|

|

市場調査レポート

商品コード

1423460

ラテックスインキの世界市場-2024-2031Global Latex Ink Market - 2024-2031 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ラテックスインキの世界市場-2024-2031 |

|

出版日: 2024年02月09日

発行: DataM Intelligence

ページ情報: 英文 192 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

世界のラテックスインキ市場は、2023年に192億米ドルに達し、2024年から2031年の予測期間中にCAGR 3.3%で成長し、2031年には250億米ドルに達すると予測されています。

米国に本社を置く企業は、最先端技術を取り入れたラテックスプリンターの製造・販売に積極的に取り組んでいます。米国企業は、高度に洗練されたラテックス・インク処方の開発で業界をリードしています。その開発の中心は、環境に優しい品質を維持しながら、印刷品質、色の明るさ、粘着性を向上させることにあります。

例えば、2023年9月19日、HP Latex 630プリンターシリーズの導入により、HP Inc.はラテックス製品ラインを拡大し、あらゆる規模のプリントサービスプロバイダーが白インク技術を利用できるようになった。ユーザーは、白インクを使用することで、エンドユーザーの注目を集めるキャンペーンを展開することができ、優れた画質とページから飛び出すような色彩で、よりインパクトのある看板や装飾作品を選択することができます。そのため、北米ラテックスインキ市場では米国市場がシェアの大半を占めています。

ダイナミクス

ラテックス技術に対する認識の高まり

意識の高まりにより、ラテックスインキの環境に有益な品質に注目が集まっています。水性ラテックスインキは従来の溶剤ベースのインキよりも揮発性有機化合物(VOC)の排出が少ないため、より環境に優しい選択です。テキスタイル、紙、ビニールを含む様々な基材上でのラテックスインキの寿命と適応性は、利害関係者に知られるようになってきています。ラテックスインキが様々な印刷目的にどのように使用できるかを理解することで、その市場性が高まる。印刷業者とエンドユーザーが単一のインキタイプを様々な印刷用途に利用することの利点を理解することで、受容性が高まる。

ラテックスインキがバナー、グラフィック、看板などのワイドフォーマット印刷用途に適していることが理解されます。多くの用途があるため、ラテックスインキは印刷サービスプロバイダーや大判印刷分野でますます好まれるようになり、市場拡大を後押ししています。例えば、ITMF(国際繊維工業連盟)の報告によると、世界の繊維産業は成長を続けており、繊維生産量は年々増加しています。この成長は、捺染デジタル印刷の市場ポテンシャルを示しています。

技術の進歩と持続可能性

ラテックス印刷インキは傷みにくく環境に優しいため、屋内外で使用される製品に最適です。ラテックスインキは、その独特の水性処方と常に進歩する商業印刷技術により、市場は着実に売上を伸ばしています。ワイドフォーマット製品市場では、こうした最新の開発により、これまでにない印刷の自由度が提供されています。

ラテックスインキのニーズは、大判プリンターやデジタル印刷機などの印刷機器の技術開発に直接影響を受けています。ラテックスインキが現代の印刷技術に対応する能力は、様々な業界の拡大するニーズを満たす高品質で効果的な印刷プロセスを可能にします。

例えば、HPは2021年2月、卓越した印刷持続性と汎用性を提供するラテックスプリンターの新ラインを発表しました。新しいHP Latex 700および800プリンターにより、プリンターは刻々と変化する市場のニーズに対応することができます。

デジタル化とインダストリー4.0

デジタル化により、印刷作業はより自動化され、効率的になります。印刷機器は、スマートセンサーやモノのインターネット(IoT)デバイスの統合といったインダストリー4.0のコンセプトにより、リアルタイムで監視・制御することができます。手動の介入を減らし、エラーを最小限に抑えることで、この自動化の向上はラテックスインキ印刷の総合的な生産効率を高めます。

インダストリー4.0は、人工知能とデータ分析に基づくスマート印刷技術を導入しています。リアルタイムのデータを活用することで、これらの技術とリンクしたラテックスインキ印刷機は、色精度の向上、メンテナンス要件の予測、印刷設定の最適化が可能になり、これらすべてが高品質印刷につながります。

代替インクとの競合

エコソルベント・インキは、印刷の耐久性と環境への配慮のバランスを提供します。ワイドフォーマット印刷のアプリケーションでは、これらのインキが頻繁に使用されます。ラテックスインキとエコソルベントインキの競合は、乾燥時間、色の鮮やかさ、基材適合性などの面で展開されることが多いです。

