|

|

市場調査レポート

商品コード

1423520

タングステン系材料の世界市場-2024-2031Global Tungsten-Based Materials Market - 2024-2031 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| タングステン系材料の世界市場-2024-2031 |

|

出版日: 2024年02月09日

発行: DataM Intelligence

ページ情報: 英文 192 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

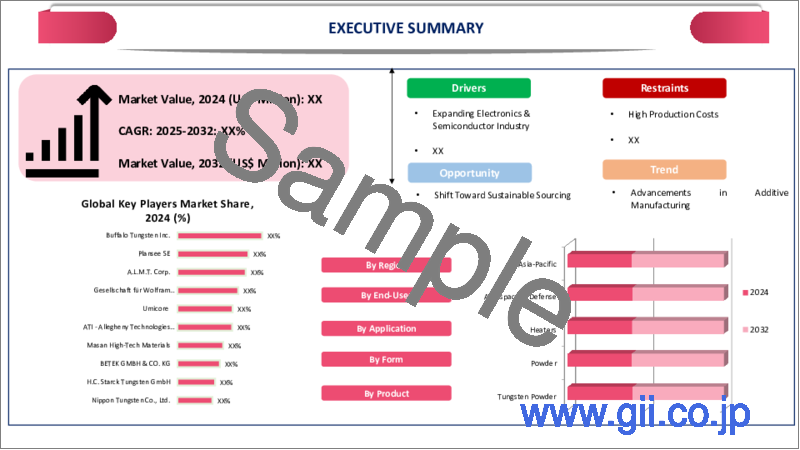

世界のタングステン系材料市場は、2023年に59億米ドルに達し、2024-2031年の予測期間中にCAGR 6.1%で成長し、2031年には94億米ドルに達すると予測されています。

蒸気タービンブレードの耐食性と振動を向上させるため、鋼材にタングステンが添加されることで市場が拡大しています。さらに、航空宇宙・軍事産業では、航空機のバラスト用途でタングステン製品のニーズが高まっているため、さらなる拡大が見込まれます。タングステン系材料市場は、自動車、航空宇宙、エレクトロニクス、石油・ガス、鉱業分野で使用するためのワイヤ、ロッド、シート、プレートなどを含むタングステン製品の需要が急速に増加した結果として拡大しました。

合金やタングステンカーバイドを含むタングステン系材料は、その卓越した品質のため、幅広い産業用途で不可欠です。航空宇宙、自動車、一般製造業を含む重工業分野で必要とされる切削工具、ドリル、その他の部品の製造には、その高い硬度、融点の上昇、耐摩耗性からタングステンが選ばれています。

アジア太平洋は、世界のタングステン系材料市場の1/3以上をカバーする成長地域の一つです。工業や建設業界では、タングステン系材料は、高性能部品、摩耗部品や切削工具に広く使用されています。これらの分野では、強度の高い高級素材へのニーズが高まっており、タングステンの使用量が増加した結果、市場が拡大しています。

ダイナミクス

エレクトロニクス分野の急速な発展

さまざまな電気機器がタングステン製品を使って大規模に生産されています。最新の集積回路で使用される最も重要な部品のひとつがタングステンです。あらゆる高度なチップの相互接続層やトランジスタは、ビアやプラグとしても知られるタングステンコンタクトによって接続されています。さらに、ヒートシンクは、オプトエレクトロニクスやマイクロ波アプリケーションでは、ICパッケージの基礎プレートとして機能します。集積回路(IC)の需要は、したがって、タングステンの提供のための需要を押し上げ、半導体部門の成長に起因する急増しています。

例えば、国際貿易局は、成長するネットワークとデジタル化が半導体産業の成長を牽引していると指摘しています。2020年の世界半導体売上高は、前年比6.8%増の4,404億米ドルとなった。また、世界半導体貿易統計グループによると、2021年の売上高は4,690億米ドルに増加し、年間成長率は8.4%です。

ヘルスケアにおけるタングステン系材料の需要拡大

タングステン線は、精密さと電流を必要とする医療用途で依然として需要があり、医療機器に利用されてきました。タングステン線は、それが医療機器に有用になり、高い引張強度を持っています。低侵襲手術用のステアラブル・ガイドワイヤーを作るとなると、機械的特性に優れた専門家向けのステンレス鋼しか使用できないです。

推定によると、医療分野での手術ロボットの使用の増加は、タングステン系材料市場の拡大を推進しています。タングステンケーブルは、その大きな引張強度のため、これまで以上に小さなロボット部品にパッケージ化することができます。これは、タングステン系材料の市場は、開発されている手術ロボット支援プラットフォームの増加に伴って上昇すると予想されます。

