|

|

市場調査レポート

商品コード

1496880

凍結乾燥注射剤の世界市場:2024~2031年Global Lyophilized Injectables Market - 2024-2031 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 凍結乾燥注射剤の世界市場:2024~2031年 |

|

出版日: 2024年06月18日

発行: DataM Intelligence

ページ情報: 英文 182 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

世界の凍結乾燥注射剤市場は2023年に31億米ドルに達し、2031年には46億米ドルに達し、予測期間2024-2031年にはCAGR5.2%で成長すると予測されています。

凍結乾燥注射剤は、組成物から水分を除去して安定した固形状態にするために凍結乾燥される医薬品です。投与前に溶媒で再構成される可能性ある高感度生物製剤やワクチンでは、こ方法によって薬剤安定性が向上し、長期保存が可能になります。

複雑な分子や生物製剤増加、ドラッグデリバリー改善、凍結乾燥施術の技術開発、慢性疾患発生、バイオ医薬品に対するニーズ高まりが、凍結乾燥注射剤世界市場を牽引する主な要因となっています。

市場力学

促進要因

生物製剤と複雑な分子の増加

世界の凍結乾燥注射剤市場の需要は複数の要因によって牽引されています。生物製剤と複雑な分子の成長は市場促進要因の一つです。生物に由来する生物製剤と呼ばれる治療物質は、自己免疫疾患、感染症、がんの治療においてますます普及しています。

これらのユニークな化合物は、患者の転帰を向上させる高度に特異的で効果的な標的治療薬を提供することで、医療の隙間を埋めるものです。凍結乾燥された注射製剤は、生物製剤の安定性と生物学的活性を保管中および輸送中も維持するため、生物製剤の送達に不可欠です。

製薬企業は、CMOの専門的な知識、インフラ、凍結乾燥能力のおかげで、外部のリソースを利用して凍結乾燥注射剤の研究・製造を行うことができます。

例えば、2022年5月、ファイザーはインドに医薬品開発のための世界のセンターを設立しました。複合型/付加価値型製剤、放出制御型製剤、デバイス配合製剤、凍結乾燥注射剤、粉末充填製剤、すぐに使える製剤など、差別化された製品の完成製剤(FDF)の開発は、このセンターの能力のひとつとなります。

さらに、同市場の主要企業が新薬を投入することも、同市場の成長を後押ししています。例えば、2022年6月、ジピルマブとしても知られるデュピクセントが、生後6ヵ月から5歳までの中等度から重度のアトピー性皮膚炎の小児への使用について米国食品医薬品局から承認されました。

この疾患は、外用処方薬で十分にコントロールできないか、そのような治療は推奨されないです。小児および成人の中等度から重度のアトピー性皮膚炎の治療において、デュピクセントは使用が承認された最初で唯一の生物学的製剤です。

抑制要因

製品リコール、厳しい規制要件、製品中のガラス粒子の存在、凍結乾燥の高コスト、製造の複雑さ、患者のトレーニングと利便性、製品品質に影響を与える包装の問題、製剤開発における技術的課題などの課題が、市場の妨げになると予想されます。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 生物製剤と複雑分子の増加

