologies. For example, China's "Healthy China 2030" plan aims to enhance healthcare infrastructure, which includes the adoption of digital health tools for chronic disease management.

Competitive Landscape

The major global players in the digital therapeutics for diabetes market include Welldoc, Inc., Omada Health Inc., Glooko, Inc., Azumio Inc., Abbott Laboratories, mySugr GmbH, Dexcom, Inc., Health2Sync, iHealth Labs Inc., Medtronic plc and among others.

Why Purchase the Report?

- Pipeline & Innovations: Reviews ongoing clinical trials, product pipelines, and forecasts upcoming advancements in medical devices and pharmaceuticals.

- Product Performance & Market Positioning: Analyzes product performance, market positioning, and growth potential to optimize strategies.

- Real-World Evidence: Integrates patient feedback and data into product development for improved outcomes.

- Physician Preferences & Health System Impact: Examines healthcare provider behaviors and the impact of health system mergers on adoption strategies.

- Market Updates & Industry Changes: Covers recent regulatory changes, new policies, and emerging technologies.

- Competitive Strategies: Analyzes competitor strategies, market share, and emerging players.

- Pricing & Market Access: Reviews pricing models, reimbursement trends, and market access strategies.

- Market Entry & Expansion: Identifies optimal strategies for entering new markets and partnerships.

- Regional Growth & Investment: Highlights high-growth regions and investment opportunities.

- Supply Chain Optimization: Assesses supply chain risks and distribution strategies for efficient product delivery.

- Sustainability & Regulatory Impact: Focuses on eco-friendly practices and evolving regulations in healthcare.

- Post-market Surveillance: Uses post-market data to enhance product safety and access.

- Pharmacoeconomics & Value-Based Pricing: Analyzes the shift to value-based pricing and data-driven decision-making in R&D.

The global digital therapeutics for diabetes market report delivers a detailed analysis with 62 key tables, more than 52 visually impactful figures, and 179 pages of expert insights, providing a complete view of the market landscape.

Target Audience 2023

- Manufacturers: Pharmaceutical, Medical Device, Biotech Companies, Contract Manufacturers, Distributors, Hospitals.

- Regulatory & Policy: Compliance Officers, Government, Health Economists, Market Access Specialists.

- Technology & Innovation: AI/Robotics Providers, R&D Professionals, Clinical Trial Managers, Pharmacovigilance Experts.

- Investors: Healthcare Investors, Venture Fund Investors, Pharma Marketing & Sales.

- Consulting & Advisory: Healthcare Consultants, Industry Associations, Analysts.

- Supply Chain: Distribution and Supply Chain Managers.

- Consumers & Advocacy: Patients, Advocacy Groups, Insurance Companies.

- Academic & Research: Academic Institutions.

Table of Contents

1. Market Introduction and Scope

- 1.1. Objectives of the Report

- 1.2. Report Coverage & Definitions

- 1.3. Report Scope

2. Executive Insights and Key Takeaways

- 2.1. Market Highlights and Strategic Takeaways

- 2.2. Key Trends and Future Projections

- 2.3. Snippet by Product Type

- 2.4. Snippet by Application

- 2.5. Snippet by End-User

- 2.6. Snippet by Region

3. Dynamics

- 3.1. Impacting Factors

- 3.1.1. Drivers

- 3.1.1.1. Rising Prevalence of Diabetes

- 3.1.1.2. Rising Technological Advancements

- 3.1.2. Restraints

- 3.1.2.1. Data Privacy Concerns

- 3.1.3. Opportunity

- 3.1.4. Impact Analysis

- 3.1.1. Drivers

4. Strategic Insights and Industry Outlook

- 4.1. Market Leaders and Pioneers

- 4.1.1. Emerging Pioneers and Prominent Players

- 4.1.2. Established leaders with largest selling Brand

- 4.1.3. Market leaders with established Product

- 4.2. Emerging Startups and Key Innovators

- 4.3. CXO Perspectives

- 4.4. Latest Developments and Breakthroughs

- 4.5. Case Studies/Ongoing Research

- 4.6. Regulatory and Reimbursement Landscape

- 4.6.1. North America

- 4.6.2. Europe

- 4.6.3. Asia Pacific

- 4.6.4. Latin America

- 4.6.5. Middle East & Africa

- 4.7. Porter's Five Force Analysis

- 4.8. Supply Chain Analysis

- 4.9. Patent Analysis

- 4.10. SWOT Analysis

- 4.11. Unmet Needs and Gaps

- 4.12. Recommended Strategies for Market Entry and Expansion

- 4.13. Scenario Analysis: Best-Case, Base-Case, and Worst-Case Forecasts

- 4.14. Pricing Analysis and Price Dynamics

5. Digital Therapeutics for Diabetes Market, By Product Type

- 5.1. Introduction

- 5.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 5.1.2. Market Attractiveness Index, By Product Type

