|

|

市場調査レポート

商品コード

1455793

ペットフード用クリル(オキアミ)の世界市場-2023年~2030年Global Krill for Pet Food Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ペットフード用クリル(オキアミ)の世界市場-2023年~2030年 |

|

出版日: 2024年03月26日

発行: DataM Intelligence

ページ情報: 英文 186 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

世界のペットフード用クリル(オキアミ)市場は、2022年に4億1,020万米ドルに達し、2023-2030年の予測期間中に11.8%のCAGRで成長し、2030年までに10億120万米ドルに達すると予測されています。

ペットの健康とウェルネスへの関心の高まりは、世界のペットフード用クリル市場成長の主要動向として作用しています。ペットの飼い主はペットの栄養に対する意識が高まっており、ペットフードに高品質で天然材料を求めるようになっています。クリルはオメガ3脂肪酸、抗酸化物質、その他の栄養素を豊富に含み、ペットフードの高級食材として人気を集めています。この動向は、消費者がペットの全体的な健康と幸福をサポートする選択肢を求めているため、クリルベースのペットフード製品の需要を牽引しています。

2021年10月、Vital Pet Lifeは、犬や猫の関節の健康をサポートする機能性粉末製品「モビリティデイリージョイントサプリメント」を発売しました。Vital Pet Lifeが考案した4つのユニークな成分、アルファルファプロテイン、クリルのプリスティンエキス、オーガニックフラックスシード、ニュージーランド産緑イ貝が配合されています。

犬の飼育数が多く、栄養豊富なプレミアムペットフードの需要が高まっているため、市場シェアの半分以上を犬が占めています。同様に、アジア太平洋地域はペットフード用クリル市場を独占しており、高品質で持続可能なペット栄養製品に対する需要が急増していることから、最大の市場シェアを獲得しています。

ダイナミクス

ペットの所有率と支出の増加

米国ペット用品協会の2021-2022年全国ペット所有者調査によると、約9,050万世帯、すなわち米国世帯の70%がペットを所有しています(APPA)。米国におけるペット分野への支出は全体で1,236億米ドルに達し、2020年の1,036億米ドルから19%増加しました。ペット所有者は、ペットの健康と幸福を確保するため、優れた栄養効果を提供するプレミアムペットフードに投資する傾向が強まっています。

クリルベースのペットフードは、オメガ3脂肪酸、特にペットの最適な被毛の健康、関節機能、全体的な活力を促進することが知られているEPAとDHAを豊富に含んでいるため、この競合情勢の中で際立っています。さらに、消費者の健康志向や環境意識が高まるにつれて、ペットフードを選ぶ際に自然で持続可能な原材料を積極的に求めるようになっています。

ペットのオメガ3への注目

オメガ3系、特にEPAとDHAは、皮膚や被毛の状態、関節の可動性、認知機能など、ペットの健康のさまざまな側面を促進する上で重要な役割を果たしています。クリルはこれらの必須脂肪酸の優れた供給源であり、生物学的利用能が高く消化しやすい形態で、ペットに最大限の効果をもたらします。消費者がペットフードの栄養成分をますます優先するようになるにつれ、ペットの食事にオメガ3系を取り入れることの重要性が認識されるようになっています。

2023年5月、QRILL Petの親会社であるAker BioMarine社とスウェーデン農業科学大学の研究者が共同で、クリルミールとフィッシュミールを比較し、アラスカンハスキーにおける様々なオメガ3脂肪酸源の有効性を評価しました。QRILL Pet社によると、調査チームが測定したオメガ3レベルの初期平均値は1.3%で、これは低くてもペットの典型的な値でした。

QRILL Pet社によれば、クリルミール食がアラスカンハスキーのオメガ3レベルを最も高めることに成功したというのが、この研究の結論です。試験後、QRILL Pet NUTRI Plusを給与した試験群では、オメガ3が平均2.4%増加しました。試験前の値と比較すると、クリルミール群では99.7%の上昇となりました。

持続可能性への懸念

クリルの個体数は有限であり、海洋生態系における重要な役割を担っていることから、持続可能性への懸念が世界のペットフード用クリル市場の成長を抑制しています。クリルの乱獲は海洋食物網の微妙なバランスを崩し、さまざまな海洋生物種や生態系に影響を与える可能性があります。消費者の環境問題に対する意識が高まるにつれ、ペットフードの生産において持続可能な調達方法を求める声が高まっています。

