|

|

市場調査レポート

商品コード

1459336

有機ミネラル肥料の世界市場:2024年~2031年Global Organo-Mineral Fertilizers Market - 2024-2031 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 有機ミネラル肥料の世界市場:2024年~2031年 |

|

出版日: 2024年04月03日

発行: DataM Intelligence

ページ情報: 英文 225 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

世界の有機ミネラル肥料の市場規模は、2023年に5億3,910万米ドルに達し、2024年~2031年の予測期間中にCAGR5.3%で成長し、2031年には8億1,480万米ドルに達すると予測されています。

従来の肥料製品の使用に関する健康と環境への懸念が高まる中、有機的に供給される肥料製品に対するニーズと需要が世界市場で急増しています。有機ミネラル肥料市場の持続可能なアプローチは、作物の収量と品質の向上という利点とともに、市場規模を押し上げています。有機食品への需要の高まりと精密農業への注目も有機ミネラル肥料市場に拍車をかけています。

有機ミネラル肥料は、有機物と利用しやすいミネラル栄養素を結合させ、その結果、植物による栄養素の取り込みが改善され、より高い収量とより良い品質の作物につながる可能性があります。政府や団体は、市場規模を拡大するための試験や支援当局や活動によって、有機ミネラル肥料市場のより良い確立を支援しています。例えば、FCOの下で認可された26の試験所は、有機肥料の試験も担当しています。

アジア太平洋は、有機農業をサポートする有機ミネラル肥料のニーズが高く、世界市場を独占しています。APEDAのNPOP 2022-23有機認証データによると、176万4,677.15ヘクタールの農地が有機栽培され、266万4,679.54トン生産され、そのうち31万2,800.51トンが輸出されました。この地域の高い有機農業の実践は、有機ミネラル肥料市場の成長にプラスに働いています。

力学

収量を向上させる優れた肥料への需要の高まり

国連食糧農業機関は、2021年の世界の農地面積は約47兆8,120億4,900万平方キロメートルと推定しています。世界レベルでの農業分野の増加は、より良い栄養サポートと成長に役立つ肥料の必要性を促進しています。農家は農業生産高を向上させるために様々な肥料を広く使用しています。

FAOによると、世界の肥料消費量は2021年に耕地1ヘクタール当たり139.8kgに達します。世界で生産される肥料の91.1%が消費されています。化学合成肥料の過剰使用は、土壌の劣化や環境汚染の原因となります。有機ミネラル肥料は、有機物と利用しやすいミネラル栄養素を組み合わせたものです。この組み合わせにより、植物による養分の取り込みが改善され、収量の増加や品質の良い作物の生産につながる可能性があります。

持続可能な農業への需要の高まり

水質汚染や土壌劣化など、従来の肥料が環境に与える影響に対する意識の高まりが、より持続可能な農業への転換を促しています。安全で持続可能な方法で生産された食品を求める消費者の声が高まり、農業分野でも有機農法への需要が高まっています。土壌の健全性と養分利用効率の向上に重点を置いた有機ミネラル肥料は、すべての農家にとって実行可能な選択肢となります。

科学環境センターによれば、有機肥料は作物への栄養供給とともに、土壌の健全性と生態系のバランスを回復するのに役立ちます。有機ミネラル肥料は、有機食品生産における持続可能な使用方法を促進することで、農家がこの需要を満たすのを助けることができ、その需要の高まりが市場の拡大を促進します。

2011年と2021年の米農務省全米農業統計局の調査によると、有機生産品に対する消費者の需要は大幅に増加しています。2021年には、有機食品の小売売上高は米国の全小売食品売上高の約5.5%になると推定されています。米国の農場と牧場は、2021年に約110億米ドルの有機製品を販売しました。有機食品の需要は、それらの最終有機食品の食品原料を生産するために、有機ミネラル肥料のような基材を必要とします。

