|

|

市場調査レポート

商品コード

1512678

乳酸菌プロバイオティクスの世界市場:2024年~2031年Global Lactobacillus Probiotic Market - 2024-2031 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 乳酸菌プロバイオティクスの世界市場:2024年~2031年 |

|

出版日: 2024年07月10日

発行: DataM Intelligence

ページ情報: 英文 213 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

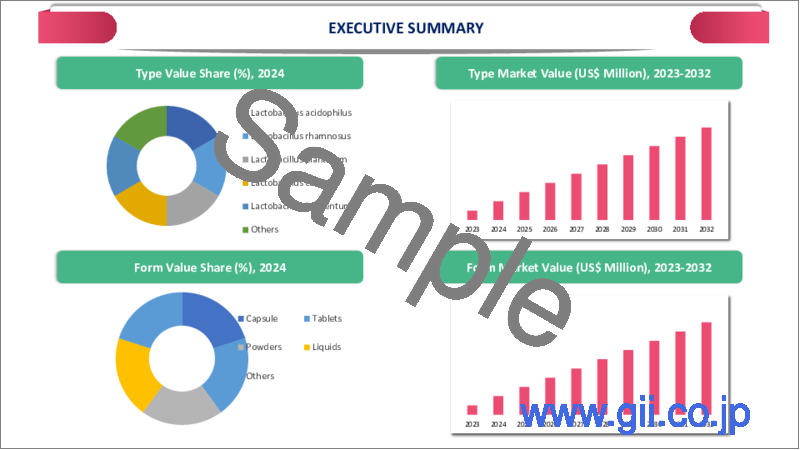

乳酸菌プロバイオティクスの世界市場は、2023年に27億米ドルに達し、2031年には49億米ドルに達し、予測期間2024-2031年にCAGR 8.9%で成長すると予測されています。

同市場では、腸の健康を促進する機能性食品や飲食品の需要が大幅に増加しています。乳酸菌プロバイオティクスは、ヨーグルト、スムージー、栄養補助食品などの製品にますます組み込まれるようになっており、便利で健康を増進する選択肢を求める消費者の需要に応えています。継続的な科学的調査は、乳酸菌プロバイオティクスの新たな健康効果を明らかにすることで市場を牽引し、消費者の関心と市場成長を後押ししています。

例えば、2024年3月21日、トゥルーノースは、49億1,000万米ドルに達すると予測されるインドの拡大する腸の健康市場と、9億米ドルの収益が予測される女性の健康市場に戦略的に焦点を当て、敏感な腸と女性の健康に関連する問題に対処するために、「Sensibiotics」というブランド名で最先端のプロバイオティクス・ソリューションを発表しました。この革新的な製剤は、世界的に最も広範に研究されているプロバイオティクス菌株の1つとして認められているラクトバチルス・ラムノサスGG(ATCC 53103)とサッカロマイセス・ブーラルディを組み合わせたものです。

アジア太平洋市場は、機能性食品と飲食品の分野で著しい成長を遂げています。乳酸菌プロバイオティクスは、健康志向の消費者に対応する新しい用途だけでなく、様々な製品に取り入れられています。プロバイオティクスの製剤と送達システムにおける革新が、この地域の市場を強化しています。マイクロカプセル化やその他の技術の進歩により、乳酸菌プロバイオティクスの安定性と有効性が向上し、消費者にとってより魅力的なものとなっています。

ダイナミクス

プロバイオティクスの健康効果に対する意識の高まり

プロバイオティクスの健康効果に対する意識の高まりが、世界の乳酸菌プロバイオティクス市場を牽引しています。プロバイオティクスが消化器系の健康、免疫機能、全体的な幸福に良い影響を与えるという消費者の情報が増えるにつれ、乳酸菌プロバイオティクスの需要が高まっています。このような意識の高まりは、健康な腸内マイクロバイオームを維持することの重要性を強調する科学的研究、メディア報道、健康キャンペーンなどの多さに後押しされています。

メーカー各社は、消費者の需要増に対応するため、栄養補助食品、機能性食品、飲食品など幅広い乳酸菌プロバイオティクス製品を開発しています。市場は、乳酸菌プロバイオティクスの有効性と安定性を高めるための研究開発への投資が増加しており、消費者の信頼と市場導入をさらに後押ししています。

