|

|

市場調査レポート

商品コード

1423519

タングステン系材料リサイクルの世界市場 2024-2031Global Tungsten-Based Materials Recycling Market - 2024-2031 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| タングステン系材料リサイクルの世界市場 2024-2031 |

|

出版日: 2024年02月09日

発行: DataM Intelligence

ページ情報: 英文 182 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

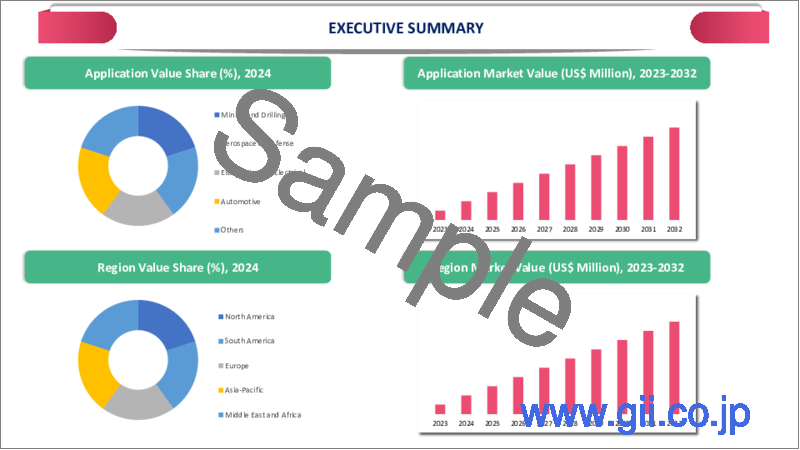

タングステン系材料リサイクルの世界市場は、2023年に7億9,920万米ドルに達し、2031年には13億6,360万米ドルに達すると予測され、予測期間2024年のCAGRは7.1%で成長します。

電気自動車や再生可能エネルギー技術への世界の移行により、タングステンのような必須金属の需要が高まっています。これらのビジネスが拡大し、タングステンの恒常的かつ持続可能な供給に対する要求が高まるにつれて、増大する需要を満たすためにリサイクル技術が採用されています。

タングステンベースの製品をリサイクルするための市場は、主にエコロジー意識の高まりと世界的に持続可能な慣行の必要性によって駆動されます。従来の採掘や抽出による生態系への影響を軽減することで、タングステンのリサイクルはより大きな持続可能性の目標に貢献します。タングステンのリサイクルの需要は、循環経済の概念の世界の採用によって駆動されています。

アジア太平洋は、世界のタングステン系材料リサイクル市場の1/3以上をカバーする成長地域の一つです。アジア太平洋のダイナミックな業界情勢と持続可能な慣行への献身の増加は、タングステンベースの製品のリサイクルのための世界市場の成長を推進している主な要因です。中国、日本、インドのような国々における急速な工業化は、電子機器、建設、製造業を含むいくつかの産業でタングステンベースの製品に対する需要を増加させています。

ダイナミクス

リサイクル技術の発展

タングステン系材料リサイクルの世界市場は、リサイクル技術の向上が大きな原動力となっています。革新的な技術やプロセスの開発により、製造スクラップや染色製品など、さまざまなソースからのタングステンのリサイクルが可能になりました。

例えば、MHTのタングステン生産量は2021年に前年比97%増という驚異的な伸びを記録したが、その26%を廃棄物のリサイクルが占めました。生産量の74%は、タイグエンにあるMHTのNui Phaoを含む主要供給源からのものです。企業収益は前年比86%増の13兆5,640億ドンとなった。

H.C.スタルク・タングステン・パウダースと2021年度のAPT価格(286ドル/mtu)が前年の222ドル/mtuを上回ったことが、タングステン収益の増加に大きく貢献しました。興味深いことに、EBITDAは2021-2022年度を通じて114%増の3兆700億ドンとなった。MHTは、ここ数年で最高の見通しであると述べており、健全なフォワードオーダーブックは、販売量と価格の両方にとって心強いものです。

