|

|

市場調査レポート

商品コード

1463553

1,2-ヘキサンジオールの世界市場-2024-2031年Global 1,2-Hexanediol Market - 2024-2031 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 1,2-ヘキサンジオールの世界市場-2024-2031年 |

|

出版日: 2024年04月16日

発行: DataM Intelligence

ページ情報: 英文 196 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

世界の1,2-ヘキサンジオール市場は2023年に1億250万米ドルに達し、2031年には1億5,730万米ドルに達すると予測され、予測期間2024年、2031年のCAGRは5.5%で成長します。

同市場は、化粧品、塗料・コーティング、医薬品などの産業にわたる多様な用途のおかげで、著しい成長を遂げています。パーソナルケア製品に対する需要の高まりと、製薬・化学分野への投資の増加が、主要な成長促進要因となっています。

化学産業の発展を奨励するため、中国政府は研究開発やインフラ投資など、いくつかの法律やプログラムを導入しています。これらの規制は、環境コンプライアンスを保証し、国内製造を刺激し、外国投資を呼び込み、イノベーションを促進することを目的としています。ビジネスフレンドリーな雰囲気の確立を通じて、政府は1,2-ヘキサンジオール市場の成長を可能にし、中国を世界の化学セクターの主要参加国として確立しました。そのため、中国は市場シェアの1/4近くを占め、世界市場の成長に大きく貢献しています。

ダイナミクス

パーソナルケア製品における需要の高まり

1,2-ヘキサンジオールには保湿性もあるため、化粧品の処方にも適しています。肌に潤いを与え、キメを整え、他の保湿物質の効果を高める。スキンケアへの意識が高まり、うるおいと栄養を与える製品を求めるようになるにつれ、保湿剤、クリーム、美容液における1,2-ヘキサンジオールの必要性は高まっています。

再生可能な資源に由来する持続可能な1,2-ヘキサンジオールは、環境に優しい処方なだけでなく、あらゆる肌タイプに適合するため、化粧品市場での採用が進んでいます。ハイドロライト6グリーンは汎用性が高いため、従来の処方とグリーン処方の両方に組み込むことができ、消費者とメーカーの多様なニーズに応えることができます。美容市場は2022年に約4,300億米ドルの収益を上げ、2031年には6,000億米ドルを超えると推定されており、こうした動向は、消費者の嗜好の変化や持続可能性への懸念に対応しつつ、技術革新と市場成長を促進する上で1,2-ヘキサンジオールの役割が拡大していることを意味しています。

医薬品分野での用途拡大

1,2-ヘキサンジオールは医薬製剤の安定剤として使用され、医薬品の化学的安定性と保存性を維持するのに役立っています。1,2-ヘキサンジオールは、劣化プロセス、酸化、微生物発生を抑制し、長期にわたる医薬品製剤の安定性と有効性を保証します。1,2-ヘキサンジオールの安定化特性は、懸濁剤、乳剤、クリームなどの液体および半固体製剤の重要な要素となっており、医薬品用途での使用を後押ししています。

1,2-ヘキサンジオールは医薬品のカプセル化と放出制御を可能にし、標的への送達、放出の延長、治療効果の向上をもたらします。1,2-ヘキサンジオールは薬物放出プロファイルを変化させ、薬物の安定性を向上させる可能性があるため、高度なドラッグデリバリーシステムへの応用が拡大し、市場の成長を後押ししています。

規制上の制約

消費者と環境を保護するため、規制機関は1,2-ヘキサンジオールのような化合物に厳しい安全性と毒性の制限を設けています。これらの規制を遵守するには、徹底的な試験、文書化、所定の安全基準の遵守が必要です。企業がこれらの基準を満たすことができなければ、罰金や罰則、あるいは製品回収に直面する可能性もあり、生産と供給ネットワークが混乱し、市場の成長が阻害されます。

1,2-ヘキサンジオールのような化学物質は、その安全性、環境への影響、意図された用途を判断するために、各国で登録や認可のプロセスを経ることがあります。製造業者は化学物質の毒性や潜在的な危険性に関する広範なデータを提供しなければならないため、規制当局の許可を得るには時間とコストのかかる手続きが必要となります。

目次

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- パーソナルケア製品における需要の高まり

- 医薬品における用途の増加

- 抑制要因

- 規制上の制約

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 タイプ別

- 製薬グレード

- 化学グレード

- その他

第8章 由来別

- バイオベース

- 石油化学ベース

第9章 エンドユーザー別

- 化粧品・パーソナルケア

- インク・コーティング

- 医薬

- 接着剤

- その他

第10章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第11章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第12章 企業プロファイル

- BASF SE

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Solvay

- Celanese Corporation

- Eastman Chemical Company

- Hefei TNJ Chemical Industry Co.,Ltd.