有機ミネラル肥料の高コスト

有機ミネラル肥料は、糞尿、堆肥、バイオ炭のような有機材料を調達する必要があり、調達と加工にコストがかかります。これらの資材は、肥料に配合する前に、収集、輸送、加工が必要になる場合があり、その工程が生産工程に複雑さとコストを増しています。

生産コストが増える分、農家にとっては従来のミネラル肥料に比べて価格が高くなります。有機ミネラル肥料には、土壌の健全性の向上や収量の増加といった長期的なメリットが期待できる一方で、一部の農家、特に費用対効果の高い農家にとっては、目先の価格差が障壁となる場合があります。

目次

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 収量向上のためのより良い肥料への需要の高まり

- 持続可能な農業への需要の高まり

- 抑制要因

- 有機ミネラル肥料のコスト高

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- DMIの見解

第6章 COVID-19分析

第7章 成分別

- 有機原料由来

- 肥料ベース

- 堆肥ベース

- その他

- ミネラル原料由来

- 岩リン酸塩

- 塩化カリウム

- その他

第8章 タイプ別

- 固形肥料

- 液体肥料

第9章 作物別

- 穀物・シリアル

- 果物・野菜

- 換金作物

- ランドスケープ・ガーデニング

第10章 栄養分別

- NPK肥料

- 単一栄養素肥料

第11章 包装別

- カートン

- 袋

- 缶/ボトル

- その他

第12章 流通チャネル別

- 肥料販売店

- オンライン小売

- その他

第13章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋

- 中東・アフリカ

第14章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第15章 企業プロファイル

- Yara International ASA

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- ICL Group

- COMPO EXPERT GmbH

- Hello Nature International Srl

- Quimicas Meristem, S.L.

- ILSA S.p.A.

- Unisalver Organomineral Liquid Fertilizer Products

- SEIPASA, S.A.

- Anorel NV.

- Harmony Ecotech Pvt. Ltd

第16章 付録

Overview

Global Organo-Mineral Fertilizers Market reached US$ 539.1 million in 2023 and is expected to reach US$ 814.8 million by 2031, growing with a CAGR of 5.3% during the forecast period 2024-2031.

With the increasing health and environmental concerns related to the use of conventional fertilizer products, the need and demand for organically sourced fertilizer products is booming in the global market. The sustainable approach of the organo-mineral fertilizers market along with its benefits on improved crop yields and quality boosts market size. Rising demand for organic food and focus on precision agriculture also add fuel to the organo-mineral fertilizers market.

Organo-mineral fertilizers combine organic matter with readily available mineral nutrients, resulting in improved nutrient uptake by plants, potentially leading to higher yields and better-quality crops. The government and organizations support the better establishment of an organo-mineral fertilizers market with testing and supporting authorities and activities to expand market size. For instance, 26 laboratories notified under FCO are also responsible for testing organic fertilizers.

Asia-Pacific dominated the global market with the high need for organo-mineral fertilizers to support organic agricultural practices. According to APEDA, Organic Certification Data under NPOP 2022-23, 1764677.15 Ha of are was cultivated organically with the production of about 2664679.54 MT farm production from which 312800.51 MT is the total export quantity. The high organic agricultural practices in the region positively help the organo-mineral fertilizers market growth.

Dynamics

Rising Demand for Better Fertilizers to Improve Yield

Food and Agriculture Organization estimated that the world's agricultural land accounted for about 47,812,049 million sq. km in 2021. The increasing agricultural sector at the global level is driving the need for fertilizers that help in better nutritional support and growth. Farmers are widely using various fertilizers to improve the output of farming.

According to FAO, the world fertilizer consumption reached 139.8 kilograms per hectare of arable land in 2021. 91.1 % of fertilizer is consumed to the total fertilizer produced worldwide. Overuse of synthetic fertilizers can contribute to soil degradation and environmental pollution. Organo-mineral fertilizers combine organic matter with readily available mineral nutrients. This combination can improve nutrient uptake by plants, leading to potentially higher yields and better-quality crops.

