|

|

市場調査レポート

商品コード

1448032

種子検査市場:2023年~2030年Seed testing market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 種子検査市場:2023年~2030年 |

|

出版日: 2024年03月08日

発行: DataM Intelligence

ページ情報: 英文 186 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

世界の種子検査市場は、2022年に8億10万米ドルに達し、2023-2030年の予測期間中にCAGR 6.2%で成長し、2030年には12億9,950万米ドルに達すると予測されています。

農家と農業利害関係者は、最適な作物収量と収益性を達成する上で種子の品質が重要であるとの認識を強めています。その結果、発芽率、純度、含水率、種子の健康状態などの要因を評価するための種子検査が重視されるようになっています。また、農業の拡大により、多様な作物の種子需要が増加しています。そのため、品質基準を維持し、市場の需要に応えるための種子検査サービスの必要性が高まっています。

技術の進歩は種子検査法に革命をもたらしました。2022年11月、森林遺伝樹木育種研究所(IFGTB)のENVISセンターは、リアルタイムの対話型スマートフォンアプリケーション「森林種子の科学と技術」を発表しました。アンドロイドベースのこのソフトウェアは、種子の収集、加工、保管、試験、休眠打破、対応する種の発芽を改善するための様々な種子処理技術に関する包括的な情報を提供します。

発芽試験は、種子の生存率と品質を評価する上で極めて重要な役割を果たすため、市場シェアの半分以上を占めています。同様に、北米は種子検査市場を独占しており、先進的な農業インフラ、厳格な規制基準、革新的な種子検査技術の広範な採用により、最大の市場シェアを獲得しています。

ダイナミクス

高品質の種子と作物に対する需要の増加

世界人口の拡大が続く中、農業生産性を向上させ、食糧安全保障を確保する必要性が高まっています。収量性、耐病性、干ばつ耐性、栄養価の向上など、望ましい形質を備えた高品質の種子は、こうした目標を達成するために不可欠です。種子検査は、植え付け前の種子の品質、純度、生存性を確保する上で重要な役割を果たします。

発芽率、種子の健康状態、遺伝的純度、病原菌や汚染物質の有無などの要素を評価することで、種子検査は劣悪な種子や欠陥のある種子を特定し、排除するのに役立ちます。2023年8月、ナイジェリアのアブジャ連邦政府は、国家農業種子評議会(NASC)に改良型中央種子検査所(CSTL)を導入しました。最新鋭の機械が導入され、国際水準に近代化されました。

種子検査施設に対する種子メーカーの投資増加

種子メーカーによる種子検査施設への投資の増加は、種子検査市場成長の重要な促進要因です。高品質の種子に対する需要の高まりと、厳格な規制基準への適合を確保する必要性から、種子メーカーは種子検査能力の強化にますます力を入れるようになっています。最先端の種子検査施設への投資により、メーカーは種子の品質、純度、生存率について包括的な分析を行うことができます。

2022年7月、Syngenta はアイダホ州ナンパに真新しい世界野菜種子品質管理ラボを開設し、100人の訪問者を迎えました。この施設は、2019年にこの場所に設立された3,000万米ドルの形質転換アクセラレーターを基盤としており、世界な種子の健全性に1,500万米ドルを投資したものです。近代的な閉鎖環境育成室と精密検査は、野菜種子の顧客と世界中の野菜ビジネスのために種子の健全性を向上させる37,000平方フィートの品質管理施設の側面です。

高額な初期投資と標準化の欠如

種子検査施設の設立には、水分計、発芽室、種子カウンター、純度分析器などの専門機器への多額の投資が必要です。新規参入企業や小規模の種子検査所にとって、このような機器の取得や維持にかかるコストは法外なものとなる可能性があります。機器費用に加え、種子検査施設の設立には、実験室スペース、空調管理された保管施設、ユーティリティなどのインフラへの投資が必要となります。

規制基準を満たすための試験所施設の建設や改修は、必要な初期投資に追加されます。さらに、種子検査方法やプロトコルは国や地域によって異なる場合があり、検査結果に一貫性がなく、種子の品質基準の調和が妨げられます。このような標準化の欠如は、複数の市場で事業を展開する種苗会社に課題をもたらす可能性があります。

