|

|

市場調査レポート

商品コード

1474058

再生PET(リサイクルPET)の世界市場-2024-2031年Global Recycled PET Market - 2024-2031 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 再生PET(リサイクルPET)の世界市場-2024-2031年 |

|

出版日: 2024年05月02日

発行: DataM Intelligence

ページ情報: 英文 201 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

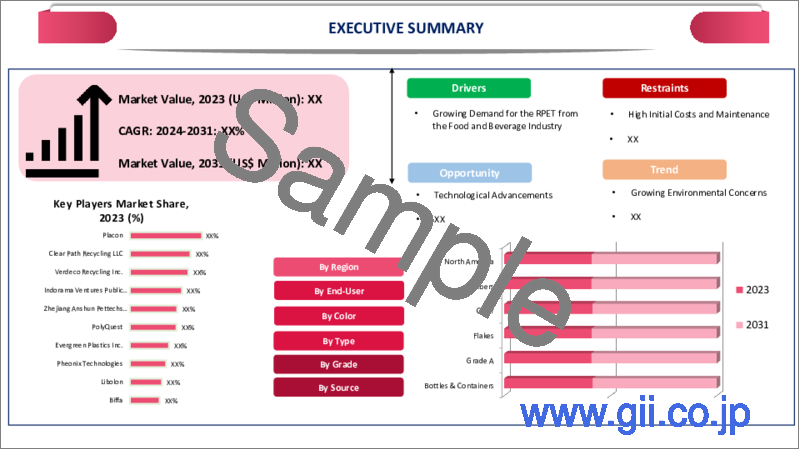

世界の再生PET(リサイクルPET)市場は2023年に105億米ドルに達し、2031年には174億米ドルに達し、予測期間2024-2031年のCAGRは6.5%で成長すると予測されます。

再生PETは、プラスチック廃棄物、海洋汚染、気候変動などの懸念に対する意識の高まりから、環境に優しいソリューションとして大きな需要があります。政府、企業、人々は、リサイクルプログラムを推進し、プラスチック廃棄物を削減することに注力しています。世界中の政府は、リサイクル材料の使用を奨励し、プラスチック廃棄物を削減するための法律や政策を実施しています。これには、拡大生産者責任イニシアティブ、プラスチック廃棄物の削減目標、梱包材に一定量のリサイクル材料を含めることを義務付ける法律などが含まれます。

資源のリサイクル、再利用、製造サイクルへの再導入は、人気を博している循環型経済の考え方の中核をなすものです。再生PETは資源効率を促進し、バージンプラスチックへの依存を減らすため、循環型経済の目標達成に不可欠です。リサイクル材料で作られた環境に優しいパッケージの製品は、ますます人気が高まっています。再生PETのニーズは、このような顧客の期待の変化により、企業が持続可能なパッケージングソリューションを採用せざるを得ない状況に追い込まれています。業界には、食品・飲料、パーソナルケア、家庭用品などが含まれます。

アジア太平洋は、主要プレーヤーによる製品発売の増加により、市場を独占している地域です。例えば、2023年6月7日、ALPLAはCOCA-COLAを支援し、インド初の100%リサイクルペットボトル飲料水を発売しました。キンレイは100%再生ペットボトルを使用したインド初のパッケージ飲料水ブランドです。同社の活動は、2031年までにすべての包装に少なくとも50%の再生材料を使用するというコカ・コーラ社の目標を支援することを目的としています。現在、同社のパッケージの90%はリサイクル可能であり、使用されているPETボトルの15%は世界中でリサイクルされています。

ダイナミクス

環境問題の高まり

プラスチック汚染が環境に及ぼす悪影響に対する意識の高まりにより、消費者の嗜好が変化し、PETなどのリサイクル材料を支持する法律が制定されました。リサイクルを含むより良い廃棄物管理技術は、世界中の政府によって推進されています。公害に対する懸念と、プラスチックゴミが環境に与える一般的な影響が、この動きを後押ししているのです。

