|

|

市場調査レポート

商品コード

1489501

2-フェニルフェノールの世界市場-2024-2031Global 2-Phenylphenol Market - 2024-2031 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 2-フェニルフェノールの世界市場-2024-2031 |

|

出版日: 2024年06月05日

発行: DataM Intelligence

ページ情報: 英文 181 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

世界の2-フェニルフェノール市場は、2023年に7,060万米ドルに達し、2031年には1億810万米ドルに達すると予測され、予測期間2024年~2031年のCAGRは5.5%で成長する見込みです。

2-フェニルフェノールは、繊維、コーティング、接着剤、プラスチックなど様々な産業で使用される重要な化学化合物です。ユニークな特性と幅広いエンドユーザーにより、2-フェニルフェノールは製造部門の重要な成分となっています。この化合物は、ナイロン66やポリウレタンなど、さまざまなポリマーを合成するための構成要素として幅広く利用されています。

農業分野では、2-フェニルフェノールは果物、野菜、作物をバクテリア、菌類、カビによる腐敗から守るポストハーベスト治療薬として使用されています。強力な殺菌剤として働き、病原菌の繁殖を防ぎ、農産物の保存期間を延ばします。米国農務省(USDA)によると、世界の農業生産量は、人口増加と食料需要の増加により、2031年までに過去最高の33億トンに達すると予想されています。農業生産の増加は、効果的な防腐剤としての2-フェニルフェノールの需要を増大させる。

アジア太平洋は、世界の2-フェニルフェノール市場の1/3以上を占める成長地域のひとつです。さらに、アジア太平洋地域の多くの国が、化学・製造部門への外国投資を誘致するために有利な政策を実施しています。前述の政策には、税制優遇措置、規制と政策の合理化、インフラ整備のイニシアチブなどが含まれます。こうした支援策が、同地域の2-フェニルフェノール市場の成長に寄与しています。

ダイナミクス

技術的進歩と製品革新と政府の好意的な取り組み

技術の進歩と製品の革新は、2-フェニルフェノール市場を押し上げる上で重要な役割を果たしています。継続的な研究開発努力により先進的な製造プロセスが導入され、製品の品質向上と生産コストの削減が実現しました。例えば、より効率的な触媒や製造方法の開発は、収率の向上とエネルギー消費量の削減に貢献しています。全米科学財団の材料科学助成金のような政府出資の研究プログラムが、こうした進歩を支えてきました。

政府の取り組みや政策も、2-フェニルフェノール市場の成長を促進する上で重要な役割を果たしています。さまざまな地域の政府が提供する支援的な規制、補助金、税制上の優遇措置は、メーカーが2-フェニルフェノールの生産と開発に投資することを後押ししています。さらに、持続可能な材料の使用とカーボンフットプリントの削減を推進する政府の取り組みが、2-フェニルフェノールの需要をさらに押し上げています。例えば、欧州連合のグリーンディールは、2-フェニルフェノールを含む環境に優しい材料の採用を奨励し、その結果、市場の需要が増加しています。

ナイロン需要の拡大と自動車産業の急成長

2-フェニルフェノールは、高性能のエンジニアリング熱可塑性プラスチックであるナイロン6,6の生産において重要な役割を果たします。繊維、自動車部品、電気部品など、さまざまな用途でナイロンの需要は増え続けています。米国国勢調査局のデータによると、米国だけでもナイロン樹脂の生産量は2020年から2022年にかけて8.3%増加しており、市場の力強い成長を示しています。それぞれのナイロン生産の伸びは、2-フェニルフェノールの需要を直接促進します。

さらに、自動車産業は2-フェニルフェノールの重要な消費者であり、主に自動車の内装、外装、ボンネット下の部品に使用されるナイロン系材料の生産に使用されます。国際自動車工業会(OICA)の政府統計によると、世界の自動車生産台数は2020年から2021年にかけて6.4%増加しました。前述のような自動車産業の拡大、特に新興国における拡大が、自動車用途に不可欠な原料としての2-フェニルフェノールの需要を牽引しています。