Increased Demand for Sustainable Agriculture

Growing awareness of the environmental impact of conventional fertilizers, such as water pollution and soil degradation, is driving a shift towards more sustainable practices. A growing consumer demand for safe and sustainably produced food demands more for organic practices in the agricultural sector. Organo-mineral fertilizers, with their focus on improved soil health and nutrient use efficiency, create viable alternatives for all farmers.

According to the Centre for Science and Environment, organic fertilizers help restore soil health and ecological balance along with providing nutrients to crops. Organo-mineral fertilizers can help farmers meet this demand by promoting sustainable practices for their use in organic food product production with their rising demand driving market expansion.

According to USDA, National Agricultural Statistics Service surveys in 2011 and 2021, consumer demand for organically produced goods has increased greatly. In 2021, organic retail sales were estimated to be about 5.5 percent of all retail food sales in United States. U.S. farms and ranches sold nearly $11 billion in organic products in 2021. The demand for organic food needs the base materials such as organo-mineral fertilizers to produce food raw materials for those end organic food products.

High Cost of the Organo-Mineral Fertilizers

Organo-mineral fertilizers require sourcing organic materials like manure, compost, or biochar, which adds more costs for sourcing and processing. These materials might require collection, transportation, and processing before being incorporated into the fertilizer blend. These steps add complexity and cost to the production process.

The additional production costs translate to higher prices for farmers compared to conventional mineral fertilizers. While organo-mineral fertilizers offer potential long-term benefits like improved soil health and potentially higher yields, the immediate price difference can be a barrier for some farmers, especially cost-effective ones.

Segment Analysis

The global organo-mineral fertilizers market is segmented based on ingredients, type, crop, nutrient content, packaging, distribution channel, and region.

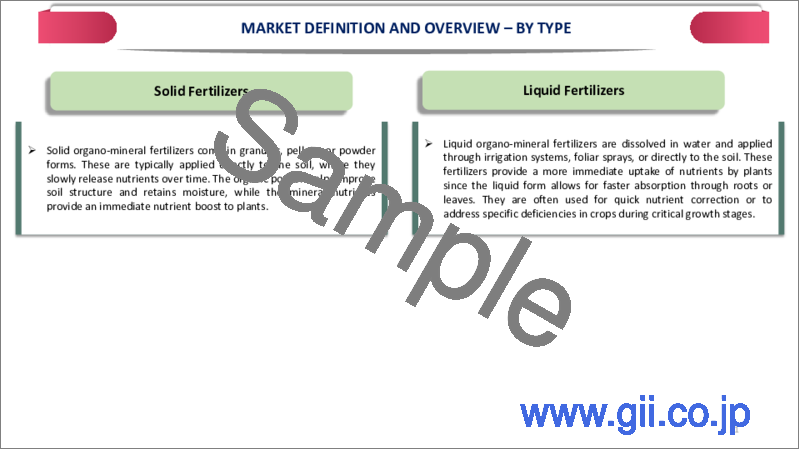

Convenient Application of Solid Fertilizers

The global organo-mineral fertilizers market is segmented based on type into solid and liquid fertilizers. The solid organo-mineral fertilizer segment accounted for the largest share. The slow and sustained nutrient release of the solid organo-mineral fertilizers is the major driving factor for the segment growth. Organic materials in the fertilizer gradually decompose, releasing nutrients over a longer period.

It reduces the risk of nutrients being washed away and ensures efficient nutrient use by plants throughout the growing season. Solid fertilizers are easier to store and handle due to their lower weight and lack of spillage risk. They require less specialized storage facilities compared to liquids helping in ease of storage and handling activities for the distributors and farmers.

In addition, these are generally cheaper to produce and transport compared to liquid fertilizers. This translates to lower prices for farmers favoring cost-effective farmers. The well-established application methods of organo-mineral fertilizers and better farmer awareness about their use add to the segment expansion.