例えば、2023年9月7日、韓国のhy社(旧社名:韓国ヤクルト)は、クリームタイプの化粧品「Leti 7714トリプルリフトアップ・アンチエイジングクリーム」を発表しました。この製品は、培養乳酸菌の発酵誘導体である皮膚乳酸菌7714を取り入れた同社の2つ目の化粧品であり、同社独自の乳酸菌を利用した発酵成分で作られた製品で化粧品市場に進出しています。

拡大する栄養補助食品産業

拡大する栄養補助食品産業が世界の乳酸菌プロバイオティクス市場を牽引しています。健康増進製品に対する消費者需要の増加を背景に栄養補助食品分野が成長するにつれ、乳酸菌プロバイオティクス市場も大きな成長を遂げています。栄養補助食品、機能性食品、飲料などを含む栄養補助食品は、健康効果を高めるためにプロバイオティクスを取り入れることが多く、乳酸菌株の市場需要を押し上げています。

市場では、栄養補助食品企業と科学研究機関との提携が増加しています。こうした提携は、乳酸菌プロバイオティクスの健康強調表示を検証し、製品の信頼性と消費者の信用を高めることを目的としています。その結果、健康志向の消費者にアピールする科学的裏付けのある乳酸菌プロバイオティクス製品が着実に市場に流入しているのが特徴です。

例えば、2023年9月9日、SIGとAnaBio Technologiesは共同で、世界初のロングライフ・プロバイオティクス・ヨーグルトを発表し、プロバイオティクス飲料と無菌パッケージングに大きな進歩をもたらしました。この先駆的な業績は、無菌カートンパックやスパウト付きパウチ包装のプロバイオティクス飲料という新しい製品カテゴリーの出現を告げるものであり、冷蔵の必要なく長期保存が可能です。

発展途上地域における消費者の認識不足

新興国市場における消費者の認識不足が、世界の乳酸菌プロバイオティクス市場を抑制しています。これらの地域では、プロバイオティクスの健康上の利点に関する知識が限られており、その使用に関する誤解が市場の成長を妨げています。乳酸菌プロバイオティクスの潜在的な健康上の利点にもかかわらず、市場は新興国市場の消費者への普及と教育という課題に直面しています。

発展途上地域の消費者は、乳酸菌プロバイオティクス製品を探し求めたり、信頼したりする傾向が低く、より伝統的な、あるいは馴染みのある健康法を優先することが多いです。その結果、乳酸菌プロバイオティクスの市場浸透は依然として限定的で、市場全体の成長に影響を与えています。市場関係者は、マーケティングと流通の難しさに直面しています。十分な知識を持った消費者層がいなければ、乳酸菌プロバイオティクス製品を普及させる努力は大きな障害に直面します。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- プロバイオティクスの健康効果に対する意識の高まり

- 拡大する栄養補助食品産業

- 抑制要因

- 発展途上地域における消費者の認識不足

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争影響分析

- DMIの見解

第6章 COVID-19分析

第7章 形態別

- 液体

- 粉末

- カプセル

- 錠剤

- その他

第8章 流通チャネル別

- 小売薬局

- 病院薬局

- スーパーマーケットとハイパーマーケット

- オンライン薬局

- その他

第9章 用途別

- 食品・飲料エンドユーザー

- 医薬品

- 栄養補助食品

- その他

第10章 エンドユーザー別

- 乳幼児

- 小児

- 成人

- 高齢者

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第12章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 企業プロファイル

- Mitushi BioPharma

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Goerlich Pharma GmbH

- Nutra Healthcare Private Limited

- Fermentis Life Sciences

- Unique Biotech

- Culturelle Probiotic Canada

- BJP Laboratories

- ProbioFerm

- Fido Pharma Pvt. Ltd.

- Probiotics Australia

第14章 付録

Overview

Global Lactobacillus Probiotic Market reached US$ 2.7 billion in 2023 and is expected to reach US$ 4.9 billion by 2031, growing with a CAGR of 8.9% during the forecast period 2024-2031.

