|

|

市場調査レポート

商品コード

1496888

巣状分節性糸球体硬化症治療薬の世界市場:2024~2031年Global Focal Segmental Glomerulosclerosis Drugs Market - 2024-2031 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 巣状分節性糸球体硬化症治療薬の世界市場:2024~2031年 |

|

出版日: 2024年06月18日

発行: DataM Intelligence

ページ情報: 英文 181 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

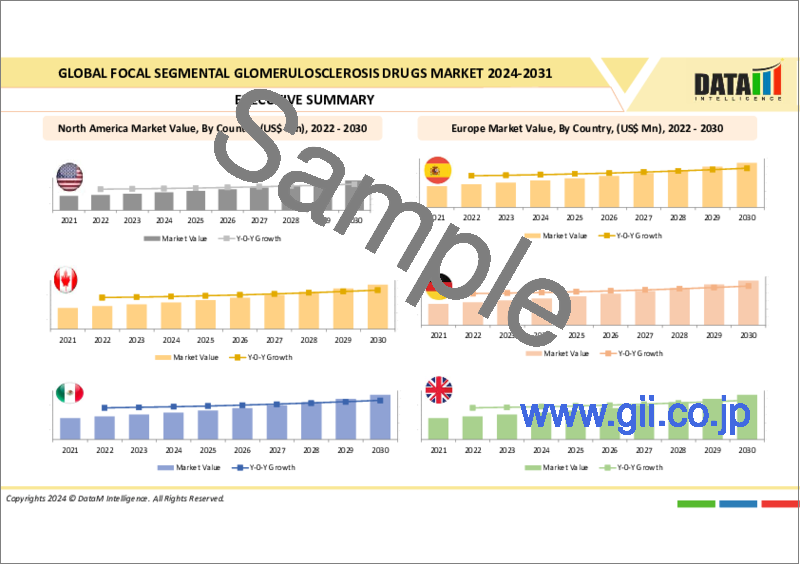

世界の巣状分節性糸球体硬化症治療薬市場は、2023年に7億米ドルに達し、2031年には14億米ドルに達すると予測され、予測期間2024-2031年にはCAGR7.5%で成長する見込みです。

巣状分節性糸球体硬化症は、糸球体と呼ばれる腎臓小さなろ過単位に影響を及ぼす腎障害一種であり、腎臓瘢痕化を伴います。自己免疫疾患、遺伝的要因、体他部分感染、硬化性疾患など多く要因によって引き起こされます。

糸球体を損傷・攻撃することで腎機能に影響を及ぼすまれな疾患一つです。腎臓欠陥は通常、肥満、鎌状赤血球貧血、閉塞性睡眠時無呼吸症候群、出生、HIVなどウイルスによってこ病気を特徴づけます。

市場力学

促進要因

巣状分節性糸球体硬化症治療薬(FSGS)の負担増

世界の巣状分節性糸球体硬化症治療薬市場の需要は、複数の要因によって牽引されています。主な要因の1つは、FSGSの負担増です。巣状分節性糸球体硬化症(FSGS)は、血液から老廃物をろ過する腎臓の小さな部分である糸球体に瘢痕組織が発生する病気です。

FSGSは様々な疾患によって引き起こされます。FSGSは腎不全に至る可能性のある重篤な疾患であり、透析または腎移植でしか治療できないです。

2023年8月のNCBI研究発表によると、巣状分節性糸球体硬化症(FSGS)はネフローゼ症候群の原因として頻繁に遭遇する疾患であり、成人では40%、小児では20%を占める。

また、新たな治療法の開拓に高い注目が集まっていることも、予測期間中の同市場の成長を後押しすると予想されます。例えば、2023年2月、スパーセンタンと呼ばれる薬剤が、急速な病勢進行のリスクがある原発性免疫グロブリンA腎症(IgAN)患者の治療薬としてFDAの早期承認を獲得しました。

IgANだけでなく、トラベレ社は巣状分節性糸球体硬化症(FSGS)治療薬も開発しています。FSGSは、腎臓の老廃物フィルターである糸球体に瘢痕組織ができる、さらにまれな腎臓病です。IgANと診断された患者の約90%は、現在ACE阻害剤またはARBを服用しています。