一例として、メドトロニックはグルグラムにある最先端の手術ロボット体験センターで、最先端のロボット支援手術プラットフォームであるヒューゴRASシステムを2021年9月に発表しました。予想される期間中、ヘルスケア分野におけるタングステンワイヤーの使用量と手術ロボットの需要の増加は、タングステン製品の市場拡大を促進すると予想されます。

タングステン価格の上昇

タングステン製品の生産に影響を与える主な困難は、タングステン価格です。2020年の3月と4月には、需要の減少の結果、川下のタングステン系材料とタングステン精鉱の大半の価格が下落しました。しかし、年が明けると、価格は横ばいか徐々に上昇しました。

USGS mineral commodity summaries 2021 publicationによると、2021年のタングステン精鉱、スクラップ、タングステン川下製品の価格の動向は、需要の増加、パラタングステン酸アンモニウムと精鉱の限られたスポット供給、スクラップの利用可能性の減少と低い在庫水準に対応して、ほとんどが上昇傾向にあった。運賃の上昇と輸送の遅延が供給制約と価格上昇の一因となった。

代替・代替素材

タングステン系材料の市場は拡大していますが、代替資源や代替方法の利用可能性によって制限されています。セラミック、炭化物、その他の材料などの他の先端合金は、タングステンに伴う高コストやサプライチェーンのリスクを伴わずに、用途によっては同等の性能品質を提供できる可能性があります。

企業がコスト削減に努め、より持続可能な代替材料を調査する中で、タングステン系材料市場は、同等以上の品質を提供する可能性のある材料で積極的に活動しています。市場の成長の見通しはまた、特定の用途におけるタングステンの必要性を最終的に代替または軽減するかもしれない新しい材料を見つけるかもしれない材料科学の研究開発活動の継続によって影響を受ける可能性があります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- エレクトロニクス分野の急速な発展

- ヘルスケア分野におけるタングステン系材料の需要拡大

- 抑制要因

- タングステン価格の上昇

- 代替・代替材料

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 タイプ別

- パウダー

- ロッド

- シート

- その他

第8章 材料別

- 金属タングステン

- 炭化タングステン

- タングステン合金

第9章 用途別

- フィラメント

- ヒーター

- 電極

- スパッタリング・ターゲット

- 切削工具

- 放射線シールド

- その他

第10章 エンドユーザー別

- 航空宇宙・防衛

- 自動車

- 電気・電子

- 建設

- 鉱業

- 医療・ヘルスケア

- その他

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第12章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 企業プロファイル

- Plansee Group

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- A.L.M.T. Corporation

- Buffalo Tungsten Inc.

- Global Tungsten & Powders

- Wolfram Company

- Aero Industries Inc.

- Novotec BV

- Elmet Technologies

- Midwest Tungsten Service

- Masan High-Tech Materials Corporation

第14章 付録

Overview

Global Tungsten-Based Materials Market reached US$ 5.9 billion in 2023 and is expected to reach US$ 9.4 billion by 2031, growing with a CAGR of 6.1% during the forecast period 2024-2031.

The market is growing as tungsten is added to steel to increase corrosion resistance and vibration in steam turbine blades. Furthermore, it is anticipated that the aerospace and military industry may see further expansion due to the rising need for tungsten goods in aircraft ballast applications. The tungsten materials market expanded as a result of the rapidly increasing demand for tungsten products, including wires, rods, sheets and plates, among others, for use in the automotive, aerospace, electronics, oil and gas and mining sectors.

Because of their exceptional qualities, tungsten-based materials, including alloys and tungsten carbide, are essential in a wide range of industrial applications. For the production of cutting tools, drills and other components required in heavy sectors including aerospace, automotive and general manufacturing, tungsten is the material of choice due to its high hardness, raised melting point and wear resistance.

Asia-Pacific is among the growing regions in the global tungsten-based materials market covering more than 1/3rd of the market. In the industrial and construction industries, tungsten-based materials are widely used for high-performance components, wear parts and cutting tools. The market is expanding as a result of the rise in tungsten use brought about by these sectors' growing need for strong, premium materials.

Dynamics

Rapid Development in the Electronics Sector

A variety of electrical devices are produced using tungsten products on a large scale. One of the most significant components used in modern integrated circuits is tungsten. The interconnecting layers and transistors in all sophisticated chips are connected by tungsten contacts, also known as vias or plugs. Furthermore, heat sinks serve as IC package foundation plates in optoelectronics and microwave applications. Demand for integrated circuits (ICs) has surged due to the growth of the semiconductor sector, hence driving up demand for tungsten offerings.