目次

目次

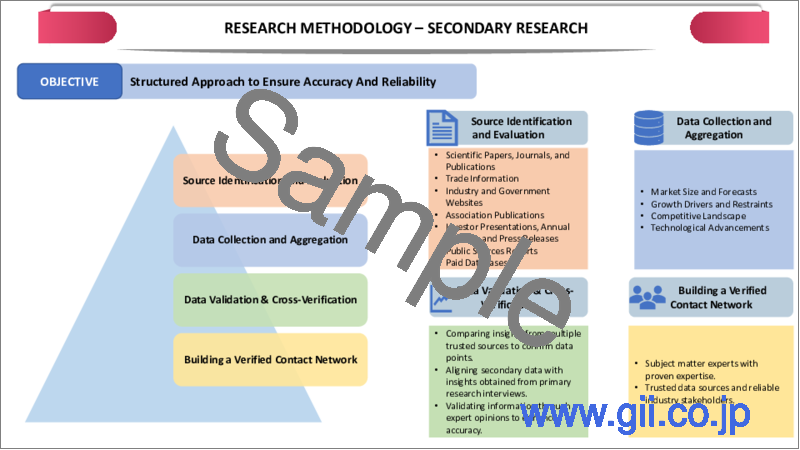

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 高品質の種子と作物に対する需要の増加

- 種子メーカーによる種子検査施設への投資の増加

- 抑制要因

- 初期投資の高さと標準化の欠如

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 検査タイプ別

- 発芽試験

- 出現回数

- 活力試験

- 水分試験

- 種子数

- 純度試験

- その他

第8章 サービスタイプ別

- オフサイト

- オンサイト

第9章 種子タイプ別

- 穀物種子

- 野菜種子

- 花の種

第10章 エンドユーザー別

- 種子メーカー

- 政府機関

- 研究機関

- その他

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第12章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 企業プロファイル

- SGS Societe Generale de Surveillance SA

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- AMM Seed Testing, Inc.

- /20 Seed Labs Inc.

- Eurofins Scientific

- PGRO

- SoDak Labs, Inc.

- CSP Labs

- RANSOM SEED LABORATORY, INC.

- Intertek Group plc

- Lifeasible

第14章 付録

Overview

Global Seed Testing Market reached US$ 800.1 million in 2022 and is expected to reach US$ 1,299.5 million by 2030, growing with a CAGR of 6.2% during the forecast period 2023-2030.

Farmers and agricultural stakeholders are becoming increasingly aware of the importance of seed quality in achieving optimal crop yields and profitability. As a result, there is a growing emphasis on seed testing to assess factors such as germination rate, purity, moisture content, and seed health. The expanding agriculture industry has also led to increased demand for seeds across diverse crop types. This, in turn, fuels the need for seed testing services to maintain quality standards and meet market demands.

Advances in technology have revolutionized seed testing methods. In November 2022, the ENVIS Centre of the Institute of Forest Genetics and Tree Breeding (IFGTB), introduced "Forest Seed Science and Technology," a real-time, interactive smartphone application. The Android-based software provides comprehensive information on seed collecting, processing, storage, testing, breaking dormancy, and various seed treatment techniques to improve the germination of the corresponding species.

Germination test accounts for over half of the market share due to its pivotal role in assessing seed viability and quality. Similarly, North America dominates the seed testing market, capturing the largest market share due to its advanced agricultural infrastructure, stringent regulatory standards, and widespread adoption of innovative seed testing technologies.

Dynamics

Increasing Demand for High-Quality Seeds & Crops

As the global population continues to expand, there is a growing need to enhance agricultural productivity and ensure food security. High-quality seeds with desirable traits such as improved yield potential, disease resistance, drought tolerance, and nutritional value are essential for achieving these objectives. Seed testing plays a crucial role in ensuring the quality, purity, and viability of seeds before they are planted.