- CHUNGDO FINE CHEMICAL CO LTD

- Sabinsa Corporation

- Kowa Europe

- Knowde

- Saiper Chemicals Pvt Ltd.

第13章 付録

Overview

Global 1,2-Hexanediol Market reached US$ 102.5 million in 2023 and is expected to reach US$ 157.3 million by 2031, growing with a CAGR of 5.5% during the forecast period 2024-2031.

The market is witnessing significant growth owing to its diverse applications across industries such as cosmetics, paints and coatings and pharmaceuticals. The escalating demand for personal care products, coupled with increasing investments in pharmaceutical and chemical sectors, serves as primary growth drivers.

To encourage the development of the chemical industry, the Chinese government has put in place several laws and programs, including as R&D and infrastructural investments. The regulations seek to guarantee environmental compliance, stimulate local manufacturing, draw in foreign investment and foster innovation. Through the establishment of a business-friendly atmosphere, the government has enabled the growth of the 1,2-hexanediol market and established China as a major participant in the global chemical sector. Therefore, China is contributing significantly to the growth of the global market capturing nearly 1/4th of the market share.

Dynamics

Growing Demand in Personal Care Products

1,2-hexanediol also has moisturizing qualities, making it appropriate for use in cosmetics formulations. It hydrates the skin, improves texture and boosts the effectiveness of other moisturizing substances. As people become more conscious of their skincare and seek products that provide moisture and nourishment, the need for 1,2-hexanediol in moisturizers, creams and serums grows.

The sustainable variant, derived from renewable sources, not only aligns with eco-friendly formulations but also offers compatibility with all skin types, driving its adoption in the cosmetics market. The versatility of Hydrolite 6 green enables its incorporation into both conventional and green formulations, catering to diverse consumer and manufacturer needs. With the beauty market generating approximately US$ 430 billion in revenue in 2022 and estimated to surpass US$ 600 billion by 2031, these trends signify the expanding role of 1,2-Hexanediol in driving innovation and market growth while addressing evolving consumer preferences and sustainability concerns.

Increasing Applications in Pharmaceuticals

1,2-hexanediol is employs as a stabilizer in pharmaceutical formulations to assist maintain the chemical stability and shelf life of drugs. It inhibits degradation processes, oxidation and microbiological development, ensuring the stability and efficacy of medicinal formulations over time. 1,2-hexanediol's stabilizing characteristics make it an important element in liquid and semi-solid formulations such as suspensions, emulsions and creams, which drives its use in pharmaceutical applications.

It allows for the encapsulation and controlled release of pharmaceuticals, resulting in targeted delivery, prolonged release and enhanced therapeutic effects. The potential of 1,2-hexanediol to change drug release profiles and improve drug stability leads to its increased application in sophisticated drug delivery systems, boosting market growth.

Regulatory Constraints

To protect consumers and the environment, regulatory bodies established severe safety and toxicity limits on compounds such as 1,2-hexanediol. Compliance with these regulations necessitates thorough testing, documentation and adherence to predetermined safety standards. If firms fail to satisfy these standards, they may face fines, penalties or even product recalls, disrupting production and supply networks and impeding market growth.

Chemical substances, such as 1,2-hexanediol, may be subject to registration and approval processes in different countries to determine its safety, environmental impact and intended application. Obtaining regulatory clearances can be a time-consuming and costly procedure, since manufacturers must provide extensive data on the chemical toxicity and potential hazards.

Segment Analysis

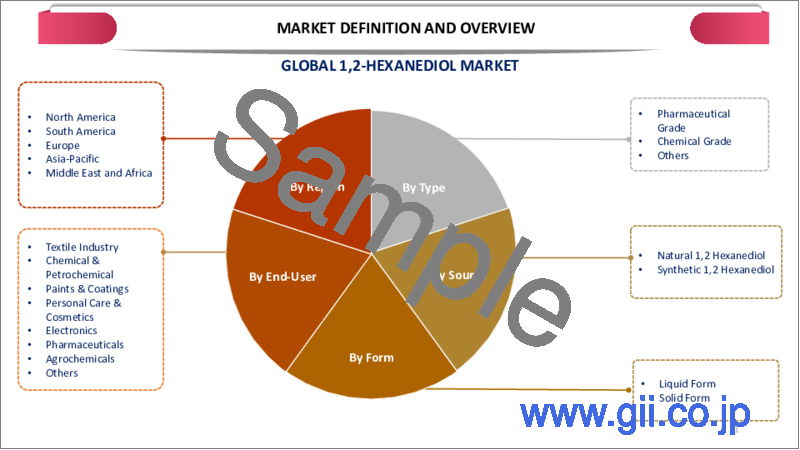

The global 1,2-hexanediol market is segmented based on type, source, end-user and region.