2-フェニルフェノールの腐食性と健康への影響

2-フェニルフェノールは低融点固体で、さまざまな商業・工業分野で使用される無色の有機化合物です。ヘキサメチレンジアミンは、硬化剤、化学中間体、腐食防止剤として使用されます。硫酸化エトキシル化2-フェニルフェノール4級は、繊維用洗剤の成分として使用されます。腐食性化合物であり、摂取すると目や皮膚に深刻な影響を与え、肝臓や腎臓を損傷する可能性があります。

さらに、2-フェニルフェノールは腐食性の高い化学物質であり、呼吸に影響を与え、肝臓、腎臓、肺を損傷する危険性があります。従って、作業者は2-フェニルフェノールの危険を防ぐため、保護作業着を着用することが推奨されます。2-フェニルフェノールからの製品製造を規制する法規制と、より優れた代替物質の研究開発の必要性が、2-フェニルフェノール市場における課題となっています。

限られた規制施行と不十分な技術基盤

強固な2-フェニルフェノール規制が存在するにもかかわらず、規制の施行が限られていることが世界の2-フェニルフェノール市場の有効性を妨げています。各国政府はコンプライアンスを強化するために十分な資源を割り当てない可能性があり、その結果、不完全な報告や不正確なデータがもたらされます。その結果、2-フェニルフェノールが公正な融資慣行を促進する全体的な効果は著しく低下します。消費者金融保護局(CFPB)が2021年に発表したデータによると、2-フェニルフェノールのコンプライアンスに関する審査に合格した貸金業者は84%に過ぎず、規制執行にギャップがあることを示しています。

同様に、時代遅れの技術インフラや不十分な技術インフラも、世界の2-フェニルフェノール市場が直面しているもう一つの重大な抑制要因です。さらに、2-フェニルフェノールの報告義務違反は前年比で9%増加し、完全なコンプライアンスを確保する上で直面する課題を示しています。

多くの金融機関や住宅ローン業者は、高度なデータ収集・報告システムの導入に苦慮しており、これがエラーや遅延、不完全なデータ提出につながっています。このような制限は、住宅ローン貸付パターンの正確な分析を妨げ、潜在的な差別的慣行の特定を妨げます。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 技術的進歩と製品革新、政府の積極的な取り組み

- ナイロン需要の拡大と自動車産業の急成長

- 抑制要因

- 2-フェニルフェノールの腐食性と健康への影響

- 限られた規制施行と不十分な技術基盤

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争影響分析

- DMIの見解

第6章 COVID-19分析

第7章 用途別

- ナイロン合成

- 潤滑油

- コーティング中間体

- 接着剤

- 殺生物剤

- 水処理薬品

- その他

第8章 エンドユーザー別

- 繊維

- 塗料・コーティング

- 自動車

- 石油化学

- その他

第9章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第10章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第11章 企業プロファイル

- Tokyo Chemical Industry Co., Ltd.

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Merck KGaA

- SimSon Pharma Limited

- Cole-Parmer Instrument Company, LLC

- LANXESS

- SANKO Co., Ltd.

- China Petrochemical Development Corporation

- Shandong Xingang Chemical Co., Ltd.

- Jiangsu Weiming New Materials Co., Ltd.

- ATAMAN Kimya A.S.

第12章 付録

Overview

Global 2-Phenylphenol Market reached US$ 70.6 million in 2023 and is expected to reach US$ 108.1 million by 2031, growing with a CAGR of 5.5% during the forecast period 2024-2031.

2-Phenylphenol is a vital chemical compound used in various industries, including textiles, coatings, adhesives and plastics. With its unique properties and wide-ranging End-Users, 2-phenylphenol has become a significant component in the manufacturing sector. The compound finds extensive utilization as a building block for the synthesis of various polymers, such as nylon 66 and polyurethane.

In the agricultural industry, 2-Phenylphenol is used as a post-harvest treatment to protect fruits, vegetables and crops from decay caused by bacteria, fungi and molds. It acts as a powerful fungicide, preventing the growth of pathogens and extending the shelf life of agricultural produce. According to U.S. Department of Agriculture (USDA), global agricultural production is expected to reach a record high of 3.3 billion metric tons by 2031, driven by population growth and increasing food demand. The growth in agricultural production augments the demand for 2-Phenylphenol as an effective preservative.