The market is witnessing a significant increase in demand for functional foods and beverages that promote gut health. Lactobacillus probiotics are increasingly incorporated into products like yogurts, smoothies, and dietary supplements, meeting consumer demand for convenient, health-boosting options. Ongoing scientific research drives the market by uncovering new health benefits of lactobacillus probiotics and propels consumer interest and market growth.

For instance, on March 21, 2024, TrueNorth introduced cutting-edge probiotic solutions under the brand name 'Sensibiotics' to address issues related to sensitive gut and feminine health, with a strategic focus on India's expanding gut health market, projected to reach $4.91 billion, and the feminine health market, projected at $0.9 billion in revenues. This innovative formulation combines lactobacillus rhamnosus GG (ATCC 53103), recognized as one of the most extensively researched probiotic strains globally, with Saccharomyces Boulardii.

The Asia-Pacific market is experiencing significant growth in the functional foods and beverages sector. Lactobacillus probiotics are being incorporated into various products, as well as novel applications, catering to health-conscious consumers. Innovations in probiotic formulations and delivery systems are enhancing the regional market. Advances in microencapsulation and other technologies are improving the stability and efficacy of lactobacillus probiotics, making them more appealing to consumers.

Dynamics

Growing Awareness about the Health Benefits of Probiotics

Growing awareness about the health benefits of probiotics is driving the global lactobacillus probiotic market. As consumers become increasingly informed about the positive impacts of probiotics on digestive health, immune function, and overall well-being, the demand for lactobacillus probiotics is rising. This heightened awareness is fueled by a plethora of scientific studies, media coverage, and health campaigns that emphasize the importance of maintaining a healthy gut microbiome.

Manufacturers are developing a wide range of lactobacillus probiotic products, including dietary supplements, functional foods, and beverages, to cater to the growing consumer demand. The market is witnessing increased investment in research and development to enhance the efficacy and stability of lactobacillus probiotics, further boosting consumer confidence and market adoption.

For instance, on September 7, 2023, South Korea's hy, previously known as Korea Yakult, introduced the Leti 7714 Triple Lift-up Anti-aging Cream, a cream-type cosmetic. This product is the company's second cosmetic offering that incorporates skin lactobacillus 7714, a fermented derivative of cultured lactic acid bacteria has ventured into the cosmetics market with products made from fermented ingredients utilizing its proprietary lactic acid bacteria.

Expanding Nutraceutical Industry

The expanding nutraceutical industry is driving the global lactobacillus probiotic market. As the nutraceutical sector grows, driven by increasing consumer demand for health-enhancing products, the market for lactobacillus probiotics is experiencing significant growth. Nutraceuticals, which encompass dietary supplements, functional foods, and beverEnd-Users, often incorporate probiotics to enhance their health benefits, thereby boosting the market demand for lactobacillus strains.

The market is seeing increased collaborations between nutraceutical companies and scientific research institutions. These partnerships aim to validate the health claims of lactobacillus probiotics, enhancing product credibility and consumer trust. As a result, the market is characterized by a steady influx of scientifically-backed lactobacillus probiotic products that appeal to health-conscious consumers.

For instance, on September 9, 2023, SIG and AnaBio Technologies collaborated to introduce the world's first long-life probiotic yogurt, marking a significant advancement in probiotic beverages and aseptic packaging. This pioneering achievement heralds the emergence of a novel product category: probiotic beverages packaged in aseptic carton packs and spouted pouches, offering extended shelf stability without the need for refrigeration.

Lack of Consumer Awareness in Developing Regions

Lack of consumer awareness in developing regions is restraining the global lactobacillus probiotic market. In these regions, limited knowledge about the health benefits of probiotics and misconceptions about their use are hindering market growth. Despite the potential health advantages of lactobacillus probiotics, the market is facing challenges in reaching and educating consumers in developing areas.

Consumers in developing regions are less likely to seek out or trust these products, often prioritizing more traditional or familiar health solutions. Consequently, market penetration for lactobacillus probiotics remains limited, impacting overall market growth. Market players are encountering difficulties in marketing and distribution. Without a well-informed consumer base, efforts to promote lactobacillus probiotic products face significant obstacles.

Segment Analysis

The global lactobacillus probiotic market is segmented based on form, distribution channel, application, end-user and region.