- ドラッグデリバリーの進歩

- 凍結乾燥プロセスの技術的進歩

- 慢性疾患の増加

- 抑制要因

- 製品回収

- 厳しい規制要件

- 機会

- 影響分析

- 促進要因

第5章 業界分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- アンメットニーズ

- PESTEL分析

- 特許分析

- SWOT分析

第6章 COVID-19分析

第7章 薬剤タイプ別

- 抗感染症薬

- 抗新生物薬

- 抗凝固剤

- ホルモン剤

- その他

第8章 送達タイプ別

- マルチステップデバイス

- プレフィルド希釈液シリンジ

- 独自の再構成デバイス

- シングルステップ機器

第9章 形状別

- 粉末

- 液体

第10章 投与経路別

- 静脈内/輸液

- 筋肉内投与

- その他

第11章 用途別

- 自己免疫疾患

- 感染症

- 代謝疾患

- 腫瘍学

- その他

第12章 包装タイプ別

- ポイントオブケア再構成

- 特殊包装

- 単回使用バイアル

第13章 エンドユーザー別

- 病院

- 外来手術センター

- 専門クリニック

- その他

第14章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 中東・アフリカ

第15章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第16章 企業プロファイル

- Merck & Co., Inc

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Protech Telelinks

- Cirondrugs

- Aristopharma Ltd

- Pfizer Inc

- Novartis AG

- F. Hoffmann-La Roche Ltd

- Sanofi

- Amgen Inc

- Novo Nordisk A/S

第17章 付録

Overview

The global lyophilized injectables market reached US$ 3.1 billion in 2023 and is expected to reach US$ 4.6 billion by 2031, growing at a CAGR of 5.2% during the forecast period 2024-2031.

Lyophilized injectables are pharmaceuticals that are freeze-dried to produce a stable, solid state by eliminating water from their compositions. For sensitive biologics and vaccines that may be reconstituted with a solvent before administration, this procedure improves drug stability and allows for long-term storage.

The rise in complex molecules and biologics, improvements in drug delivery, technological developments in lyophilization procedures, the incidence of chronic illnesses, and the growing need for biopharmaceuticals are the main factors driving the global market for lyophilized injectables.

Market Dynamics

Drivers

Rise in Biologics and Complex Molecules

The demand for the global lyophilized injectables market is driven by multiple factors. The growth of biologics and complicated molecules is one of the main drivers propelling the Market. Therapeutic substances called biologics, which are derived from living things, are becoming more and more popular in the treatment of autoimmune illnesses, infectious diseases, and cancer.

These unique compounds fill gaps in medicine by providing highly specific and effective targeted therapeutic alternatives that enhance patient outcomes. Injectable formulations that are lyophilized are essential for the delivery of biologics because they maintain the biologics' stability and biological activity throughout storage and transit.

Pharmaceutical firms can use outside resources to research and produce lyophilized injectable pharmaceuticals thanks to CMOs' specialized knowledge, infrastructure, and lyophilization capacity.

For instance, in May 2022, Pfizer established a worldwide center for drug development in India. The development of finished dosage forms (FDFs) of differentiated products, such as complex/value-added formulations, controlled-release dosage forms, device-combination products, lyophilized injections, powder-fill products, and ready-to-use formulations, will be one of the center's capabilities.

Furthermore, major key players in the market introduce new drugs help to drive this market growth. For instance, in June 2022, Dupixent, also known as dipilumab, was approved by the U.S. Food and Drug Administration for use in children with moderate-to-severe atopic dermatitis between the ages of six months and five years.

The illness cannot be sufficiently controlled with topical prescription medications, or such therapies are not recommended. For the treatment of moderate-to-severe atopic dermatitis in children and adults, dupixent is the first and only biologic medication authorized for use.

Restraints

Factors such as product recalls, stringent regulatory requirements, presence of glass particles in the product, high costs of lyophilization, production complexities, patient training & convenience, packaging issues impacting product quality, and technological challenges in formulation development, are expected to hamper the market.

For more details on this report - Request for Sample

Segment Analysis

The global lyophilized injectables market is segmented based on drug type, type of delivery, form, route of administration, application, type of packaging, end-user, and region.

The oncology segment accounted for approximately 37.4% of the global lyophilized injectables market share

The oncology segment is expected to hold the largest market share over the forecast period. Cyclophosphamide is used to treat various types of cancer. It is a chemotherapy drug that works by slowing or stopping cell growth. Cyclophosphamide also works by decreasing your immune system's response to various diseases.

For instance, in February 2024, Fresenius Kabi introduced Cyclophosphamide for Injection, USP, a generic substitute for Cytoxan, for use in treating several forms of cancer. Now available in the U.S., Cyclophosphamide for Injection, USP is the newest addition to Fresenius Kabi's broad portfolio of generic oncology injectables.

