|

|

市場調査レポート

商品コード

1401296

ポリフェニレンサルファイド(PPS)の世界市場:2023年~2030年Global Polyphenylene Sulfide (PPS) Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ポリフェニレンサルファイド(PPS)の世界市場:2023年~2030年 |

|

出版日: 2023年12月29日

発行: DataM Intelligence

ページ情報: 英文 207 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

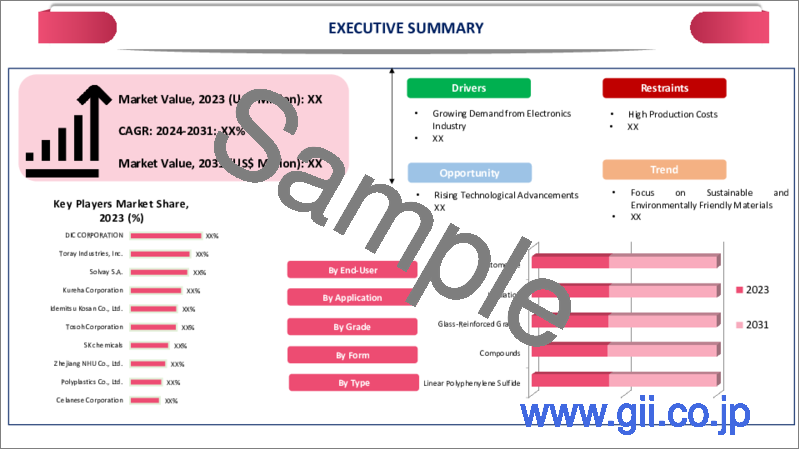

世界のポリフェニレンサルファイド(PPS)の市場規模は、2022年に26億米ドルに達し、2023年~2030年の予測期間中にCAGR9.6%で成長し、2030年には53億米ドルに達すると予測されています。

PPS市場の拡大は、主に電気・電子分野が牽引しています。PPSは、その優れた電気絶縁性により、絶縁材料、スイッチ、ソケット、接続部など、この業界の多くの用途に推奨されています。PPSは、技術革新と技術的ブレークスルーが高性能材料へのニーズに拍車をかける中、急成長する電子分野で新たな用途を見いだし続けています。

PPSは、自動車分野、特にパッケージングや車両部品のような高性能で軽量な製品の製造において、非常に人気が高まっています。自動車業界が燃費、低排出ガス、電気自動車の導入を優先し続ける中、PPSはその軽量特性と電気自動車部品への適切性から、需要が高まっています。

ポリフェニレンサルファイド(PPS)の世界市場では、アジア太平洋が市場の1/3以上を占める成長地域となっています。ポリフェニレンサルファイドは、アジア太平洋で需要の高い軽量自動車の生産に不可欠です。様々な投資計画が進行中であり、中国が電子・電気製品の世界トップ生産国であることを考慮すると、PPSはこれらの急成長業界の需要を満たす上で極めて重要な役割を担っています。

力学

自動車生産における電気自動車の成長

ポリフェニレンサルファイド(PPS)は、自動車業界、特にパッケージングや自動車部品で使用量が増加しています。PPSの人気は、軽量でコスト効率が高く、製造が容易で、電気自動車の燃料消費量削減に貢献することに起因しています。PPSは、他の材料よりもますます好まれるようになっており、自動車用途の拡大動向とさらなる拡大の可能性を示しています。

国際エネルギー機関(IEA)の報告によると、パンデミックにもかかわらず、2019年には世界の自動車販売台数の2.6%、世界の自動車在庫の約1%を電気自動車が占め、前年比40%増となりました。電気自動車と自動車分野が世界的危機から立ち直る能力を実証しており、その結果、ポリフェニレンサルファイド市場は活発な状態を維持しています。

電子・電気業界での需要拡大

最近、電気・電子業界の需要が増加しています。ポリフェニレンサルファイド(PPS)の需要が増加しているのは、電気製品、ガジェット、電池、モーター、電動機械などでの用途が拡大しているためです。

