|

|

市場調査レポート

商品コード

1401304

アルミニウム線材・ケーブル・導体の世界市場:2023年~2030年Global Aluminum Wire Rod, Cables & Conductors Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| アルミニウム線材・ケーブル・導体の世界市場:2023年~2030年 |

|

出版日: 2023年12月29日

発行: DataM Intelligence

ページ情報: 英文 181 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

世界のアルミニウム線材・ケーブル・導体の市場規模は、2022年に286億米ドルに達し、2023年~2030年の予測期間中にCAGR4.8%で成長し、2030年には416億米ドルに達すると予測されています。

アルミニウム線材の製造への投資は、近年、組織や投資家の間でますます一般的になってきています。アルミニウム線材のニーズは、エレクトロニクス、エネルギー、輸送、建設など複数の産業の成長により世界的に急増しています。線材は、ケーブル、導電体、建築用電線など、さまざまなアルミニウム製品を製造する際の中間製品として使用されます。このようなニーズの高まりを受けて、アルミニウム線材の需要は増加すると予想されます。

インドは、ケーブルや導体の生産に革新的な方法を採用する努力と研究開発への投資により、国際規格を満たすアルミニウムをベースとした高品質の電気製品を製造しています。

例えば、2023年10月にニューデリーで開催されたケーブル・アンド・ワイヤー・フェア2023では、インドの大手アルミニウムメーカーであるVedanta Aluminumが、T4、AL59、8xxxシリーズなどの革新的な線材を発表しました。洗練された連続鋳造技術で製造されるこの最先端製品は、国際的な動力・ギアボックス業界の標準を高める態勢を整えています。その用途は、エレクトロニクス、建築、自動車、インフラストラクチャーなどの業界に広がっています。そのため、インド市場は地域市場において大きなシェアを占めています。

力学

自動車製造における理論的枠組みと展望に注目

自動車用ケーブルの代替導体としてのアルミニウム金属の使用は、自動車の軽量化需要の高まりと、天然資源の枯渇による銅金属のコスト高騰に後押しされています。本レポートの目的は、新しい自動車ケーブル、すなわちアルミケーブルの導入に関する将来の調査と進歩のための理論的枠組みを確立することです。スカニア製品における自動車用アルミニウムケーブルの使用についてさらに調査を進めることで、現在の自動車部門におけるこれらのケーブルの展開や、自動車用アルミニウムケーブルに関連する故障解析・評価手法を構築することができます。

代替導体としてアルミニウムが注目されているのは、自動車産業における軽量化という動向に沿ったものです。ケーブルや導体の製造では、自動車が燃費向上と低排出ガス化を目指すにつれて、アルミニウムのような軽量材料の必要性が高まっています。

例えば、CRUグループのデータによると、アルミニウム棒の上位10社の生産量は、世界の線材生産量の36%を占めています。上位10社の生産シェアは54%で、インド政府とAditya Birla Group、Nalco、Vedantaといったインドに本社を置く企業がアルミニウム線材生産者の上位を独占しています。上位10社では、ロシアのRusalが第2位の生産者です。

電気産業からの需要増加

送電と配電のために、電気部門は効率的な導体とケーブルを必要としています。アルミニウムはその優れた導電性と軽量の性質から、この種の用途に非常に好まれる材料であり、信頼性の高い電力ネットワークに対するニーズの高まりに応えています。

効果的な電気配線とケーブルは、電気産業に含まれる産業機械、商業ビル、通信インフラストラクチャの運用に不可欠です。アルミニウム導体・ケーブルは、その仕様に適合しており、需要の増加を支えています。

例えば、2023年2月、インド最大のアルミニウムメーカーであるVedanta Aluminumは、国際アルミニウム会議(IAC)2023において、電気部門向けに特別に設計された新製品を発表しました。560キロ・トンの生産能力を持つ12mmアルミニウム線材は、最新のProperziの連続鋳造技術を利用して生産されます。比類のない金属純度の100%一次アルミニウムで構成されています。また、カスタマイズされた巻線パターン、顧客要件に基づく潤滑の柔軟性、優れた表面品質を可能にします。

代替手段の利用可能性

アルミニウムを材料として使用する利点やアルミニウム線材の需要の増加にもかかわらず、起業家や投資家は市場における課題と機会を認識する必要があります。ビジネスが直面している問題の一つは、鉄や銅のような代替材料との競合が激化していることです。強度と導電性により、これらの材料は建築用ケーブルや導電体の製造にも利用できます。

