|

|

市場調査レポート

商品コード

1423518

伸縮性導電性インクの世界市場-2024-2031Global Stretchable Conductive Ink Market - 2024-2031 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 伸縮性導電性インクの世界市場-2024-2031 |

|

出版日: 2024年02月09日

発行: DataM Intelligence

ページ情報: 英文 201 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

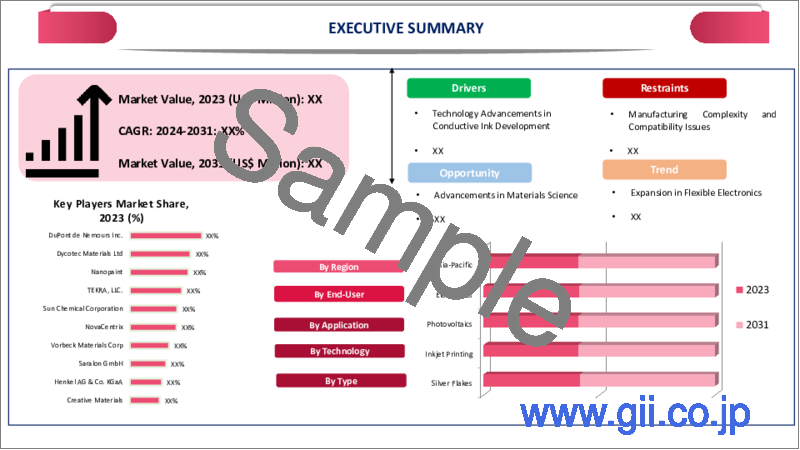

ストレッチャブル導電性インクの世界市場は、2023年に4億3,210万米ドルに達し、2031年には7億4,800万米ドルに達すると予測され、予測期間2024年~2031年のCAGRは7.1%で成長する見込みです。

この業界は、伸縮性導電性インクを電子テキスタイルまたは"E-テキスタイル"に組み込むことで拡大しています。Eテキスタイルとは、導電経路や統合センサーを含むスマート衣料やテキスタイルを作るために、電気部品と組み合わされたテキスタイルのことです。柔軟で洗濯可能な回路の作成は、伸縮性導電性インクによって容易になり、衣服へのシームレスな統合が可能になった。

伸縮性導電インクは、ヘルスケア業界、特にウェアラブルや電子医療機器の分野で大きな広がりを見せています。人体の曲線に適応できる柔軟なセンサーや回路は、伸縮性導電性インクによって実現可能であり、離散的で快適な健康監視を提供します。ヘルスケアへの応用は多岐にわたり、センサー内蔵のスマートファブリックから電子パッチまで幅広いです。

アジア太平洋は、世界の伸縮性導電インク市場の1/3以上を占める成長地域のひとつです。健康とフィットネスに対する消費者の意識の高まりとライフスタイルの変化により、アジア太平洋地域ではウェアラブル技術の利用が急増しています。快適さと柔軟性を可能にするため、伸縮性導電インクはフィットネストラッカーやスマートウォッチなどのウェアラブル電子機器に頻繁に使用されています。

ダイナミクス

エレクトロニクス産業における革新と技術的成長

スクリーン印刷やインクジェット印刷などのプリンテッド・エレクトロニクス手法の使用は、電子部品の生産方法を根本的に変えてきました。フレキシブルで伸縮性のある素材を含む様々な基材上の弾性導電回路は、プリンテッド・エレクトロニクスによって迅速かつスケーラブルに作成される可能性があります。伸縮性のある導電性インクを使ったガジェットは、大量生産が容易なこの技術のおかげで、一般的な使用方法として経済的に実行可能になった。

例えば、2023年、セラニーズ・コーポレーションのマイクロマックス導電性インクは、IPC APEX EPXOにおいて、プリンテッドエレクトロニクス業界向けに9つの新しい製品グレードを発表しました。Insulectro/Celanese Micromax Conductive Inksの展示番号534では、製品を紹介するショート・パワートークが開催されます。Micromax Conductive Inksは、タッチセンサー、バスバー、EMIシールドを含む民生用電気アプリケーション向けに、より柔軟で耐久性のある導電性インクに対する業界の高まる需要に応えてPE800ファミリーのソリューションを開発しました。

