|

|

市場調査レポート

商品コード

1423529

PETフィルムの世界市場:2024年~2031年Global PET Films Market - 2024-2031 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| PETフィルムの世界市場:2024年~2031年 |

|

出版日: 2024年02月09日

発行: DataM Intelligence

ページ情報: 英文 195 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

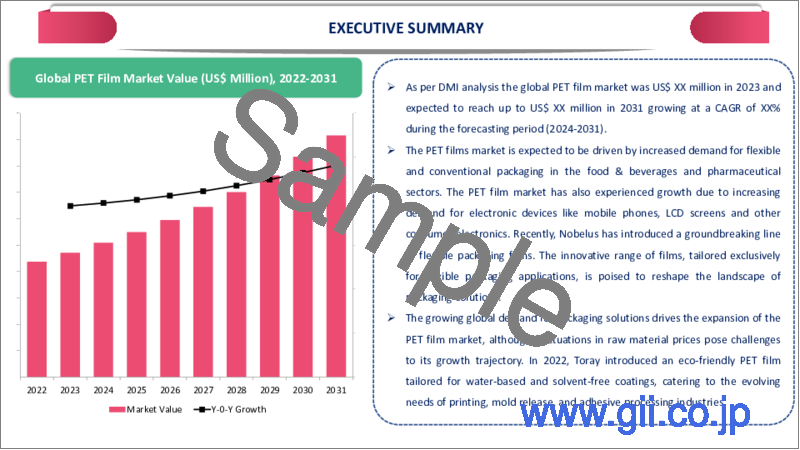

世界のPETフィルム市場は、2023年に431億米ドルに達し、2031年までに6,690万米ドルに達し、予測期間の2024年から2031年のCAGRは5.8%で成長すると予測されます。

PETフィルム市場は、食品・飲料や医薬品分野でのフレキシブル包装や従来型包装の需要増によって牽引されると予想されます。PETフィルム市場は、携帯電話、LCDスクリーン、その他の家電製品などの電子機器需要の増加によっても成長を遂げています。最近、Nobelusは画期的な軟包装用フィルムのラインナップを発表しました。軟包装用途に特化したこの革新的なフィルムシリーズは、包装ソリューションの展望を塗り替える勢いです。

アジア太平洋は、エレクトロニクスとパッケージング産業とともに成長するPETフィルムの最大市場です。中国やインドのような国々では、パッケージングセクターが著しい成長と変貌を遂げています。Invest Indiaによると、インドにおける包装資材の消費量は過去10年間で200%と大幅に増加しており、同地域の包装業界におけるPETフィルムの成長を後押ししています。

力学

技術の進歩

PETフィルム市場は、特にデジタル革命と情報革命の領域における継続的な技術革新と進歩に後押しされ、大幅な成長を遂げようとしています。ポリエステルフィルムの特徴的な特性と特性は、新しいフィルムと包装ソリューションの進化における重要なプレーヤーとなっています。ポリエステルフィルムは技術的な飛躍を促進する上で極めて重要な役割を果たし、数多くの最先端用途に適した選択肢としての地位を確立してきました。

2022年のPETフィルム市場では、注目すべき発展が顕著でした。例えばFrugalpacは、再生紙をベースにした材料と金属化PETパウチを組み合わせることで、環境に配慮した包装ソリューションを導入し、より軽量で環境に優しいボトルを実現しました。Sidelは、持続可能なディスペンシングスプレー包装をサポートすることを目的とした革新的なPETエアゾール容器デザイン、PressureSAFを発表しました。

さらに、PETフィルムとフレキシブル包装・プロセスに最先端技術を注入することで、生産方法を再構築し、より持続可能で効率的なものにしています。その代表的な例が、ALPLA Groupとオーストリアのミネラルウォーター市場の主要企業であるVoslauerとの共同作業です。両社は共同で、二酸化炭素排出量の削減とパッケージングの持続可能性の向上を目指した画期的なソリューションを導入しました。この共同作業の結果、二酸化炭素排出量を大幅に削減し、環境に優しい慣行を促進するよう設計された、新しいリターナブルPETボトルが開発されました。この事例は、PETフィルムの生産に先端技術を取り入れることで変革がもたらされ、より持続可能で環境に配慮した産業が育成されることを強調しています。