また、効率的で耐久性のある電気機械が求められていることも、さまざまな用途でPPSが脚光を浴びている一因となっています。世界各国の政府は、温室効果ガスの排出量が少ない電気製品への移行を奨励しており、気候変動対策という世界の優先課題に合致しています。PPSは、そのコスト効率と軽量特性により、金属、合金、熱可塑性プラスチックに取って代わり、電気・電子分野で好ましい選択肢として台頭しています。

例えば2023年、Solvayはテキサスでポリフェニレンサルファイド(PPS)の生産を拡大し、ベルギーでRyton PPS ECHOコンパウンドのISCC PLUS認証を取得しました。Ryton PPSコンパウンドは、自動車、航空宇宙、電子分野で広く使用されており、高い熱的・機械的規格に適合しています。金属を代替することで、燃料消費量とコストを削減し、業界を超えた有効性の歴史を示しています。

代替コンパウンドとの競合

ポリエーテルエーテルケトン(PEEK)やポリエーテルイミド(PEI)のような代替化合物が利用可能であることは、PPS業界にとってさらなる大きな障壁となっています。PPSは強い耐熱性や化学的安定性といった特殊な性質を持っていますが、これらの代替品も状況によっては有利に働く性質を持っています。

例えば、PEEKはその卓越した機械的特性から、高性能用途においてPPSの代替品として頻繁に使用されています。代替コンパウンドは、各企業が独自の要件を満たす最適な材料を求めているため、ますます競合が激しくなっています。さらに、代替材料の入手可能性は購買の意思決定に影響するため、PPSが広く受け入れられ、売上を伸ばす上で問題となっています。

価格変動と高い製造コスト

ポリフェニレンサルファイド(PPS)は、一般的に使用されている材料とは異なる特徴や特性を誇り、様々な用途で高い効率を発揮します。ポリフェニレンサルファイド(PPS)の価格変動は、1kgあたり9~18米ドルにも及び、メーカーにとっても消費者にとっても大きな課題となっています。

予測不可能な価格設定はメーカーに財務的損失のリスクをもたらし、市場全体の成長にとって大きな障壁となっています。さらに、PPSの生産関連の高いコストは、市場拡大の大きな脅威となっています。PEEKやPEIのような代替コンパウンドの存在と原料コストの変動が課題をさらに複雑にしており、ポリフェニレンサルファイド市場の成長にとって重要な抑制要因となっています。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 自動車生産における電気自動車の成長

- 電子・電気業界における需要の拡大

- 抑制要因

- 代替コンパウンドとの競合

- 価格変動と高い製造コスト

- 機会

- 影響分析

- 促進要因

第5章 業界分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 タイプ別

- 線状ポリフェニレンサルファイド

- 湾曲ポリフェニレンサルファイド

- 分岐ポリフェニレンサルファイド

第8章 形態別

- コンパウンド

- ファイバー

- フィラメント

- コーティング

- その他

第9章 グレード別

- ガラス強化グレード

- ガラス繊維・粒子ミネラル充填グレード

- 炭素繊維強化グレード

- 潤滑繊維入りグレード

第10章 用途別

- 断熱材

- パッケージング

- プラグとスイッチ

- リレー

- 医療機器

- フィルターバッグ

- その他

第11章 エンドユーザー別

- 自動車

- 電気・電子

- 産業

- 航空宇宙

- 医療

- コーティング

- その他

第12章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋

- 中東・アフリカ

第13章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第14章 企業プロファイル

- DIC Corporation

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Toray Industries, Inc.

- Celanese Corporation

- Solvay SA

- Kureha Corporation

- Lotte Chemical Corporation

- Mitsubishi Chemical Group

- Tosoh Corporation

- Zhejiang NHU Special Materials Co., Ltd.

- Polyplastics Co., Ltd.

第15章 付録

Overview

Global Polyphenylene Sulfide (PPS) Market reached US$ 2.6 billion in 2022 and is expected to reach US$ 5.3 billion by 2030, growing with a CAGR of 9.6% during the forecast period 2023-2030.