水性インキには他のタイプもあるが、ラテックスインキはその一種です。このカテゴリーでは、顔料インキや水性染料のような様々な配合が競合となる可能性があります。ラテックスインキを使うか、他の種類の水性インキを使うかは、価格、印刷品質、基材適合性などの変数に影響されるかもしれないです。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- ラテックス技術に対する認識の高まり

- 技術の進歩と持続可能性

- 抑制要因

- 代替インキとの競合

- 機会

- デジタル化とインダストリー4.0

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 タイプ別

- 水性ラテックスインキ

- 溶剤型ラテックスインキ

- UV硬化型ラテックスインキ

第8章 用途別

- 印刷

- 看板

- 装飾印刷

- ラベルおよびパッケージ

- その他

第9章 技術別

- サーマルインクジェット

- 圧電インクジェット

第10章 エンドユーザー別

- 印刷会社

- 広告・マーケティング会社

- テキスタイルメーカー

- パッケージメーカー

- その他

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第12章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 企業プロファイル

- HP Inc.

- 会社概要

- 製品ポートフォリオと概要

- 財務概要

- 主な発展

- Epson Corporation

- Canon Inc.

- Roland DG Corporation

- Mimaki Engineering Co., Ltd.

- Seiko Epson Corporation

- DuPont de Nemours, Inc.

- Agfa-Gevaert N.V.

- Fujifilm Holdings Corporation

- Sun Chemical Corporation

第14章 付録

Overview

Global Latex Ink Market reached US$ 19.2 billion in 2023 and is expected to reach US$ 25.0 billion by 2031, growing with a CAGR of 3.3% during the forecast period 2024-2031.

Companies with headquarters in U.S. are actively engaged in the creation and marketing of latex printers that incorporate cutting-edge technology. American companies are leading the way in the development of highly sophisticated latex ink formulas. The developments frequently center on preserving eco-friendly qualities while improving print quality, color brightness and adhesive features.

For instance, on September 19, 2023, with the introduction of the HP Latex 630 printer series, HP Inc. expanded its Latex product line and enabled Print Service Providers of all sizes to utilize white ink technology. Users can produce attention-grabbing campaigns for end-users by using white ink to develop a more impactful selection of signs and decor works with superb image quality and colors that jump off the page. Therefore, U.S. market place accounts for the majority of the market shares in the North American latex inks market.

Dynamics

Increased Awareness of Latex Technology

Growing awareness brings attention to latex inks' environmentally beneficial qualities. Water-based latex inks are a more environmentally friendly choice since they emit fewer volatile organic compounds (VOCs) than conventional solvent-based inks. The longevity and adaptability of latex ink on a variety of substrates, including textiles, paper and vinyl, are becoming known to stakeholders. Understanding how latex inks can be used for a variety of printing purposes increases their marketability. Increased acceptance results from printers and end-users realizing the benefits of utilizing a single ink type for a variety of printing applications.

Understanding of latex inks' appropriateness for wide-format printing uses, including banners, graphics and signage. Due to their many uses, latex inks are increasingly preferred by print service providers and large-format printing sectors, which fuels market expansion. For instance, as per report by the ITMF (International Textile Manufacturers Federation), the global textile industry has been growing, with a rise in textile production year over year. The growth is indicative of the market potential for textile digital printing.

Technological Advancements and Sustainability

Since latex printing ink is damage-resistant and environmentally friendly, it is the ideal option for products that are used both indoors and outdoors. The market has seen a steady increase in latex ink sales due to its distinct water-based formula and constantly advancing commercial print technology. The wide-format product market now offers unprecedented degrees of printing freedom because of these latest developments.

The need for latex inks is directly impacted by technological developments in printing equipment, such as large-format printers and digital printing machines. Latex inks' ability to work with contemporary printing technology enables high-quality, effective printing processes that satisfy the expanding needs of a variety of industries.

For instance, in February 2021, HP has unveiled their new line of Latex printers, which offers exceptional printing sustainability and versatility. With the new HP Latex 700 and 800 printers, printers can adapt to the ever-changing needs of the market.

Digitalization and Industry 4.0

Digitalization makes printing operations more automated and efficient. Printing equipment may be monitored and controlled in real-time thanks to Industry 4.0 concepts like the integration of smart sensors and Internet of Things (IoT) devices. Through the reduction of manual intervention and the minimization of errors, this improved automation enhances the total production efficiency in latex ink printing.

Industry 4.0 introduces artificial intelligence and data analytics-based smart printing technology. By utilizing real-time data, latex ink printers that are linked with these technologies can improve color accuracy, anticipate maintenance requirements and optimize print settings, all of which result in higher-quality prints.