- 5.2. Software Solutions*

- 5.2.1. Introduction

- 5.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 5.2.3. Mobile Apps

- 5.2.4. Web-Based Solutions

- 5.3. Hardware Solutions

- 5.3.1. Wearable Devices

- 5.3.2. Continuous Glucose Monitors

- 5.3.3. Others

6. Digital Therapeutics for Diabetes Market, By Application

- 6.1. Introduction

- 6.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 6.1.2. Market Attractiveness Index, By Application

- 6.2. Type-1 Diabetes*

- 6.2.1. Introduction

- 6.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 6.3. Type-2 Diabetes

- 6.4. Pre-Diabetes

7. Digital Therapeutics for Diabetes Market, By End-User

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 7.1.2. Market Attractiveness Index, By End-User

- 7.2. Hospitals*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Specialty Clinics

- 7.4. Homecare Settings

- 7.5. Others

8. Digital Therapeutics for Diabetes Market, By Regional Market Analysis and Growth Opportunities

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 8.1.2. Market Attractiveness Index, By Region

- 8.2. North America

- 8.2.1. Introduction

- 8.2.2. Key Region-Specific Dynamics

- 8.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 8.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 8.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 8.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 8.2.6.1. U.S.

- 8.2.6.2. Canada

- 8.2.6.3. Mexico

- 8.3. Europe

- 8.3.1. Introduction

- 8.3.2. Key Region-Specific Dynamics

- 8.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 8.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 8.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 8.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 8.3.6.1. Germany

- 8.3.6.2. U.K.

- 8.3.6.3. France

- 8.3.6.4. Spain

- 8.3.6.5. Italy

- 8.3.6.6. Rest of Europe

- 8.4. South America

- 8.4.1. Introduction

- 8.4.2. Key Region-Specific Dynamics

- 8.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 8.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 8.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 8.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 8.4.6.1. Brazil

- 8.4.6.2. Argentina

- 8.4.6.3. Rest of South America

- 8.5. Asia-Pacific

- 8.5.1. Introduction

- 8.5.2. Key Region-Specific Dynamics

- 8.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 8.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 8.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 8.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 8.5.6.1. China

- 8.5.6.2. India

- 8.5.6.3. Japan

- 8.5.6.4. South Korea

- 8.5.6.5. Rest of Asia-Pacific

- 8.6. Middle East and Africa

- 8.6.1. Introduction

- 8.6.2. Key Region-Specific Dynamics

- 8.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 8.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 8.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

9. Competitive Landscape and Market Positioning

- 9.1. Competitive Overview and Key Market Players

- 9.2. Market Share Analysis and Positioning Matrix

- 9.3. Strategic Partnerships, Mergers & Acquisitions

- 9.4. Key Developments in Product Portfolios and Innovations

- 9.5. Company Benchmarking

10. Company Profiles

- 10.1. Welldoc, Inc.*

- 10.1.1. Company Overview

- 10.1.2. Product Portfolio and Description

- 10.1.3. Financial Overview

- 10.1.4. Key Developments

- 10.1.5. SWOT Analysis

- 10.2. Omada Health Inc.

- 10.3. Glooko, Inc.

- 10.4. Azumio Inc.

- 10.5. Abbott Laboratories

- 10.6. mySugr GmbH

- 10.7. Dexcom, Inc.

- 10.8. Health2Sync

- 10.9. iHealth Labs Inc.

- 10.10. Medtronic plc

LIST NOT EXHAUSTIVE

11. Assumption and Research Methodology

- 11.1. Data Collection Methods

- 11.2. Data Triangulation

- 11.3. Forecasting Techniques

- 11.4. Data Verification and Validation

12. Appendix

- 12.1. About Us and Services

- 12.2. Contact Us