For instance, the International Trade Administration notes that growing networking and digitalization are driving growth in the semiconductor industry. Globally semiconductor sales in 2020 were US$ 440.4 billion, a 6.8% increase over the year previously. In addition, sales increased to US$ 469 billion in 2021, according to the World Semiconductor Trade Statistics group, showing an 8.4% yearly growth rate.

Growing Demand in Healthcare for Tungsten Materials

Tungsten wire is still in demand in medical applications requiring precision and electric current and has been utilized in medical equipment. Tungsten wire has a high tensile strength, which makes it useful for medical equipment. When it comes to creating a steerable guide wire for minimally invasive surgery, only specialist stainless steel with its exceptional mechanical properties can be used.

According to estimations, the growing use of surgical robots in the medical field drives the expansion of the tungsten materials market. Tungsten cables may be packaged into ever-smaller robotic components because of their greater tensile strength. It is expected that the market for tungsten materials will rise in step with the increasing number of surgical robotic-assisted platforms being developed.

As an example, at its state-of-the-art Surgical Robotics Experience Center in Gurugram, Medtronic unveiled the Hugo RAS system in September 2021, a cutting-edge robotic-assisted surgery platform. Over the anticipated period, rising tungsten wire usage and surgical robot demand in the healthcare sector are anticipated to fuel market expansion for tungsten products.

Increases in Tungsten Price

The main difficulties affecting tungsten product production is tungsten price. In March and April of 2020, the prices for the majority of downstream tungsten materials and tungsten concentrates decreased as a result of a decrease in demand. As the year went on, however, prices steadied or gradually increased.

According to USGS mineral commodity summaries 2021 publication, most prices of tungsten concentrates, scrap and downstream tungsten products trended upward in 2021 in response to the rising demand, limited spot supplies of ammonium paratungstate and concentrates decreased scrap availability and low inventory levels. Increased freight costs and delays in transit contributed to supply constraints and pricing increases.

Alternatives and Replacement Materials

The market for tungsten-based materials is growing, but it is limited by the availability of replacement resources and alternative methods. Other advanced alloys, such as ceramics, carbides and other materials, may provide comparable performance qualities in some applications without the high cost and supply chain risks that come with tungsten.

The market for tungsten-based materials is aggressive with materials that may offer comparable or better qualities, as businesses strive to reduce costs and investigate more sustainable alternatives. The prospects for the market's growth may also be affected by continuing materials science research and development activities that may find novel materials that might eventually replace or lessen the need for tungsten in particular applications.

Segment Analysis

The global tungsten-based materials market is segmented based on type, Material, application, end-user and region.

Rising Demand for Tungsten Materials in Aerospace Industry

The aerospace & defense segment is among the growing regions in the global tungsten-based materials market market covering more than 1/3rd of the market. Metal tungsten has the greatest heat resistance along with several other buildings: low vapor pressure, low coefficient of expansion, high density, high strength and high modulus of elasticity.

The mechanism design and safety performance of aerospace equipment are strongly correlated with the mechanical, chemical and physical properties of the materials used. Tungsten metal, for example, has several exceptional physical and chemical properties that can meet the requirements of material properties for aerospace and has been widely used in satellites, aircraft, aircraft engines and other equipment.

The demand for tungsten materials is predicted to be driven by the aerospace sector's increasing expansion. For example, a press release from Boeing in April 2020 states that the country's growing middle class and developing economy will drive strong aviation growth in India, creating demand for more than 2,200 new aircraft valued at about US$ 320 billion over the next 20 years.

Geographical Penetration

Growing Demand for Materials Based on Tungsten in the Electronics Sector Asia-Pacific

Asia-Pacific has been a dominant force in the global tungsten-based materials market. Asia-Pacific has been a major contributor to the expansion of the global market for tungsten-based materials due to the strong economic development and industrialization of nations like China, which is a major producer and consumer of tungsten.

In the Asia-Pacific, there has been a sharp increase in demand for materials based on tungsten, especially in industries including electronics, construction and manufacturing. Tungsten has a sizable market thanks to the region's expanding infrastructural projects and strong industrial base, which are driving its expansion.