Geographical Penetration

High Dominance of Agriculture Sector in Asia-Pacific

Asia-Pacific dominated the global organo-mineral fertilizers market. The large and fast-growing agricultural sector in the region demands large-scale fertilizer products. According to the Indian government, India's agriculture sector grew by 3.5% in FY 2022-23. Not only has India's agriculture grown, but the country has also become a net exporter of agricultural products, with exports reaching $50.2 billion in the same year.

The greater agricultural produce leads to the greater need for mineral support and fertilisers to support their growth. According to the Fertiliser Association of India, the production of total fertilizer products at 48.68 million MT during 2022-23 showed an increase of 11.3% over 2021-22. Total consumption of all fertilizer products is at 63.76 million MT during 2022-23. The rise in awareness about the benefits associated with the use of organic fertilizers to support organic food practices.

According to the Ministry of Agriculture and Farmers' Welfare, India's organic fertilizer production settled at 38.8 lakh tonnes by 2020-21. Chattisgarh, Karnataka and Assam took over higher positions in the organic fertilizer production states in India. Some governments in the Asia-Pacific are actively promoting the use of organo-mineral fertilizers to improve soil health and agricultural sustainability, boosting market growth.

Competitive Landscape

The major global players in the market include Yara International ASA, ICL Group, COMPO EXPERT GmbH, Hello Nature International Srl, Quimicas Meristem, S.L., ILSA S.p.A., Unisalver Organomineral Liquid Fertilizer Products, SEIPASA, S.A., Anorel NV. and Harmony Ecotech Pvt. Ltd.

COVID-19 Impact Analysis

The supply chain disruptions caused by COVID-19 pandemic lockdowns and travel restrictions caused delays in obtaining raw materials used for the production of finished fertilizers and their transportation, leading to temporary shortages and price fluctuations. COVID-19 outbreaks in some regions caused labor shortages in processing plants, leading to decreased production of agricultural products and consequently lower demand for fertilizers.

The pandemic highlighted the importance of strong food systems leading to a long-term shift towards sustainable agriculture practices, potentially benefiting the organo-mineral fertilizer market due to its environmental advantages. The rise in health and environmental concerns and high demand for organic food products improved the market demand during the pandemic period.

By Ingredients

- Organic Material Source

- Manure-Based

- Compost-Based

- Others

- Mineral Source

- Rock Phosphate

- Potassium Chloride

- Others

By Type

- Solid Fertilizers

- Liquid Fertilizers

By Crop

- Grains and Cereals

- Fruits and Vegetables

- Cash Crops

- Landscape and Gardening

By Nutrient Content

- NPK Fertilizers

- Single-Nutrient Fertilizers

By Packaging

- Cartons

- Bags

- Can/bottle

- Others

By Distribution Channel

- Fertilizer Stores

- Online Retail

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In June 2022, Nika PetroTech, a member of the Ural Interregional Research and Education Center, developed new organomineral fertilizers. These fertilizers are more effective than organic fertilizers and safer than mineral fertilizers.

- In February 2022, Yara introduced Yara Nature, a new organo-mineral fertiliser product into the market. The product contains 38% organic matter produced from food and green waste compost.

- In April 2020, ICL Group Ltd., a multi-national fertilizer manufacturing company announced the launch of Gronamic, a new range of organo-mineral fertilizers. The Gronamic range combines the benefits of mineral and organic sources of nutrients.

Why Purchase the Report?