ウェアラブル技術における需要の高まり

世界の伸縮性導電性インク市場は、ウェアラブル技術の人気の高まりにより拡大しています。伸縮自在で柔軟な電子部品は、フィットネストラッカー、スマートウォッチ、医療用モニタリング機器などを含むウェアラブル技術の快適性と機能に不可欠です。人体の有機的な曲線に適応できるフレキシブルな回路やセンサーの開発は、伸縮性導電性インクによって可能になっています。

例えば、2021年、Dycotec Materialsは、KYMIRA Ltd.およびCPI(Centre for Process Innovation)と提携し、プロスポーツやヘルスケアにおける遠隔バイオセンシングやモニタリングのためのウェアラブルでスマートな衣服へのフレキシブルな電子システムの統合を容易にする高性能先端材料インクを開発しました。インクは快適で使いやすいです。このプロジェクトは、ウェアラブル技術向けのDycotecの伸縮性プリントインクシステムの製品ラインを拡大するものです。

高い生産コスト

製造工程で利用されるいくつかの革新的材料の製造コストが異常に高いことが、世界の伸縮性導電性インク市場の成長にとって大きな障害となっています。伸縮性導電性インクのコスト構造全体は、グラフェン、カーボンナノチューブ、特殊ポリマーなどの材料の価格設定によって影響を受ける可能性があります。

いくつかのセクターで広く受け入れられるには、こうした高い生産コストが妨げとなる可能性があり、生産者とエンドユーザーの双方にとって完成品の価格が手ごろでなくなる可能性があります。伸縮自在の導電性インクを生産する企業は通常、費用対効果と、市場で競争力を持つための革新的で高性能な素材への要求とのバランスを取るのに苦労しています。

困難な環境では適性が制限

極端な天候、特に温度、湿度、化学物質への暴露において、伸縮性導電性インクの機能には限界があるかもしれません。この制限は、伸縮性導電性インクを使用して製造された電子機器や部品の品質や耐久性に影響を与える可能性があり、航空宇宙産業や自動車産業など、機器が過酷な作業条件にさらされる可能性のある分野での使用が制限される可能性があります。

伸縮性導電インクメーカーは、より多くの場面で使用できるよう、常に製品の耐久性を高めようとしているが、そのためには特定の障害を乗り越えるための絶え間ない研究開発が必要です。ストレッチャブル導電インクメーカーは、製品の堅牢性と寿命の向上を目指し、常に最新の研究開発に取り組んでいます。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- エレクトロニクス産業における革新と技術的成長

- ウェアラブル技術における需要の高まり

- 抑制要因

- 高い製造コスト

- 困難な環境下での使用による限界

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 タイプ別

- 銀フレーク

- カーボン/グラフェン

- 銀ナノ粒子

- 銀ナノワイヤー

- 銀コート銅ナノ粒子

- カーボンナノチューブインク

- 銅フレーク

- 銅ナノ粒子

- 酸化銅ナノ粒子インク

- 導電性ポリマー

- その他

第8章 技術別

- インクジェット印刷

- スクリーン印刷

- フレキソ印刷

- グラビア印刷

- その他

第9章 用途別

- 太陽光発電

- メンブレンスイッチ

- ディスプレイ

- 自動車

- バイオセンサー

- RFID

- プリント基板

- サーマルヒーティング

- その他

第10章 エンドユーザー別

- エレクトロニクス

- ヘルスケア

- 繊維

- 自動車

- 航空宇宙

- その他

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第12章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 企業プロファイル

- DowDuPont Inc

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Dycotec Materials Ltd

- Nanopaint

- TEKRA, LLC.

- Sun Chemical Corporation

- NovaCentrix

- Vorbeck Materials Corp

- Saralon GmbH

- Henkel AG & Co. KGaA

- Creative Materials

第14章 付録

Overview

Global Stretchable Conductive Ink Market reached US$ 432.1 Million in 2023 and is expected to reach US$ 748.0 Million by 2031, growing with a CAGR of 7.1% during the forecast period 2024-2031.