Additionally, the growing use of tungsten in some end-use industries is driving market growth in the area. The USGS mineral commodity summaries 2021 publication states that China is now a net importer of tungsten concentrate as a result of new import and export restrictions on tungsten ore, as well as rising domestic demand from the production of tungsten materials with added value.

Also, China maintains the lead in the tungsten industry due in large part to these factors as well as the nation's explosive expansion in the automotive, aerospace, mining and electronics industries. The Ministry of Industry and Information Technology reports that 19.99 million passenger cars were sold in China in 2020, out of a total of over 25 million automobiles sold globally. Additionally, sales of commercial vehicles rose by 20% in 2021 compared to 2019 to reach 5.23 million units.

COVID-19 Impact Analysis

The market for tungsten-based materials has been significantly impacted by the COVID-19 pandemic, as have other international markets. The pandemic affected the production and consumption of tungsten-based products by upsetting demand, industrial processes and supply networks in some industries. During the pandemic's early stages, lockdowns required many production facilities to close or operate at reduced capacity, which affected the demand for tungsten in industries including electronics, automotive and aerospace.

Additionally, the tungsten materials market noticed problems associated with the general economic slowdown as economic activity progressively recovered. The demand for tungsten decreased in sectors including manufacturing and construction, which rely largely on the metal. Investment choices in tungsten-based projects have been affected by firms' cautious expenditure due to the uncertainty surrounding the pandemic's severity and length.

In 2020, the COVID-19 pandemic had a detrimental effect on the tungsten product industry's expansion. China consumes half of the world's manufactured tungsten, hence there is a strong correlation between tungsten consumption and global GDP. Exports and delivery of tungsten APT and related goods were impeded by logistical obstacles.

According to Argus a media organization that on February 12, 2020, domestic APT prices in China jumped by 1.5% to Yn137,000-139,000/t ($19,635-$19,922), while APT prices in Europe increased by more than 5% weekly to US$240-245/mtu. Therefore, in 2020, the expansion of the tungsten goods market was obstructed by the instability of tungsten prices.

Russia-Ukraine War Impact Analysis

The global demand for tungsten-based materials could be greatly affected by geopolitical tensions and wars. An essential metal utilized in many sectors, including electronics, manufacturing and defense, is tungsten. Market price volatility and shortages can come from a conflict that affects production or supply systems in important tungsten-producing nations.

The uncertainties affect industry stakeholders and investors, affecting the way they plan and investment decisions. Furthermore, demand patterns may be impacted by global instability. There may be a spike in demand for tungsten-based products during times of war in some businesses, notably the defense sector, for things like armor-piercing ammunition and military gear.

However, trade delays and financial instability could result in lower demand in other industries, which would have a complicated and multifaceted impact on the world tungsten market. The reality would vary on the intensity, length and geographic scope of any war, thus it's important to remember that the situation is dynamic. It is essential to study industry publications and recent news sources for the most accurate and current information on the present situation and its influence on the market for tungsten-based products.

By Type

- Powder

- Rods

- Sheets

- Others

By Material

- Tungsten Metal

- Tungsten Carbide

- Tungsten Alloys

By Application

- Filaments

- Heaters

- Electrodes

- Sputtering Targets

- Cutting Tools

- Radiation Shielding

- Others

By End-User

- Aerospace & Defense

- Automotive

- Electrical & Electronics

- Construction

- Mining

- Medical & Healthcare

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On August 16, 2023, CB-CERATIZIT, a joint venture of CERATIZIT, a division of the Plansee Group, has acquired a 70% stake in Changzhou CW Toolmaker Inc. The China-based company specializes in designing, producing and selling tungsten carbide cutting tools for industries such as electronics, aviation, railway and mold and die.

- On December 22, 2021, The Plansee Group, headquartered in Reutte, Austria, has purchased Mi-Tech Tungsten Metals, which is based in Indianapolis. Recognized as a prominent supplier of tungsten-based products in United States, Mi-Tech's acquisition is part of Plansee's strategy to enhance its market presence for tungsten products in North America.

Competitive Landscape

The major global players in the market include Plansee Group, A.L.M.T. Corporation, Buffalo Tungsten Inc., Global Tungsten & Powders, Wolfram Company, Aero Industries Inc., Novotec BV, Elmet Technologies, Midwest Tungsten Service and Masan High-Tech Materials Corporation.

Why Purchase the Report?