アルミニウムは軽量で十分な導電性を持っているため、銅の代わりに線材やケーブル、導体として使用することができます。供給が制限されたり、銅の価格が上昇したりするにつれて、アルミニウムがより手頃な代替品であるという業界の認識は高まっています。アルミニウムは銅よりも経済的で、豊富です。線材や導体の原料としてアルミニウムが入手可能なため、特に大規模な用途において、費用対効果の高いソリューションを求める産業にとって魅力的な選択肢となります。

銅価格の変動

銅価格の変動は、線材、ケーブル、導体の代替材料としてのアルミニウムの魅力に直接影響を与えます。銅の価格が低いか安定しているときは、アルミニウムに転換する必要性や動機が減少し、アルミニウムをベースにした製品の市場の成長可能性に影響を与えます。銅の価格変動は、アルミニウムの代替品としての競争力に影響を与えます。銅の価格が下落したり、長期間安定した状態が続けば、アルミニウムの価格優位性が低下する可能性があり、その場合、アルミニウムの市場浸透に影響を与え、拡大が制限されることになります。

産業界やメーカーは、線材や導体のニーズに対して銅とアルミのどちらを選ぶかを決める前に、材料費など多くの基準を総合的に判断します。銅の価格変動が長引けば、意思決定のプロセスに不確実性と遅れが生じ、企業は代替資源への移行を延期したり、再検討したりすることになります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 新興経済国での生産拡大

- 電気産業からの需要増大

- 抑制要因

- 代替品の入手可能性

- 銅価格の変動

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 製品別

- アルミニウム線材

- アルミニウムケーブル

- アルミニウム導体

第8章 エンドユーザー別

- 自動車

- 送配電

- 建設

- 通信

- その他

第9章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋

- 中東・アフリカ

第10章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第11章 企業プロファイル

- Nexans

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Prysmian Group

- Southwire Company

- Norsk Hydro ASA

- General Cable Corporation

- Eland Cables

- Alcan Cable

- Jiangsu Zhongchao Holding Co., Ltd.

- AFC Cable Systems, Inc.

- Vedanta Ltd.(Sterlite Copper)

第12章 付録

Overview

Global Aluminum Wire Rod, Cables & Conductors Market reached US$ 28.6 billion in 2022 and is expected to reach US$ 41.6 billion by 2030, growing with a CAGR of 4.8% during the forecast period 2023-2030.

Investing in the manufacturing of aluminum wire rod has become more and more common among organizations and investors in recent years. The need for aluminum wire rod has surged globally due to the growth of multiple industries such as electronics, energy, transportation and construction. The wire rod is used as an intermediary product in the production of various aluminum items, such as cables, electrical conductors and construction wires. The demand for aluminum wire rod is expected to increase in response to this growing need for these products.

India manufactures high-quality electrical products based on aluminum that meet international standards due to its efforts to adopt innovative methods in the production of cables and conductors as well as its investments in research and development.

For instance, in October 2023, at the Cable & Wire Fair 2023 in New Delhi, Vedanta Aluminum, the leading aluminum manufacturer in India, unveiled an innovative range of wire rods, including the T4, AL59 and 8xxx series. The cutting-edge items, made using sophisticated continuous casting techniques, are poised to increase the standard in the international power and gearbox industry. Its uses are widespread in industries like electronics, building, automotive and infrastructure. Therefore, the Indian market place accounts for the significant market shares in the regional market.

Dynamics

Focus on Theoretical Framework and Prospects in Vehicle Manufacturing

The use of aluminum metal as an alternative conductor for automobile cables has been encouraged by the growing demand for lightweight vehicles and the skyrocketing cost of copper metal due to the depletion of natural resources. The purpose of this thesis work is to establish the theoretical framework for future investigation and advancement concerning the introduction of new vehicle cables, namely aluminum cables. Further investigation into the use of automotive aluminum cables in Scania products can build upon the current automotive sector deployment of these cables, as well as failure analysis and evaluation methodologies pertaining to automotive aluminum cables.

The focus on aluminum as a substitute conductor is in line with the trend in the automotive industry towards the production of lighter vehicles. In the fabrication of cables and conductors, there is an increasing need for lighter materials like as aluminum as cars strive for greater fuel efficiency and lower emissions.