- To visualize the global organo-mineral fertilizers market segmentation based on ingredients, type, crop, nutrient content, packaging, distribution channel, and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of organo-mineral fertilizers market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

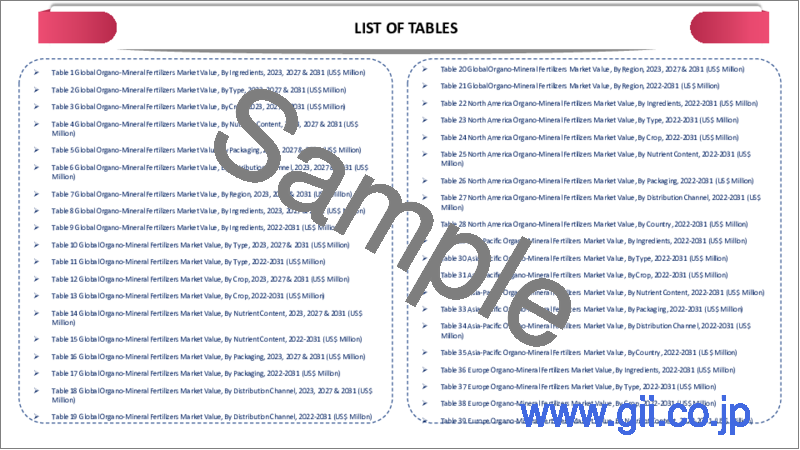

The global organo-mineral fertilizers market report would provide approximately 86 tables, 81 figures, and 225 pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

Table of Contents

1.Methodology and Scope

- 1.1.Research Methodology

- 1.2.Research Objective and Scope of the Report

2.Definition and Overview

3.Executive Summary

- 3.1.Snippet by Ingredients

- 3.2.Snippet by Type

- 3.3.Snippet by Crop

- 3.4.Snippet by Nutrient Content

- 3.5.Snippet by Packaging

- 3.6.Snippet by Distribution Channel

- 3.7.Snippet by Region

4.Dynamics

- 4.1.Impacting Factors

- 4.1.1.Drivers

- 4.1.1.1.Rising Demand for Better Fertilizers to Improve Yield

- 4.1.1.2.Increased Demand for Sustainable Agriculture

- 4.1.2.Restraints

- 4.1.2.1.High Cost of the Organo-Mineral Fertilizers

- 4.1.3.Opportunity

- 4.1.4.Impact Analysis

- 4.1.1.Drivers

5.Industry Analysis

- 5.1.Porter's Five Force Analysis

- 5.2.Supply Chain Analysis

- 5.3.Pricing Analysis

- 5.4.Regulatory Analysis

- 5.5.DMI Opinion

6.COVID-19 Analysis

- 6.1.Analysis of COVID-19

- 6.1.1.Scenario Before COVID

- 6.1.2.Scenario During COVID

- 6.1.3.Scenario Post COVID

- 6.2.Pricing Dynamics Amid COVID-19

- 6.3.Demand-Supply Spectrum

- 6.4.Government Initiatives Related to the Market During Pandemic

- 6.5.Manufacturers Strategic Initiatives

- 6.6.Conclusion

7.By Ingredients

- 7.1.Introduction

- 7.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Ingredients

- 7.1.2.Market Attractiveness Index, By Ingredients

- 7.2.Organic Material Source

- 7.2.1.Introduction

- 7.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.2.3.Manure-Based

- 7.2.4.Compost-Based

- 7.2.5.Others

- 7.3.Mineral Source

- 7.3.1.Rock Phosphate

- 7.3.2.Potassium Chloride

- 7.3.3.Others

8.By Type

- 8.1.Introduction

- 8.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 8.1.2.Market Attractiveness Index, By Type

- 8.2.Solid Fertilizers

- 8.2.1.Introduction

- 8.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3.Liquid Fertilizers

9.By Crop

- 9.1.Introduction

- 9.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Crop

- 9.1.2.Market Attractiveness Index, By Crop

- 9.2.Grains and Cereals

- 9.2.1.Introduction

- 9.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3.Fruits and Vegetables

- 9.4.Cash Crops

- 9.5.Landscape and Gardening

10.By Nutrient Content

- 10.1.Introduction

- 10.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Nutrient Content

- 10.1.2.Market Attractiveness Index, By Nutrient Content

- 10.2.NPK Fertilizers

- 10.2.1.Introduction

- 10.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3.Single-Nutrient Fertilizers