PETをリサイクルすることで、多くの資源を使用し、その過程で温室効果ガスを発生させるバージンプラスチックの生産需要を減らすことができます。再生PETを使用することで、二酸化炭素排出量が減少し、気候変動防止に貢献します。循環経済理論は、廃棄物を減らし、資源利用の効果を高めることを目的としています。再生PETは、プラスチック材料のループを閉じ、製造時に使用するエネルギーを減らし、原材料の採取を少なくするため、これらの目的を達成するために極めて重要です。プラスチック廃棄物に取り組み、リサイクルを促進するために、各国政府は法律や政策を整備しています。その中には、生産者の説明責任を強化したり、包装にリサイクル材料を使用するよう要求したりするなど、再生PETの需要を高める政策も含まれています。

食品・飲料業界からのRPET需要の増加

食品・飲料業界は、環境への責任と持続可能性に対する意識が高まっています。リサイクル材料の使用を奨励し、循環経済の原則を維持することで、RPET包装はこれらの目標に適合しています。パッケージングソリューションにおけるRPETのニーズは、持続可能性を高く評価する企業によって煽られています。RPETはプラスチック廃棄物の扉を閉ざし、食品・飲料部門が循環型経済を実践することを可能にします。包装資材に再生ペットボトルを組み込むことで、バージンプラスチックの必要性を減らし、資源効率を促進することで、持続可能なサプライチェーンを構築することができます。PET廃棄物は回収され、新しい包装資材にリサイクルされます。

顧客は、持続可能性への取り組みを示す環境問題への意識を高めています。RPET包装は、環境に優しい選択肢を求める環境意識の高い消費者にアピールし、環境への影響を減らすことに尽力する企業を支援します。食品・飲料業界では、RPETの採用は、環境に優しいパッケージの選択肢を求める消費者の需要の高まりによって推進されています。リサイクル材料は、業界基準と衛生規制を遵守する限り、食品包装に利用されます。食品・飲料メーカーは、多くの場合、食品と接触する用途の規制に準拠したRPETを受け入れ、利用することで、コンプライアンスを確保し、持続可能性の目標を推進しています。

高いコスト

再生PETの製造にかかる総費用は、選別・回収設備、洗浄・加工設備、品質管理工程を含むリサイクルインフラの確立と維持に影響されます。特殊なリサイクル技術と品質保証手順には、多額の初期費用と継続費用が必要です。

高度なリサイクル技術や工程を使用して、高品質の再生PETやグレードA材料を生成するためには、複雑な歯車、複雑な選別方法、エネルギー集約的な手順が頻繁に必要になります。再生PETは、これらの技術の複雑さや特殊な装置の必要性から製造コストが上昇し、市場での競争力が低下する可能性があります。

再生PETプラスチックの安全性、純度、品質を保証するためには、特に食品包装、飲料、医薬品に使用する場合は、厳格な品質管理と試験手順が必要です。色選別、材料試験、汚染物質除去は品質保証手順の一例であり、製造コストを上昇させ、グレードAの再生PETの価格上昇につながります。市場の需要、製造数、規模の経済はすべて、再生PETの単位当たりの価格に影響します。大規模なリサイクル施設に比べ、小規模なリサイクル事業者は、処理量が少なく、非効率的な手順や管理コストが大きいため、製造コストが高くなります。単位当たりの経費を削減し、市場競争力を高めることが、規模の経済を達成する2つの利点です。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 世界の電気自動車(EV)普及の高まり

- パワーエレクトロニクスおよび半導体デバイスにおけるSiCウエハーの採用拡大

- 抑制要因

- 高い初期投資

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 供給源別

- ボトル・容器

- フィルム・シート

第8章 グレード別

- グレードA

- グレードB

第9章 タイプ別

- フレーク

- チップ

第10章 色別

- 透明

- 着色

第11章 エンドユーザー別

- 繊維

- フィルム・シート

- 食品・飲料容器・ボトル

- 非食品容器・ボトル

- その他

第12章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第13章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第14章 企業プロファイル

- Placon

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Clear Path Recycling LLC

- Verdeco Recycling Inc.

- Indorama Ventures Public Ltd.

- Zhejiang Anshun Pettechs Fibre Co., Ltd.

- PolyQuest

- Evergreen Plastics Inc.

- Pheonix Technologies

- Libolon

- Biffa

第15章 付録

Overview

Global Recycled PET Market reached US$ 10.5 Billion in 2023 and is expected to reach US$ 17.4 Billion by 2031, growing with a CAGR of 6.5% during the forecast period 2024-2031.

