|

|

市場調査レポート

商品コード

1496872

ホットメルト接着剤の世界市場:2024-2031年Global Hot Melt Adhesives Market - 2024-2031 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ホットメルト接着剤の世界市場:2024-2031年 |

|

出版日: 2024年06月18日

発行: DataM Intelligence

ページ情報: 英文 182 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

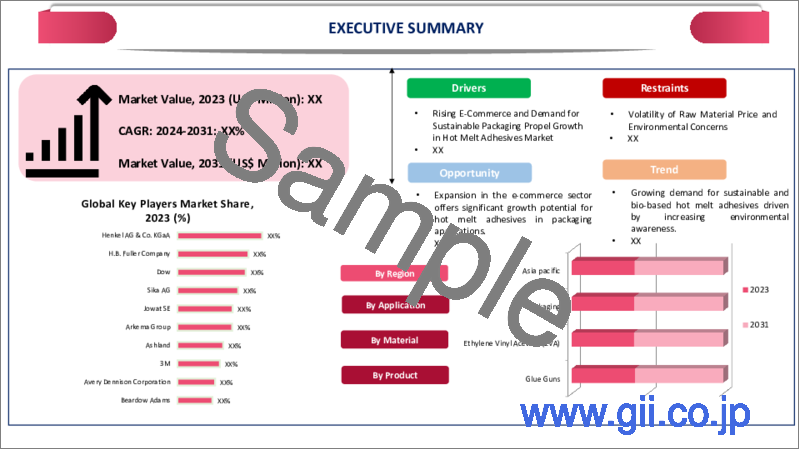

ホットメルト接着剤の世界市場は、2023年に69億米ドルに達し、2024-2031年の予測期間中にCAGR 4.5%で成長し、2031年には98億米ドルに達すると予測されています。

包装分野はホットメルト接着剤の主要ユーザーです。接着剤は一般的に、ケースやカートンのシール、トレイ成形、ラベリング、ラミネートなどの用途で、板紙、段ボール、プラスチックフィルム、箔などの包装材料を接着するために使用されます。業界のホットメルト接着剤の広範な使用は、膨大な需要と市場の優位性を生成します。

ホットメルト接着剤(HMA)は、布、紙、磁器、金属、段ボール、プラスチックなど幅広い素材や表面に接着するため、DIY用途に最適です。さらに2020年10月、ピディライト・インダストリーズ社は、DIY消費者向け接着剤市場向けの製品群を拡大するため、ハンツマン・グループのインド子会社であるハンツマン・アドバンスト・マテリアル・ソリューションズ・プライベート・リミテッドに2億5,700万米ドルを支払った。これにより、同社は市場の拡大を利用できるようになります。

2023年には、北米が世界のホットメルト接着剤市場の20%以上を占め、2番目に優位な地域になると予想されています。この地域には、International Paper、Ball Corporation、Owens-Illinoisといったトップクラスのパッケージング・メーカーが存在し、市場拡大の重要な要因になると予想されます。M&Aは市場の主要プレーヤーの主要戦略です。2021年9月、水性・ホットメルト接着剤とコーティング剤の著名な製造・配合メーカーであるMeridian Adhesives Groupは、Prime Blend LLCを買収しました。

市場力学

紙製パッケージの需要拡大

eコマースの急速な普及により、包装資材の需要が大幅に増加しています。ホットメルト接着剤は、強力で迅速な接着ソリューションを提供するため、カートンのシール、ラベリング、組み立てなどの包装用途に不可欠です。さらに、Statistisches Bundesamtは、2023年にドイツの包装業界の売上高は約379億4,000万米ドルになると予測しています。これは前年の320億9,000万米ドルを上回るものです。

2008年以降、中国は世界最大の紙製包装材と段ボールの生産国となっています。中国紙業協会の調査によると、2023年の中国の紙・板紙製造業の総数は2,500社で、全国の紙・板紙生産量は前年比4.35%増の1億2,965万トンとなった。

持続可能性への関心の高まり

エコロジカルでリサイクル可能なパッケージング・ソリューションへの需要が高まっています。ホットメルト接着剤は様々な素材を接着でき、リサイクル工程に適合するため、パッケージング分野で使用されています。メーカー各社は、持続可能なパッケージングに対するニーズの高まりに対応するため、環境に優しいホットメルト接着剤を開発しています。