制約

透析や腎移植の費用が高いこと、FSGSの認知度が低いこと、有効な治療オプションが限られていること、規制や償還政策が厳しいことなどが、市場の妨げになると予想されます。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 巣状分節性糸球体硬化症(FSGS)治療薬の負担増

- 診断技術の進歩

- 抑制要因

- 透析および腎移植の高額費用

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- アンメットニーズ

- PESTEL分析

- 特許分析

- SWOT分析

第6章 疾患タイプ別

- 一次性巣状分節性糸球体硬化症治療薬

- 二次性巣状分節性糸球体硬化症治療薬

第7章 薬剤別

- 副腎皮質ステロイド薬

- 免疫抑制薬

- ACE阻害薬

- アンジオテンシン受容体遮断薬

- 利尿薬

- その他

第8章 投与経路別

- 経口

- 非経口

第9章 流通チャネル別

- 病院薬局

- オンライン薬局

- 小売薬局

第10章 エンドユーザー別

- 病院

- 専門クリニック

- その他

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 中東・アフリカ

第12章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 企業プロファイル

- GlaxoSmithKline plc

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Pfizer Inc

- Travere Therapeutics, Inc

- Variant Pharmaceuticals, Inc

- Dimerix

- Complexa Inc

- ChemoCentryx Inc

- AstraZeneca

- Novartis AG

- Vertex Pharmaceuticals Incorporated

第14章 付録

Overview

The global focal segmental glomerulosclerosis drugs market reached US$ 0.7 billion in 2023 and is expected to reach US$ 1.4 billion by 2031, growing at a CAGR of 7.5% during the forecast period 2024-2031.

Focal segmental glomerulosclerosis is a type of renal disorder affecting the small filtering unit of kidneys called glomeruli which involves scarring of the kidney. It is caused by numerous factors such as autoimmune disorders, genetic factors, infection in other parts of the body, and sclerotic diseases.

It is one of the rare diseases that affects kidney function by damaging and attacking the glomeruli. Kidney defects typically characterize this disease by obesity, sickle cell anemia, obstructive sleep apnea, birth, and viruses such as HIV.

Market Dynamics

Drivers

The rising burden of focal segmental glomerulosclerosis drugs(FSGS)

The demand for the global focal segmental glomerulosclerosis drugs market is driven by multiple factors. One of the key factors is the increasing burden of FSGS. Focal segmental glomerulosclerosis drugs(FSGS) is a disease in which scar tissue develops on the glomeruli, the small parts of the kidneys that filter waste from the blood.

FSGS can be caused by a variety of conditions. FSGS is a serious condition that can lead to kidney failure, which can only be treated with dialysis or a kidney transplant.

According to an NCBI research publication in August 2023, focal segmental glomerular sclerosis (FSGS) is a frequently encountered cause of nephrotic syndrome, accounting for 40% of cases in adults and 20% in children.

In addition, a high focus on developing new treatment options is expected to drive the growth of this market over the forecast period. For instance, in February 2023, the drug, called sparsentan, snagged an FDA accelerated approval to treat patients with primary immunoglobulin A nephropathy (IgAN) who are at risk of rapid disease progression.

Moreover, IgAN, Travere is also developing Filspari for focal segmental glomerulosclerosis drugs(FSGS), an even rarer kidney disease in which scar tissue develops on the kidney's waste filter glomeruli. About 90% of patients diagnosed with IgAN are currently on an ACE inhibitor or an ARB.

Restraints

Factors such as the high cost of dialysis & kidney transplant, limited awareness of FSGS, limited availability of effective treatment options, and stringent regulatory and reimbursement policies, are expected to hamper the market.

For more details on this report - Request for Sample

Segment Analysis

The global focal segmental glomerulosclerosis drugs market is segmented based on disease type, drugs, route of administration, distribution channel, end-user, and region.

The primary focal segmental glomerulosclerosis drugs segment accounted for approximately 45.3% of the global focal segmental glomerulosclerosis drugs market share

The primary focal segmental glomerulosclerosis drugs segment is expected to hold the largest market share over the forecast period. The primary FSGS is usually "idiopathic," referring to the rise of disease without any known, definite, or apparent reason. It has several prototypical characteristics and is the most common form in adolescents and young adults.