The industry is expanding as a result of the incorporation of stretchable conductive inks into electronic textiles or "e-textiles." E-textiles are textiles that have been combined with electrical components to create smart clothing and textiles that include conductive pathways and integrated sensors. The creation of flexible, washable circuits is made easy by stretchable conductive inks, which enable seamless integration into clothing..

Stretchable conductive inks have enjoyed significant expansion in the healthcare industry, especially in the area of wearables and electronic medical equipment. Flexible sensors and circuits that can adapt to the curves of the human body are made achievable by stretchable conductive inks, providing discrete and pleasant health monitoring. The applications in healthcare are many and range from smart fabrics with integrated sensors to electronic patches.

Asia-Pacific is among the growing regions in the global stretchable conductive ink market covering more than 1/3rd of the market. Growing consumer awareness of health and fitness together with changing lifestyles have led to a sharp growth in wearable technology usage in the Asia-Pacific. To allow for comfort and flexibility, stretchy conductive inks are frequently used in wearable electronics, such as fitness trackers and smartwatches.

Dynamics

Innovation and Technological Growth in the Electronics Industry

The use of printed electronics methods, such as screen and inkjet printing, has radically altered how electronic components are produced. elastic conductive circuits on a variety of substrates, including flexible and stretchy materials, may be created quickly and scalable with printed electronics. Stretchable conductive ink-based gadgets are now more economically viable for general usage owing to this technology, which makes mass production simple.

For Instance, in 2023, Celanese Corporation Micromax Conductive Inks introduced nine new product grades for the printed electronics industry during the IPC APEX EPXO. Short PowerTalks introducing the products will be held at the Insulectro/ Celanese Micromax Conductive Inks exhibit number 534. Micromax Conductive Inks created the PE800 family of solutions for consumer electrical applications including touch sensors, busbars and EMI shielding in response to the growing industry's demand for more flexible but durable conductive inks.

Rising Demand in Wearable Technology

The global stretchable conductive ink market is expanding due in significant part to the growing popularity of wearable technology. Stretchable and flexible electronic components are essential to the comfort and functioning of wearable technology, which includes fitness trackers, smartwatches and medical monitoring devices. The development of flexible circuits and sensors that can adapt to the organic curves of the human body is made possible in large part by stretchable conductive inks.

For Instance, in 2021, Dycotec Materials developed high performance advanced material inks in partnership with KYMIRA Ltd. and CPI (Centre for Process Innovation) to facilitate the integration of flexible electronic systems into wearable, smart clothing for remote biosensing and monitoring in professional sports and healthcare. The inks are comfortable and easy to use. The projects expand upon the line of stretchy printed ink systems from Dycotec, which are intended for wearable technology.

High Production Costs

The unusually high production costs of several innovative materials utilized in the manufacturing process are a major impediment to the growth of the globally stretchable conductive ink market. The whole cost structure of stretchable conductive inks can be impacted by the pricing of materials including graphene, carbon nanotubes and specialized polymers.

The widespread acceptance across several sectors may be hampered by these high production costs, which may make the finished goods less affordable for both producers and end-users. Businesses that produce stretchable conductive ink usually have trouble achieving a balance between cost-effectiveness and the requirement for innovative, high-performance materials to be competitive in the market.

Limited Suitable in Difficult Environments

There may be limitations on how well stretchable conductive inks function in extreme weather, particularly if it comes to temperature, humidity or chemical exposure. The limitation may have an impact on the quality and durability of electronic equipment and parts made using stretchy conductive inks, which may restrict their use in sectors like the aerospace or automotive industries where equipment may be subjected to harsh working conditions.

Stretchable conductive ink manufacturers are always trying to increase the durability of their products so that they may be used in more situations, but this takes constant research and development to get over specific obstacles. Stretchable conductive ink manufacturers are constantly involved in current research and development initiatives aimed at improving the robustness and longevity of their products.