Recycled PET is in great demand for its green solutions due to growing awareness of concerns including plastic waste, ocean pollution and climate change. Governments, corporations and people are concentrating on promoting recycling programs and cutting down on plastic waste. Governments throughout the world are putting laws and policies into place to encourage the use of recycled materials and reduce plastic waste. The includes extended producer responsibility initiatives, goals for reducing plastic waste and laws requiring packaging to include a specific amount of recycled material.

Recycling, reusing and reintroducing resources into the manufacturing cycle is the core of the circular economy idea that has gained popularity. Recycled PET is essential to reaching the objectives of the circular economy since it promotes resource efficiency and reduces dependency on virgin plastics. Products with environmentally friendly packaging made of recycled materials are becoming increasingly popular. The need for recycled PET is being driven by this shift in customer expectations, which has forced firms to embrace sustainable packaging solutions. The industries include food and beverage, personal care and home items.

Asia-Pacific is the dominating region in the market due to the growing product launches by the major key players. For instance, on June 07, 2023, ALPLA, supported COCA-COLA in the launch of India's first 100% recycled pet bottle for packaged drinking water. Kinley is India's first packaging drinking water brand which use 100% recycled PET bottles. The company's activities aim to support coca-colas goal of using at least 50% recycled material in all packaging by 2031. Currently 90% of the company's packaging is recyclable and 15% of PET used is recycled globally.

Dynamics

Growing Environmental Concerns

Growing awareness of the harmful effects that plastic pollution poses to the environment has resulted in a change in consumer preferences and legislation that support recycled materials such as PET. Better waste management techniques, including recycling, are being pushed for by governments across the world. Concerns over pollution and the general effects of plastic trash on the environment are what are driving this movement.

Recycling PET reduces the demand for virgin plastic production, a process that uses a lot of resources and produces greenhouse gases in the process. By using recycled PET, carbon emissions is decreased, contributing to the prevention of climate change. The circular economy theory aims to reduce waste and increase the effectiveness of resource use. Because it closes the loop on plastic materials, uses less energy during manufacture and requires less extraction of raw materials, recycled PET is crucial for reaching these objectives. To tackle plastic waste and encourage recycling, governments are putting laws and policies into place. The includes policies that increase demand for recycled PET, such as increased producer accountability and demands that require packaging to contain recycled materials.

Growing Demand for the RPET from the Foood and Beverage Industry

The beverage and food industry are becoming increasingly conscious of environmental responsibility and sustainability. By encouraging the use of recycled materials and maintaining the principles of the circular economy, RPET packaging conforms with these goals. The need for RPET in packaging solutions is fueled by businesses that value sustainability highly. RPET shuts the door on plastic waste, enabling the food and beverage sector to implement circular economy practices. The incorporation of recycled plastic bottles into packaging materials creates a sustainable supply chain by lowering the need for virgin plastics and encouraging resource efficiency. PET waste is collected and recycled into new packaging goods.

Customers are becoming more conscious of environmental concerns that exhibit sustainability initiatives. RPET packaging appeals to environmentally conscious consumers who look for eco-friendly options and support businesses who are devoted to reducing their impact on the environment. In the food and beverage industry, RPET adoption is driven by consumers growing demand for environmentally friendly packaging choices. Recycled materials utilized in food packaging as long as they adhere to industry standards and hygienic regulations. Food and beverage producers often accept and utilize RPET that complies with regulations for applications involving food contact, assuring compliance and advancing sustainability objectives.

High Cost

The total expense of producing recycled PET is influenced by the establishment and maintenance of recycling infrastructure, which includes sorting and collection facilities, equipment for washing and processing and quality control processes. Specialized recycling technology and quality assurance procedures require significant initial and ongoing costs.

Complex gear, complex sorting methods and energy-intensive procedures are frequently needed to generate the high-quality recycled PET or Grade A material, using advanced recycling technologies and processes. Recycled PET could grow less competitive in the market as a result of production costs increasing due to the complexity of these technologies and the requirement for specialized equipment.