The expansion of the PPS market is mostly driven by the electrical and electronics sectors. PPS is a recommended option for many applications in this industry, such as insulating materials, switches, sockets and connections, due to its superior electrical insulation qualities. PPS continues to find new uses in the rapidly growing electronics sector as innovations and technical breakthroughs fuel the need for high-performance materials.

PPS has grown quite popular in the automotive sector, especially in producing high-performance, lightweight products like packaging and vehicle parts. PPS is in greater demand because of its lightweight characteristics and appropriateness for electric car components as the automotive industry continues prioritizing fuel efficiency, lower emissions and introducing electric vehicles.

Asia-Pacific is among the growing regions in the global polyphenylene sulfide (PPS) market covering more than 1/3rd of the market. Polyphenylene sulfide is integral to the production of lightweight automobiles in high demand in the Asia-Pacific. With various investment programs underway and considering China's status as the top global producer of electronic and electrical products, PPS maintains a pivotal role in meeting the demands of these rapidly growing industries.

Dynamics

Growing Electric Vehicles in Automotive Production

Polyphenylene sulfide (PPS) is experiencing heightened usage in the automotive industry, particularly in packaging and auto parts. Its popularity stems from being lightweight, cost-effective, easily manufacturable and contributing to reduced fuel consumption in electric vehicles. PPS is increasingly preferred over other materials, indicating a growing trend in its automotive applications with the potential for further expansion.

The International Energy Agency (IEA) reports that, despite a pandemic, electric cars accounted for 2.6% of globally auto sales and around 1% of global car stock in 2019, representing a 40% year-over-year gain. demonstrating the ability of electric vehicles and the automotive sector to bounce back from a globally crisis and as a result, keeping the market for polyphenylene sulfide active.

Growing Demand in the Electronics and Electrical Industry

The electrical and electronics industries have seen a rise in demand lately. The electrical and electronics industries have seen a rise in demand lately. The increasing demand for polyphenylene sulfide (PPS) is driven by its growing usage in electric appliances, gadgets, batteries, motors and motorized machinery.

Additionally, the need for efficient and durable electric machines contributes to the rising prominence of PPS in various applications. Governments globally are encouraging a shift to electric appliances due to their lower greenhouse emissions, aligning with global priorities to combat climate change. PPS is emerging as a preferred choice in the electrical and electronic sector, replacing metals, alloys and thermoplastics due to its cost-effectiveness and lightweight characteristics.

For Instance, in 2023, Solvay expanded polyphenylene sulfide (PPS) production in Texas and received ISCC PLUS certification for Ryton PPS ECHO compounding in Belgium. Ryton PPS compounds, widely used in automotive, aerospace and electronics, meet high thermal and mechanical standards. Recognized for replacing metals, they reduce fuel consumption and costs, showcasing a history of effectiveness across industries.

Competition from Alternative Compounds

The availability of replacement compounds such as Polyether Ether Ketone (PEEK) and Polyetherimide (PEI) is a major further barrier to the PPS industry. Although PPS has special qualities such as strong heat resistance and chemical stability, these alternatives also have positive qualities that can be favored in some situations.

For instance, due to its exceptional mechanical qualities, PEEK is frequently used as a substitute for PPS in high-performance applications. The alternative compounds are becoming increasingly competitive as companies seek materials that best meet their unique requirements. Furthermore, the availability of substitute materials affects purchasing decisions, which presents a problem for PPS's widespread acceptance and growth in sales.

Price Volatility and High Production Costs

Polyphenylene sulfide (PPS) boasts distinctive features and properties that set it apart from commonly used materials, rendering it highly efficient for diverse applications. The persistent price volatility of Polyphenylene Sulfide (PPS), with fluctuations spanning from US$ 9 to US$ 18 per kg, presents a notable challenge for manufacturers and consumers alike.

The unpredictability in pricing poses a risk of financial losses for manufacturers, serving as a substantial barrier to the overall growth of the market. Additionally, the high production costs associated with PPS production represent a substantial threat to market expansion. The presence of alternative compounds like PEEK and PEI, coupled with fluctuating raw material costs, further compounds the challenges, serving as a key restraint for the growth of the polyphenylene sulfide market.