By assessing factors such as germination rate, seed health, genetic purity, and the presence of pathogens or contaminants, seed testing helps identify and eliminate inferior or defective seeds. In August 2023, the Federal Government of Abuja, Nigeria, introduced the upgraded Central Seed Testing Laboratory (CSTL) in the National Agricultural Seeds Council(NASC). With cutting-edge machinery, it has been modernized to an international standard.

Increasing Investment by Seed Manufacturers in Seed Testing Facilities

Increasing investment by seed manufacturers in seed testing facilities is a significant driver for the growth of the seed testing market. With the rising demand for high-quality seeds and the need to ensure compliance with stringent regulatory standards, seed manufacturers are increasingly focusing on enhancing their seed testing capabilities. Investments in state-of-the-art seed testing facilities allow manufacturers to conduct comprehensive analyses of seed quality, purity, and viability.

In July 2022, Syngenta opened its brand-new Global Vegetable Seeds Quality Control Lab in Nampa, Idaho, to a hundred visitors. This facility builds on the $30 million Trait Conversion Accelerator that was established at the location in 2019 and represents a $15 million investment in global seed health. Modern confined environment growth rooms and precision testing are aspects of the 37,000-square-foot quality control facility that will improve seed health for clients of vegetable seed and the worldwide vegetable business.

High Initial Investment and Lack of Standardization

Setting up a seed testing facility requires substantial investment in specialized equipment such as moisture meters, germination chambers, seed counters, and purity analyzers. The cost of acquiring and maintaining this equipment can be prohibitive for new entrants or smaller seed testing laboratories. In addition to equipment costs, establishing a seed testing facility necessitates investment in infrastructure such as laboratory space, climate-controlled storage facilities, and utilities.

The construction or renovation of laboratory facilities to meet regulatory standards adds to the initial investment required. Additionally, seed testing methods and protocols may vary between countries or regions, leading to inconsistencies in test results and hindering the harmonization of seed quality standards. This lack of standardization can create challenges for seed companies operating in multiple markets.

Segment Analysis

The global seed testing market is segmented based on testing type, service type, seed type, end-user and region.

Germination Test's Pivotal Role in Assessing Seed Viability and Quality

Germination tests have the highest share in the seed testing market due to their fundamental importance in assessing seed viability and quality. Germination testing involves the process of planting seeds under controlled conditions to determine their ability to sprout and grow into healthy plants. This test is widely utilized by seed producers, distributors, and regulatory authorities to evaluate the performance and potential of seeds for planting purposes.

In May 2022, to assist farmers, AgroStar Quality Assurance Lab (AQAL) opened India's Largest Agri Advisory Centre and Seed & Fertilizer Quality Assurance Lab. The lab can perform seed testing under ISTA (International Seed Testing Association) guidelines. Tests such as the standard germination test, physical purity test, moisture test, relative humidity maintenance, temperature monitoring, and periodic germination sample monitoring will all be performed by AQAL. More than 150 seed germination and other tests have already been conducted in the seed lab.

Geographical Penetration

North America's Robust Agricultural Sector & Increasing Investments by Various Companies

North America holds the highest share of the seed testing market due to several factors driving its growth. One key factor is the region's strong agricultural sector, which demands high-quality seeds for crop production. Additionally, stringent regulations regarding seed quality and certification contribute to the demand for seed testing services. Moreover, increasing investments in research and development activities aimed at improving seed quality and crop yields drive the demand for seed testing services in the region.

In May 2021, SGS enhanced Seed Testing for Cross-Border Exports from North America. The International Seed Testing Association (ISTA) formally accredited both the SGS flagship US laboratory in Brookings, South Dakota, and its Sherwood Park, Alberta laboratory. These facilities now complement each other for seed testing and sampler services.

COVID-19 Impact Analysis

The market faced disruptions in the supply chain due to lockdowns, travel restrictions, and labor. The COVID-19 pandemic has disrupted the global economy and halted the key processes of almost all companies. Therefore, even the global seed testing market suffered due to it. The disturbances in supply chain management and transportation of goods and services restrained the growth of the market. Many testing units were disrupted due to the government-enforced lockdowns and curfews across the world which led to losses and wastage of many seed testing machines.