Competition from Alternative Inks

Eco-solvent inks offer a balance between print durability and environmental concerns. Applications for wide-format printing frequently use these inks. The competition between latex inks and eco-solvent inks frequently revolves around aspects such as drying time, colour vibrancy and substrate compatibility.

Though there are other types of water-based inks as well, latex inks are one kind of them. In this category, competition may come from various formulations like pigment inks or aqueous dyes. The decision to use latex or another type of water-based ink may be influenced by variables such as price, print quality and substrate compatibility.

Segment Analysis

The global latex ink market is segmented based on type, application, technology, end-user and region.

Water-Based Latex Ink Revolutionizes Printing and Packaging

A special blend of water, colors and latex polymer particles is used to create water-based latex ink. The latex particles serve as the binder, offering superior durability and adherence on a range of substrates. Water-based latex ink is an environmentally acceptable substitute for solvent-based inks because it doesn't contain any hazardous volatile organic compounds (VOCs).

Keeping up with current trends is essential in the quick-paced world of packaging and printing. Water-based latex ink was developed in response to the growing need for high-quality, environmentally friendly prints. Professionals in the packaging and printing industries will find this innovative solution to be highly advantageous compared to conventional inks. Therefore, the water-based latex ink captures the majority of the total global segmental shares.

Geographical Penetration

China's Economic Growth and E-Commerce Boom Propel Latex Ink Market Expansion in Asia-Pacific

Strong economic growth in China has raised consumer demand for a wide range of goods, particularly in the e-commerce industry. Due to the increase in packaging needs for shipping and delivery of goods brought about by the growth of e-commerce, there is a need for premium printing supplies, such as latex inks.

The need for printed materials has grown across a number of industries, including retail, packaging and advertising, as a result of China's steady economic expansion and fast urbanization. The need for printed products is rising, which propels the use of latex inks and fuels the market's expansion in the Asia-Pacific. Therefore, the China is growing at a highest CAGR during the forecasted period.

COVID-19 Impact Analysis

Global supply networks were thrown off balance by the pandemic, which had an impact on the transportation and manufacture of raw ingredients needed to make latex ink. Manufacturers of latex ink may have encountered manufacturing issues as a result of supply chain delays and shortages.

The implementation of lockdowns and limits resulted in a decline in the market for a variety of printed publications, particularly those pertaining to the advertising, events and physical retail sectors. The market for latex ink may have been impacted by this drop in printed material demand since fewer orders from historically printing-dependent industries may have had an effect on total sales.

Russia-Ukraine War Impact Analysis

Economic instability brought on by geopolitical crises frequently affects consumer and company confidence. Uncertainty in the economy might lead to lower expenditure, which would impact printing-dependent sectors like packaging and advertising.

Currency exchange rates are subject to variations based on geopolitical events. The cost of imported supplies and, thus, the total cost of production for latex inks could be impacted by the war if it affects the stability of the local currency. The conflict might have a more noticeable effect on the nearby area, which would affect the latex ink industry there. It could be difficult for businesses in the impacted areas to continue operating normally and satisfy consumer demand.

By Type

- Water-based Latex Inks

- Solvent-based Latex Inks

- UV-curable Latex Inks

By Application

- Printing

- Signage

- Decorative Printing

- Labels and Packaging

- Others

By Technology

- Thermal Inkjet

- Piezoelectric Inkjet

By End-User

- Printing Agencies

- Advertising and Marketing Agencies

- Textile Manufacturers

- Packaging Manufacturers

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On September 19, 2023, with the introduction of the HP Latex 630 printer series, HP Inc. expanded its Latex product line and enabled Print Service Providers of all sizes to utilize white ink technology.

- In June 2023, HP uses 1500 square meters of sustainable latex prints to adorn the Cannes Film Festival. H2O, a nearby print service business situated just outside of Cannes, designed and built the prints.

- In February 2021, HP has unveiled their new line of Latex printers, which offers exceptional printing sustainability and versatility.

Competitive Landscape

The major global players in the market include HP Inc., Epson Corporation, Canon Inc., Roland DG Corporation, Mimaki Engineering Co., Ltd., Seiko Epson Corporation, DuPont de Nemours, Inc., Agfa-Gevaert N.V., Fujifilm Holdings Corporation and Sun Chemical Corporation.

Why Purchase the Report?

- To visualize the global latex ink market segmentation based on type, application, technology, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of latex ink market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Type mapping available as excel consisting of key products of all the major players.