Also, in March 2024, Avenacy, a specialty pharmaceutical company focused on supplying injectable medications, launched Fosaprepitant for Injection and Fulvestrant Injection. The product contains 150 mg of Fosaprepitant as a lyophilized powder in a single-dose vial for reconstitution.

Moreover, major players in the industry launch new drugs and approvals would drive this market growth. For instance, in April 2024, Gland Pharma received approval from the United States Food and Drug Administration (USFDA) for Eribulin Mesylate Injection. It is used to treat breast cancer that has spread to other parts of the body and that has already been treated with certain other chemotherapy medications.

Similarly, in August 2022, Accord Healthcare, Inc., a leading generic pharmaceutical company, added Carmustine to its line of chemotherapy drugs. The drug is formulated as a sterile lyophilized (freeze-dried) powder to be reconstituted for intravenous infusion. Carmustine is approved for use in the treatment of certain types of brain tumors and blood cancers.

Geographical Analysis

North America accounted for approximately 42.3% of the global lyophilized injectables market share

North America region is expected to hold the largest market share over the forecast period owing to the increasing incidence of chronic diseases and a higher adoption rate of lyophilized injectable drugs in the region.

In this region, advanced healthcare infrastructure, robust research and development activities, technological advances, and an established regulatory framework are propelling market growth.

Research and development initiatives combined with key pharmaceutical players playing an instrumental role in driving growth and innovation within the lyophilized injectable drug market are factors of growth and innovation that contribute to its leadership position.

For instance, in January 2024, Avenacy launched the Melphalan Hydrochloride for Injection in the United States as a therapeutic equivalent generic for Alkeran for Injection (melphalan hydrochloride) which is approved by the U.S. Food and Drug Administration.

Also, in November 2022, Cipla Limited announced the launch of Leuprolide Acetate Injection Depot 22.5mg. The product was approved by the United States Food and Drug Administration based on a New Drug Application (NDA) submitted under the 505(b)(2) regulatory pathway.

COVID-19 Impact Analysis

The COVID-19 pandemic positively impacted the global lyophilized injectables market. The pandemic has accelerated the development and approval of lyophilized medicines, particularly for the treatment of severe COVID-19 symptoms. For instance, in May 2020, Cipla introduced CIPREMI, a Remdesivir lyophilized powder for injection (100mg), which has received FDA approval for emergency use authorization (EUA) in the United States.

Manufacturers are working to obtain regulatory approvals and EUAs from authorities like the FDA and the Drug Controller General of India (DCGI) to use their products in emergencies. This has led to a surge in the number of approvals and EUAs granted, driving the market growth.

The pandemic has highlighted the benefits of lyophilization technology, such as longer shelf life and reduced cold chain requirements. This has led to increased adoption of lyophilization technology by pharmaceutical companies, further driving market growth.

Market Segmentation

By Drug Type

- Anti-infective

- Anti-neoplastic

- Anticoagulant

- Hormones

- Others

By Type of Delivery

- Multi-step Devices

- Prefilled Diluent Syringes

- Proprietary Reconstitution Devices

- Single-step Devices

By Form

- Powder

- Liquid

By Route of Administration

- Intravenous/Infusion

- Intramuscular

- Others

By Application

- Autoimmune Diseases

- Infectious Diseases

- Metabolic Conditions

- Oncology

- Others

By Type of Packaging

- Point-of-Care Reconstitution

- Specialty Packaging

- Single-use Vials

By End User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Spain

- Italy

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia-Pacific

- Middle East and Africa

Competitive Landscape

The major global players in the lyophilized injectables market include Merck & Co., Inc., Protech Telelinks, Cirondrugs, Aristopharma Ltd, Pfizer Inc., Novartis AG, F. Hoffmann-La Roche Ltd, Sanofi, Amgen Inc., Novo Nordisk A/S, among others.