Primary FSGS has been associated with the presence of circulating permeability factors/cytokines, which cause foot process effacement and proteinuria. These include corticotrophin-like cytokine factor 1, apoA1b, anti-CD40 Ab, and suPAR. Primary FSGS may respond to corticosteroids, immunomodulatory agents, plasmapheresis, or immunoadsorption3 and is prone to recur post-transplantation.

Moreover, key players' focus on innovative developments would propel this market growth. For instance, in May 2023, CSL Vifor announced topline primary efficacy results from the pivotal Phase 3 DUPLEX Study of sparsentan, a Dual Endothelin Angiotensin Receptor Antagonist (DEARA), in focal segmental glomerulosclerosis drugs(FSGS) from its partner Travere Therapeutics.

Also, in December 2023, Travere completed a successful pre-NDA meeting for FILSPARI in IgAN. It provides regulatory updates for both IgAN and FSGS.

IgAN is the most common type of primary glomerulonephritis worldwide and a leading cause of kidney failure due to glomerular disease. IgAN is estimated to affect up to 150,000 people in the U.S. and is one of the most common glomerular diseases in Europe and Japan.

Geographical Analysis

North America accounted for approximately 42.1% of the global focal segmental glomerulosclerosis drugs market share

North America region is expected to hold the largest market share over the forecast period. The high prevalence of FSGS in North America is driving the demand for effective FSGS therapeutics. The region has a well-established research and development infrastructure that is constantly driving innovation in FSGS therapeutics. As per Springer's research publication in September 2023, FSGS is predominant in North America, accounting for 19.1% of primary glomerular diseases.

In addition, a major key player's presence, increasing awareness of FSGS among healthcare professionals, and new drug approvals would drive this market growth. For instance, in May 2022, Travere Therapeutics, Inc. announced that the U.S. Food and Drug Administration (FDA) has accepted its New Drug Application (NDA) under Subpart H for accelerated approval of sparsentan to treat IgA nephropathy (IgAN) and has granted Priority Review.

Travere Therapeutics is looking forward to working with the FDA throughout the review process to potentially deliver sparsentan to the IgA nephropathy community.

Market Segmentation

By Disease Type

- Primary Focal Segmental Glomerulosclerosis

- Secondary Focal Segmental Glomerulosclerosis

By Drugs

- Corticosteroids

- Immunosuppressive Drugs

- ACE inhibitors

- Angiotensin Receptor Blockers

- Diuretics

- Others

By Route of Administration

- Oral

- Parenteral

By Distribution Channel

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

By End-Users

- Hospitals

- Specialty Clinics

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Spain

- Italy

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia-Pacific

- Middle East and Africa

Competitive Landscape

The major global players in the focal segmental glomerulosclerosis drugs market include GlaxoSmithKline plc, Pfizer Inc., Travere Therapeutics, Inc., Variant Pharmaceuticals, Inc., Dimerix, Complexa Inc., ChemoCentryx Inc., AstraZeneca, Novartis AG, and Vertex Pharmaceuticals Incorporated among others.

Key Developments

- In June 2023, Delta4 identified a potential new therapeutic option for focal segmental glomerulosclerosis drugs (FSGS) using the computational hyper-C drug discovery platform. The anti-platelet drug clopidogrel was among the top predictions and was shown to alleviate disease progression in an accepted FSGS animal model, suggesting it is a promising candidate for clinical trials.

- In May 2023, Travere had to deal with the FDA after Filspari door number two opens weak in the FSGS Duplex trial.

- In February 2022 Goldfinch Bio announced positive preliminary data from a phase 2 clinical trial evaluating gfb-887 as a precision medicine for patients with focal segmental glomerulosclerosis drugs (FSGS).

- In December 2021, Vertex Pharmaceuticals Incorporated announced that in a Phase 2 proof-of-concept (POC) study in patients with APOL1-mediated focal segmental glomerulosclerosis drugs(FSGS), VX-147 on top of standard of care achieved a statistically significant, substantial and clinically meaningful mean reduction of 47.6% in the urine protein to creatinine ratio (UPCR) at Week 13 compared to baseline.

Why Purchase the Report?

- To visualize the global focal segmental glomerulosclerosis drug market segmentation based on disease type, drugs, route of administration, distribution channel, end-user, and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development

- Excel data sheet with numerous data points of global focal segmental glomerulosclerosis drugs market level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping is available in excel consisting of key products of all the major players.