包装業界におけるPETフィルムの需要拡大

PETフィルム市場は、包装業界における需要の増加に牽引され、力強い成長を遂げています。この拡大は、PETフィルムの優れた特性と、市場の進化するニーズとの合致によるものです。持続可能で効率的な包装ソリューションに対する需要の急増は、製品の安全性と環境への配慮の両方に対応し、この上昇軌道を後押しする重要な要因となっています。

PETフィルムは、特にピスタチオ・ナッツのような重要な製品の品質と安全性を保持する上で、包装材料として好ましい選択肢として浮上してきました。パッケージングの分野では、PETのリサイクル性を向上させ、環境フットプリントを削減するという、注目すべき先進的な取り組みが行われてきました。その一例が、Buen Vatの画期的な取り組みで、750mLの金属化PETパウチを備えたボトル型板紙容器に詰められた世界初のテキーラを発売しました。この革新的なアプローチは、従来のパッケージング手法を見直し、持続可能な手法を取り入れることで、市場に大きなインパクトを与えました。包装業界において環境に優しいソリューションが強調され続けていることは、PETフィルムが持続可能性の目標を守りながら市場のダイナミックな要求に応える上で極めて重要な役割を果たしていることを強調しています。

炭素排出による環境効果

PETフィルム市場は、その生産、使用、廃棄を通じて環境に望ましくない影響を与えるため、抑制されると予想されます。EPAによると、ポリエチレンテレフタレートプラスチックの生産は大幅な炭素排出をもたらします。PETが1オンス生産されるごとに約1オンスの二酸化炭素が排出されます。つまり、PETを生産することは、環境に相当量の炭素を排出することになります。

PETを含むプラスチックの生産は、炭素排出のかなりの部分に寄与しています。世界全体では、年間約1億トンのプラスチックが消費されています。ボトル、容器、包装材などの製品によく使用されるPETに限って考えてみると、その生産過程では化石燃料の採掘と精製が行われています。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 技術の進歩

- 包装業界におけるPETフィルムの需要拡大

- 抑制要因

- 炭素排出による環境への影響

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

第6章 COVID-19分析

第7章 タイプ別

- 従来のPETフィルム

- シュリンクPETフィルム

- 等方性PETフィルム

- その他

第8章 厚み別

- 極薄フィルム(20ミクロン以下)

- 薄フィルム(20~50ミクロン)

- 厚フィルム(50ミクロン以上)

第9章 用途別

- 食品包装

- 海洋・航空

- 絶縁フィルム

- 電子・音響用途

第10章 エンドユーザー別

- 食品・飲料

- 電気・電子

- 医薬品

- 化粧品

- その他

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋

- 中東・アフリカ

第12章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 企業プロファイル

- CS Hyde Company

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 最近の動向

- Lumirror

- Polyplex Corporation Ltd.

- Hengli Group

- Jiangsu Yuxing Films Technology Co., Ltd.

- Sealed Air Corporation

- Avient Corporation

- DuPont

- UFLEX

- Xpro India Ltd.

第14章 付録

Overview

Global PET Films Market reached US$ 43.1 billion in 2023 and is expected to reach US$ 66.9 million by 2031, growing with a CAGR of 5.8% during the forecast period 2024-2031.

The PET films market is expected to be driven by increased demand for flexible and conventional packaging in the food & beverages and pharmaceutical sectors. The PET film market has also experienced growth due to increasing demand for electronic devices like mobile phones, LCD screens and other consumer electronics. Recently, Nobelus has introduced a groundbreaking line of flexible packaging films. The innovative range of films, tailored exclusively for flexible packaging applications, is poised to reshape the landscape of packaging solutions.