市場を牽引しているのは、米国におけるバイオベースのホットメルト接着剤に対する需要の高まりであり、持続可能性が高まっています。例えば、接着剤メーカーであるJowat社は、特に北米市場向けに、米国農務省から認可を取得した再生可能原料由来のソリューションを発表しています。

原料価格の変動と環境への懸念

ホットメルト接着剤の大部分は、エチレン酢酸ビニル(EVA)、ポリエチレン、ポリプロピレンなどの石油化学誘導体で構成されています。これらの基礎原料の価格は非常に変動しやすく、原油価格の変動、地政学的緊張、需給不均衡の影響を受ける。この変動はホットメルト接着剤の生産コストに大きな影響を与え、メーカーが安定した価格設定と収益性を維持することを難しくしています。

ホットメルト接着剤の生産と使用は、特に接着剤製品の廃棄と潜在的な環境への影響をめぐる環境問題を引き起こす可能性があります。特に、生分解性やリサイクル性に乏しい接着剤についてはそうです。持続可能で環境に優しい製品に対する認識と需要の高まりは、従来のホットメルト接着剤に対する監視の強化につながり、生産者はより環境に優しい代替品を見つけることを余儀なくされています。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 紙製包装に対する需要の高まり

- 持続可能性への関心の高まり

- 抑制要因

- 原料価格の変動と環境への懸念

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争影響分析

- DMIの見解

第6章 COVID-19分析

第7章 製品別

- グルーガン

- スプレー式接着剤

- その他

第8章 材料別

- エチレンビニルアセテート

- 熱可塑性ゴム

- ポリオレフィン

- ポリアミド

- その他

第9章 用途別

- 包装

- 組み立て

- 木工

- 自動車

- 不織布

- その他

第10章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第11章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第12章 企業プロファイル

- Henkel AG & Co. KGaA

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- H.B. Fuller Company

- Dow

- Sika AG

- Jowat SE

- Arkema Group

- Ashland

- 3M

- Avery Dennison Corporation

- Beardow Adams

第13章 付録

Overview

Global Hot Melt Adhesives Market reached US$ 6.9 billion in 2023 and is expected to reach US$ 9.8 billion by 2031, growing with a CAGR of 4.5% during the forecast period 2024-2031.

The packaging sector is a major user of hot melt adhesives. The adhesives are commonly used to bond packaging materials like paperboard, corrugated cardboard, plastic films and foils in applications like case and carton sealing, tray forming, labeling and laminating. The industry's widespread use of hot melt adhesives produces enormous demand and market dominance.

Hot melt adhesives (HMAs) adhere to a wide range of materials and surfaces, including fabric, paper, porcelain, metal, cardboard and plastics, making them ideal for DIY applications. Furthermore, in October 2020, Pidilite Industries Ltd. paid US$ 257 million for Huntsman Group's Indian subsidiary Huntsman Advanced Materials Solutions Private Limited in order to broaden its product range for the do-it-yourself consumer adhesives market. It allows the company to exploit market expansion.

In 2023, North America is expected to be the second-dominant region with over 20% of the global Hot Melt Adhesives market. The presence of some of the top packaging manufacturers in the region, such as International Paper, Ball Corporation and Owens-Illinois, is expected to be a crucial factor in market expansion. Mergers and acquisitions are the primary strategies of the market's leading players. In September 2021, Meridian Adhesives Group, a prominent manufacturer and formulator of water-based and hot-melt adhesives and coatings, bought Prime Blend LLC.

Dynamics

Growing Demand for Paper Packaging

The rapid increase of e-commerce has led to a huge increase in demand for packaging materials. Hot melt adhesives are crucial in packing applications such carton sealing, labeling and assembly because they provide strong and quick bonding solutions. Furthermore, the Statistisches Bundesamt estimates that in 2023, the German packaging industry will earn around US$ 37.94 billion in sales. It was an increase over the previous year, totaling US$ 32.09 billion.

Since 2008, China has been the world's largest producer of paper packaging and cardboard. According to a survey performed by the China Paper Association, the total number of paper and paperboard manufacturing businesses in China stood at 2,500 in 2023, with a nationwide paper and paperboard output of 129.65 million tons, a 4.35% increase over the previous year.

Rising Concerns About Sustainability

There is an increasing demand for ecological and recyclable packaging solutions. Hot melt adhesives are used in the packaging sector because they can bond a wide range of materials and are compatible with recycling processes. Manufacturers are developing environmentally friendly hot melt adhesives to address the growing need for sustainable packaging choices.