Segment Analysis

The global stretchable conductive ink market is segmented based on type, technology, application, end-user and region.

Rising Conductive Inks Use in Photovoltaics Application

The Photovoltaics segment is among the growing regions in the global stretchable conductive ink market covering more than 1/3rd of the market. The photovoltaic (PV) sector has been growing rapidly on a global basis, with China leading the way in terms of capacity increases both now and in the future. Globally, solar photovoltaics and wind energy have had the fastest growth of all the renewable energy sources. Each year, two-thirds of the renewable energy generated comes from these two sources.

The total photovoltaic power capacity global was 1053.12 gigawatts in 2022, up 22.2% from 861.54 gigawatts in 2021, according to the Statistical Review of World Energy 2023. The International Energy Agency reports that in 2022, solar PV generation reached a record 270 terawatt hours (TWh), up almost 26% from the previous year and nearly approaching 1 300 TWh. In terms of the rise in generation of all renewable technologies in 2022, it has eclipsed wind energy.

Geographical Penetration

Growing Demand for Innovative Materials and Rising Printed Circuit Boar Industry in Asia-Pacific

Asia-Pacific has been a dominant force in the global stretchable conductive ink market is being driven by the electronics and wearable technology industries in Asia-Pacific, which includes China, Japan, South Korea and India, which have been major growth factors for the global stretchable conductive ink market. The demand for innovative materials such as stretchy conductive inks has been driven by a growing demand for flexible and elastic electronics in wearables, fitness trackers and smart clothing.

Additionally, China is the market leader in Asia-Pacific and global photovoltaic capacity increases. It is anticipated that China, India and other Asia-Pacific countries provide the majority of the capacity expansion throughout the next years. Conductive inks are being utilized more often in manufacturing printed circuit boards (PCBs), sensors and antennas due to the growing need for flexible and printable electronics.

Furthermore, Taiwan has an important seat in the PCB industry. The printed circuit board sector, with a 33.9% market share, has briefly taken the lead in the global market, according to the Taipei Printed Circuit Association (TPCA). Taiwan produced over 625 million square feet of printed circuit boards in 2022. If the government creates a globally center for innovative PCB fabrication and strives for supply autonomy for PCB materials, Taiwan could be able to hold onto its technical use for up to five years.

Furthermore, China is spending heavily on developing new methods to advance the shrinking of electronics products quickly and controls almost the whole value chain of the global electronics production sector. As of 2022, China has 390 gigawatts of installed solar power capacity, according to the China Electricity Council. China has made significant progress in increasing its solar power capacity; from just 4.2 gigawatts in 2012 to 392.6 gigawatts in 2022, the country has increased its cumulative capacity.

In addition, the Indian government has set an ambitious goal of installing 500 GW of renewable energy by 2031, including 280 GW of solar power. It would raise the need for stretchable conductive inks in India and help usher in a green revolution.

COVID-19 Impact Analysis

The stretchable conductive ink market has not been exempted from the COVID-19 pandemic's complex repercussions on the world economy. Widespread interruptions in production, transportation and supply chains during the early stages of the pandemic presented serious obstacles for the stretchable conductive ink market.

Lockdowns, labor shortages and travel restrictions forced several manufacturing facilities to evacuate or scale back activities, resulting in delays in supply and production. The market experienced changes on the demand side as customer priorities evolved. The market for some applications of stretchable conductive inks, such as those in consumer electronics and wearable technology influenced by the implementation of lockdowns and social distancing techniques.

Stretchable conductive inks for use in medical devices and sensors may see a rise in interest and demand as a result of the pandemic's focus on the significance of healthcare applications. As the pandemic progressed, manufacturing operations gradually recovered as businesses adjusted to new safety regulations and labor standards.

Increased emphasis on robust and diverse supply chains, faster innovation in healthcare-related applications and a persistent focus on technologies that facilitate remote work and healthcare monitoring are some potential long-term effects on the market for stretchable conductive ink. For the most recent information on the stretchable conductive ink market's post-pandemic scenario, it is important to continue keeping updated on industry publications and market evaluations as the situation develops.