規制機関は持続可能な管理方法を確保するため、クリル漁に対してより厳しいガイドラインを導入しており、ペットフードメーカーが入手できるクリルは制限されています。2024年2月、クリル業界の有害な慣行と闘うため、Sea Shepherdが世界のマーケティングキャンペーンの第一弾を開始しました。

目次

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- ペットの所有率と支出の増加

- ペットにおけるオメガ3への注目

- 抑制要因

- 持続可能性への懸念

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 製品別

- クリルミール

- クリルオイル

- クリルトリーツ

- その他

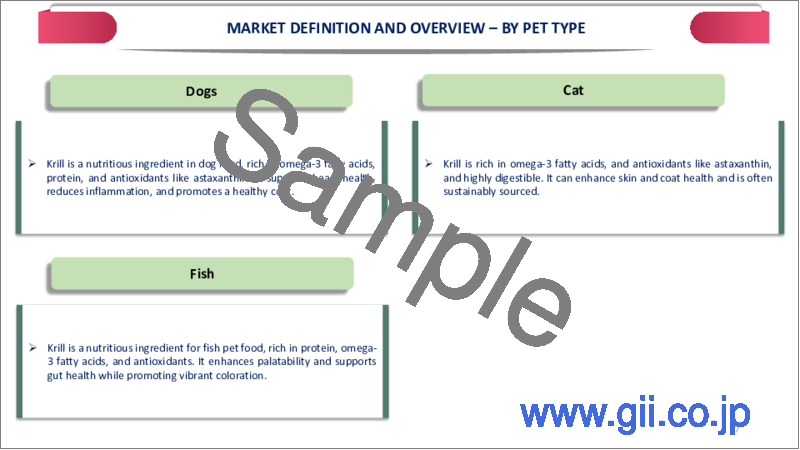

第8章 ペットタイプ別

- 犬

- 猫

- 魚

- その他

第9章 流通チャネル別

- スーパーマーケット/ハイパーマーケット

- ペット専門店

- 動物病院

- eコマース

- その他

第10章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第11章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第12章 企業プロファイル

- Aker BioMarine

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Rimfrost AS

- Kessler Zoologiewholesale GmbH & Co. KG

- Qingdao Antarctic Weikang Biotechnology Co., Ltd.

- LazyPet Foods

- GRIZZLY PET PRODUCTS

- BEWITAL petfood GmbH & Co.KG

- Hikari Sales USA, Inc.

- Northfin Fish Food

- San Francisco Bay Brand, Inc.

第13章 付録

Overview

Global Krill for Pet Food Market reached US$ 410.2 million in 2022 and is expected to reach US$ 1,001.2 million by 2030, growing with a CAGR of 11.8% during the forecast period 2023-2030.

The increasing focus on pet health and wellness acts as a key trend for global krill for pet food market growth. Pet owners are becoming more conscious of their pet's nutrition and are seeking high-quality, natural ingredients in their pet food. Krill, being rich in omega-3 fatty acids, antioxidants, and other nutrients, is gaining popularity as a premium ingredient in pet food formulations. This trend is driving the demand for krill-based pet food products as consumers seek out options that support their pets' overall health and well-being.

In October 2021, Vital Pet Life introduced the Mobility Daily Joint Supplement product, a functional powder that supports the health of dogs' and cats' joints. Four unique ingredients, designed by Vital Pet Life, are included in the product's formulation: alfalfa protein, krill pristine extract, organic flaxseed, and New Zealand green-lipped mussels.

Dogs account for over half of the market share due to their large population and increasing demand for premium, nutrient-rich pet food options. Similarly, the Asia-Pacific dominates the Krill for Pet Food market, capturing the largest market share due to due to its burgeoning demand for high-quality and sustainable pet nutrition products.

Dynamics

Rising Pet Ownership and Expenditure

According to the American Pet Products Association's 2021-2022 National Pet Owners Survey, about 90.5 million families, or 70% of American households, are pet owners (APPA). Spending on the pet sector in the United States came to $123.6 billion overall, a 19% increase from $103.6 billion in 2020. Pet owners are increasingly inclined to invest in premium pet foods that offer superior nutritional benefits to ensure the health and well-being of their furry companions.

Krill-based pet foods stand out in this competitive landscape due to their rich content of omega-3 fatty acids, particularly EPA and DHA, which are known to promote optimal coat health, joint function, and overall vitality in pets. Moreover, as consumers become more health-conscious and environmentally aware, they are actively seeking out natural and sustainable ingredients in their pet food choices.

