|

|

市場調査レポート

商品コード

1512688

リン脂質の世界市場:2024年~2031年Global Phospholipids Market - 2024-2031 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| リン脂質の世界市場:2024年~2031年 |

|

出版日: 2024年07月10日

発行: DataM Intelligence

ページ情報: 英文 243 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

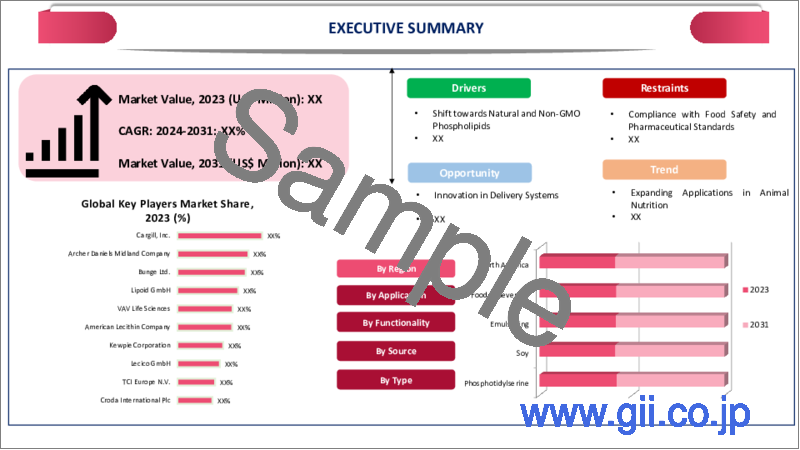

世界のリン脂質市場は、2023年に29億7,000万米ドルに達し、2031年には51億3,000万米ドルに達すると予測され、予測期間2024-2031年のCAGRは7.03%で成長する見込みです。

リン脂質は、そのユニークな特性と機能により、多様な用途を持つ必須成分です。大豆、ヒマワリ、卵などから供給され、ホスファチジルセリンやホスファチジルコリンなど様々な種類があります。リン脂質は、心臓血管の健康、認知機能のサポート、皮膚の健康増進など、さまざまな健康促進効果が認められています。

リン脂質は様々な機能性を提供するため、飲食品、栄養補助食品、医薬品など様々な産業で応用されており、その他の分野でも応用されています。消費者の意識の高まりが、多業種にわたるリン脂質の採用を促進し、市場の成長に寄与しています。

北米が世界市場を独占しています。この地域は、心臓病や糖尿病などの慢性疾患の有病率の高さに悩まされています。米国疾病予防管理センターによると、2021年には米国人口の8.9%が糖尿病と診断されました。また、米国では2021年に約695,000人が心臓病で死亡しています。このため、効果的な治療が必要であり、リン脂質はドラッグデリバリーやバイオアベイラビリティの向上において重要な役割を果たし、地域市場における需要を牽引しています。

ダイナミクス

医薬品・栄養補助食品業界におけるリン脂質の需要拡大

心臓病や糖尿病のような慢性疾患が蔓延するにつれ、効果的な治療に対する需要が増加しています。人々の健康維持への関心が高まり、栄養補助食品や医薬品市場が形成されています。予防ヘルスケアへの関心の高まりは、総合的な健康に役立つと考えられているリン脂質を含む医薬品や栄養補助食品の需要を促進しています。

リン脂質は薬物の体内吸収を助け、薬物の効果を高める。多くの薬は水に溶けにくいです。リン脂質はある種のドラッグの溶解性を低下させ、より良いデリバリーを可能にします。医薬品と栄養補助食品の分野が世界的に拡大し続ける中、リン脂質の需要は大幅に増加すると予想されます。

新しく革新的な上市

市場に導入された新製品や新技術は、様々な最終用途におけるリン脂質の探求と利用を増加させ、新しく利用しやすい有用性の選択肢を提供し、市場の成長を拡大させる。例えば、2024年5月、Vitafoods Europe社は海洋リン脂質の細胞栄養と革新的な製品であるMPL+を発売しました。MPL+技術プラットフォームは、栄養補助食品業界にイノベーションをもたらすユニークなデリバリー・プラットフォームとしてリン脂質の可能性を利用しています。

同様に、2022年11月、アーカー・バイオマリンは、オキアミ由来のリン脂質を使用し、生物学的利用能や吸収率の低い成分の溶解性や乳化性を改善する新しいPL+技術プラットフォームを発表しました。PL+技術は、カンナビジオール、クルクミンなどの課題成分をソフトジェルにカプセル化したものです。アーカー・バイオマリンによると、PL+は吸収率を最大25倍高めることができます。