11.By Packaging

- 11.1.Introduction

- 11.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Packaging

- 11.1.2.Market Attractiveness Index, By Packaging

- 11.2.Cartons

- 11.2.1.Introduction

- 11.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 11.3.Bags

- 11.4.Can/bottle

- 11.5.Others

12.By Distribution Channel

- 12.1.Introduction

- 12.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 12.1.2.Market Attractiveness Index, By Distribution Channel

- 12.2.Fertilizer Stores

- 12.2.1.Introduction

- 12.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 12.3.Online Retail

- 12.4.Others

13.By Region

- 13.1.Introduction

- 13.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 13.1.2.Market Attractiveness Index, By Region

- 13.2.North America

- 13.2.1.Introduction

- 13.2.2.Key Region-Specific Dynamics

- 13.2.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Ingredients

- 13.2.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 13.2.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Crop

- 13.2.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Nutrient Content

- 13.2.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By Packaging

- 13.2.8.Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 13.2.9.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 13.2.9.1.U.S.

- 13.2.9.2.Canada

- 13.2.9.3.Mexico

- 13.3.Europe

- 13.3.1.Introduction

- 13.3.2.Key Region-Specific Dynamics

- 13.3.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Ingredients

- 13.3.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 13.3.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Crop

- 13.3.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Nutrient Content

- 13.3.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By Packaging

- 13.3.8.Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 13.3.9.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 13.3.9.1.Germany

- 13.3.9.2.U.K.

- 13.3.9.3.France

- 13.3.9.4.Italy

- 13.3.9.5.Spain

- 13.3.9.6.Rest of Europe

- 13.4.South America

- 13.4.1.Introduction

- 13.4.2.Key Region-Specific Dynamics

- 13.4.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Ingredients

- 13.4.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 13.4.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Crop

- 13.4.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Nutrient Content

- 13.4.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By Packaging

- 13.4.8.Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 13.4.9.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 13.4.9.1.Brazil

- 13.4.9.2.Argentina

- 13.4.9.3.Rest of South America

- 13.5.Asia-Pacific

- 13.5.1.Introduction

- 13.5.2.Key Region-Specific Dynamics

- 13.5.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Ingredients

- 13.5.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 13.5.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Crop

- 13.5.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Nutrient Content

- 13.5.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By Packaging

- 13.5.8.Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 13.5.9.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 13.5.9.1.China

- 13.5.9.2.India

- 13.5.9.3.Japan

- 13.5.9.4.Australia

- 13.5.9.5.Rest of Asia-Pacific

- 13.6.Middle East and Africa

- 13.6.1.Introduction

- 13.6.2.Key Region-Specific Dynamics

- 13.6.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Ingredients

- 13.6.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 13.6.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Crop

- 13.6.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Nutrient Content

- 13.6.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By Packaging

- 13.6.8.Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

14.Competitive Landscape

- 14.1.Competitive Scenario

- 14.2.Market Positioning/Share Analysis

- 14.3.Mergers and Acquisitions Analysis

15.Company Profiles

- 15.1.Yara International ASA

- 15.1.1.Company Overview

- 15.1.2.Product Portfolio and Description

- 15.1.3.Financial Overview

- 15.1.4.Key Developments

- 15.2.ICL Group

- 15.3.COMPO EXPERT GmbH

- 15.4.Hello Nature International Srl

- 15.5.Quimicas Meristem, S.L.

- 15.6.ILSA S.p.A.

- 15.7.Unisalver Organomineral Liquid Fertilizer Products

- 15.8.SEIPASA, S.A.

- 15.9.Anorel NV.

- 15.10.Harmony Ecotech Pvt. Ltd

LIST NOT EXHAUSTIVE

16.Appendix

- 16.1.About Us and Services

- 16.2.Contact Us