循環経済と持続可能なプロセスへの注目の高まり

循環型経済と持続可能なプロセスへの関心の高まりは、タングステン系材料リサイクルの世界市場を後押しする大きな要因です。産業界も消費者も、環境への関心が高まるにつれ、タングステンのような必須資源をリサイクルすることの重要性をますます認識するようになっています。

循環経済戦略は、資源効率、廃棄物の削減、寿命の延長を奨励しています。一次資源への依存を減らし、生態系への影響を軽減し、より倫理的で持続可能なサプライチェーンをサポートする必要があるため、リサイクルされたタングステンベースのコンポーネントの需要が高まっています。

タングステンをリサイクルするための限られたインフラ

世界市場は、タングステンのリサイクル施設の不足によって大きく制限されています。タングステンのリサイクル施設は、鉄鋼やアルミニウムのような日常的にリサイクルされる金属に比べると数が少なく、タングステンをベースとした品目の処理と回収は物流上の困難をもたらす可能性があります。

このプロセスでは、機能するリサイクル・インフラを構築するために、専門的な機械や設備への多額の投資が必要となります。このようなインフラが不足していると、輸送費がかさみ、リサイクル工程の効率が悪くなる可能性があります。さらに、タングステンのリサイクルに積極的に取り組もうとする企業やセクターを躊躇させる要因として、回収場所やリサイクル施設の不足が挙げられます。

価格変動と経済変動

タングステン系材料リサイクルに対する世界市場の受容性は、価格と経済の変動に対する大きな制約です。地政学的動向、市場の思惑、一般的な経済状況はすべてタングステン価格に影響を与えます。景気の悪化は産業活動の縮小を招き、リサイクル市場の活力だけでなく、タングステンをベースとする製品全体の需要にも影響を及ぼす可能性があります。

さらに、タングステンは他の金属に比べて市場規模が小さいため、需給のミスマッチによる価格変動の影響を受けやすく、その結果、価格が急速かつ予測不能に変動する可能性があります。リサイクル企業はこのような変動により困難に直面する可能性があり、投資の選択や収益性に影響を及ぼす可能性があります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- リサイクル技術の発展

- 循環型経済と持続可能なプロセスへの注目の高まり

- 抑制要因

- タングステンをリサイクルするための限られたインフラ

- 価格変動と景気変動

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 タイプ別

- 直接リサイクル

- 間接リサイクル

- 溶解冶金

第8章 タングステン材料別

- 炭化タングステン

- タングステン合金

- タングステン金属

第9章 用途別

- 超硬合金と合金

- 電子・電気産業

- 化学用途

- その他

第10章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第11章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第12章 企業プロファイル

- GEM Co., Ltd

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Masan High-Tech Materials Corporation

- Sandvik Group

- Sumitomo Electric Group

- Tungco

- Oerlikon

- Global Tungsten & Powders

- Umicore

- Tungsten Alloy CO., Ltd.

- Hyperion

第13章 付録

Overview

Global Tungsten-Based Materials Recycling Market reached US$ 799.2 million in 2023 and is expected to reach US$ 1,363.6 million by 2031, growing with a CAGR of 7.1% during the forecast period 2024-2031.

The demand for essential metals, such as tungsten, is rising owing to the global transition towards electric cars and renewable energy technology. Recycling techniques are being adopted to fulfill the growing demand as these businesses expand and the requirement for a constant and sustainable supply of tungsten rises.

The market for recycling tungsten-based products is driven primarily by growing ecological awareness and the need for sustainable practices globally. By lessening the ecological effects of conventional mining and extraction, recycling tungsten contributes to larger sustainability objectives. The demand for tungsten recycling is being driven by the global adoption of circular economy concepts.

Asia-Pacific is among the growing regions in the global tungsten-based materials recycling market covering more than 1/3rd of the market. The Asia-Pacific dynamic industrial landscape and growing dedication to sustainable practices are major factors propelling the growth of the global market for the recycling of tungsten-based products. Rapid industrialization in countries like China, Japan and India has increased demand for tungsten-based products in some industries, including electronics, construction and manufacturing.