Asia-Pacific is among the growing regions in the global 2-Phenylphenol market covering more than 1/3rd of the market. Further, many countries in the Asia-Pacific have implemented favorable policies to attract foreign investments in the chemical and manufacturing sectors. The aforementioned policies include tax incentives, streamlined regulations and infrastructure development initiatives. Such supportive measures have contributed to the growth of the 2-phenylphenol market in the region.

Dynamics

Technological Advancements and Product Innovations coupled with Favorable Government Initiatives

Technological advancements and product innovations have played a significant role in boosting the 2-phenylphenol market. Continuous research and development efforts have led to the introduction of advanced manufacturing processes, resulting in improved product quality and reduced production costs. For instance, the development of more efficient catalysts and production methods has contributed to enhanced yields and reduced energy consumption. Government-funded research programs, such as the National Science Foundation's grants for materials science, have supported these advancements.

Government initiatives and policies have also played a crucial role in driving the growth of the 2-phenylphenol market. Supportive regulations, subsidies and tax incentives provided by governments across various regions have encouraged manufacturers to invest in the production and development of 2-phenylphenol. Additionally, government initiatives promoting the use of sustainable materials and reducing carbon footprints have further bolstered the demand for 2-phenyl phenol. For example, the European Union's Green Deal has incentivized the adoption of environmentally friendly materials, including 2-phenylphenol, resulting in increased market demand.

Growing Demand For Nylon And Exponential Growth Of Automotive Industry

2-Phenylphenol serves as a crucial component in the production of nylon 6,6, a high-performance engineering thermoplastic. The demand for nylon in various applications, such as textiles, automotive parts and electrical components, continues to rise. According to data from U.S. Census Bureau, the production of nylon resins in U.S. alone increased by 8.3% from 2020 to 2022, indicating a strong market growth. The respective growth in nylon production directly fuels the demand for 2-phenylphenol.

Additionally, the automotive industry is a significant consumer of 2-phenylphenol, primarily for the production of nylon-based materials used in vehicle interiors, exteriors and under-the-hood components. Government statistics from the International Organization of Motor Vehicle Manufacturers (OICA) reveal that global vehicle production increased by 6.4% from 2020 to 2021. The aforementioned expansion in the automotive industry, especially in emerging economies, drives the demand for 2-phenyl phenol as a vital raw material for automotive applications

Corrosive Nature of 2-Phenylphenol and its Health Impacts

2-Phenylphenol is a low-melting solid, colorless organic compound used in various commercial and industrial sectors. Hexamethylenediamine is used as a curing agent, chemical intermediate and corrosion inhibitor. Sulfated ethoxylated 2-phenylphenol quaternized is used as an ingredient in fabric detergents. It is a corrosive compound that can severely impact the eyes and skin and may damage the liver and kidneys if consumed.

Furthermore, 2-phenylphenol is a highly corrosive chemical and a hazardous substance that can affect breathing and damage the liver, kidneys and lungs. Therefore, workers are advised to wear protective work clothing to prevent 2-phenylphenol hazards. Regulatory regulations governing the manufacturing of products from 2-phenylphenol and the emerging need to research and develop better substitutes are challenging in the 2-phenylphenol market.

Limited Regulatory Enforcement and Inadequate Technology Infrastructure

Despite the existence of robust 2-phenylphenol regulations, limited regulatory enforcement hampers the effectiveness of the global 2-phenylphenol market. Governments may not allocate sufficient resources to enforce compliance, leading to incomplete reporting and inaccurate data. As a result, the overall impact of 2-phenylphenol in promoting fair lending practices is significantly reduced. According to the data released by the Consumer Financial Protection Bureau (CFPB) in 2021, only 84% of lenders were successfully examined for 2-phenylphenol compliance, indicating a gap in regulatory enforcement.

Similarly, outdated or inadequate technology infrastructure is another significant restraint facing the global 2-phenylphenol market. Furthermore, violations of 2-phenylphenol reporting requirements increased by 9% compared to the previous year, showcasing the challenges faced in ensuring full compliance.

Many financial institutions and mortgage lenders struggle to adopt advanced data collection and reporting systems, which leads to errors, delays and incomplete data submissions. Such limitations hinder the accurate analysis of mortgage lending patterns and impede the identification of potential discriminatory practices.