Strict quality control and testing procedures are needed to guarantee the safety, purity and quality of recycled PET plastic, particularly for use in food packaging, drinks and medications. Color sorting, material testing and contaminant removal are instances of quality assurance procedures that raise manufacturing costs and lead to increased pricing for Grade A recycled PET. Demand in the market, manufacturing numbers and economies of scale all affect the price per unit of recycled PET. Compared to large-scale recycling facilities, smaller recycling businesses have higher production costs because of their lower throughput, inefficient procedures and greater administrative costs. Reducing expenses per unit and enhancing market competitiveness are two benefits of achieving economies of scale.

Segment Analysis

The global recycled PET market is segmented based on source, grade, type, color, end-user and region.

Growing Industrial Adoption of Grade A Recycled PET Globally

Based on the process, the recycled PET market is segmented into mechanical, chemical-mechanical, electropolishing, chemical, plasma-assisted and others.

PET recycled that has gone through extensive sorting, cleaning and processing to fulfil exacting quality criteria is referred to as grade A recycled PET. For the production of premium recycled PET resin, pollutants, labels and impurities have to be removed. A increasing number of sectors and applications that demand the finest standards of material quality, consistency and performance are driving the need for Grade A recycled PET. PET packaging materials have to satisfy quality standards and industry regulations in many markets and industries. Grade A recycled PET fulfils or exceeds these legal requirements, making it appropriate for use in industries where purity and safety are crucial, such as food packaging, beverage containers, drugs and cosmetics. The market for Grade A recycled PET is driven by laws.

Customers are looking for things created from recycled materials, such as Grade A recycled PET, as they become more concerned about environmental sustainability. In accordance with customer desires and manufacturers utilize Grade A recycled PET in their containers and products, encouraging environmentally conscious decisions and the circular economy. Corporate responsibility, green practices and sustainability efforts receive top priority by businesses and brands. Utilizing Grade A recycled PET reduces carbon footprint, improves brand reputation and shows a dedication to environmental treatment. Demand for Grade A recycled PET is driven by market leaders and companies that care about the environment in order to accomplish sustainability targets.

Geographical Penetration

Asia-Pacific is Dominating the Recycled PET Market

Asia-Pacific is home to a significant portion of the world's population, including densely populated countries such as India and China. The population size contributes to substantial consumption of goods and packaging materials, including PET-based products. Recycled PET is extremely sought after in the area to fulfil demands for packaging. The region is a major hub for manufacturing across various industries such as consumer products, automotive and textiles. Recycled PET is used by these sectors for producing bottles, containers, textiles and other objects. The growing need for recycled PET in the area is fueled by the existence of manufacturing enterprises.

In Asia-Pacific, issues about plastic waste management and environmental sustainability are increasing. Strategies for waste reduction have been adopted by consumers and businesses. The demand for recycled PET as a competitive alternative to virgin PET is driven by the emphasis on protecting the environment. Asia-Pacific governments have enacted laws and incentives to support eco-friendly materials and circular economy operations. Extended producer responsibility for recycling encourages the usage of recycled PET and promotes market expansion. Major key players in the region increased their use of PET bottles helps to boost regional market growth over the forecast period.

For instance, on October 18, 2023, SLMG Beverages launched 100% recycled PET bottles for Coca-Cola. It helps to reflect company's dedication towards environmental stewardship but also signifies a pivotal moment in the beverage industry's landscape in India. The company successfully supplies 90% coca Coca-Cola bottles in Uttar Pradesh and 100% in Uttarakhand and it has a presence in also Bihar and Madhya Pradesh. The company has 7 plants in Uttar Pradesh with a production capacity of 41 crore bottles a day.

Competitive Landscape

The major global players in the market include Placon, Clear Path Recycling LLC, Verdeco Recycling Inc., Indorama Ventures Public Ltd., Zhejiang Anshun Pettechs Fibre Co., Ltd., PolyQuest, Evergreen Plastics Inc., Pheonix Technologies, Libolon and Biffa.

COVID-19 Impact Analysis

The pandemic affected post-consumer PET waste collection and processing by disrupting global supply systems. The supply of recycled PET feedstock fluctuated as a consequence of lockdowns and changes in consumer behavior, which had an effect on distribution. Recycled PET is utilized in packaging and textile however, the pandemic changed buying patterns and customer demand. The market for recycled PET materials was impacted by fluctuations in the demand for packaged foods and drinks during lockdowns.