- To visualize the global tungsten-based materials market segmentation based on type, Material, application, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of tungsten-based materials market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

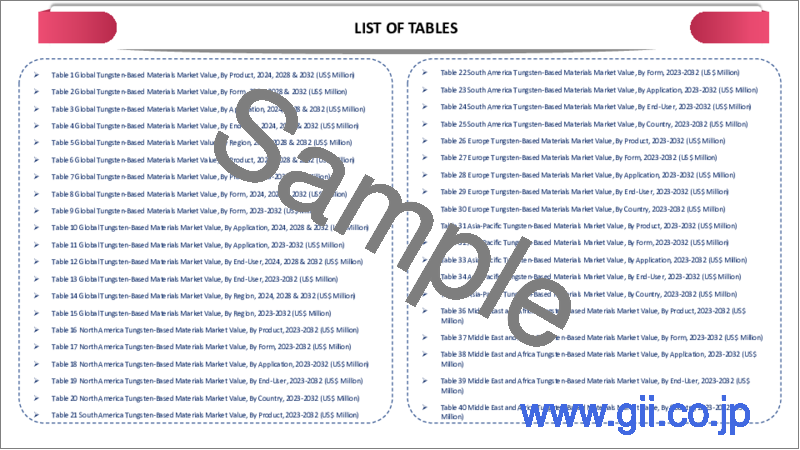

The global tungsten-based materials market report would provide approximately 70 tables, 71 figures and 192 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Type

- 3.2. Snippet by Material

- 3.3. Snippet by Application

- 3.4. Snippet by End-User

- 3.5. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Rapid Development in the Electronics Sector

- 4.1.1.2. Growing Demand in Healthcare for Tungsten Materials

- 4.1.2. Restraints

- 4.1.2.1. Increases in Tungsten Price

- 4.1.2.2. Alternatives and Replacement Materials

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Powder*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Rods

- 7.4. Sheets

- 7.5. Others

8. By Material

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 8.1.2. Market Attractiveness Index, By Material

- 8.2. Tungsten Metal*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Tungsten Carbide

- 8.4. Tungsten Alloys

9. By Application

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.1.2. Market Attractiveness Index, By Application

- 9.2. Filaments*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Heaters

- 9.4. Electrodes

- 9.5. Sputtering Targets

- 9.6. Cutting Tools

- 9.7. Radiation Shielding

- 9.8. Others

10. By End-User

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.1.2. Market Attractiveness Index, By End-User

- 10.2. Aerospace & Defense*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Automotive

- 10.4. Electrical & Electronics

- 10.5. Construction

- 10.6. Mining

- 10.7. Medical & Healthcare

- 10.8. Others

11. By Region

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2. Market Attractiveness Index, By Region

- 11.2. North America

- 11.2.1. Introduction

- 11.2.2. Key Region-Specific Dynamics

- 11.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.7.1. U.S.

- 11.2.7.2. Canada

- 11.2.7.3. Mexico

- 11.3. Europe

- 11.3.1. Introduction

- 11.3.2. Key Region-Specific Dynamics

- 11.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.7.1. Germany

- 11.3.7.2. UK

- 11.3.7.3. France

- 11.3.7.4. Russia

- 11.3.7.5. Spain

- 11.3.7.6. Rest of Europe

- 11.4. South America

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 11.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.7.1. Brazil

- 11.4.7.2. Argentina

- 11.4.7.3. Rest of South America

- 11.5. Asia-Pacific

- 11.5.1. Introduction

- 11.5.2. Key Region-Specific Dynamics

- 11.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.7.1. China

- 11.5.7.2. India

- 11.5.7.3. Japan

- 11.5.7.4. Australia

- 11.5.7.5. Rest of Asia-Pacific

- 11.6. Middle East and Africa

- 11.6.1. Introduction

- 11.6.2. Key Region-Specific Dynamics

- 11.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

12. Competitive Landscape

- 12.1. Competitive Scenario

- 12.2. Market Positioning/Share Analysis

- 12.3. Mergers and Acquisitions Analysis

13. Company Profiles

- 13.1. Plansee Group*

- 13.1.1. Company Overview

- 13.1.2. Product Portfolio and Description

- 13.1.3. Financial Overview

- 13.1.4. Key Developments

- 13.2. A.L.M.T. Corporation

- 13.3. Buffalo Tungsten Inc.

- 13.4. Global Tungsten & Powders

- 13.5. Wolfram Company

- 13.6. Aero Industries Inc.

- 13.7. Novotec BV

- 13.8. Elmet Technologies

- 13.9. Midwest Tungsten Service

- 13.10. Masan High-Tech Materials Corporation

LIST NOT EXHAUSTIVE

14. Appendix

- 14.1. About Us and Services

- 14.2. Contact Us