The global focal segmental glomerulosclerosis market report would provide approximately 78 tables, 73 figures, and 181 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Disease Type

- 3.2. Snippet by Drugs

- 3.3. Snippet by Route of Administration

- 3.4. Snippet by Distribution Channel

- 3.5. Snippet by End-User

- 3.6. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. The Rising Burden of Focal Segmental Glomerulosclerosis Drugs (FSGS)

- 4.1.1.2. Advancements in Diagnostic Techniques

- 4.1.2. Restraints

- 4.1.2.1. High Cost of Dialysis & Kidney Transplant

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Unmet Needs

- 5.6. PESTEL Analysis

- 5.7. Patent Analysis

- 5.8. SWOT Analysis

6. By Disease Type

- 6.1. Introduction

- 6.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Disease Type

- 6.1.2. Market Attractiveness Index, By Disease Type

- 6.2. Primary Focal segmental glomerulosclerosis drugs*

- 6.2.1. Introduction

- 6.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 6.3. Secondary Focal segmental glomerulosclerosis drugs

7. By Drugs

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Drugs

- 7.1.2. Market Attractiveness Index, By Drugs

- 7.2. Corticosteroids *

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Immunosuppressive Drugs

- 7.4. ACE inhibitors

- 7.5. Angiotensin Receptor Blockers

- 7.6. Diuretics

- 7.7. Others

8. By Route of Administration

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

- 8.1.2. Market Attractiveness Index, By Route of Administration

- 8.2. Oral*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Parenteral

9. By Distribution Channel

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 9.1.2. Market Attractiveness Index, By Distribution Channel

- 9.2. Hospital Pharmacies *

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Online Pharmacies

- 9.4. Retail Pharmacies

10. By End-User

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.1.2. Market Attractiveness Index, By End-User

- 10.2. Hospitals *

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Specialty Clinics

- 10.4. Others

11. By Region

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2. Market Attractiveness Index, By Region

- 11.2. North America

- 11.2.1. Introduction

- 11.2.2. Key Region-Specific Dynamics

- 11.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Disease Type

- 11.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Drugs

- 11.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

- 11.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.2.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.8.1. U.S.

- 11.2.8.2. Canada

- 11.2.8.3. Mexico

- 11.3. Europe

- 11.3.1. Introduction

- 11.3.2. Key Region-Specific Dynamics

- 11.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Disease Type

- 11.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Drugs

- 11.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

- 11.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.3.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.8.1. Germany

- 11.3.8.2. UK

- 11.3.8.3. France

- 11.3.8.4. Italy

- 11.3.8.5. Spain

- 11.3.8.6. Rest of Europe

- 11.4. South America

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 11.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Disease Type

- 11.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Drugs

- 11.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

- 11.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.4.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.8.1. Brazil

- 11.4.8.2. Argentina

- 11.4.8.3. Rest of South America

- 11.5. Asia-Pacific

- 11.5.1. Introduction

- 11.5.2. Key Region-Specific Dynamics

- 11.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Disease Type

- 11.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Drugs

- 11.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

- 11.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.5.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.8.1. China

- 11.5.8.2. India

- 11.5.8.3. Japan

- 11.5.8.4. South Korea

- 11.5.8.5. Rest of Asia-Pacific

- 11.6. Middle East and Africa

- 11.6.1. Introduction

- 11.6.2. Key Region-Specific Dynamics

- 11.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Disease Type

- 11.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Drugs

- 11.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

- 11.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.6.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

12. Competitive Landscape

- 12.1. Competitive Scenario

- 12.2. Market Positioning/Share Analysis

- 12.3. Mergers and Acquisitions Analysis

13. Company Profiles

- 13.1. GlaxoSmithKline plc *

- 13.1.1. Company Overview

- 13.1.2. Product Portfolio & Description

- 13.1.3. Financial Overview

- 13.1.4. Key Developments

- 13.2. Pfizer Inc

- 13.3. Travere Therapeutics, Inc

- 13.4. Variant Pharmaceuticals, Inc

- 13.5. Dimerix

- 13.6. Complexa Inc

- 13.7. ChemoCentryx Inc

- 13.8. AstraZeneca

- 13.9. Novartis AG

- 13.10. Vertex Pharmaceuticals Incorporated

LIST NOT EXHAUSTIVE

14. Appendix

- 14.1. About Us and Services

- 14.2. Contact Us