Russia-Ukraine War Impact Analysis

The market for stretchable conductive ink is impacted by trade disputes and other geopolitical events. The war between Russia and Ukraine may throw up the world's supply chain for the raw ingredients required for producing stretchable conductive inks. Should Russia or Ukraine take a substantial role in the manufacturing or provision of essential resources, such as chemicals or metals, shortages or higher prices could adversely impact companies globally.

Additionally, modifications to currency exchange rates may be a result of political instability and economic instability in the area, which might have an impact on market dynamics and the price of imported products. In addition, the conflict-affected global company investments and consumer confidence, which might affect many industries, including wearable technology and electronics.

Demand trends for stretchable conductive ink, which is used in consumer electronics, wearable technology and medical equipment, may change. As a response to geopolitical alterations, businesses may review their sourcing and supply chains, posing new possibilities and difficulties for the stretchable conductive ink industry. For the most up-to-date information on the precise effects of the Russia-Ukraine war on the global stretchable conductive ink market, it is imperative to refer to recent publications and industry analyses.

By Type

- Silver Flakes

- Carbon/Graphene

- Silver Nanoparticles

- Silver Nanowire

- Silver Coated Copper Nanoparticles

- Carbon Nanotube Inks

- Copper Flakes

- Copper Nanoparticles

- Copper Oxide Nanoparticle Inks

- Conductive Polymer

- Others

By Technology

- Inkjet Printing

- Screen Printing

- Flexographic Printing

- Gravure Printing

- Others

By Application

- Photovoltaics

- Membrane Switches

- Displays

- Automotive

- Bio-sensors

- RFID

- Printed Circuit Boards

- Thermal Heating

- Others

By End-User

- Electronics

- Healthcare

- Textiles

- Automotive

- Aerospace

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On February 18, 2022, DuPont and Celanese Corporation agreed to an agreement for the sale of the majority of the Mobility & Materials segment for US$11.0 billion in cash, subject to customary transaction adjustments made per the definitive agreement. The sale includes the Engineering Polymers business line and select product lines within the Performance Resins and Advanced Solutions business lines.

- On November 17, 2021, In November 2021, NovaCentrix a company that designs and develops top-notch conductive inks was awarded a Global Technology Award in the Best Product - North America category for their Pulse Forge Soldering In-Line. The prize, which contributes to a product's influence on the market, was presented during a ceremony held during Productronica in Munich, Germany.

Competitive Landscape

The major global players in the market include DowDuPont Inc, Dycotec Materials Ltd, Nanopaint, TEKRA, LLC., Sun Chemical Corporation, NovaCentrix, Vorbeck Materials Corp, Saralon GmbH, Henkel AG & Co. KGaA and Creative Materials.

Why Purchase the Report?

- To visualize the global stretchable conductive ink market segmentation based on type, technology, application, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of stretchable conductive ink market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available in Excel consisting of key products of all the major players.

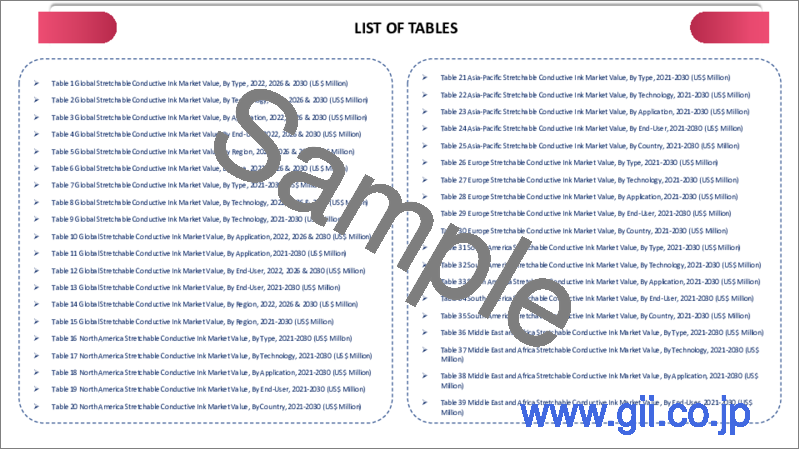

The global stretchable conductive ink market report would provide approximately 70 tables, 81 figures and 201 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Type