The pandemic also significantly changed consumer demand and behavior. Consumers refrained from purchasing non-essential products amid the pandemic. The uncertain and unexpected situation caused by the pandemic significantly impacted the market hence, slowing its growth. However, the post-pandemic scene has improved and the seed testing market has recovered. The market is set to grow at a high rate.

Russia-Ukraine War Impact Analysis

The Russia-Ukraine war has impacted the seed testing market by disrupting supply chains, causing uncertainty in trade relations, and leading to increased prices of agricultural inputs. With Ukraine being a major exporter of agricultural products, including seeds, the conflict has raised concerns about seed availability and quality assurance. Moreover, the instability in the region has led to a decline in investor confidence and agricultural investments, further impacting the seed testing market.

By Testing Type

- Germination Test

- Emergence Count

- Vigor Test

- Moisture Test

- Seed Count

- Purity Test

- Others

By Service Type

- Off-Site

- On-Site

By Seed Type

- Cereal Seeds

- Vegetable Seeds

- Flower Seeds

By End-User

- Seed Manufacturers

- Government Organizations

- Research Organizations

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In April 2022, the International Seed Testing Association (ISTA) announced the launch of www.seedtest.org, its new website. The updated, advanced, and more organized website reflects ISTA's superior work, skill, and experience in a relevant and enhanced design, extremely useful features, and easily navigable and significant information.

- In February 2022, the International Seed Testing Authority (ISTA) authorized the seed testing lab that the Telangana State Seed and Organic Certification Authority (TSSOCA) constructed in Rajendranagar, Telangana, under the Telangana International Seed Testing Authority (TISTA) name. It is the country's second public-sector seed lab to receive ISTA approval.

- In January 2021, Agdhi, a startup in the agriculture industry, announced the launch of a technology to evaluate seed quality that is based on artificial intelligence (AI). AI vision technology provides effective techniques for seed quality analysis and classification when combined with photometry, radiometry, and computer vision.

Competitive Landscape

The major global players in the market include SGS Societe Generale de Surveillance SA, AMM Seed Testing, Inc., 20/20 Seed Labs Inc., Eurofins Scientific, PGRO, SoDak Labs, Inc., CSP Labs, RANSOM SEED LABORATORY, INC., Intertek Group plc, Lifeasible

Why Purchase the Report?

- To visualize the global seed testing market segmentation based on testing type, service type, seed type, end-user and region as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of seed testing market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global Seed Testing market report would provide approximately 78 tables, 73 figures and 186 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