Segment Analysis

The global polyphenylene sulfide (PPS) market is segmented based on type, form, grade, application, end-user and region.

Increasing Polyphenylene Sulfide (PPS) Resins in Automotive Industry

The Automotive segment is among the growing regions in the global polyphenylene sulfide (PPS) market covering more than 1/3rd of the market. Polyphenylene sulfide (PPS) resins are widely used in fuel injection systems, coolant systems and vehicle water pump impellers, making the automobile industry the dominant segment.

According to the OICA reports globally, 80.1 million vehicles were produced in 2021 a 4% increase over 77.6 million units produced the year before. The primary driver behind the market's expansion is the increased manufacturing of automobiles due to customers' increasing demands. A high-performance thermoplastic with a maximum crystallinity of 65% is polyphenylene sulfide. The International Energy Agency projects that by 2025, 445.25 million metric tons of thermoplastics will have been produced globally.

Geographical Penetration

Growing Automotive Production and Technologies in Asia-Pacific

Asia-Pacific has been a dominant force in the global polyphenylene sulfide (PPS) market. The world's biggest center for automobile production is located in Asia. Future developments in electric car technology will probably pick up steam, particularly in China, where some government initiatives are encouraging the transition away from fossil fuels in response to a range of sustainability concerns.

China has the largest automotive production sector in the world and is the base of the vehicle industry. But lately, the industry's manufacturing and sales have gone down. In December 2022, automotive sales fell 8.4% year over year to 2.56 million units, as reported by the China Association of Automotive Manufacturers. The total number of units sold in 2022 was an astounding 26.86 million, even with this month-to-month decline.

The Indian automobile market is predicted by the India Brand Equity Foundation to grow at a compound annual growth rate (CAGR) of more than 9% and reach US$ 54.84 billion by 2027. By 2026, the Indian automobile sector hopes to have increased car exports five times. 5,617,246 automobiles were exported from India overall in 2022.

Moreover, China is the global center of electronic manufacturing. The electronics category is seeing the fastest rise in items including smartphones, tablets, OLED TVs, wires, cables and earbuds. The electronics sector produced US$ 7,098.34 million in total in November 2022, according to JEITA (Japan Electronics and Information Technology Industries Association). Japan exported electronics worth US$ 8,395.45 million in December 2022.

COVID-19 Impact Analysis

The COVID-19 pandemic affected numerous businesses, including the globally polyphenylene sulfide (PPS) industry. The demand for and production of PPS were greatly impacted in the early phases of the pandemic by widespread lockdowns, interruptions in global supply lines and decreased industrial activity. Production and delivery were delayed as a result of the temporary closures or operating limitations that many manufacturing facilities encountered.

PPS users, the aerospace and automobile industries, were especially hard hit as a result of production reductions made in the face of uncertain economic times and declining customer demand. The resurgence of industrial activity and the implementation of safety measures in production facilities drove the PPS market's recovery as the pandemic spread.

The slow recovery of the PPS market was facilitated by the rising demand for electronic components and the revival of the automobile industry. Companies reevaluated their supply chain strategy in response to the epidemic, emphasizing the need to increase flexibility and resilience to lessen future disruptions.

The development of the PPS market in the future will be determined by variables including the strength of end-user sectors, continuous supply chain modifications and the state of the global economy. The industry's strategy for risk management and supply chain optimization is probably going to be influenced by the lessons learned from the pandemic, which might have an impact on how the Polyphenylene Sulfide market develops in the future.

Russia-Ukraine War Impact Analysis

The PPS market may be affected by the crisis between Russia and Ukraine as a result of supply chain interruptions and modifications to market structures. Every disruption in the manufacturing, shipping or sale of chemical goods, including PPS, has the potential to affect pricing and availability since both Russia and Ukraine are major players in the global chemical sector.

Furthermore, the geopolitical tension could be a factor in wider economic worries that affect international commerce, exchange rates and investor mood in general. The may have an impact on the choice of investments, the market for industrial materials such as PPS and the long-term strategy of chemical businesses. To manage the shifting geopolitical landscape, businesses may need to regularly monitor the situation, evaluate risks and adjust their plans.