The efficiency of recycling infrastructure was impacted by the closure of recycling plants and operational difficulties during lockdowns. The cost of manufacturing and pricing strategies for recycled PET products were affected by fluctuations in oil prices and market uncertainty, which in turn impacted the dynamics of the market. The supply of recycled PET to the market was hampered by delays in waste collection and disruptions in recycling operations. The pandemic caused changes in raw material costs, affecting virgin and recycled PET.

Russia-Ukraine War Impact Analysis

The war had an impact on supply chains for recycled PET, as Ukraine and Russia are major participants in the plastics sectors. Disruptions in the raw material supply and logistics cause shortages and price fluctuations in the globally market for recycled PET. Prices for natural gas and crude oil, which are crucial feedstocks for the manufacture of PET, including recycled PET, fluctuate as a result of the ongoing dispute. Fluctuations in the price of raw materials have a direct impact on the cost of producing recycled PET, as well as pricing strategies and market dynamics.

The region's recycling infrastructure is impacted by the conflict's geopolitical and financial consequences. globally variations in investment and recycling-related business practices affect the quantity and quality of recycled PET. Changes in trade patterns and regional demand are just a few of the ways that the conflict could impact market dynamics. In reaction to geopolitical changes, companies operating in the recycled PET industry could reevaluate their sourcing strategy, goals for market expansion and approaches to risk management.

By Source

- Bottles & Containers

- Films & Sheets

By Grade

- Grade A

- Grade B

By Type

- Flakes

- Chips

By Color

- Clear

- Colored

By End-User

- Fibers

- Films & Sheets

- Food & Beverage Containers & Bottles

- Non-Food Containers & Bottles

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On October 04, 2023, Coca-Cola India launched fully recycled PET bottles for its flagship Coca-Cola brand in pack sizes of 750 ml and 250 ml across various markets in the country. The recycled bottles are made from food-grade recycled polyethylene terephthalate (PET) and is approved by US FDA and European Food Safety Authority (EFSA).

- On September 25, 2023, Indorama Ventures achieved 100 billion PET bottles recycling milestone. The has diverted 2.1 million tons of waste from the environment and saved 2.9 million tons of carbon footprint from the product lifecycles.

- On August 06, 2023, ENVICCO, a joint venture between PTT Global Chemical (GC) and ALPLA launched Thailand's first food-grade rPET to the market which is already being used for Thailand's first 100% rPET bottles. Pepsi and Minere two companies are adopting the high-quality Post-Consumer Recycled (PCR) material from ENVICCO for their plastic bottles.

Why Purchase the Report?

- To visualize the global recycled PET market segmentation based on source, grade, type, color, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of recycled PET market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global recycled PET market report would provide approximately 78 tables, 70 figures and 201 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1.Methodology and Scope

- 1.1.Research Methodology

- 1.2.Research Objective and Scope of the Report

2.Definition and Overview

3.Executive Summary

- 3.1.Snippet by Source

- 3.2.Snippet by Grade

- 3.3.Snippet by Type

- 3.4.Snippet by Color

- 3.5.Snippet by End-User

- 3.6.Snippet by Region

4.Dynamics

- 4.1.Impacting Factors

- 4.1.1.Drivers

- 4.1.1.1.Rise in Electric Vehicle (EV) Adoption Globally

- 4.1.1.2.Growing Adoption of SiC Wafers in Power Electronics and Semiconductor Devices

- 4.1.2.Restraints

- 4.1.2.1.High Initial Investment

- 4.1.3.Opportunity

- 4.1.4.Impact Analysis

- 4.1.1.Drivers

5.Industry Analysis

- 5.1.Porter's Five Force Analysis

- 5.2.Supply Chain Analysis

- 5.3.Pricing Analysis

- 5.4.Regulatory Analysis

- 5.5.Russia-Ukraine War Impact Analysis

- 5.6.DMI Opinion

6.COVID-19 Analysis

- 6.1.Analysis of COVID-19

- 6.1.1.Scenario Before COVID-19

- 6.1.2.Scenario During COVID-19

- 6.1.3.Scenario Post COVID-19

- 6.2.Pricing Dynamics Amid COVID-19

- 6.3.Demand-Supply Spectrum

- 6.4.Government Initiatives Related to the Market During Pandemic

- 6.5.Manufacturers Strategic Initiatives

- 6.6.Conclusion

7.By Source

- 7.1.Introduction

- 7.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 7.1.2.Market Attractiveness Index, By Source