For instance, as per CRU Group data, The top ten producers of aluminum rod account for 36% of the world's wire rod production. With a 54% production share of the top 10, the Indian government and firms with headquarters in India, such as Aditya Birla Group, Nalco and Vedanta, dominate the list of aluminum wire rod producers. In the top ten list, Russia's Rusal is the second-largest producer.

Growing Demand from Electrical Industry

For the transmission and distribution of power, the electrical sector needs conductors and cables that are efficient. Because of its excellent conductivity and lightweight nature, aluminum is a highly preferred material for these kinds of applications, fulfilling the growing need for dependable power networks.

Effective electrical wiring and cables are essential to the operation of industrial machinery, commercial buildings and telecommunications infrastructure, all of which are included in the electrical industry. The specifications are met by aluminum conductors and cables, which supports their increasing demand.

For instance, in February 2023, the largest aluminum manufacturer in India, Vedanta Aluminum, unveiled a new product at the International Aluminum Conference (IAC) 2023 specifically designed for the electrical sector. With a 560 Kilo Tons production capacity, the 12 mm Aluminum Wire Rod is produced utilizing the most recent Properzi Continuous Casting technology. It is composed of 100% primary aluminum for unmatched metal purity. It also enables customized winding patterns, flexibility in lubrication based on customer requirements and superior surface quality.

Availability of Alternatives

Entrepreneurs as well as investors need to be aware of the challenges and opportunities in the market despite the advantages of using aluminum as a material and the growing demand for aluminum wire rod. One of the issues facing the business is the growing competition from alternative materials like steel and copper. Due to their strength and electrical conductivity, these materials can also be utilized to make building cables and electrical conductors.

Due to its lighter and has sufficient conductivity, aluminum can be used as wire rod, cables and conductors in place of copper. Industry perceptions of aluminum as a more affordable alternative are growing as supply becomes more limited or as copper prices rise. Cost-Effectiveness and Abundance: Aluminum is more economical and abundant than copper. The availability of aluminum as a raw material for wire rods and conductors makes it an appealing option for industries looking for cost-effective solutions, particularly in large-scale applications.

Copper Price Volatility

Copper price fluctuations have a direct impact on aluminum's appeal as a substitute material for wire rods, cables and conductors. The need or motivation to convert to aluminum decreases when copper prices are low or stable, which has an impact on the market's potential for growth for products based on aluminum. The price volatility of copper has an impact on aluminum's ability to compete as a substitute. The price advantage of aluminum could be reduced if copper prices drop or stay steady for a long time, which would affect its market penetration and limit its expansion.

Industries and manufacturers weigh a number of criteria, such as the cost of materials, before selecting between copper and aluminum for their wire rod and conductor needs. Prolonged volatility in copper prices can induce uncertainty and delay in the decision-making process, leading enterprises to defer or reevaluate their transition to substitute resources.

Segment Analysis

The global aluminum wire rod, cables & conductors market is segmented based on product, end-user and region.

The Growing Demand for Power Transmission and Distribution

Electrical cables and conductors are extensively used in ongoing infrastructure projects globally, such as the upgrading and extension of power grids, electrical networks and renewable energy installations. Because of its low weight, aluminum is a suitable material for power transmission lines. Because of its lower weight, installation and maintenance are easier to handle and more affordable because there is less strain on towers and other support structures.

For instance, in January 2023, The framework for enhancing the eco-balance of power lines has been established by aluminum manufacturer Trimet and Nexans. Both companies collaborated on an innovative initiative that produced a substance including recycled aluminum that can be used to make aluminum rod, which is utilized in electrical wires.

With a lower carbon footprint, Trimet and Nexans have developed a new product that can meet the stringent technical specifications for the alloy's conductivity and mechanical qualities. Up until now, primary aluminum has been the only material used in the production of power cables. Therefore, the power transmission and distribution segment capture the majority of the total segmental shares.

Geographical Penetration

Asia-Pacific's Infrastructure Development and Growing Energy Demands Propel Aluminum Product Market Dominance

The region's ongoing infrastructure development initiatives, such as the building of industrial zones, smart cities and transportation networks, necessitate substantial electrical wiring and distribution systems, which in turn drives up demand for items made of aluminum.