The market is being driven by rising demand for bio-based hot melt adhesives in U.S., which are becoming more sustainable. For example, Jowat, an adhesive manufacturer, has introduced solutions derived from renewable raw materials that have acquired approval from U.S. Department of Agriculture, particularly for the North American market.

Volatility of Raw Material Price and Environmental Concerns

Hot melt adhesives are largely composed of petrochemical derivatives like ethylene-vinyl acetate (EVA), polyethylene and polypropylene. Prices for these basic materials are extremely variable, impacted by shifts in crude oil prices, geopolitical tensions and supply-demand imbalances. The volatility has a substantial impact on the production costs of hot melt adhesives, which makes it difficult for manufacturers to maintain steady pricing and profitability.

The production and usage of hot melt adhesives can create environmental concerns, notably over adhesive product disposal and the potential environmental impact. The is especially true for adhesives that aren't biodegradable or recyclable. Increasing awareness and demand for sustainable and eco-friendly products has led to increased scrutiny of traditional hot melt adhesives, forcing producers to find greener alternatives.

Segment Analysis

The global hot melt adhesives market is segmented based on product, material, application and region.

Rising Demand for Paper Packaging Drives the Segment Growth

Packaging is expected to be the dominant segment with over 30% of the market during the forecast period 2024-2031. Hot melt adhesives are becoming more popular in the packaging industry as food consumption rises and new applications emerge. For example, packaging is one of India's fastest-growing sectors. The sector has grown steadily over the last few years and is predicted to expand further, notably in the export sector.

For example, from April to December 2023, paper imports in India increased by 37% to 1.47 million tons, according to data from the Indian Paper Manufacturers Association. Furthermore, according to an estimate provided by the Statistisches Bundesamt in March 2023, paper packaging accounted for around 46% of packaging sector sales in Germany in 2022. Almost 34% consisted of plastic packaging.

Geographical Penetration

Rapid Investments in Infrastructure Drives Demand in Asia-Pacific

Asia-Pacific is expected to be the dominant region in the global hot melt adhesives market covering over 30% of the market. Governments and the business sector in Asia-Pacific are investing in infrastructure projects such as transportation, utilities and residential and commercial building. Hot melt adhesives are utilized in a variety of construction applications, such as paneling, flooring installation, insulation bonding and roofing, which increases demand for adhesives in the industry.

In accordance to the Indian Brand Equity Foundation, capital investment in infrastructure is expected to expand by 33%, to around US$ 122 billion, for the fiscal year 2023-24, accounting for 3% of GDP. Furthermore, the Indian government has created a number of strategies to attract private investment in the sectors of roads and highways, airports, business parks and higher education and skill development. Private equity and venture capital firms spent US$ 3.5 billion in Indian enterprises between May 2023, with 71 agreements.

Competitive Landscape

The major global players in the market include Henkel AG & Co. KGaA, H.B. Fuller Company, Dow, Sika AG, Jowat SE, Arkema Group, Ashland, 3M, Avery Dennison Corporation and Beardow Adams.

COVID-19 Impact Analysis

The pandemic significantly disrupted supply chains for raw materials used in hot melt adhesives, including ethylene-vinyl acetate, polyethylene and other petrochemicals. Lockdowns and limitations in key manufacturing countries resulted in shortages and higher raw material prices. Transportation limitations and reduced staff availability during lockdowns caused disruptions in the globally logistics network. Delays in shipment and increasing freight costs further disrupted the supply chain of hot melt glue manufacturers.

It boosted demand for packing materials, which was driven by a boom in e-commerce and home delivery. Hot melt adhesives are used extensively in the packaging sector for carton sealing, labeling and other purposes. On the other hand, the automotive and construction industries, which are major users of hot melt adhesives, experienced downturns due to suspended production and decreased economic activity. It caused a temporary decrease in demand for adhesives used in these industries.

Russia-Ukraine War Impact

The conflict has affected the availability of critical raw materials used in the production of hot melt glue. Russia and Ukraine are large exporters of a variety of chemicals and raw materials, especially petroleum derivatives, which are required for adhesive production. The battle has caused a surge in global energy prices, particularly for oil and natural gas. Due to the manufacturing of hot melt adhesives is energy-intensive, growing energy costs have greatly raised the entire production costs.