Dynamics

Technological Developments in Recycling Techniques

The global market for recycled materials based on tungsten is driven in a major way by increasing technological improvements in recycling. The recycling of tungsten from a variety of sources, including manufacturing scrap and dying products, is now possible because of the development of innovative technologies and processes.

For Instance, the tungsten production at MHT increased by an astounding 97% in 2021 over the previous year, with tungsten waste recycling accounting for 26% of the production increase. Seventy-four percent of the production came from main supply sources, including MHT's Nui Phao in Thai Nguyen. The company's net revenues increased by a significant 86% year over year to reach VND13,564 billion.

The combination of H.C. Starck Tungsten Powders and the increased APT price for the fiscal year 2021 ($286/mtu) above the previous year's amount of US$222/mtu contributed significantly to the increase in tungsten revenues. Interestingly, the EBITDA increased by 114% to VND3,070 billion throughout the 2021-2022 year. A healthy forward order book, which MHT noted as having the best outlook in some years, is encouraging for both sales volumes and pricing.

Increasing Focus on Circular Economy and Sustainable Processes

The adoption of circular economy ideas and a growing focus on sustainable practices are major factors propelling the global market for the recycling of tungsten-based products. Industries and consumers alike are realizing more and more how important it is to recycle essential resources like tungsten as environmental concerns rise.

The circular economics strategy encourages resource efficiency, waste reduction and lifespan extension. Because of the need to lessen dependency on primary raw resources, lessen the ecological impact and support a more ethical and sustainable supply chain, there is an increasing demand for recycled tungsten-based components.

Limited Infrastructure for Recycling Tungsten

The global market is severely restricted by the lack of facilities for tungsten recycling. Tungsten recycling facilities are less frequent than those for more routinely recycled metals like steel or aluminum and the processing and collecting of items based on tungsten might provide logistical difficulties.

The process requires a substantial investment in specialized machinery and facilities to set up a recycling infrastructure that works. A deficiency in this kind of infrastructure might lead to higher transportation expenses and worse recycling process efficiency. A further factor that might deter companies and sectors from actively engaging in tungsten recycling initiatives is the lack of collection sites and recycling facilities.

Variations in Prices and Economic Volatility

The receptivity of the global market for the recycling of tungsten-based products to price and economic variations is a major constraint. Geopolitical developments, market speculation and general economic conditions all have an impact on tungsten pricing. Economic downturns may result in fewer industrial operations, which may have an effect on the dynamics of the recycling market as well as the overall demand for products based on tungsten.

Furthermore, tungsten's market is smaller than that of other metals, which makes it more vulnerable to mismatches in supply and demand that can cause prices to fluctuate quickly and unpredictably. Recycling companies may face difficulties as a result of these swings, which may have an impact on their investment choices and profitability.

Segment Analysis

The global tungsten-based materials recycling market is segmented based on type, tungsten material, application and region.

Rising Demand for Tungsten Carbide Due to Technological Developments

The tungsten carbide segment is among the growing regions in the global tungsten-based materials recycling market market covering more than 1/3rd of the market. The performance, quality and efficiency of tungsten carbide products have all increased due to technological developments in manufacturing techniques, such as powder metallurgy, that have expanded the range of possible uses for these products.

For Instance, in 2023, Sandvik AB, a Sweden-based equipment manufacturer, launched the mining and quarrying industry's inaugural "opt-out" recycling program for carbide drill bits. The program seeks to revolutionize the utilization of a material projected to deplete within 40 to 100 years if current consumption rates persist. Sandvik's drill bits for mining, quarrying and construction are constructed from cemented carbide, a composite of carbon and tungsten alloyed with cobalt or nickel.