In order to transmit the electricity produced by these renewable sources and support market expansion, aluminum conductors are essential. Therefore, the Asia-Pacific holds for the significant market shares in the global product market.

COVID-19 Impact Analysis

The manufacture and transportation of raw materials, components and completed commodities, including as aluminum wire rods, cables and conductors, were all impacted by the pandemic's disruption of global supply networks. Manufacturing was hampered as the supply of necessary materials was disrupted by lockdowns, limitations and logistical difficulties.

The prevailing economic uncertainty and lockdown measures have led to a decrease in industrial activity, construction projects and infrastructure development. Consequently, there has been a reduction in demand for electrical materials, particularly products based on aluminum. The pandemic's effects on numerous industries caused numerous projects to be postponed or shelved.

Workforce shortages, social distance regulations and health and safety regulations posed operating obstacles for manufacturing operations. The supply of aluminum wire rods, cables and conductors was impacted as a result, resulting in production slowdowns or temporary closures.

Russia-Ukraine War Impact Analysis

The availability and price of aluminum used in wire rods, cables and conductors could be impacted by a disruption in the raw material supply chain caused by the conflict, particularly if it directly impacts areas recognized for their production of aluminum or important supply routes. Any unrest or uncertainty in the conflict-affected areas could lead to fluctuations in commodity prices, especially aluminum. The volatility may have an impact on the price strategies and production costs in the market for aluminum wire and cable.

Trade relations between participating countries may be strained by geopolitical disputes, which may result in trade restrictions, tariffs or policy changes. Market dynamics may be impacted by these shifts in the global flow of aluminum and its derivatives.

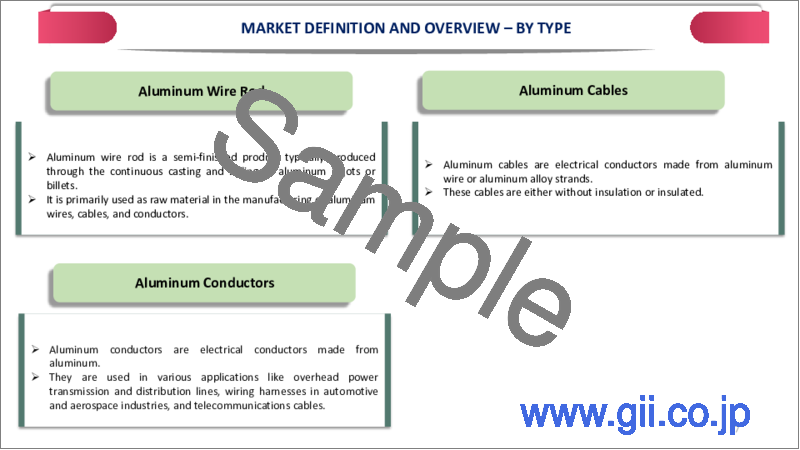

By Product

- Aluminum Wire Rod

- Aluminum Cables

- Aluminum Conductors

By End-User

- Automotive

- Power Transmission and Distribution

- Construction

- Telecommunication

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In February 2023, the largest aluminum manufacturer in India, Vedanta Aluminum, unveiled a new product at the International Aluminum Conference (IAC) 2023 specifically designed for the electrical sector.

- In October 2023, at the Cable & Wire Fair 2023 in New Delhi, Vedanta Aluminum, the leading aluminum manufacturer in India, unveiled an innovative range of wire rods, including the T4, AL59 and 8xxx series.

- In January 2022, the global leader in the energy and telecom cable systems sector, Prysmian Group, which has over 50 years of expertise supplying aluminum raw materials to OEMs, has announced the rebranding of its Aluminum Rod & Strip Business.

Competitive Landscape

The major global players in the market include Nexans, Prysmian Group, Southwire Company, Norsk Hydro ASA, General Cable Corporation, Eland Cables, Alcan Cable, Jiangsu Zhongchao Holding Co., Ltd., AFC Cable Systems, Inc. and Vedanta Ltd. (Sterlite Copper).

Why Purchase the Report?