Asia-Pacific is the largest market in PET films rising with the electronics and packaging industry. Countries like China and India's packaging sector are experiencing significant growth and transformation. According to Invest India, the consumption of packaging materials in India has seen a significant increase of 200% over the past decade propelling the growth of PET films in the packaging industry in the region.

Dynamics

Technology Advancements

The PET film market is poised for substantial growth, propelled by continuous technological innovations and advancements, particularly in the realms of digital and information revolutions. The distinct characteristics and properties of polyester films make them key players in the evolving landscape of new films and packaging solutions. The films have played a pivotal role in fostering technological breakthroughs, establishing themselves as preferred options for a multitude of cutting-edge applications.

Significant strides were witnessed in the PET films market in 2022, exemplified by noteworthy developments. Frugalpac, for instance, introduced an environmentally conscious packaging solution by combining recycled paper-based material with a metalized PET pouch, resulting in a lighter and more eco-friendly bottle. Sidel introduced PressureSAF, an innovative PET aerosol container design aimed at supporting sustainable dispensing spray packaging.

Further the infusion of cutting-edge technology into PET films and flexible packaging processes is reshaping production methods, making them more sustainable and efficient. A prime example is the collaborative effort between ALPLA Group and Voslauer, a key player in Austria's mineral water market. Together, they introduced a groundbreaking solution aimed at reducing carbon emissions and enhancing sustainability in packaging. The joint effort resulted in the development of a new returnable PET bottle, designed to significantly decrease the carbon footprint and promote eco-friendly practices. The instance underscores the transformative impact of integrating advanced technology into PET film production, fostering a more sustainable and environmentally conscious industry.

Growing Demand for PET Films in the Packaging Industry

The PET film market is experiencing robust growth, driven by increasing demand within the packaging industry. The expansion is attributed to the exceptional properties of PET films and their alignment with the evolving needs of the market. The surge in demand for sustainable and efficient packaging solutions is a key factor propelling this upward trajectory, addressing both product safety and environmental considerations.

PET films have emerged as the preferred choice for packaging material, particularly in preserving the quality and safety of significant products such as pistachio nuts. The packaging sector has undergone notable advancements in improving PET recyclability and reducing its environmental footprint. An illustrative example is Buen Vato's groundbreaking initiative, introducing the world's first tequila packaged in a bottle-shaped paperboard container featuring a 750-mL metalized PET pouch. The innovative approach has made a substantial impact on the market by reimagining traditional packaging methods and embracing sustainable practices. The ongoing emphasis on eco-friendly solutions within the packaging industry underscores the pivotal role that PET films play in meeting the dynamic demands of the market while adhering to sustainability goals.

Environmental Effect through Carbon Emission

The PET film market is expected to be restrained by its undesirable environmental impacts through its production, use and disposal. According to EPA, the production of polyethylene terephthalate plastic results in significant carbon emissions. Approximately one ounce of carbon dioxide is emitted for each ounce of PET produced. The means that producing PET contributes a substantial amount of carbon emissions to the environment.

Plastic production, including PET, contributes to a significant portion of carbon emissions. globally, approximately 100 million tons of plastic are consumed annually. When we specifically consider PET, which is commonly used in products like bottles, containers and packaging materials, its production process involves the extraction and refining of fossil fuels The massive consumption further exacerbates the environmental impact of PET production due to the associated carbon emissions.

Segment Analysis

The global PET films market is segmented based on type, thickness, application, end-user and region.

Surging Demand for Shrink PET Films

Shrink PET film dominates the PET film market, occupying 2/3rd of the market owing to its distinctive properties and versatile applications. The polyethylene terephthalate (PET) Shrink film stands out by offering a compelling blend of high density and strength, making it a superior choice in the market. With a higher shrink percentage compared to PVC and OPS shrink films, PET Shrink film is increasingly favored for a wide range of packaging needs.