Segment Analysis

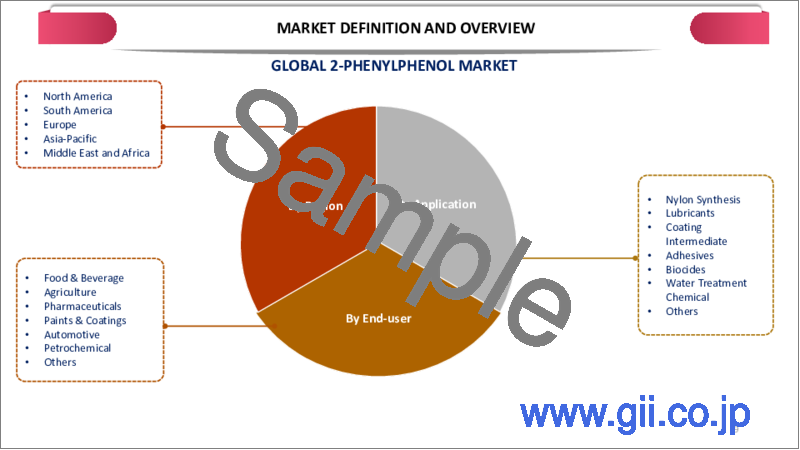

The global 2-Phenylphenol market is segmented based on application, end-user and region.

Increasing Use of Nylon Fibers in the Textile Industry

The textile segment is among the growing regions in the global 2-Phenylphenol market covering more than 1/3rd of the market. . It is a chemical compound widely used in the textile industry as a raw material for producing nylon fibers and fabrics. The demand for 2-phenylphenol in the textile industry has been growing in recent years due to the increasing use of nylon fibers in various applications such as clothing, industrial fabrics and automotive textiles.

The global textile industry has been steadily expanding, driven by rising population, increasing urbanization and growing disposable incomes in emerging economies. As per the latest World Trade Organization data, the consumption of textiles has witnessed a remarkable upswing after 2020. In 2021, textile consumption rose by 5.8% globally compared to the previous year, reaching a total value of US$ 1.2 trillion.

Moreover, nylon fibers, extensively used in the textile industry, have gained significant traction due to their exceptional strength, durability and versatility. The production of nylon fibers heavily relies on 2-phenylphenol, thereby bolstering the growth of the 2-phenylphenol market. National Textile Bureau's statistics indicate a robust surge in nylon fiber production post-2020, with a growth rate of 8.2% globally. Thus it is conclusive to say that the increasing consumption of textiles, coupled with the growing demand for nylon fibers, has fueled the demand for 2-phenylphenol.

Geographical Penetration

Increasing Demand for 2-Phenylphenol from Automotive and Other Manufacturing Industries in Asia-Pacific

Asia-Pacific has been a dominant force in the global 2-Phenylphenol market. The major manufacturers of nylon are planning to shift their manufacturing bases in the growing economies of Asia-Pacific, such as India, China and Taiwan, owing to low-cost labor and easy availability of raw materials at a cheap production cost. China is leading in Asia-Pacific due to its world-leading manufacturing industry. Many global corporations across various industrial domains are based in China.

China and India are leading global producers of plastics, chemicals, petrochemicals and personal care. The highly skilled workforce, huge customer base and easy access to raw materials have propelled the region's industrial development. Many foreign investors commenced manufacturing facilities in the region due to low production costs. It is the one major factor contributing to the growth of the 2-phenylphenol market in Asia-Pacific.

The global demand for nylon 6,6 has witnessed significant growth, thus driving the demand for 2-phenylphenol. Asia-Pacific has experienced rapid industrialization, driven by emerging economies such as China, India and Southeast Asian countries. The respective nations have invested heavily in expanding their manufacturing capabilities, resulting in increased demand for 2-phenylphenol.

Additionally, Asia-Pacific boasts a massive consumer base, resulting from its large population and increasing middle-class segment. Rising disposable incomes and changing lifestyles have led to an upsurge in demand for various consumer goods, including textiles, apparel and automobiles, which extensively utilize 2-phenylphenol-based products.