- To visualize the global aluminum wire rod, cables & conductors market segmentation based on product, end-user and region, as well as understands key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of aluminum wire rod, cables & conductors market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

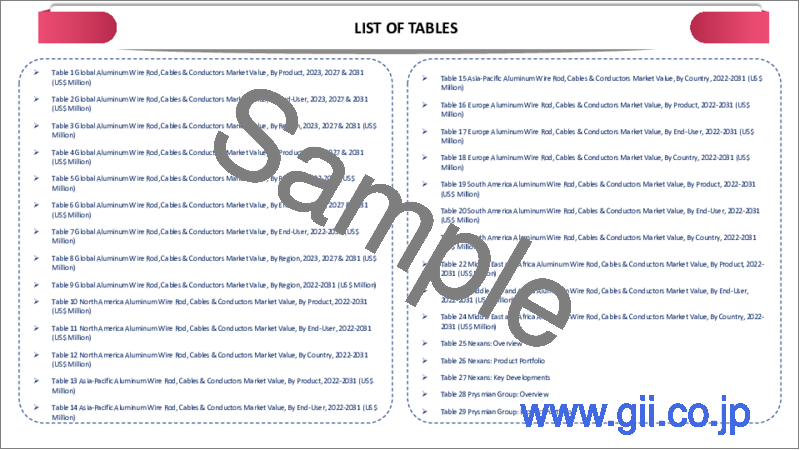

The global aluminum wire rod, cables & conductors market report would provide approximately 61 tables, 62 figures and 181 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Product

- 3.2. Snippet by End-User

- 3.3. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Growing production in the Emerging Economies

- 4.1.1.2. Growing Demand from Electrical Industry

- 4.1.2. Restraints

- 4.1.2.1. Availability of Alternatives

- 4.1.2.2. Copper Price Volatility

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Product

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 7.1.2. Market Attractiveness Index, By Product

- 7.2. Aluminum Wire Rod*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Aluminum Cables

- 7.4. Aluminum Conductors

8. By End-User

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 8.1.2. Market Attractiveness Index, By End-User

- 8.2. Automotive*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Power Transmission and Distribution

- 8.4. Construction

- 8.5. Telecommunication

- 8.6. Others

9. By Region

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 9.1.2. Market Attractiveness Index, By Region

- 9.2. North America

- 9.2.1. Introduction

- 9.2.2. Key Region-Specific Dynamics

- 9.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 9.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 9.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.2.5.1. U.S.

- 9.2.5.2. Canada

- 9.2.5.3. Mexico

- 9.3. Europe

- 9.3.1. Introduction

- 9.3.2. Key Region-Specific Dynamics

- 9.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 9.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 9.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.3.5.1. Germany

- 9.3.5.2. UK

- 9.3.5.3. France

- 9.3.5.4. Italy

- 9.3.5.5. Russia

- 9.3.5.6. Rest of Europe

- 9.4. South America

- 9.4.1. Introduction

- 9.4.2. Key Region-Specific Dynamics

- 9.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 9.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 9.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.4.5.1. Brazil

- 9.4.5.2. Argentina

- 9.4.5.3. Rest of South America

- 9.5. Asia-Pacific

- 9.5.1. Introduction

- 9.5.2. Key Region-Specific Dynamics

- 9.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 9.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 9.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.5.5.1. China

- 9.5.5.2. India

- 9.5.5.3. Japan

- 9.5.5.4. Australia

- 9.5.5.5. Rest of Asia-Pacific

- 9.6. Middle East and Africa

- 9.6.1. Introduction

- 9.6.2. Key Region-Specific Dynamics

- 9.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 9.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

10. Competitive Landscape

- 10.1. Competitive Scenario

- 10.2. Market Positioning/Share Analysis

- 10.3. Mergers and Acquisitions Analysis

11. Company Profiles

- 11.1. Nexans*

- 11.1.1. Company Overview

- 11.1.2. Product Portfolio and Description

- 11.1.3. Financial Overview

- 11.1.4. Key Developments

- 11.2. Prysmian Group

- 11.3. Southwire Company

- 11.4. Norsk Hydro ASA

- 11.5. General Cable Corporation

- 11.6. Eland Cables

- 11.7. Alcan Cable

- 11.8. Jiangsu Zhongchao Holding Co., Ltd.

- 11.9. AFC Cable Systems, Inc.

- 11.10. Vedanta Ltd. (Sterlite Copper)

LIST NOT EXHAUSTIVE

12. Appendix

- 12.1. About Us and Services

- 12.2. Contact Us