Focus on Omega-3s in Pet

Omega-3s, particularly EPA and DHA, play crucial roles in promoting various aspects of pet health, including skin and coat condition, joint mobility, and cognitive function. Krill serves as an excellent source of these essential fatty acids, offering a bioavailable and easily digestible form that maximizes their benefits for pets. As consumers increasingly prioritize the nutritional content of pet foods, there's a growing recognition of the importance of incorporating omega-3s into their pets' diets.

In May 2023, the parent firm of QRILL Pet, Aker BioMarine, and researchers from the Swedish University of Agricultural Sciences collaborated to compare krill meal to fish meal to assess the efficacy of various sources of Omega 3 fatty acids in Alaskan Huskies. According to QRILL Pet, the initial average of the researchers' measured Omega 3 levels was 1.3%, which is low but typical in pets.

According to QRILL Pet, the study's conclusive findings showed that the krill meal diet was the most successful in increasing the levels of Omega 3 in Alaskan Huskies. After the trial, the test group fed QRILL Pet NUTRI Plus had an average of 2.4% in Omega 3. In comparison to pre-trial values, this represented a 99.7% rise for the krill meal group.

Sustainability Concerns

Sustainability concerns are restraining global krill for pet food market growth due to the finite nature of krill populations and their crucial role in marine ecosystems. Overfishing of krill can disrupt the delicate balance of oceanic food webs, impacting various marine species and ecosystems. As consumers become increasingly aware of environmental issues, there's a growing demand for sustainable sourcing practices in pet food production.

Regulatory bodies are implementing stricter guidelines on krill fishing to ensure sustainable management practices, limiting the availability of krill for pet food manufacturers. In February 2024, to combat the harmful practices of the krill industry, Sea Shepherd launched the first part of a global marketing campaign. To map the industry and assist customers in identifying the companies most involved in krill exploitation, the business initiated a grassroots inquiry.

Segment Analysis

The global krill for pet food market is segmented based on product, pet type, distribution channel and region.

Large Population of Dogs in Pet

Dogs comprise a significant portion of the pet population worldwide, leading to a higher demand for pet food products. According to the 2021-2022 National Pet Owners Survey conducted by the American Pet Products Association (APPA), from 90.5 million families having pets, 69 million have dong as a pet. This large demographic provides a considerable consumer base for krill-based pet food products.

Furthermore, dogs' dietary requirements align well with the nutritional benefits offered by krill. Krill is an excellent source of omega-3 fatty acids, particularly EPA and DHA, which are crucial for supporting dogs' overall health, including their coat, skin, joint, and cognitive functions. As pet owners become increasingly conscious of their pets' health and seek premium nutrition options, the demand for krill-based dog food rises correspondingly

Geographical Penetration

Increasing Pet Food Industry in North America

North America's pet food industry is highly developed and continuously seeks innovative ingredients to meet the evolving demands of pet owners. According to the American Pet Products Association (APPA), in 2022, the United States spent $136.8 billion on pets and from that $58.1 billion was spent on pet food and treats. In this large pet food industry, krill has gained recognition for its nutritional benefits, particularly its high omega-3 fatty acid content, which is essential for pets' overall health and well-being.

Secondly, North American consumers are increasingly aware of the importance of natural and sustainable ingredients in pet food, and krill fits these criteria well. Its sustainable harvesting methods and minimal environmental impact appeal to environmentally conscious consumers. Additionally, the region's affluent demographic, coupled with a growing trend toward premium pet food products, further boosts the demand for krill-based pet foods

COVID-19 Impact Analysis

Initially, disruptions in supply chains due to lockdown measures and restrictions on movement hindered the harvesting and distribution of krill, leading to shortages in raw materials for pet food production. This resulted in fluctuations in the availability of krill-based pet food products and subsequently affected consumer demand. Additionally, economic uncertainties stemming from the pandemic led to changes in consumer spending habits, with many prioritizing essential items over premium pet food options.

Consequently, there was a temporary decline in the demand for krill-based pet food products as consumers opted for more affordable alternatives. However, as the pandemic progressed and people spent more time at home with their pets, there was a noticeable shift towards premium and healthier pet food options, including those containing krill. This trend was driven by a growing awareness of the nutritional benefits of krill and an increased focus on pet health and wellness.