Geographical Penetration

Increasing Demand for Tungsten-Based Materials in Asia-Pacific

Asia-Pacific has been a dominant force in the global tungsten-based materials recycling market. The region's growing manufacturing and industrial sectors, especially in China, Japan, South Korea and India, provide a significant market for tungsten-based materials used in a variety of applications, such as electronics, mining equipment and cutting instruments.

Additionally, tungsten recycling is being used to satisfy both economic and environmental goals as a result of a growing focus on sustainable practices and resource efficiency in these industries. The expansion of tungsten recycling in the Asia-Pacific is being further accelerated by government programs and policies that support a circular economy and sustainable resource management.

Furthermore, reducing dependency on basic raw resources is becoming increasingly important to nations and recycling is now strategically included in their strategies for resource security. The Asia-Pacific tungsten recycling business is developing in a favorable environment because of incentives, laws and investments in recycling infrastructure. Because of this, companies in the Asia-Pacific are using more and more recycled tungsten resources in their production processes, which is in line with both efficiency and ecological goals.

For Instance, in 2023, GEM Co Ltd invested US$500 million in a joint venture for a nickel project in Indonesia's Morowali Industrial Park. The project targets an annual production of 20,000 Tons of nickel intermediate product used in the new energy sector. GEM (Wuxi) Energy Materials, a GEM subsidiary, will hold 51%, of Cahaya Jaya Investment Pte. Ltd from Singapore will own 26% and Weiming (Hong Kong) International Holdings Limited will have an 18% share in the project.

COVID-19 Impact Analysis

The global market for the recycling of tungsten-based products has been impacted by the COVID-19 pandemic in some ways. Early in the pandemic, the manufacturing and construction industries two major markets for tungsten products slowed down due to widespread lockdowns and delays in industrial activity. As a result, the recycling market was impacted by a decline in the demand for tungsten-based products.

The tungsten recycling market did, however, start to rebound as businesses adjusted to the new normal and economic activity picked back up. Resilient supply chains are essential and the pandemic has brought this point home. Recycling and sustainable sourcing of essential commodities, like tungsten, have received more attention.

The market is expanding as a result of a renewed emphasis on recycling tungsten-based products due to growing awareness of environmental sustainability and the concepts of the circular economy. The global infrastructure and technology industries have benefited from ongoing recovery efforts and stimulus packages, which have also raised demand for tungsten and favorably impacted the recycling industry.

The COVID-19 pandemic has created chances for development and sustainability for the tungsten recycling sector in addition to posing obstacles. To fulfill the demand for this essential metal while minimizing environmental effects, the tungsten recycling market is anticipated to be extremely important as long as businesses continue to emphasize sustainability and resilience in their supply chains.

Russia-Ukraine War Impact Analysis

The tungsten market may be impacted by supply chain interruptions, price fluctuations and instability in international markets in the case of a war. The makes it imperative for all parties involved in the tungsten business, ranging from miners to manufacturers and recyclers, to keep a close eye on developments and modify their approaches as necessary to effectively traverse any obstacles and capitalize on emerging possibilities within the changing geopolitical scene.

Because supply chains and commerce are international, the tungsten market, like many other commodity markets, may be affected by geopolitical developments. Since both Russia and Ukraine are major participants in the global metals market, any interruption to their export or manufacturing operations might have a knock-on effect on other industries, such as the recycling of tungsten.

The precise effects of a war between Russia and Ukraine on the tungsten market would depend on the length, scope and particulars of any conflict as well as the broader geopolitical reactions from other countries and international organizations. It is important to remember that this analysis is based on general principles.

By Type

- Direct Recycling

- Indirect Recycling

- Melting Metallurgy

By Tungsten Material

- Tungsten Carbide

- Tungsten Alloys

- Tungsten Metal

By Application

- Cemented Carbide and Alloys

- Electronics and Electrical Industries

- Chemical Applications

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On November 03, 2022, The US business Mi-Tech Tungsten Metals in Indianapolis was acquired by the Plansee Group. Mi-Tech is considered one of the top US providers of tungsten-based products. We are further strengthening our position in the North American tungsten product industry with the acquisition of Mi-Tech.