Rising Demand for High-Quality Pharmaceutical Ingredients

1,2-hexanediol is used as a pharmaceutical component in many medication compositions. It performs several functions, including solvent, preservative and co-solvent, which contribute to the stability, efficiency and safety of medicinal products. The pharmaceutical industry depends on high-purity, pharmaceutical-grade 1,2-hexanediol to maintain drug formulation quality and uniformity.

In pharmaceutical formulations, 1,2-hexanediol serves as a preservative, reducing microbiological contamination and extending the shelf life of prescription goods. It prevents the growth of bacteria, fungus and other microbes that can hamper the purity and safety of medicinal products. The demand for pharmaceutical-grade 1,2-hexanediol derives from the necessity for effective preservatives in a variety of medication compositions. Therefore, the pharmaceuticals grade segment dominates the global 1,2-hexanediol market with the more than 1/3rd of the market share.

Geographical Penetration

Increased Awareness and Demand for Green and Sustainable Cosmetics

Several cosmetic companies in the region are developing their green product lines to meet the growing demand for sustainable alternatives. As part of these practices or innovations, 1,2-hexanediol is being added to formulations labelled as eco-friendly or natural. The rise of green product lines increases overall demand for 1,2-hexanediol in the cosmetics industry.

In 2022, Symrise will add Hydrolite 6 green to its offering. The 6-carbon 1,2-alkanediol is one of the cosmetics industry's first green 1,2-hexanediols. It is marketed as a greener version of Symrise's multifunctional components Hydrolite 6 and Hydrolite 6O. It is derived from renewable sources and is an effective skin moisturizer. Therefore, Asia-Pacific captures nearly half of the regional market share.

COVID-19 Impact Analysis

The pandemic severely affected the global supply chains, causing delay in procurement of raw material, labor shortages and transportation delays. Manufacturers producing 1,2-hexanediol encountered difficulties in obtaining necessary inputs and delivering final products, resulting in production schedule interruptions and supply chain inefficiencies.

Additionally, pandemic has boosted the need for the sanitization products such as hand sanitizer and other cleaning and hygiene products. In order to decrease the risk of the illness and other threats during pandemic, companies across variety of industries and individuals were preferring hygiene products, which further fueled the demand for the 1,2-hexanediol's in the global product market.

Russia-Ukraine War Impact Analysis

The global supply chain of 1,2-hexanediol can be disrupted by factors such as including trade prohibitions, transportation difficulties or production halts caused by conflict. It can cause shortages in the market, which would affect manufacturers further down the supply chain who depend on the chemical.

Market dynamics may be impacted by the conflict's unpredictability and instability, which could result in shifting patterns of supply and demand. Players in the market might take a cautious stance, which would alter their future investments plans and product development. In order to reduce risks, companies could also search for different suppliers and supply chain avenues, which could eventually change the dynamics of the market.

By Type

- Pharmaceutical Grade

- Chemical Grade

- Others

By Source

- Bio-based 1,2-Hexanediol

- Petrochemical-based 1,2-Hexanediol

By End-User

- Cosmetic & Personal Care

- Inks & Coatings

- Medicine

- Adhesives

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In November 2022, Symrise has expanded its line to include Hydrolite 6 green. The 6-carbon 1,2-alkanediol is advertised as the first green 1,2-hexanediol to hit the cosmetics industry.

- In 2018, BASF has planned to enhance the manufacturing capacity of Hexanediol at its Ludwigshafen Verbund plant by more than 50%.

- LANXESS has boosted production of 1,6-hexanediol at its Uerdingen plant in Germany for the global market.

Competitive Landscape

The major global players in the market include BASF SE, Solvay, Celanese Corporation, Eastman Chemical Company, Hefei TNJ Chemical Industry Co.,Ltd., CHUNGDO FINE CHEMICAL CO LTD, Sabinsa Corporation, Kowa Europe, Knowde and Saiper Chemicals Pvt Ltd.

Why Purchase the Report?