Russia-Ukraine War Impact Analysis

The Russia-Ukraine war had a notable impact on the global krill for pet food market growth, primarily due to its effect on the fishing industry in the region. The conflict has disrupted fishing activities, leading to a decrease in krill supply from these areas. As a result, there were shortages in raw materials for pet food production, particularly for companies sourcing krill from the affected regions. This disruption created challenges for pet food manufacturers reliant on a steady supply of krill, potentially leading to increased costs and supply chain uncertainties.

By Product

- Krill Meal

- Krill Oil

- Krill Treats

- Others

By Pet Type

- Dogs

- Cats

- Fish

- Other

By Distribution Channel:

- Supermarkets/Hypermarkets

- Specialty Pet Stores

- Veterinary Clinics

- E-Commerce

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In April 2021, Aker BioMarine a biotech innovator and Antarctic krill-harvesting company, announced the expansion into six new contracts and strategic alliances to fortify its position in the pet food and supplement industry in Asia. With this, krill meal from Aker BioMarine will be a significant component of high-end pet food in China.

- In May 2022, For the distinctive line of pet krill products, Rimfrost invested in R&D, sales, and marketing.

- In December 2023, Real Mushrooms, a company that specializes in food, health, and supplement products based on mushrooms, announced the debut of Daily Dawg, a new multipurpose dog supplement with numerous health advantages. Herbal adaptogens, probiotics, seaweed, phytoplankton, krill, lignans, antioxidants, and fatty acids are also included in the supplement formulation.

- In April 2022, We are NDependent, a pet treat company, introduced its new Sticks line of dog treats. The ingredients of the treats include sweet potatoes, dandelion leaf, cinnamon, goat's milk, beef tripe, duck eggs, and krill, among other things.

Competitive Landscape

The major global players in the market include Aker BioMarine, Rimfrost AS, Kessler Zoologiewholesale GmbH & Co. KG, Qingdao Antarctic Weikang Biotechnology Co., Ltd., LazyPet Foods, GRIZZLY PET PRODUCTS, BEWITAL petfood GmbH & Co.KG, Hikari Sales USA, Inc., Northfin Fish Food, San Francisco Bay Brand, Inc.

Why Purchase the Report?

- To visualize the global krill for pet food market segmentation based on product, pet type, distribution channel and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of krill for pet food market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

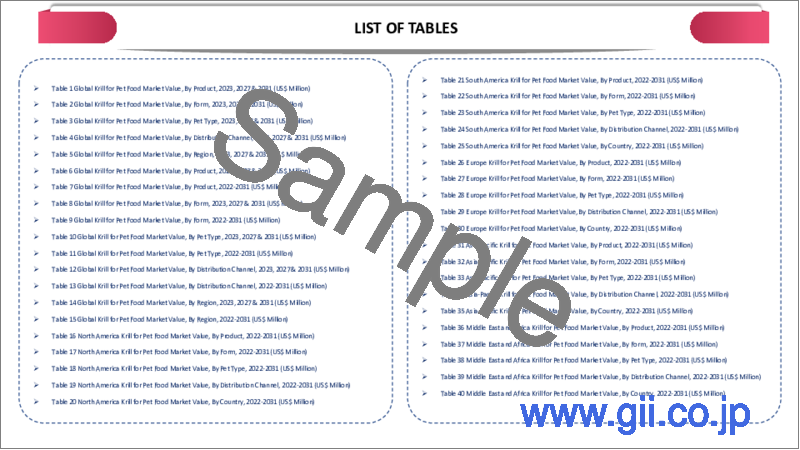

The global krill for pet food market report would provide approximately 62 tables, 56 figures and 186 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