The Shrink film market is witnessing continuous innovation, exemplified by Gunze, a plastic films manufacturer, introducing an environmentally friendly heat-shrinkable film featuring recycled resin. Named GEOPLAS HCT3, this product utilizes a mass balance approach-based polystyrene/polyethylene terephthalate multi-layered design, incorporating 30% chemical recycled raw materials. Notably, GEOPLAS HCT3 maintains the same shrink appearance as products derived from petroleum, while simultaneously minimizing its environmental impact. The advancements underscore the dynamic nature of the Shrink PET film market, where innovation is driving sustainability and performance simultaneously.

Geographical Penetration

Asia-Pacific's Growing PET film Industry

Asia-Pacific stands as the predominant market for PET film, covering about 1/4th of the market and experiencing noteworthy growth driven by a confluence of factors. A pivotal driver of this expansion is the escalating demand within China's packaging industry. The increasing consumer preference for bottled packaged water, in alignment with a burgeoning focus on healthier lifestyles, further fuels the demand for PET film-based packaging solutions.

Moreover, the food industry emerges as a major consumer of packaging materials in China, commanding a substantial market share. As the landscape of the food packaging market undergoes transformation, there is a discernible surge in demand for innovative PET packaging solutions. The solutions aim to enhance food safety, prolong shelf life and offer convenient storage and transportation, addressing the evolving needs of a dynamic and growing market. The Asia-Pacific's PET film industry is thus not only witnessing impressive growth but also responding adeptly to the changing demands of key sectors within the region.

Competitive Landscape

The major global players include CS Hyde Company, Lumirror, Polyplex Corporation Ltd., Hengli Group, Jiangsu Yuxing Films Technology Co., Ltd., Sealed Air Corporation, Avient Corporation, DowDuPont, UFLEX and Xpro India Ltd.

COVID-19 Impact Analysis

COVID-19 pandemic has exerted a significant influence on the PET film market, presenting a mix of challenges and potential advantages. Supply chain disruptions and widespread trade implications have directly impacted the demand for PET film, stemming from reduced manufacturing capabilities and complexities in shipping processes.

In response to the challenges posed by COVID-19, companies have identified opportunities to introduce advanced products aimed at mitigating contamination risks within their offerings. An illustrative example is Ikonos Proficoat, which seized the moment during the pandemic to launch the PET series, featuring the innovative PET-250 film specifically designed for anti-COVID-19 protection. Leveraging PET's intrinsic physical characteristics, this film emerged as the ideal substrate for crafting antivirus protective items.

Russia-Ukraine War Impact

The ongoing conflict between Russia and Ukraine made a substantial and far-reaching effect on the PET film market, resulting in significant disruptions to the supply chain. The impact has been primarily attributed to economic sanctions imposed by Western countries in response to the conflict. The sanctions have caused disruptions across global supply chain.

In the short term, the effects on PET film manufacturing appear manageable. However, the prevailing uncertainty surrounding the duration of the conflict and its potential consequences for the costs of raw materials and supply chains could precipitate more profound disruptions in the years ahead. The market is navigating through a complex landscape shaped by geopolitical tensions, with implications for the production, distribution and overall stability of the PET film industry. Monitoring these developments will be crucial for stakeholders to adapt to the evolving circumstances and make informed decisions in an environment marked by geopolitical uncertainties.

- By Type

- Conventional PET Films

- Shrink PET Films

- Isotropic PET Films

- Others

- By Thickness

- Very Thin Films (Less than 20 Microns) *

- Thin Films (20 to 50 Microns)

- Thick Films (More than 50 Microns)

- By Application

- Packaging

- Imaging

- Lamination

- Others

- By End-User

- Food and Beverage

- Electrical and Electronics

- Pharmaceutical

- Cosmetics

- Others

- By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In February 2023, UFlex launched F-TFE Thermoformable BOPET mono or co-extruded transparent biaxially-oriented polyethylene terephthalate (BOPET) film, which is specifically designed for thermoforming applications that require depth formation.