Key Developments

- In May 2024, Global contract development and manufacturing organization (CDMO), Sterling Pharma Solutions, announced that it has invested $3 million into expanding its integrated antibody-drug conjugate (ADC) development and manufacturing capabilities in its Germantown, Wis. facility in the United States.

- In July 2023, WuXi STA, a contract research development and manufacturing organization (CRDMO) that functions as a subsidiary of WuXi AppTech, announced the launch of its first high potency (HP) fully automated sterile injectable manufacturing line at its drug product site in Wuxi City, China.

- In February 2023, Thermo Fisher Scientific announced that its Applied Biosystems business introduced the TaqMan 2.5X Lyo-Ready 1-step qPCR Master Mix with an excipient, optimized, ready-to-use formulation for a lyophilization process.

Why Purchase the Report?

- To visualize the global lyophilized injectables market segmentation based on drug type, type of delivery, form, route of administration, application, type of packaging, end-user, and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development

- Excel data sheet with numerous data points of global lyophilized injectables market level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping is available in excel consisting of key products of all the major players.

The global lyophilized injectables market report would provide approximately 94 tables, 97 figures, and 182 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

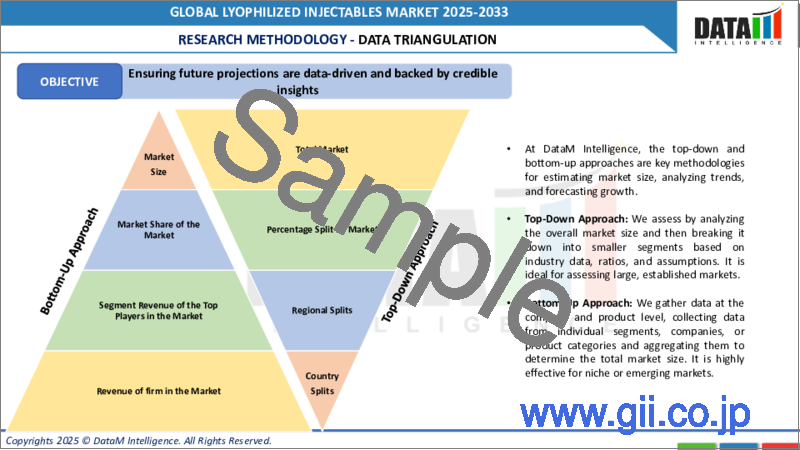

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Drug Type

- 3.2. Snippet by Type of Delivery

- 3.3. Snippet by Form

- 3.4. Snippet by Route of Administration

- 3.5. Snippet by Application

- 3.6. Snippet by Type of Packaging

- 3.7. Snippet by End-User

- 3.8. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Rise in Biologics & Complex Molecules

- 4.1.1.2. Advancements in Drug Delivery

- 4.1.1.3. Technological Advancements in Lyophilization Processes

- 4.1.1.4. Rising Prevalence of Chronic Diseases

- 4.1.2. Restraints

- 4.1.2.1. Product Recalls

- 4.1.2.2. Stringent Regulatory Requirements

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Unmet Needs

- 5.6. PESTEL Analysis

- 5.7. Patent Analysis

- 5.8. SWOT Analysis

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During the Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Drug Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Drug Type

- 7.1.2. Market Attractiveness Index, By Drug Type

- 7.2. Anti-infective*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Anti-neoplastic

- 7.4. Anticoagulant

- 7.5. Hormones

- 7.6. Others

8. By Type of Delivery

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type of Delivery

- 8.1.2. Market Attractiveness Index, By Type of Delivery

- 8.2. Multi-step Devices*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Prefilled Diluent Syringes

- 8.4. Proprietary Reconstitution Devices

- 8.5. Single-step Devices

9. By Form

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 9.1.2. Market Attractiveness Index, By Form

- 9.2. Powder*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Liquid

10. By Route of Administration

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

- 10.1.2. Market Attractiveness Index, By Route of Administration

- 10.2. Intravenous/Infusion *

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Intramuscular

- 10.4. Others

11. By Application

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.1.2. Market Attractiveness Index, By Application