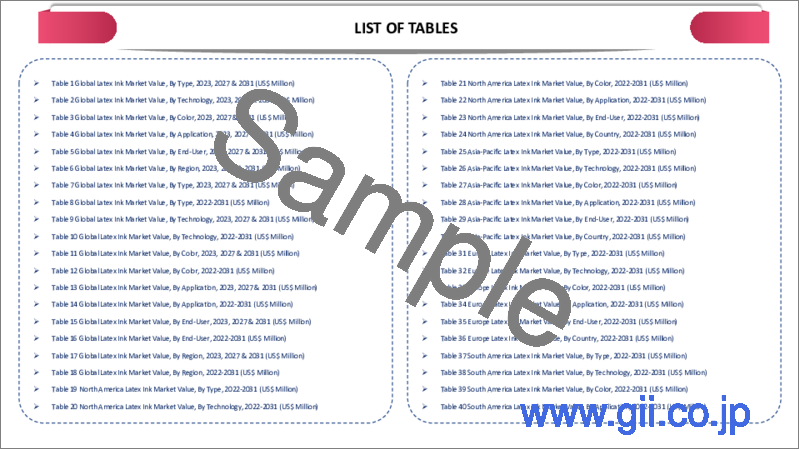

The global latex ink market report would provide approximately 69 tables, 69 figures and 192 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Type

- 3.2. Snippet by Application

- 3.3. Snippet by Technology

- 3.4. Snippet by End-User

- 3.5. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Increased Awareness of Latex Technology

- 4.1.1.2. Technological Advancements and Sustainability

- 4.1.2. Restraints

- 4.1.2.1. Competition from Alternative Inks

- 4.1.3. Opportunity

- 4.1.3.1. Digitalization and Industry 4.0

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Water-based Latex Inks*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Solvent-based Latex Inks

- 7.4. UV-curable Latex Inks

8. By Application

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 8.1.2. Market Attractiveness Index, By Application

- 8.2. Printing*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Signage

- 8.4. Decorative Printing

- 8.5. Labels and Packaging

- 8.6. Others

9. By Technology

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 9.1.2. Market Attractiveness Index, By Technology

- 9.2. Thermal Inkjet*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Piezoelectric Inkjet

10. By End-User

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.1.2. Market Attractiveness Index, By End-User

- 10.2. Printing Agencies*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Advertising and Marketing Agencies

- 10.4. Textile Manufacturers

- 10.5. Packaging Manufacturers

- 10.6. Others

11. By Region

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2. Market Attractiveness Index, By Region

- 11.2. North America

- 11.2.1. Introduction

- 11.2.2. Key Region-Specific Dynamics

- 11.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 11.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.7.1. U.S.

- 11.2.7.2. Canada

- 11.2.7.3. Mexico

- 11.3. Europe

- 11.3.1. Introduction

- 11.3.2. Key Region-Specific Dynamics

- 11.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 11.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.7.1. Germany

- 11.3.7.2. UK

- 11.3.7.3. France

- 11.3.7.4. Italy

- 11.3.7.5. Russia

- 11.3.7.6. Rest of Europe

- 11.4. South America

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 11.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 11.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.7.1. Brazil

- 11.4.7.2. Argentina

- 11.4.7.3. Rest of South America

- 11.5. Asia-Pacific

- 11.5.1. Introduction

- 11.5.2. Key Region-Specific Dynamics

- 11.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 11.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.7.1. China

- 11.5.7.2. India

- 11.5.7.3. Japan

- 11.5.7.4. Australia

- 11.5.7.5. Rest of Asia-Pacific

- 11.6. Middle East and Africa

- 11.6.1. Introduction

- 11.6.2. Key Region-Specific Dynamics

- 11.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 11.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

12. Competitive Landscape

- 12.1. Competitive Scenario

- 12.2. Market Positioning/Share Analysis

- 12.3. Mergers and Acquisitions Analysis

13. Company Profiles

- 13.1. HP Inc.*

- 13.1.1. Company Overview

- 13.1.2. Type Portfolio and Description

- 13.1.3. Financial Overview

- 13.1.4. Key Developments

- 13.2. Epson Corporation

- 13.3. Canon Inc.

- 13.4. Roland DG Corporation

- 13.5. Mimaki Engineering Co., Ltd.

- 13.6. Seiko Epson Corporation

- 13.7. DuPont de Nemours, Inc.

- 13.8. Agfa-Gevaert N.V.

- 13.9. Fujifilm Holdings Corporation

- 13.10. Sun Chemical Corporation

LIST NOT EXHAUSTIVE

14. Appendix

- 14.1. About Us and Services

- 14.2. Contact Us