COVID-19 Impact Analysis

The COVID-19 pandemic had an uneven impact on the global 2-phenylphenol market. The various industries instituted remote work from home (WFH) was instituted by various industries to ensure the continuity of operations during the pandemic. Manufacturing was closed during the pandemic, so plastic and rubber production is prohibited. Trade restrictions, breaking supply chains, government restrictions on manufacturing products and global lockdowns can affect plastic and rubber demand.

Further, with the government movement restrictions and lockdowns, the development of new products was slowed considerably. It also hampered the ability of petrochemical companies to respond to supply chains making it much more challenging. However, the pandemic will not impact the long-term growth prospects of the global 2-phenylphenol market since growing textiles and paints & coatings will rise in the coming years. The demand for 2-phenylphenol remains strong and is expected to grow gradually in the coming years.

The outbreak of the COVID-19 pandemic in late 2019 has had far-reaching consequences on the global economy, affecting numerous industries around the globe. One such sector significantly impacted is the 2-Phenylphenol market. The 2-phenylphenol market heavily relies on complex supply chains involving raw material sourcing, production and distribution networks.

The COVID-19 pandemic severely disrupted these supply chains, leading to a shortage of essential chemicals and raw materials required for 2-phenylphenol production. Lockdown measures, travel restrictions and reduced workforce in various countries disrupted global trade, causing delays and interruptions in the supply of 2-phenylphenol and related products.

Russia-Ukraine War Impact Analysis

The war between Russia and Ukraine has a big effect on regional trade dynamics and raw Application supply chains, which affects the globally insulated packaging industry. Applications including polymers, resins and foams that are utilized in the manufacturing of insulated packaging are substantial products from both Russia and Ukraine.

Furthermore, Price volatility and shortages of essential raw Applications might be experienced by insulated packaging producers globally if trade restrictions, transportation issues or geopolitical concerns cause disruptions in these supply chains. Moreover, the intensification of the war can lead to wider economic instability, impacting consumer assurance and manufacturing productivity in many areas and potentially decreasing the need for insulated packaging in multiple sectors.

By Application

- Nylon Synthesis

- Lubricants

- Coating Intermediate

- Adhesives

- Biocides

- Water Treatment Chemical

- Others

By End-User

- Textile

- Paints & Coatings

- Automotive

- Petrochemical

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On January 17, 2022, BASF SE announced to building of a new 2-phenylphenol plant in France. The new plant is set to improve BASF SE annual 2-phenylphenol production capacity to 260,000 metric tons. Production is expected to start in 2024. Furthermore, BASF SE announced it to expand its polyamide 6.6 production in Freiburg, Germany, starting in 2022.

- On May 10, 2023, Asahi Kasei partnered with Microwave Chemical to launch a demonstration project capable of manufacturing adipic acid and 2-phenylphenol by recycling polyamide 66 using microwave.

- On January 12, 2022, Chinese materials manufacturer, Ascend Performance Materials announced the construction of a new specialty chemicals and 2-phenylphenol plant in Lianyungang, China. The company intends to improve its domestic supply with the construction of the aforementioned plant.

Competitive Landscape

The major global players in the market include Tokyo Chemical Industry Co., Ltd., Merck KGaA, SimSon Pharma Limited, Cole-Parmer Instrument Company, LLC, LANXESS, SANKO Co., Ltd., China Petrochemical Development Corporation, Shandong Xingang Chemical Co., Ltd., Jiangsu Weiming New Materials Co., Ltd. and ATAMAN Kimya A.S.

Why Purchase the Report?

- To visualize the global 2-Phenylphenol market segmentation based on application, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of 2-Phenylphenol market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global 2-Phenylphenol market report would provide approximately 54 tables, 48 figures and 181 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1.Methodology and Scope

- 1.1.Research Methodology

- 1.2.Research Objective and Scope of the Report

2.Definition and Overview

3.Executive Summary

- 3.1.Snippet by Application

- 3.2.Snippet by End-User

- 3.3.Snippet by Region

4.Dynamics

- 4.1.Impacting Factors

- 4.1.1.Drivers

- 4.1.1.1.Technological Advancements and Product Innovations Coupled with Favorable Government Initiatives

- 4.1.1.2.Growing Demand For Nylon And Exponential Growth Of Automotive Industry

- 4.1.2.Restraints

- 4.1.2.1.Corrosive Nature of 2-Phenylphenol and its Health Impacts

- 4.1.2.2.Limited Regulatory Enforcement and Inadequate Technology Infrastructure