- 11.2. Autoimmune Diseases *

- 11.2.1. Introduction

- 11.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 11.3. Infectious Diseases

- 11.4. Metabolic Conditions

- 11.5. Oncology

- 11.6. Others

12. By Type of Packaging

- 12.1. Introduction

- 12.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Packaging

- 12.1.2. Market Attractiveness Index, By Packaging

- 12.2. Point-of-Care Reconstitution *

- 12.2.1. Introduction

- 12.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 12.3. Specialty Packaging

- 12.4. Single-use Vials

13. By End-User

- 13.1. Introduction

- 13.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 13.1.2. Market Attractiveness Index, By End-User

- 13.2. Hospitals *

- 13.2.1. Introduction

- 13.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 13.3. Ambulatory Surgical Centers

- 13.4. Specialty Clinics

- 13.5. Others

14. By Region

- 14.1. Introduction

- 14.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 14.1.2. Market Attractiveness Index, By Region

- 14.2. North America

- 14.2.1. Introduction

- 14.2.2. Key Region-Specific Dynamics

- 14.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Drug Type

- 14.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type of Delivery

- 14.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 14.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

- 14.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 14.2.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type of Packaging

- 14.2.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

- 14.2.10. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 14.2.10.1. U.S.

- 14.2.10.2. Canada

- 14.2.10.3. Mexico

- 14.3. Europe

- 14.3.1. Introduction

- 14.3.2. Key Region-Specific Dynamics

- 14.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Drug Type

- 14.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type of Delivery

- 14.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 14.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

- 14.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 14.3.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type of Packaging

- 14.3.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

- 14.3.10. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 14.3.10.1. Germany

- 14.3.10.2. UK

- 14.3.10.3. France

- 14.3.10.4. Italy

- 14.3.10.5. Spain

- 14.3.10.6. Rest of Europe

- 14.4. South America

- 14.4.1. Introduction

- 14.4.2. Key Region-Specific Dynamics

- 14.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Drug Type

- 14.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type of Delivery

- 14.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 14.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

- 14.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 14.4.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type of Packaging

- 14.4.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

- 14.4.10. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 14.4.10.1. Brazil

- 14.4.10.2. Argentina

- 14.4.10.3. Rest of South America

- 14.5. Asia-Pacific

- 14.5.1. Introduction

- 14.5.2. Key Region-Specific Dynamics

- 14.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Drug Type

- 14.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type of Delivery

- 14.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 14.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

- 14.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 14.5.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type of Packaging

- 14.5.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

- 14.5.10. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 14.5.10.1. China

- 14.5.10.2. India

- 14.5.10.3. Japan

- 14.5.10.4. South Korea

- 14.5.10.5. Rest of Asia-Pacific

- 14.6. Middle East and Africa

- 14.6.1. Introduction

- 14.6.2. Key Region-Specific Dynamics

- 14.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Drug Type

- 14.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type of Delivery

- 14.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 14.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Route of Administration

- 14.6.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 14.6.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type of Packaging

- 14.6.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

15. Competitive Landscape

- 15.1. Competitive Scenario

- 15.2. Market Positioning/Share Analysis

- 15.3. Mergers and Acquisitions Analysis

16. Company Profiles

- 16.1. Merck & Co., Inc *

- 16.1.1. Company Overview

- 16.1.2. Product Portfolio & Description

- 16.1.3. Financial Overview

- 16.1.4. Key Developments

- 16.2. Protech Telelinks

- 16.3. Cirondrugs

- 16.4. Aristopharma Ltd

- 16.5. Pfizer Inc

- 16.6. Novartis AG

- 16.7. F. Hoffmann-La Roche Ltd

- 16.8. Sanofi

- 16.9. Amgen Inc

- 16.10. Novo Nordisk A/S

LIST NOT EXHAUSTIVE

17. Appendix

- 17.1. About Us and Services

- 17.2. Contact Us