リン脂質に伴う高コスト

世界のリン脂質市場の大きな阻害要因の一つは、生産と抽出プロセスに関連する高コストです。リン脂質を大豆や卵のような天然源から得るのは容易ではないです。これらの複雑な抽出技術には、高価な装置、高度な技術、熟練した労働力が必要です。効率的な抽出は高度な技術に依存するため、全体的なコストがかさみます。

加えて、原材料の変動も価格上昇に拍車をかける。リン脂質の主な原料である大豆、卵、ヒマワリの種のコストは、大きく変動する可能性があります。この不安定さは、生産者が価格設定全体を予測・管理することを困難にします。このため、リン脂質市場への参入を控える企業が増え、消費者がリン脂質製品を購入しやすい価格には限界があります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 医薬品・栄養補助食品業界におけるリン脂質の需要拡大

- 新しく革新的な上市

- 抑制要因

- リン脂質に関連する高コスト

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- DMIの見解

第6章 COVID-19分析

第7章 タイプ別

- ホスホチジルセリン

- ホスホチジルコリン

- その他

第8章 供給源別

- 大豆

- ひまわり

- 卵

- その他

第9章 機能別

- 乳化

- 湿潤・分散

- 増粘・ゲル化

- 栄養デリバリー

第10章 用途別

- 飲食品

- 栄養補助食品

- 医薬品

- その他

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第12章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 企業プロファイル

- Cargill, Inc.

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Archer Daniels Midland Company

- Bunge Ltd.

- Lipoid GmbH

- VAV Life Sciences

- American Lecithin Company

- Kewpie Corporation

- Lecico GmbH

- Nabros Pharma Pvt. Ltd.

- Croda International Plc.

第14章 付録

Overview

Global Phospholipids Market reached US$ 2.97 billion in 2023 and is expected to reach US$ 5.13 billion by 2031, growing with a CAGR of 7.03% during the forecast period 2024-2031.

Phospholipids are essential components with diverse applications due to their unique properties and functions. They can be sourced from soybeans, sunflowers, eggs and others and come in various types, including phosphatidylserine and phosphatidylcholine. Phospholipids are recognised for their various health-promoting properties, including cardiovascular health, cognitive function support and skin health improvement.

Phospholipids offer a range of functionalities, due to which they find applications in various industries including food and beverages, nutraceutical supplements, and pharmaceuticals with additional applications in other sectors. The growing consumer awareness is driving the adoption of phospholipids across multiple industries and contributing to market growth.

North America dominates the global market. The region struggles with a high prevalence of chronic diseases like heart disease and diabetes. According to the Centers for Disease Control and Prevention, 8.9% of US population was diagnosed with diabetes in 2021. Also, about 695,000 people in US died from heart disease in 2021. This necessitates effective treatments, and phospholipids play a crucial role in drug delivery and improving bioavailability, driving its demand in the regional market.

Dynamics

Growing Demand for Phospholipids in Pharmaceutical and Nutraceutical Industries

As chronic diseases like heart disease and diabetes become more prevalent, the demand for effective treatments increases. People are more interested in maintaining good health and creating a market for nutraceutical and pharmaceutical products. The growing focus on preventive healthcare fuels the demand for pharmaceutical and nutraceutical products containing phospholipids which are seen as beneficial for overall health.

Phospholipids help drugs get absorbed better by the body, making them more effective. Many drugs are poorly soluble in water. Phospholipids fix poorly the solubility of certain drugs allowing for better delivery. As the pharmaceutical and nutraceutical sectors continue to expand globally, the demand for phospholipids is expected to rise significantly.

New and Innovative Launches

The new products and technologies introduced into the market increase the exploration and utilisation of phospholipids in various end-use applications with new and accessible utility options, expanding the market growth. For instance, in May 2024, Vitafoods Europe launched MPL+, a marine phospholipid cellular nutrition and innovative product. MPL+ technology platform utilises the potential of phospholipids as a unique delivery platform to bring innovations to the nutraceuticals industry.

Similarly, in November 2022, Aker BioMarine launched a new PL+ technology platform that uses phospholipids from krill to improve the solubility and emulsification of ingredients with poor bioavailability or absorption rates. The PL+ technology comes encapsulated in soft gels with challenging ingredients, such as cannabidiol, curcumin and others. According to Aker BioMarine, PL+ can boost absorption by up to 25 times.