- To visualize the global 1,2-hexanediol market segmentation based on type, source, end-user and region, as well as understands key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of 1,2-hexanediol market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global 1,2-hexanediol market report would provide approximately 61 tables, 53 figures and 196 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

Table of Contents

1.Methodology and Scope

- 1.1.Research Methodology

- 1.2.Research Objective and Scope of the Report

2.Definition and Overview

3.Executive Summary

- 3.1.Snippet by Type

- 3.2.Snippet by Source

- 3.3.Snippet by End-User

- 3.4.Snippet by Region

4.Dynamics

- 4.1.Impacting Factors

- 4.1.1.Drivers

- 4.1.1.1.Growing Demand in Personal Care Products

- 4.1.1.2.Increasing Applications in Pharmaceuticals

- 4.1.2.Restraints

- 4.1.2.1.Regulatory Constraints

- 4.1.3.Opportunity

- 4.1.4.Impact Analysis

- 4.1.1.Drivers

5.Industry Analysis

- 5.1.Porter's Five Force Analysis

- 5.2.Supply Chain Analysis

- 5.3.Pricing Analysis

- 5.4.Regulatory Analysis

- 5.5.Russia-Ukraine War Impact Analysis

- 5.6.DMI Opinion

6.COVID-19 Analysis

- 6.1.Analysis of COVID-19

- 6.1.1.Scenario Before COVID

- 6.1.2.Scenario During COVID

- 6.1.3.Scenario Post COVID

- 6.2.Pricing Dynamics Amid COVID-19

- 6.3.Demand-Supply Spectrum

- 6.4.Government Initiatives Related to the Market During Pandemic

- 6.5.Manufacturers Strategic Initiatives

- 6.6.Conclusion

7.By Type

- 7.1.Introduction

- 7.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2.Market Attractiveness Index, By Type

- 7.2.Pharmaceutical Grade*

- 7.2.1.Introduction

- 7.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3.Chemical Grade

- 7.4.Others

8.By Source

- 8.1.Introduction

- 8.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 8.1.2.Market Attractiveness Index, By Source

- 8.2.Bio-based 1,2-Hexanediol*

- 8.2.1.Introduction

- 8.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3.Petrochemical-based 1,2-Hexanediol

9.By End-User

- 9.1.Introduction

- 9.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 9.1.2.Market Attractiveness Index, By End-User

- 9.2.Cosmetic & Personal Care*

- 9.2.1.Introduction

- 9.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3.Inks & Coatings

- 9.4.Medicine

- 9.5.Adhesives

- 9.6.Others

10.By Region

- 10.1.Introduction

- 10.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 10.1.2.Market Attractiveness Index, By Region

- 10.2.North America

- 10.2.1.Introduction

- 10.2.2.Key Region-Specific Dynamics

- 10.2.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.2.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 10.2.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.2.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.2.6.1.U.S.

- 10.2.6.2.Canada

- 10.2.6.3.Mexico

- 10.3.Europe

- 10.3.1.Introduction

- 10.3.2.Key Region-Specific Dynamics

- 10.3.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.3.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 10.3.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.3.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.3.6.1.Germany

- 10.3.6.2.UK

- 10.3.6.3.France

- 10.3.6.4.Italy

- 10.3.6.5.Russia

- 10.3.6.6.Rest of Europe

- 10.4.South America

- 10.4.1.Introduction

- 10.4.2.Key Region-Specific Dynamics

- 10.4.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.4.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 10.4.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.4.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.4.6.1.Brazil

- 10.4.6.2.Argentina

- 10.4.6.3.Rest of South America

- 10.5.Asia-Pacific

- 10.5.1.Introduction

- 10.5.2.Key Region-Specific Dynamics

- 10.5.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.5.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 10.5.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.5.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.5.6.1.China

- 10.5.6.2.India

- 10.5.6.3.Japan

- 10.5.6.4.Australia

- 10.5.6.5.Rest of Asia-Pacific

- 10.6.Middle East and Africa

- 10.6.1.Introduction

- 10.6.2.Key Region-Specific Dynamics

- 10.6.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.6.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 10.6.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

11.Competitive Landscape

- 11.1.Competitive Scenario

- 11.2.Market Positioning/Share Analysis

- 11.3.Mergers and Acquisitions Analysis

12.Company Profiles

- 12.1.BASF SE*

- 12.1.1.Company Overview

- 12.1.2.Product Portfolio and Description

- 12.1.3.Financial Overview

- 12.1.4.Key Developments

- 12.2.Solvay

- 12.3.Celanese Corporation

- 12.4.Eastman Chemical Company

- 12.5.Hefei TNJ Chemical Industry Co.,Ltd.

- 12.6.CHUNGDO FINE CHEMICAL CO LTD

- 12.7.Sabinsa Corporation

- 12.8.Kowa Europe

- 12.9.Knowde

- 12.10.Saiper Chemicals Pvt Ltd.

LIST NOT EXHAUSTIVE

13.Appendix

- 13.1. About Us and Services

- 13.2.Contact Us