Increasing Consumer Focus on Health and Wellness

The dietary supplements segment holds the largest share of the global lactobacillus probiotic market. In an era where individuals are increasingly prioritizing their health and wellness, dietary supplements, particularly those containing lactobacillus probiotics, have become a popular choice. These supplements are widely recognized for their benefits in supporting digestive health, enhancing immune function, and maintaining overall wellness, propelling the dietary supplements segment to the forefront of the lactobacillus probiotic market.

Market innovations are also playing a critical role in the dominance of the dietary supplements segment. Companies within the probiotic industry are continuously investing in research and development to create advanced and more effective probiotic formulations. These innovations include the development of multi-strain probiotic supplements, time-release capsules, and targeted delivery systems that enhance the efficacy and stability of lactobacillus probiotics.

Geographical Penetration

Growing Health-conscious Consumer Base and Innovations in Asia-Pacific

Asia-Pacific is positioned to dominate the global lactobacillus probiotic market. The Asia-Pacific region has a long history of consuming fermented foods, which naturally contain probiotics. This cultural familiarity with probiotics makes it easier for consumers to embrace lactobacillus probiotic supplements and functional foods, propelling the lactobacillus probiotic market growth.

Consumers are proactively seeking products that support long-term health and wellness, leading to a surge in demand for lactobacillus probiotics as part of a preventive health regimen. The market in Asia-Pacific is characterized by significant investments in research and development. Companies are innovating with new formulations and delivery methods, such as probiotic beverages, snacks, and supplements, tailored to local tastes and preferences, enhancing market appeal.

COVID-19 Impact Analysis

The market experienced supply chain disruptions due to lockdowns and restrictions. These disruptions affected the production and distribution of lactobacillus probiotic products, leading to temporary short-end users and delays in product availability. However, with the focus on preventive health rising during the pandemic, the market has seen a surge in demand for functional foods and beverages. Products containing lactobacillus probiotics have become popular as consumers look for ways to enhance their health through diet.

The pandemic accelerated the shift to online retail as consumers avoided physical stores. The market saw a significant increase in the sale of lactobacillus probiotic products through e-commerce platforms, which provided a convenient and safe way for consumers to purchase health supplements. Companies have developed new formulations and delivery formats for lactobacillus probiotics, to cater to the growing health-conscious consumer base.

Russia-Ukraine War Impact Analysis

The Russia-Ukraine war has significantly impacted the global lactobacillus probiotic market through a series of complex and interrelated factors. The most prominent effect has been on supply chain disruptions. Both Russia and Ukraine are crucial players in the global agricultural market, providing essential raw materials used in the production of lactobacillus probiotics. The conflict has led to severe interruptions in the supply of these raw materials, which has in turn affected the manufacturing processes of probiotic producers.

Market demand has also experienced fluctuations due to the economic instability triggered by the war. Consumer spending patterns have shifted, with many individuals prioritizing essential goods over discretionary items like health supplements. This change in consumer behavior has led to a potential decline in demand for lactobacillus probiotics in regions heavily affected by the conflict.

By Form

- Liquid

- Powder

- Capsule

- Tablet

- Others

By Distribution Channel

- Retail Pharmacy

- Hospital Pharmacy

- Supermarkets and Hypermarkets

- Online Pharmacy

- Others

By Application

- Food and Beverage

- Drugs

- Dietary Supplements

- Others

By End-User

- Infants

- Children

- Adults

- Seniors

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On April 27, 2023, Gnosis by Lesaffre expanded its probiotic lineup with the introduction of LifeinU L. rhamnosus GG 350, a new quality specification of their well-established probiotic strain LifeinU L. rhamnosus GG. Lactobacillus rhamnosus GG is widely utilized in various products around the world to promote digestive health.

- On February 11, 2022, Indian scientists launched a breakthrough in probiotic research, introducing a next-generation probiotic with promising implications for longevity and healthy aging. The probiotic bacterium, Lactobacillus Plantarum JBC5, represents a significant discovery in the quest for beneficial bacteria to enhance well-being, particularly in fermented dairy products.

- On February 26, 2021, Sweet Cures, a globally recognized manufacturer and retailer of natural health food supplements, introduced an innovative line of probiotics, featuring up to 17 live strains of bacteria supported by clinical research. Expanding on the popularity of Sweet Cures Probiotic Blend Capsules, the company has partnered with industry leader Danisco to develop the new UniBac range.