- In August 2023, a prominent Dairy Product Company is set to introduce an all-polyethylene (PE) film pouch in China. Dow Chemical Company has announced a collaboration with Mengniu, a major dairy company in China, to launch an innovative yogurt pouch that is entirely made of polyethylene and designed for recyclability.

- In April 2023, ITC Savlon, a prominent FMCG company, introduced sustainable packaging for its soap products. The company revealed that its soap wrapper is now made using PET film containing 70% recycled material.

Why Purchase the Report?

- To visualize the global PET films market segmentation based on type, thickness, application, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of PET films market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global PET films market report would provide approximately 72 tables, 75 figures and 195 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Type

- 3.2. Snippet by Thickness

- 3.3. Snippet by Application

- 3.4. Snippet by End-User

- 3.5. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Technology Advancements

- 4.1.1.2. Growing Demand for PET Films in the Packaging Industry

- 4.1.2. Restraints

- 4.1.2.1. Environmental Effect Through Carbon Emission

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Conventional PET Films*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Shrink PET Films

- 7.4. Isotropic PET Films

- 7.5. Others

8. By Thickness

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Thickness

- 8.1.2. Market Attractiveness Index, By Thickness

- 8.2. Very Thin Films (Less than 20 Microns) *

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Thin Films (20 to 50 Microns)

- 8.4. Thick Films (More than 50 Microns

9. By Application

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.1.2. Market Attractiveness Index, By Application

- 9.2. Food Packaging

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Marine and Aviation

- 9.4. Insulating Film

- 9.5. Electronic and acoustic applications

10. By End-User

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.1.2. Market Attractiveness Index, By End-User

- 10.2. Food and Beverage

- 10.3. Electrical and Electronics

- 10.4. Pharmaceutical

- 10.5. Cosmetic

- 10.6. Others

11. By Region

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2. Market Attractiveness Index, By Region

- 11.2. North America

- 11.2.1. Introduction

- 11.2.2. Key Region-Specific Dynamics

- 11.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Thickness

- 11.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.7.1. U.S.

- 11.2.7.2. Canada

- 11.2.7.3. Mexico

- 11.3. Europe

- 11.3.1. Introduction

- 11.3.2. Key Region-Specific Dynamics

- 11.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Thickness

- 11.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.7.1. Germany

- 11.3.7.2. UK

- 11.3.7.3. France

- 11.3.7.4. Italy

- 11.3.7.5. Spain

- 11.3.7.6. Rest of Europe

- 11.4. South America

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 11.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Thickness

- 11.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.7.1. Brazil

- 11.4.7.2. Argentina

- 11.4.7.3. Rest of South America

- 11.5. Asia-Pacific

- 11.5.1. Introduction

- 11.5.2. Key Region-Specific Dynamics

- 11.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Thickness

- 11.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.7.1. China

- 11.5.7.2. India

- 11.5.7.3. Japan

- 11.5.7.4. Australia

- 11.5.7.5. Rest of Asia-Pacific

- 11.6. Middle East and Africa

- 11.6.1. Introduction

- 11.6.2. Key Region-Specific Dynamics

- 11.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Thickness

- 11.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

12. Competitive Landscape

- 12.1. Competitive Scenario

- 12.2. Market Positioning/Share Analysis

- 12.3. Mergers and Acquisitions Analysis

13. Company Profiles

- 13.1. CS Hyde Company *

- 13.1.1. Company Overview

- 13.1.2. Product Portfolio and Description

- 13.1.3. Financial Overview

- 13.1.4. Recent Developments

- 13.2. Lumirror

- 13.3. Polyplex Corporation Ltd.

- 13.4. Hengli Group

- 13.5. Jiangsu Yuxing Films Technology Co., Ltd.

- 13.6. Sealed Air Corporation

- 13.7. Avient Corporation

- 13.8. DuPont

- 13.9. UFLEX

- 13.10. Xpro India Ltd.

LIST NOT EXHAUSTIVE

14. Appendix

- 14.1. About Us and Services

- 14.2. Contact Us