Competitive Landscape

The major global players in the market include GEM Co., Ltd, Masan High-Tech Materials Corporation, Sandvik Group, Sumitomo Electric Group, Tungco, Oerlikon, Global Tungsten & Powders, Umicore, Tungsten Alloy CO., Ltd. and Hyperion.

Why Purchase the Report?

- To visualize the global tungsten-based materials recycling market segmentation based on type, tungsten material, application and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of tungsten-based materials recycling market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global tungsten-based materials recycling market report would provide approximately 62 tables, 53 figures and 182 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Type

- 3.2. Snippet by Tungsten Material

- 3.3. Snippet by Application

- 3.4. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Technological Developments in Recycling Techniques

- 4.1.1.2. Increasing Focus on Circular Economy and Sustainable Processes

- 4.1.2. Restraints

- 4.1.2.1. Limited Infrastructure for Recycling Tungsten

- 4.1.2.2. Variations in Prices and Economic Volatility

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Direct Recycling*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Indirect Recycling

- 7.4. Melting Metallurgy

8. By Tungsten Material

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Tungsten Material

- 8.1.2. Market Attractiveness Index, By Tungsten Material

- 8.2. Tungsten Carbide*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Tungsten Alloys

- 8.4. Tungsten Metal

9. By Application

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.1.2. Market Attractiveness Index, By Application

- 9.2. Cemented Carbide and Alloys*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Electronics and Electrical Industries

- 9.4. Chemical Applications

- 9.5. Others

10. By Region

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 10.1.2. Market Attractiveness Index, By Region

- 10.2. North America

- 10.2.1. Introduction

- 10.2.2. Key Region-Specific Dynamics

- 10.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Tungsten Material

- 10.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.2.6.1. U.S.

- 10.2.6.2. Canada

- 10.2.6.3. Mexico

- 10.3. Europe

- 10.3.1. Introduction

- 10.3.2. Key Region-Specific Dynamics

- 10.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Tungsten Material

- 10.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.3.6.1. Germany

- 10.3.6.2. UK

- 10.3.6.3. France

- 10.3.6.4. Russia

- 10.3.6.5. Spain

- 10.3.6.6. Rest of Europe

- 10.4. South America

- 10.4.1. Introduction

- 10.4.2. Key Region-Specific Dynamics

- 10.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Tungsten Material

- 10.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.4.6.1. Brazil

- 10.4.6.2. Argentina

- 10.4.6.3. Rest of South America

- 10.5. Asia-Pacific

- 10.5.1. Introduction

- 10.5.2. Key Region-Specific Dynamics

- 10.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Tungsten Material

- 10.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.5.6.1. China

- 10.5.6.2. India

- 10.5.6.3. Japan

- 10.5.6.4. Australia

- 10.5.6.5. Rest of Asia-Pacific

- 10.6. Middle East and Africa

- 10.6.1. Introduction

- 10.6.2. Key Region-Specific Dynamics

- 10.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Tungsten Material

- 10.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

11. Competitive Landscape

- 11.1. Competitive Scenario

- 11.2. Market Positioning/Share Analysis

- 11.3. Mergers and Acquisitions Analysis

12. Company Profiles

- 12.1. GEM Co., Ltd*

- 12.1.1. Company Overview

- 12.1.2. Product Portfolio and Description

- 12.1.3. Financial Overview

- 12.1.4. Key Developments

- 12.2. Masan High-Tech Materials Corporation

- 12.3. Sandvik Group

- 12.4. Sumitomo Electric Group

- 12.5. Tungco

- 12.6. Oerlikon

- 12.7. Global Tungsten & Powders

- 12.8. Umicore

- 12.9. Tungsten Alloy CO., Ltd.

- 12.10. Hyperion

LIST NOT EXHAUSTIVE

13. Appendix

- 13.1. About Us and Services

- 13.2. Contact Us