Table of Contents

1.Methodology and Scope

- 1.1.Research Methodology

- 1.2.Research Objective and Scope of the Report

2.Definition and Overview

3.Executive Summary

- 3.1.Snippet by Product

- 3.2.Snippet by Pet Type

- 3.3.Snippet by Distribution Channel

- 3.4.Snippet by Region

4.Dynamics

- 4.1.Impacting Factors

- 4.1.1.Drivers

- 4.1.1.1.Rising Pet Ownership and Expenditure

- 4.1.1.2.Focus on Omega-3s in Pet

- 4.1.2.Restraints

- 4.1.2.1.Sustainability Concerns

- 4.1.3.Opportunity

- 4.1.4.Impact Analysis

- 4.1.1.Drivers

5.Industry Analysis

- 5.1.Porter's Five Force Analysis

- 5.2.Supply Chain Analysis

- 5.3.Pricing Analysis

- 5.4.Regulatory Analysis

- 5.5.Russia-Ukraine War Impact Analysis

- 5.6.DMI Opinion

6.COVID-19 Analysis

- 6.1.Analysis of COVID-19

- 6.1.1.Scenario Before COVID

- 6.1.2.Scenario During COVID

- 6.1.3.Scenario Post COVID

- 6.2.Pricing Dynamics Amid COVID-19

- 6.3.Demand-Supply Spectrum

- 6.4.Government Initiatives Related to the Market During Pandemic

- 6.5.Manufacturers Strategic Initiatives

- 6.6.Conclusion

7.By Product

- 7.1.Introduction

- 7.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 7.1.2.Market Attractiveness Index, By Product

- 7.2.Krill Meal *

- 7.2.1.Introduction

- 7.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3.Krill Oil

- 7.4.Krill Treats

- 7.5.Others

8.By Pet Type

- 8.1.Introduction

- 8.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Pet Type

- 8.1.2.Market Attractiveness Index, By Pet Type

- 8.2.Dogs*

- 8.2.1.Introduction

- 8.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3.Cats

- 8.4.Fish

- 8.5.Other

9.By Distribution Channel

- 9.1.Introduction

- 9.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 9.1.2.Market Attractiveness Index, By Distribution Channel

- 9.2.Supermarkets/Hypermarkets *

- 9.2.1.Introduction

- 9.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3.Specialty Pet Stores

- 9.4.Veterinary Clinics

- 9.5.E-Commerce

- 9.6.Others

10.By Region

- 10.1.Introduction

- 10.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 10.1.2.Market Attractiveness Index, By Region

- 10.2.North America

- 10.2.1.Introduction

- 10.2.2.Key Region-Specific Dynamics

- 10.2.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.2.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Pet Type

- 10.2.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.2.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.2.6.1.U.S.

- 10.2.6.2.Canada

- 10.2.6.3.Mexico

- 10.3.Europe

- 10.3.1.Introduction

- 10.3.2.Key Region-Specific Dynamics

- 10.3.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.3.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Pet Type

- 10.3.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 10.3.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.3.6.1.Germany

- 10.3.6.2.UK

- 10.3.6.3.France

- 10.3.6.4.Italy

- 10.3.6.5.Russia

- 10.3.6.6.Rest of Europe

- 10.4.South America

- 10.4.1.Introduction

- 10.4.2.Key Region-Specific Dynamics

- 10.4.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.4.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Pet Type

- 10.4.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 10.4.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.4.6.1.Brazil

- 10.4.6.2.Argentina

- 10.4.6.3.Rest of South America

- 10.5.Asia-Pacific

- 10.5.1.Introduction

- 10.5.2.Key Region-Specific Dynamics

- 10.5.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.5.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Pet Type

- 10.5.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 10.5.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.5.6.1.China

- 10.5.6.2.India

- 10.5.6.3.Japan

- 10.5.6.4.Australia

- 10.5.6.5.Rest of Asia-Pacific

- 10.6.Middle East and Africa

- 10.6.1.Introduction

- 10.6.2.Key Region-Specific Dynamics

- 10.6.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.6.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Pet Type

- 10.6.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

11.Competitive Landscape

- 11.1.Competitive Scenario

- 11.2.Market Positioning/Share Analysis

- 11.3.Mergers and Acquisitions Analysis

12.Company Profiles

- 12.1.Aker BioMarine *

- 12.1.1.Company Overview

- 12.1.2.Product Portfolio and Description

- 12.1.3.Financial Overview

- 12.1.4.Key Developments

- 12.2.Rimfrost AS

- 12.3.Kessler Zoologiewholesale GmbH & Co. KG

- 12.4.Qingdao Antarctic Weikang Biotechnology Co., Ltd.

- 12.5.LazyPet Foods

- 12.6.GRIZZLY PET PRODUCTS

- 12.7.BEWITAL petfood GmbH & Co.KG

- 12.8.Hikari Sales USA, Inc.

- 12.9.Northfin Fish Food

- 12.10.San Francisco Bay Brand, Inc.

LIST NOT EXHAUSTIVE

13.Appendix

- 13.1.About Us and Services

- 13.2.Contact Us