High Costs Associated with Phospholipids

One major hindering factor for the global phospholipids market is the high cost associated with production and extraction processes. Phospholipids aren't easy to get from their natural sources like soybeans or eggs. These complex extraction techniques require expensive equipment, advanced technology and a skilled workforce. Efficient extraction relies on sophisticated technology, adding to the overall cost.

In addition, raw material fluctuations can also add fuel to the higher prices. The cost of soybeans, eggs, or sunflower seeds, the main sources of phospholipids, can change significantly. This instability makes it difficult for producers to predict and manage their overall pricing. This can discourage companies from entering the market and limit the affordability of phospholipid products for consumers.

Segment Analysis

The global phospholipids market is segmented based on type, source, functionality, application and region.

Rising Need for Functional Food and Beverage Products

The global phospholipids market is segmented based on application into food & beverage, nutraceutical supplements, pharmaceuticals and others. The food & beverage segment accounts for the largest share of the global market. The multifunctional properties of phospholipids, coupled with consumer demand for healthier, clean-label food and beverage products, contribute to the dominance of the food and beverage application segment in the global phospholipids market.

People are increasingly prioritizing healthy eating and functional foods that offer additional health benefits. With a growing emphasis on health and wellness, consumers are increasingly seeking out food and beverage products that offer functional benefits. Phospholipids play a crucial role in improving the texture and mouthfeel of food and beverage products.

In the food and beverage industry, phospholipids are widely used emulsifiers in products such as margarine, chocolate, dressings, and beverages to create stable emulsions, improve texture, and enhance mouthfeel. Phospholipids can be added to functional beverages to enhance nutrient delivery, improve stability, and impart health benefits, aligning with consumer preferences for functional and convenient beverage options.

Geographical Penetration

Greater Presence of Phospholipids Utilising Industries in North America

North America dominates the global market with the presence of various leading pharmaceutical and nutraceutical companies that heavily rely on phospholipids for various applications. These industries are at the forefront of research and development, driving demand for innovative phospholipid products. The region's well-established pharmaceutical industry utilizes phospholipids in drug delivery systems and formulations.

Additionally, the region has a robust food and beverage industry, where phospholipids are used as emulsifiers and functional ingredients in a wide range of products. The presence of key market players and research institutions focused on lipid science also contributes to the region's dominance. The region is benefited from the presence of advanced technology and skilled labor, which leads to efficient extraction and processing methods.

Competitive Landscape

The major global players in the market include Cargill, Inc., Archer Daniels Midland Company, Bunge Ltd, Lipoid GmbH, VAV Life Sciences, American Lecithin Company, Kewpie Corporation, Lecico GmbH, Nabros Pharma Pvt. Ltd., and Croda International Plc.

COVID-19 Impact Analysis

The COVID-19 pandemic had both positive and negative impact on the global phospholipids market. During the initial phases of the pandemic, lockdowns, travel restrictions and disruptions in transportation networks led to challenges in the supply chain for raw materials and finished phospholipid products. This resulted in delays in production, procurement difficulties and increased logistics costs for manufacturers and suppliers.

The pandemic altered consumer behaviours and preferences, leading to changes in demand for phospholipid-containing products, due to an increased focus on health and wellness. There was increased demand for certain pharmaceutical formulations and functional foods with immune-boosting ingredients. The pharmaceutical and nutraceutical industries, which are significant consumers of phospholipids, experienced varying impacts, positively impacting the market growth.

By Type

- Phosphotidylserine

- Phosphotidylcholine

- Others

By Source

- Soy

- Sunflower

- Egg

- Others

By Functionality

- Emulsifying

- Wetting & Dispersion

- Thickening & Gelling

- Nutrient Delivery

By Application

- Food & beverage

- Nutraceutical Supplements

- Pharmaceuticals

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In May 2024, Vitafoods Europe launched MPL+, a marine phospholipid cellular nutrition and innovative product. MPL+ technology platform utilises the potential of phospholipids as a unique delivery platform to bring innovations to the nutraceuticals industry.

- In November 2022, Aker BioMarine launched a new PL+ technology platform that uses phospholipids from krill to improve the solubility and emulsification of ingredients with poor bioavailability or absorption rates.

- In January 2021, NZMP, a dairy ingredient-solutions brand by global dairy mainstay Fonterra, launched milk phospholipids. Naturally present in milk, these complex lipids are clinically proven to help manage the effects of stress, to allow consumers to stay focused and positive under stress.

Why Purchase the Report?