- 4.1.3.Opportunity

- 4.1.4.Impact Analysis

- 4.1.1.Drivers

5.Industry Analysis

- 5.1.Porter's Five Force Analysis

- 5.2.Supply Chain Analysis

- 5.3.Pricing Analysis

- 5.4.Regulatory Analysis

- 5.5.Russia-Ukraine War Impact Analysis

- 5.6.DMI Opinion

6.COVID-19 Analysis

- 6.1.Analysis of COVID-19

- 6.1.1.Scenario Before COVID-19

- 6.1.2.Scenario During COVID-19

- 6.1.3.Scenario Post COVID-19

- 6.2.Pricing Dynamics Amid COVID-19

- 6.3.Demand-Supply Spectrum

- 6.4.Government Initiatives Related to the Market During Pandemic

- 6.5.Manufacturers Strategic Initiatives

- 6.6.Conclusion

7.By Application

- 7.1.Introduction

- 7.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 7.1.2.Market Attractiveness Index, By Application

- 7.2.Nylon Synthesis*

- 7.2.1.Introduction

- 7.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3.Lubricants

- 7.4.Coating Intermediate

- 7.5.Adhesives

- 7.6.Biocides

- 7.7.Water Treatment Chemical

- 7.8.Others

8.By End-User

- 8.1.Introduction

- 8.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 8.1.2.Market Attractiveness Index, By End-User

- 8.2.Textile*

- 8.2.1.Introduction

- 8.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3.Paints & Coatings

- 8.4.Automotive

- 8.5.Petrochemical

- 8.6.Others

9.By Region

- 9.1.Introduction

- 9.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 9.1.2.Market Attractiveness Index, By Region

- 9.2.North America

- 9.2.1.Introduction

- 9.2.2.Key Region-Specific Dynamics

- 9.2.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.2.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 9.2.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.2.5.1.U.S.

- 9.2.5.2.Canada

- 9.2.5.3.Mexico

- 9.3.Europe

- 9.3.1.Introduction

- 9.3.2.Key Region-Specific Dynamics

- 9.3.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.3.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 9.3.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.3.5.1.Germany

- 9.3.5.2.UK

- 9.3.5.3.France

- 9.3.5.4.Russia

- 9.3.5.5.Spain

- 9.3.5.6.Rest of Europe

- 9.4.South America

- 9.4.1.Introduction

- 9.4.2.Key Region-Specific Dynamics

- 9.4.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.4.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 9.4.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.4.5.1.Brazil

- 9.4.5.2.Argentina

- 9.4.5.3.Rest of South America

- 9.5.Asia-Pacific

- 9.5.1.Introduction

- 9.5.2.Key Region-Specific Dynamics

- 9.5.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.5.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 9.5.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.5.5.1.China

- 9.5.5.2.India

- 9.5.5.3.Japan

- 9.5.5.4.Australia

- 9.5.5.5.Rest of Asia-Pacific

- 9.6.Middle East and Africa

- 9.6.1.Introduction

- 9.6.2.Key Region-Specific Dynamics

- 9.6.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.6.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

10.Competitive Landscape

- 10.1.Competitive Scenario

- 10.2.Market Positioning/Share Analysis

- 10.3.Mergers and Acquisitions Analysis

11.Company Profiles

- 11.1.Tokyo Chemical Industry Co., Ltd.*

- 11.1.1.Company Overview

- 11.1.2.Product Portfolio and Description

- 11.1.3.Financial Overview

- 11.1.4.Key Developments

- 11.2.Merck KGaA

- 11.3.SimSon Pharma Limited

- 11.4.Cole-Parmer Instrument Company, LLC

- 11.5.LANXESS

- 11.6.SANKO Co., Ltd.

- 11.7.China Petrochemical Development Corporation

- 11.8.Shandong Xingang Chemical Co., Ltd.

- 11.9.Jiangsu Weiming New Materials Co., Ltd.

- 11.10.ATAMAN Kimya A.S.

LIST NOT EXHAUSTIVE

12.Appendix

- 12.1.About Us and Services

- 12.2.Contact Us