The might have an impact on the globally PPS market. It is advised to review recent industry studies and news sources that offer insights into the effects of geopolitical events on the chemical and polymer markets to obtain the most up-to-date and accurate information. Additionally, trade restrictions, geopolitical unpredictability and sanctions are a few examples of factors that might provide problems for companies doing business in the area and for those whose goods or raw materials come from the concerned regions.

By Type

- Linear Polyphenylene Sulfide

- Curved Polyphenylene Sulfide

- Branched Polyphenylene Sulfide

By Form

- Compounds

- Fibers

- Filaments

- Films

- Coatings

- Others

By Grade

- Glass-Reinforced Grades

- Glass-Fiber/Particulate-Mineral-Filled Grades

- Carbon-Fiber-Reinforced Grades

- Lubricated Fiber-Filled Grades

By Application

- Insulation

- Packaging

- Plugs and Switches

- Relays

- Medical Devices

- Filter Bags

- Others

By End-User

- Automotive

- Electrical and Electronics

- Industrial

- Aerospace

- Healthcare

- Coatings

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On October 04, 2023, Solvay, a leading global supplier of specialty materials, launched two new Ryton polyphenylene sulfide (PPS) grades Ryton Supreme HV and HF. The additions to the Supreme polymer range are tailored to significantly enhance performance in electrification. Specifically designed for the automotive industry, the PPS grades aim to simplify drivers' experiences by reducing charging times and extending driving ranges, aligning with the industry's shift towards electrified vehicles.

- On January 23, 2021, Kureha Corporation expanded its Iwaki Factory in Iwaki, Japan and built a new facility to make Polyphenylene Sulfide (PPS). The Iwaki PPS plant in Kureha used to produce 10,700 tons annually and ran at full capacity in previous years. It now meets growing customer demand by producing an extra 5,000 tons, bringing its annual capacity to 15,700 tons.

Competitive Landscape

The major global players in the market include DIC Corporation, Toray Industries, Inc., Celanese Corporation, Solvay SA, Kureha Corporation, Lotte Chemical Corporation, Mitsubishi, Chemical Group, Tosoh Corporation, Zhejiang NHU Special Materials Co., Ltd. and Polyplastics Co., Ltd.

Why Purchase the Report?

- to visualize the global polyphenylene sulfide (PPS) market segmentation based on type, form, grade, application, end-user and region and understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of polyphenylene sulfide (PPS) market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

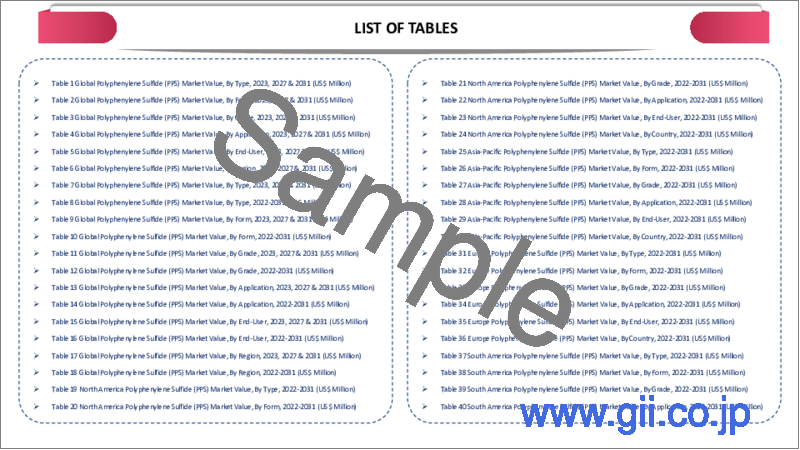

The global polyphenylene sulfide (PPS) market report would provide approximately 77 tables, 89 figures and 207 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Type

- 3.2. Snippet by Form

- 3.3. Snippet by Grade

- 3.4. Snippet by Application

- 3.5. Snippet by End-User

- 3.6. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Growing Electric Vehicles in Automotive Production