- To visualize the global phospholipids market segmentation based on type, source, functionality, application and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of phospholipids market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global phospholipids market report would provide approximately 70 tables, 64 figures and 243 pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

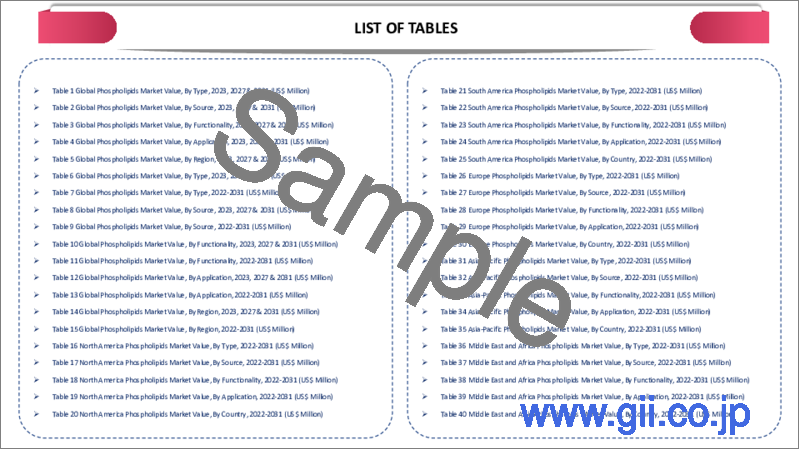

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Type

- 3.2. Snippet by Source

- 3.3. Snippet by Functionality

- 3.4. Snippet by Application

- 3.5. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Growing Demand for Phospholipids in Pharmaceutical and Nutraceutical Industries

- 4.1.1.2. New and Innovative Launches

- 4.1.2. Restraints

- 4.1.2.1. High Costs Associated with Phospholipids

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Phosphotidylserine

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Phosphotidylcholine

- 7.4. Others

8. By Source

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 8.1.2. Market Attractiveness Index, By Source

- 8.2. Soy

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Sunflower

- 8.4. Egg

- 8.5. Others

9. By Functionality

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Functionality

- 9.1.2. Market Attractiveness Index, By Functionality

- 9.2. Emulsifying

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Wetting & Dispersion

- 9.4. Thickening & Gelling

- 9.5. Nutrient Delivery

10. By Application

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.1.2. Market Attractiveness Index, By Application

- 10.2. Food & Beverage

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Nutraceutical Supplements

- 10.4. Pharmaceuticals

- 10.5. Others

11. By Region

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2. Market Attractiveness Index, By Region

- 11.2. North America

- 11.2.1. Introduction

- 11.2.2. Key Region-Specific Dynamics

- 11.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 11.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Functionality

- 11.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.7.1. U.S.

- 11.2.7.2. Canada

- 11.2.7.3. Mexico

- 11.3. Europe

- 11.3.1. Introduction

- 11.3.2. Key Region-Specific Dynamics

- 11.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 11.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Functionality

- 11.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.7.1. Germany

- 11.3.7.2. U.K.

- 11.3.7.3. France

- 11.3.7.4. Italy

- 11.3.7.5. Spain

- 11.3.7.6. Rest of Europe

- 11.4. South America

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 11.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 11.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Functionality

- 11.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.7.1. Brazil

- 11.4.7.2. Argentina

- 11.4.7.3. Rest of South America

- 11.5. Asia-Pacific

- 11.5.1. Introduction

- 11.5.2. Key Region-Specific Dynamics

- 11.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 11.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Functionality

- 11.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.7.1. China

- 11.5.7.2. India

- 11.5.7.3. Japan

- 11.5.7.4. Australia

- 11.5.7.5. Rest of Asia-Pacific

- 11.6. Middle East and Africa

- 11.6.1. Introduction

- 11.6.2. Key Region-Specific Dynamics

- 11.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 11.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Functionality

- 11.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

12. Competitive Landscape

- 12.1. Competitive Scenario

- 12.2. Market Positioning/Share Analysis

- 12.3. Mergers and Acquisitions Analysis

13. Company Profiles

- 13.1. Cargill, Inc.

- 13.1.1. Company Overview

- 13.1.2. Product Portfolio and Description

- 13.1.3. Financial Overview

- 13.1.4. Key Developments

- 13.2. Archer Daniels Midland Company

- 13.3. Bunge Ltd.

- 13.4. Lipoid GmbH

- 13.5. VAV Life Sciences

- 13.6. American Lecithin Company

- 13.7. Kewpie Corporation

- 13.8. Lecico GmbH

- 13.9. Nabros Pharma Pvt. Ltd.

- 13.10. Croda International Plc.

LIST NOT EXHAUSTIVE

14. Appendix

- 14.1. About Us and Services

- 14.2. Contact Us