- 7.2.Bottles & Containers*

- 7.2.1.Introduction

- 7.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3.Films & Sheets

8.By Grade

- 8.1.Introduction

- 8.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Grade

- 8.1.2.Market Attractiveness Index, By Grade

- 8.2.Grade A*

- 8.2.1.Introduction

- 8.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3.Grade B

9.By Type

- 9.1.Introduction

- 9.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 9.1.2.Market Attractiveness Index, By Type

- 9.2.Flakes*

- 9.2.1.Introduction

- 9.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3.Chips

10.By Color

- 10.1.Introduction

- 10.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Color

- 10.1.2.Market Attractiveness Index, By Color

- 10.2.Clear*

- 10.2.1.Introduction

- 10.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3.Colored

11.By End-User

- 11.1.Introduction

- 11.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.1.2.Market Attractiveness Index, By End-User

- 11.2.Fibers*

- 11.2.1.Introduction

- 11.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 11.3.Films & Sheets

- 11.4.Food & Beverage Containers & Bottles

- 11.5.Non-Food Containers & Bottles

- 11.6.Others

12.By Region

- 12.1.Introduction

- 12.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 12.1.2.Market Attractiveness Index, By Region

- 12.2.North America

- 12.2.1.Introduction

- 12.2.2.Key Region-Specific Dynamics

- 12.2.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 12.2.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Grade

- 12.2.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.2.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Color

- 12.2.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.2.8.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.2.8.1.U.S.

- 12.2.8.2.Canada

- 12.2.8.3.Mexico

- 12.3.Europe

- 12.3.1.Introduction

- 12.3.2.Key Region-Specific Dynamics

- 12.3.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 12.3.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Grade

- 12.3.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.3.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Color

- 12.3.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.3.8.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.3.8.1.Germany

- 12.3.8.2.UK

- 12.3.8.3.France

- 12.3.8.4.Italy

- 12.3.8.5.Spain

- 12.3.8.6.Rest of Europe

- 12.4.South America

- 12.4.1.Introduction

- 12.4.2.Key Region-Specific Dynamics

- 12.4.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 12.4.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Grade

- 12.4.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.4.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Color

- 12.4.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.4.8.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.4.8.1.Brazil

- 12.4.8.2.Argentina

- 12.4.8.3.Rest of South America

- 12.5.Asia-Pacific

- 12.5.1.Introduction

- 12.5.2.Key Region-Specific Dynamics

- 12.5.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 12.5.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Grade

- 12.5.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.5.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Color

- 12.5.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.5.8.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.5.8.1.China

- 12.5.8.2.India

- 12.5.8.3.Japan

- 12.5.8.4.Australia

- 12.5.8.5.Rest of Asia-Pacific

- 12.6.Middle East and Africa

- 12.6.1.Introduction

- 12.6.2.Key Region-Specific Dynamics

- 12.6.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 12.6.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Grade

- 12.6.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.6.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Color

- 12.6.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

13.Competitive Landscape

- 13.1.Competitive Scenario

- 13.2.Market Positioning/Share Analysis

- 13.3.Mergers and Acquisitions Analysis

14.Company Profiles

- 14.1.Placon*

- 14.1.1.Company Overview

- 14.1.2.Product Portfolio and Description

- 14.1.3.Financial Overview

- 14.1.4.Key Developments

- 14.2.Clear Path Recycling LLC

- 14.3.Verdeco Recycling Inc.

- 14.4.Indorama Ventures Public Ltd.

- 14.5.Zhejiang Anshun Pettechs Fibre Co., Ltd.

- 14.6.PolyQuest

- 14.7.Evergreen Plastics Inc.

- 14.8.Pheonix Technologies

- 14.9.Libolon

- 14.10.Biffa

LIST NOT EXHAUSTIVE

15.Appendix

- 15.1.About Us and Services

- 15.2.Contact Us