- 3.2. Snippet by Technology

- 3.3. Snippet by Application

- 3.4. Snippet by End-User

- 3.5. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Innovation and Technological Growth in the Electronics Industry

- 4.1.1.2. Rising Demand in Wearable Technology

- 4.1.2. Restraints

- 4.1.2.1. High Production Costs

- 4.1.2.2. Limited Suitable in Difficult Environments

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Silver Flakes*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Carbon/Graphene

- 7.4. Silver Nanoparticles

- 7.5. Silver Nanowire

- 7.6. Silver Coated Copper Nanoparticles

- 7.7. Carbon Nanotube Inks

- 7.8. Copper Flakes

- 7.9. Copper Nanoparticles

- 7.10. Copper Oxide Nanoparticle Inks

- 7.11. Conductive Polymer

- 7.12. Others

8. By Technology

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 8.1.2. Market Attractiveness Index, By Technology

- 8.2. Inkjet Printing*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Screen Printing

- 8.4. Flexographic Printing

- 8.5. Gravure Printing

- 8.6. Others

9. By Application

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.1.2. Market Attractiveness Index, By Application

- 9.2. Photovoltaics*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Membrane Switches

- 9.4. Displays

- 9.5. Automotive

- 9.6. Bio-sensors

- 9.7. RFID

- 9.8. Printed Circuit Boards

- 9.9. Thermal Heating

- 9.10. Others

10. By End-User

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.1.2. Market Attractiveness Index, By End-User

- 10.2. Electronics*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Healthcare

- 10.4. Textiles

- 10.5. Automotive

- 10.6. Aerospace

- 10.7. Others

11. By Region

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2. Market Attractiveness Index, By Region

- 11.2. North America

- 11.2.1. Introduction

- 11.2.2. Key Region-Specific Dynamics

- 11.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 11.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.7.1. U.S.

- 11.2.7.2. Canada

- 11.2.7.3. Mexico

- 11.3. Europe

- 11.3.1. Introduction

- 11.3.2. Key Region-Specific Dynamics

- 11.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 11.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.7.1. Germany

- 11.3.7.2. UK

- 11.3.7.3. France

- 11.3.7.4. Russia

- 11.3.7.5. Spain

- 11.3.7.6. Rest of Europe

- 11.4. South America

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 11.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 11.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.7.1. Brazil

- 11.4.7.2. Argentina

- 11.4.7.3. Rest of South America

- 11.5. Asia-Pacific

- 11.5.1. Introduction

- 11.5.2. Key Region-Specific Dynamics

- 11.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 11.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.7.1. China

- 11.5.7.2. India

- 11.5.7.3. Japan

- 11.5.7.4. Australia

- 11.5.7.5. Rest of Asia-Pacific

- 11.6. Middle East and Africa

- 11.6.1. Introduction

- 11.6.2. Key Region-Specific Dynamics

- 11.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 11.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

12. Competitive Landscape

- 12.1. Competitive Scenario

- 12.2. Market Positioning/Share Analysis

- 12.3. Mergers and Acquisitions Analysis

13. Company Profiles

- 13.1. DowDuPont Inc*

- 13.1.1. Company Overview

- 13.1.2. Product Portfolio and Description

- 13.1.3. Financial Overview

- 13.1.4. Key Developments

- 13.2. Dycotec Materials Ltd

- 13.3. Nanopaint

- 13.4. TEKRA, LLC.

- 13.5. Sun Chemical Corporation

- 13.6. NovaCentrix

- 13.7. Vorbeck Materials Corp

- 13.8. Saralon GmbH

- 13.9. Henkel AG & Co. KGaA

- 13.10. Creative Materials

LIST NOT EXHAUSTIVE

14. Appendix

- 14.1. About Us and Services

- 14.2. Contact Us