The conflict has resulted in variations in demand across various businesses. Manufacturers are facing greater operational costs, which are frequently passed on to customers in the form of higher pricing for hot melt adhesive. Prices for important raw materials like ethylene-vinyl acetate and polyolefins have risen due to supply problems and rising demand. It has increased the financial pressure on glue manufacturers.

By Product

- Glue Guns

- Sprayable Adhesives

- Others

By Material

- Ethylene-vinyl acetate

- Thermoplastic rubber

- Polyolefin

- Polyamide

- Others

By Application

- Packaging

- Assembly

- Woodworking

- Automotive

- Nonwovens

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In April 2023, Avery Dennison and Dow cooperated to create a novel and sustainable hot melt label adhesive solution. It allows polyolefin film labels and polypropylene (PP) or polyethylene (PE) packaging to be technically recycled in the same stream. Avery Dennison sells CF3050 throughout Europe, Middle East and North Africa (EMENA) region, based on Dow's AFFINITY(TM) GA polymers.

- In June 2022, Henkel has expanded its hot melt adhesive manufacturing capacity by building a plant in Nuevo Leon, Mexico.

Why Purchase the Report?

- To visualize the global hot melt adhesives market segmentation based on product, material, application and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of hot melt adhesives market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global hot melt adhesives market report would provide approximately 62 tables, 57 figures and 205 pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Product

- 3.2. Snippet by Material

- 3.3. Snippet by Application

- 3.4. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Growing Demand for Paper Packaging

- 4.1.1.2. Rising Concerns About Sustainability

- 4.1.2. Restraints

- 4.1.2.1. Volatility of Raw Material Price and Environmental Concerns

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID-19

- 6.1.2. Scenario During COVID-19

- 6.1.3. Scenario Post COVID-19

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Product

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 7.1.2. Market Attractiveness Index, By Product

- 7.2. Glue Guns*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Sprayable Adhesives

- 7.4. Others

8. By Material

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 8.1.2. Market Attractiveness Index, By Material

- 8.2. Ethylene-vinyl acetate*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Thermoplastic rubber

- 8.4. Polyolefin

- 8.5. Polyamide

- 8.6. Others

9. By Application

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.1.2. Market Attractiveness Index, By Application

- 9.2. Packaging*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Assembly

- 9.4. Woodworking

- 9.5. Automotive

- 9.6. Nonwovens

- 9.7. Others

10. By Region

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 10.1.2. Market Attractiveness Index, By Region

- 10.2. North America

- 10.2.1. Introduction

- 10.2.2. Key Region-Specific Dynamics

- 10.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 10.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.2.6.1. U.S.

- 10.2.6.2. Canada

- 10.2.6.3. Mexico

- 10.3. Europe

- 10.3.1. Introduction

- 10.3.2. Key Region-Specific Dynamics

- 10.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 10.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.3.6.1. Germany

- 10.3.6.2. UK

- 10.3.6.3. France

- 10.3.6.4. Italy

- 10.3.6.5. Russia

- 10.3.6.6. Rest of Europe

- 10.4. South America

- 10.4.1. Introduction

- 10.4.2. Key Region-Specific Dynamics

- 10.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 10.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.4.6.1. Brazil

- 10.4.6.2. Argentina

- 10.4.6.3. Rest of South America

- 10.5. Asia-Pacific

- 10.5.1. Introduction

- 10.5.2. Key Region-Specific Dynamics

- 10.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 10.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.5.6.1. China

- 10.5.6.2. India

- 10.5.6.3. Japan

- 10.5.6.4. Australia

- 10.5.6.5. Rest of Asia-Pacific

- 10.6. Middle East and Africa

- 10.6.1. Introduction

- 10.6.2. Key Region-Specific Dynamics

- 10.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 10.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

11. Competitive Landscape

- 11.1. Competitive Scenario

- 11.2. Market Positioning/Share Analysis

- 11.3. Mergers and Acquisitions Analysis

12. Company Profiles

- 12.1. Henkel AG & Co. KGaA*

- 12.1.1. Company Overview

- 12.1.2. Product Portfolio and Description

- 12.1.3. Financial Overview

- 12.1.4. Key Developments

- 12.2. H.B. Fuller Company

- 12.3. Dow

- 12.4. Sika AG

- 12.5. Jowat SE

- 12.6. Arkema Group

- 12.7. Ashland

- 12.8. 3M

- 12.9. Avery Dennison Corporation

- 12.10. Beardow Adams

LIST NOT EXHAUSTIVE

13. Appendix

- 13.1. About Us and Services

- 13.2. Contact Us