Table of Contents

1.Methodology and Scope

- 1.1.Research Methodology

- 1.2.Research Objective and Scope of the Report

2.Definition and Overview

3.Executive Summary

- 3.1.Snippet by Testing Type

- 3.2.Snippet by Service Type

- 3.3.Snippet by Seed Type

- 3.4.Snippet by End-User

- 3.5.Snippet by Region

4.Dynamics

- 4.1.Impacting Factors

- 4.1.1.Drivers

- 4.1.1.1.Increasing Demand for High-Quality Seeds & Crops

- 4.1.1.2.Increasing Investment by Seed Manufacturers in Seed Testing Facilities

- 4.1.2.Restraints

- 4.1.2.1.High Initial Investment and Lack of Standardization

- 4.1.3.Opportunity

- 4.1.4.Impact Analysis

- 4.1.1.Drivers

5.Industry Analysis

- 5.1.Porter's Five Force Analysis

- 5.2.Supply Chain Analysis

- 5.3.Pricing Analysis

- 5.4.Regulatory Analysis

- 5.5.Russia-Ukraine War Impact Analysis

- 5.6.DMI Opinion

6.COVID-19 Analysis

- 6.1.Analysis of COVID-19

- 6.1.1.Scenario Before COVID

- 6.1.2.Scenario During COVID

- 6.1.3.Scenario Post COVID

- 6.2.Pricing Dynamics Amid COVID-19

- 6.3.Demand-Supply Spectrum

- 6.4.Government Initiatives Related to the Market During Pandemic

- 6.5.Manufacturers Strategic Initiatives

- 6.6.Conclusion

7.By Testing Type

- 7.1.Introduction

- 7.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Testing Type

- 7.1.2.Market Attractiveness Index, By Testing Type

- 7.2.Germination Test*

- 7.2.1.Introduction

- 7.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3.Emergence Count

- 7.4.Vigor Test

- 7.5.Moisture Test

- 7.6.Seed Count

- 7.7.Purity Test

- 7.8.Others

8.By Service Type

- 8.1.Introduction

- 8.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Service Type

- 8.1.2.Market Attractiveness Index, By Service Type

- 8.2.Off-Site*

- 8.2.1.Introduction

- 8.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3.On-Site

9.By Seed Type

- 9.1.Introduction

- 9.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Seed Type

- 9.1.2.Market Attractiveness Index, By Seed Type

- 9.2.Cereal Seeds*

- 9.2.1.Introduction

- 9.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3.Vegetable Seeds

- 9.4.Flower Seeds

10.By End-User

- 10.1.Introduction

- 10.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.1.2.Market Attractiveness Index, By End-User

- 10.2.Seed Manufacturers *

- 10.2.1.Introduction

- 10.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3.Government Organizations

- 10.4.Research Organizations

- 10.5.Others

11.By Region

- 11.1.Introduction

- 11.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2.Market Attractiveness Index, By Region

- 11.2.North America

- 11.2.1.Introduction

- 11.2.2.Key Region-Specific Dynamics

- 11.2.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Testing Type

- 11.2.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Service Type

- 11.2.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Seed Type

- 11.2.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.2.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.7.1.U.S.

- 11.2.7.2.Canada

- 11.2.7.3.Mexico

- 11.3.Europe

- 11.3.1.Introduction

- 11.3.2.Key Region-Specific Dynamics

- 11.3.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Testing Type

- 11.3.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Service Type

- 11.3.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Seed Type

- 11.3.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.3.7.

- 11.3.8.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.8.1.Germany

- 11.3.8.2.UK

- 11.3.8.3.France

- 11.3.8.4.Italy

- 11.3.8.5.Russia

- 11.3.8.6.Rest of Europe

- 11.4.South America

- 11.4.1.Introduction

- 11.4.2.Key Region-Specific Dynamics

- 11.4.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Testing Type

- 11.4.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Service Type

- 11.4.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Seed Type

- 11.4.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.4.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.7.1.Brazil

- 11.4.7.2.Argentina

- 11.4.7.3.Rest of South America

- 11.5.Asia-Pacific

- 11.5.1.Introduction

- 11.5.2.Key Region-Specific Dynamics

- 11.5.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Testing Type

- 11.5.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Service Type

- 11.5.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Seed Type

- 11.5.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.5.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.7.1.China

- 11.5.7.2.India

- 11.5.7.3.Japan

- 11.5.7.4.Australia

- 11.5.7.5.Rest of Asia-Pacific

- 11.6.Middle East and Africa

- 11.6.1.Introduction

- 11.6.2.Key Region-Specific Dynamics

- 11.6.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Testing Type

- 11.6.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Service Type

- 11.6.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Seed Type

- 11.6.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

12.Competitive Landscape

- 12.1.Competitive Scenario

- 12.2.Market Positioning/Share Analysis

- 12.3.Mergers and Acquisitions Analysis

13.Company Profiles

- 13.1.SGS Societe Generale de Surveillance SA*

- 13.1.1.Company Overview

- 13.1.2.Product Portfolio and Description

- 13.1.3.Financial Overview

- 13.1.4.Key Developments

- 13.2.AMM Seed Testing, Inc.

- 13.3.20/20 Seed Labs Inc.

- 13.4.Eurofins Scientific

- 13.5.PGRO

- 13.6.SoDak Labs, Inc.

- 13.7.CSP Labs

- 13.8.RANSOM SEED LABORATORY, INC.

- 13.9.Intertek Group plc

- 13.10.Lifeasible

LIST NOT EXHAUSTIVE

14.Appendix

- 14.1.About Us and Services

- 14.2.Contact Us