Competitive Landscape

The major global players in the lactobacillus probiotic market include Mitushi BioPharma, Goerlich Pharma GmbH, Nutra Healthcare Private Limited, Fermentis Life Sciences, Unique Biotech, Culturelle Probiotic Canada, BJP Laboratories, ProbioFerm, Fido Pharma Pvt. Ltd., and Probiotics Australia.

Why Purchase the Report?

- To visualize the global lactobacillus probiotic market segmentation based on form, distribution channel, application, end-user and region, as well as understand critical commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous global lactobacillus probiotic market-level data points with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of critical products of all the major players.

The global lactobacillus probiotic market report would provide approximately 70 tables, 68 figures, and 213 users.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Form

- 3.2. Snippet by Distribution Channel

- 3.3. Snippet by Application

- 3.4. Snippet by End-User

- 3.5. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Growing Awareness about the Health Benefits of Probiotics

- 4.1.1.2. Expanding Nutraceutical Industry

- 4.1.2. Restraints

- 4.1.2.1. Lack of Consumer Awareness in Developing Regions

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Form

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 7.1.2. Market Attractiveness Index, By Form

- 7.2. Liquid*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Powder

- 7.4. Capsule

- 7.5. Tablet

- 7.6. Others

8. By Distribution Channel

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 8.1.2. Market Attractiveness Index, By Distribution Channel

- 8.2. Retail Pharmacy*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Hospital Pharmacy

- 8.4. Supermarkets and Hypermarkets

- 8.5. Online Pharmacy

- 8.6. Others

9. By Application

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.1.2. Market Attractiveness Index, By Application

- 9.2. Food and Bever End-User*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Drugs

- 9.4. Dietary Supplements

- 9.5. Others

10. By End-User

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.1.2. Market Attractiveness Index, By End-User

- 10.2. Infants*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Children

- 10.4. Adults

- 10.5. Seniors

11. By Region

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2. Market Attractiveness Index, By Region

- 11.2. North America

- 11.2.1. Introduction

- 11.2.2. Key Region-Specific Dynamics

- 11.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 11.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.7.1. U.S.

- 11.2.7.2. Canada

- 11.2.7.3. Mexico

- 11.3. Europe

- 11.3.1. Introduction

- 11.3.2. Key Region-Specific Dynamics

- 11.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 11.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.7.1. Germany

- 11.3.7.2. UK

- 11.3.7.3. France

- 11.3.7.4. Italy

- 11.3.7.5. Russia

- 11.3.7.6. Rest of Europe

- 11.4. South America

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 11.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 11.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.7.1. Brazil

- 11.4.7.2. Argentina

- 11.4.7.3. Rest of South America

- 11.5. Asia-Pacific

- 11.5.1. Introduction

- 11.5.2. Key Region-Specific Dynamics

- 11.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 11.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.7.1. China

- 11.5.7.2. India

- 11.5.7.3. Japan

- 11.5.7.4. Australia

- 11.5.7.5. Rest of Asia-Pacific

- 11.6. Middle East and Africa

- 11.6.1. Introduction

- 11.6.2. Key Region-Specific Dynamics

- 11.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 11.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

12. Competitive Landscape

- 12.1. Competitive Scenario

- 12.2. Market Positioning/Share Analysis

- 12.3. Mergers and Acquisitions Analysis

13. Company Profiles

- 13.1. Mitushi BioPharma*

- 13.1.1. Company Overview

- 13.1.2. Product Portfolio and Description

- 13.1.3. Financial Overview

- 13.1.4. Key Developments

- 13.2. Goerlich Pharma GmbH

- 13.3. Nutra Healthcare Private Limited

- 13.4. Fermentis Life Sciences

- 13.5. Unique Biotech

- 13.6. Culturelle Probiotic Canada

- 13.7. BJP Laboratories

- 13.8. ProbioFerm

- 13.9. Fido Pharma Pvt. Ltd.

- 13.10. Probiotics Australia

LIST NOT EXHAUSTIVE

14. Appendix

- 14.1. About Us and Services

- 14.2. Contact Us