- 4.1.1.2. Growing Demand in the Electronics and Electrical Industry

- 4.1.2. Restraints

- 4.1.2.1. Competition from Alternative Compounds

- 4.1.2.2. Price Volatility and High Production Costs

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Linear Polyphenylene Sulfide*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Curved Polyphenylene Sulfide

- 7.4. Branched Polyphenylene Sulfide

8. By Form

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 8.1.2. Market Attractiveness Index, By Form

- 8.2. Compounds*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Fibers

- 8.4. Filaments

- 8.5. Coatings

- 8.6. Others

9. By Grade

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Grade

- 9.1.2. Market Attractiveness Index, By Grade

- 9.2. Glass-Reinforced Grades*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Glass-Fiber/Particulate-Mineral-Filled Grades

- 9.4. Carbon-Fiber-Reinforced Grades

- 9.5. Lubricated Fiber-Filled Grades

10. By Application

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.1.2. Market Attractiveness Index, By Application

- 10.2. Insulation*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Packaging

- 10.4. Plugs and Switches

- 10.5. Relays

- 10.6. Medical Devices

- 10.7. Filter Bags

- 10.8. Others

11. By End-User

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.1.2. Market Attractiveness Index, By End-user

- 11.2. Automotive*

- 11.2.1. Introduction

- 11.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 11.3. Electrical and Electronics

- 11.4. Industrial

- 11.5. Aerospace

- 11.6. Healthcare

- 11.7. Coatings

- 11.8. Others

12. By Region

- 12.1. Introduction

- 12.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 12.1.2. Market Attractiveness Index, By Region

- 12.2. North America

- 12.2.1. Introduction

- 12.2.2. Key Region-Specific Dynamics

- 12.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 12.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Grade

- 12.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.2.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.2.8.1. U.S.

- 12.2.8.2. Canada

- 12.2.8.3. Mexico

- 12.3. Europe

- 12.3.1. Introduction

- 12.3.2. Key Region-Specific Dynamics

- 12.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 12.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Grade

- 12.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.3.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.3.8.1. Germany

- 12.3.8.2. UK

- 12.3.8.3. France

- 12.3.8.4. Russia

- 12.3.8.5. Spain

- 12.3.8.6. Rest of Europe

- 12.4. South America

- 12.4.1. Introduction

- 12.4.2. Key Region-Specific Dynamics

- 12.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 12.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Grade

- 12.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.4.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.4.8.1. Brazil

- 12.4.8.2. Argentina

- 12.4.8.3. Rest of South America

- 12.5. Asia-Pacific

- 12.5.1. Introduction

- 12.5.2. Key Region-Specific Dynamics

- 12.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 12.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Grade

- 12.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.5.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.5.8.1. China

- 12.5.8.2. India

- 12.5.8.3. Japan

- 12.5.8.4. Australia

- 12.5.8.5. Rest of Asia-Pacific

- 12.6. Middle East and Africa

- 12.6.1. Introduction

- 12.6.2. Key Region-Specific Dynamics

- 12.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 12.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Grade

- 12.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.6.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

13. Competitive Landscape

- 13.1. Competitive Scenario

- 13.2. Market Positioning/Share Analysis

- 13.3. Mergers and Acquisitions Analysis

14. Company Profiles

- 14.1. DIC Corporation*

- 14.1.1. Company Overview

- 14.1.2. Product Portfolio and Description

- 14.1.3. Financial Overview

- 14.1.4. Key Developments

- 14.2. Toray Industries, Inc.

- 14.3. Celanese Corporation

- 14.4. Solvay SA

- 14.5. Kureha Corporation

- 14.6. Lotte Chemical Corporation

- 14.7. Mitsubishi Chemical Group

- 14.8. Tosoh Corporation

- 14.9. Zhejiang NHU Special Materials Co., Ltd.

- 14.10. Polyplastics Co., Ltd.

LIST NOT EXHAUSTIVE

15. Appendix

- 15.1. About Us and Services

- 15.2. Contact Us